Professional Documents

Culture Documents

Rajiv Gandhi Produyogiki Vishwavidhyalaya: Name of The Institute:-Ujjain Polytechnic College

Rajiv Gandhi Produyogiki Vishwavidhyalaya: Name of The Institute:-Ujjain Polytechnic College

Uploaded by

Amit0 ratings0% found this document useful (0 votes)

44 views5 pagesThe document discusses different methods for valuing buildings, including the rental method, direct comparison method, valuation based on profit, valuation based on cost, development method, and depreciation method. It explains that valuation depends on factors like the type, size, and quality of construction of the building as well as the location and land. The various methods calculate valuation based on rental income, sale prices of similar properties, potential profit, construction costs, development costs for dividing land, and depreciation of building components over time.

Original Description:

this ppt tell about valuation

Original Title

VALUATION

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses different methods for valuing buildings, including the rental method, direct comparison method, valuation based on profit, valuation based on cost, development method, and depreciation method. It explains that valuation depends on factors like the type, size, and quality of construction of the building as well as the location and land. The various methods calculate valuation based on rental income, sale prices of similar properties, potential profit, construction costs, development costs for dividing land, and depreciation of building components over time.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

44 views5 pagesRajiv Gandhi Produyogiki Vishwavidhyalaya: Name of The Institute:-Ujjain Polytechnic College

Rajiv Gandhi Produyogiki Vishwavidhyalaya: Name of The Institute:-Ujjain Polytechnic College

Uploaded by

AmitThe document discusses different methods for valuing buildings, including the rental method, direct comparison method, valuation based on profit, valuation based on cost, development method, and depreciation method. It explains that valuation depends on factors like the type, size, and quality of construction of the building as well as the location and land. The various methods calculate valuation based on rental income, sale prices of similar properties, potential profit, construction costs, development costs for dividing land, and depreciation of building components over time.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 5

Rajiv Gandhi Produyogiki Vishwavidhyalaya

Name of the Institute :- Ujjain Polytechnic College

Presented By:- Prof.N.D.Mahajan

Department:- Construction Technology and Management

Quantity Surveying and Costing

Topic to be Covered:- Valuation

Semester : Vth

Branch:- Construction Technology and Management

VALUATION

Valuation of a building depends on the type of the building, its structure and durability,

on the situation, size, shape, frontage, width of roadways, the quality of materials used

in the construction and present-day prices of materials. This also depends on the height

of the building, height of the plinth, thickness of wall, nature of floor, roof, doors,

windows, etc. A building located market area will have higher value than a similar

building in the residential area. Building area having sewer, water supply and electricity

will have increased value. Building on treen will have higher value than building on

leasehold land. The value also depends on the purchase which varies from time to

time.

Method of valuation. The following are the different methods of valuation

(1) Rental method of valuation. In this method, the net income by way of rent is found

out ung all outgoings from the gross rent. A suitable rate of interest as smthe market

is assumed and year's purchase is calculated. This net income multiplied by Y.P.

Gives the capitalized value or valuation of the property.

(2) Direct comparison with the capital value. This method may be adopted when the

rental “value is not available from the property concerned. but there are evidences

of sale price of a whole. In such cases the capitalized value of the property is fixed

by direct comparison with capitalized value of similar property in the locality

(3) Valuation based on profit. - This method of valuation is suitable for buildings like

hotels theatres, etc. for which the capitalized value depends on the profit. In such

cases the net annual income is worked out after deducting from the gross income all

possible working expense outgoings, interest on the capital invested, etc. The net

profit is multiplied by Y.P. to get capitalized value. In such cases the valuation may

work out to be too high in comparison with the cost of construction

(4) Valuation based on cost. -- In this method the actual cost incurred in construction

building or in possessing the property is taken as basis to determine the value of

property. In Sink cases necessary depreciation should be allowed and the points of

obsolescence should also considered

(5) Development method of valuation. This method of valuation is used for the

proper which are in the undeveloped stage or partly developed and partly

undeveloped stage. If a large place of land is required to be divided into plots after

providing for roads, parks, etc., this method or valuation is to be adopted. In such

cases, the probable selling price of the divided plots, the area required for roads,

parks, etc., and other expenditures for development should be known.

(6) Depreciation method of valuation. - According to this method of

valuation the building should be divided into four parts viz. --(i) Walls,

(ii) Roofs, (iii) Floor and (iv) Doors and windows; and the cost of each

parts should first be worked out on the present-day rates by detailed

measurements. The life of each of the four parts should then be

ascertained the depreciated value of each part is ascertained by the

formula D = P (100 - rd)n

100

where D is depreciated value, P is the cost at present market rate and rd

the fixed percentage of depreciation (rate of depreciation, r stands for

rate and d for depreciation) and n the number of years the building had

been constructed.

You might also like

- Valuation Report On Multistory Building-Hritik AwasthyDocument13 pagesValuation Report On Multistory Building-Hritik AwasthyEr Hritik AwasthyNo ratings yet

- Information Sheet, Class-8 Economics: Chapter 5: Microeconomics and MacroeconomicsDocument2 pagesInformation Sheet, Class-8 Economics: Chapter 5: Microeconomics and MacroeconomicsSami Sumon100% (1)

- Dhawal EacDocument13 pagesDhawal EacSoham KumbharNo ratings yet

- Valuation NotesDocument2 pagesValuation NotesveeranjaneyuluNo ratings yet

- Notes For Studies DR - PK Singhai Qty Surveying & Costing CE602 5 Valuation LNCTS, Civil Engg. 6 Semester Civil Diploma 29 MARCH 2020Document8 pagesNotes For Studies DR - PK Singhai Qty Surveying & Costing CE602 5 Valuation LNCTS, Civil Engg. 6 Semester Civil Diploma 29 MARCH 2020SNo ratings yet

- Valuation of Real PropertiesDocument7 pagesValuation of Real PropertiesLavanya LakshmiNo ratings yet

- Definitions of ConstructionDocument11 pagesDefinitions of ConstructionAbisha TeslinNo ratings yet

- L117010812S19Document7 pagesL117010812S19Rohil JulaniyaNo ratings yet

- Valuation PROFESSIONAL PRACTICEDocument15 pagesValuation PROFESSIONAL PRACTICEsanchit guptaNo ratings yet

- Preliminary or Approximate Construction Cost EstimationDocument2 pagesPreliminary or Approximate Construction Cost EstimationHari RNo ratings yet

- Chap 3. Cost ApproachDocument36 pagesChap 3. Cost Approachchewwie3003No ratings yet

- Methods of ValuationDocument19 pagesMethods of ValuationRohit KulkarniNo ratings yet

- Valuation: DepreciationDocument3 pagesValuation: DepreciationsaurabhNo ratings yet

- AR3601-Estimation AssignmentDocument5 pagesAR3601-Estimation Assignmentvijayakumar mNo ratings yet

- EAC ProjectDocument9 pagesEAC ProjectGopal mutkekarNo ratings yet

- Methods of EstimateDocument14 pagesMethods of EstimateRoshan de Silva50% (4)

- Valuation AssignmentDocument9 pagesValuation AssignmentPalvi DeshmukhNo ratings yet

- Types of EstimatesDocument4 pagesTypes of Estimateskisansah145No ratings yet

- Methods of Approximate Construction Cost Estimation PreparationDocument5 pagesMethods of Approximate Construction Cost Estimation PreparationcivilNo ratings yet

- Estimating & TenderingDocument13 pagesEstimating & TenderingRoshan de Silva80% (5)

- CPMworktext Chapter4Document11 pagesCPMworktext Chapter4Rose Anne LabaniegoNo ratings yet

- Contracts and ValuationDocument32 pagesContracts and ValuationdiwakarNo ratings yet

- Methods of Valuation of A BuildingDocument9 pagesMethods of Valuation of A BuildingNanda Kumar100% (1)

- Ppe 1 PDFDocument30 pagesPpe 1 PDFMahendra DewasiNo ratings yet

- Training of Valuers For Specialized PropertiesDocument26 pagesTraining of Valuers For Specialized Propertieservin sasongkoNo ratings yet

- EstimateDocument4 pagesEstimateOgbuka ChibuzoNo ratings yet

- Specification and Estimation: Innovative WorkDocument11 pagesSpecification and Estimation: Innovative WorkSibi NvnNo ratings yet

- Valuation of Building - Methods and Calculation of ValuationDocument27 pagesValuation of Building - Methods and Calculation of ValuationAbhishek AcharyaNo ratings yet

- Valuation RuksarDocument17 pagesValuation RuksarruksarNo ratings yet

- Zeal Polytechnic, Narhe: Micro ProjectDocument17 pagesZeal Polytechnic, Narhe: Micro ProjectOmkar DeshpandeNo ratings yet

- Principles and Techniques of Cost EstiatingDocument8 pagesPrinciples and Techniques of Cost EstiatingNick BelieberNo ratings yet

- Cost ApproachDocument43 pagesCost ApproachMarites BalmasNo ratings yet

- Lecture 9-Cost or Contractor MethodDocument9 pagesLecture 9-Cost or Contractor MethodMuhammad Faiz Akmal SabarinNo ratings yet

- Material Break DawnDocument19 pagesMaterial Break DawnYihun abrahamNo ratings yet

- Lecture 7 Estimates CIE 332 - 2021Document33 pagesLecture 7 Estimates CIE 332 - 2021Perpetual hubbyNo ratings yet

- Estimating and Cost Engineering Unit - IDocument69 pagesEstimating and Cost Engineering Unit - IVennela ReddyNo ratings yet

- Project EstimationDocument15 pagesProject Estimationsahul hameedNo ratings yet

- Residual Appraisals P10489Document24 pagesResidual Appraisals P10489ElaineNo ratings yet

- Review Paper On Building ValuvationDocument6 pagesReview Paper On Building Valuvationdivya rNo ratings yet

- Report in Development ValuationDocument17 pagesReport in Development ValuationRhea RepajaNo ratings yet

- Report On ValuationDocument10 pagesReport On ValuationGovindNo ratings yet

- ESTIMATING Copy2Document6 pagesESTIMATING Copy2Shem HaElohim EjemNo ratings yet

- 1 Estimate of Building TheoryDocument61 pages1 Estimate of Building TheoryShaheryar AhmadNo ratings yet

- Rev151 Topic 2 (A) - Cost Approach (A)Document20 pagesRev151 Topic 2 (A) - Cost Approach (A)khaihafiz14No ratings yet

- Tendering For Construction Works - 1Document22 pagesTendering For Construction Works - 1Dunapo CompanionNo ratings yet

- Professional Practice: Topic: ValuationDocument7 pagesProfessional Practice: Topic: ValuationManpreet KaurNo ratings yet

- Valuation NoteDocument11 pagesValuation Noteयुबराज 'याक्खा'No ratings yet

- Approximate Chap 5Document14 pagesApproximate Chap 5Risselle Bayore EdullantesNo ratings yet

- Quantity Surveying and EstimationDocument8 pagesQuantity Surveying and EstimationHrishikesh GadhaveNo ratings yet

- Estimating and CostingDocument67 pagesEstimating and Costinga_j_sanyal259100% (1)

- Lecture Notes no. 1 Construction Estimation For Civil Engineering ةدﺎﻣ تاﺮﺿﺎﺤﻣ ﺔﻴﻧﺪﻤﻟا ﺔﺳﺪﻨﻬﻟا ﻲﻓ ﺔﻌﺑاﺮﻟا ﺔﻨﺴﻠﻟ ﻲﺋﺎﺸﻧﻻا ﻦﻴﻤﺨﺘﻟاDocument14 pagesLecture Notes no. 1 Construction Estimation For Civil Engineering ةدﺎﻣ تاﺮﺿﺎﺤﻣ ﺔﻴﻧﺪﻤﻟا ﺔﺳﺪﻨﻬﻟا ﻲﻓ ﺔﻌﺑاﺮﻟا ﺔﻨﺴﻠﻟ ﻲﺋﺎﺸﻧﻻا ﻦﻴﻤﺨﺘﻟاJalil TahirNo ratings yet

- Types of Cost E-WPS OfficeDocument4 pagesTypes of Cost E-WPS OfficeMadushani NilakshikaNo ratings yet

- Residual Land Valuation MethodDocument7 pagesResidual Land Valuation Methodrajeshjadhav89100% (1)

- Principles of Property ValuationDocument8 pagesPrinciples of Property ValuationcivilsadiqNo ratings yet

- The DemandDocument20 pagesThe DemandFiraol NigussieNo ratings yet

- Valuation BarchDocument29 pagesValuation BarchNymisa RavuriNo ratings yet

- Eco Final ExamDocument6 pagesEco Final ExamZeiti AtikahNo ratings yet

- Construction Estimates (2016)Document6 pagesConstruction Estimates (2016)Lester LazoNo ratings yet

- Business Project Investment: Risk Assessment & Decision MakingFrom EverandBusiness Project Investment: Risk Assessment & Decision MakingNo ratings yet

- Sharegenius SIPDocument1,401 pagesSharegenius SIPAmitNo ratings yet

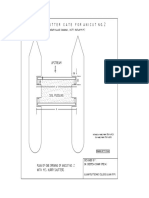

- M.S. Kurry Shutter Gate For Anicut No.2: Front Elevation Side ElevationDocument1 pageM.S. Kurry Shutter Gate For Anicut No.2: Front Elevation Side ElevationAmitNo ratings yet

- Kitchen Bedroom 9'X9'6" 12'6"X9'Document1 pageKitchen Bedroom 9'X9'6" 12'6"X9'AmitNo ratings yet

- M.S. Kurry Shutter Gate For Anicut No.2: UpstreamDocument1 pageM.S. Kurry Shutter Gate For Anicut No.2: UpstreamAmitNo ratings yet

- DJ SIRji-ModelDocument1 pageDJ SIRji-ModelAmitNo ratings yet

- Same As Plan Same As Plan Same As Plan: STORE ROOM 7'2"X4'Document1 pageSame As Plan Same As Plan Same As Plan: STORE ROOM 7'2"X4'AmitNo ratings yet

- Quantity Surveying and CostingDocument5 pagesQuantity Surveying and CostingAmit0% (1)

- Same As Plan Same As Plan Same As Plan: STORE ROOM 7'2"X4'Document1 pageSame As Plan Same As Plan Same As Plan: STORE ROOM 7'2"X4'AmitNo ratings yet

- Same As Plan Same As Plan Same As Plan: Kitchen 7'8"x9'8"Document1 pageSame As Plan Same As Plan Same As Plan: Kitchen 7'8"x9'8"AmitNo ratings yet

- Rajiv Gandhi Produyogiki VishwavidhyalayaDocument2 pagesRajiv Gandhi Produyogiki VishwavidhyalayaAmitNo ratings yet

- Lec16 PDFDocument19 pagesLec16 PDFAmitNo ratings yet

- CIVILBookDocument2 pagesCIVILBookAmitNo ratings yet

- Earthwork:-: Deduction For Opening, Bearings Etc, in MasonaryDocument4 pagesEarthwork:-: Deduction For Opening, Bearings Etc, in MasonaryAmitNo ratings yet

- Lec 15Document22 pagesLec 15AmitNo ratings yet

- Lec 13Document17 pagesLec 13AmitNo ratings yet

- Project Planning & Control Prof. Koshy Varghese Department of Civil Engineering Indian Institute of Technology, MadrasDocument10 pagesProject Planning & Control Prof. Koshy Varghese Department of Civil Engineering Indian Institute of Technology, MadrasAmitNo ratings yet

- Lec 11Document10 pagesLec 11AmitNo ratings yet

- Lec 14Document17 pagesLec 14AmitNo ratings yet

- Lec 10Document11 pagesLec 10AmitNo ratings yet

- Lec 12Document25 pagesLec 12AmitNo ratings yet

- CIPS L4M2 Defining Business NeedDocument11 pagesCIPS L4M2 Defining Business NeedMohamed Elsir100% (1)

- Note - If Using An Existing PNR, Do The Following Prior To Storing Your PriceDocument2 pagesNote - If Using An Existing PNR, Do The Following Prior To Storing Your PriceSusan Hegarty100% (1)

- Usha Martin: Competitive Advantage Through Vertical IntegrationDocument9 pagesUsha Martin: Competitive Advantage Through Vertical IntegrationsafwanhossainNo ratings yet

- Free Trading System RulesDocument10 pagesFree Trading System RulesJoe DNo ratings yet

- Sba Conclusion SamplesDocument4 pagesSba Conclusion SamplesPincianna WilliamsNo ratings yet

- Starbucks FinalDocument2 pagesStarbucks FinalPritam BhowmickNo ratings yet

- Assign 3Document1 pageAssign 3Acua RioNo ratings yet

- Drowling Mountain ResortDocument6 pagesDrowling Mountain ResortrsriramtceNo ratings yet

- Marketing Mix 4psDocument7 pagesMarketing Mix 4psJhanela MalateNo ratings yet

- EGB Review Sheet First Exam On TradeDocument2 pagesEGB Review Sheet First Exam On TradeErinNo ratings yet

- Group 6 PROSALEDocument5 pagesGroup 6 PROSALENisa GonzalesNo ratings yet

- Equity Valuation QuestionsDocument9 pagesEquity Valuation Questionssairaj bhatkarNo ratings yet

- Can I Price Options in My Head?: Clive Bastow, CFA, CAIADocument10 pagesCan I Price Options in My Head?: Clive Bastow, CFA, CAIAsadan gopanNo ratings yet

- Chapter Five: Cost EstimationDocument9 pagesChapter Five: Cost EstimationKindu MunaNo ratings yet

- Econs Tutorial - Q Chapter 5Document3 pagesEcons Tutorial - Q Chapter 5Deandra EricNo ratings yet

- PPE and BORROWING COSTDocument21 pagesPPE and BORROWING COSTmeemisuNo ratings yet

- DCF Simple Exercises1Document12 pagesDCF Simple Exercises1Lauren JamesNo ratings yet

- Assignment 5Document2 pagesAssignment 5Esther LiuNo ratings yet

- Report On Financial ModellingDocument5 pagesReport On Financial ModellingSourabh Singh100% (1)

- Economics Chapter 9 & 10 SummaryDocument15 pagesEconomics Chapter 9 & 10 SummaryAlex HdzNo ratings yet

- 1-Price Elasticity of DemandDocument51 pages1-Price Elasticity of DemandMOHIT SIGIRISETTYNo ratings yet

- Be - Tutorial 5 - Stu 2Document16 pagesBe - Tutorial 5 - Stu 2Gia LinhNo ratings yet

- AndersonmiquelawrittenreportprojectstockvaluationDocument4 pagesAndersonmiquelawrittenreportprojectstockvaluationapi-631992517No ratings yet

- Bodie Essentials of Investments 12e Chapter 09 PPT AccessibleDocument33 pagesBodie Essentials of Investments 12e Chapter 09 PPT AccessibleEdna DelantarNo ratings yet

- June 2016 QP - Paper 1 Edexcel (A) Economics AS-levelDocument24 pagesJune 2016 QP - Paper 1 Edexcel (A) Economics AS-levelMarik IsaacsNo ratings yet

- Air Deccan CaseDocument7 pagesAir Deccan CasePrakash VadavadagiNo ratings yet

- CO - CON2 - JPN - Revaluation at Actual Activity PriceDocument15 pagesCO - CON2 - JPN - Revaluation at Actual Activity PricenguyencaohuyNo ratings yet

- Oxford IB Diploma Programme IB Economics Course Book (JOCELYN. DORTON BLINK (IAN.), Ian Dorton)Document601 pagesOxford IB Diploma Programme IB Economics Course Book (JOCELYN. DORTON BLINK (IAN.), Ian Dorton)sophieperervinNo ratings yet

- London Philatelist:: An Official ContrastDocument24 pagesLondon Philatelist:: An Official ContrastVIORELNo ratings yet