Professional Documents

Culture Documents

HOUSING MARKET SURVEY - Sneha (1IE18AT030)

HOUSING MARKET SURVEY - Sneha (1IE18AT030)

Uploaded by

SNEHA DEVARAJUCopyright:

Available Formats

You might also like

- Market Report Home Appliances Industry in India (2023 - 2028)Document28 pagesMarket Report Home Appliances Industry in India (2023 - 2028)sameer tajneNo ratings yet

- Egypt Green Building Market Intelligence EXPORTDocument12 pagesEgypt Green Building Market Intelligence EXPORTMohamed El ZayatNo ratings yet

- Tiger Global - Draft of New Yorker Story Doing The Rounds in NYCDocument9 pagesTiger Global - Draft of New Yorker Story Doing The Rounds in NYCdeepanshu12No ratings yet

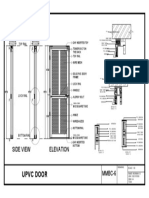

- Upvc Door: Side View ElevationDocument1 pageUpvc Door: Side View ElevationSNEHA DEVARAJU100% (1)

- Wooden Sliding Folding Door: MMBC-6Document1 pageWooden Sliding Folding Door: MMBC-6SNEHA DEVARAJU100% (2)

- Wooden Sliding Folding Door: MMBC-6Document1 pageWooden Sliding Folding Door: MMBC-6SNEHA DEVARAJU100% (1)

- Ambit - Real EstateDocument119 pagesAmbit - Real EstateKrishna ChennaiNo ratings yet

- 7 P's of Insurance IndustryDocument13 pages7 P's of Insurance IndustryFazlur RahmanNo ratings yet

- HOUSING MARKET SURVEY - Sneha (1IE18AT030)Document1 pageHOUSING MARKET SURVEY - Sneha (1IE18AT030)SNEHA DEVARAJUNo ratings yet

- Insite: Mumbai Residential Market UpdateDocument14 pagesInsite: Mumbai Residential Market UpdateDivyesh BhayaniNo ratings yet

- India Pune Residential Q1 2019Document2 pagesIndia Pune Residential Q1 2019Viren BhuptaniNo ratings yet

- Hyderabad Real Estateddddd Report Jan Mar 2022Document8 pagesHyderabad Real Estateddddd Report Jan Mar 2022sreenivassn00No ratings yet

- PuneDocument2 pagesPuneJimmy JonesNo ratings yet

- KEC K-Blitz IIMKozhikodeDocument12 pagesKEC K-Blitz IIMKozhikodeMegha BepariNo ratings yet

- Real Estate Market Outlook: CambodiaDocument23 pagesReal Estate Market Outlook: CambodiaJay YuanNo ratings yet

- Cairo: The Real Estate MarketDocument5 pagesCairo: The Real Estate MarketGamal SalemNo ratings yet

- CB Richard Ellis Report - India Office Market View - q3, 2010 - FinalDocument12 pagesCB Richard Ellis Report - India Office Market View - q3, 2010 - FinalMayank19mNo ratings yet

- India Delhi NCR Residential Q1 2021Document2 pagesIndia Delhi NCR Residential Q1 2021Ramkrishnan MuduliNo ratings yet

- Nairobi Metropolitan Area Residential Report 2023 Full ReportDocument30 pagesNairobi Metropolitan Area Residential Report 2023 Full Reportj.mcleanjackNo ratings yet

- India Mumbai Residential Q1 2021 v2Document2 pagesIndia Mumbai Residential Q1 2021 v2San JayNo ratings yet

- Colliers Iloilo H1 2021 ResidentialDocument4 pagesColliers Iloilo H1 2021 ResidentialKrisha Mae MarconNo ratings yet

- Condominium Rates Hold Steady Amidst Spike in Supply: Phnom Penh, Q4 2018Document6 pagesCondominium Rates Hold Steady Amidst Spike in Supply: Phnom Penh, Q4 2018Jay YuanNo ratings yet

- HIA Land Monitor Report 2018Document28 pagesHIA Land Monitor Report 2018Toby VueNo ratings yet

- Resilience of Hyderabad Residential Market During COVID-19Document5 pagesResilience of Hyderabad Residential Market During COVID-19Celestine DcruzNo ratings yet

- Real Estate: December 2016 December 2016Document46 pagesReal Estate: December 2016 December 2016Sahil Gupta0% (1)

- PuneDocument5 pagesPuneadvisor.housegptNo ratings yet

- Collier QuarterlyDocument7 pagesCollier QuarterlysitiNo ratings yet

- Q1 2024 Market in Review Dubai Real Estate 1715673397Document28 pagesQ1 2024 Market in Review Dubai Real Estate 1715673397znakkashNo ratings yet

- Past & Future of Real Estate in IndiaDocument21 pagesPast & Future of Real Estate in IndiaKetan BhingardeNo ratings yet

- Stockifi - Prestige Estates Projects - ICDocument16 pagesStockifi - Prestige Estates Projects - ICsudhansumail102No ratings yet

- January - June 2019 - Status of The Built Environment PDFDocument11 pagesJanuary - June 2019 - Status of The Built Environment PDFMichael LangatNo ratings yet

- Colliers Q4 2019 Metro Manila Residential CondoDocument4 pagesColliers Q4 2019 Metro Manila Residential CondoChristian OcampoNo ratings yet

- Real Estate Sector: Residential - The Cycle Has Turned Office - Cyclical Upswing Continues Post CovidDocument7 pagesReal Estate Sector: Residential - The Cycle Has Turned Office - Cyclical Upswing Continues Post Covidpal kitNo ratings yet

- Indian Real Estate Sector and Funding Options For DevelopersDocument53 pagesIndian Real Estate Sector and Funding Options For Developersshwetank daveNo ratings yet

- Mapping Consumer GenomeDocument10 pagesMapping Consumer Genomeapi-26164262No ratings yet

- India Chennai Residential Q1 2021Document2 pagesIndia Chennai Residential Q1 2021Ayshwarya AyshuNo ratings yet

- Real Estate March 2017Document46 pagesReal Estate March 2017Anonymous P1dMzVxNo ratings yet

- Namrata Kushwaha 221510000681 Industry CellDocument6 pagesNamrata Kushwaha 221510000681 Industry Cellhallid25No ratings yet

- Integrated Smart City Framework PlanDocument16 pagesIntegrated Smart City Framework PlanSansriti VardhanNo ratings yet

- Colliers Quarterly Manila Q4 2018 ResidentialDocument5 pagesColliers Quarterly Manila Q4 2018 ResidentialLemuel Bryan Gonzales DenteNo ratings yet

- Real Insight Residential July September q3 2021 Proptiger Research NEXUCi6Document51 pagesReal Insight Residential July September q3 2021 Proptiger Research NEXUCi6YoxajaNo ratings yet

- JLLM Report The Transforming Landscape of Indian Warehousing 1Document11 pagesJLLM Report The Transforming Landscape of Indian Warehousing 1Anjum Karmali100% (1)

- Colliers Pampanga 2021 Residential JB Edits BO EditsDocument4 pagesColliers Pampanga 2021 Residential JB Edits BO EditsRoselyn Molina SorianoNo ratings yet

- Colliers India Global Capability Center Report Feb 2024Document11 pagesColliers India Global Capability Center Report Feb 2024Bitan SahaNo ratings yet

- KnightFrank - India Real Estate H2 2020Document150 pagesKnightFrank - India Real Estate H2 2020Swanand KulkarniNo ratings yet

- High Growth in Gross Absorption: Summary & RecommendationsDocument4 pagesHigh Growth in Gross Absorption: Summary & RecommendationsbiswasjpNo ratings yet

- Real Estate IBEF PresentationDocument31 pagesReal Estate IBEF PresentationGurava MaruriNo ratings yet

- Affordable Housing in India 24072012Document20 pagesAffordable Housing in India 24072012Arjun GunasekaranNo ratings yet

- Square YardsDocument14 pagesSquare YardsSanjeev KasaniNo ratings yet

- Colliers Bulacan 2021 Residential JB 03172022 BO EditsDocument4 pagesColliers Bulacan 2021 Residential JB 03172022 BO Edits100forplatesNo ratings yet

- IIM Calcutta - Priceless BrainsDocument15 pagesIIM Calcutta - Priceless BrainsASDASNo ratings yet

- The Four Horsemen - ShubhamDocument14 pagesThe Four Horsemen - ShubhamAnonymous PVFheu0QvNo ratings yet

- Indianapolis - Retail - 4/1/2008Document4 pagesIndianapolis - Retail - 4/1/2008Russell Klusas100% (1)

- 01 - Foo Gee JenDocument14 pages01 - Foo Gee JenHafiz FadzilNo ratings yet

- Sunteck Realty LTD.: Rachana V HingarajiaDocument4 pagesSunteck Realty LTD.: Rachana V HingarajiaJagannath DNo ratings yet

- Bangkok Property Market Snapshot 2Q2023Document2 pagesBangkok Property Market Snapshot 2Q2023alexm.linkedNo ratings yet

- Anarock Research 1663675132Document11 pagesAnarock Research 1663675132Anusha ShanmugamNo ratings yet

- Residential Traction at GlanceDocument6 pagesResidential Traction at GlanceVASUNo ratings yet

- Visit Note: Ansal Properties and Infrastructure Limited (APIL)Document5 pagesVisit Note: Ansal Properties and Infrastructure Limited (APIL)royrakeshNo ratings yet

- Urban Housing - Class 1Document46 pagesUrban Housing - Class 1Muhammad ArshathNo ratings yet

- BSE Forum ViewsDocument3 pagesBSE Forum ViewsPrashant PatilNo ratings yet

- Just Read - How Govt. Capital Expenditure Is Driving GrowthDocument1 pageJust Read - How Govt. Capital Expenditure Is Driving GrowthShubham TiwariNo ratings yet

- Real Estate May 2020Document46 pagesReal Estate May 2020ravenraven0000No ratings yet

- A New Dawn for Global Value Chain Participation in the PhilippinesFrom EverandA New Dawn for Global Value Chain Participation in the PhilippinesNo ratings yet

- Aavarna 2Document13 pagesAavarna 2SNEHA DEVARAJU100% (1)

- Article 33856Document12 pagesArticle 33856SNEHA DEVARAJUNo ratings yet

- 34 TH Surajkund International Crafts Mela - 2020Document1 page34 TH Surajkund International Crafts Mela - 2020SNEHA DEVARAJUNo ratings yet

- Good City Form-Kevin Lynch: Topic: SenseDocument9 pagesGood City Form-Kevin Lynch: Topic: SenseSNEHA DEVARAJUNo ratings yet

- Pragati MaidanDocument3 pagesPragati MaidanSNEHA DEVARAJUNo ratings yet

- MMBC Portfolio-WsDocument1 pageMMBC Portfolio-WsSNEHA DEVARAJUNo ratings yet

- Literature Study: Business HotelDocument56 pagesLiterature Study: Business HotelSNEHA DEVARAJUNo ratings yet

- MMBC Portfolio-UwDocument1 pageMMBC Portfolio-UwSNEHA DEVARAJUNo ratings yet

- Case Study Dayananda Sagar Dental CollegeDocument21 pagesCase Study Dayananda Sagar Dental CollegeSNEHA DEVARAJUNo ratings yet

- HOUSING MARKET SURVEY - Sneha (1IE18AT030)Document1 pageHOUSING MARKET SURVEY - Sneha (1IE18AT030)SNEHA DEVARAJUNo ratings yet

- MMBC Glass Group 3Document16 pagesMMBC Glass Group 3SNEHA DEVARAJUNo ratings yet

- Practical Strategies: HotelsDocument15 pagesPractical Strategies: HotelsSNEHA DEVARAJUNo ratings yet

- Communities: Module 2 - SESSION 3 Faculty: Ar Mahiima J DATE: 30 - 08-19Document21 pagesCommunities: Module 2 - SESSION 3 Faculty: Ar Mahiima J DATE: 30 - 08-19SNEHA DEVARAJUNo ratings yet

- History of Architecture: BY, Rajab Sharique Sneha Shreya Vaibhavi Yadhu YashaswiniDocument13 pagesHistory of Architecture: BY, Rajab Sharique Sneha Shreya Vaibhavi Yadhu YashaswiniSNEHA DEVARAJUNo ratings yet

- Detailed Design Program (Area Statements and Requirements) - Ad5Document1 pageDetailed Design Program (Area Statements and Requirements) - Ad5SNEHA DEVARAJUNo ratings yet

- The Mysore Palace: An Architectural OverviewDocument40 pagesThe Mysore Palace: An Architectural OverviewSNEHA DEVARAJU100% (1)

- Qutb Complex: Sneha Devaraj USN-1IE18AT030 9/11/2020Document12 pagesQutb Complex: Sneha Devaraj USN-1IE18AT030 9/11/2020SNEHA DEVARAJUNo ratings yet

- Griha Griha: Sneha Devaraju Architectural Design Architectural Design Sneha DevarajuDocument5 pagesGriha Griha: Sneha Devaraju Architectural Design Architectural Design Sneha DevarajuSNEHA DEVARAJUNo ratings yet

- Study On BUSINESS HOTEL - SnehaDocument20 pagesStudy On BUSINESS HOTEL - SnehaSNEHA DEVARAJUNo ratings yet

- Electricity Generation ProcessDocument26 pagesElectricity Generation ProcessSNEHA DEVARAJUNo ratings yet

- Solar Passive DesignDocument3 pagesSolar Passive DesignSNEHA DEVARAJU0% (1)

- Illustration Qc0n50rclvfw0Document2 pagesIllustration Qc0n50rclvfw0Sumitt SinghNo ratings yet

- Quality Control & Measuremnet BookDocument23 pagesQuality Control & Measuremnet BookLohith GowdaNo ratings yet

- Queueing Theory and Operations ManagementDocument11 pagesQueueing Theory and Operations ManagementMarthandeNo ratings yet

- MC 2023 02 NpoDocument12 pagesMC 2023 02 Npokat perezNo ratings yet

- Wallstreetjournal 20160329 The Wall Street JournalDocument42 pagesWallstreetjournal 20160329 The Wall Street JournalstefanoNo ratings yet

- .Archivetempenglish5 Q1 LP-1Document7 pages.Archivetempenglish5 Q1 LP-1Niko Hakeem TubaleNo ratings yet

- M. Mudassar (Fa19-Baf-067) Sri LankaDocument10 pagesM. Mudassar (Fa19-Baf-067) Sri LankaMudassar Gul Bin AshrafNo ratings yet

- PgasDocument3 pagesPgasMateriNo ratings yet

- End Term Presentation: Robotics in Garment ManufacturingDocument26 pagesEnd Term Presentation: Robotics in Garment ManufacturingAkriti SinghNo ratings yet

- Cathay PacificDocument15 pagesCathay PacificClarisse GonzalesNo ratings yet

- Relationship Between Inflation and Stock Prices in ThailandDocument6 pagesRelationship Between Inflation and Stock Prices in ThailandEzekiel WilliamNo ratings yet

- Factsheet 210129 27 IdxenergyDocument1 pageFactsheet 210129 27 IdxenergyNeedlaregNo ratings yet

- Essential Drugs Frameworkagreementtender PDFDocument81 pagesEssential Drugs Frameworkagreementtender PDFIntegrated user03No ratings yet

- CBSE Class 10 History Notes Chapter 3 - The Making of A Global WorldDocument8 pagesCBSE Class 10 History Notes Chapter 3 - The Making of A Global WorldGitika DasNo ratings yet

- Foundations of Financial Management: Spreadsheet TemplatesDocument7 pagesFoundations of Financial Management: Spreadsheet Templatesalaa_h1100% (1)

- Lisa Peattie Two PuzzlesDocument6 pagesLisa Peattie Two Puzzlesna22b020No ratings yet

- Accounting For Partnerships: Basic Considerations and FormationDocument22 pagesAccounting For Partnerships: Basic Considerations and FormationAj CapungganNo ratings yet

- CB Insights - Fintech Report Q3 2021Document236 pagesCB Insights - Fintech Report Q3 2021Seba CabezasNo ratings yet

- Company Profile of ShreeSatya GroupDocument4 pagesCompany Profile of ShreeSatya GroupRohan HajelaNo ratings yet

- 05 Activity 1 BALADocument3 pages05 Activity 1 BALAPola PolzNo ratings yet

- COURSE PLAN - BBA3 - Indian EconomyDocument16 pagesCOURSE PLAN - BBA3 - Indian EconomypriyankaNo ratings yet

- Letter To Mr. FairbairnDocument5 pagesLetter To Mr. FairbairnCalgary HeraldNo ratings yet

- Cash Receipt Template 3 WordDocument1 pageCash Receipt Template 3 WordSaqlain MalikNo ratings yet

- Anup Engineering - NanoNivesh - ICICI DirectDocument8 pagesAnup Engineering - NanoNivesh - ICICI DirectAmit SharmaNo ratings yet

- Income Tax RefundDocument3 pagesIncome Tax RefundAKHiiLESH BhamaNo ratings yet

- A Study On The Role and Importance of Treasury Management SystemDocument6 pagesA Study On The Role and Importance of Treasury Management SystemPAVAN KumarNo ratings yet

- Perfect Practice SolutionDocument41 pagesPerfect Practice Solutionnarutevarsha5No ratings yet

- AP Voucher List: Palembang City Sewerage - Jakarta IndonesiaDocument6 pagesAP Voucher List: Palembang City Sewerage - Jakarta IndonesiaIhsan HbbNo ratings yet

HOUSING MARKET SURVEY - Sneha (1IE18AT030)

HOUSING MARKET SURVEY - Sneha (1IE18AT030)

Uploaded by

SNEHA DEVARAJUOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HOUSING MARKET SURVEY - Sneha (1IE18AT030)

HOUSING MARKET SURVEY - Sneha (1IE18AT030)

Uploaded by

SNEHA DEVARAJUCopyright:

Available Formats

PUNE RESIDENTIAL MARKET

ANALYSIS * Graph depicts demand and supply of

residential inventory across budget

segments in top eight metro cities in the

studied quarter

BUDGET-WISE

DEMAND SUPPLY

City wise growth Capital Rental

DEMAND & SUPPLY

Across the country, most of the markets have exhibited similar

trends, except Pune. Pune is emerging as one of the most sought

DYNAMICS

after investment destinations, driven by the IT/ITES hub in Hinjewadi

and automotive industry belt in Chakan. 31% of unit sales in Pune

this quarter are intended for investment, while in other cities, Baner Wagholi Hinjewadi Undri Hadapsar Kharadi Waked Pimple Kothrud Bavdhan

investments are in the range of 22-25%.

Saudagar

Over view

•Pune witnessed about 40 percent dip in the residential enquiries, QoQ.

Close to 1,800 units were sold in Apr-Jun 2020 as against 5,000

properties in Jan-Mar 2020.

•While yearly rentals grew by four percent, average ‘asks’ did not post

any hike amid the distressed sentiment.

•Bavdhan, Hinjewadi, Balewadi and Kharadi Annexe remained popular

amid homebuyers for configurations priced within Rs 45-65 lakh.

•A mere 16 new projects were launched in this quarter, denoting a 65

percent fall, QoQ. While technologically equipped and financially well-

placed Grade A developers leveraged the digital platforms, Grade B and

C developers took a backseat.

Demand Supply

•Unsold residential stock in Pune remained unchanged at 96,000 units

as construction-linked challenges kept the sceptical buyers at bay. NAME:SNEHA DEVARAJU

USN:1IE18AT030

SUBJECT:SOCIOLOGY

You might also like

- Market Report Home Appliances Industry in India (2023 - 2028)Document28 pagesMarket Report Home Appliances Industry in India (2023 - 2028)sameer tajneNo ratings yet

- Egypt Green Building Market Intelligence EXPORTDocument12 pagesEgypt Green Building Market Intelligence EXPORTMohamed El ZayatNo ratings yet

- Tiger Global - Draft of New Yorker Story Doing The Rounds in NYCDocument9 pagesTiger Global - Draft of New Yorker Story Doing The Rounds in NYCdeepanshu12No ratings yet

- Upvc Door: Side View ElevationDocument1 pageUpvc Door: Side View ElevationSNEHA DEVARAJU100% (1)

- Wooden Sliding Folding Door: MMBC-6Document1 pageWooden Sliding Folding Door: MMBC-6SNEHA DEVARAJU100% (2)

- Wooden Sliding Folding Door: MMBC-6Document1 pageWooden Sliding Folding Door: MMBC-6SNEHA DEVARAJU100% (1)

- Ambit - Real EstateDocument119 pagesAmbit - Real EstateKrishna ChennaiNo ratings yet

- 7 P's of Insurance IndustryDocument13 pages7 P's of Insurance IndustryFazlur RahmanNo ratings yet

- HOUSING MARKET SURVEY - Sneha (1IE18AT030)Document1 pageHOUSING MARKET SURVEY - Sneha (1IE18AT030)SNEHA DEVARAJUNo ratings yet

- Insite: Mumbai Residential Market UpdateDocument14 pagesInsite: Mumbai Residential Market UpdateDivyesh BhayaniNo ratings yet

- India Pune Residential Q1 2019Document2 pagesIndia Pune Residential Q1 2019Viren BhuptaniNo ratings yet

- Hyderabad Real Estateddddd Report Jan Mar 2022Document8 pagesHyderabad Real Estateddddd Report Jan Mar 2022sreenivassn00No ratings yet

- PuneDocument2 pagesPuneJimmy JonesNo ratings yet

- KEC K-Blitz IIMKozhikodeDocument12 pagesKEC K-Blitz IIMKozhikodeMegha BepariNo ratings yet

- Real Estate Market Outlook: CambodiaDocument23 pagesReal Estate Market Outlook: CambodiaJay YuanNo ratings yet

- Cairo: The Real Estate MarketDocument5 pagesCairo: The Real Estate MarketGamal SalemNo ratings yet

- CB Richard Ellis Report - India Office Market View - q3, 2010 - FinalDocument12 pagesCB Richard Ellis Report - India Office Market View - q3, 2010 - FinalMayank19mNo ratings yet

- India Delhi NCR Residential Q1 2021Document2 pagesIndia Delhi NCR Residential Q1 2021Ramkrishnan MuduliNo ratings yet

- Nairobi Metropolitan Area Residential Report 2023 Full ReportDocument30 pagesNairobi Metropolitan Area Residential Report 2023 Full Reportj.mcleanjackNo ratings yet

- India Mumbai Residential Q1 2021 v2Document2 pagesIndia Mumbai Residential Q1 2021 v2San JayNo ratings yet

- Colliers Iloilo H1 2021 ResidentialDocument4 pagesColliers Iloilo H1 2021 ResidentialKrisha Mae MarconNo ratings yet

- Condominium Rates Hold Steady Amidst Spike in Supply: Phnom Penh, Q4 2018Document6 pagesCondominium Rates Hold Steady Amidst Spike in Supply: Phnom Penh, Q4 2018Jay YuanNo ratings yet

- HIA Land Monitor Report 2018Document28 pagesHIA Land Monitor Report 2018Toby VueNo ratings yet

- Resilience of Hyderabad Residential Market During COVID-19Document5 pagesResilience of Hyderabad Residential Market During COVID-19Celestine DcruzNo ratings yet

- Real Estate: December 2016 December 2016Document46 pagesReal Estate: December 2016 December 2016Sahil Gupta0% (1)

- PuneDocument5 pagesPuneadvisor.housegptNo ratings yet

- Collier QuarterlyDocument7 pagesCollier QuarterlysitiNo ratings yet

- Q1 2024 Market in Review Dubai Real Estate 1715673397Document28 pagesQ1 2024 Market in Review Dubai Real Estate 1715673397znakkashNo ratings yet

- Past & Future of Real Estate in IndiaDocument21 pagesPast & Future of Real Estate in IndiaKetan BhingardeNo ratings yet

- Stockifi - Prestige Estates Projects - ICDocument16 pagesStockifi - Prestige Estates Projects - ICsudhansumail102No ratings yet

- January - June 2019 - Status of The Built Environment PDFDocument11 pagesJanuary - June 2019 - Status of The Built Environment PDFMichael LangatNo ratings yet

- Colliers Q4 2019 Metro Manila Residential CondoDocument4 pagesColliers Q4 2019 Metro Manila Residential CondoChristian OcampoNo ratings yet

- Real Estate Sector: Residential - The Cycle Has Turned Office - Cyclical Upswing Continues Post CovidDocument7 pagesReal Estate Sector: Residential - The Cycle Has Turned Office - Cyclical Upswing Continues Post Covidpal kitNo ratings yet

- Indian Real Estate Sector and Funding Options For DevelopersDocument53 pagesIndian Real Estate Sector and Funding Options For Developersshwetank daveNo ratings yet

- Mapping Consumer GenomeDocument10 pagesMapping Consumer Genomeapi-26164262No ratings yet

- India Chennai Residential Q1 2021Document2 pagesIndia Chennai Residential Q1 2021Ayshwarya AyshuNo ratings yet

- Real Estate March 2017Document46 pagesReal Estate March 2017Anonymous P1dMzVxNo ratings yet

- Namrata Kushwaha 221510000681 Industry CellDocument6 pagesNamrata Kushwaha 221510000681 Industry Cellhallid25No ratings yet

- Integrated Smart City Framework PlanDocument16 pagesIntegrated Smart City Framework PlanSansriti VardhanNo ratings yet

- Colliers Quarterly Manila Q4 2018 ResidentialDocument5 pagesColliers Quarterly Manila Q4 2018 ResidentialLemuel Bryan Gonzales DenteNo ratings yet

- Real Insight Residential July September q3 2021 Proptiger Research NEXUCi6Document51 pagesReal Insight Residential July September q3 2021 Proptiger Research NEXUCi6YoxajaNo ratings yet

- JLLM Report The Transforming Landscape of Indian Warehousing 1Document11 pagesJLLM Report The Transforming Landscape of Indian Warehousing 1Anjum Karmali100% (1)

- Colliers Pampanga 2021 Residential JB Edits BO EditsDocument4 pagesColliers Pampanga 2021 Residential JB Edits BO EditsRoselyn Molina SorianoNo ratings yet

- Colliers India Global Capability Center Report Feb 2024Document11 pagesColliers India Global Capability Center Report Feb 2024Bitan SahaNo ratings yet

- KnightFrank - India Real Estate H2 2020Document150 pagesKnightFrank - India Real Estate H2 2020Swanand KulkarniNo ratings yet

- High Growth in Gross Absorption: Summary & RecommendationsDocument4 pagesHigh Growth in Gross Absorption: Summary & RecommendationsbiswasjpNo ratings yet

- Real Estate IBEF PresentationDocument31 pagesReal Estate IBEF PresentationGurava MaruriNo ratings yet

- Affordable Housing in India 24072012Document20 pagesAffordable Housing in India 24072012Arjun GunasekaranNo ratings yet

- Square YardsDocument14 pagesSquare YardsSanjeev KasaniNo ratings yet

- Colliers Bulacan 2021 Residential JB 03172022 BO EditsDocument4 pagesColliers Bulacan 2021 Residential JB 03172022 BO Edits100forplatesNo ratings yet

- IIM Calcutta - Priceless BrainsDocument15 pagesIIM Calcutta - Priceless BrainsASDASNo ratings yet

- The Four Horsemen - ShubhamDocument14 pagesThe Four Horsemen - ShubhamAnonymous PVFheu0QvNo ratings yet

- Indianapolis - Retail - 4/1/2008Document4 pagesIndianapolis - Retail - 4/1/2008Russell Klusas100% (1)

- 01 - Foo Gee JenDocument14 pages01 - Foo Gee JenHafiz FadzilNo ratings yet

- Sunteck Realty LTD.: Rachana V HingarajiaDocument4 pagesSunteck Realty LTD.: Rachana V HingarajiaJagannath DNo ratings yet

- Bangkok Property Market Snapshot 2Q2023Document2 pagesBangkok Property Market Snapshot 2Q2023alexm.linkedNo ratings yet

- Anarock Research 1663675132Document11 pagesAnarock Research 1663675132Anusha ShanmugamNo ratings yet

- Residential Traction at GlanceDocument6 pagesResidential Traction at GlanceVASUNo ratings yet

- Visit Note: Ansal Properties and Infrastructure Limited (APIL)Document5 pagesVisit Note: Ansal Properties and Infrastructure Limited (APIL)royrakeshNo ratings yet

- Urban Housing - Class 1Document46 pagesUrban Housing - Class 1Muhammad ArshathNo ratings yet

- BSE Forum ViewsDocument3 pagesBSE Forum ViewsPrashant PatilNo ratings yet

- Just Read - How Govt. Capital Expenditure Is Driving GrowthDocument1 pageJust Read - How Govt. Capital Expenditure Is Driving GrowthShubham TiwariNo ratings yet

- Real Estate May 2020Document46 pagesReal Estate May 2020ravenraven0000No ratings yet

- A New Dawn for Global Value Chain Participation in the PhilippinesFrom EverandA New Dawn for Global Value Chain Participation in the PhilippinesNo ratings yet

- Aavarna 2Document13 pagesAavarna 2SNEHA DEVARAJU100% (1)

- Article 33856Document12 pagesArticle 33856SNEHA DEVARAJUNo ratings yet

- 34 TH Surajkund International Crafts Mela - 2020Document1 page34 TH Surajkund International Crafts Mela - 2020SNEHA DEVARAJUNo ratings yet

- Good City Form-Kevin Lynch: Topic: SenseDocument9 pagesGood City Form-Kevin Lynch: Topic: SenseSNEHA DEVARAJUNo ratings yet

- Pragati MaidanDocument3 pagesPragati MaidanSNEHA DEVARAJUNo ratings yet

- MMBC Portfolio-WsDocument1 pageMMBC Portfolio-WsSNEHA DEVARAJUNo ratings yet

- Literature Study: Business HotelDocument56 pagesLiterature Study: Business HotelSNEHA DEVARAJUNo ratings yet

- MMBC Portfolio-UwDocument1 pageMMBC Portfolio-UwSNEHA DEVARAJUNo ratings yet

- Case Study Dayananda Sagar Dental CollegeDocument21 pagesCase Study Dayananda Sagar Dental CollegeSNEHA DEVARAJUNo ratings yet

- HOUSING MARKET SURVEY - Sneha (1IE18AT030)Document1 pageHOUSING MARKET SURVEY - Sneha (1IE18AT030)SNEHA DEVARAJUNo ratings yet

- MMBC Glass Group 3Document16 pagesMMBC Glass Group 3SNEHA DEVARAJUNo ratings yet

- Practical Strategies: HotelsDocument15 pagesPractical Strategies: HotelsSNEHA DEVARAJUNo ratings yet

- Communities: Module 2 - SESSION 3 Faculty: Ar Mahiima J DATE: 30 - 08-19Document21 pagesCommunities: Module 2 - SESSION 3 Faculty: Ar Mahiima J DATE: 30 - 08-19SNEHA DEVARAJUNo ratings yet

- History of Architecture: BY, Rajab Sharique Sneha Shreya Vaibhavi Yadhu YashaswiniDocument13 pagesHistory of Architecture: BY, Rajab Sharique Sneha Shreya Vaibhavi Yadhu YashaswiniSNEHA DEVARAJUNo ratings yet

- Detailed Design Program (Area Statements and Requirements) - Ad5Document1 pageDetailed Design Program (Area Statements and Requirements) - Ad5SNEHA DEVARAJUNo ratings yet

- The Mysore Palace: An Architectural OverviewDocument40 pagesThe Mysore Palace: An Architectural OverviewSNEHA DEVARAJU100% (1)

- Qutb Complex: Sneha Devaraj USN-1IE18AT030 9/11/2020Document12 pagesQutb Complex: Sneha Devaraj USN-1IE18AT030 9/11/2020SNEHA DEVARAJUNo ratings yet

- Griha Griha: Sneha Devaraju Architectural Design Architectural Design Sneha DevarajuDocument5 pagesGriha Griha: Sneha Devaraju Architectural Design Architectural Design Sneha DevarajuSNEHA DEVARAJUNo ratings yet

- Study On BUSINESS HOTEL - SnehaDocument20 pagesStudy On BUSINESS HOTEL - SnehaSNEHA DEVARAJUNo ratings yet

- Electricity Generation ProcessDocument26 pagesElectricity Generation ProcessSNEHA DEVARAJUNo ratings yet

- Solar Passive DesignDocument3 pagesSolar Passive DesignSNEHA DEVARAJU0% (1)

- Illustration Qc0n50rclvfw0Document2 pagesIllustration Qc0n50rclvfw0Sumitt SinghNo ratings yet

- Quality Control & Measuremnet BookDocument23 pagesQuality Control & Measuremnet BookLohith GowdaNo ratings yet

- Queueing Theory and Operations ManagementDocument11 pagesQueueing Theory and Operations ManagementMarthandeNo ratings yet

- MC 2023 02 NpoDocument12 pagesMC 2023 02 Npokat perezNo ratings yet

- Wallstreetjournal 20160329 The Wall Street JournalDocument42 pagesWallstreetjournal 20160329 The Wall Street JournalstefanoNo ratings yet

- .Archivetempenglish5 Q1 LP-1Document7 pages.Archivetempenglish5 Q1 LP-1Niko Hakeem TubaleNo ratings yet

- M. Mudassar (Fa19-Baf-067) Sri LankaDocument10 pagesM. Mudassar (Fa19-Baf-067) Sri LankaMudassar Gul Bin AshrafNo ratings yet

- PgasDocument3 pagesPgasMateriNo ratings yet

- End Term Presentation: Robotics in Garment ManufacturingDocument26 pagesEnd Term Presentation: Robotics in Garment ManufacturingAkriti SinghNo ratings yet

- Cathay PacificDocument15 pagesCathay PacificClarisse GonzalesNo ratings yet

- Relationship Between Inflation and Stock Prices in ThailandDocument6 pagesRelationship Between Inflation and Stock Prices in ThailandEzekiel WilliamNo ratings yet

- Factsheet 210129 27 IdxenergyDocument1 pageFactsheet 210129 27 IdxenergyNeedlaregNo ratings yet

- Essential Drugs Frameworkagreementtender PDFDocument81 pagesEssential Drugs Frameworkagreementtender PDFIntegrated user03No ratings yet

- CBSE Class 10 History Notes Chapter 3 - The Making of A Global WorldDocument8 pagesCBSE Class 10 History Notes Chapter 3 - The Making of A Global WorldGitika DasNo ratings yet

- Foundations of Financial Management: Spreadsheet TemplatesDocument7 pagesFoundations of Financial Management: Spreadsheet Templatesalaa_h1100% (1)

- Lisa Peattie Two PuzzlesDocument6 pagesLisa Peattie Two Puzzlesna22b020No ratings yet

- Accounting For Partnerships: Basic Considerations and FormationDocument22 pagesAccounting For Partnerships: Basic Considerations and FormationAj CapungganNo ratings yet

- CB Insights - Fintech Report Q3 2021Document236 pagesCB Insights - Fintech Report Q3 2021Seba CabezasNo ratings yet

- Company Profile of ShreeSatya GroupDocument4 pagesCompany Profile of ShreeSatya GroupRohan HajelaNo ratings yet

- 05 Activity 1 BALADocument3 pages05 Activity 1 BALAPola PolzNo ratings yet

- COURSE PLAN - BBA3 - Indian EconomyDocument16 pagesCOURSE PLAN - BBA3 - Indian EconomypriyankaNo ratings yet

- Letter To Mr. FairbairnDocument5 pagesLetter To Mr. FairbairnCalgary HeraldNo ratings yet

- Cash Receipt Template 3 WordDocument1 pageCash Receipt Template 3 WordSaqlain MalikNo ratings yet

- Anup Engineering - NanoNivesh - ICICI DirectDocument8 pagesAnup Engineering - NanoNivesh - ICICI DirectAmit SharmaNo ratings yet

- Income Tax RefundDocument3 pagesIncome Tax RefundAKHiiLESH BhamaNo ratings yet

- A Study On The Role and Importance of Treasury Management SystemDocument6 pagesA Study On The Role and Importance of Treasury Management SystemPAVAN KumarNo ratings yet

- Perfect Practice SolutionDocument41 pagesPerfect Practice Solutionnarutevarsha5No ratings yet

- AP Voucher List: Palembang City Sewerage - Jakarta IndonesiaDocument6 pagesAP Voucher List: Palembang City Sewerage - Jakarta IndonesiaIhsan HbbNo ratings yet