Professional Documents

Culture Documents

Accounting 1: The Effects of The Business Transactions in The Asset, Liability and Owner's Equity

Accounting 1: The Effects of The Business Transactions in The Asset, Liability and Owner's Equity

Uploaded by

Glad Bongcaron0 ratings0% found this document useful (0 votes)

26 views12 pages- Mr. Ng opened Milk Tea Station by investing PHP250,000 cash, increasing assets and owner's equity.

- Equipment was purchased for PHP125,000 on account, increasing assets and liabilities.

- Supplies of PHP35,000 were bought on account from Franzi, increasing assets and liabilities.

- Tables and chairs of PHP50,000 were bought for cash, increasing assets.

- The PHP35,000 account with Franzi was paid in cash, decreasing a liability and an asset.

Original Description:

Original Title

Activity 7

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document- Mr. Ng opened Milk Tea Station by investing PHP250,000 cash, increasing assets and owner's equity.

- Equipment was purchased for PHP125,000 on account, increasing assets and liabilities.

- Supplies of PHP35,000 were bought on account from Franzi, increasing assets and liabilities.

- Tables and chairs of PHP50,000 were bought for cash, increasing assets.

- The PHP35,000 account with Franzi was paid in cash, decreasing a liability and an asset.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

26 views12 pagesAccounting 1: The Effects of The Business Transactions in The Asset, Liability and Owner's Equity

Accounting 1: The Effects of The Business Transactions in The Asset, Liability and Owner's Equity

Uploaded by

Glad Bongcaron- Mr. Ng opened Milk Tea Station by investing PHP250,000 cash, increasing assets and owner's equity.

- Equipment was purchased for PHP125,000 on account, increasing assets and liabilities.

- Supplies of PHP35,000 were bought on account from Franzi, increasing assets and liabilities.

- Tables and chairs of PHP50,000 were bought for cash, increasing assets.

- The PHP35,000 account with Franzi was paid in cash, decreasing a liability and an asset.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 12

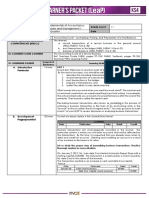

ACCOUNTING 1

The effects of the Business Transactions in the Asset, Liability and

Owner’s Equity

ILLUSTRATIONS:

INCREASE IN AN ASSET AND INCREASE IN LIABILITY

July 1 Purchase on account one (1) unit of laptop, Php65,000.00 from Thinking Tools, Inc. for use in the business.

ANALYSIS:

The value we received is a thing of value (the laptop) which increases an asset of the business.

As a result, the Office Equipment account should be increased.

The value we parted is our promise to pay the amount (on account-is an accounting term which denotes an

oral promise to pay), which increases a liability of the business.

To JOURNALIZED THE TRANSACTION, we must debit, Office Equipment-Laptop with Php65,000.00 for

the value received and Credit Accounts Payable (Thinking Tools Inc.) for the value parted.

Date Particulars PR Debit Credit

July 1 Office Equipment-Laptop Php65,000.00

Accounts Payable (Thinking Tools Inc.) Php65,000.00

Purchase Laptop on Account

DECREASE IN A LIABILITY AND DECREASE IN ASSET

July 2 Paid cash, Php2,500.00 to Exprints Supply in full payment of account.

ANALYSIS:

The value we received is the cancellation of our oral promise to pay, which decreases a liability of the

business. Therefore, the Accounts payable (liability account) should be decreased by Php2,500.00

The value we parted with a thing of value—cash , which decreases an asset account of the business.

To JOURNALIZED THE TRANSACTION, we must debit, Accounts Payable with Php2,500.00 for the value

received and Credit Cash for the value parted.

Date Particulars PR Debit Credit

July 2 Accounts Payable (Exprints Supply) Php2,500.00

Cash Php2,500.00

In full payment of an account

INCREASE IN ASSET AND DECREASE IN ANOTHER ASSET

July 3 Received cash, Php8,500.00, from Juan Dela Cruz for full payment in the services rendered.

ANALYSIS:

The value we received is a thing of value—cash , which increases an asset account of the business. So, the

cash account should be increased by Php8,500.00

The value we parted with is the cancellation of the oral promise to pay of a debtor, Juan Dela Cruz (Accounts

Receivable-an asset account), which decreases another asset of the business. For this reason, the Accounts

receivable should be decreased by Php8,500.00

To JOURNALIZED THE TRANSACTION, we must debit, Cash with Php8,500.00 for the value received and

Credit Accounts receivable for the value parted.

Date Particulars PR Debit Credit

July 3 Cash Php8,500.00

Accounts Receivable (Juan Dela Cruz) Php8,500.00

In full payment of services rendered an

account

INCREASE IN ASSET AND INCREASE IN OWNER’S EQUITY

July 4 Received cash, Php100,00.00, from Eunice Tongco, the owner an additional capital for the business.

ANALYSIS:

The value we received is a thing of value—cash , which increases an asset account of the business. So, the

cash account should be increased by Php100,000.00

The value we parted with is our implied promise to safeguard the owner’s equity, which increase

the Capital Account. Consequently, the capital account should be increased by Php100,000.00

To JOURNALIZED THE TRANSACTION, we must debit, Cash with Php100,000.00 for the value received

and Credit Eunice Tongco, Capital for the value parted.

Date Particulars PR Debit Credit

July 4 Cash Php100,000.00

Eunice Tongco, Capital Php100,000.00

Additional investment

USING THE ILLUSTRATIONS

ABOVE, JOURNALIZE THE

FOLLOWING

TRANSACTIONS

INCREASE IN ASSET AND INCREASE IN OWNER’S EQUITY

February 1 Mr. Ng opened Milk Tea Station by investing Php250,000.00 cash.

ANALYSIS:

The value we received cash , which increases an asset account of the business. So, the cash account should be

increased by Php250,000.00

The value we parted with is our implied promise to safeguard the owner’s equity, which increase

the Capital Account. Consequently, the capital account should be increased by Php250,000.00

To JOURNALIZED THE TRANSACTION, we must debit, Cash with Php250,000.00 for the value received

and Credit Mr. Ng, Capital for the value parted.

Date Particulars PR Debit Credit

Feb. 1 Cash 250, 000

Mr. Ng 250, 000

Investment

INCREASE IN AN ASSET AND INCREASE IN LIABILITY

February 2 Mr. Ng bought equipment's for the business amounting to Php125,000.00 .

ANALYSIS:

The value we received is a thing of value (bought equipment’s) which increases an asset of the business. As a

result, the Office Equipment account should be increased.

The value we parted is our promise to pay the amount (on account-is an accounting term which denotes an

oral promise to pay), which increases a liability of the business.

To JOURNALIZED THE TRANSACTION, we must debit, Office Equipment with Php125,000.00 for the value

received and Credit Mr. Ng for the value parted.

Date Particulars PR Debit Credit

Feb. 2 Office

To JOURNALIZED THEEquipment 125,000

TRANSACTION, _______________________________________________

Mr. Ng 125,000

Bought Equiptment

INCREASE IN AN ASSET AND INCREASE IN LIABILITY

February 3 Purchased supplies on account at Franzi General Merchandise worth Php35,000.00.

ANALYSIS:

The value we received is a thing of value (purchased supplies) which increases an asset of the business.

As a result, the purchased supplies on account should be increased.

The value we parted is our promise to pay the amount (on account-is an accounting term which denotes an oral

promise to pay), which increases a liability of the business.

To JOURNALIZED THE TRANSACTION, we must debit, Purchases with Php35,000.00 for the value received

and Cash for the value parted.

Date Particulars PR Debit Credit

Feb. 3 Purchases 35,000

Cash 35,000

Purchased Supplies on Cash

INCREASE IN AN ASSET AND INCREASE IN LIABILITY

February 4 Bought tables and chairs worth Php 50,000.00 cash.

ANALYSIS:

The value we received is a thing of value (Tables and Chairs) which increases an asset of the business.

As a result, the Furniture account should be increased.

The value we parted is our promise to pay the amount (on account-is an accounting term which denotes an

oral promise to pay), which increases a liability of the business.

To JOURNALIZED THE TRANSACTION, we must debit, Furniture with Php50,000.00 for the value received

and Credit Cash for the value parted.

Date Particulars PR Debit Credit

Feb 4 Furniture 50,000

Cash 50,000

Bought Furniture for cash

DECREASE IN A LIABILITY AND DECREASE IN ASSET

February 7 Paid Franci Merchandise for the supplies bought on account worth Php35,000.00.

ANALYSIS:

The value we received is the cancellation of our oral promise to pay, which decreases a liability of the

business. Therefore, the Accounts payable (liability account) should be decreased by Php35,000.00

The value we parted with a thing of value—cash , which decreases an asset account of the business.

To JOURNALIZED THE TRANSACTION,we must debit, Account Payable_Franci Merchandise

with Php35,000.00 for the value received and Credit Cash for the value parted.

Date Particulars PR Debit Credit

Feb. 7 Account Payable_Franci Merchandise 35,000

Cash 35,000

Paid Credit to Franci Merchandise

You might also like

- Chapter 3 Review Problems With SolutionsDocument13 pagesChapter 3 Review Problems With Solutionsaby251188No ratings yet

- Accounting 1 Review QuizDocument6 pagesAccounting 1 Review QuizAikalyn MangubatNo ratings yet

- Journal Entries Ledger Trial Balance Problem and SolutionDocument7 pagesJournal Entries Ledger Trial Balance Problem and SolutionArgha DuttaNo ratings yet

- Journalizing, Posting and Trial Balance: For Non-WiredDocument8 pagesJournalizing, Posting and Trial Balance: For Non-WiredCj ArquisolaNo ratings yet

- Quizzer Cash - Solution Printed KoDocument119 pagesQuizzer Cash - Solution Printed Kogoerginamarquez80% (10)

- M4 Transaction Analysis JEDocument7 pagesM4 Transaction Analysis JEJohn Benedict Capiral TehNo ratings yet

- Accounting Non-Accountants Part 2Document37 pagesAccounting Non-Accountants Part 2Vanessa Gapas0% (1)

- EFA1 Exercise 2&3 SolutionDocument12 pagesEFA1 Exercise 2&3 SolutionDiep NguyenNo ratings yet

- Session 5Document28 pagesSession 5Sarvesh ChandraNo ratings yet

- Session 5-6: Accounting Records: Instructor Dr. Jagan Kumar SurDocument48 pagesSession 5-6: Accounting Records: Instructor Dr. Jagan Kumar SurBabusona SahaNo ratings yet

- The Accounting Equation PP TDocument39 pagesThe Accounting Equation PP TMelu Jean MayoresNo ratings yet

- Business Transactions and Their Analysis As Applied To Service BusinessDocument57 pagesBusiness Transactions and Their Analysis As Applied To Service BusinessRhona Primne ServañezNo ratings yet

- 9.books of Accounts and Rules On DR and CRDocument18 pages9.books of Accounts and Rules On DR and CRcristin l. viloriaNo ratings yet

- Chapter 5Document6 pagesChapter 5mardyjanedahuyagNo ratings yet

- Recording in The Journals or JournalizingDocument6 pagesRecording in The Journals or JournalizingMardy DahuyagNo ratings yet

- Fundamentals of Accountancy, Business, and Management 1Document12 pagesFundamentals of Accountancy, Business, and Management 1Muyco Mario AngeloNo ratings yet

- Chapter 6Document6 pagesChapter 6Ellen Joy PenieroNo ratings yet

- Question BankDocument21 pagesQuestion BankIan ChanNo ratings yet

- Debit and Credit Rules of AccountingDocument6 pagesDebit and Credit Rules of AccountingsbcluincNo ratings yet

- Basic Accounting EquationDocument42 pagesBasic Accounting Equationlily smithNo ratings yet

- The Accounting Equation: Assets Liabilities + EquityDocument4 pagesThe Accounting Equation: Assets Liabilities + EquityRegine CariñoNo ratings yet

- Business Finance: Financial Statement Preparation, Analysis, and InterpretationDocument7 pagesBusiness Finance: Financial Statement Preparation, Analysis, and InterpretationRosalyn Mauricio VelascoNo ratings yet

- Principles of Accounting Lecture 3Document21 pagesPrinciples of Accounting Lecture 3Masum HossainNo ratings yet

- Principles of Accounting Lecture 3Document30 pagesPrinciples of Accounting Lecture 3Masum HossainNo ratings yet

- Financial Statement Preparation, Analysis and InterpretationDocument3 pagesFinancial Statement Preparation, Analysis and Interpretationjhosal diazNo ratings yet

- Lecture 4Document44 pagesLecture 4Tanveer AhmedNo ratings yet

- Chapter 2 - Accounting Equation and Double EntryDocument10 pagesChapter 2 - Accounting Equation and Double EntrykundiarshdeepNo ratings yet

- QuestionsDocument3 pagesQuestionsRaca DesuNo ratings yet

- Accounting Cycle and Book of AccountsDocument23 pagesAccounting Cycle and Book of AccountsChaaaNo ratings yet

- Additional Questions On Financial Statements and Cash BookDocument5 pagesAdditional Questions On Financial Statements and Cash BookBoi NonoNo ratings yet

- Accounts FinalDocument10 pagesAccounts FinalNeha PNo ratings yet

- 11 Concepts of Accounting (Hashi)Document9 pages11 Concepts of Accounting (Hashi)mohamedNo ratings yet

- Chap2 AccountingDocument11 pagesChap2 AccountingClash ClanNo ratings yet

- ABM 1 Transactions IllustrationDocument29 pagesABM 1 Transactions IllustrationMarilou EustaquioNo ratings yet

- Financial Accounting and Analysis - EditedDocument10 pagesFinancial Accounting and Analysis - EditedAnthony KimaniNo ratings yet

- Analysis of Business TransactionsDocument21 pagesAnalysis of Business TransactionsDan Gideon Cariaga100% (1)

- Lecture - RevisedDocument8 pagesLecture - RevisedDanny LeonenNo ratings yet

- Latihan Asdos 1 - Pengantar AkunDocument1 pageLatihan Asdos 1 - Pengantar AkunNuky Presiari DjajalaksanaNo ratings yet

- Chapter 6 Accounting Equations: Short Answer QuestionDocument16 pagesChapter 6 Accounting Equations: Short Answer QuestionSaransh BattaNo ratings yet

- Fa1 Assignment #1 DacayananDocument9 pagesFa1 Assignment #1 DacayananMikha DacayananNo ratings yet

- Analyzing Business TransactionsDocument8 pagesAnalyzing Business TransactionsLyrra Jorramie Rull GragedaNo ratings yet

- Chart of Accounts Example Gray Electronic Repair Services Chart of Accounts ASSETS (1000-1999)Document50 pagesChart of Accounts Example Gray Electronic Repair Services Chart of Accounts ASSETS (1000-1999)Richard Dan Ilao ReyesNo ratings yet

- Rules of Debit and Credit Module 3Document12 pagesRules of Debit and Credit Module 3rima riveraNo ratings yet

- Accounting Transaction Processing Chapter 3Document73 pagesAccounting Transaction Processing Chapter 3Rupesh PolNo ratings yet

- Tally NotesDocument32 pagesTally NotesenuNo ratings yet

- Lesson 1 - Analyzing Transactions and JournalizingDocument7 pagesLesson 1 - Analyzing Transactions and JournalizingMikaela GaytaNo ratings yet

- Fundamentals of Accountancy Business and Management 1 11 FourthDocument4 pagesFundamentals of Accountancy Business and Management 1 11 FourthPaulo Amposta CarpioNo ratings yet

- Module 4 Cash and Accrual BasisDocument4 pagesModule 4 Cash and Accrual BasisSeulgi KangNo ratings yet

- What Is Accounting???Document15 pagesWhat Is Accounting???Modassar NazarNo ratings yet

- Sample ProblemDocument5 pagesSample ProblemNath BongalonNo ratings yet

- MBA Financial AccountingDocument5 pagesMBA Financial AccountingabhinavNo ratings yet

- The Accounting Equation: Business EducationDocument44 pagesThe Accounting Equation: Business EducationMarcus WongNo ratings yet

- TransactionDocument4 pagesTransactionapi-351243280No ratings yet

- Review: Adjusting Entries: NameDocument4 pagesReview: Adjusting Entries: NameJohn BushNo ratings yet

- General JournalDocument10 pagesGeneral JournalsameerdsportsmanNo ratings yet

- Fabm 1 LeapDocument4 pagesFabm 1 Leapanna paulaNo ratings yet

- BKP 9 Accounting EquationDocument16 pagesBKP 9 Accounting EquationPhilpNil8000No ratings yet

- Financial Reporting - Basic - The Accounting Equation - Part 2Document4 pagesFinancial Reporting - Basic - The Accounting Equation - Part 2Ulitz QangaeNo ratings yet

- Lesson 4-2Document28 pagesLesson 4-2Alexis Nicole Joy Manatad86% (7)

- Course Name 9Document6 pagesCourse Name 9Revise PastralisNo ratings yet

- Transport Layer: Goals: OverviewDocument18 pagesTransport Layer: Goals: OverviewGlad BongcaronNo ratings yet

- By Bowerman, O'Connell, and MurphreeDocument7 pagesBy Bowerman, O'Connell, and MurphreeGlad BongcaronNo ratings yet

- Business Organizations: Economics: Principles in ActionDocument4 pagesBusiness Organizations: Economics: Principles in ActionGlad BongcaronNo ratings yet

- Dot Plots Excel Template: VisitDocument3 pagesDot Plots Excel Template: VisitGlad BongcaronNo ratings yet

- Quantitative MethodsDocument28 pagesQuantitative MethodsGlad BongcaronNo ratings yet

- The Cigarette Advertisement CaseDocument2 pagesThe Cigarette Advertisement CaseGlad BongcaronNo ratings yet

- Network DiagramDocument1 pageNetwork DiagramGlad BongcaronNo ratings yet

- Identification of A New Coronavirus PDFDocument7 pagesIdentification of A New Coronavirus PDFGlad BongcaronNo ratings yet

- Eb - Contract.Balances: Main Office Branch-KhDocument3 pagesEb - Contract.Balances: Main Office Branch-KhMrCHANTHANo ratings yet

- Cost Accounting3Document9 pagesCost Accounting3stephborinagaNo ratings yet

- Summative Test 1ST SemDocument2 pagesSummative Test 1ST Semmark turbanadaNo ratings yet

- FY 2021 SQMI Wilton+Makmur+Indonesia+TbkDocument106 pagesFY 2021 SQMI Wilton+Makmur+Indonesia+TbkYadi CahyadiNo ratings yet

- Penyata Akaun: Tarikh Date Keterangan Description Terminal ID ID Terminal Amaun (RM) Amount (RM) Baki (RM) Balance (RM)Document1 pagePenyata Akaun: Tarikh Date Keterangan Description Terminal ID ID Terminal Amaun (RM) Amount (RM) Baki (RM) Balance (RM)ROHANI SAUDNo ratings yet

- Akuntansi Pengatar Pertemuan Ke 3Document4 pagesAkuntansi Pengatar Pertemuan Ke 3WiwitvlogNo ratings yet

- Partnership SBCDocument10 pagesPartnership SBChyosunglover100% (1)

- Accounts Debit Credit: Jolly Company's Accounts Have The Following Balances As of December 31, 2018Document38 pagesAccounts Debit Credit: Jolly Company's Accounts Have The Following Balances As of December 31, 2018Allen CarlNo ratings yet

- Partnership AccountingDocument10 pagesPartnership AccountingAether SkywardNo ratings yet

- 01 - Audit of Cash & Cash EquivalentsDocument4 pages01 - Audit of Cash & Cash EquivalentsEARL JOHN RosalesNo ratings yet

- SADMADocument19 pagesSADMAVenkatesh KamathNo ratings yet

- AccountingDocument17 pagesAccountingKimberly Mae AriasNo ratings yet

- #01 Accounting ProcessDocument3 pages#01 Accounting ProcessZaaavnn VannnnnNo ratings yet

- Cash Flow ForecastingDocument3 pagesCash Flow Forecastingrohit_kumraNo ratings yet

- Supply Chain Management-BinusDocument8 pagesSupply Chain Management-BinusdsuharnoNo ratings yet

- Total DataDocument1,828 pagesTotal Dataanon_981731217No ratings yet

- Final Practice SetDocument28 pagesFinal Practice SetWisley GamuzaNo ratings yet

- Kimberly ClarkDocument2 pagesKimberly ClarkRanita ChatterjeeNo ratings yet

- Activity/Assignment #2 - Financial Models - Comparative DataDocument5 pagesActivity/Assignment #2 - Financial Models - Comparative DataNazzer NacuspagNo ratings yet

- Rekening Koran (Account Statement) : Date & Time Value Date Description Debit Balance Credit Reference NoDocument2 pagesRekening Koran (Account Statement) : Date & Time Value Date Description Debit Balance Credit Reference NofirmanNo ratings yet

- Chapter 3Document28 pagesChapter 3addea100% (1)

- AIS Ch6Document48 pagesAIS Ch6Abdii DhufeeraNo ratings yet

- Chapter 02 TestbankDocument372 pagesChapter 02 TestbankAvisha SinghNo ratings yet

- Pertemuan-1 PENGENALAN LOGISTIKDocument24 pagesPertemuan-1 PENGENALAN LOGISTIKFeriNo ratings yet

- Gaya Selingkung Jurnal (Template Jurnal UNTAG) - DikonversiDocument4 pagesGaya Selingkung Jurnal (Template Jurnal UNTAG) - DikonversifirmanNo ratings yet

- Kap 1 6th Workbook Te CH 7Document96 pagesKap 1 6th Workbook Te CH 7Gurpreet KaurNo ratings yet

- Six Sigma Master Black Belt - ISI MBB 2223 02 Part-A: Descriptive Questions 5 Questions Each Carrying 10 MarksDocument4 pagesSix Sigma Master Black Belt - ISI MBB 2223 02 Part-A: Descriptive Questions 5 Questions Each Carrying 10 MarksSanjoy sharmaNo ratings yet

- Cost Accounting: "Backflush Costing"Document40 pagesCost Accounting: "Backflush Costing"John Derek GarreroNo ratings yet

- Bab 2 - Perilaku BiayaDocument40 pagesBab 2 - Perilaku BiayaAndy ReynaldyyNo ratings yet