Professional Documents

Culture Documents

Logistics Inventory

Logistics Inventory

Uploaded by

lsurendra0 ratings0% found this document useful (0 votes)

43 views11 pages Here are the calculations for Nittany Fans:

EOQ = √(2*Annual demand*Ordering cost)/(Carrying cost rate*Unit value)

= √(2*36000*$200)/(0.25*$4000) = 480 units

Total cost of EOQ (not including transportation) =

1/2 * EOQ * Unit value * Carrying cost rate + Ordering cost/Orders per year

= 1/2 * 480 * $4000 * 0.25 + $200/36000/480 = $1920

Total cost using rail = EOQ cost + In-transit inventory cost

= $1920 + 480 * $4000 * 0

Original Description:

Inventory costs attributed to logistics activities presented.

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document Here are the calculations for Nittany Fans:

EOQ = √(2*Annual demand*Ordering cost)/(Carrying cost rate*Unit value)

= √(2*36000*$200)/(0.25*$4000) = 480 units

Total cost of EOQ (not including transportation) =

1/2 * EOQ * Unit value * Carrying cost rate + Ordering cost/Orders per year

= 1/2 * 480 * $4000 * 0.25 + $200/36000/480 = $1920

Total cost using rail = EOQ cost + In-transit inventory cost

= $1920 + 480 * $4000 * 0

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

43 views11 pagesLogistics Inventory

Logistics Inventory

Uploaded by

lsurendra Here are the calculations for Nittany Fans:

EOQ = √(2*Annual demand*Ordering cost)/(Carrying cost rate*Unit value)

= √(2*36000*$200)/(0.25*$4000) = 480 units

Total cost of EOQ (not including transportation) =

1/2 * EOQ * Unit value * Carrying cost rate + Ordering cost/Orders per year

= 1/2 * 480 * $4000 * 0.25 + $200/36000/480 = $1920

Total cost using rail = EOQ cost + In-transit inventory cost

= $1920 + 480 * $4000 * 0

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 11

Inventory Costs

Capital cost or opportunity cost

Customer priorities

Unexpected orders/spare requirement

Cost of lost sales

Storage space cost: includes handling costs and rent

Inventory service cost: includes insurance and taxes

Inventory risk cost:

Shelf-life

Product obsolescence

Material price variation

Inventory Costs

In-transit inventory cost:

does not include storage space cost, taxes and insurance

Obsolescence and deterioration are lesser risks

Generally costs less than carrying in the warehouse

Carrying cost vs order costs

Inventory Costs

Classifying inventory:

1951 GE suggestion:

Relative sales volume, cash flows, lead time or stock-

out costs

80-20 rule (Pareto's Law)

ABC classification of inventories

20% items 80% sales

50% items 15% sales

30% items 5% sales

Inventory Costs

Casey-Lynn Corporation

Product# Units sold Price/unit Profit/unit

SR101 12386 275 82.50

SR103 784 1530 459.00

SR105 1597 579 173.30

SR201 48 2500 975.00

SR203 2 3000 1200.00

SR205 9876 450 149.00

SR301 673 600 180.00

SR303 547 725 200.00

SR305 3437 917 240.00

SR500 78 1000 312.00

Do an ABC inventory analysis based on revenue and profits.

Managing Inventory

Fixed Order Quantity Approach

Economic order quantity approach

Conditions of certainty

Conditions of uncertainty

Probability

Normal distribution

If demand is erratic mini-max approach is suitable

Safety stock approach

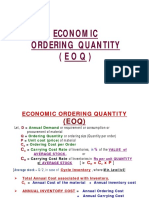

EOQ

R=Annual rate of demand in units

Q=Quantity ordered lot size

A=Cost of placing order Rs per order

V=Value or cost of one unit of inventory

W=Carrying cost per Rs value of inventory per

year (% of product value)

TAC=Total annual cost=½QV*W + A(R/Q)

EOQ=d(TAC)/dQ=√((2R*A)/(V*W))

EOQ

R=3600 units

A=Rs200 per order

V=Rs100 per unit of inventory

W=25%

EOQ=?

Inventory at Multiple Locations

(The Square Root Law)

n1=number of existing facilities

n2=number of future facilities

X1=total inventory in existing facilities

X2=total inventory in future facilities

X2=(x1)(√n2/n1)

Managing Inventory

Additional approaches:

KANBAN

JIT

Two-bin system

Reducing lead times

MRP System

Impact of 'Pull' and 'Push' on inventory

Nittany Fans

Annual demand: 36000 fans

Fan value: $4000

Inventory carrying cost: 25%

Ordering cost=$200

In-transit inventory carrying cost = 15%

Order cycle time using rail=4 days

Order cycle time using motor carrier=2 days

Rail rate=$10/ton

Motor rate=$12.5/ton

Weight of fan(including packing)=100kg

Nittany Fans

What is the EOQ for Nittany Fans in units?

What is the total cost (not considering transportation

related costs) of the EOQ?

What is the total cost of using rail transportation?

What is the cost of using motor transportation?

What alternative should Nittany use?

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Amazon Go ReportDocument3 pagesAmazon Go ReportkatyaNo ratings yet

- MAS - 1410 Inventory ManagementDocument25 pagesMAS - 1410 Inventory ManagementAzureBlazeNo ratings yet

- Din en 1537 - Ground Anchors PDFDocument63 pagesDin en 1537 - Ground Anchors PDFbelf a gorNo ratings yet

- Chapter 3 Capital Structure and LeverageDocument14 pagesChapter 3 Capital Structure and LeverageJishan Mahmud-1220No ratings yet

- Unit 2Document25 pagesUnit 2din zahurNo ratings yet

- Inv MGTDocument35 pagesInv MGTAsCreations DesignerClothingNo ratings yet

- Inventories in The Supply ChainDocument36 pagesInventories in The Supply ChainPreeti AroraNo ratings yet

- Inventory - Management Session 12Document44 pagesInventory - Management Session 12Revalina Dwi OktavianiNo ratings yet

- Inventory Management For EM StudentsDocument24 pagesInventory Management For EM StudentsShahriar KabirNo ratings yet

- Inventory Hides Problems: Poor Quality Unreliable Supplier Machine Breakdown Inefficient Layout Bad Design Lengthy SetupsDocument37 pagesInventory Hides Problems: Poor Quality Unreliable Supplier Machine Breakdown Inefficient Layout Bad Design Lengthy Setupsauro auroNo ratings yet

- Pem M C07: Project Materials ManagementDocument276 pagesPem M C07: Project Materials ManagementKingSantoshNo ratings yet

- Input Form: Input For Venture Guidance AppraisalDocument7 pagesInput Form: Input For Venture Guidance AppraisalgenergiaNo ratings yet

- Chap.4 - Inventory Management EditedDocument44 pagesChap.4 - Inventory Management EditedadmasuNo ratings yet

- Inventory ManagementDocument76 pagesInventory ManagementAnshul NataniNo ratings yet

- 102.COA PL I Solution CMA Special Examination 2021novemberDocument7 pages102.COA PL I Solution CMA Special Examination 2021novemberSky WalkerNo ratings yet

- 306 CH 12Document38 pages306 CH 12Mahendra ThengNo ratings yet

- BruhDocument15 pagesBruhspaghettisaucerersNo ratings yet

- Activity Based-WPS OfficeDocument6 pagesActivity Based-WPS OfficeTakudzwa BenjaminNo ratings yet

- Inventory Management - Control - Lecture 3Document44 pagesInventory Management - Control - Lecture 3JoannaOSzNo ratings yet

- Final ExamDocument9 pagesFinal ExamWaizin KyawNo ratings yet

- Independent Demand Inventory Management: by 2 Edition © Wiley 2005 Powerpoint Presentation by R.B. Clough - UnhDocument38 pagesIndependent Demand Inventory Management: by 2 Edition © Wiley 2005 Powerpoint Presentation by R.B. Clough - Unhnaveed_nawabNo ratings yet

- Nisha Verma, BEM/809 Assignment - Project Procurement Management BEM 3.1 Topic: Material Management Session: Aug 21-Dec 21Document5 pagesNisha Verma, BEM/809 Assignment - Project Procurement Management BEM 3.1 Topic: Material Management Session: Aug 21-Dec 21Nisha VermaNo ratings yet

- Chapter 4 - Costs of Production - AllDocument29 pagesChapter 4 - Costs of Production - AllNetsanet MeleseNo ratings yet

- Plant Assets, Intangibles, and Long-Term Investments Chapter 8Document67 pagesPlant Assets, Intangibles, and Long-Term Investments Chapter 8Rupesh PolNo ratings yet

- ABC SystemDocument11 pagesABC SystemSyarifatuz Zuhriyah UmarNo ratings yet

- Final For PDFDocument8 pagesFinal For PDFWaizin KyawNo ratings yet

- Inventory Valuation TutorialDocument4 pagesInventory Valuation TutorialSalma HazemNo ratings yet

- Far410 Chapter 6 InventoriesDocument25 pagesFar410 Chapter 6 Inventoriesmochiilovely95No ratings yet

- Inventory Mgmt.Document25 pagesInventory Mgmt.Sunil PillaiNo ratings yet

- Wilkerson Company: Iim, IndoreDocument4 pagesWilkerson Company: Iim, IndoreSwapan Kumar SahaNo ratings yet

- Chapter 10Document9 pagesChapter 10teresaypilNo ratings yet

- Sessions 1 & 2-Inventory MGMTDocument53 pagesSessions 1 & 2-Inventory MGMTojasshukla15No ratings yet

- Chapter 4 - Costs of Production-1Document42 pagesChapter 4 - Costs of Production-1idolhevevNo ratings yet

- 7114afe WK5 (WS3) AnsDocument8 pages7114afe WK5 (WS3) AnsFrasat IqbalNo ratings yet

- Fallsem2017-18 Bmt2013 TH Sjt601 Vl2017181002989 Reference Material I Course Matrl-3 SCM JPM F Sem 2017-18Document39 pagesFallsem2017-18 Bmt2013 TH Sjt601 Vl2017181002989 Reference Material I Course Matrl-3 SCM JPM F Sem 2017-18Pulkit JainNo ratings yet

- Cost SheetDocument20 pagesCost SheetKeshviNo ratings yet

- Inventory MGMT AsmDocument22 pagesInventory MGMT Asmsulabhagarwal1985No ratings yet

- EOQDocument31 pagesEOQTarang SolaniNo ratings yet

- CH 19 Inventory TheoryDocument15 pagesCH 19 Inventory TheoryRitesh SharmaNo ratings yet

- SCA 12 - Inventory ManagementDocument123 pagesSCA 12 - Inventory ManagementManish SinghNo ratings yet

- Fundamentals of Operations Management: University of Central Punjab, LahoreDocument24 pagesFundamentals of Operations Management: University of Central Punjab, LahoreMalik UmerNo ratings yet

- Process Costing and Joint Product and byDocument4 pagesProcess Costing and Joint Product and byGeetika BhattiNo ratings yet

- FoxyDocument10 pagesFoxyRishi HisariyaNo ratings yet

- Independent Demand Inventory Management: by 2 Edition © Wiley 2005 Powerpoint Presentation by R.B. Clough - UnhDocument38 pagesIndependent Demand Inventory Management: by 2 Edition © Wiley 2005 Powerpoint Presentation by R.B. Clough - UnhSaurav ShawNo ratings yet

- Costs of Production 1Document23 pagesCosts of Production 1Daksh AnejaNo ratings yet

- WMP10059 Arpan Khare Case - Inexperience 2Document6 pagesWMP10059 Arpan Khare Case - Inexperience 2thearpan100% (1)

- Activity Based-WPS (Number 1 C)Document9 pagesActivity Based-WPS (Number 1 C)Takudzwa BenjaminNo ratings yet

- Independent Demand Inventory Management: Operations ResearchDocument37 pagesIndependent Demand Inventory Management: Operations ResearchAmisha SinghNo ratings yet

- Shared Module 4 5-Inventory, QM, SCM-LogisticsDocument107 pagesShared Module 4 5-Inventory, QM, SCM-Logisticstaxifake910No ratings yet

- Managing Stock, Considering Alternative Sourcing ArrangementsDocument60 pagesManaging Stock, Considering Alternative Sourcing Arrangementsabdul rehmanNo ratings yet

- Practice Problem 2Document5 pagesPractice Problem 2panda 1No ratings yet

- MSC 705 Lecture 10Document19 pagesMSC 705 Lecture 10nusratpte07No ratings yet

- OMT 8604 Logistics in Supply Chain Management: Master of Business AdministrationDocument42 pagesOMT 8604 Logistics in Supply Chain Management: Master of Business AdministrationMr. JahirNo ratings yet

- Inventory Management AnalysisDocument13 pagesInventory Management AnalysisMd Ashraful Al AsifNo ratings yet

- Costs of Production 1Document31 pagesCosts of Production 1chandel08No ratings yet

- Inventory Management (Complete)Document71 pagesInventory Management (Complete)ANCHETA, Yuri Mark Christian N.No ratings yet

- FinancialsDocument7 pagesFinancialsWajahat RehmanNo ratings yet

- ABC Practice Question 2 With SolutionDocument5 pagesABC Practice Question 2 With SolutionBennie KingNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Marine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandMarine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 13 Variations in Management ControlDocument7 pages13 Variations in Management ControllsurendraNo ratings yet

- 10 Internet in FranchisingDocument6 pages10 Internet in FranchisinglsurendraNo ratings yet

- Hitech Product DevelopmentDocument22 pagesHitech Product DevelopmentlsurendraNo ratings yet

- 4 Geopolitics Forms of GovernmentDocument23 pages4 Geopolitics Forms of GovernmentlsurendraNo ratings yet

- 2 Channel MKTG SOD Channel FlowsDocument29 pages2 Channel MKTG SOD Channel FlowslsurendraNo ratings yet

- Geopolitics ArchitectureDocument22 pagesGeopolitics ArchitecturelsurendraNo ratings yet

- Four Levels of MarketingDocument24 pagesFour Levels of MarketinglsurendraNo ratings yet

- Steps in Legalizing BusinessDocument2 pagesSteps in Legalizing BusinessRJ DAVE DURUHANo ratings yet

- Ps9004 Complete For PharmaceuticalDocument128 pagesPs9004 Complete For PharmaceuticalValmik SoniNo ratings yet

- Keyiana C Moye ResumeDocument3 pagesKeyiana C Moye Resumekm091179No ratings yet

- ACC2001 Lecture 10 Interco TransactionsDocument42 pagesACC2001 Lecture 10 Interco Transactionsmichael krueseiNo ratings yet

- Balance Sheet BasicsDocument24 pagesBalance Sheet Basicsnavya sreeNo ratings yet

- Topic: Adjusting Entries / Adjustments Compiled By: Sir Ghalib HussainDocument8 pagesTopic: Adjusting Entries / Adjustments Compiled By: Sir Ghalib HussainGhalib HussainNo ratings yet

- ERP in BASFDocument11 pagesERP in BASFSyed Monirul Islam KanakNo ratings yet

- Evaluating Public Transit Benefits and CostsDocument142 pagesEvaluating Public Transit Benefits and CostsKristine Paul GarciaNo ratings yet

- To The End Buyer Via Paul/Laos - KP FARM GROUP: Soft Corporate Offer (Sco)Document3 pagesTo The End Buyer Via Paul/Laos - KP FARM GROUP: Soft Corporate Offer (Sco)Trindra PaulNo ratings yet

- Jason Fanjaya Jana MKT ResearchDocument7 pagesJason Fanjaya Jana MKT Researchaudityaeros666No ratings yet

- Stifel ComplaintDocument47 pagesStifel ComplaintZerohedgeNo ratings yet

- Practical Applications of Operations ResearchDocument26 pagesPractical Applications of Operations ResearchPranav Marathe89% (9)

- International Marketing 15th EditionDocument14 pagesInternational Marketing 15th EditionArifNo ratings yet

- Pinto Pm2 Ch04Document15 pagesPinto Pm2 Ch04Abshir MaadaaNo ratings yet

- IP and Student Project Agreement InstructionsDocument15 pagesIP and Student Project Agreement InstructionsLead HeadNo ratings yet

- Unit I: Introduction: 6 Business Level Strategic Planning: Porter FourDocument2 pagesUnit I: Introduction: 6 Business Level Strategic Planning: Porter FourPriyank GangwalNo ratings yet

- Kausar AlamDocument1 pageKausar AlamVenu Gopal RaoNo ratings yet

- AFM-Module 4 Part-B Ratio Analysis ProblemsDocument5 pagesAFM-Module 4 Part-B Ratio Analysis ProblemskanikaNo ratings yet

- Division Memo. No. 098, S. 2021Document19 pagesDivision Memo. No. 098, S. 2021Gregson GucelaNo ratings yet

- Liquidity Spigot 1684333089Document27 pagesLiquidity Spigot 1684333089Alexei LeonNo ratings yet

- SWOT Analysis of Wal-Mart Organizational StructureDocument6 pagesSWOT Analysis of Wal-Mart Organizational StructureBrock MeyerNo ratings yet

- Report Palm Haul Sdn. BHDDocument15 pagesReport Palm Haul Sdn. BHDAsan BerlinNo ratings yet

- Snowflake & StarflakeDocument9 pagesSnowflake & Starflakead_b4u100% (1)

- Intellectual RightsDocument2 pagesIntellectual RightsNori FajardoNo ratings yet

- Vietnam DX SaaS Landscape 2022 enDocument32 pagesVietnam DX SaaS Landscape 2022 enLinh Nguyễn VănNo ratings yet

- Foreign Exchange MarketDocument24 pagesForeign Exchange MarketAnamika SonawaneNo ratings yet

- AmcorDocument13 pagesAmcorSamuel DavisNo ratings yet