Professional Documents

Culture Documents

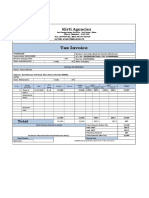

Business Tax: Value Added Tax Percentage Tax Excise Tax Documentary Stamp Tax

Business Tax: Value Added Tax Percentage Tax Excise Tax Documentary Stamp Tax

Uploaded by

Jessa0 ratings0% found this document useful (0 votes)

13 views7 pagesThis document summarizes various business taxes in the Philippines. It discusses value added tax (VAT) of 12% imposed on the value added to goods and services. It also covers percentage tax imposed on certain non-VAT registered services, and excise tax which can be specific or ad valorem based on goods. Finally, it outlines documentary stamp tax levied on documents transferring obligations, rights, or property.

Original Description:

Original Title

BUSINESS-TAX

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes various business taxes in the Philippines. It discusses value added tax (VAT) of 12% imposed on the value added to goods and services. It also covers percentage tax imposed on certain non-VAT registered services, and excise tax which can be specific or ad valorem based on goods. Finally, it outlines documentary stamp tax levied on documents transferring obligations, rights, or property.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

13 views7 pagesBusiness Tax: Value Added Tax Percentage Tax Excise Tax Documentary Stamp Tax

Business Tax: Value Added Tax Percentage Tax Excise Tax Documentary Stamp Tax

Uploaded by

JessaThis document summarizes various business taxes in the Philippines. It discusses value added tax (VAT) of 12% imposed on the value added to goods and services. It also covers percentage tax imposed on certain non-VAT registered services, and excise tax which can be specific or ad valorem based on goods. Finally, it outlines documentary stamp tax levied on documents transferring obligations, rights, or property.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 7

BUSINESS TAX

VALUE ADDED TAX

PERCENTAGE TAX

EXCISE TAX

DOCUMENTARY STAMP TAX

BUSINESS TAX

Tax imposed on onerous transfers such as

sale, barter, or exchange.

Can be a Specific Tax or Ad Valorem Tax or

both.

EXEMPTION: Any business by an INDIVIDUAL

where the aggregate gross sales do not

exceed P 100,000 during the any 12 month

period. It shall be considered principally for

subsistence or livelihood.

VALUE ADDED TAX (VAT) 12%

Tax on the value added to the purchase price

or cost in the sale or lease of goods, property

or service in the course of trade or business.

It is an Indirect Tax and the amount of tax can

be shifted to the buyer, lessee, or transferee of

the goods. The party directly liable is the seller

although the burden can be shifted to the

buyer.

Cannot be imposed at the same time with

Percentage Tax

Can be imposed at the same time with Excise

Tax.

PERSONS SUBJECT TO VAT:

Those who are VAT registered persons

Those who are not VAT registered persons

but exceeded the P 3,000,000 Gross Sales

threshold.

Importer of goods that are subject to VAT.

GR: Service rendered by a non-resident

foreign person in the Philippines shall be

considered in course of trading or business

even if it is not regular

OTHER PERCENTAGE TAX

Tax imposed on certain services

Imposed on Non-VAT registered persons

Tax Base:

1. Sale of Goods- Gross Sales

2. Sale of Services- Gross Receipts

EXCISE TAX

Specific Tax- Fixed amount based on

volume, weight or quantity of goods as

measured by tools, instruments or standards.

(e.g. excise tax on cigars and liquors)

Ad Valorem Tax- Imposition of tax is based

on the value of property subject to tax. (e.g.

VAT, income tax, donor’s tax and estate tax)

Imposed on the exercise of Police Power.

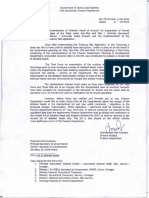

DOCUMENTARY STAMP TAX

A tax levied on documents, instruments, loan

agreements, and papers, evidencing the

acceptance, assignment, sale or transfer of

obligation, rights or property incident thereto.

The amount may be fix or based on par or face

value of the document or instrument

Failure to pay DST shall not invalidate the

document or instrument. However, it shall not be

recorded or admitted or used as evidence in any

court until the required stamp is affixed thereto

and cancelled.

No notary or other officer authorized to administer

oaths shall add his JURAT or acknowledgement to

the document unless the proper Documentary

Stamp is affixed thereto and cancelled.

You might also like

- Dentists and TaxesDocument9 pagesDentists and TaxesZHAREIGHNEILE C. MAMOLONo ratings yet

- Income Taxation Edt 2022 Sol ManDocument35 pagesIncome Taxation Edt 2022 Sol ManJessa50% (2)

- Value Added Tax in The PhilippinesDocument14 pagesValue Added Tax in The Philippinesagathe laurent100% (1)

- PM Reyes Notes On Taxation 2 - Valued Added Tax (Working Draft)Document22 pagesPM Reyes Notes On Taxation 2 - Valued Added Tax (Working Draft)dodong123100% (1)

- Business Tax: Value Added Tax Percentage Tax Excise Tax Documentary Stamp TaxDocument7 pagesBusiness Tax: Value Added Tax Percentage Tax Excise Tax Documentary Stamp TaxJessaNo ratings yet

- Usiness Axes AX: By: Jennifer M. Villegas, CpaDocument16 pagesUsiness Axes AX: By: Jennifer M. Villegas, CpaHelen AlvaradoNo ratings yet

- TAX ReviewerDocument3 pagesTAX ReviewerCely jisonNo ratings yet

- Notes On VATDocument15 pagesNotes On VATErnest Benz Sabella DavilaNo ratings yet

- Percentage Taxes: Transfer of Goods or ServicesDocument10 pagesPercentage Taxes: Transfer of Goods or ServicesCPAREVIEWNo ratings yet

- Taxn03b Vat IntroDocument20 pagesTaxn03b Vat IntroTrishamae legaspiNo ratings yet

- VAT - GuidenotesDocument14 pagesVAT - GuidenotesNardz AndananNo ratings yet

- Answer Tax Concepts RehashDocument2 pagesAnswer Tax Concepts RehashAnice YumulNo ratings yet

- Comprehensive VAT TAXATION (3!31!14)Document166 pagesComprehensive VAT TAXATION (3!31!14)dereckriveraNo ratings yet

- National Taxation System - RamosDocument10 pagesNational Taxation System - RamosAldrich RamosNo ratings yet

- Kinds of TaxDocument1 pageKinds of TaxMaricar Corina CanayaNo ratings yet

- Tax InformationDocument2 pagesTax InformationAlvin WatinNo ratings yet

- Final PaperDocument20 pagesFinal PaperLaila PaleyanNo ratings yet

- Tax 2Document14 pagesTax 2Nash Ortiz LuisNo ratings yet

- Tax - Vat GuidenotesDocument13 pagesTax - Vat GuidenotesNardz AndananNo ratings yet

- Business TaxDocument33 pagesBusiness TaxKiro ParafrostNo ratings yet

- National Taxation System - RamosDocument10 pagesNational Taxation System - RamosAldrich RamosNo ratings yet

- Value-Added Tax PDFDocument118 pagesValue-Added Tax PDFRazel MhinNo ratings yet

- 3 VatDocument95 pages3 VatGileah ZuasolaNo ratings yet

- Tax 2 Notes Finals 4Document36 pagesTax 2 Notes Finals 4Boom ManuelNo ratings yet

- Taxation SchemeDocument27 pagesTaxation SchemeCristina Atienza SamsamanNo ratings yet

- Value Added TaxationDocument76 pagesValue Added Taxationxz wyNo ratings yet

- Anti-Terrorism Act of 2020Document1 pageAnti-Terrorism Act of 2020Bithey BolivarNo ratings yet

- Bantillo, Cheska Kate M. Cid, Manuel Lionel MDocument47 pagesBantillo, Cheska Kate M. Cid, Manuel Lionel MCHESKAKATE BANTILLO100% (1)

- Value Added TaxesDocument33 pagesValue Added TaxesCathleen TenaNo ratings yet

- Business TaxDocument34 pagesBusiness Taxprecy.calusaNo ratings yet

- Kinds of Taxes: Indirect Taxes Are Taxes That Are Levied Upon Commodities Before They Reach The Consumer Who UltimatelyDocument3 pagesKinds of Taxes: Indirect Taxes Are Taxes That Are Levied Upon Commodities Before They Reach The Consumer Who Ultimatelytere_aquinoluna828No ratings yet

- Gruba Tax 2 NotesDocument13 pagesGruba Tax 2 NotesPJezrael Arreza FrondozoNo ratings yet

- Module 3 - Value Added TaxDocument113 pagesModule 3 - Value Added TaxAllan C. MarquezNo ratings yet

- Taxation Report2Document22 pagesTaxation Report2Ritchelyn ArbonNo ratings yet

- VAT ReportDocument32 pagesVAT ReportNoel Christopher G. BellezaNo ratings yet

- Vat TaxDocument6 pagesVat TaxJunivenReyUmadhayNo ratings yet

- What Is Output?Document1 pageWhat Is Output?Kathrine CruzNo ratings yet

- 8VATDocument70 pages8VATNoelNo ratings yet

- VALUE ADDED TAX and EXCISE TAXDocument18 pagesVALUE ADDED TAX and EXCISE TAXTrisha Nicole Flores0% (1)

- Value Added Tax NotesDocument12 pagesValue Added Tax NotesAimeeNo ratings yet

- TaxxxxDocument3 pagesTaxxxxfaye gNo ratings yet

- Taxation IIDocument3 pagesTaxation IIAnonymous BNrz1arNo ratings yet

- VATPT For PicpaDocument73 pagesVATPT For PicpaJoy Superales SalaoNo ratings yet

- VAT Concepts Tax 321Document28 pagesVAT Concepts Tax 321justineNo ratings yet

- Case: Cir V PLDTDocument29 pagesCase: Cir V PLDTJaymee Andomang Os-agNo ratings yet

- 1Document1 page1Christine RaizNo ratings yet

- GNotes2 VAT 2018 With TRAIN AmendmentsDocument31 pagesGNotes2 VAT 2018 With TRAIN AmendmentsKristine Bucu100% (4)

- Entrep - Summary Report Sophia GandaDocument3 pagesEntrep - Summary Report Sophia GandaRenelle HabacNo ratings yet

- VAT ON SALES OF GOODS A 12Document48 pagesVAT ON SALES OF GOODS A 12Ivan Jester BautistaNo ratings yet

- Vat System and OptDocument15 pagesVat System and Optlyra21No ratings yet

- VALUE-ADDED Tax Notes - Atyy. Cabaniero-2Document2 pagesVALUE-ADDED Tax Notes - Atyy. Cabaniero-2Emjie KingNo ratings yet

- VatDocument15 pagesVatEller-JedManalacMendozaNo ratings yet

- 07 Chap 15 16 Mamalateo 2019 Tax BookDocument19 pages07 Chap 15 16 Mamalateo 2019 Tax BookJeremias CusayNo ratings yet

- Value Added TAX: Taxation Law 2 3-S Atty. Nicasio CabaineroDocument139 pagesValue Added TAX: Taxation Law 2 3-S Atty. Nicasio CabaineroAnselmo Rodiel IVNo ratings yet

- Ad Valorem TaxDocument6 pagesAd Valorem TaxPRINCESSLYNSEVILLANo ratings yet

- Administration of Value Added Tax-VatDocument13 pagesAdministration of Value Added Tax-VatRuth NyawiraNo ratings yet

- Princples of Taxation: Janet G. Taojo-Matuguinas, Cpa, Mba PresenterDocument43 pagesPrincples of Taxation: Janet G. Taojo-Matuguinas, Cpa, Mba PresenterMae NamocNo ratings yet

- Accounting Ed.04 (Business & Transfer Taxes) Ma. Daria N. Labalan, Cpa, Mba TF-7:20-8:55Document3 pagesAccounting Ed.04 (Business & Transfer Taxes) Ma. Daria N. Labalan, Cpa, Mba TF-7:20-8:55Jerbert JesalvaNo ratings yet

- OtesvatDocument18 pagesOtesvatRichelle Joy Reyes BenitoNo ratings yet

- Value Added Tax (Cap 476)Document15 pagesValue Added Tax (Cap 476)Triila manillaNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 94-Final PB-AUD - UnlockedDocument13 pages94-Final PB-AUD - UnlockedJessaNo ratings yet

- 94 - Final Preaboard AFAR - UnlockedDocument17 pages94 - Final Preaboard AFAR - UnlockedJessaNo ratings yet

- SOLMAN TAX2 2020 Edition Final PDFDocument41 pagesSOLMAN TAX2 2020 Edition Final PDFsol luna100% (3)

- RizalDocument8 pagesRizalJessaNo ratings yet

- Campaign To End Violence Against WomenDocument1 pageCampaign To End Violence Against WomenJessaNo ratings yet

- Phil Lit ReviewewrDocument11 pagesPhil Lit ReviewewrJessaNo ratings yet

- 16 - Discontinued OperationsDocument3 pages16 - Discontinued OperationsJessaNo ratings yet

- Arts MidtermDocument13 pagesArts MidtermJessaNo ratings yet

- United Stars Assembly 2020Document2 pagesUnited Stars Assembly 2020JessaNo ratings yet

- AgeDocument30 pagesAgeJessaNo ratings yet

- Itinerary ReceiptDocument2 pagesItinerary ReceiptJessaNo ratings yet

- Itinerary ReceiptDocument2 pagesItinerary ReceiptJessaNo ratings yet

- CH 13Document20 pagesCH 13Johan GutierrezNo ratings yet

- Course Code and Title: Lesson Number: TopicDocument15 pagesCourse Code and Title: Lesson Number: TopicJessaNo ratings yet

- International EntrepreneurshipDocument6 pagesInternational EntrepreneurshipJessaNo ratings yet

- General Principles of TaxationDocument11 pagesGeneral Principles of TaxationJessaNo ratings yet

- Cost AccountingDocument128 pagesCost AccountingCarl Adrian Valdez50% (2)

- DifferentDocument75 pagesDifferentJessaNo ratings yet

- Aced 23 Module 2-3Document14 pagesAced 23 Module 2-3JessaNo ratings yet

- 25511764Document8 pages25511764JessaNo ratings yet

- Course Code and Title: Lesson Number: Topic:: Solve LP Problems Using Simplex Maximization MethodDocument10 pagesCourse Code and Title: Lesson Number: Topic:: Solve LP Problems Using Simplex Maximization MethodJessaNo ratings yet

- Aced 23 Module 1Document15 pagesAced 23 Module 1JessaNo ratings yet

- EngoDocument154 pagesEngoJessaNo ratings yet

- 1Document7 pages1JessaNo ratings yet

- Cpa Review School of The Philippines Manila Management Advisory Services Relevant CostingDocument27 pagesCpa Review School of The Philippines Manila Management Advisory Services Relevant CostingJessaNo ratings yet

- Chap 4 CVP AnalysisDocument45 pagesChap 4 CVP AnalysisJessaNo ratings yet

- Wto PresentationDocument22 pagesWto Presentationmansimanu100% (9)

- RMIT International University Vietnam Individual Assignment 3Document26 pagesRMIT International University Vietnam Individual Assignment 3Tuan MinhNo ratings yet

- Central Avenue Price ListDocument2 pagesCentral Avenue Price Listsignature globalNo ratings yet

- Intro To GST 09.11Document18 pagesIntro To GST 09.11aashrit sukhijaNo ratings yet

- ECON 247 Practice Midterm ExaminationDocument9 pagesECON 247 Practice Midterm ExaminationRobyn ShirvanNo ratings yet

- TicketDocument3 pagesTicketsandeep uttaralaNo ratings yet

- Red Bus Bill 04.03.2024Document1 pageRed Bus Bill 04.03.2024sa jaNo ratings yet

- Tanzania Single Administrative Document: Component No Item Invoice Price Unit Price 48.model, Specification QuantityDocument1 pageTanzania Single Administrative Document: Component No Item Invoice Price Unit Price 48.model, Specification QuantityHonest consolidationNo ratings yet

- Hotel Voucher MardhiyyahDocument1 pageHotel Voucher MardhiyyahkamsaniNo ratings yet

- Fiscal Policy and Its ObjectivesDocument2 pagesFiscal Policy and Its ObjectivesSamad Raza Khan100% (1)

- PWC Vat in Africa 2022Document280 pagesPWC Vat in Africa 2022Andrey Pavlovskiy100% (1)

- International Economics Multiple Choice QuestionsDocument68 pagesInternational Economics Multiple Choice QuestionsAdv Samarth KumarNo ratings yet

- Kirti Dec BillDocument1 pageKirti Dec BillVishnuNadarNo ratings yet

- 1 Abakada Guro Partylist v. Executive SecretaryDocument3 pages1 Abakada Guro Partylist v. Executive SecretaryMarvic AmazonaNo ratings yet

- Food Bill 2Document1 pageFood Bill 2Jalaj GuptaNo ratings yet

- Ed Sept 9 - Courtyard by Marriott Mumbai International AirportDocument2 pagesEd Sept 9 - Courtyard by Marriott Mumbai International Airportvaibhav rockingNo ratings yet

- The Investing Tales Borosil Renewables Ltd.Document18 pagesThe Investing Tales Borosil Renewables Ltd.Sathwik PadamNo ratings yet

- DR Rao's Ent Super Speciality Hospital KPHB: 115-034014-00 SP1 Guide Rail Assembly 20,160 90189099Document1 pageDR Rao's Ent Super Speciality Hospital KPHB: 115-034014-00 SP1 Guide Rail Assembly 20,160 90189099noore rabbaniNo ratings yet

- Application Form: Assistant Secretary (BS-17)Document3 pagesApplication Form: Assistant Secretary (BS-17)Ahmar NiaziNo ratings yet

- Intl Markets, Chapter 9 SVDocument38 pagesIntl Markets, Chapter 9 SVNada El khassouaniNo ratings yet

- Quote Template TopDocument1 pageQuote Template TopAJESHNo ratings yet

- MPSG JV LTD - Modec: Change Support Fund 4Document9 pagesMPSG JV LTD - Modec: Change Support Fund 4Docktee GhNo ratings yet

- Lampiran 1B Jabatan Pengairan Dan Saliran: Preliminary Detailed Abstract ForDocument3 pagesLampiran 1B Jabatan Pengairan Dan Saliran: Preliminary Detailed Abstract ForAdib HilmanNo ratings yet

- Standardization of Detailed Heads of AccountsDocument20 pagesStandardization of Detailed Heads of AccountsSanjiv KubalNo ratings yet

- JaponDocument208 pagesJaponMarwa Qasem AnisNo ratings yet

- Valuation Lucky CementDocument2 pagesValuation Lucky CementAhsan KhanNo ratings yet

- Proper Officer Circularno-31-Under CGSTDocument4 pagesProper Officer Circularno-31-Under CGSTGroupA PreventiveNo ratings yet

- Afro-Asian Institue Afro-Asian Institue Afro-Asian Institue: Bank Stamp Bank Stamp Bank StampDocument1 pageAfro-Asian Institue Afro-Asian Institue Afro-Asian Institue: Bank Stamp Bank Stamp Bank StampUsama AliNo ratings yet

- Import Procurement Process in SAP MMDocument2 pagesImport Procurement Process in SAP MMKrishnavel R100% (3)

- Trade War Presentation SLE - International EconomicsDocument11 pagesTrade War Presentation SLE - International EconomicsArnav BothraNo ratings yet