Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

26 viewsPresentation: BSBFIM601 - Manage Finances

Presentation: BSBFIM601 - Manage Finances

Uploaded by

nehaThe document discusses closing the unprofitable Cairns restaurant due to ongoing losses and how that would affect other departments by increasing their fixed costs. It analyzes the financial position of the Cairns restaurant and recommends closing it down as the restaurant department is currently making losses. Reasons for closing include that profits for other departments would decrease due to having to take on the fixed costs from the restaurant.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Finance For Non Financial Managers: Avingtrans and Flowtech Fluid Power PWCDocument11 pagesFinance For Non Financial Managers: Avingtrans and Flowtech Fluid Power PWCThanapas Buranapichet100% (2)

- Kinder Morgan Detailed Analysis - DraftDocument11 pagesKinder Morgan Detailed Analysis - Draftenergyanalyst100% (2)

- Assignment# 9-10uploadDocument6 pagesAssignment# 9-10uploadneha100% (2)

- Week 3. Assignment 2 - Journat Entries and Adjustments and Preparing StatmentsDocument3 pagesWeek 3. Assignment 2 - Journat Entries and Adjustments and Preparing Statmentsayush guptaNo ratings yet

- Comparative Income Statements and Balance Sheets For Merck ($ Millions) FollowDocument6 pagesComparative Income Statements and Balance Sheets For Merck ($ Millions) FollowIman naufalNo ratings yet

- Mother - Please Speak Out: Income Statement For The Year Ended March 31, 2019 ($000s) Net Sales 100,000Document3 pagesMother - Please Speak Out: Income Statement For The Year Ended March 31, 2019 ($000s) Net Sales 100,000Jayash Kaushal0% (2)

- Finman ProblemDocument16 pagesFinman ProblemKatrizia FauniNo ratings yet

- Lucky Cement Limited: Managerial Accounting Submitted To: Dr. Nayyer ZaidiDocument21 pagesLucky Cement Limited: Managerial Accounting Submitted To: Dr. Nayyer ZaidiMuhammad AreebNo ratings yet

- BSBFIM601 Manage FinancesDocument34 pagesBSBFIM601 Manage Financesneha0% (1)

- Profitability Ratios 2019 2018Document9 pagesProfitability Ratios 2019 2018FidoNo ratings yet

- Chapter 2 Introduction To Cost Behavior and Cost-Volume RelationshipsDocument42 pagesChapter 2 Introduction To Cost Behavior and Cost-Volume RelationshipsNishita Akter67% (3)

- ch03 Part9Document6 pagesch03 Part9Sergio HoffmanNo ratings yet

- Bsbfim601 Manage Finances Prepare BudgetsDocument9 pagesBsbfim601 Manage Finances Prepare BudgetsAli Butt100% (4)

- Individual Assignment 2B - Aisyah Nuralam 29123362Document5 pagesIndividual Assignment 2B - Aisyah Nuralam 29123362Aisyah NuralamNo ratings yet

- Ma 10112021Document17 pagesMa 10112021Vaibhav ShahNo ratings yet

- Section A - Answer Question One (Compulsory Question)Document5 pagesSection A - Answer Question One (Compulsory Question)Adeel KhalidNo ratings yet

- Task 1 Finance ManagementDocument17 pagesTask 1 Finance Managementraj ramukNo ratings yet

- Interest Income, Non-BankDocument206 pagesInterest Income, Non-BankArturo RiveroNo ratings yet

- Income Statement Account Year 1 Year 2 Year 3 Year 4 Year 5Document1 pageIncome Statement Account Year 1 Year 2 Year 3 Year 4 Year 5Anonymous OWNHEhtDNo ratings yet

- Case Study Accounting Oart2Document5 pagesCase Study Accounting Oart2Vero MinaNo ratings yet

- BSBFIM601 Task 1Document10 pagesBSBFIM601 Task 1Kitpipoj PornnongsaenNo ratings yet

- Financial PlanDocument20 pagesFinancial Planzhijaescosio25No ratings yet

- NWG PLC q3 ResultsDocument48 pagesNWG PLC q3 ResultsAna LoweNo ratings yet

- Finman FinalsDocument4 pagesFinman FinalsDianarose RioNo ratings yet

- Financial Analysis 2019Document27 pagesFinancial Analysis 2019Umer MalikNo ratings yet

- Accounting 101Document21 pagesAccounting 101Armaan IrelandNo ratings yet

- Chapter 04-Syndicate 1Document5 pagesChapter 04-Syndicate 1Ahike HukatenNo ratings yet

- SuleeDocument8 pagesSuleefuadzeyniNo ratings yet

- Chapter 5Document15 pagesChapter 5khodorNo ratings yet

- FS Analysis Horizontal Vertical ExerciseDocument5 pagesFS Analysis Horizontal Vertical ExerciseCarla Noreen CasianoNo ratings yet

- Chapter 6 PDFDocument23 pagesChapter 6 PDFreyNo ratings yet

- Danu IctDocument21 pagesDanu Ictanwar kadiNo ratings yet

- Overview of Gemini Sea Food LimitedDocument7 pagesOverview of Gemini Sea Food LimitedAsif Al HasnatNo ratings yet

- Financial StatementsDocument41 pagesFinancial StatementsJan Carla Cabusas CurimatmatNo ratings yet

- Assignment FinalDocument10 pagesAssignment FinalJamal AbbasNo ratings yet

- 高顿财经ACCA acca.gaodun.cn: Advanced Performance ManagementDocument13 pages高顿财经ACCA acca.gaodun.cn: Advanced Performance ManagementIskandar BudionoNo ratings yet

- I. Financial AssumptionsDocument14 pagesI. Financial AssumptionsJaera shopaholicNo ratings yet

- IAS 7 - Statement of CashflowsDocument4 pagesIAS 7 - Statement of CashflowsTope JohnNo ratings yet

- Session 5 Financial Statement Analysis Part 1-2Document17 pagesSession 5 Financial Statement Analysis Part 1-2Prakriti ChaturvediNo ratings yet

- Services & Offers and Financial ProjectionDocument13 pagesServices & Offers and Financial ProjectionMark Leonil FunaNo ratings yet

- Acma Final ReportDocument11 pagesAcma Final ReportparidhiNo ratings yet

- Zuying. XueDocument9 pagesZuying. XueAbiot Asfiye GetanehNo ratings yet

- Year 2018 2019 2020: Task 1Document9 pagesYear 2018 2019 2020: Task 1Prateek ChandnaNo ratings yet

- Professional - May 2021Document173 pagesProfessional - May 2021Jason Baba KwagheNo ratings yet

- Whirlpool Financial AnalysisDocument5 pagesWhirlpool Financial AnalysisuddhavkulkarniNo ratings yet

- Analysis of Financial Statements - VICO Foods CorporationDocument19 pagesAnalysis of Financial Statements - VICO Foods CorporationHannah Bea LindoNo ratings yet

- FSA Tutorial 1Document2 pagesFSA Tutorial 1KHOO TAT SHERN DEXTONNo ratings yet

- Questions Business IncomeDocument8 pagesQuestions Business IncomeMbeiza MariamNo ratings yet

- Milestone Three Consolidated Financials Final Paper - Workbook...Document19 pagesMilestone Three Consolidated Financials Final Paper - Workbook...Ishan MishraNo ratings yet

- Introduction of MTM: StatementDocument23 pagesIntroduction of MTM: StatementALI SHER HaidriNo ratings yet

- Juishat Financial Plan: College Park, Dipolog City Tel. No. (065) 212-8049 WebsiteDocument11 pagesJuishat Financial Plan: College Park, Dipolog City Tel. No. (065) 212-8049 WebsiteMeosjinNo ratings yet

- TCS and Infosys - Financial AnalysisDocument10 pagesTCS and Infosys - Financial AnalysisGhritachi PaulNo ratings yet

- Advance Tax-Basis PeriodDocument6 pagesAdvance Tax-Basis PeriodFunshoNo ratings yet

- Topic 10-12 Alk (Hitungannya)Document6 pagesTopic 10-12 Alk (Hitungannya)Daffa Permana PutraNo ratings yet

- Acc Projects by Adnan SHKDocument23 pagesAcc Projects by Adnan SHKADNAN SHEIKHNo ratings yet

- 2020 FS The American Scandinavian FoundationDocument25 pages2020 FS The American Scandinavian FoundationPhạm KhánhNo ratings yet

- Case 1Document4 pagesCase 1Roger BartelsNo ratings yet

- Financial Statement PresentationDocument17 pagesFinancial Statement PresentationAbdul RehmanNo ratings yet

- Template - MIDTERM EXAM INTERMEDIATE 1Document7 pagesTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNo ratings yet

- Donam Corporate FinanceDocument9 pagesDonam Corporate FinanceMAGOMU DAN DAVIDNo ratings yet

- CHB Mar19 PDFDocument14 pagesCHB Mar19 PDFSajeetha MadhavanNo ratings yet

- Gbs 520:financial and Management Accounting: Bryson MumbaDocument46 pagesGbs 520:financial and Management Accounting: Bryson MumbaSANDFORD MALULUNo ratings yet

- Chap 4 (Fix)Document11 pagesChap 4 (Fix)Misu NguyenNo ratings yet

- Topic 3.5 Ratio AnalysisDocument22 pagesTopic 3.5 Ratio AnalysisSevarakhon UmarovaNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- A Guide To Managing InfertilityDocument38 pagesA Guide To Managing InfertilitynehaNo ratings yet

- Palliative Care Management of ConstipationDocument5 pagesPalliative Care Management of ConstipationnehaNo ratings yet

- 53 Hamada Et Al Genetics and Male InfertilityDocument45 pages53 Hamada Et Al Genetics and Male InfertilitynehaNo ratings yet

- Liberty Construction College: Student Assessment - Written ActivityDocument12 pagesLiberty Construction College: Student Assessment - Written ActivitynehaNo ratings yet

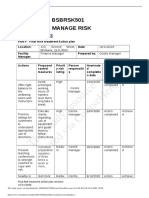

- This Study Resource Was: Unit Code: Bsbrsk501 Unit Name: Manage RiskDocument2 pagesThis Study Resource Was: Unit Code: Bsbrsk501 Unit Name: Manage RisknehaNo ratings yet

- Comprehensive Overview of Constipation: William E. Whitehead, PHD Center Co-DirectorDocument3 pagesComprehensive Overview of Constipation: William E. Whitehead, PHD Center Co-DirectornehaNo ratings yet

- Assessment Task 1 Unit Code: BSBMKG523 Unit Name: Design and Develop An Integrated Marketing Communication PlanDocument12 pagesAssessment Task 1 Unit Code: BSBMKG523 Unit Name: Design and Develop An Integrated Marketing Communication PlannehaNo ratings yet

- 2437 The Complex Path To Simple Elegance The Story of 432 Park AvenueDocument7 pages2437 The Complex Path To Simple Elegance The Story of 432 Park AvenuenehaNo ratings yet

- Improvement and Support Plan (ISP)Document3 pagesImprovement and Support Plan (ISP)nehaNo ratings yet

- This Study Resource Was: ASSESSMENT 2 - Written ReportDocument9 pagesThis Study Resource Was: ASSESSMENT 2 - Written ReportnehaNo ratings yet

- Photocopiable Resources: Macmillan Children's Readers Worksheets and Teacher's NotesDocument8 pagesPhotocopiable Resources: Macmillan Children's Readers Worksheets and Teacher's NotesnehaNo ratings yet

- Worksheet Pharaohs, Pyramids and The World of The GodsDocument9 pagesWorksheet Pharaohs, Pyramids and The World of The GodsnehaNo ratings yet

- BSBMGT617 Format of AssessmentDocument8 pagesBSBMGT617 Format of AssessmentnehaNo ratings yet

- Pes Anserine BursitisDocument4 pagesPes Anserine BursitisnehaNo ratings yet

- O D e V Leverage and Capital StructureDocument9 pagesO D e V Leverage and Capital StructureYaldiz YaldizNo ratings yet

- Chapter 2 Solutions: Solutions To Questions For Review and DiscussionDocument31 pagesChapter 2 Solutions: Solutions To Questions For Review and DiscussionAlbert CruzNo ratings yet

- TDI TradestationDocument24 pagesTDI TradestationAndrei Georgescu100% (2)

- Barter System History - The Past and PresentDocument13 pagesBarter System History - The Past and PresentJohn TurnerNo ratings yet

- Unit - 2 CaptalisationDocument13 pagesUnit - 2 Captalisationraghav bhardwajNo ratings yet

- 6 Types of Adjusting EntriesDocument23 pages6 Types of Adjusting EntriesMarjorie GabonNo ratings yet

- Payment of Bonus Act 1965Document38 pagesPayment of Bonus Act 1965Prajapati Kalpesh BhagvandasNo ratings yet

- Partnership Liquidation - InstallmentDocument2 pagesPartnership Liquidation - InstallmentRonnelson PascualNo ratings yet

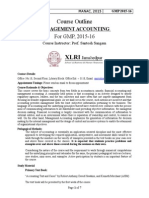

- Course Outline-MANACDocument7 pagesCourse Outline-MANACdkrirayNo ratings yet

- Landau CompanyDocument4 pagesLandau Companyrond_2728No ratings yet

- MusharkahDocument44 pagesMusharkahAsad AliNo ratings yet

- Accounting HeadsDocument6 pagesAccounting HeadsTekumani Naveen Kumar100% (11)

- OnlinePayslip Pages NewPayslipModuleDocument1 pageOnlinePayslip Pages NewPayslipModulerujean romy p guisando57% (7)

- DBH 1st Mutual FundDocument34 pagesDBH 1st Mutual Fundrishav_agarwal_1No ratings yet

- Jollibee Foods Corporation Financial Data (2017)Document10 pagesJollibee Foods Corporation Financial Data (2017)Sheila Mae AramanNo ratings yet

- AQR JPM Quant Style Investing 2018 PDFDocument14 pagesAQR JPM Quant Style Investing 2018 PDFAbhimanyu GuptaNo ratings yet

- Unit 3 Revenue AccountingDocument20 pagesUnit 3 Revenue Accountingjatin4verma-2No ratings yet

- Ind As 11Document37 pagesInd As 11CA Keshav MadaanNo ratings yet

- ACC101 Su20 HuyenDTT GroupAssignment Group3Document40 pagesACC101 Su20 HuyenDTT GroupAssignment Group3An Hoài ThuNo ratings yet

- Vsi Jaipur Ca Final ABC Analysis For May 2022 FRDocument4 pagesVsi Jaipur Ca Final ABC Analysis For May 2022 FRKeerthan GowdaNo ratings yet

- Valuation 1-3Document8 pagesValuation 1-3HERMENIA PAGUINTONo ratings yet

- AES2 Indepependent Business Valuation EngagementsDocument10 pagesAES2 Indepependent Business Valuation EngagementsAnonymous MFRxX34caNo ratings yet

- Ekonomi Public Bab 6.3 Efficiency Condition For Public Goods)Document5 pagesEkonomi Public Bab 6.3 Efficiency Condition For Public Goods)Andre AlvarezNo ratings yet

- White Company Manufactures A Single ProductDocument10 pagesWhite Company Manufactures A Single ProductMA Valdez100% (1)

- 005 Perfecto vs. MeerDocument2 pages005 Perfecto vs. Meerannamariepagtabunan100% (1)

- Reliance Communication and Bharti AirtelDocument22 pagesReliance Communication and Bharti Airtelvicky273No ratings yet

Presentation: BSBFIM601 - Manage Finances

Presentation: BSBFIM601 - Manage Finances

Uploaded by

neha0 ratings0% found this document useful (0 votes)

26 views9 pagesThe document discusses closing the unprofitable Cairns restaurant due to ongoing losses and how that would affect other departments by increasing their fixed costs. It analyzes the financial position of the Cairns restaurant and recommends closing it down as the restaurant department is currently making losses. Reasons for closing include that profits for other departments would decrease due to having to take on the fixed costs from the restaurant.

Original Description:

x fvdvv dvdvv vxv xdvdv

Original Title

BSBFIM601

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses closing the unprofitable Cairns restaurant due to ongoing losses and how that would affect other departments by increasing their fixed costs. It analyzes the financial position of the Cairns restaurant and recommends closing it down as the restaurant department is currently making losses. Reasons for closing include that profits for other departments would decrease due to having to take on the fixed costs from the restaurant.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

26 views9 pagesPresentation: BSBFIM601 - Manage Finances

Presentation: BSBFIM601 - Manage Finances

Uploaded by

nehaThe document discusses closing the unprofitable Cairns restaurant due to ongoing losses and how that would affect other departments by increasing their fixed costs. It analyzes the financial position of the Cairns restaurant and recommends closing it down as the restaurant department is currently making losses. Reasons for closing include that profits for other departments would decrease due to having to take on the fixed costs from the restaurant.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 9

Presentation

BSBFIM601 – Manage finances

Explain that the management is considering the closure of the Cairns restaurant

The financial position of cairns restaurant analyzed in the

previous sector, the restaurant department was making

losses. This has prompted the management of the store

to consider closing down the restaurant department.

Doing so, traditions restaurant is will be faced with

various implications, both financial and non financial.

Currently, the restaurant department is making losses

and as such, it is her responsibility to advice the

management whether to close down the restaurant or to

put more capital in it so as to make it more profitable

Reasons for closing

The contribution margin will increase leading to

reduction in profits

Since fixed costs per period of time do not vary by the

amount of units produced, the other three

departments will have to incur these costs. This will

increase the overall costs leading to reduced profits.

Explain the new budget you have developed for

Melbourne for the Current Year (Year Y)

a.Total Sales (including all line items)

Sales Current Year (Year Y3) Budgets

Restaurant beverage sales 77,818

Restaurant food sales 129,720

Catering sales 46,644

Total Sales 254,182

Operating Expenses (including all line items)

Operating Expenses Current Year (Year Y3) Budgets

Food and beverage cost (direct cost of sales) 110,244

Advertising 5,854

Bank Service Charges 258

Credit Card Fees 258

Insurances 6,180

Payroll 62,364

Professional Fees 1,352

Rent or Lease 15,360

Hospitality Supplies 3,893

Licenses 1,648

Utilities and Telephone 3,152

Equipment Leases 4,635

Maintenance 734

Total Operating Expenses 215,931

Net Profit Before Tax

Net Profit Before Tax Current Year (Year Y3) Budgets

Net Profit Before Tax (EBIT) 38,252

Corporate Taxes 10,902

Net Profit

Net Profit Current Year (Year Y3) Budgets

Net Profit (or Net Income) 27,350

Ensure that managers and accounts

officer understand reporting

requirements

Managers:

Develop daily sales and expenses reports for Finance

Manager, in conjuction with Accounts Officer

Oversee monthly financial reporting for CEO, including:

oCash flow reports oAgeing summary

Accounts officer:

Develop daily sales and expenses reports for Finance

Manager, in conjuction with Restaurant Managers

Develop monthly finance reports for Finance Manager and

CEO, including: oCash flow reports oAgeing summary

Ensure that managers and accounts

officer understand financial

delegations

Manager:

Comply with Financial Management Policy.

Authorise Supplier Claim Forms.

Process petty cash expenditure at restaurants.

Delegation authority - $20,000

Accounts officer:

Comply with Financial Management Policy.

Process petty cash expenditure at Corporate Office.

Delegation authority - $1,000

Recommendations

Based on a survey of similar businesses across Australia, it was

determined that an LRG restaurant with five full-time staff members

could be expected to have the financial goals for each restaurant for

the coming year:

Increase net earnings from beverage sales by at least 15% in all

restaurants

Achieve 10% of sales through catering at all restaurants

Holding spending, as a percentage of sales, at a steady rate, at all

restaurants

Increase net earnings from food sales by at least 10% in all restaurants

You might also like

- Finance For Non Financial Managers: Avingtrans and Flowtech Fluid Power PWCDocument11 pagesFinance For Non Financial Managers: Avingtrans and Flowtech Fluid Power PWCThanapas Buranapichet100% (2)

- Kinder Morgan Detailed Analysis - DraftDocument11 pagesKinder Morgan Detailed Analysis - Draftenergyanalyst100% (2)

- Assignment# 9-10uploadDocument6 pagesAssignment# 9-10uploadneha100% (2)

- Week 3. Assignment 2 - Journat Entries and Adjustments and Preparing StatmentsDocument3 pagesWeek 3. Assignment 2 - Journat Entries and Adjustments and Preparing Statmentsayush guptaNo ratings yet

- Comparative Income Statements and Balance Sheets For Merck ($ Millions) FollowDocument6 pagesComparative Income Statements and Balance Sheets For Merck ($ Millions) FollowIman naufalNo ratings yet

- Mother - Please Speak Out: Income Statement For The Year Ended March 31, 2019 ($000s) Net Sales 100,000Document3 pagesMother - Please Speak Out: Income Statement For The Year Ended March 31, 2019 ($000s) Net Sales 100,000Jayash Kaushal0% (2)

- Finman ProblemDocument16 pagesFinman ProblemKatrizia FauniNo ratings yet

- Lucky Cement Limited: Managerial Accounting Submitted To: Dr. Nayyer ZaidiDocument21 pagesLucky Cement Limited: Managerial Accounting Submitted To: Dr. Nayyer ZaidiMuhammad AreebNo ratings yet

- BSBFIM601 Manage FinancesDocument34 pagesBSBFIM601 Manage Financesneha0% (1)

- Profitability Ratios 2019 2018Document9 pagesProfitability Ratios 2019 2018FidoNo ratings yet

- Chapter 2 Introduction To Cost Behavior and Cost-Volume RelationshipsDocument42 pagesChapter 2 Introduction To Cost Behavior and Cost-Volume RelationshipsNishita Akter67% (3)

- ch03 Part9Document6 pagesch03 Part9Sergio HoffmanNo ratings yet

- Bsbfim601 Manage Finances Prepare BudgetsDocument9 pagesBsbfim601 Manage Finances Prepare BudgetsAli Butt100% (4)

- Individual Assignment 2B - Aisyah Nuralam 29123362Document5 pagesIndividual Assignment 2B - Aisyah Nuralam 29123362Aisyah NuralamNo ratings yet

- Ma 10112021Document17 pagesMa 10112021Vaibhav ShahNo ratings yet

- Section A - Answer Question One (Compulsory Question)Document5 pagesSection A - Answer Question One (Compulsory Question)Adeel KhalidNo ratings yet

- Task 1 Finance ManagementDocument17 pagesTask 1 Finance Managementraj ramukNo ratings yet

- Interest Income, Non-BankDocument206 pagesInterest Income, Non-BankArturo RiveroNo ratings yet

- Income Statement Account Year 1 Year 2 Year 3 Year 4 Year 5Document1 pageIncome Statement Account Year 1 Year 2 Year 3 Year 4 Year 5Anonymous OWNHEhtDNo ratings yet

- Case Study Accounting Oart2Document5 pagesCase Study Accounting Oart2Vero MinaNo ratings yet

- BSBFIM601 Task 1Document10 pagesBSBFIM601 Task 1Kitpipoj PornnongsaenNo ratings yet

- Financial PlanDocument20 pagesFinancial Planzhijaescosio25No ratings yet

- NWG PLC q3 ResultsDocument48 pagesNWG PLC q3 ResultsAna LoweNo ratings yet

- Finman FinalsDocument4 pagesFinman FinalsDianarose RioNo ratings yet

- Financial Analysis 2019Document27 pagesFinancial Analysis 2019Umer MalikNo ratings yet

- Accounting 101Document21 pagesAccounting 101Armaan IrelandNo ratings yet

- Chapter 04-Syndicate 1Document5 pagesChapter 04-Syndicate 1Ahike HukatenNo ratings yet

- SuleeDocument8 pagesSuleefuadzeyniNo ratings yet

- Chapter 5Document15 pagesChapter 5khodorNo ratings yet

- FS Analysis Horizontal Vertical ExerciseDocument5 pagesFS Analysis Horizontal Vertical ExerciseCarla Noreen CasianoNo ratings yet

- Chapter 6 PDFDocument23 pagesChapter 6 PDFreyNo ratings yet

- Danu IctDocument21 pagesDanu Ictanwar kadiNo ratings yet

- Overview of Gemini Sea Food LimitedDocument7 pagesOverview of Gemini Sea Food LimitedAsif Al HasnatNo ratings yet

- Financial StatementsDocument41 pagesFinancial StatementsJan Carla Cabusas CurimatmatNo ratings yet

- Assignment FinalDocument10 pagesAssignment FinalJamal AbbasNo ratings yet

- 高顿财经ACCA acca.gaodun.cn: Advanced Performance ManagementDocument13 pages高顿财经ACCA acca.gaodun.cn: Advanced Performance ManagementIskandar BudionoNo ratings yet

- I. Financial AssumptionsDocument14 pagesI. Financial AssumptionsJaera shopaholicNo ratings yet

- IAS 7 - Statement of CashflowsDocument4 pagesIAS 7 - Statement of CashflowsTope JohnNo ratings yet

- Session 5 Financial Statement Analysis Part 1-2Document17 pagesSession 5 Financial Statement Analysis Part 1-2Prakriti ChaturvediNo ratings yet

- Services & Offers and Financial ProjectionDocument13 pagesServices & Offers and Financial ProjectionMark Leonil FunaNo ratings yet

- Acma Final ReportDocument11 pagesAcma Final ReportparidhiNo ratings yet

- Zuying. XueDocument9 pagesZuying. XueAbiot Asfiye GetanehNo ratings yet

- Year 2018 2019 2020: Task 1Document9 pagesYear 2018 2019 2020: Task 1Prateek ChandnaNo ratings yet

- Professional - May 2021Document173 pagesProfessional - May 2021Jason Baba KwagheNo ratings yet

- Whirlpool Financial AnalysisDocument5 pagesWhirlpool Financial AnalysisuddhavkulkarniNo ratings yet

- Analysis of Financial Statements - VICO Foods CorporationDocument19 pagesAnalysis of Financial Statements - VICO Foods CorporationHannah Bea LindoNo ratings yet

- FSA Tutorial 1Document2 pagesFSA Tutorial 1KHOO TAT SHERN DEXTONNo ratings yet

- Questions Business IncomeDocument8 pagesQuestions Business IncomeMbeiza MariamNo ratings yet

- Milestone Three Consolidated Financials Final Paper - Workbook...Document19 pagesMilestone Three Consolidated Financials Final Paper - Workbook...Ishan MishraNo ratings yet

- Introduction of MTM: StatementDocument23 pagesIntroduction of MTM: StatementALI SHER HaidriNo ratings yet

- Juishat Financial Plan: College Park, Dipolog City Tel. No. (065) 212-8049 WebsiteDocument11 pagesJuishat Financial Plan: College Park, Dipolog City Tel. No. (065) 212-8049 WebsiteMeosjinNo ratings yet

- TCS and Infosys - Financial AnalysisDocument10 pagesTCS and Infosys - Financial AnalysisGhritachi PaulNo ratings yet

- Advance Tax-Basis PeriodDocument6 pagesAdvance Tax-Basis PeriodFunshoNo ratings yet

- Topic 10-12 Alk (Hitungannya)Document6 pagesTopic 10-12 Alk (Hitungannya)Daffa Permana PutraNo ratings yet

- Acc Projects by Adnan SHKDocument23 pagesAcc Projects by Adnan SHKADNAN SHEIKHNo ratings yet

- 2020 FS The American Scandinavian FoundationDocument25 pages2020 FS The American Scandinavian FoundationPhạm KhánhNo ratings yet

- Case 1Document4 pagesCase 1Roger BartelsNo ratings yet

- Financial Statement PresentationDocument17 pagesFinancial Statement PresentationAbdul RehmanNo ratings yet

- Template - MIDTERM EXAM INTERMEDIATE 1Document7 pagesTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNo ratings yet

- Donam Corporate FinanceDocument9 pagesDonam Corporate FinanceMAGOMU DAN DAVIDNo ratings yet

- CHB Mar19 PDFDocument14 pagesCHB Mar19 PDFSajeetha MadhavanNo ratings yet

- Gbs 520:financial and Management Accounting: Bryson MumbaDocument46 pagesGbs 520:financial and Management Accounting: Bryson MumbaSANDFORD MALULUNo ratings yet

- Chap 4 (Fix)Document11 pagesChap 4 (Fix)Misu NguyenNo ratings yet

- Topic 3.5 Ratio AnalysisDocument22 pagesTopic 3.5 Ratio AnalysisSevarakhon UmarovaNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- A Guide To Managing InfertilityDocument38 pagesA Guide To Managing InfertilitynehaNo ratings yet

- Palliative Care Management of ConstipationDocument5 pagesPalliative Care Management of ConstipationnehaNo ratings yet

- 53 Hamada Et Al Genetics and Male InfertilityDocument45 pages53 Hamada Et Al Genetics and Male InfertilitynehaNo ratings yet

- Liberty Construction College: Student Assessment - Written ActivityDocument12 pagesLiberty Construction College: Student Assessment - Written ActivitynehaNo ratings yet

- This Study Resource Was: Unit Code: Bsbrsk501 Unit Name: Manage RiskDocument2 pagesThis Study Resource Was: Unit Code: Bsbrsk501 Unit Name: Manage RisknehaNo ratings yet

- Comprehensive Overview of Constipation: William E. Whitehead, PHD Center Co-DirectorDocument3 pagesComprehensive Overview of Constipation: William E. Whitehead, PHD Center Co-DirectornehaNo ratings yet

- Assessment Task 1 Unit Code: BSBMKG523 Unit Name: Design and Develop An Integrated Marketing Communication PlanDocument12 pagesAssessment Task 1 Unit Code: BSBMKG523 Unit Name: Design and Develop An Integrated Marketing Communication PlannehaNo ratings yet

- 2437 The Complex Path To Simple Elegance The Story of 432 Park AvenueDocument7 pages2437 The Complex Path To Simple Elegance The Story of 432 Park AvenuenehaNo ratings yet

- Improvement and Support Plan (ISP)Document3 pagesImprovement and Support Plan (ISP)nehaNo ratings yet

- This Study Resource Was: ASSESSMENT 2 - Written ReportDocument9 pagesThis Study Resource Was: ASSESSMENT 2 - Written ReportnehaNo ratings yet

- Photocopiable Resources: Macmillan Children's Readers Worksheets and Teacher's NotesDocument8 pagesPhotocopiable Resources: Macmillan Children's Readers Worksheets and Teacher's NotesnehaNo ratings yet

- Worksheet Pharaohs, Pyramids and The World of The GodsDocument9 pagesWorksheet Pharaohs, Pyramids and The World of The GodsnehaNo ratings yet

- BSBMGT617 Format of AssessmentDocument8 pagesBSBMGT617 Format of AssessmentnehaNo ratings yet

- Pes Anserine BursitisDocument4 pagesPes Anserine BursitisnehaNo ratings yet

- O D e V Leverage and Capital StructureDocument9 pagesO D e V Leverage and Capital StructureYaldiz YaldizNo ratings yet

- Chapter 2 Solutions: Solutions To Questions For Review and DiscussionDocument31 pagesChapter 2 Solutions: Solutions To Questions For Review and DiscussionAlbert CruzNo ratings yet

- TDI TradestationDocument24 pagesTDI TradestationAndrei Georgescu100% (2)

- Barter System History - The Past and PresentDocument13 pagesBarter System History - The Past and PresentJohn TurnerNo ratings yet

- Unit - 2 CaptalisationDocument13 pagesUnit - 2 Captalisationraghav bhardwajNo ratings yet

- 6 Types of Adjusting EntriesDocument23 pages6 Types of Adjusting EntriesMarjorie GabonNo ratings yet

- Payment of Bonus Act 1965Document38 pagesPayment of Bonus Act 1965Prajapati Kalpesh BhagvandasNo ratings yet

- Partnership Liquidation - InstallmentDocument2 pagesPartnership Liquidation - InstallmentRonnelson PascualNo ratings yet

- Course Outline-MANACDocument7 pagesCourse Outline-MANACdkrirayNo ratings yet

- Landau CompanyDocument4 pagesLandau Companyrond_2728No ratings yet

- MusharkahDocument44 pagesMusharkahAsad AliNo ratings yet

- Accounting HeadsDocument6 pagesAccounting HeadsTekumani Naveen Kumar100% (11)

- OnlinePayslip Pages NewPayslipModuleDocument1 pageOnlinePayslip Pages NewPayslipModulerujean romy p guisando57% (7)

- DBH 1st Mutual FundDocument34 pagesDBH 1st Mutual Fundrishav_agarwal_1No ratings yet

- Jollibee Foods Corporation Financial Data (2017)Document10 pagesJollibee Foods Corporation Financial Data (2017)Sheila Mae AramanNo ratings yet

- AQR JPM Quant Style Investing 2018 PDFDocument14 pagesAQR JPM Quant Style Investing 2018 PDFAbhimanyu GuptaNo ratings yet

- Unit 3 Revenue AccountingDocument20 pagesUnit 3 Revenue Accountingjatin4verma-2No ratings yet

- Ind As 11Document37 pagesInd As 11CA Keshav MadaanNo ratings yet

- ACC101 Su20 HuyenDTT GroupAssignment Group3Document40 pagesACC101 Su20 HuyenDTT GroupAssignment Group3An Hoài ThuNo ratings yet

- Vsi Jaipur Ca Final ABC Analysis For May 2022 FRDocument4 pagesVsi Jaipur Ca Final ABC Analysis For May 2022 FRKeerthan GowdaNo ratings yet

- Valuation 1-3Document8 pagesValuation 1-3HERMENIA PAGUINTONo ratings yet

- AES2 Indepependent Business Valuation EngagementsDocument10 pagesAES2 Indepependent Business Valuation EngagementsAnonymous MFRxX34caNo ratings yet

- Ekonomi Public Bab 6.3 Efficiency Condition For Public Goods)Document5 pagesEkonomi Public Bab 6.3 Efficiency Condition For Public Goods)Andre AlvarezNo ratings yet

- White Company Manufactures A Single ProductDocument10 pagesWhite Company Manufactures A Single ProductMA Valdez100% (1)

- 005 Perfecto vs. MeerDocument2 pages005 Perfecto vs. Meerannamariepagtabunan100% (1)

- Reliance Communication and Bharti AirtelDocument22 pagesReliance Communication and Bharti Airtelvicky273No ratings yet