Professional Documents

Culture Documents

Accounting 5 CFAS Chapter 17

Accounting 5 CFAS Chapter 17

Uploaded by

박은하Copyright:

Available Formats

You might also like

- Qualifying Asset: Commencement of CapitalisationDocument11 pagesQualifying Asset: Commencement of Capitalisationjktech 36No ratings yet

- The Internationalization Process of High Fashion CompaniesDocument19 pagesThe Internationalization Process of High Fashion CompaniesLiv AmatoNo ratings yet

- Ia1 BC 2020Document33 pagesIa1 BC 2020Jm Sevalla100% (6)

- Cash Management PoliciesDocument6 pagesCash Management Policieskinggeorge352No ratings yet

- RequiredDocument11 pagesRequiredKean Brean GallosNo ratings yet

- Intermediate Accounting 1 - MODULE 8: Content StandardsDocument4 pagesIntermediate Accounting 1 - MODULE 8: Content StandardsGee-Anne GonzalesNo ratings yet

- Chapter 25 - Borrowing CostsDocument35 pagesChapter 25 - Borrowing Costsmhel moyetNo ratings yet

- CHAPTER 17 - PAS 23 Borrowing CostsDocument16 pagesCHAPTER 17 - PAS 23 Borrowing CostsMarriel Fate CullanoNo ratings yet

- CHAPTER 25 - Borrowing CostsDocument6 pagesCHAPTER 25 - Borrowing CostsRosee D.No ratings yet

- PAS 23 Borrowing Costs: Learning ObjectivesDocument5 pagesPAS 23 Borrowing Costs: Learning ObjectivesFhrince Carl CalaquianNo ratings yet

- Borrowing Costs That Are Directly Attributable To The Acquisition, Construction orDocument4 pagesBorrowing Costs That Are Directly Attributable To The Acquisition, Construction orJustine VeralloNo ratings yet

- Pas 23: Borrowing Cost Borrowing CostDocument7 pagesPas 23: Borrowing Cost Borrowing CostJustine Reine CornicoNo ratings yet

- Borrowing Costs CVDocument34 pagesBorrowing Costs CVRigine Pobe Morgadez100% (1)

- Borrowing Cost Problem Solutions - CompressDocument16 pagesBorrowing Cost Problem Solutions - CompressSyreNo ratings yet

- AC20 MIDTERM EXAMINATION FY21 22 - DGCupdDocument10 pagesAC20 MIDTERM EXAMINATION FY21 22 - DGCupdMaricar PinedaNo ratings yet

- Borrowing Cost Problem SolutionsDocument17 pagesBorrowing Cost Problem SolutionsNicole ConcepcionNo ratings yet

- IAS 23 Borrowing Cost F7Document10 pagesIAS 23 Borrowing Cost F7Maria100% (1)

- Borrowing Cost (PAS 23)Document6 pagesBorrowing Cost (PAS 23)CharléNo ratings yet

- 206B 3rd Preboard ActivityDocument9 pages206B 3rd Preboard ActivityJERROLD EIRVIN PAYOPAYNo ratings yet

- Accounting For Borrowing Cost (English)Document9 pagesAccounting For Borrowing Cost (English)gracel angela tolejanoNo ratings yet

- Mock Test Qe1 1Document31 pagesMock Test Qe1 1Ma. Fatima H. FabayNo ratings yet

- Solution AldineDocument8 pagesSolution AldineAkshay TulshyanNo ratings yet

- AMF 2202 Test 2 2022-2023 - 221111 - 085401Document3 pagesAMF 2202 Test 2 2022-2023 - 221111 - 085401mugenyi DixonNo ratings yet

- Intermediate Accounting 3 Midterm Exam Answer KeyDocument9 pagesIntermediate Accounting 3 Midterm Exam Answer Keyshadowlord468No ratings yet

- 13.8 AS 16 Borrowing CostsDocument8 pages13.8 AS 16 Borrowing CostsAakshi SharmaNo ratings yet

- R4acads Finacc PrefinalDocument4 pagesR4acads Finacc PrefinalChristine Herico CurryNo ratings yet

- Module 6 CFAS PAS 23 - BORROWING COSTDocument6 pagesModule 6 CFAS PAS 23 - BORROWING COSTJan JanNo ratings yet

- ITFAQuestion June 2018 ExamDocument4 pagesITFAQuestion June 2018 ExamF A Saffat RahmanNo ratings yet

- Internal Controls in MicrofinanceDocument10 pagesInternal Controls in Microfinancemugenyi DixonNo ratings yet

- Entrepreneurship P230pp2Document5 pagesEntrepreneurship P230pp2nasasiraluke861No ratings yet

- Quiz No. 2 IntAcc1&2 With AnswersDocument4 pagesQuiz No. 2 IntAcc1&2 With AnswersFrancis AsisNo ratings yet

- Week 3 Tutorial Solutions (S1)Document14 pagesWeek 3 Tutorial Solutions (S1)Silo KetenilagiNo ratings yet

- 3 - Cash Flow From Financing Activities: Balance Sheet For The Years 2019-20 and 2020-21Document1 page3 - Cash Flow From Financing Activities: Balance Sheet For The Years 2019-20 and 2020-21Raja kumarNo ratings yet

- Question CMA April 2019 SP Exam.Document4 pagesQuestion CMA April 2019 SP Exam.F A Saffat RahmanNo ratings yet

- Icandocumentsnovemebr 2017 Pathfinder Skills PDFDocument179 pagesIcandocumentsnovemebr 2017 Pathfinder Skills PDFDaniel AdegboyeNo ratings yet

- Test 4Document8 pagesTest 4govarthan1976No ratings yet

- Assignments 01 and 02 Statement of Cash FlowsDocument3 pagesAssignments 01 and 02 Statement of Cash FlowsTshina Jill BranzuelaNo ratings yet

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- IA3 Chapter 22 29Document5 pagesIA3 Chapter 22 29ZicoNo ratings yet

- Finals Answer KeyDocument6 pagesFinals Answer Keymarx marolinaNo ratings yet

- Problem Set 06Document6 pagesProblem Set 06siddharth bishnoiNo ratings yet

- Class Work - CH 3 (1) - TaggedDocument13 pagesClass Work - CH 3 (1) - TaggedManar FakhrNo ratings yet

- ARC-FAR May 2022 Batch - 1st PreboardDocument11 pagesARC-FAR May 2022 Batch - 1st PreboardjoyhhazelNo ratings yet

- f7sgp 2010 Jun QDocument9 pagesf7sgp 2010 Jun Q2010aungmyatNo ratings yet

- Fin Reporting and FSA-fund Flow Statment 6th Sem by VS (Vinay Shaw0 For MorningDocument12 pagesFin Reporting and FSA-fund Flow Statment 6th Sem by VS (Vinay Shaw0 For MorningSarfraz AhmedNo ratings yet

- Basic Accounting and PartnershipDocument11 pagesBasic Accounting and PartnershipMichelle Chandria Bernardo-FordNo ratings yet

- Intermediate Accounting 3 Final Examination: Name: Date: Professor: Section: ScoreDocument19 pagesIntermediate Accounting 3 Final Examination: Name: Date: Professor: Section: ScoreMay Ramos100% (2)

- CFAS Chapter40 IFRIC Interpretations (Gutierrez-Ingat)Document19 pagesCFAS Chapter40 IFRIC Interpretations (Gutierrez-Ingat)Fran GutierrezNo ratings yet

- 2017-12 ICMAB FL 001 PAC Year Question December 2017Document3 pages2017-12 ICMAB FL 001 PAC Year Question December 2017Mohammad ShahidNo ratings yet

- Exam 2Document19 pagesExam 2SHE50% (2)

- MIDTERM EXAM FDocument14 pagesMIDTERM EXAM FJoyce LunaNo ratings yet

- Chapter 40 IFRIC InterpretationsDocument5 pagesChapter 40 IFRIC InterpretationsEllen MaskariñoNo ratings yet

- Tutorial Sheet 3Document6 pagesTutorial Sheet 3lemiemwanduNo ratings yet

- Diagnostic Exam Accounting 1.1 AKDocument14 pagesDiagnostic Exam Accounting 1.1 AKRobert CastilloNo ratings yet

- Financial Management PORTFOLIO MidDocument8 pagesFinancial Management PORTFOLIO MidMyka Marie CruzNo ratings yet

- Financial Management PORTFOLIO MidDocument8 pagesFinancial Management PORTFOLIO MidMyka Marie CruzNo ratings yet

- National Mock Board Examination 2017 Auditing: A. Consolidated Net Profit After Tax Attributable To ParentDocument13 pagesNational Mock Board Examination 2017 Auditing: A. Consolidated Net Profit After Tax Attributable To ParentKez MaxNo ratings yet

- ACFrOgCZvV8y8c31SB9JwJMX3w-YM9CorcTp3WIbzdLvq5I7h5g1Mn9yq JGGLJyxyxmHcTSrgN3xkjSd1VF5Qy9lJ2U83Tq54bUz-mUPzoP123Gs3yrkbJ2lizVYLj qzPyoo7SEGPLRGR1 HVMDocument12 pagesACFrOgCZvV8y8c31SB9JwJMX3w-YM9CorcTp3WIbzdLvq5I7h5g1Mn9yq JGGLJyxyxmHcTSrgN3xkjSd1VF5Qy9lJ2U83Tq54bUz-mUPzoP123Gs3yrkbJ2lizVYLj qzPyoo7SEGPLRGR1 HVMRamin AminNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- Teamwork For Ibl1201Document16 pagesTeamwork For Ibl1201Thanh Phat Nguyen MyNo ratings yet

- Handbook of Asset and Liability Management: From Models to Optimal Return StrategiesFrom EverandHandbook of Asset and Liability Management: From Models to Optimal Return StrategiesNo ratings yet

- Foreign CorporationDocument2 pagesForeign Corporation박은하No ratings yet

- Lifeworks of RizalDocument12 pagesLifeworks of Rizal박은하No ratings yet

- Student PARTNERSHIP Session 3 Rights AmongDocument14 pagesStudent PARTNERSHIP Session 3 Rights Among박은하No ratings yet

- Financial Market Chapter 8-10Document32 pagesFinancial Market Chapter 8-10박은하No ratings yet

- Sundiang & Aquino, Reviewer 2014Document3 pagesSundiang & Aquino, Reviewer 2014박은하No ratings yet

- SEC. 73. Books To Be Kept Stock Transfer Agent. - Every Corporation Shall Keep and CarefullyDocument2 pagesSEC. 73. Books To Be Kept Stock Transfer Agent. - Every Corporation Shall Keep and Carefully박은하No ratings yet

- CHAPTER 3 Dissolution and Winding UpDocument4 pagesCHAPTER 3 Dissolution and Winding Up박은하No ratings yet

- SECTION 2 Property Rights of A PartnerDocument2 pagesSECTION 2 Property Rights of A Partner박은하No ratings yet

- PARTNERSHIP Session 5 SECTION 3 Obligations of The Partners With Regard To Third PersonsDocument4 pagesPARTNERSHIP Session 5 SECTION 3 Obligations of The Partners With Regard To Third Persons박은하No ratings yet

- Chapter 3 Dissolution and Winding Up (Art. 1837-1842)Document5 pagesChapter 3 Dissolution and Winding Up (Art. 1837-1842)박은하No ratings yet

- Corporation Code Session 16 Sec.40-44: Title Iv Powers of CorporationsDocument2 pagesCorporation Code Session 16 Sec.40-44: Title Iv Powers of Corporations박은하No ratings yet

- Corp. Code Session 15 Sec. 35-39 Title Iv Powers of CorporationsDocument3 pagesCorp. Code Session 15 Sec. 35-39 Title Iv Powers of Corporations박은하No ratings yet

- Title V By-Laws: SEC. 45. Adoption of Bylaws. - For The Adoption of Bylaws by The Corporation, TheDocument2 pagesTitle V By-Laws: SEC. 45. Adoption of Bylaws. - For The Adoption of Bylaws by The Corporation, The박은하No ratings yet

- Conceptual Framework and Accounting StandardsDocument27 pagesConceptual Framework and Accounting Standards박은하No ratings yet

- Board of Directors: Corporation Code Session 14 Sec.28-34Document2 pagesBoard of Directors: Corporation Code Session 14 Sec.28-34박은하No ratings yet

- Solutions To Activity 3A and 3BDocument2 pagesSolutions To Activity 3A and 3B박은하No ratings yet

- SEC. 22. The Board of Directors or Trustees of A Corporation Qualification and TermDocument3 pagesSEC. 22. The Board of Directors or Trustees of A Corporation Qualification and Term박은하No ratings yet

- Private Sector Developmen in EthiopiaDocument22 pagesPrivate Sector Developmen in EthiopiaSulemanNo ratings yet

- Cost of Capital (Cost of Debts, Cost of Preferred Stocks, Wacc)Document3 pagesCost of Capital (Cost of Debts, Cost of Preferred Stocks, Wacc)Jerel Aaron FojasNo ratings yet

- Multiple Choice Problems 111618Document2 pagesMultiple Choice Problems 111618Dominic Dalton Caling75% (4)

- Vaikunth Mehta National Institute of Co-Operative Management, PuneDocument13 pagesVaikunth Mehta National Institute of Co-Operative Management, PuneNilesh ThoraveNo ratings yet

- Aleksandar Joksimovic Urban Transformation in A Post-Socialist Society-From Unity To SeparationDocument12 pagesAleksandar Joksimovic Urban Transformation in A Post-Socialist Society-From Unity To SeparationDorina PllumbiNo ratings yet

- 22 June 2012 Review On Risk Based Capital Framework For Insurers in Singapore RBC2 ReviewDocument33 pages22 June 2012 Review On Risk Based Capital Framework For Insurers in Singapore RBC2 ReviewKotchapornJirapadchayaropNo ratings yet

- Uae Taxation LawDocument21 pagesUae Taxation LawchandanhiremathNo ratings yet

- Bayeh AsnakewDocument126 pagesBayeh AsnakewMahmood Khan100% (2)

- ACC 30 Research PaperDocument29 pagesACC 30 Research PaperPat RiveraNo ratings yet

- CG CocoDocument3 pagesCG CocosahagaNo ratings yet

- Acquaculture Fish FarmingDocument17 pagesAcquaculture Fish FarmingAnonymous xv5fUs4AvNo ratings yet

- p2 - Guerrero Ch6Document20 pagesp2 - Guerrero Ch6JerichoPedragosa60% (5)

- CAMELS JournalDocument18 pagesCAMELS JournaltiwixzNo ratings yet

- Ashok LeylandDocument12 pagesAshok LeylandDwarakesh Rocky YadavNo ratings yet

- Midterm 1 Review Selected From Lecture Slides and Assignments - 001 MarkupsDocument14 pagesMidterm 1 Review Selected From Lecture Slides and Assignments - 001 MarkupsXIAODANNo ratings yet

- Mutual Funds: by - Gaurang TrivediDocument7 pagesMutual Funds: by - Gaurang TrivedisanskritiNo ratings yet

- ACCO1115 - May 2017 - EXAMDocument9 pagesACCO1115 - May 2017 - EXAMSarah RanduNo ratings yet

- The Neoclassical-Keynesian SynthesisDocument19 pagesThe Neoclassical-Keynesian SynthesisMilan ZoanNo ratings yet

- Profitability AnalysisDocument29 pagesProfitability AnalysisJocelyn CorpuzNo ratings yet

- SUMMARY OF ChAPTER 4 EXTERNAL ASSESSMENTDocument6 pagesSUMMARY OF ChAPTER 4 EXTERNAL ASSESSMENTadilla ikhsaniiNo ratings yet

- A Project On: Submitted To University of Pune For The Partial Fulfilment of Master of Business AdministrastionDocument69 pagesA Project On: Submitted To University of Pune For The Partial Fulfilment of Master of Business AdministrastionharshNo ratings yet

- A Study On Ratio Analysis in Heritage: Vol 11, Issue 5, May/ 2020 ISSN NO: 0377-9254Document7 pagesA Study On Ratio Analysis in Heritage: Vol 11, Issue 5, May/ 2020 ISSN NO: 0377-9254DedipyaNo ratings yet

- Goat Farming Finance Project Report PDFDocument15 pagesGoat Farming Finance Project Report PDFAllwyn Mendonca100% (1)

- Training Pajak Introduction To WP&B and AFEDocument48 pagesTraining Pajak Introduction To WP&B and AFEIndra Siallagan100% (1)

- Identifying Implicit and Explicit ClaimsDocument57 pagesIdentifying Implicit and Explicit Claimsargus.dump11No ratings yet

- 7 2010 Jun QDocument8 pages7 2010 Jun QWeezy360No ratings yet

- Briefly Explain The Concept of IPP & CPP and Discuss Challenges Faced by Them?Document18 pagesBriefly Explain The Concept of IPP & CPP and Discuss Challenges Faced by Them?Sayan DattaNo ratings yet

- 7 ADocument20 pages7 AJaya Prasad KNo ratings yet

- Managing Director COO Operations in Palm Springs CA Resume Jeff PluthDocument3 pagesManaging Director COO Operations in Palm Springs CA Resume Jeff PluthJeffPluthNo ratings yet

Accounting 5 CFAS Chapter 17

Accounting 5 CFAS Chapter 17

Uploaded by

박은하Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting 5 CFAS Chapter 17

Accounting 5 CFAS Chapter 17

Uploaded by

박은하Copyright:

Available Formats

CHAPTER 17

BORROWING

COSTS

PAS 23

FELECITAS C. TUAZON

Department of Accountancy - Accounting 5 CFAS

TECHNICAL KNOWLEDGE

• To know the concept of qualifying asset for

purposes of capitalization of borrowing costs.

• To understand the proper accounting treatment

of borrowing costs.

• To distinguish specific borrowing and general

borrowing in relation to capitalization of

borrowing costs.

Department of Accountancy - Accounting 5 CFAS

BORROWING

COSTS

Department of Accountancy - Accounting 5 CFAS

BORROWING COSTS

• Under PAS 23, paragraph 5, borrowing costs are defined as interest and

other costs that an entity incurs in connection with borrowing of funds.

• Paragraph 6 provides that borrowing costs specifically include.

a. Interest expense calculated using the effective interest method.

b. Finance charge with respect to a finance lease.

c. Exchange difference arising from foreign currency borrowing to the

extent that it is regarded as an adjustment to interest cost.

Department of Accountancy - Accounting 5 CFAS

QUALIFYING ASSET

• A qualifying asset is an asset that necessarily takes a substantial period

of time to get ready for the intended use of sale.

• Examples include the following:

a. Manufacturing plant

b. Power generation facility

c. Intangible asset

d. Investment property

Department of Accountancy - Accounting 5 CFAS

EXCLUDED FROM CAPITALIZATION

• PAS 23 does not require capitalization of borrowing costs relating to the

following:

a. Asset measured at fair value, such as biological asset

b. Inventory that is manufactured in large quantity on a repetitive

basis, such as maturing whisky, even if it takes a substantial period

of time to get ready for sale

c. Asset that is ready for the intended use or sale when acquired

Department of Accountancy - Accounting 5 CFAS

ACCOUNTING FOR BORROWING COST

• PAS 23, paragraph 8, mandates the following rules on borrowing cost:

1. -If the borrowing is directly attributable to the acquisition,

construction or production of a qualifying asset, the borrowing

cost is required to be capitalized as cost of the asset.

-In other words, the capitalization of borrowing cost is mandatory

for a qualifying asset.

-Borrowing cost can be capitalized when the asset is a qualifying

asset and it is probable that the borrowing cost will result to future

economic benefit and the cost can be measured reliably.

Department of Accountancy - Accounting 5 CFAS

ACCOUNTING FOR BORROWING COST

• PAS 23, paragraph 8, mandates the following rules on borrowing cost:

2. -All other borrowing costs shall be expensed as incurred.

-In other words, if the borrowing is not directly attributable to a

qualifying asset, the borrowing cost is expensed immediately.

Department of Accountancy - Accounting 5 CFAS

ASSET FINANCED BY SPECIFIC BORROWING

• PAS 23, paragraph 12, provides that if the funds are borrowed

specifically for the purpose of acquiring a qualifying asset, the amount

of capitalizable borrowing cost is the actual borrowing cost incurred

during the period less any investment income from the temporary

investment of those borrowings.

Department of Accountancy - Accounting 5 CFAS

ASSET FINANCED BY SPECIFIC BORROWING

(ILLUSTRATION)

• At the beginning of the current year, an entity obtained a loan of

P4,000,000 at an interest rate of 10%, specifically to finance the

construction of new building. The building was completed at the current

year-end.

• Availments from the loan were made quarterly in equal amounts. Total

borrowing cost incurred amounted to P250,000 for the current year.

• Prior to their disbursement, the proceeds of the borrowing were

temporarily invested and earned interest income of P40,000.

Actual borrowing cost 250,000

Interest income from investment of proceeds ( 40,000)

Capitalizable borrowing cost 210,000

Department of Accountancy - Accounting 5 CFAS

ASSET FINANCED BY GENERAL BORROWING

• PAS 23, paragraph 14, provides that if the funds are borrowed generally

and used for acquiring a qualifying asset, the amount of capitalizable

borrowing cost is equal to the average carting amount of the asset

during the period multiplied by a capitalization rate or average interest

rate.

• However, the capitalizable borrowing cost shall not exceed the actual

interest incurred.

• The capitalization rate or average interest rate is equal to the total

annual borrowing cost divided by the total general borrowings

outstanding during the period.

Department of Accountancy - Accounting 5 CFAS

ASSET FINANCED BY GENERAL BORROWING

• No specific guidance is provided for general borrowing with respect to

investment income.

• Accordingly, any investment income from general borrowing is not

deducted from capitalizable borrowing cost.

Department of Accountancy - Accounting 5 CFAS

ASSET FINANCED BY GENERAL BORROWING

(ILLUSTRATION)

• An entity had the following borrowings on January 1 of the current year.

The borrowings were made for general purposes and the proceeds were

partly used to finance the construction of a new building.

Principal Borrowing cost

10% bank loan 3,000,000 300,000

12% short-term note 1,500,000 180,000

8% long-term loan 3,500,000 280,000

8,000,000 760,000

Department of Accountancy - Accounting 5 CFAS

ASSET FINANCED BY GENERAL BORROWING

(ILLUSTRATION)

• The construction of the building was started on January 1 and was

completed on December 31 of the current year.

January 1 400,000

March 31 1,000,000

June 30 1,200,000

September 30 1,000,000

December 31 400,000

Total expenditures on the building 4,000,000

Department of Accountancy - Accounting 5 CFAS

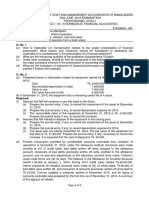

AVERAGE CARRYING AMOUNT OF THE BUILDING

(a) (b) (a x b)

Date Expenditures Months outstanding Amount

January 1 400,000 12 4,800,000

March 31 1,000,000 9 9,000,000

June 30 1,200,000 6 7,200,000

September 30 1,000,000 3 3,000,000

December 31 400,000 0 -

24,000,000

Average carrying amount (24,000,000/12) 2,000,000

Department of Accountancy - Accounting 5 CFAS

AVERAGE CARRYING AMOUNT OF THE BUILDING

ANOTHER APPROACH

(a) (b) (a x b)

Date Expenditures Fraction Average

January 1 400,000 12 / 12 400,000

March 31 1,000,000 9 / 12 750,000

June 30 1,200,000 6 / 12 600,000

September 30 1,000,000 3 / 12 250,000

December 31 400,000 - -

2,000,000

The capitalization rate is computed by dividing the total annual borrowing cost by the

total general borrowings.

Thus, P760,000 divided by P8,000,00 equals 9.5%.

Department of Accountancy - Accounting 5 CFAS

AVERAGE CARRYING AMOUNT OF THE BUILDING

ANOTHER APPROACH

• The amount of capitalizable borrowing cost is the average carrying

amount of the building multiplied by the capitalization rate.

• Thus, P2,000,000 x 9.5% equals P190,000.

• The capitalizable borrowing cost shall not exceed the actual borrowing

cost.

• The amount P190,000 is the proper capitalizable borrowing cost

because it is less than the actual borrowing cost of P760,000.

• The excess of P760,000 over P190,000 or P570,000 is charged to

interest expense.

Department of Accountancy - Accounting 10 & 11 Intermediate

Accounting Part 2

ASSET FINANCED BOTH BY SPECIFIC AND GENERAL

BORROWING

• At the beginning of the current year, an entity borrowed P1,500,000 at

an interest of 10% specifically for the construction of a new building.

The actual borrowing cost on this loan is P150,000.

• The entity had also outstanding during the year a 5-year 8% general

borrowing of P7,000,000.

• The construction of the building started on January 1 and was

completed on December 31 of the current year.

January 1 500,000

April 1 1,000,000

May 1 1,500,000

September 1 1,500,000

December 31 500,000

Total cost 5,000,000

Department of Accountancy - Accounting 10 & 11 Intermediate

Accounting Part 2

ASSET FINANCED BOTH BY SPECIFIC AND GENERAL

BORROWING

(a) (b) (a x b)

Date Expenditures Fraction Average

January 1 500,000 12 / 12 500,000

March 1 1,000,000 9 / 12 750,000

June 1 1,500,000 8 / 12 1,000,000

September 1 1,500,000 4 / 12 500,000

December 31 500,000 - -

Average expenditures 2,750,000

Average expenditures 2,750,000

Specific borrowing (1,500,000)

Applicable to general borrowing 1,250,000

Department of Accountancy - Accounting 10 & 11 Intermediate

Accounting Part 2

CAPITALIZABLE INTEREST

Specific borrowing (10% x 1,500,000) 150,000

General borrowing ( 8% x 1,250,000) 100,000

Total capitalizable interest 250,000

Department of Accountancy - Accounting 10 & 11 Intermediate

Accounting Part 2

COMMENCEMENT OF CAPITALIZATION

• The capitalization of borrowing costs as parts of the cost of a qualifying

asset shall commence when the following three conditions are present:

a. When the entity incurs expenditures for the asset.

b. When the entity incurs borrowing costs.

c. When the entity undertakes activities that are necessary to

prepare the asset for the intended use or sale.

Department of Accountancy - Accounting 10 & 11 Intermediate

Accounting Part 2

ACTIVITIES NECESSARY TO PREPARE

• The activities necessary to prepare the asset for the intended use or

sale encompass more than the physical construction of the asset.

• These include technical and administrative work prior to do

commencement of physical construction, such as drawing up plans and

obtaining permit for a building.

• However, merely holding assets for use or development without any

associated development activity does not qualify for capitalization.

Department of Accountancy - Accounting 10 & 11 Intermediate

Accounting Part 2

ACTIVITIES NECESSARY TO PREPARE

• For example, borrowing costs incurred while land is under development

are capitalized during the period in which development activities are

being undertaken.

• But borrowing costs incurred while land acquired for building purposes

is held without any associated development activity do not qualify for

capitalization.

Department of Accountancy - Accounting 10 & 11 Intermediate

Accounting Part 2

SUSPENSE OF CAPITALIZATION

• Capitalization of borrowing costs shall be suspended during extended periods

in which active development is interrupted.

• However, capitalization of borrowing costs is not normally suspended during

a period when substantial technical and administrative work is being carried

out.

• Capitalization of borrowing costs is not also suspended when a temporary

delay is a necessary part of the process of getting an asset ready for its

intended use or sale.

• For example, capitalization continues during the extended period that high

water levels delay the construction of a bridge, if such high water levels are

common during the construction period in the geographical region involved.

Department of Accountancy - Accounting 10 & 11 Intermediate

Accounting Part 2

CESSATION OF CAPITALIZATION

• Capitalization of borrowing costs shall cease when substantially all the

activities necessary to prepare the qualifying asset for the intended use

or sale are complete.

• An asset is normally ready for the intended use or sale when the

physical construction of the asset is complete even though routine

administrative work might still continue.

Department of Accountancy - Accounting 10 & 11 Intermediate

Accounting Part 2

DISCLOSURES RELATED TO BORROWING COSTS

a. The amount of borrowing costs capitalized during the period.

b. The capitalization rate used to determine the amount of borrowing

costs eligible for capitalization.

Segregation of assets that are “qualifying needs” from other assets in the

statement of financial position is not required to be disclosed.

Department of Accountancy - Accounting 10 & 11 Intermediate

Accounting Part 2

THANK YOU

STAY SAFE

Department of Accountancy - Accounting 5 CFAS

You might also like

- Qualifying Asset: Commencement of CapitalisationDocument11 pagesQualifying Asset: Commencement of Capitalisationjktech 36No ratings yet

- The Internationalization Process of High Fashion CompaniesDocument19 pagesThe Internationalization Process of High Fashion CompaniesLiv AmatoNo ratings yet

- Ia1 BC 2020Document33 pagesIa1 BC 2020Jm Sevalla100% (6)

- Cash Management PoliciesDocument6 pagesCash Management Policieskinggeorge352No ratings yet

- RequiredDocument11 pagesRequiredKean Brean GallosNo ratings yet

- Intermediate Accounting 1 - MODULE 8: Content StandardsDocument4 pagesIntermediate Accounting 1 - MODULE 8: Content StandardsGee-Anne GonzalesNo ratings yet

- Chapter 25 - Borrowing CostsDocument35 pagesChapter 25 - Borrowing Costsmhel moyetNo ratings yet

- CHAPTER 17 - PAS 23 Borrowing CostsDocument16 pagesCHAPTER 17 - PAS 23 Borrowing CostsMarriel Fate CullanoNo ratings yet

- CHAPTER 25 - Borrowing CostsDocument6 pagesCHAPTER 25 - Borrowing CostsRosee D.No ratings yet

- PAS 23 Borrowing Costs: Learning ObjectivesDocument5 pagesPAS 23 Borrowing Costs: Learning ObjectivesFhrince Carl CalaquianNo ratings yet

- Borrowing Costs That Are Directly Attributable To The Acquisition, Construction orDocument4 pagesBorrowing Costs That Are Directly Attributable To The Acquisition, Construction orJustine VeralloNo ratings yet

- Pas 23: Borrowing Cost Borrowing CostDocument7 pagesPas 23: Borrowing Cost Borrowing CostJustine Reine CornicoNo ratings yet

- Borrowing Costs CVDocument34 pagesBorrowing Costs CVRigine Pobe Morgadez100% (1)

- Borrowing Cost Problem Solutions - CompressDocument16 pagesBorrowing Cost Problem Solutions - CompressSyreNo ratings yet

- AC20 MIDTERM EXAMINATION FY21 22 - DGCupdDocument10 pagesAC20 MIDTERM EXAMINATION FY21 22 - DGCupdMaricar PinedaNo ratings yet

- Borrowing Cost Problem SolutionsDocument17 pagesBorrowing Cost Problem SolutionsNicole ConcepcionNo ratings yet

- IAS 23 Borrowing Cost F7Document10 pagesIAS 23 Borrowing Cost F7Maria100% (1)

- Borrowing Cost (PAS 23)Document6 pagesBorrowing Cost (PAS 23)CharléNo ratings yet

- 206B 3rd Preboard ActivityDocument9 pages206B 3rd Preboard ActivityJERROLD EIRVIN PAYOPAYNo ratings yet

- Accounting For Borrowing Cost (English)Document9 pagesAccounting For Borrowing Cost (English)gracel angela tolejanoNo ratings yet

- Mock Test Qe1 1Document31 pagesMock Test Qe1 1Ma. Fatima H. FabayNo ratings yet

- Solution AldineDocument8 pagesSolution AldineAkshay TulshyanNo ratings yet

- AMF 2202 Test 2 2022-2023 - 221111 - 085401Document3 pagesAMF 2202 Test 2 2022-2023 - 221111 - 085401mugenyi DixonNo ratings yet

- Intermediate Accounting 3 Midterm Exam Answer KeyDocument9 pagesIntermediate Accounting 3 Midterm Exam Answer Keyshadowlord468No ratings yet

- 13.8 AS 16 Borrowing CostsDocument8 pages13.8 AS 16 Borrowing CostsAakshi SharmaNo ratings yet

- R4acads Finacc PrefinalDocument4 pagesR4acads Finacc PrefinalChristine Herico CurryNo ratings yet

- Module 6 CFAS PAS 23 - BORROWING COSTDocument6 pagesModule 6 CFAS PAS 23 - BORROWING COSTJan JanNo ratings yet

- ITFAQuestion June 2018 ExamDocument4 pagesITFAQuestion June 2018 ExamF A Saffat RahmanNo ratings yet

- Internal Controls in MicrofinanceDocument10 pagesInternal Controls in Microfinancemugenyi DixonNo ratings yet

- Entrepreneurship P230pp2Document5 pagesEntrepreneurship P230pp2nasasiraluke861No ratings yet

- Quiz No. 2 IntAcc1&2 With AnswersDocument4 pagesQuiz No. 2 IntAcc1&2 With AnswersFrancis AsisNo ratings yet

- Week 3 Tutorial Solutions (S1)Document14 pagesWeek 3 Tutorial Solutions (S1)Silo KetenilagiNo ratings yet

- 3 - Cash Flow From Financing Activities: Balance Sheet For The Years 2019-20 and 2020-21Document1 page3 - Cash Flow From Financing Activities: Balance Sheet For The Years 2019-20 and 2020-21Raja kumarNo ratings yet

- Question CMA April 2019 SP Exam.Document4 pagesQuestion CMA April 2019 SP Exam.F A Saffat RahmanNo ratings yet

- Icandocumentsnovemebr 2017 Pathfinder Skills PDFDocument179 pagesIcandocumentsnovemebr 2017 Pathfinder Skills PDFDaniel AdegboyeNo ratings yet

- Test 4Document8 pagesTest 4govarthan1976No ratings yet

- Assignments 01 and 02 Statement of Cash FlowsDocument3 pagesAssignments 01 and 02 Statement of Cash FlowsTshina Jill BranzuelaNo ratings yet

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- IA3 Chapter 22 29Document5 pagesIA3 Chapter 22 29ZicoNo ratings yet

- Finals Answer KeyDocument6 pagesFinals Answer Keymarx marolinaNo ratings yet

- Problem Set 06Document6 pagesProblem Set 06siddharth bishnoiNo ratings yet

- Class Work - CH 3 (1) - TaggedDocument13 pagesClass Work - CH 3 (1) - TaggedManar FakhrNo ratings yet

- ARC-FAR May 2022 Batch - 1st PreboardDocument11 pagesARC-FAR May 2022 Batch - 1st PreboardjoyhhazelNo ratings yet

- f7sgp 2010 Jun QDocument9 pagesf7sgp 2010 Jun Q2010aungmyatNo ratings yet

- Fin Reporting and FSA-fund Flow Statment 6th Sem by VS (Vinay Shaw0 For MorningDocument12 pagesFin Reporting and FSA-fund Flow Statment 6th Sem by VS (Vinay Shaw0 For MorningSarfraz AhmedNo ratings yet

- Basic Accounting and PartnershipDocument11 pagesBasic Accounting and PartnershipMichelle Chandria Bernardo-FordNo ratings yet

- Intermediate Accounting 3 Final Examination: Name: Date: Professor: Section: ScoreDocument19 pagesIntermediate Accounting 3 Final Examination: Name: Date: Professor: Section: ScoreMay Ramos100% (2)

- CFAS Chapter40 IFRIC Interpretations (Gutierrez-Ingat)Document19 pagesCFAS Chapter40 IFRIC Interpretations (Gutierrez-Ingat)Fran GutierrezNo ratings yet

- 2017-12 ICMAB FL 001 PAC Year Question December 2017Document3 pages2017-12 ICMAB FL 001 PAC Year Question December 2017Mohammad ShahidNo ratings yet

- Exam 2Document19 pagesExam 2SHE50% (2)

- MIDTERM EXAM FDocument14 pagesMIDTERM EXAM FJoyce LunaNo ratings yet

- Chapter 40 IFRIC InterpretationsDocument5 pagesChapter 40 IFRIC InterpretationsEllen MaskariñoNo ratings yet

- Tutorial Sheet 3Document6 pagesTutorial Sheet 3lemiemwanduNo ratings yet

- Diagnostic Exam Accounting 1.1 AKDocument14 pagesDiagnostic Exam Accounting 1.1 AKRobert CastilloNo ratings yet

- Financial Management PORTFOLIO MidDocument8 pagesFinancial Management PORTFOLIO MidMyka Marie CruzNo ratings yet

- Financial Management PORTFOLIO MidDocument8 pagesFinancial Management PORTFOLIO MidMyka Marie CruzNo ratings yet

- National Mock Board Examination 2017 Auditing: A. Consolidated Net Profit After Tax Attributable To ParentDocument13 pagesNational Mock Board Examination 2017 Auditing: A. Consolidated Net Profit After Tax Attributable To ParentKez MaxNo ratings yet

- ACFrOgCZvV8y8c31SB9JwJMX3w-YM9CorcTp3WIbzdLvq5I7h5g1Mn9yq JGGLJyxyxmHcTSrgN3xkjSd1VF5Qy9lJ2U83Tq54bUz-mUPzoP123Gs3yrkbJ2lizVYLj qzPyoo7SEGPLRGR1 HVMDocument12 pagesACFrOgCZvV8y8c31SB9JwJMX3w-YM9CorcTp3WIbzdLvq5I7h5g1Mn9yq JGGLJyxyxmHcTSrgN3xkjSd1VF5Qy9lJ2U83Tq54bUz-mUPzoP123Gs3yrkbJ2lizVYLj qzPyoo7SEGPLRGR1 HVMRamin AminNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- Teamwork For Ibl1201Document16 pagesTeamwork For Ibl1201Thanh Phat Nguyen MyNo ratings yet

- Handbook of Asset and Liability Management: From Models to Optimal Return StrategiesFrom EverandHandbook of Asset and Liability Management: From Models to Optimal Return StrategiesNo ratings yet

- Foreign CorporationDocument2 pagesForeign Corporation박은하No ratings yet

- Lifeworks of RizalDocument12 pagesLifeworks of Rizal박은하No ratings yet

- Student PARTNERSHIP Session 3 Rights AmongDocument14 pagesStudent PARTNERSHIP Session 3 Rights Among박은하No ratings yet

- Financial Market Chapter 8-10Document32 pagesFinancial Market Chapter 8-10박은하No ratings yet

- Sundiang & Aquino, Reviewer 2014Document3 pagesSundiang & Aquino, Reviewer 2014박은하No ratings yet

- SEC. 73. Books To Be Kept Stock Transfer Agent. - Every Corporation Shall Keep and CarefullyDocument2 pagesSEC. 73. Books To Be Kept Stock Transfer Agent. - Every Corporation Shall Keep and Carefully박은하No ratings yet

- CHAPTER 3 Dissolution and Winding UpDocument4 pagesCHAPTER 3 Dissolution and Winding Up박은하No ratings yet

- SECTION 2 Property Rights of A PartnerDocument2 pagesSECTION 2 Property Rights of A Partner박은하No ratings yet

- PARTNERSHIP Session 5 SECTION 3 Obligations of The Partners With Regard To Third PersonsDocument4 pagesPARTNERSHIP Session 5 SECTION 3 Obligations of The Partners With Regard To Third Persons박은하No ratings yet

- Chapter 3 Dissolution and Winding Up (Art. 1837-1842)Document5 pagesChapter 3 Dissolution and Winding Up (Art. 1837-1842)박은하No ratings yet

- Corporation Code Session 16 Sec.40-44: Title Iv Powers of CorporationsDocument2 pagesCorporation Code Session 16 Sec.40-44: Title Iv Powers of Corporations박은하No ratings yet

- Corp. Code Session 15 Sec. 35-39 Title Iv Powers of CorporationsDocument3 pagesCorp. Code Session 15 Sec. 35-39 Title Iv Powers of Corporations박은하No ratings yet

- Title V By-Laws: SEC. 45. Adoption of Bylaws. - For The Adoption of Bylaws by The Corporation, TheDocument2 pagesTitle V By-Laws: SEC. 45. Adoption of Bylaws. - For The Adoption of Bylaws by The Corporation, The박은하No ratings yet

- Conceptual Framework and Accounting StandardsDocument27 pagesConceptual Framework and Accounting Standards박은하No ratings yet

- Board of Directors: Corporation Code Session 14 Sec.28-34Document2 pagesBoard of Directors: Corporation Code Session 14 Sec.28-34박은하No ratings yet

- Solutions To Activity 3A and 3BDocument2 pagesSolutions To Activity 3A and 3B박은하No ratings yet

- SEC. 22. The Board of Directors or Trustees of A Corporation Qualification and TermDocument3 pagesSEC. 22. The Board of Directors or Trustees of A Corporation Qualification and Term박은하No ratings yet

- Private Sector Developmen in EthiopiaDocument22 pagesPrivate Sector Developmen in EthiopiaSulemanNo ratings yet

- Cost of Capital (Cost of Debts, Cost of Preferred Stocks, Wacc)Document3 pagesCost of Capital (Cost of Debts, Cost of Preferred Stocks, Wacc)Jerel Aaron FojasNo ratings yet

- Multiple Choice Problems 111618Document2 pagesMultiple Choice Problems 111618Dominic Dalton Caling75% (4)

- Vaikunth Mehta National Institute of Co-Operative Management, PuneDocument13 pagesVaikunth Mehta National Institute of Co-Operative Management, PuneNilesh ThoraveNo ratings yet

- Aleksandar Joksimovic Urban Transformation in A Post-Socialist Society-From Unity To SeparationDocument12 pagesAleksandar Joksimovic Urban Transformation in A Post-Socialist Society-From Unity To SeparationDorina PllumbiNo ratings yet

- 22 June 2012 Review On Risk Based Capital Framework For Insurers in Singapore RBC2 ReviewDocument33 pages22 June 2012 Review On Risk Based Capital Framework For Insurers in Singapore RBC2 ReviewKotchapornJirapadchayaropNo ratings yet

- Uae Taxation LawDocument21 pagesUae Taxation LawchandanhiremathNo ratings yet

- Bayeh AsnakewDocument126 pagesBayeh AsnakewMahmood Khan100% (2)

- ACC 30 Research PaperDocument29 pagesACC 30 Research PaperPat RiveraNo ratings yet

- CG CocoDocument3 pagesCG CocosahagaNo ratings yet

- Acquaculture Fish FarmingDocument17 pagesAcquaculture Fish FarmingAnonymous xv5fUs4AvNo ratings yet

- p2 - Guerrero Ch6Document20 pagesp2 - Guerrero Ch6JerichoPedragosa60% (5)

- CAMELS JournalDocument18 pagesCAMELS JournaltiwixzNo ratings yet

- Ashok LeylandDocument12 pagesAshok LeylandDwarakesh Rocky YadavNo ratings yet

- Midterm 1 Review Selected From Lecture Slides and Assignments - 001 MarkupsDocument14 pagesMidterm 1 Review Selected From Lecture Slides and Assignments - 001 MarkupsXIAODANNo ratings yet

- Mutual Funds: by - Gaurang TrivediDocument7 pagesMutual Funds: by - Gaurang TrivedisanskritiNo ratings yet

- ACCO1115 - May 2017 - EXAMDocument9 pagesACCO1115 - May 2017 - EXAMSarah RanduNo ratings yet

- The Neoclassical-Keynesian SynthesisDocument19 pagesThe Neoclassical-Keynesian SynthesisMilan ZoanNo ratings yet

- Profitability AnalysisDocument29 pagesProfitability AnalysisJocelyn CorpuzNo ratings yet

- SUMMARY OF ChAPTER 4 EXTERNAL ASSESSMENTDocument6 pagesSUMMARY OF ChAPTER 4 EXTERNAL ASSESSMENTadilla ikhsaniiNo ratings yet

- A Project On: Submitted To University of Pune For The Partial Fulfilment of Master of Business AdministrastionDocument69 pagesA Project On: Submitted To University of Pune For The Partial Fulfilment of Master of Business AdministrastionharshNo ratings yet

- A Study On Ratio Analysis in Heritage: Vol 11, Issue 5, May/ 2020 ISSN NO: 0377-9254Document7 pagesA Study On Ratio Analysis in Heritage: Vol 11, Issue 5, May/ 2020 ISSN NO: 0377-9254DedipyaNo ratings yet

- Goat Farming Finance Project Report PDFDocument15 pagesGoat Farming Finance Project Report PDFAllwyn Mendonca100% (1)

- Training Pajak Introduction To WP&B and AFEDocument48 pagesTraining Pajak Introduction To WP&B and AFEIndra Siallagan100% (1)

- Identifying Implicit and Explicit ClaimsDocument57 pagesIdentifying Implicit and Explicit Claimsargus.dump11No ratings yet

- 7 2010 Jun QDocument8 pages7 2010 Jun QWeezy360No ratings yet

- Briefly Explain The Concept of IPP & CPP and Discuss Challenges Faced by Them?Document18 pagesBriefly Explain The Concept of IPP & CPP and Discuss Challenges Faced by Them?Sayan DattaNo ratings yet

- 7 ADocument20 pages7 AJaya Prasad KNo ratings yet

- Managing Director COO Operations in Palm Springs CA Resume Jeff PluthDocument3 pagesManaging Director COO Operations in Palm Springs CA Resume Jeff PluthJeffPluthNo ratings yet