Professional Documents

Culture Documents

Chapter 7 - Rate of Return Analysis: EGR 403 Capital Allocation Theory

Chapter 7 - Rate of Return Analysis: EGR 403 Capital Allocation Theory

Uploaded by

hmmnksy0 ratings0% found this document useful (0 votes)

1 views20 pagesThe document discusses rate of return analysis and calculating internal rate of return (IRR). It provides examples of calculating IRR for projects with different cash flow patterns using present worth tables, trial and error, and the IRR function in Excel. It also discusses using IRR to evaluate mutually exclusive projects and defines minimum attractive rate of return (MARR). When projects have equivalent benefits, incremental rate of return (ΔROR) should be calculated on the incremental cash flows to determine which project to select.

Original Description:

im the mafia

Original Title

egr403_sv9_chapter7 (1)

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses rate of return analysis and calculating internal rate of return (IRR). It provides examples of calculating IRR for projects with different cash flow patterns using present worth tables, trial and error, and the IRR function in Excel. It also discusses using IRR to evaluate mutually exclusive projects and defines minimum attractive rate of return (MARR). When projects have equivalent benefits, incremental rate of return (ΔROR) should be calculated on the incremental cash flows to determine which project to select.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

1 views20 pagesChapter 7 - Rate of Return Analysis: EGR 403 Capital Allocation Theory

Chapter 7 - Rate of Return Analysis: EGR 403 Capital Allocation Theory

Uploaded by

hmmnksyThe document discusses rate of return analysis and calculating internal rate of return (IRR). It provides examples of calculating IRR for projects with different cash flow patterns using present worth tables, trial and error, and the IRR function in Excel. It also discusses using IRR to evaluate mutually exclusive projects and defines minimum attractive rate of return (MARR). When projects have equivalent benefits, incremental rate of return (ΔROR) should be calculated on the incremental cash flows to determine which project to select.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 20

Chapter 7 - Rate of

Return Analysis

Click here for Streaming Audio To Acco

mpany Presentation (optional)

EGR 403 Capital Allocation Theory

Dr. Phillip R. Rosenkrantz

Industrial & Manufacturing Engineering Department

Cal Poly Pomona

EGR 403 - The Big Picture

• Framework: Accounting & Breakeven Analysis

• “Time-value of money” concepts - Ch. 3, 4

• Analysis methods

– Ch. 5 - Present Worth

– Ch. 6 - Annual Worth

– Ch. 7, 8 - Rate of Return (incremental analysis)

– Ch. 9 - Benefit Cost Ratio & other techniques

• Refining the analysis

– Ch. 10, 11 - Depreciation & Taxes

– Ch. 12 - Replacement Analysis

EGR 403 - Cal Poly Pomona - SA9 2

Three Major Methods of

Economic Analysis

• PW - Present Worth

• AW - Annual Worth

• IRR - Internal Rate of Return

If P = A(P/A, i, n)

Then (P/A, i, n) = P/A

Solve for (P/A, i, n) and look up

interest in Compound Interest Tables

EGR 403 - Cal Poly Pomona - SA9 3

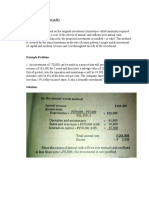

Internal Rate of Return (IRR)

• The interest rate paid on the unpaid balance of a

loan such that the payment schedule makes the

unpaid loan balance equal to zero when the final

payment is made. Ex: P = $5000, i = 10%, n = 5

Year Principal Prin. Paid Int Paid Payment

1 5000.00 818.99 500.00 1318.99

2 4181.01 900.89 418.10 1318.99

3 3280.13 990.97 328.01 1318.99

4 2289.15 1090.07 228.92 1318.99

5 1199.08 1199.08 119.91 1318.99

6 0.00 0.00

EGR 403 - Cal Poly Pomona - SA9 4

Calculating Rate of Return

• The IRR is the interest rate at which the

benefits equal the costs. IRR = i*

PW Benefit - PW Cost = 0

PW Benefit/PW Cost = 1

NPW = 0

EUAB - EUAC = 0

PW Benefit = PW Cost

EGR 403 - Cal Poly Pomona - SA9 5

Calculating IRR - Example 7-1

• PWB/PWC = 1

• 2000(P/A, i, 5)/8200 = 1

• (P/A, i, 5) = 8200/2000 =

4.1

• From Table, IRR =

7%

From Compound Interest Tables

Interest rate (P/A,i,5)

6% 4.212

7% 4.100

8% 3.993

EGR 403 - Cal Poly Pomona - SA9 6

Calculating IRR - Example 7-2

Sometimes we have more than one factor in our equation.

When that happens we cannot solve for just one factor.

If we use: EUAB - EUAC = 0

100 + 75(A/G, i, 4) - 700(A/P, i, 4) = 0

EGR 403 - Cal Poly Pomona - SA9 7

Calculating IRR - Example 7-2 (cont’d)

• No direct method for calculating. Use trial and error

and iterate to get answer.

• Try i = 5%:

100 + 75(A/G, 5%, 4) - 700(A/P, 5%, 4) = + 11

+ 11 is too high. The interest rate was too low

• Try i = 8%

100 + 75(A/G, 8%, 4) - 700(A/P, 8%, 4) = - 6

- 6 is too low. The interest rate was too high

• Try i = 7%

100 + 75(A/G, 8%, 4) - 700(A/P, 8%, 4) = 0

Therefore IRR = 7%

EGR 403 - Cal Poly Pomona - SA9 8

Calculating IRR - Example 7-3

• Example 7-3 shows a series of cash flows that does not match any

of our known patterns. We must use trial and error.

• Using NPW = 0, suppose we start with i = 10% . NPW = + 10.16,

which is too high.

• Using i = 15%, NPW = - 4.02. IRR is between 10% & 15%

• The iterations may be graphed and the true IRR will be indicated

at the point where the NPW curve = 0.

Yr CF

0 - 100

1 + 20

2 + 20

3 + 30

4 + 40

5 + 40

EGR 403 - Cal Poly Pomona - SA9 9

Calculating IRR - Example 7-3 (Cont’d)

• We can use linear interpolation to find estimate

the point where the curve crosses 0.

• IRR = i* = 10% + (15%-10%)[10.16/(10.16 +

4.02)] = 13.5%

• This is a linear interpolation of a non-linear

function so the answer is slightly inaccurate,

but good enough for decision making here

(after all, the guesswork in our future cash

flows introduces uncertainty in the analysis).

EGR 403 - Cal Poly Pomona - SA9 10

Calculating IRR - Example 7-3 (Cont’d)

• To get an exact answer, we can use the IRR function in

EXCEL

• Select the IRR function from the fx icon.

• Block the column on the spreadsheet that has the cash flows for

all years.

• The function returns the IRR.

-100

20

The IRR function in

30

EXCEL allows you to

20

evaluate the return of

40 investments very easily

40

13.47% =IRR(A1:A6)

EGR 403 - Cal Poly Pomona - SA9 11

Calculating IRR for a Bond - Example 7-4a

Bond Costs and Benefits:

Purchase price = $1000

Dividends = $40 every six months

Sold after one year for $950

Calculation of Periodic interest rate & IRR:

m = 2 compounding periods/year

1000 = 40(P/A, i, 2) + 950(P/F, i, 2)

By trial and error and interpolation i* 1.5%

IRR Nominal rate = 2 x 0.015 = 0.03 (3%)

IRR Effective rate = (1 + 0.015)2 - 1 = 0.0302 (3.02%)

EGR 403 - Cal Poly Pomona - SA9 12

Example 7-4a EXCEL Solution

• Use IRR function to find periodic IRR (i)

• Find nominal using r = i * m

• Use EFFECT function to find effective interest rate

Period Buy/sell Dividend Total

0 -1000 -1000

1 40 40

2 950 40 990

1.52% periodic

3.04% nominal

3.06% effective

EGR 403 - Cal Poly Pomona - SA9 13

Rate Of Return (ROR) Analysis

• Most frequently used measure of merit in

industry.

• More accurately called Internal Rate of

Return (IRR).

EGR 403 - Cal Poly Pomona - SA9 14

Calculating ROR

• Where two mutually exclusive alternatives will

provide the same benefit, ROR is performed using an

incremental rate of return (ROR) on the difference

between the alternatives.

• You cannot simply choose the higher IRR alternative.

Two-alternative Decision

situation

ROR MARR Choose higher-cost

alternative

ROR MARR Choose lower-cost

alternative

EGR 403 - Cal Poly Pomona - SA9 15

The Minimum Attractive Rate of

Return (MARR)

• The MARR is a minimum return the

company will accept on the money it invests

• The MARR is usually calculated by financial

analysts in the company and provided to

those who evaluate projects

• It is the same as the interest rate used for

Present Worth and Annual Worth analysis.

EGR 403 - Cal Poly Pomona - SA9 16

ROR on Alternatives With Equivalent Benefits

Example 7-5: Consider the lease vs. buy situation. MARR = 10%

• Leasco: Lease for five years for 3 annual payments of $1000 each

• Saleco: Purchase up front for $2783

• Both alternatives have a $1200/year benefit for 5 years

Cash flow - Cash flow - Cash flow -

Year alternative alternative alternative

A (Leaseco) B (Saleco) B-A

0 -$1,000.00 -$2,783.00 -$1,783.00

1 $200.00 $1,200.00 $1,000.00

2 $200.00 $1,200.00 $1,000.00

3 $1,200.00 $1,200.00 $0.00

4 $1,200.00 $1,200.00 $0.00

5 $1,200.00 $1,200.00 $0.00

IRR/period 48.72% 32.60% 8.01%

EGR 403 - Cal Poly Pomona - SA9 17

Example 7-5 (Cont’d)

• Cannot simply pick the highest IRR if alternatives have

different investment costs

• Must examine the incremental cash flows!!

• Subtract the cash flows for the “Lower First Cost”

alternative from the cash flows of the “Higher First Cost”

alternative to obtain the “Incremental Cash Flow” or

• Compute the IRR on the incremental cash flow. This is

the ROR.

• For this problem the ROR is 8.01% which is

MARR, therefore choose the lower cost alternative.

EGR 403 - Cal Poly Pomona - SA9 18

Example 7-5 (Cont’d)

• Q. Why did we do this?

• A. Both alternatives were acceptable compared only to the

MARR. Since either alternative will work, the question is

whether we want to spend the additional $1783 to go from

the lower cost to the higher cost alternative. The benefit for

doing so is the savings of two years of $1000 lease

payments. Essentially we are getting an 8.01% return on

that $1783 investment. The company can get 10% ROR on

its money elsewhere, so reject the increment. That is, spend

$1000 now on Leaseco and invest the other $1783 for a

higher return.

EGR 403 - Cal Poly Pomona - SA9 19

Analysis Period

• Just as in PW and AW analysis the analysis period must be

considered:

– Useful life of the alternative equals the analysis period.

– Alternatives have useful lives different from the analysis period.

– The analysis period is infinite, n =

For an example of that uses a

common multiple of the

alternate service lives, see

Example 7-10. EXCEL would 7-10

be useful here because of the

irregularity of the cash flows.

EGR 403 - Cal Poly Pomona - SA9 20

You might also like

- DissertationDocument135 pagesDissertationKhushbu ChadhaNo ratings yet

- Macroeconomics - Principles and PoliciesDocument6 pagesMacroeconomics - Principles and PoliciesJasneet BaidNo ratings yet

- Lecture - Notes17 - Economic Comparisons of Mutually Exclusive AlternativesDocument6 pagesLecture - Notes17 - Economic Comparisons of Mutually Exclusive AlternativesprofdanielNo ratings yet

- FinGame 5.0 Participants Ch04Document46 pagesFinGame 5.0 Participants Ch04Martin Vazquez100% (1)

- Report On Salem Telephone CompanyDocument11 pagesReport On Salem Telephone Companyasheesh100% (1)

- Biomimicry An Economic Game Changer InfographicDocument1 pageBiomimicry An Economic Game Changer Infographicrodolfo barbosa100% (1)

- Chapter 3 - Interest and Equivalence: EGR 403 Capital Allocation TheoryDocument32 pagesChapter 3 - Interest and Equivalence: EGR 403 Capital Allocation TheoryBartholomew SzoldNo ratings yet

- Egr403 sv6 Chapter4Document14 pagesEgr403 sv6 Chapter4Jaka WibowoNo ratings yet

- Lecture 5Document14 pagesLecture 5Khalid RehmanNo ratings yet

- Class 22 - Rate of Return AnalysisDocument23 pagesClass 22 - Rate of Return AnalysisSwastikNo ratings yet

- Lecture 6. Chapter 7Document22 pagesLecture 6. Chapter 7I.. IshaNo ratings yet

- Analisa Ekonomi TeknikDocument47 pagesAnalisa Ekonomi TeknikVachri MNo ratings yet

- Chap 6Document40 pagesChap 6minhhoang37033No ratings yet

- Chapter 5Document46 pagesChapter 5xffbdgngfNo ratings yet

- Chapter 9 Capital Budgeting Decision LectureDocument9 pagesChapter 9 Capital Budgeting Decision LectureAia GarciaNo ratings yet

- Rate of Return AnalysisDocument20 pagesRate of Return AnalysisM. Kurnia Sandy 1707113892No ratings yet

- Engineering Economics (MS-291) : Lecture # 19Document21 pagesEngineering Economics (MS-291) : Lecture # 19M Ali AsgharNo ratings yet

- Chapter 3 - Replacement Analysis-1Document28 pagesChapter 3 - Replacement Analysis-1VENKATA SAI KRISHNA YAGANTINo ratings yet

- Eng Econ Internal and External RORDocument20 pagesEng Econ Internal and External RORMohammad AlmafrajiNo ratings yet

- Breakeven Analysis: EGR 403 Capital Allocation TheoryDocument12 pagesBreakeven Analysis: EGR 403 Capital Allocation TheoryBartholomew SzoldNo ratings yet

- HCHE 511 - Lecture Notes 2Document14 pagesHCHE 511 - Lecture Notes 2dreenaNo ratings yet

- Chapter 3 (2) ROR 2015Document26 pagesChapter 3 (2) ROR 2015ananiya dawitNo ratings yet

- Lect 7Document31 pagesLect 7Ziad Al qudwahNo ratings yet

- Annuity (Continuous Compounding) and MARRDocument31 pagesAnnuity (Continuous Compounding) and MARRJordan Ronquillo100% (1)

- 1.1 What Is Their Profit Margin? Profit MarginDocument16 pages1.1 What Is Their Profit Margin? Profit MarginVenay SahadeoNo ratings yet

- Module 11e PWDocument10 pagesModule 11e PWCarljohari Hussein AriffNo ratings yet

- Chapter 8 - Incremental Rate of Return Analysis: EGR 403 Capital Allocation TheoryDocument11 pagesChapter 8 - Incremental Rate of Return Analysis: EGR 403 Capital Allocation TheoryDamien Di VittorioNo ratings yet

- AF5353: Security Analysis & Portfolio ManagementDocument38 pagesAF5353: Security Analysis & Portfolio ManagementkerenkangNo ratings yet

- Proctor 2012 - Investment AppraisalDocument25 pagesProctor 2012 - Investment AppraisalThanh TienNo ratings yet

- Stock - Eval-Risk and Return-Capital Budgeting-And Cashflow - CHPTR - Answers-Summary (Latest)Document4 pagesStock - Eval-Risk and Return-Capital Budgeting-And Cashflow - CHPTR - Answers-Summary (Latest)Mix MặtNo ratings yet

- Rate of Return CalculationsDocument37 pagesRate of Return CalculationsSrushti MNo ratings yet

- 4 Year Mechanical Power: Dr. Mohamed Hammam 2020Document9 pages4 Year Mechanical Power: Dr. Mohamed Hammam 2020Mohamed HammamNo ratings yet

- Rate of Return One Project: Engineering EconomyDocument20 pagesRate of Return One Project: Engineering EconomyEmran JanemNo ratings yet

- Slides Medley of ConceptsDocument26 pagesSlides Medley of ConceptsolaNo ratings yet

- The AW Method and IRR Method (Week 9)Document4 pagesThe AW Method and IRR Method (Week 9)raymond moscosoNo ratings yet

- Chapter 8 - Incremental Rate of Return Analysis: EGR 403 Capital Allocation TheoryDocument11 pagesChapter 8 - Incremental Rate of Return Analysis: EGR 403 Capital Allocation TheoryEndeshuNo ratings yet

- Incremental AnalysisDocument25 pagesIncremental AnalysisAngel MallariNo ratings yet

- Ekonomika Teknik: Rate of Return AnalysisDocument26 pagesEkonomika Teknik: Rate of Return AnalysisDonni Wasington NapitupuluNo ratings yet

- Chapter 10 - Depreciation: EGR 403 Capital Allocation TheoryDocument30 pagesChapter 10 - Depreciation: EGR 403 Capital Allocation TheorySolomon Risty CahuloganNo ratings yet

- Project Appraisal - Investment Appraisal - 2023Document40 pagesProject Appraisal - Investment Appraisal - 2023ThaboNo ratings yet

- Amit Pandey - FMDocument8 pagesAmit Pandey - FMAmit PandeyNo ratings yet

- Rate of Return CalculationsDocument25 pagesRate of Return CalculationsarunNo ratings yet

- INDE/EGRM 6617-02 Engineering Economy and Cost Estimating: Chapter 6: Comparison and Selection Among AlternativesDocument27 pagesINDE/EGRM 6617-02 Engineering Economy and Cost Estimating: Chapter 6: Comparison and Selection Among Alternativesfahad noumanNo ratings yet

- 604 Chap9Document28 pages604 Chap9Rashid ZafarNo ratings yet

- Engineering EconomyDocument29 pagesEngineering EconomyDonna Grace PacaldoNo ratings yet

- Rate of Return CalculationsDocument25 pagesRate of Return CalculationsSai Krish PotlapalliNo ratings yet

- Rate of Return Analisi (Terjemahan)Document20 pagesRate of Return Analisi (Terjemahan)M. Kurnia Sandy 1707113892No ratings yet

- Engineering Economics: Rate of Return AnalysisDocument29 pagesEngineering Economics: Rate of Return AnalysisEkoNo ratings yet

- Chapter 7 RORDocument29 pagesChapter 7 RORAbdulrahman ezzaldeenNo ratings yet

- Evaluating Alternatives: Chethan S.GowdaDocument82 pagesEvaluating Alternatives: Chethan S.GowdaTodesa HinkosaNo ratings yet

- Chapter 3 - Forecasting and Financial PlanningDocument55 pagesChapter 3 - Forecasting and Financial Planningdyanaryssa71No ratings yet

- Chapter #6Document65 pagesChapter #6Kyle JacksonNo ratings yet

- Rate of Return: Engineering Economics 1Document24 pagesRate of Return: Engineering Economics 1王泓鈞No ratings yet

- Final Examination: SPJCM Honor CodeDocument5 pagesFinal Examination: SPJCM Honor CodeRaguraman ShenbagarajanNo ratings yet

- Analysis & Interpretation of Financial StatementsDocument44 pagesAnalysis & Interpretation of Financial StatementsSecret DeityNo ratings yet

- SM 300 EE Annual WorthDocument36 pagesSM 300 EE Annual WorthAnushka DasNo ratings yet

- Capital Budegting - Project and Risk AnalysisDocument46 pagesCapital Budegting - Project and Risk AnalysisUpasana Thakur100% (1)

- Lecture 6Document32 pagesLecture 6MarvinNo ratings yet

- Capital BudgetingDocument32 pagesCapital BudgetingKonstantinos DelaportasNo ratings yet

- CH Rate of Return AnalysisDocument31 pagesCH Rate of Return Analysiseclipseband7gmailcom100% (1)

- Analysis & Interpretation of Financial StatementsDocument45 pagesAnalysis & Interpretation of Financial StatementsSofia Clarkson0% (1)

- FM10e ch09Document59 pagesFM10e ch09jawadzaheerNo ratings yet

- Annual Worth AnalysisDocument26 pagesAnnual Worth AnalysisOrangeNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- 1PDF DocumentDocument1 page1PDF DocumenthmmnksyNo ratings yet

- Group 2 PresentationDocument14 pagesGroup 2 PresentationhmmnksyNo ratings yet

- Minimum Equipment List (MEL) - SKYbrary Aviation SafetyDocument1 pageMinimum Equipment List (MEL) - SKYbrary Aviation SafetyhmmnksyNo ratings yet

- Worksheet: ST ND RD THDocument1 pageWorksheet: ST ND RD THhmmnksyNo ratings yet

- AbcdDocument1 pageAbcdhmmnksyNo ratings yet

- Lesson 1: The Steady Beat Let's Learn This!: Sto. Nino de Novaliches SchoolDocument4 pagesLesson 1: The Steady Beat Let's Learn This!: Sto. Nino de Novaliches Schoolhmmnksy100% (1)

- Health Declaration Form: Republic of The Philippines Commission On ElectionsDocument2 pagesHealth Declaration Form: Republic of The Philippines Commission On ElectionshmmnksyNo ratings yet

- GARCH Models in Python 4Document30 pagesGARCH Models in Python 4visNo ratings yet

- Fixed RatioDocument4 pagesFixed RatioarjbakNo ratings yet

- SaaS Valuation Multiples - Exclusive For SaaSRiseDocument24 pagesSaaS Valuation Multiples - Exclusive For SaaSRiseA RNo ratings yet

- Call For Papers SUBMITTD TO OECD FRANCE BY ALTAF JAHANGIRDocument4 pagesCall For Papers SUBMITTD TO OECD FRANCE BY ALTAF JAHANGIRAltaf Jahangir0% (1)

- Economics Assign Mba 9Document34 pagesEconomics Assign Mba 9Dickson MdhlaloseNo ratings yet

- Assignment in Contemporary WorldDocument2 pagesAssignment in Contemporary WorldKyla Shaine VelchezNo ratings yet

- 12 Economics-Indian Economy 1950-1990 - AssignmentDocument2 pages12 Economics-Indian Economy 1950-1990 - AssignmentSiddharthNo ratings yet

- Standard CostingDocument15 pagesStandard CostingSumit HukmaniNo ratings yet

- Anthropology Compiled1Document187 pagesAnthropology Compiled1savignesh1No ratings yet

- Transit Logistics ProfileDocument3 pagesTransit Logistics ProfileMelwin DsouzaNo ratings yet

- Chapter 1 The Economic ProblemDocument3 pagesChapter 1 The Economic ProblemAnanYasinNo ratings yet

- Foreign Exchange Business PlanDocument8 pagesForeign Exchange Business PlanbillrocksNo ratings yet

- Strategic Marketing: 15. Marketing Strategy Implementation and ControlDocument29 pagesStrategic Marketing: 15. Marketing Strategy Implementation and ControlamitcmsNo ratings yet

- ConflictologiaDocument16 pagesConflictologiaWellington GomesNo ratings yet

- Overview Facility Management Financing in The Construction Industry in Accra, GhanaDocument5 pagesOverview Facility Management Financing in The Construction Industry in Accra, GhanaAlexander DeckerNo ratings yet

- MBA 502 Session 1 Dec 21Document16 pagesMBA 502 Session 1 Dec 21Dilan ThilangaNo ratings yet

- Guided Reflective JournalsDocument3 pagesGuided Reflective JournalsAna Cristina ArandaNo ratings yet

- Break Even AnalysisDocument2 pagesBreak Even AnalysisVille4everNo ratings yet

- 4.6 Economic GrowthDocument5 pages4.6 Economic GrowthVeraDanNo ratings yet

- Basic Economic ProblemsDocument146 pagesBasic Economic ProblemsRichard DancelNo ratings yet

- The Effect of Population Growth On Economic GrowthDocument78 pagesThe Effect of Population Growth On Economic GrowthvishalNo ratings yet

- Case Discussion QuestionsDocument3 pagesCase Discussion QuestionsEVA SALVATIERRA LOPEZNo ratings yet

- Abdul RaheemDocument12 pagesAbdul RaheemrambabuNo ratings yet

- Chapter One: Introduction To Global MarketingDocument20 pagesChapter One: Introduction To Global MarketingDanny FrancisNo ratings yet

- What's Behind Microsoft & Skype Acquisition?Document18 pagesWhat's Behind Microsoft & Skype Acquisition?Piotr BartenbachNo ratings yet