Professional Documents

Culture Documents

Kalpa-Taru Power Transimmition Limited: Topic On Working Capital Prepared By-Gaurang.P.Raval SMU - 12

Kalpa-Taru Power Transimmition Limited: Topic On Working Capital Prepared By-Gaurang.P.Raval SMU - 12

Uploaded by

Gaurang RavalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kalpa-Taru Power Transimmition Limited: Topic On Working Capital Prepared By-Gaurang.P.Raval SMU - 12

Kalpa-Taru Power Transimmition Limited: Topic On Working Capital Prepared By-Gaurang.P.Raval SMU - 12

Uploaded by

Gaurang RavalCopyright:

Available Formats

Kalpa-Taru Power

Transimmition Limited

1

T O P I C O N W O R K IN G C A P I T A L

P R EP A R ED BY -

G A U R A N G. P . R A VA L

SMU - 12

IBMR BUSINESS SCHOOL

Content

2

Research Methodology

Introduction of working capital

Types of working capital

Objective of study

WORKING CAPITAL ANALYSIS OF KPTL

Limitation

IBMR BUSINESS SCHOOL

Research Methodology

3

Scope of the study :-

Planning of working capital management

Working capital finance

Methods of Data collection :-

Primary data:

Basic information collected from the local sources

as well as from the company staff like managers,

accountants and officers. Moreover information gathered

through practically preparing the data for working capital

IBMR BUSINESS SCHOOL

Contd….

4

Secondary data:

1 From the B/S of the company

2 From CMA proposal report

3 From internet

4 From books

IBMR BUSINESS SCHOOL

Introduction of working capital

5

Working capital refers to the cash a business requires

for day-to-day operations, or, more specifically, for

financing the conversion of raw materials into finished

goods, which the company sells for payment. Among the

most important items of working capital are levels of

inventory, accounts receivable, and accounts payable.

Working capital is commonly defined as the difference

between current assets and current liabilities

There are two concepts of working capital

IBMR BUSINESS SCHOOL

Contd………

6

1} Gross

The term gross working capital, also referred to as

working capital, means the total current assets.

2}Net

The term net working capital can be defined in two

ways:

A difference between current assets and current liabilities

B Alternate definition of NWC is that portion of current

assets which is financed with long-term funds

IBMR BUSINESS SCHOOL

Types of working capital

7

1. Permanent working capital:

It refers to that minimum amount of investment

in all current assets which is required at all times

to carry out minimum level of business activities.

2. Temporary working capital:

The amount of such working capital keeps on

fluctuating from time to time on the basis of

business activities.

IBMR BUSINESS SCHOOL

Contd……

8

• Initial working capital

The capital, which is required at the time of the

commencement of business, is called initial

working capital. These are the promotionexpenses

incurred at the earliest stage of formation of

the enterprise which include the incorporation fees.

Attorney's fees, office expenses and other

preliminary expenses

IBMR BUSINESS SCHOOL

Contd…….

9

. Regular working capital

This type of working capital remains always in the

enterprise for the successful operation. It supplies

the funds necessary to meet the current working

expenses i.e. for purchasing raw material and

supplies, payment of wages, salaries and other

sundry expenses

IBMR BUSINESS SCHOOL

Contd...

10

Fluctuating working capital

This capital is needed to meet the seasonal

requirements of the business. It is used to raise

the volume of production by improvement or

extension of machinery. It may be secured from any

financial institution which can, of course, be met

with short term capital. It is also called

variable working capital

IBMR BUSINESS SCHOOL

Objective of study

11

To study the nature of working capital, concepts and

definition of working capital.

To examine the effectiveness of working capital

management practices of the firm.

To find out how adequacy or otherwise of working capital

affects commercial operations of the company.

To prescribe remedial measures to encounter the

problems faced by the firm.

To study the working capital financing or means of

financing of the company.

IBMR BUSINESS SCHOOL

WORKING CAPITAL ANALYSIS OF KPTL

12

There are two methods are used for working capital.

1)Gross operating cycle.

2)Ratio analysis

the conversion of resources into inventories, into

cash. The cycle of a manufacturing company involves

three phases:

Conversion of cash into inventory;

Conversion of inventory into receivables;

Conversion of receivables into cash.

IBMR BUSINESS SCHOOL

Inventory conversion period

13

Raw material storage period:

RMCP = Avg. inventory of Raw material * 365

……………………………………………..

Raw material consumed

= 15598.6 * 365 ( Rs. In Lacs)

= 86208.49

= 66 days

IBMR BUSINESS SCHOOL

Work-in-progress inventory conversion period

14

WIPCP = Avg. inventory of WIP * 365

--------------------------

Cost of production

= 1096.23 * 365

= 124820.01

= 3 days

IBMR BUSINESS SCHOOL

Finished goods conversion period

15

FGCP = Avg. inventory of finished goods * 365

---------------------------------------

Cost of goods sold

= 3264.25 * 365

= 125594.11

= 9 days

IBMR BUSINESS SCHOOL

DEBTORS CONVERSION PERIOD

16

DCP = Avg. debtors * 365

----------------

Credit sales

= 59386.70 * 365 (Rs. In Lacs)

= 188183.54

= 115 days

IBMR BUSINESS SCHOOL

CREDITORS DEFERRAL PERIOD

17

CDP = Avg. creditors * 365

------------------

Credit purchase

= 19791.4 * 365

= 59488.1

= 121 days

IBMR BUSINESS SCHOOL

WORKING CAPITAL CYCLE

18

Net operating cycle = Gross operating cycle –

Creditors deferral period

= (RMCP + WIPCP + FGCP + DCP) – CDP

= (182 – 111) days

= 72 days

IBMR BUSINESS SCHOOL

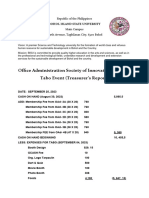

CURRENT LIABILITIES(rs in lacs)

19

Current liabilities 2005-2006 2006-2007 2007-2008

1. Sundry Creditors 13619.83 16132.46 23450.34

2. Advances from

customers 9324.94 18006.19 14923.75

3. Other Liabilities 4239.92 8003.36 10034.09

4. Payables under

Letter of credit 6462.40 3292.25 2836.63

5. Interest accrued

But not due 44.50 60.59 50.84

6. Unclaimed dividend ---- 10.07 13.91

7. Total Liabilities 33691.62 45494.87 51309.58

IBMR BUSINESS SCHOOL

CURRENT ASSETS(rs in lacs)

20

CURRENT ASSETS 2005-2006 2006-2007 2007-2008

8. Cash & Bank

1664.88 9365.23 8917.15

balances

9. Inventories 13870.25 15826.99 15370.21

10. Accrued value of

Work done 8118.64 17474.23 28567.92

11. Sundry debtors 29734.83 53705.10 65068.30

12. Loans & Advances 6698.45 12104.68 15117.60

13. Total Current Assets 60087.07 108476.25 133041.21

14. Net Working Capital

(16-10) 26395.45 62981.38 81731.63

IBMR BUSINESS SCHOOL

Ratio analysis

21

Ratio(Times) 1.78 2.38 2.59

3

2.5

2

RATIOS 1.5

1 z

Current ratio

0.5

0

2005-06 2006-07 2007-08

YEARS

IBMR BUSINESS SCHOOL

Quick Ratio= Quick Assets/Current Liabilities

22

2005-06 2006-07 2007-08

Quick Assets

46216.82 92649.26 117671

Current Liabilities 33691.62 45494.87 51309.58

Ratio(Times)

1.37 2.04 2.29

2.5

1.5

RATIO S

1

0.5

0

2005-06 20 06-07 2007-08

YEAR S

IBMR BUSINESS SCHOOL

Working capital turnover ratio= Net Sales/Net working capital

23

2005-06 2006-07 2007-08

Net Sales

87123.02 156696.35 176820.34

Net working capital 26395.45 62981.38 81731.63

Ratio(Times)

1.25 2.49 2.16

2.5

1.5

RATIOS

1

0.5

0

2005-06 2006 -07 200 7-08

YEAR S

IBMR BUSINESS SCHOOL

Inventory turnover ratio = Net Sales/Inventory

24

2005-06 2006-07 2007-08

Net Sales

87123.02 156696.35 176820.34

Inventory 13870.25 15826.99 15370.21

Ratio(Times)

6.28 9.90 11.50

12

10

8

RA TIOS 6

4

2

0

20 05- 06 2 006- 07 200 7-0 8

YEARS

IBMR BUSINESS SCHOOL

Debtors turnover ratio = Net Sales/Debtors

25

2004-05 2005-06 2006-07

Net Sales

87123.02 156696.35 176820.34

Debtors 29734.83 53705.10 65068.30

Ratio(Times)

2.93 2.92 2.72

2.95

2.9

2.85

2.8

RATIOS

2.75

2.7

2.65

2.6

2004-05 2005-06 2006-07

YEARS

IBMR BUSINESS SCHOOL

Current asset turnover ratio = Net Sales/current assets

26

2005-06 2006-07 2007-08

Net Sales

87123.02 156696.35 176820.34

Current assets 60087.07 108476.25 133041.21

Ratio(Times)

1.45 1.44 1.33

1.46

1.44

1.42

1.4

1.38

RATIOS 1.36

1.34

1.32

1.3

1.28

1.26

2005-06 2006-07 2007-08

YEARS

IBMR BUSINESS SCHOOL

Suggestions and Conclusion

27

Credit period for debtors should be one month and from

creditors it should be two months so that the float of

comfort is one month

To identify and locate the idle assets of the firm and

dispose off the same at competitive price in order to meet

the present working capital needs of the company.

To make commercial, financial and economic feasibility

-studies and cash flow analysis before going for any new

project. If net present value of future cash flows is

positive, then the management should go for the project

IBMR BUSINESS SCHOOL

THANK YOU

IBMR BUSINESS SCHOOL 28

You might also like

- Admin Project Consultant CV ExampleDocument2 pagesAdmin Project Consultant CV ExampleMike Kelley100% (5)

- Audit Report VDA 6.3 Potential Analysis: Findings Question According VDA 6.3 Questionnaire 0 0Document1 pageAudit Report VDA 6.3 Potential Analysis: Findings Question According VDA 6.3 Questionnaire 0 0ssierro100% (2)

- 3.8 ExercisesDocument8 pages3.8 ExercisesGeorgios Militsis50% (2)

- Go, J. (2017) - Principles and Practices in Marketing in The Philippine SettingDocument2 pagesGo, J. (2017) - Principles and Practices in Marketing in The Philippine SettingKimberly HipolitoNo ratings yet

- Can Your Company Afford To: Tool KitDocument9 pagesCan Your Company Afford To: Tool KitEsmeralda HerreraNo ratings yet

- Your Canadian Résumé Template: Experience To Carry Forward Onto The Second Page. Limit Your Resumé To Two Pages ONLYDocument2 pagesYour Canadian Résumé Template: Experience To Carry Forward Onto The Second Page. Limit Your Resumé To Two Pages ONLYAkib AliNo ratings yet

- Operating Cycle ProjectDocument34 pagesOperating Cycle Projectdravi88% (8)

- Working Capital ManagementDocument54 pagesWorking Capital ManagementTanishqa JoganiNo ratings yet

- Corporate FinanceDocument8 pagesCorporate FinanceamitNo ratings yet

- Name-Ishwor Rijal LBU I'd - 77271300 Subject - Corporate FinanceDocument10 pagesName-Ishwor Rijal LBU I'd - 77271300 Subject - Corporate FinanceIshwor RijalNo ratings yet

- Capital BudgetingDocument108 pagesCapital Budgetingdhanraj_aartiNo ratings yet

- Principles of Working Capital ManagementDocument63 pagesPrinciples of Working Capital ManagementPavan Koundinya100% (2)

- Pioneer Cement LTDDocument13 pagesPioneer Cement LTDAhmerNo ratings yet

- Working Capital Management: Arpit.W.Gajbhiye 3 Sem Beta DmimsDocument14 pagesWorking Capital Management: Arpit.W.Gajbhiye 3 Sem Beta DmimsarpitrgdaNo ratings yet

- Working Capital Management: Ca - Ipcc CA. Pramod Prabhu. S.H, B.SC, P.G.D.B.A, F.C.A, C.I.S.A (U.S.A)Document13 pagesWorking Capital Management: Ca - Ipcc CA. Pramod Prabhu. S.H, B.SC, P.G.D.B.A, F.C.A, C.I.S.A (U.S.A)19101977No ratings yet

- 6e Brewer CH09 B EOCDocument10 pages6e Brewer CH09 B EOCJonathan Altamirano BurgosNo ratings yet

- UEU Penilaian Asset Bisnis Pertemuan 3Document38 pagesUEU Penilaian Asset Bisnis Pertemuan 3Saputra SanjayaNo ratings yet

- Small Scale IndustriesDocument15 pagesSmall Scale IndustriesSumit KumarNo ratings yet

- L2 - Capital BudgetingDocument53 pagesL2 - Capital BudgetingZhenyi ZhuNo ratings yet

- Completing The Accounting Cycle: QuestionsDocument90 pagesCompleting The Accounting Cycle: QuestionsAmna Tahir100% (1)

- Strategic AssignmentDocument7 pagesStrategic AssignmentManali AhujaNo ratings yet

- OC & CCC Activity 1-4Document8 pagesOC & CCC Activity 1-4Maria Klaryce AguirreNo ratings yet

- Credit Risk AnalysisDocument32 pagesCredit Risk AnalysisVishal Suthar100% (1)

- Understanding Financial StatementsDocument36 pagesUnderstanding Financial StatementsHarshita Rajput HarshuNo ratings yet

- Reformulation Profitability AnalysisDocument20 pagesReformulation Profitability AnalysisAlexander GombergNo ratings yet

- Answers To Questions From Worksheet 2Document8 pagesAnswers To Questions From Worksheet 2Anisha KirlewNo ratings yet

- Financial Reporting and Analysis PDFDocument2 pagesFinancial Reporting and Analysis PDFTushar VatsNo ratings yet

- Valutation by Damodaran Chapter 3Document36 pagesValutation by Damodaran Chapter 3akhil maheshwariNo ratings yet

- Cash Management CaseDocument10 pagesCash Management CaseKim CustodioNo ratings yet

- CBM Fin Working Capital 2021 SwiDocument22 pagesCBM Fin Working Capital 2021 SwiKhrisna Aditya YudhaNo ratings yet

- Chapter 04 SMDocument86 pagesChapter 04 SMAthena LauNo ratings yet

- Session3.Working CapitalDocument14 pagesSession3.Working Capitalsincere sincereNo ratings yet

- Working Capital: Apl Apollo Tubes LTDDocument17 pagesWorking Capital: Apl Apollo Tubes LTDDhirajsharma123No ratings yet

- Chapter 6 Homework QuestionsDocument3 pagesChapter 6 Homework QuestionsLovepreet malhiNo ratings yet

- 15 DR Krishna GuptaDocument4 pages15 DR Krishna GuptaRavi ModiNo ratings yet

- Plant Assets, Natural Resources and Intangibles: QuestionsDocument42 pagesPlant Assets, Natural Resources and Intangibles: QuestionsCh Radeel MurtazaNo ratings yet

- NWC Current Assets - Current Liabilities .. (I) : (CITATION Ste15 /L 1033)Document3 pagesNWC Current Assets - Current Liabilities .. (I) : (CITATION Ste15 /L 1033)GR PandeyNo ratings yet

- Arens Chapter20Document105 pagesArens Chapter20rochielanciolaNo ratings yet

- Factors Determining Working CapitalDocument13 pagesFactors Determining Working CapitalrajiguhanNo ratings yet

- Basic Accounting Financial AnalysisDocument439 pagesBasic Accounting Financial AnalysisBuilding Substance PodNo ratings yet

- Revision Pack and AnsjjwersDocument34 pagesRevision Pack and AnsjjwersShree Punetha PeremaloNo ratings yet

- Group 07Document29 pagesGroup 07dilshanindika1998No ratings yet

- Financial PlanningDocument22 pagesFinancial Planningangshu002085% (13)

- Lecture NotesDocument15 pagesLecture NotesibrahimNo ratings yet

- Project Report: RIDA SHEIKH (61573) WAQAR MASNOOR (62790) ALI ABDULLAH (61112) MUHAMMAD ALI (61251)Document15 pagesProject Report: RIDA SHEIKH (61573) WAQAR MASNOOR (62790) ALI ABDULLAH (61112) MUHAMMAD ALI (61251)rida sheikhNo ratings yet

- Session 4 - WCMDocument68 pagesSession 4 - WCMMayank PatelNo ratings yet

- How Fast Can Your Company Afford To GrowDocument9 pagesHow Fast Can Your Company Afford To GrowSairam PrakashNo ratings yet

- External Financial Reporting Decisions-02Document11 pagesExternal Financial Reporting Decisions-02Subramani KNo ratings yet

- Lecture 12 - Working Capital and Current Assets ManagementDocument76 pagesLecture 12 - Working Capital and Current Assets ManagementNero ShaNo ratings yet

- The Scope of Financial Management and Financing Working CapitalDocument24 pagesThe Scope of Financial Management and Financing Working CapitalbluesnakerNo ratings yet

- Management AccountingDocument101 pagesManagement AccountingKartikNo ratings yet

- Working Capital Management 2Document78 pagesWorking Capital Management 2Roopan DoluiNo ratings yet

- MB20202 Corporate Finance Unit V Study MaterialsDocument33 pagesMB20202 Corporate Finance Unit V Study MaterialsSarath kumar CNo ratings yet

- Working Capital Planing and ManagementDocument9 pagesWorking Capital Planing and ManagementAshish JainNo ratings yet

- 6002AFYPC Corporate Finance Coursework (Zaini)Document15 pages6002AFYPC Corporate Finance Coursework (Zaini)Zaini ZainNo ratings yet

- Ef Assessment 2Document5 pagesEf Assessment 2Charbel HatemNo ratings yet

- Ratio Analysis of "Altas Battery": TitleDocument15 pagesRatio Analysis of "Altas Battery": TitleahmadkamranNo ratings yet

- Operating Cycle of Business and Financing Working - CapitalDocument23 pagesOperating Cycle of Business and Financing Working - CapitalKarthik SuryanarayananNo ratings yet

- Valuation Methods (DDM, EVA and DCF)Document36 pagesValuation Methods (DDM, EVA and DCF)Angelo Torres100% (1)

- Ca Inter FM Chapter 10 Management of Working CapitalDocument43 pagesCa Inter FM Chapter 10 Management of Working CapitalLisha ShobaNo ratings yet

- Mid Test FRC Blemba 69 Evening Class - Berlin Novanolo G (29123112)Document10 pagesMid Test FRC Blemba 69 Evening Class - Berlin Novanolo G (29123112)catatankotakkuningNo ratings yet

- 2.1 Working Capital ManagementDocument26 pages2.1 Working Capital ManagementMANAV ROYNo ratings yet

- Siebel Incentive Compensation Management ( ICM ) GuideFrom EverandSiebel Incentive Compensation Management ( ICM ) GuideNo ratings yet

- PDF PDFDocument188 pagesPDF PDFFadli UmawiNo ratings yet

- What Are The Four Stages of The Deming CycleDocument2 pagesWhat Are The Four Stages of The Deming CycleDr.K.BaranidharanNo ratings yet

- Good AfternoonDocument12 pagesGood AfternoonMatt Lawrence BerdinNo ratings yet

- Sirim Qas-Engineering-Inspection-April-2019Document31 pagesSirim Qas-Engineering-Inspection-April-2019HaziqNo ratings yet

- Tre ReportDocument2 pagesTre ReportMAYETTE CHIONGNo ratings yet

- Assignment 1 Complete The Assignment and Submit It On Moodle. Marks Weightage - 20%Document12 pagesAssignment 1 Complete The Assignment and Submit It On Moodle. Marks Weightage - 20%Shivam SharmaNo ratings yet

- Equity Crowdfunding (Asean) PDFDocument107 pagesEquity Crowdfunding (Asean) PDFAnson LiangNo ratings yet

- Registration Kenya Print Pack Sign Expo 19-21 Jan 2021Document4 pagesRegistration Kenya Print Pack Sign Expo 19-21 Jan 2021MAYANK CHHATWALNo ratings yet

- Technical Offer: OrascomDocument28 pagesTechnical Offer: OrascomAhmed HussienNo ratings yet

- 620398a80c3fed65e4e82ee9 - Amazon Leadership Principles Interview QuestionsDocument4 pages620398a80c3fed65e4e82ee9 - Amazon Leadership Principles Interview Questionsdopivof312No ratings yet

- Contract AdministrationDocument6 pagesContract AdministrationMohamed SaaDNo ratings yet

- 56-59 CPA AwardsDocument4 pages56-59 CPA AwardstanhaianNo ratings yet

- International Standard: Iso/Iec 38500Document6 pagesInternational Standard: Iso/Iec 38500ggcvbcNo ratings yet

- Bid Bulletin No. 4 Bid No. 23 004 02 Bukidnon Airport Development Project CY 2022 - CompressedDocument6 pagesBid Bulletin No. 4 Bid No. 23 004 02 Bukidnon Airport Development Project CY 2022 - CompressedAlbert Conrad II LopezNo ratings yet

- High-Low Method ER PDFDocument8 pagesHigh-Low Method ER PDFafreenessaniNo ratings yet

- Auditor Reporting Model Comment Letters (PDFDrive)Document176 pagesAuditor Reporting Model Comment Letters (PDFDrive)Ali AyubNo ratings yet

- CIS Midterm For PracticeDocument15 pagesCIS Midterm For PracticeJane Clarisse SantosNo ratings yet

- Register of Events QAQCDocument2 pagesRegister of Events QAQCbinan simangunsongNo ratings yet

- Interview Questions - SAP RAR (60 Questions)Document18 pagesInterview Questions - SAP RAR (60 Questions)pammi veeranji Reddy100% (1)

- Chapter - 20 An Introduction To Decision TheoryDocument14 pagesChapter - 20 An Introduction To Decision TheoryjoginiariNo ratings yet

- Orange and Pink Trendy Gradient Student Part-Time Product Marketing Manager Resume PresentationDocument14 pagesOrange and Pink Trendy Gradient Student Part-Time Product Marketing Manager Resume PresentationAdinda Lita RachmanNo ratings yet

- Esg Investment Outcomes Performance Evaluation and AttributionDocument34 pagesEsg Investment Outcomes Performance Evaluation and Attribution111 333No ratings yet

- SP 1171Document45 pagesSP 1171Vasudev ShanmughanNo ratings yet

- IFMIS QA Tender Doc 2020Document51 pagesIFMIS QA Tender Doc 2020MahiNo ratings yet

- AutoRecovery Save of Document4Document3 pagesAutoRecovery Save of Document4Fazlee KanNo ratings yet

- HOSP 106: Responsibilities of CoordinatorDocument2 pagesHOSP 106: Responsibilities of CoordinatorLuke MelvinceNo ratings yet