Professional Documents

Culture Documents

Meetings and Resolution

Meetings and Resolution

Uploaded by

Trina Barua0 ratings0% found this document useful (0 votes)

26 views11 pagesGeneral meetings allow shareholders of a limited company to discuss and vote on important matters relating to the company's operations and structure. Proper notice must be provided ahead of any general meeting. Formal decisions are made through resolutions, which are legally binding votes that must be recorded in meeting minutes. There are two main types of resolutions - ordinary resolutions that require a simple majority to pass, and special resolutions that require approval from 75% of shareholders.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGeneral meetings allow shareholders of a limited company to discuss and vote on important matters relating to the company's operations and structure. Proper notice must be provided ahead of any general meeting. Formal decisions are made through resolutions, which are legally binding votes that must be recorded in meeting minutes. There are two main types of resolutions - ordinary resolutions that require a simple majority to pass, and special resolutions that require approval from 75% of shareholders.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

26 views11 pagesMeetings and Resolution

Meetings and Resolution

Uploaded by

Trina BaruaGeneral meetings allow shareholders of a limited company to discuss and vote on important matters relating to the company's operations and structure. Proper notice must be provided ahead of any general meeting. Formal decisions are made through resolutions, which are legally binding votes that must be recorded in meeting minutes. There are two main types of resolutions - ordinary resolutions that require a simple majority to pass, and special resolutions that require approval from 75% of shareholders.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 11

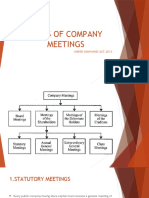

MEETINGS AND RESOLUTIONS

What is a general meeting in a limited company?

Any formal meeting of limited company shareholders is called a general meeting. The conduct of these

meetings is governed by the Companies Act, the articles of association, and any shareholders’ agreement a

company puts in place. General meetings are usually called by directors to allow shareholders to discuss the

following types of matters:

Appointment and removal of a director.

Changing directors’ powers.

Altering the articles of association.

Altering the shareholders’ agreement.

Company finances.

Changing the name of the company.

Changing the structure of the company.

Altering the objectives of the business.

Issuing more company shares.

Approving share transfers.

Creating new share classes.

Dissolving the company.

Legal claims and proceedings.

Providing Notice of a General Meeting

If a general meeting is called, a notice period of at least 14

days is required. This notice must be provided to every

shareholder and it should contain the following

information:

Date, time and location of the meeting.

Type of general meeting.

Nature of the meeting.

Statement declaring that every shareholder has the right

to appoint a proxy.

Date the notice is issued.

Name of the person calling the meeting.

Any formal decisions made by shareholders at a

general meeting require ‘passing a resolution’.

These decisions are legally binding. Copies of

resolutions must be filed with Companies

House. The company should also keep copies at

its registered office or SAIL address.

Minutes must be taken at all general meetings

to officially record the proceedings, the names

of all those present and any decisions taken.

What is a limited company board meeting?

A board meeting is an official meeting of

limited company directors. These individuals

are appointed to manage a limited company

on behalf of its shareholders or guarantors.

Board meetings are held when directors need

to collectively make decisions, present

proposals, raise concerns, review the financial

position of the business and discuss

strategies.

First board meeting of directors

First board meeting of directors

The purpose of this meeting is to provide an opportunity for directors to discuss the formalities of the new

business, such as:

Consult the articles of association.

Determine the rights, duties and responsibilities of each director.

Confirm the objectives, vision and values of the company.

Allot shares.

Issue share certificates.

Appoint a strong leader as the chairperson of the board.

Appoint a company secretary.

Delegate duties and responsibilities to the company secretary.

Confirming the company’s accounting reference date.

Confirming statutory filing deadlines for annual accounts, annual returns and tax returns.

Setting up a business bank account.

Record-keeping and accounting requirements.

Appointing an accountant and auditor.

Discuss the hiring of staff.

Directors are legally required to document the proceedings of board meetings by taking minutes (even if

there is just one director).

Taking minutes of meetings

It is extremely beneficial to keep an accurate record of everything that occurs in board

meetings and general meetings in case any disagreements should arise at a later date.

Minutes serve as evidence of the proceedings and they should contain details such as:

Company name and registered office address.

Time, date and location of meeting.

Names of all persons in attendance.

Apologies for absences.

Proposals put forth for consideration.

Proposed resolutions.

Decisions that were taken – resolutions that were passed.

Names of those who supported or opposed any proposed resolutions.

Queries or objections that were raised.

Any other matters raised or discussed during the course of the meeting.

Signature of director or company secretary.

Limited companies must maintain copies of all minutes at their registered office or SAIL

address for a minimum period of two years.

What are resolutions?

A resolution is a legally binding decision made

by limited company directors or shareholders.

If a majority vote is achieved in favour of the

decision, a resolution is ‘passed’. Shareholders

can pass ordinary resolutions or special

resolutions at general meetings, or they can

pass written resolutions. All types of collective

decisions of directors are simply referred to as

‘resolutions’. These decisions can be made at

board meetings or in writing.

Types of resolutions

There are 3 types of resolutions available to limited

company shareholders:

Ordinary resolutions– Passed by a simple majority of

shareholders’ votes. Used for all matters, unless the

Companies Act, the articles of association, and/or a

shareholders’ agreement stipulates the need for a special

resolution. The majority of ordinary resolutions must be

filed with Companies House.

Special resolutions– Passed by a 75% majority of

shareholders’ votes at a general meeting. Used for

extraordinary matters that cannot be passed by an

ordinary resolution.

What decisions require an ordinary resolution?

An ordinary resolution is passed if a simple majority (above 50%) of the

votes cast are in favour of the resolution. This type of resolution can be

used by shareholders and directors for all day-to-day matters, such as:

Appointing and removing directors.

Appointing and removing secretaries.

Matters pertaining to directors’ employment contracts.

Amending directors’ powers.

Approving dividend payments.

Authorising directors’ loans.

Authorising the transfer of shares.

The types of decisions that company directors can make will depend on

the powers they are granted by the shareholders. Their rights and powers

will be outlined in the articles of association and shareholders’ agreement.

What is a special resolution?

In the context of limited companies, a special resolution is a motion or proposal

that requires approval of at least 75% of shareholder votes. This kind of resolution

is reserved for important and rare decisions, such as

Changing a company name.

Reducing share capital.

Allotting more shares.

Issuing different share classes.

Altering the articles of association.

Removing pre-emption rights.

Re-registering a company.

Changing a private company to a public company, or vice versa.

Winding up a company by members’ voluntary liquidation.

The Companies Act 2006 specifies the types of decisions requiring a special

resolution. Where no type of resolution is specified, shareholders may pass an

ordinary resolution with a simple majority of 50.01% of the votes.

You might also like

- 2.2.7 Practice - Applying Constitutional PrinciplesDocument5 pages2.2.7 Practice - Applying Constitutional PrinciplesKyle75% (4)

- Tad Crawford Business and Legal Forms For IllustratorsDocument161 pagesTad Crawford Business and Legal Forms For IllustratorsVVRAO90100% (1)

- Joint Affidavit of Discrepancy SampleDocument1 pageJoint Affidavit of Discrepancy SampleAiken Alagban Ladines83% (6)

- Company Meeting NotesDocument14 pagesCompany Meeting NotesManish RoydaNo ratings yet

- Summary of Company Act 2063 NepalDocument6 pagesSummary of Company Act 2063 NepalPrashant Pokharel100% (4)

- Module - 4 Company Management and AdministrationDocument59 pagesModule - 4 Company Management and Administrationkavitagothe100% (1)

- Articles of AssociationDocument4 pagesArticles of AssociationChandrakant HakeNo ratings yet

- Supreme Court State of Connecticut - : Plaintiff in Error 'S BriefDocument27 pagesSupreme Court State of Connecticut - : Plaintiff in Error 'S BriefJosephine MillerNo ratings yet

- PNB vs. de Ong AceroDocument2 pagesPNB vs. de Ong AceroZaira Gem GonzalesNo ratings yet

- Meetings and ResolutionsDocument5 pagesMeetings and Resolutionsabhishek singh100% (1)

- Company Law AsnDocument4 pagesCompany Law AsnAgna gandhiNo ratings yet

- Resolution by Circulation - ArticleDocument4 pagesResolution by Circulation - Articlenancy mandholiaNo ratings yet

- ResolutionDocument9 pagesResolutionh98hsmcgvqNo ratings yet

- MEETINGSDocument36 pagesMEETINGSLevin makokhaNo ratings yet

- FEDERAL UNIVERS-WPS OfficeDocument11 pagesFEDERAL UNIVERS-WPS Officetersoobenard150No ratings yet

- Valid MeetingsDocument4 pagesValid Meetings18 Pranav mlalNo ratings yet

- Fourth ModuleDocument35 pagesFourth Moduletituthomas00No ratings yet

- 76 DavidsonDocument13 pages76 DavidsonTejas BaldaniyaNo ratings yet

- Presentation On Meetings: Presented By:-Yusuf Ali Gheewala Hardik Parekh Ramesh RajpurohitDocument22 pagesPresentation On Meetings: Presented By:-Yusuf Ali Gheewala Hardik Parekh Ramesh RajpurohitRajpurohit RameshNo ratings yet

- Presentation On Meetings in The Companies ActDocument16 pagesPresentation On Meetings in The Companies ActGokul SoodNo ratings yet

- Shareholders Rights, Powers and Restraining Restrictions Against DirectorsDocument4 pagesShareholders Rights, Powers and Restraining Restrictions Against DirectorsgamucharukaNo ratings yet

- Members and Shareholders: A Quick GuideDocument12 pagesMembers and Shareholders: A Quick GuideChristieNo ratings yet

- Company Meetings NavinDocument12 pagesCompany Meetings NavinNavin SureshNo ratings yet

- Class 5 Company MeetingsDocument31 pagesClass 5 Company MeetingsSwati Sucharita DasNo ratings yet

- Company Meeting and ResolutionDocument32 pagesCompany Meeting and ResolutionTawsif AnikNo ratings yet

- 1-10 Business Law For PrintingDocument9 pages1-10 Business Law For PrintingKamran MirzaNo ratings yet

- KSL Commercial Law NotesDocument47 pagesKSL Commercial Law Noteslittle missNo ratings yet

- MeetingsDocument14 pagesMeetingsrmwsrwz2k2No ratings yet

- Unit III-Part 2Document26 pagesUnit III-Part 2Aman RaiNo ratings yet

- Unit 5Document9 pagesUnit 5chethanraaz_66574068No ratings yet

- Formal MeetingsDocument2 pagesFormal Meetingsleebritney646No ratings yet

- Meetings and Proceedings at The CompanyDocument5 pagesMeetings and Proceedings at The CompanyPopular Youtube VideosNo ratings yet

- CL GCT - IiDocument9 pagesCL GCT - IiHarsh RNo ratings yet

- Unit 5 &6Document11 pagesUnit 5 &6chethanraaz_66574068No ratings yet

- CompanyDocument7 pagesCompanyaditim1308No ratings yet

- Meetings of A Company: University Businees School, Panjab University ChandigarhDocument24 pagesMeetings of A Company: University Businees School, Panjab University ChandigarhRamneet ParmarNo ratings yet

- Module-4: Strengthening Corporate GovernanceDocument10 pagesModule-4: Strengthening Corporate GovernanceVikas PrajapatiNo ratings yet

- CL Meeting NoteDocument10 pagesCL Meeting Noteapple_gurlNo ratings yet

- Types of Meetings in Companies: BY Anandbabu.V 1 MBADocument21 pagesTypes of Meetings in Companies: BY Anandbabu.V 1 MBAramesh.k100% (1)

- A Study ON: Corporate Legal Enviroment "General Meetings"Document26 pagesA Study ON: Corporate Legal Enviroment "General Meetings"Mukesh AgrawalNo ratings yet

- Lecture 4 Spring 15Document54 pagesLecture 4 Spring 15salmanNo ratings yet

- The Indian Companies Act, 1956Document66 pagesThe Indian Companies Act, 1956ShamayitaNo ratings yet

- All About Powers and Duties of Shareholders Under Companies Act by Jyotsana UplavdiyaDocument6 pagesAll About Powers and Duties of Shareholders Under Companies Act by Jyotsana UplavdiyaNandita GogoiNo ratings yet

- The Decisions Made Within A Company Are Either TheDocument4 pagesThe Decisions Made Within A Company Are Either TheNarh AdamiteyNo ratings yet

- Meeting-Company LawDocument17 pagesMeeting-Company Lawramesh.kNo ratings yet

- MeetingsDocument8 pagesMeetingssher khanNo ratings yet

- Corporate Administration and Management 2008Document11 pagesCorporate Administration and Management 2008azmat18No ratings yet

- Importance of Meeting, Proceeding and AuditorDocument18 pagesImportance of Meeting, Proceeding and Auditorb26shantnusharmaNo ratings yet

- Meetings and ResolutionsDocument13 pagesMeetings and ResolutionsRaghu GowdaNo ratings yet

- Formal Duties:: Answer # 1Document2 pagesFormal Duties:: Answer # 1Hareem ZehraNo ratings yet

- Company ManagementDocument4 pagesCompany Managementakg641569No ratings yet

- What Is An Annual General Meeting (AGM) ?: AuditorsDocument3 pagesWhat Is An Annual General Meeting (AGM) ?: AuditorsAmirNo ratings yet

- A Company Is An Association of Several Persons AssignDocument16 pagesA Company Is An Association of Several Persons AssigngeethaNo ratings yet

- Key Managing Personels in A Company - Corporate LawDocument23 pagesKey Managing Personels in A Company - Corporate LawsimranhadiNo ratings yet

- CLSP Unit 2Document59 pagesCLSP Unit 2Shikhar BavejaNo ratings yet

- MGT211 Lecture 07Document12 pagesMGT211 Lecture 07Abdul Hannan Sohail0% (1)

- Statutory Requirement:: Contents of The Statutory ReportDocument3 pagesStatutory Requirement:: Contents of The Statutory ReportAhsan RazaNo ratings yet

- Company MeetingsDocument13 pagesCompany Meetings20AH419 Talukdar DebanjanaNo ratings yet

- Company MeetingsDocument5 pagesCompany MeetingsHiral SoniNo ratings yet

- Meetings and TypesDocument20 pagesMeetings and Typescarahul89No ratings yet

- Meetings & Resolutions: 1. Statutory MeetingDocument5 pagesMeetings & Resolutions: 1. Statutory MeetingMostafa Ahmed SuntuNo ratings yet

- A Study ON: Corporate Legal Enviroment "General Meetings"Document26 pagesA Study ON: Corporate Legal Enviroment "General Meetings"Siddharth DhamijaNo ratings yet

- Introduction To BusinessDocument12 pagesIntroduction To BusinessAbu HasanNo ratings yet

- DreptDocument17 pagesDreptMaria-Diana URSUNo ratings yet

- Labour LawDocument20 pagesLabour LawTrina BaruaNo ratings yet

- Negotiable Instruments Act, 1881Document27 pagesNegotiable Instruments Act, 1881Trina BaruaNo ratings yet

- LAW200Document1 pageLAW200Trina BaruaNo ratings yet

- Sales Forecast: Estimated Sales Per MonthDocument3 pagesSales Forecast: Estimated Sales Per MonthTrina BaruaNo ratings yet

- North South University: Spring, 2020Document7 pagesNorth South University: Spring, 2020Trina BaruaNo ratings yet

- Group Project On UnileverDocument11 pagesGroup Project On UnileverTrina BaruaNo ratings yet

- Ethics AssignmentDocument18 pagesEthics AssignmentTrina BaruaNo ratings yet

- Banking TSNDocument68 pagesBanking TSNBelle FabeNo ratings yet

- Sandiganbayan JurisdictionDocument2 pagesSandiganbayan JurisdictionGin FranciscoNo ratings yet

- Dilg Officials 20181026-010225Document20 pagesDilg Officials 20181026-010225purpleromero0% (1)

- Omni Bridgeway Capital V GBC (CV-20-0651273-OOCL)Document2 pagesOmni Bridgeway Capital V GBC (CV-20-0651273-OOCL)AnonymousLNeRx4be7dNo ratings yet

- Labor Relations Digests Batch 5Document42 pagesLabor Relations Digests Batch 5Karla Kat0% (2)

- Robbery With Homicide PP V Beriber Case DigestDocument3 pagesRobbery With Homicide PP V Beriber Case DigestDawn Jessa GoNo ratings yet

- Group 4 Cases Llovit Part IDocument30 pagesGroup 4 Cases Llovit Part Iayhen01No ratings yet

- TariffDocument8 pagesTariffprobuddhaNo ratings yet

- CP575Notice 1687280684508Document3 pagesCP575Notice 1687280684508Кайлие Лйнн СтеинNo ratings yet

- Enforcement of Competition Law in India: A Comparative Analysis With EU and UKDocument28 pagesEnforcement of Competition Law in India: A Comparative Analysis With EU and UKYash TiwariNo ratings yet

- Businessday vs. NLRCDocument2 pagesBusinessday vs. NLRCJose Dula II0% (1)

- Memorandum: Regional Trial Court Branch 31Document6 pagesMemorandum: Regional Trial Court Branch 31Eric Jopson MANo ratings yet

- Right To Education Act 2010Document2 pagesRight To Education Act 2010Dev HudNo ratings yet

- Book Bound ThirdDocument11 pagesBook Bound ThirdBOLINANo ratings yet

- Institution of Engineering Technologists and Technicians (Iet) Application For MembershipDocument3 pagesInstitution of Engineering Technologists and Technicians (Iet) Application For MembershipPEng. Tech. Alvince KoreroNo ratings yet

- Phil. Communications Satellite Corporation vs. AlcuazDocument19 pagesPhil. Communications Satellite Corporation vs. AlcuazRustom IbañezNo ratings yet

- United States v. Aldridge, 4th Cir. (2009)Document4 pagesUnited States v. Aldridge, 4th Cir. (2009)Scribd Government DocsNo ratings yet

- 2022 PA Super 146Document14 pages2022 PA Super 146PennCapitalStarNo ratings yet

- Peoria County Jail Booking Sheet For Aug. 29, 2016Document6 pagesPeoria County Jail Booking Sheet For Aug. 29, 2016Journal Star police documentsNo ratings yet

- Reyes Vs Vda. de VidalDocument2 pagesReyes Vs Vda. de Vidalviva_33100% (1)

- People v. Gaffud, Jr.Document10 pagesPeople v. Gaffud, Jr.Eunicqa Althea SantosNo ratings yet

- Baritua vs. MercaderDocument8 pagesBaritua vs. MercaderAnakataNo ratings yet

- Padhle - Federalism - PYQDocument5 pagesPadhle - Federalism - PYQ10d classNo ratings yet

- Chapter 3-Emerging Business Ethics Issues: Multiple ChoiceDocument8 pagesChapter 3-Emerging Business Ethics Issues: Multiple ChoiceBlack UnicornNo ratings yet

- Geraldez v. CA, 230 SCRA 239 (1994)Document9 pagesGeraldez v. CA, 230 SCRA 239 (1994)Clive HendelsonNo ratings yet