Professional Documents

Culture Documents

Marketing Cost and Profitability Analysis

Marketing Cost and Profitability Analysis

Uploaded by

Bharathi Raju0 ratings0% found this document useful (0 votes)

49 views10 pagesOriginal Title

chap015

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

49 views10 pagesMarketing Cost and Profitability Analysis

Marketing Cost and Profitability Analysis

Uploaded by

Bharathi RajuCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 10

Chapter

15 Marketing Cost and

Profitability Analysis

Business prophets tell us what

should happen – but business

profits tell us what did happen.

Earl Wilson

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved.

A Comparison of Marketing Cost Analysis

and Production Cost Accounting (Fig. 15-1)

Comparison Marketing Cost Production Cost

Factors Analysis Accounting

Bases for Marketing unit: Unit of product

computing costs territory, customer

group, order size, as

well as product

More complex Relatively simple

Source of cost Salespeople in the Machines and closely

incurred field supervised workers

Less exact More precise

Cost-volume Volume is a function of Cost is a function of

relationship cost V=f( C ) volume C=f(V)

Difficult to measure Relatively easy to

measure

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved.

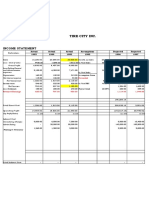

Income and Expense Statement, 2002,

Colorado Ski Company ($000) (Fig. 15-2)

Net sales $27,000

Less cost of goods sold 18,900

Gross margin 8,100

Less operating expenses:

Sales salaries and commissions $3,240

Sales force travel 372

Supplies and telephone 178

Media space 870

Advertising salaries 218

Property taxes 120

Heat and light 168

Insurance 84

Administrative salaries 930

Other expenses 120

Total operating expenses 6,300

Net profit $ 1,800

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved.

Expense Distribution Sheet, Colorado

Ski Company, 2002 (Fig. 15-3)

(showing allocation of ledger expense items to activity categories)

Activity Cost Categories

Personal Warehousing Order

Ledger expenses Totals Selling Advertising and Shipping Processing Administration

Sales salaries/commis $3,240,000 $3,240,000 — — — —

Sales force travel 372,000 372,000 — — — —

Supplies & telephone 178,000 43,200 22,200 40,900 43,500 28,200

Media space 870,000 — 870,000 — — —

Advertising salaries 218,000 — 218,000 — — —

Property taxes 120,000 10,000 14,500 66,000 14,000 15,500

Heat and light 168,000 15,300 17,400 100,500 16,200 18,600

Insurance 84,000 12,000 4,200 46,300 14,000 7,500

Administ. salaries 930,000 144,000 62,000 168,000 126,000 430,000

Other expenses 120,000 10,500 11,700 58,300 26,300 13,200

Totals $6,300,000 3,847,000 1,220,000 480,000 240,000 513,000

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved.

Allocation of Activity Costs to Sales Regions,

Col Ski Co. 2002 (Fig. 15-4)

Personal Warehousing Order

Activity Selling Advertising and Shipping Processing Administration

Allocation Scheme

Allocation Direct expense No. of pages No. of orders No. of invoice Equally among

basis to each region of ads shipped lines regions

Total activity

cost $3,847,000 $1,220,00 $480,000 $240,000 $513,000

No. of

allocation units — 61 pages 9,600 orders 120,000 lines 3 regions

Cost per

allocation unit — $20,000/pg. $50 per order $2 per line $171,000/reg.

Region Allocation of Costs

units — 21 pages 3,800 orders 39,500 lines one

Eastern

cost $1,070,000 $420,000 $190,000 $79,000 $171,000

units — 11 pages 2,500 orders 28,000 lines one

Midwestern

cost $747,000 $220,000 $125,000 $56,000 $171,000

units — 29 pages 3,300 orders 52,500 lines one

Western

cost $2,030,000 $580,000 $165,000 $105,000 $171,000

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved.

Income and Expense Statement, by Sales

Region, Col Ski Co. 2002 ($000) (Fig. 15-5)

Total Eastern Midwestern Western

Net sales $27,000 $9,000 $4,500 $13,500

Less cost of goods sold 18,900 6,300 3,150 9,450

Gross margin 8,100 2,700 1,350 4,050

Less operating expenses:

Personal selling 3,847 1,070 802 1,975

Advertising 1,220 420 220 580

Warehousing/shipping 480 190 125 165

Order processing 240 79 56 105

Administration 513 171 171 171

Total operating expenses 6,300 1,930 1,374 2,996

Net profit (loss) $ 1,800 $ 770 ($24) $ 1,054

Net profit (loss) as percentage of sales 6.70% 8.60% (0.53%) 7.80%

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved.

Methods Used to Allocate Indirect Costs

(Fig. 15-6)

Method Evaluation

Divide cost equally among territories or Easy to do, but inaccurate and usually unfair

whatever market segments are being to some market segments.

analyzed.

Allocate costs in proportion to sales Underlying philosophy: apply cost burden

volume obtained from each territory (or where it can best be borne. That is, charge a

product or customer group). high-volume market segment with a large

share of the indirect cost. This method is

simple and easy to do, but may be very

inaccurate. Tells very little about a segment’

Allocate indirect costs in same proportion Again, easy to do but can be inaccurate and

as the total direct costs. Thus if product A misleading. Falsely assumes a close

accounted for 25 percent of the total relationship between direct and indirect

direct costs, then A would also be expenses.

charged with 25 percent of theindirect

expenses.

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved.

Income and Expense Statement by Sales Region, Col Ski Co

2002, in $000, using contribution-margin approach (Fig. 15-7)

Total Eastern Midwestern Western

Net sales $27,000 $9,000 $4,500 $13,500

Less cost of goods sold 18,900 6,300 3,150 9,450

Gross margin 8,100 2,700 1,350 4,050

Less direct operating expenses:

Personal selling 3,082 845 595 1,642

Advertising 732 254 127 351

Warehousing/shipping 160 64 42 54

Order processing 130 43 30 57

Total direct expenses 4,104 1,206 794 2,104

Contribution margin $ 3,996 $1,494 $ 556 $1,946

Less indirect operating expenses:

Personal selling 765

Advertising 488

Warehousing/shipping 320

Order processing 110

Administration 513

Total indirect expenses $2,196

Net profit $1,800

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved.

Fig. 15-8 Ways to Increase Order Size and

Reduce Small Order Marketing Costs

•Educate customers who buy from several different suppliers. Stress the advantages of

purchasing from one supplier.

•For customers who purchase large total quantities in frequent small orders, stress the

advantages of ordering once a month instead of once a week. Point out that the buyer

eliminates all handling, billing, and accounting expenses connected with three of the four

orders. Note further that the buyer writes only one check and one purchase order. In

addition, stress that there will be only one bill to process and one shipment to put into

inventory instead of three or four.

•Educate the sales force as well as customers. In fact, it may be necessary to change the

compensation plan to discourage acceptance of smaller orders.

•Substitute direct mail or telephone selling for sales calls or unprofitable or small-order

accounts; or continue to call on these accounts, but less frequently.

•Shift an account to a wholesaler or some other type of middleman rather than dealing

directly, even by mail or telephone.

•Drop a mass-distribution policy and adopt a selective one. This new policy may actually

increase sales because sales reps can spend more time with profitable accounts.

•Establish a minimum-order size.

•Establish a minimum charge or a service charge to combat small orders

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved.

Return on Assets Managed (ROAM)

Sales $ 10,000,000

Cost of goods sold 7,000,000

Gross margin 3,000,000

Salaries 150,000

Commission 850,000

Travel 150,000

District office expense 400,000

Total direct expenses 150,000

Contribution margin $ 1,450,000

Accounts receivable 2,200,000

Inventories 2,000,000

Total assets $ 4,200,000

Contribution margin 1,450,000

Profit on sales % = Sales volume = 10,000,000 x 100 = 14.5%

Sales volume $10,000,000

Asset turnover = Accounts receivable + = $ 4,200,000 = 2.38

Inventories

ROAM = Profit on sales % x Asset turnover

1,450,000

= x 10,000,000

10,000,000 4,200,000

= 14.5% x 2.38 = 34.5%

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved.

You might also like

- Prajwal G Bharadwaj - EY Internship ReportDocument55 pagesPrajwal G Bharadwaj - EY Internship ReportBharathi Raju100% (2)

- BUS 400 Business Model CanvasDocument2 pagesBUS 400 Business Model CanvasMugambi OliverNo ratings yet

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDocument7 pagesAccounting For Managers (Assignment One (E-Finance) ) Question OnehananNo ratings yet

- V-Ride, Inc.: Case 4-1Document11 pagesV-Ride, Inc.: Case 4-1Dave Castillo Bangisan100% (1)

- Chapter 12 SolutionsDocument10 pagesChapter 12 Solutionshassan.murad100% (2)

- De Beers, Marketing Diamonds To MillennialsDocument13 pagesDe Beers, Marketing Diamonds To MillennialsNitish100% (1)

- Personal Branding WorksheetDocument3 pagesPersonal Branding WorksheetAgnes DessyNo ratings yet

- Business Plan of Manufacturing Air PurifiersDocument7 pagesBusiness Plan of Manufacturing Air PurifiersSakshi BaiwalNo ratings yet

- RUNNING HEAD: Accounting Questions 1Document6 pagesRUNNING HEAD: Accounting Questions 1Chirayu ThapaNo ratings yet

- Harvard Financial Accounting Final Exam 3Document11 pagesHarvard Financial Accounting Final Exam 3Bharathi Raju0% (1)

- Harvard Financial Accounting Final Exam 2Document12 pagesHarvard Financial Accounting Final Exam 2Bharathi RajuNo ratings yet

- Applying Mindstate Marketing For Consistent Brand Growth 06082020Document17 pagesApplying Mindstate Marketing For Consistent Brand Growth 06082020Sergiu Alexandru VlasceanuNo ratings yet

- Resolución CaseDocument21 pagesResolución CaseyojaniNo ratings yet

- Prestige Telephone CompanyDocument8 pagesPrestige Telephone CompanyRiandy Ar RasyidNo ratings yet

- FABM2 Chapter2Document7 pagesFABM2 Chapter2Archie CampomanesNo ratings yet

- Cost Management Accounting DEC 2023Document4 pagesCost Management Accounting DEC 2023Aash RedmiNo ratings yet

- Cost Management Accounting AM1 STDocument5 pagesCost Management Accounting AM1 STAash RedmiNo ratings yet

- Tutorial 3 AnswersDocument7 pagesTutorial 3 AnswersFEI FEINo ratings yet

- Prestige Telephone Company Work SheetDocument8 pagesPrestige Telephone Company Work SheetaaaaNo ratings yet

- A Case Study On Roxor Watch Company Pty LTD Team Divergents 120522 10.41pmDocument5 pagesA Case Study On Roxor Watch Company Pty LTD Team Divergents 120522 10.41pmKrystel Joie Caraig ChangNo ratings yet

- Income Statement TemplateDocument4 pagesIncome Statement Templatesally ngNo ratings yet

- Ch13-Leverage, Capital Structure-Part 2Document32 pagesCh13-Leverage, Capital Structure-Part 2Hatem MohammedNo ratings yet

- GSBA002 - Management Accounting - Realyn Austria - Case Study 3BDocument4 pagesGSBA002 - Management Accounting - Realyn Austria - Case Study 3BRealyn AustriaNo ratings yet

- Prestige Data Services Exhibit 1 Jan Feb MarDocument3 pagesPrestige Data Services Exhibit 1 Jan Feb MarRajat GargNo ratings yet

- AC2105 Seminar 3 Group 3Document37 pagesAC2105 Seminar 3 Group 3Kwang Yi JuinNo ratings yet

- Assignment 3 ACT502Document6 pagesAssignment 3 ACT502Mahdi KhanNo ratings yet

- Acc AssignmentDocument8 pagesAcc AssignmentKashémNo ratings yet

- Financial Model For BrandsDocument60 pagesFinancial Model For BrandsAnjali SrivastavaNo ratings yet

- Software Asssociates11Document13 pagesSoftware Asssociates11Arslan ShaikhNo ratings yet

- SecD Group7 PrestigeDocument10 pagesSecD Group7 PrestigePushpendra Kumar RaiNo ratings yet

- Financial Statement Analysis QuestionsDocument11 pagesFinancial Statement Analysis QuestionsShrunaliNo ratings yet

- EE Financial ProjectionsDocument2 pagesEE Financial Projectionsnishatmridula06No ratings yet

- Answer Key To Test #3 - ACCT-312 - Fall 2019Document8 pagesAnswer Key To Test #3 - ACCT-312 - Fall 2019Amir ContrerasNo ratings yet

- Teodoro M. Luansing College of Rosario: Accounts Dr. CRDocument8 pagesTeodoro M. Luansing College of Rosario: Accounts Dr. CRSamantha Alice LysanderNo ratings yet

- Tire City IncDocument18 pagesTire City IncSoumyajitNo ratings yet

- Analysis of Sales VolumeDocument10 pagesAnalysis of Sales VolumeBharathi RajuNo ratings yet

- Relevant Cost Exercise SolutionDocument14 pagesRelevant Cost Exercise SolutionHimadri DeyNo ratings yet

- A. Calculate The Break-Even Dollar Sales For The MonthDocument25 pagesA. Calculate The Break-Even Dollar Sales For The MonthPriyankaNo ratings yet

- Managerial Accounting - Final Project - Yahya Patanwala.12028Document4 pagesManagerial Accounting - Final Project - Yahya Patanwala.12028Yahya SaifuddinNo ratings yet

- Managerial Final Project Study NotesDocument8 pagesManagerial Final Project Study NotesShawn KPNo ratings yet

- ManAc Midterms Chuckie ChukieDocument2 pagesManAc Midterms Chuckie ChukieVAUGHN MARTINEZNo ratings yet

- PrestigeDocument13 pagesPrestigeMona SahooNo ratings yet

- Seatwork 4 - Decentralized OperationsDocument3 pagesSeatwork 4 - Decentralized OperationsJessaLyza CordovaNo ratings yet

- Angel's Pizza Pro Forma Income Statement January 2019 - December 2019Document5 pagesAngel's Pizza Pro Forma Income Statement January 2019 - December 2019Rimar LuayNo ratings yet

- CVP MC 1920 W KeyDocument6 pagesCVP MC 1920 W KeyGale RasNo ratings yet

- Management AccountingDocument6 pagesManagement AccountingBornyNo ratings yet

- Software ExcelDocument12 pagesSoftware ExcelparvathysiyyerNo ratings yet

- Intacc 3 Ans To Chap 1 ProbsDocument4 pagesIntacc 3 Ans To Chap 1 ProbsMhico MateoNo ratings yet

- 6 Section - CustomerDocument41 pages6 Section - CustomerFenandoNo ratings yet

- This Study Resource Was Shared Via: RequiredDocument1 pageThis Study Resource Was Shared Via: RequiredJalaj GuptaNo ratings yet

- Chapter 6 CVP Analysis - Part I - LMSDocument43 pagesChapter 6 CVP Analysis - Part I - LMSPiece of WritingsNo ratings yet

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDocument24 pagesAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Software Associates CoursewareDocument27 pagesSoftware Associates CoursewareAISHWARYA SONINo ratings yet

- Cost & Management Accounting MBADocument4 pagesCost & Management Accounting MBAashwinimore811No ratings yet

- Chapter 5 - A2, B1, & 59Document5 pagesChapter 5 - A2, B1, & 59詹鎮豪No ratings yet

- AccountingDocument7 pagesAccountingDaniela Pedrosa100% (1)

- SD17 Hybrid F5 Section C Answers Clean Proof PDFDocument12 pagesSD17 Hybrid F5 Section C Answers Clean Proof PDFShaksham SharmaNo ratings yet

- Business Break EvenDocument2 pagesBusiness Break Eventaona madanhireNo ratings yet

- WHOLESALE and RETAIL EXAM QUESTIONS WITH MODEL ANSWERS - SEPT 2017Document3 pagesWHOLESALE and RETAIL EXAM QUESTIONS WITH MODEL ANSWERS - SEPT 2017chelasimunyolaNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Department AccountingDocument12 pagesDepartment AccountingRajesh NangaliaNo ratings yet

- Problem Solving AssignmentDocument13 pagesProblem Solving AssignmentRajesh MongerNo ratings yet

- Financial Plan OkDocument7 pagesFinancial Plan OkSYED ARSALANNo ratings yet

- What Is A Segment?: in Financial ReportingDocument74 pagesWhat Is A Segment?: in Financial ReportingJerianne PascoNo ratings yet

- f9 Answer-Mock-Exam-F9Document9 pagesf9 Answer-Mock-Exam-F9amalthomas557No ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- Illustration On Double Column Cash BookDocument1 pageIllustration On Double Column Cash BookBharathi RajuNo ratings yet

- Introduction of The Company: Mckinsey's 7's Framework: Functions and ProcessDocument1 pageIntroduction of The Company: Mckinsey's 7's Framework: Functions and ProcessBharathi RajuNo ratings yet

- Name: Rajesh Kumar K.R SRN: PES1PG19MB274 Company: Exotalent Consultancy Services LLPDocument6 pagesName: Rajesh Kumar K.R SRN: PES1PG19MB274 Company: Exotalent Consultancy Services LLPBharathi RajuNo ratings yet

- FInal Internship Report-Rajesh Kumar K.R (MB274)Document58 pagesFInal Internship Report-Rajesh Kumar K.R (MB274)Bharathi RajuNo ratings yet

- Name: SRN: Company:: Meghna Ashwin Kurunji PES1PG19MB091 Exotalent Consultancy Services LLPDocument8 pagesName: SRN: Company:: Meghna Ashwin Kurunji PES1PG19MB091 Exotalent Consultancy Services LLPBharathi RajuNo ratings yet

- Raspberry Pi Based Solar Street Light: (IEEE-2015)Document4 pagesRaspberry Pi Based Solar Street Light: (IEEE-2015)Bharathi RajuNo ratings yet

- Global Foreign-Exchange Markets: International BusinessDocument20 pagesGlobal Foreign-Exchange Markets: International BusinessBharathi RajuNo ratings yet

- Qwikcilver Corporate Reward SolutionsDocument6 pagesQwikcilver Corporate Reward SolutionsBharathi RajuNo ratings yet

- Sms SynopsisDocument6 pagesSms SynopsisBharathi RajuNo ratings yet

- Chap 9 IBDocument20 pagesChap 9 IBBharathi RajuNo ratings yet

- Question Bank UM19MB602: Introduction To Machine Learning Unit 4: Decision TreeDocument4 pagesQuestion Bank UM19MB602: Introduction To Machine Learning Unit 4: Decision TreeBharathi RajuNo ratings yet

- Python Networking PDFDocument4 pagesPython Networking PDFBharathi RajuNo ratings yet

- Question Bank UM19MB602: Introduction To Machine Learning Unit 3: Classification ProblemsDocument2 pagesQuestion Bank UM19MB602: Introduction To Machine Learning Unit 3: Classification ProblemsBharathi RajuNo ratings yet

- Question Bank UM19MB602: Introduction To Machine Learning Unit 2: Regression MethodsDocument1 pageQuestion Bank UM19MB602: Introduction To Machine Learning Unit 2: Regression MethodsBharathi RajuNo ratings yet

- 6.density Chart 20 - 08 - 20 - Day6Document13 pages6.density Chart 20 - 08 - 20 - Day6Bharathi RajuNo ratings yet

- Proportional Symbol MapDocument5 pagesProportional Symbol MapBharathi RajuNo ratings yet

- Proportional Symbol MapDocument5 pagesProportional Symbol MapBharathi RajuNo ratings yet

- OB Billgates Leadership Final VDocument16 pagesOB Billgates Leadership Final VBharathi RajuNo ratings yet

- 1st Quarter SummativeDocument4 pages1st Quarter SummativeGlychalyn Abecia 23No ratings yet

- FM AssignmentDocument10 pagesFM Assignmentshingirai kasaeraNo ratings yet

- Sun SilkDocument15 pagesSun SilkArjun KapoorNo ratings yet

- SWOT Titan FinalDocument29 pagesSWOT Titan FinalMukesh Manwani100% (1)

- Sale Data Analysis - Group Project Statistics.Document15 pagesSale Data Analysis - Group Project Statistics.Trang CaoNo ratings yet

- Learings-Gagan Singh Mokha: INTRODUCTION: What Is Not Strategy-Day To Day Plans Broad Principles For Governing TheDocument5 pagesLearings-Gagan Singh Mokha: INTRODUCTION: What Is Not Strategy-Day To Day Plans Broad Principles For Governing ThegaganNo ratings yet

- MGH Case Study MTNDocument17 pagesMGH Case Study MTNZeeh MaqandaNo ratings yet

- Questionpaper ALevelPaper3 June2018 - 3Document36 pagesQuestionpaper ALevelPaper3 June2018 - 3evansNo ratings yet

- The Ultimate Affiliate Marketing Cheat SheetDocument11 pagesThe Ultimate Affiliate Marketing Cheat SheetVash Memar0% (1)

- Sumec Textile PresentationDocument42 pagesSumec Textile PresentationmechiniNo ratings yet

- SUMMER TRAINING REPORT KoyalDocument69 pagesSUMMER TRAINING REPORT KoyalNARENDERNo ratings yet

- Jonathan's PresentationDocument9 pagesJonathan's PresentationJonathan AbishekNo ratings yet

- Phifer - Major FinalDocument106 pagesPhifer - Major Finalraj kumarNo ratings yet

- Marketing Interview Questions and Answers Guide.: Global GuidelineDocument30 pagesMarketing Interview Questions and Answers Guide.: Global GuidelineAMITAVA ROYNo ratings yet

- What Is Strategic Audit?: Strategy Implementation Requires A Firm To EstablishDocument3 pagesWhat Is Strategic Audit?: Strategy Implementation Requires A Firm To EstablishDSAW VALERIONo ratings yet

- CHAPTER 1 - The Meaning of Marketing Communications in Travel and Tourism-1Document19 pagesCHAPTER 1 - The Meaning of Marketing Communications in Travel and Tourism-1Haziq AujiNo ratings yet

- Fashion Business PlanDocument12 pagesFashion Business PlanMAVERICK MONROE100% (1)

- Research Paper On Social MediaDocument6 pagesResearch Paper On Social Mediauifjzvrif100% (1)

- Oil Transportation Ltd. Business PlanDocument37 pagesOil Transportation Ltd. Business PlansaraNo ratings yet

- Big BasketDocument10 pagesBig BasketvigneshNo ratings yet

- Marketing For Hospitality and Tourism 7th Edition Kotler Test BankDocument7 pagesMarketing For Hospitality and Tourism 7th Edition Kotler Test Bankkaylayoungfpkgwdbjcz100% (28)

- Man Environment Interaction of Naz BasinDocument28 pagesMan Environment Interaction of Naz BasinTp TpNo ratings yet

- Analisis Strategi Pemasaran Dalam Meningkatkan PenjualanDocument8 pagesAnalisis Strategi Pemasaran Dalam Meningkatkan Penjualanhanahnuza channelNo ratings yet

- Cramble Brew Business PlanDocument34 pagesCramble Brew Business Plan2A, Valencia, Maxene V.No ratings yet

- A. Cases Midterm: Chap 1: Puma Gives The Boot To Cardboard Shoe BoxesDocument17 pagesA. Cases Midterm: Chap 1: Puma Gives The Boot To Cardboard Shoe BoxesVương HườngNo ratings yet

- Retail Store Design: 2. International Case StudyDocument3 pagesRetail Store Design: 2. International Case StudyNisha LamixaneNo ratings yet