Professional Documents

Culture Documents

CSC Ch14 - Company Analysis

CSC Ch14 - Company Analysis

Uploaded by

lily northOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CSC Ch14 - Company Analysis

CSC Ch14 - Company Analysis

Uploaded by

lily northCopyright:

Available Formats

Investment Analysis

CHAPTER 14: Company Analysis

CSI Global Education Inc.

Company Analysis

Analysing a company to determine whether or not it is a good

investment by closely examining the Financial statements.

Other factors used in company analysis are:

Qualitative Analysis – management effectiveness and other

intangibles.

Liquidity of common shares

Continuous monitoring of the company.

CSI Global Education Inc. 2

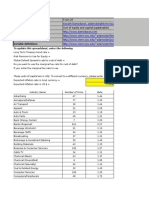

Trend Analysis

Ratios from a company’s financial statements are used when

analyzing a company. However, a ratio for just one year has little

value. These ratios have more meaning when they are compared

from one year to the next.

Ratios are compared with one another over a period of time by

using a base year. For example: Year 1 is the base year

Year Year 1 Year 2 Year 3 Year 4

EPS $1.18 $1.32 $1.73 $1.76

1.18 1.32 1.73 1.76

1.18 1.18 1.18 1.18

Trend 100 112 147 149

CSI Global Education Inc. 3

Ratio Analysis

A ratio shows the relationship between two numbers, in which a

number is usually related to 1, e.g., 2.2 to 1 or 2.2:1. The four

general categories of ratios are:

Liquidity Ratios: used to judge a company’s ability to meet its

short-term commitments.

Risk Analysis Ratios: show how well a company can deal with its

debt obligations.

Operating Performance Ratios: illustrates how well management

has made use of the company’s resources.

Value Ratios: shows the market worth of the company’s shares or

the return on owning them.

CSI Global Education Inc. 4

Current Ratio (or Working Capital)

Purpose:

Assess liquidity (the ability to meet short-term financial obligations)

Current Assets

Formula:

Current Liabilities

2:1 is a suggested or recommended level. But depends on type of

business and industry.

CSI Global Education Inc. 5

Quick Ratio or Acid Test

Purpose:

More stringent test of liquidity

Formula: Current Assets – Inventory

Current Liabilities

1:1 is the suggested or industry recommended level. But depends

on type of business and industry.

CSI Global Education Inc. 6

Risk Analysis Ratios

Focus: analyze the riskiness of a company.

1. Is the debt level reasonable?

2. What is the company’s ability to pay interest, as measured

through the interest coverage ratio

3. What is the company’s ability to repay its debt, as measured

through asset coverage & cash flow to total debt ratios

CSI Global Education Inc. 7

Asset Coverage Ratio

Purpose:

Assess debt holder protection provided by the company’s tangible

assets after removing all liabilities

Formula:

Total Assets – Def. Charges – Intangible Assets – (Current Liabilities Less Short Term Debt)

Total Debt (i.e. LTD + STD)/1000

CSI Global Education Inc. 8

Asset Coverage

• Industry standards for this ratio vary due, in part, to the stability

of income provided by the company.

• Utilities, for example, have a fairly stable source of income as

they are characterized by heavy investment in permanent

property, which accounts for a large part of their total assets.

• They are also subject to regulation, which ensures the utility a

fair return on its investment.

CSI Global Education Inc. 9

Debt/Equity Ratio

Purpose:

Shows the proportion of borrowed funds used relative to the

investments made by shareholders in the company.

Total Debt (STD + LTD)

Formula:

Book Value of Equity

If the debt burden is too large, it reduces the margin of safety

protecting debt holders capital. Financial risk also increases.

CSI Global Education Inc. 10

Cash Flow/Total Debt

Purpose:

Measure of ability to repay borrowed funds

Formula:

Cash flow from operations

Total debt outstanding

Where cash flow =

earnings before extraordinary items – equity income + non-controlling

interest in subsidiaries + deferred taxes + amortization + other non-

cash expenses + net change in working capital requirements

Or, simply use cash flows from operating activities (CFO) from the cash

flow statement.

CSI Global Education Inc. 11

Interest Coverage

Purpose:

Measure of ability to pay interest on debt

Formula:

Profit before interest charges and taxes

Interest Charges

CSI Global Education Inc. 12

Operating Performance Ratios

Purpose:

• Measure of the profit left after various expenses.

• Shows how well management used the company’s resources.

• Used to compare to others in industry and historic performance.

CSI Global Education Inc. 13

Operating Performance Ratios (continued)

Gross Profit Margin:

Revenue – Cost of Sales

Revenue

Net Profit Margin:

Profit - Share of Profit of Associates

Revenue

CSI Global Education Inc. 14

After-tax return on common equity

Purpose:

Shows the dollar amount of earnings that were produced for each

dollar invested by the company’s common share holders.

Formula:

Profit X 100

Total Equity

CSI Global Education Inc. 15

Inventory Turnover

Purpose:

Measures amount of inventory in relation to sales.

Formula:

Cost of Sales

Inventory

Eg $28,250,000 = 3.13 times

$9,035,000

To calculate ratio into days

365 = 116.61 days

3.13

CSI Global Education Inc. 16

Value Ratios

Ratios used to assess the value of a stock in relation to its price.

Used to relate a stock’s price to dividends and earnings.

CSI Global Education Inc. 17

Percentage Dividend Payout Ratios

Purpose:

Measures extent that profits were paid to shareholders.

Formulas:

Common Share Dividends X 100

Profit

CSI Global Education Inc. 18

Earnings Per Common Share

Purpose:

Measures earnings available to each common share.

Formula:

Profit

Number of common shares outstanding

CSI Global Education Inc. 19

Dividend Yield

Purpose:

Measures investors % return on investment from dividends.

Formula:

Annual Dividend per share X 100

Current market per share

CSI Global Education Inc. 20

Price-Earnings Ratio

Purpose:

• Used to show how much an investor is paying for a company’s

earnings.

• Allows a common comparison between others in the same

industry.

Formula:

Current Market Price of Common

Earnings Per Share O ver Last 12 Months

CSI Global Education Inc. 21

Price-Earnings Ratio

Purpose:

• Helps to evaluate stock value over market cycle.

• P/Es in increasing stock market.

• P/Es in decreasing stock market.

• High growth companies tend to have higher P/Es than low

growth companies.

• P/Es tend to move in the opposite direction to inflation.

CSI Global Education Inc. 22

Equity (Book Value) per Common Shares

Purpose:

Assess the asset coverage for each common share.

Formula:

Equity

Number of common shares outstanding

CSI Global Education Inc. 23

Investment Quality of Preferreds

There are four tests to consider:

1. Preferred Dividend Coverage

– Is income sufficient to pay the dividend

– Is it stable and rising

2. Record of Continuous Dividend Payments

3. Equity Per Preferred Share

– Is equity adequate to repay the par value of the preferred

4. Independent Credit Assessment

CSI Global Education Inc. 24

You might also like

- Contemporary Financial Management 14th Edition Moyer Solutions ManualDocument7 pagesContemporary Financial Management 14th Edition Moyer Solutions Manualbenjaminnelsonijmekzfdos100% (13)

- Financial Management Handbook 1704942604Document45 pagesFinancial Management Handbook 1704942604alenNo ratings yet

- Discussion 3Document1 pageDiscussion 3lily northNo ratings yet

- Stock ValuationDocument24 pagesStock ValuationamarjeetNo ratings yet

- H of M CH 10Document1 pageH of M CH 10lily northNo ratings yet

- Ratios AnalysisDocument48 pagesRatios AnalysisfranskasangaNo ratings yet

- Finance L5Document40 pagesFinance L5Rida RehmanNo ratings yet

- Chapter 5. Financial Statement AnalysisDocument52 pagesChapter 5. Financial Statement AnalysisHuy Nguyễn NgọcNo ratings yet

- Financial Management Economics For Finance 1679035282Document135 pagesFinancial Management Economics For Finance 1679035282Alaka BelkudeNo ratings yet

- Chapter TWO FM I1Document65 pagesChapter TWO FM I1Embassy and NGO jobsNo ratings yet

- Top 30 Investment Banking Interview Questions and AnswersDocument7 pagesTop 30 Investment Banking Interview Questions and AnswersVidit ParuthiNo ratings yet

- Chapter 03 Im 10th EdDocument32 pagesChapter 03 Im 10th EdAzman MendaleNo ratings yet

- Managerial Economics 214ECN: Department of Economics, Finance and AccountingDocument62 pagesManagerial Economics 214ECN: Department of Economics, Finance and AccountingphuongfeoNo ratings yet

- Chapter TWODocument37 pagesChapter TWOEmbassy and NGO jobsNo ratings yet

- Chapter 4Document11 pagesChapter 4Seid KassawNo ratings yet

- Name: Meenakshi MBA-II Semester MB0029 Financial ManagementDocument10 pagesName: Meenakshi MBA-II Semester MB0029 Financial Managementbaku85No ratings yet

- My Brigham CH 4Document45 pagesMy Brigham CH 4sabapshafaghNo ratings yet

- Tutorial 5 - Ratio Analysis - AnswerDocument5 pagesTutorial 5 - Ratio Analysis - Answernurfatimah473No ratings yet

- Accounting HandbookDocument42 pagesAccounting Handbookinfoyazid5No ratings yet

- C11 An Introduction To Security ValuationDocument37 pagesC11 An Introduction To Security Valuationharisali55No ratings yet

- Comparative Analysis of Prism Cement LTD With JK Cement LTDDocument57 pagesComparative Analysis of Prism Cement LTD With JK Cement LTDRajudimple100% (1)

- Financial Statements Analysis - Q&aDocument6 pagesFinancial Statements Analysis - Q&aNaga NagendraNo ratings yet

- 1 - Unit III Full Unit NotesDocument54 pages1 - Unit III Full Unit NotesPrasanna VenkatesanNo ratings yet

- Comparative Analysis of Prism Cement LTD With JK Cement LTDDocument56 pagesComparative Analysis of Prism Cement LTD With JK Cement LTDBhushan NagalkarNo ratings yet

- FM PDFDocument11 pagesFM PDFRushikesh GadhaveNo ratings yet

- Purpose of Understanding Financial AnalysisDocument5 pagesPurpose of Understanding Financial AnalysisMaya SariNo ratings yet

- RATIOSDocument16 pagesRATIOSantra10tiwariNo ratings yet

- ADB1023 Corporate Finance Valuation of Assets, Shares and CompaniesDocument31 pagesADB1023 Corporate Finance Valuation of Assets, Shares and CompaniesJesterdanceNo ratings yet

- Tutorial 5 - Ratio Analysis - AnswerDocument6 pagesTutorial 5 - Ratio Analysis - AnswerSaravanan KandasamyNo ratings yet

- FinanceDocument34 pagesFinanceAmrinder KhuralNo ratings yet

- Portfolio Analysis: CHAPTER 15: Introduction To The Portfolio ApproachDocument26 pagesPortfolio Analysis: CHAPTER 15: Introduction To The Portfolio Approachlily northNo ratings yet

- Financial Statement AnalysisDocument73 pagesFinancial Statement AnalysisDivyanshi KapoorNo ratings yet

- Equity Research Interview Questions and AnswersDocument22 pagesEquity Research Interview Questions and AnswersHarsh JainNo ratings yet

- Financial RatiosDocument4 pagesFinancial Ratios14 Files OnlyNo ratings yet

- Lecture 9 FIN 449Document28 pagesLecture 9 FIN 449anhhong.24092002No ratings yet

- Dividend: Dividend Payout Ratio Refers To The Percent of Net Profit To Be DistributedDocument7 pagesDividend: Dividend Payout Ratio Refers To The Percent of Net Profit To Be Distributedsonal jainNo ratings yet

- Determinants of Dividends Policy and Dividend Policy of Companies Trend and Ratio AnalysisDocument31 pagesDeterminants of Dividends Policy and Dividend Policy of Companies Trend and Ratio Analysissonal jainNo ratings yet

- Tutorial 12Document72 pagesTutorial 12Irene WongNo ratings yet

- FABM2 Module 06 (Q1-W7)Document8 pagesFABM2 Module 06 (Q1-W7)Christian Zebua75% (4)

- FM Unit 2 Lecture Notes - Financial Statement AnalysisDocument4 pagesFM Unit 2 Lecture Notes - Financial Statement AnalysisDebbie DebzNo ratings yet

- Ratio Analisis PresentationDocument21 pagesRatio Analisis PresentationMian TalhaNo ratings yet

- 11modelos de Valorización de AccionesDocument46 pages11modelos de Valorización de AccionesMario Zambrano CéspedesNo ratings yet

- RATIO ANALYSIS Unit 1Document18 pagesRATIO ANALYSIS Unit 1DWAYNE HARVEYNo ratings yet

- Accounting For Managers: Professor ZHOU NingDocument43 pagesAccounting For Managers: Professor ZHOU Ningtest boyNo ratings yet

- Ratio Analysis Sem IIDocument39 pagesRatio Analysis Sem IIAmit7079No ratings yet

- Financial Reporting and Analysis 21BAT-602: Master of Business AdministrationDocument38 pagesFinancial Reporting and Analysis 21BAT-602: Master of Business AdministrationAshutosh prakashNo ratings yet

- Lecture 3.3Document28 pagesLecture 3.3Classinfo CuNo ratings yet

- CHAPTER 18: Mutual Funds: Types and FeaturesDocument18 pagesCHAPTER 18: Mutual Funds: Types and Featureslily northNo ratings yet

- Chapter 3 Solutions & NotesDocument17 pagesChapter 3 Solutions & NotesStudy PinkNo ratings yet

- MBA711 - Answers To Book - Chapter 3Document17 pagesMBA711 - Answers To Book - Chapter 3anonymathieu50% (2)

- Control: The Management Control EnvironmentDocument49 pagesControl: The Management Control EnvironmentvinnaNo ratings yet

- Unit IV MBADocument6 pagesUnit IV MBAMiyonNo ratings yet

- Tips RatiosDocument8 pagesTips RatiosMelvin Amoh100% (1)

- FSAV+6e PPT Mod+03Document89 pagesFSAV+6e PPT Mod+03lubna.attariNo ratings yet

- FIN 571 Connect Problem Final Exam Answers - UOP E AssignmentsDocument14 pagesFIN 571 Connect Problem Final Exam Answers - UOP E AssignmentsuopeassignmentsNo ratings yet

- Unit 5Document28 pagesUnit 5Vamshika KattaNo ratings yet

- Ratio AnalysisDocument6 pagesRatio AnalysisMilcah QuisedoNo ratings yet

- FABM2 Wk7Document6 pagesFABM2 Wk7john lester pangilinanNo ratings yet

- Chapter 3 Financial AnalysisDocument39 pagesChapter 3 Financial AnalysisnuggsNo ratings yet

- Unit 7 Capital StructureDocument12 pagesUnit 7 Capital StructurepnkgoudNo ratings yet

- @2015 FM I CH 2-IFRS Based Financilal AnlysisDocument50 pages@2015 FM I CH 2-IFRS Based Financilal Anlysismkmkd854No ratings yet

- Discussion 1Document2 pagesDiscussion 1lily northNo ratings yet

- A. B. C. D.: 0.25 PointsDocument2 pagesA. B. C. D.: 0.25 Pointslily northNo ratings yet

- A. B. C. D.: 0.5 PointsDocument1 pageA. B. C. D.: 0.5 Pointslily northNo ratings yet

- Econ 206 Course Readings ListDocument3 pagesEcon 206 Course Readings Listlily northNo ratings yet

- H of M CH 6Document1 pageH of M CH 6lily northNo ratings yet

- H of M CH 4Document1 pageH of M CH 4lily northNo ratings yet

- H of M CH 3Document1 pageH of M CH 3lily northNo ratings yet

- Course Outline: Shawn RichardsDocument11 pagesCourse Outline: Shawn Richardslily northNo ratings yet

- WK 3 N 4 Lecture 3 N 4 Ch.16 Analysing Cash FlowsDocument9 pagesWK 3 N 4 Lecture 3 N 4 Ch.16 Analysing Cash Flowslily northNo ratings yet

- Insurance Claim Phone NumbersDocument5 pagesInsurance Claim Phone Numberswes MashburnNo ratings yet

- Sample - Period Panties Market Report, 2032Document40 pagesSample - Period Panties Market Report, 2032Tu NguyenNo ratings yet

- Date Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsDocument15 pagesDate Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsPedro CooperNo ratings yet

- st124 Fill inDocument2 pagesst124 Fill inABODE PVT LIMITEDNo ratings yet

- Problems - Final ExaminationDocument3 pagesProblems - Final Examinationjhell de la cruzNo ratings yet

- Vortum PPP DatabaseDocument4 pagesVortum PPP DatabaseJigisha VasaNo ratings yet

- The Micro Economy Today 16Th Edition Bradley Schiller Online Ebook Texxtbook Full Chapter PDFDocument69 pagesThe Micro Economy Today 16Th Edition Bradley Schiller Online Ebook Texxtbook Full Chapter PDFmarx.shelton172100% (6)

- Chapter 8Document16 pagesChapter 8sanjay chandwaniNo ratings yet

- Statistique Du 01/03/2022 Au 31/03/2022: Matricule Type Controleur Date de Début Résultat Client Numéro de PVDocument23 pagesStatistique Du 01/03/2022 Au 31/03/2022: Matricule Type Controleur Date de Début Résultat Client Numéro de PVmbarek jariNo ratings yet

- Ramky One Symphony Price SheetDocument2 pagesRamky One Symphony Price SheetkrishnaNo ratings yet

- PUBLIC FINANCE OF PHILIPPINES AND THAILAND by ESTELLE GADIADocument40 pagesPUBLIC FINANCE OF PHILIPPINES AND THAILAND by ESTELLE GADIAEstelle Gadia100% (1)

- Consumer and Producer SurplusDocument3 pagesConsumer and Producer SurplusRonan FerrerNo ratings yet

- Notes of MGL EconomicsDocument45 pagesNotes of MGL Economicsmohanraokp2279100% (1)

- Production Possibility CurveDocument21 pagesProduction Possibility Curvespikeinellect07No ratings yet

- GST Return 12 DEC 2019Document1 pageGST Return 12 DEC 2019Abasaheb RaskarNo ratings yet

- Macroeconomics Assignment: Dr. Pooja Mishra & Professor Jagdish ShittegarDocument10 pagesMacroeconomics Assignment: Dr. Pooja Mishra & Professor Jagdish Shittegarvishnu sehrawatNo ratings yet

- Schedule IagoDocument8 pagesSchedule IagoIago MartinsNo ratings yet

- CEV417 - Engineering Economy ModuleDocument20 pagesCEV417 - Engineering Economy ModuleJan Alexis MonsaludNo ratings yet

- Afar.3202 Corporate LiquidationDocument6 pagesAfar.3202 Corporate Liquidationruel c armillaNo ratings yet

- GST in IndiaDocument11 pagesGST in IndiarameshNo ratings yet

- Analisis Strategi Bisnis Usaha Mikro Kecil Dan Menengah (UMKM) Dalam Pengembangan Usaha UD. Mete Mubaraq Lombe Kota KendariDocument12 pagesAnalisis Strategi Bisnis Usaha Mikro Kecil Dan Menengah (UMKM) Dalam Pengembangan Usaha UD. Mete Mubaraq Lombe Kota KendariPutri 123No ratings yet

- KPMG Green Tax Index 2013 PDFDocument40 pagesKPMG Green Tax Index 2013 PDFSandeep K TiwariNo ratings yet

- Your Texas Exes - University of Texas Adv Tiered Interest CHKGDocument12 pagesYour Texas Exes - University of Texas Adv Tiered Interest CHKGblon majors0% (1)

- Ilan Group Operation Enterprise: Imran AminuddinDocument1 pageIlan Group Operation Enterprise: Imran AminuddinIzhar AminuddinNo ratings yet

- DoNER Annual Report 2021-22Document171 pagesDoNER Annual Report 2021-22svNo ratings yet

- Form 4 English Paper1 Ujian Pengesanan Sept2021Document16 pagesForm 4 English Paper1 Ujian Pengesanan Sept2021NAJWA ZAHIDAH BINTI RAZALI MoeNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)nhat duy leNo ratings yet

- Yap vs. First E-Bank Corporation, 601 SCRA 250, September 29, 2009Document12 pagesYap vs. First E-Bank Corporation, 601 SCRA 250, September 29, 2009Reynald CruzNo ratings yet

- 4009 Monticello CT Mrs Cindy Thaxton: Make Checks Payable To Og&EDocument1 page4009 Monticello CT Mrs Cindy Thaxton: Make Checks Payable To Og&EA Random GamerNo ratings yet