Professional Documents

Culture Documents

Market Commentary 13mar11

Market Commentary 13mar11

Uploaded by

AndysTechnicalsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Commentary 13mar11

Market Commentary 13mar11

Uploaded by

AndysTechnicalsCopyright:

Available Formats

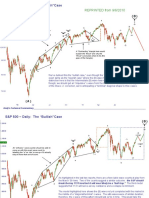

S&P 500 ~ Daily non-Log Scale REPRINTED from 2/13/2011

(B)

“y”

The pattern up from the 1040 has now become very difficult to determine. We’ve been pointing out

the lack of clear “impulsions” higher, which means we’re dealing with some sort of corrective g?

pattern higher. I’m suggesting a “diametric” labelling here, but there is little conviction in this

counting. e

c f

b

“w” a

d

d

b

a

1040

e

c

“x”

If this happens to be the correct larger degree counting, the “x” wave corrected exactly

23.6% of the “w” wave. One possible target for the “y” wave would be 61.8% of “w” at 1339.

That level would also be 38.2% of “w” measure up from the top of “w.” So, we will stand

back and observe how the market behaves into 1339….

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500: Weekly (Log Scale)

( B )? ( B )?

“y” peaks @ 61.8% of “w” ?? “y”? “z”?

b

“w”

“w” concludes @ 1150 e d

“x”

c

“x” corrects 23.6% of “w”

a e

d

c “x”

a

b

Following up from our count on 2/13/2011, this would be an updated longer term look at the price

action. The “w” up is better counted as some sort of contracting triangle pattern with an abnormally

strong upward slope and of an unusual character.* The subsequent “x” wave corrected exactly

23.6% of “w.” The “y” wave which has followed has peaked around 61.8% of “w.” Based on the

slower moving, and corrective nature, of the move from the recent high, another “x” wave lower is

the highest probability. I’m expecting at least a 38.2% of the “y” wave--1227 or lower with the “x”

wave lasting a few months.

(A)

* The c and e-waves should not be bigger than the preceding waves in a contracting

triangle. Who knows? We might be dealing with a “new shape” here.” That’s an idea we’ve

been discussing for a year now.

Andy’s Technical Commentary__________________________________________________________________________________________________

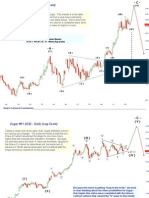

S&P 500: Daily with Fibonacci Retracements

“y”?

Notice the way the 23.6% and 38.2% aligned so well with previous resistance

points. This market almost looks destined to revisit 1272 and then 1227 at some

point. I wouldn’t attempt to buy this market “for a bounce” until 1227.

“x”

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500: Weekly Support and Resistance

REPRINTED from 3/6/2011

(b)

[a] [c]

[1]?

[b]

(a)

The market did not give us a lot of clarity from last week’s commentary in terms of waves structure. The

labelling above is a “guess” at what might be going on. The nice thing going on here is that Mr. Market will

give us some “answers” early in the week and support and resistance is well defined. 1325 is the 62%

retrace of Friday’s move down. If the count above is correct, then the Market should NOT trade above 1325.

1302 looks like decent support for any “bulls/longs” Below, 1302, I don’t see much support until 1275.

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 (120 min.) w/ Weekly Support and Resistance

Last week, the market failed miserably into our 1325 resistance, opening at 1327 and then tumbling. The (b) wave looks a lot like

a triangle. If that’s the case, one would expect the subsequent (c) wave to last a little longer than the 1292 low.

[c]

[a]

(b)

[e]

[2]?

[d]

[b]

(a)

[1]?

So, while it’s “possible,” that the (c) wave concluded at 1292, we favor more price action lower

this week. New shorts/bears should use 1312 for “stop loss” levels on this theory. Second level

of resistance would be 1322, the point at which the possible triangle concluded. The (a)=(c)

target would be down at 1272, thus, it’s our major support for the week.

Andy’s Technical Commentary__________________________________________________________________________________________________

May 2011 Silver Futures - 60 min chart: Flags and Pennants

REPRINTED from 3/13/2011

Last week it was pointed out that the short term picture was not “bearish.” Indeed, Silver

busted out of what was a decent sized flag pattern to set a new high. At the end of the week, it

congested in another smaller sized flag/pennant pattern and then busted out of that one. The

targets for the various flags/pennants is the $37-$38/oz range. The 60 min. RSI hit a fresh

high--if one looks back at the other fresh “overbought” signals, it was bullish. Silver bulls

should consider $34/oz for “stop loss levels” on length.

New RSI High

Andy’s Technical Commentary__________________________________________________________________________________________________

May 2011 Silver Futures - 120 min chart

Wonder if we get a Head

Last week’s message on Silver was that there was upside to the $37-38/oz range and that $34 and Shoulder top here?

should be considered support for “stop loss strategies.” Silver peaked at $36.75 before falling

to $34.05. So, support was NOT broken. The result is what we have here: A nice up trend

channel on the 120 min. chart. This lower trendline appears to be very important along with

last week’s low of $34.05. Silver bulls remain in control until that lower trend breaks or

$34.05 gets taken out. A break of $34.05 should send bulls

to the exits.

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any

kind. This report is technical commentary only. The author is Wave Symbology

NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s "I" or "A" = Grand Supercycle

interpretation of technical analysis. The author may or may not I or A = Supercycle

trade in the markets discussed. The author may hold positions <I>or <A> = Cycle

opposite of what may by inferred by this report. The information -I- or -A- = Primary

contained in this commentary is taken from sources the author (I) or (A) = Intermediate

believes to be reliable, but it is not guaranteed by the author as to "1“ or "a" = Minor

the accuracy or completeness thereof and is sent to you for 1 or a = Minute

information purposes only. Commodity trading involves risk and -1- or -a- = Minuette

is not for everyone. (1) or (a) = Sub-minuette

[1] or [a] = Micro

Here is what the Commodity Futures Trading Commission (CFTC) [.1] or [.a] = Sub-Micro

has said about futures trading: Trading commodity futures and

options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or

options contracts, you should consider your financial experience,

goals and financial resources, and know how much you can afford

to lose above and beyond your initial payment to a broker. You

should understand commodity futures and options contracts and

your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by

thoroughly reviewing the risk disclosure documents your broker is

required to give you.

You might also like

- Romanian Commodity ExchangeDocument14 pagesRomanian Commodity Exchangeabhishekbehal5012No ratings yet

- REPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseDocument8 pagesREPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseAndysTechnicalsNo ratings yet

- Market Update 11 July 10Document13 pagesMarket Update 11 July 10AndysTechnicalsNo ratings yet

- Market Update 28 Nov 10Document8 pagesMarket Update 28 Nov 10AndysTechnicalsNo ratings yet

- REPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseDocument7 pagesREPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseAndysTechnicalsNo ratings yet

- S&P 500 Update 9 Nov 09Document6 pagesS&P 500 Update 9 Nov 09AndysTechnicalsNo ratings yet

- S&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010Document10 pagesS&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010AndysTechnicalsNo ratings yet

- Unorthodox Corrections & Weird Fractals & SP500 ImplicationsDocument8 pagesUnorthodox Corrections & Weird Fractals & SP500 ImplicationsAndysTechnicals100% (1)

- S& P 500 Update 2 May 10Document9 pagesS& P 500 Update 2 May 10AndysTechnicalsNo ratings yet

- Market Update 18 July 10Document10 pagesMarket Update 18 July 10AndysTechnicalsNo ratings yet

- S&P 500 Update 4 Apr 10Document10 pagesS&P 500 Update 4 Apr 10AndysTechnicalsNo ratings yet

- Market Update 25 July 10Document13 pagesMarket Update 25 July 10AndysTechnicalsNo ratings yet

- S&P 500 Update 25 Apr 10Document7 pagesS&P 500 Update 25 Apr 10AndysTechnicalsNo ratings yet

- Sugar Nov 28 2009Document9 pagesSugar Nov 28 2009AndysTechnicalsNo ratings yet

- Market Discussion 5 Dec 10Document9 pagesMarket Discussion 5 Dec 10AndysTechnicalsNo ratings yet

- Morning View 12feb2010Document8 pagesMorning View 12feb2010AndysTechnicalsNo ratings yet

- S&P 500 Daily: The "Double Top Count"Document7 pagesS&P 500 Daily: The "Double Top Count"AndysTechnicalsNo ratings yet

- SP500 Update 2 Jan 11Document9 pagesSP500 Update 2 Jan 11AndysTechnicalsNo ratings yet

- Morning View 27jan2010Document6 pagesMorning View 27jan2010AndysTechnicals100% (1)

- Market Update 29 Aug 10Document13 pagesMarket Update 29 Aug 10AndysTechnicalsNo ratings yet

- S&P 500 Update 2 Jan 10Document8 pagesS&P 500 Update 2 Jan 10AndysTechnicalsNo ratings yet

- DXY Report 11 April 2010Document8 pagesDXY Report 11 April 2010AndysTechnicalsNo ratings yet

- Gold Report 12 Sep 2010Document16 pagesGold Report 12 Sep 2010AndysTechnicalsNo ratings yet

- S&P 500 Update 19 Mar 10Document8 pagesS&P 500 Update 19 Mar 10AndysTechnicalsNo ratings yet

- SP500 Update 31 May 10Document13 pagesSP500 Update 31 May 10AndysTechnicalsNo ratings yet

- S&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100Document7 pagesS&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100AndysTechnicalsNo ratings yet

- S&P 500 Update 15 Feb 10Document9 pagesS&P 500 Update 15 Feb 10AndysTechnicalsNo ratings yet

- Market Commentary 21feb11Document10 pagesMarket Commentary 21feb11AndysTechnicalsNo ratings yet

- Dollar Index (180 Minute) "Unorthodox Model"Document6 pagesDollar Index (180 Minute) "Unorthodox Model"AndysTechnicalsNo ratings yet

- S&P 500 Update 23 Jan 10Document7 pagesS&P 500 Update 23 Jan 10AndysTechnicalsNo ratings yet

- Market Update 21 Nov 10Document10 pagesMarket Update 21 Nov 10AndysTechnicalsNo ratings yet

- Dollar Index 15 Feb 2010Document4 pagesDollar Index 15 Feb 2010AndysTechnicalsNo ratings yet

- Gold Report 7 Nov 2010Document8 pagesGold Report 7 Nov 2010AndysTechnicalsNo ratings yet

- Morning View 19 Feb 10Document4 pagesMorning View 19 Feb 10AndysTechnicalsNo ratings yet

- In If BC in - /S' - I5' - : As (C) As (D) - (RF) 21 Be BeDocument1 pageIn If BC in - /S' - I5' - : As (C) As (D) - (RF) 21 Be BejosNo ratings yet

- Circular Motion IB N07 A2Document2 pagesCircular Motion IB N07 A2superpooh-1No ratings yet

- Chapter1 VectorsDocument87 pagesChapter1 Vectorshyacinth4eveNo ratings yet

- Sugar Report Nov 06 2009Document6 pagesSugar Report Nov 06 2009AndysTechnicalsNo ratings yet

- SP500 Update 22 Aug 10Document7 pagesSP500 Update 22 Aug 10AndysTechnicalsNo ratings yet

- Gold Report 30 May 2010Document7 pagesGold Report 30 May 2010AndysTechnicalsNo ratings yet

- Continuous Flattening of Truncated Tetrahedra: Jin-Ichi Itoh and Chie NaraDocument15 pagesContinuous Flattening of Truncated Tetrahedra: Jin-Ichi Itoh and Chie NaraEduardo CostaNo ratings yet

- Exam2 March31 10 PDFDocument2 pagesExam2 March31 10 PDFNhanNo ratings yet

- Gold Report 15 Nov 2009Document11 pagesGold Report 15 Nov 2009AndysTechnicalsNo ratings yet

- 202002-SW02L2 Y10 Transformations Practice WorksheetDocument8 pages202002-SW02L2 Y10 Transformations Practice WorksheetSarah TseungNo ratings yet

- Ch201 Class 9Document9 pagesCh201 Class 9djbhutadaNo ratings yet

- SP500 Update 24apr11Document7 pagesSP500 Update 24apr11AndysTechnicalsNo ratings yet

- CIE IGCSE 0580 2018 Hardest Questions CompilationDocument89 pagesCIE IGCSE 0580 2018 Hardest Questions CompilationAnisha Bushra AkondNo ratings yet

- Diagrama CMP Challenger 1Document1 pageDiagrama CMP Challenger 1Mega CANo ratings yet

- Gold Report 16 May 2010Document11 pagesGold Report 16 May 2010AndysTechnicalsNo ratings yet

- CIE IGCSE 0580 - 2018 Hardest Questions CompilationDocument89 pagesCIE IGCSE 0580 - 2018 Hardest Questions CompilationJiyaNo ratings yet

- Market Discussion 19 Dec 10Document6 pagesMarket Discussion 19 Dec 10AndysTechnicalsNo ratings yet

- HO - Handout w7Document3 pagesHO - Handout w7Billy JimenezNo ratings yet

- Test Bank For Precalculus 7th EditionDocument17 pagesTest Bank For Precalculus 7th Editionmatthewhannajzagmqiwdt100% (29)

- 10 - Chapter 1Document15 pages10 - Chapter 1sreenus1729No ratings yet

- JEE Main 2023 Vector Algebra Revision Notes - Free PDF DownloadDocument4 pagesJEE Main 2023 Vector Algebra Revision Notes - Free PDF DownloadYash SaxenaNo ratings yet

- Scalar Triple ProductDocument14 pagesScalar Triple Productfavoursam785No ratings yet

- The Fiftieth Annual William Lowell Putnam Competition Saturday, December 2, 1989Document1 pageThe Fiftieth Annual William Lowell Putnam Competition Saturday, December 2, 1989劉星雨No ratings yet

- Vector Algebra: - Coordinates in SpaceDocument102 pagesVector Algebra: - Coordinates in SpaceAli HassenNo ratings yet

- AIEEE Online 2015 April 10-4-15Document8 pagesAIEEE Online 2015 April 10-4-15ManalNo ratings yet

- Introduction To Graph Theory: Mustamin AnggoDocument13 pagesIntroduction To Graph Theory: Mustamin AnggoLailatul QadarNo ratings yet

- Mathematical Analysis 1: theory and solved exercisesFrom EverandMathematical Analysis 1: theory and solved exercisesRating: 5 out of 5 stars5/5 (1)

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Market Commentary 22JUL12Document6 pagesMarket Commentary 22JUL12AndysTechnicalsNo ratings yet

- Market Commentary 17JUN12Document7 pagesMarket Commentary 17JUN12AndysTechnicalsNo ratings yet

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocument6 pagesS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 25mar12Document8 pagesMarket Commentary 25mar12AndysTechnicalsNo ratings yet

- Market Commentary 10JUN12Document7 pagesMarket Commentary 10JUN12AndysTechnicalsNo ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Market Commentary 29apr12Document6 pagesMarket Commentary 29apr12AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Market Commentary 1apr12Document8 pagesMarket Commentary 1apr12AndysTechnicalsNo ratings yet

- Market Commentary 18mar12Document8 pagesMarket Commentary 18mar12AndysTechnicalsNo ratings yet

- Copper Commentary 11dec11Document6 pagesCopper Commentary 11dec11AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 16jan12Document7 pagesMarket Commentary 16jan12AndysTechnicalsNo ratings yet

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- Sp500 Update 11sep11Document6 pagesSp500 Update 11sep11AndysTechnicalsNo ratings yet

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- Market Commentary 25SEP11Document8 pagesMarket Commentary 25SEP11AndysTechnicalsNo ratings yet

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- Sp500 Update 5sep11Document7 pagesSp500 Update 5sep11AndysTechnicalsNo ratings yet

- 7 Equity Futures and Delta OneDocument65 pages7 Equity Futures and Delta OneBarry HeNo ratings yet

- Chilli Teja PN Mar16 19022016Document22 pagesChilli Teja PN Mar16 19022016Anurag KushwahaNo ratings yet

- 13 Option MarketDocument5 pages13 Option MarketBilly SNo ratings yet

- Share Market BasicsDocument8 pagesShare Market BasicsHardik ShahNo ratings yet

- Emmett T.J. Fibonacci Forecast ExamplesDocument9 pagesEmmett T.J. Fibonacci Forecast ExamplesAnantJaiswal100% (1)

- Prestige Institute of Management & Research, Indore: "Analysis of Stock Market at Arihant Capital"Document27 pagesPrestige Institute of Management & Research, Indore: "Analysis of Stock Market at Arihant Capital"Samyak JainNo ratings yet

- Chap011 Ed 9 Full Jawaban AdaDocument78 pagesChap011 Ed 9 Full Jawaban AdaShofiana IfadaNo ratings yet

- Foreign Currency TransactionsDocument24 pagesForeign Currency TransactionsCAPSNo ratings yet

- Annexure - V: Mba (Full-Time & Part-Time) and Mib Courses List of ElectivesDocument21 pagesAnnexure - V: Mba (Full-Time & Part-Time) and Mib Courses List of ElectivesRizzy PopNo ratings yet

- ITC Coffee 4th Report 20210930 Web PagesDocument332 pagesITC Coffee 4th Report 20210930 Web PagesAlejandro MotorToolsNo ratings yet

- CFA630Document15 pagesCFA630Cfa Pankaj KandpalNo ratings yet

- Course Outline Derivatives (Term-IV) 2017-19 SKDocument5 pagesCourse Outline Derivatives (Term-IV) 2017-19 SKAnkit BhardwajNo ratings yet

- Future & Options FinalDocument8 pagesFuture & Options Finalabhiraj_bangeraNo ratings yet

- CFA L1 - DerivativesDocument44 pagesCFA L1 - Derivativesnur syahirah bt ab.rahmanNo ratings yet

- Copeland-Financial Theory and Corporate Policy - Copeland - 3rd - EdDocument958 pagesCopeland-Financial Theory and Corporate Policy - Copeland - 3rd - EdKatie Novrianti100% (2)

- Classification of Financial MarketsDocument12 pagesClassification of Financial Marketsvijaybhaskarreddymee67% (6)

- MainDocument57 pagesMainNagireddy KalluriNo ratings yet

- The 400% Man - MarketWatc14hDocument39 pagesThe 400% Man - MarketWatc14hnabs100% (1)

- CandleStick EbookDocument19 pagesCandleStick EbookRebecca HayesNo ratings yet

- FIN 444 Mid Term Summer 2021Document5 pagesFIN 444 Mid Term Summer 2021Abdulla HussainNo ratings yet

- Special Topics in Financial ManagementDocument36 pagesSpecial Topics in Financial ManagementChristel Mae Boseo100% (1)

- SwapsDocument15 pagesSwapsleo_lac3No ratings yet

- Bangladesh Stock Market Analysis ReportDocument46 pagesBangladesh Stock Market Analysis Reportanon_472625099100% (2)

- Option TerminologyDocument3 pagesOption Terminologysrku289No ratings yet

- MScFE 560 FM - Compiled - Notes - M6Document23 pagesMScFE 560 FM - Compiled - Notes - M6sadiqpmpNo ratings yet

- A Six Part Study Guide To Market Profile Part 4 - 190655Document76 pagesA Six Part Study Guide To Market Profile Part 4 - 190655nguyenquang213123123No ratings yet

- Chap 7Document45 pagesChap 7kimngan.nguyen8803No ratings yet

- Document 2152023 125149 PM 1dap52crDocument8 pagesDocument 2152023 125149 PM 1dap52crJose CaballeroNo ratings yet

- 10 Myths About Financial DerivativesDocument6 pages10 Myths About Financial DerivativesArshad FahoumNo ratings yet