Professional Documents

Culture Documents

Payment Gateway India by QARTPAY

Payment Gateway India by QARTPAY

Uploaded by

qart payOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payment Gateway India by QARTPAY

Payment Gateway India by QARTPAY

Uploaded by

qart payCopyright:

Available Formats

QARTPAY PAYMENT GATEWAY

Signet Payments Solution Pvt Ltd

@2015-2020

INTRODUCTION

Team Platform

Young, Agile and Dynamic Team having DasshPe owns the technology platform,

30+ man years of experience resulting in easier feature

in payments industry (PSP’s and Banks) rollouts for Web, Mobile and Social Media

platforms

Assurance Analytics

Tried and Tested While-Labelled Solutions Get a better insight into customer’s buyer

for Enterprise Clients, journey, transactions and

Banks and Resellers other reports

Private & Confidential Page 2

PRODUCTS & SOLUTIONS

Product description Benefits for Merchants

Allows the customer of the merchant to pay • Various Modules- Reconciliation, reporting, settlement etc.

digitally using the host of integrated payment • Payment page customization

options provided by DasshPe. The merchant • Various payment options and modes of payment including

can SMS/

choose to integrate: • Email/QR Code based payments

Payment Gateway

a. A DasshPe-branded payment Gateway • Multi- language payment page

Platform

b. A White label payment Gateway • Other features-split payments, recurring payments,

marketplace

• settlement

DasshPe offers co-branded Wallets which can be

integrated with prepaid cards for its clients. It also

• Reloadable cards enabled for POS/e-commerce/ATM

supports distribution of the PPts via its channel

• No need for a PPI license

partners/distribution network.

• Future-ready features like HFC,NFC & Bluetooth

The cards maybe closed-loop, semi-closed loop,

• Issue of the Physical prepaid cards with corporate branding

Wallet Platform open-loop in association with banks and • Integration of flights/offers etc.

Mastercard/Rupay • Limit management

Allows merchants to carry out frequent and bulk • Single service provider, Single reporting, reconciliation and

payment in a seamless manner along with • settlement system

automated reports, instant notifications and • Single agreement with bank

minimum manual intervention. It helps in • Chargeback management

multivendor • Cost benefits from merchants

Smart Payout payment management and keeps a check • Transaction risk monitoring system

Platform •

of all transactions. Report customization and integration etc.

Private & Confidential Page 3

PRODUCTS & SOLUTIONS

Extensible and Scalable Payments Platform

1 Simple to implement 2 Rich features 3 Intuitive admin system

• Fully functional demo account • Payment API • Self on boarding platform

• Compehensive API tools • Tokenization • Reporting

• Explanatory Integration documents • Recurring billing • Real-time transaction

• E-Invoicing dashboard

• Rich Admin interface • Manage team permissions

4 Payment tools for 5 High secure 6 Native checkout

merchants witahout a experience

• PCI DSS Lavel 1 Certifited

website • Real time fraud detection

• Multi currency

• E-Invoicing • Multi Languages

• Quick Links • Transparent pages

• QR Codes • Branded pages

Private & Confidential Page 4

PLATFORM FEATURES

White & Private Label 24/7 Customer Support

Smart Routing & Payment Network Go LIVE in 2 hours

Key

Differentiations

Top-end MIS and Transaction analysis Instant SMS updates

Timely Reconciliation Reliable Statements

Private & Confidential Page 5

OTHER ADVANCED FEATURES

• Payment Page Customization • Automated API for integration,

• Multiple Currency Acceptance • Verification

• QR Code based Payments • Smart Router for switching

• SMS based Payments • between gateways

• Email based Payments • Alerts Configuration

• Surcharge/Partial Surcharge • I-Frame Integration

• Various Pricing Configuration • Push Response technology

• Multi-accounts Settlement • Payment Analytics

• White-Label Capability • Status Query API

• Uptime/Downtime View • Social Media Payments*

• Sandbox • Spilt Payments*

• JS checkout Integration* • Recurring Payments*

• Dynamic Currency Conversion*

• Retry Option

*denotes under integration

Private & Confidential Page 6

OTHER ADVANCED FEATURES

SMS Invoice Multi Currency

Enhanced User Experience Processing

Payments

Email Invoice I-Frame

Shopping Cart Integration

Payments Integration

Increased Conversion Rates Payment Page Un-paralleled Client

Hosting Support

Wide Range of Payment Smart Processing Best Relationship

Methods Capabilities Management

Innovative Features

Private & Confidential Page 7

PAYMENT OPTIONS - INDIA

M-wallet (8+ Wallets) • UPI

Card Processors • Mobikwik, • EMI*

• VISA, MasterCard

• Freecharge, • NEFT/RTGS/DD*

• Amex-Amex, JCB

• Olamoney, Jio • NACH*

• Maestro*, Rupay, Diners*

• Money, Wallet and • Cash Collection*

NetBanking (40+ banks) • Oxicash, Paytm • Debit Card with PIN*

*denotes under integration

Private & Confidential Page 8

WHITE LABEL COMMERCIALS

CAPEX AMOUNT (INR)

One time Setup and Customisation of White Label Payment Gateway 3,00,000

OPEX % AMOUNT (INR)

Fixed monthly fee (KYC, Operational and Technical Support 50,000

and Merchant

integration support to merchants on AdsPlay’s behalf)

CAPEX PAYMENT MILESTONES % AMOUNT (INR)

ADVANCE 50% 1,50,000

UAT SIGN OFF 50% 1,50,000 50% 1,50,000

TERMS and CONDITIONS :

1.) All Fees and charges are exclusive of taxes

2.) Payment should be made within 15 days from the date of the Invoice

3.) Client is responsible for getting the PCI DSS certification

4.) Monthly fees will be reviewed depending on volumes and number of merchants

Private & Confidential Page 9

PAYMENT METHODS COMMERCIALS

Payment Gateway Modes Commercials

Credit Card 1.78%

Debit Card (Rupay) 0.20%

Debit Card (Below 2000) 0.47%

Debit Card Above 2000) 0.92%

Net Banking (HDFC, ICICI) 1.60%

Net Banking (Rest) 1.15%

UPI 0.20%

Wallets 1.75%

Private & Confidential Page 10

THANK YOU!

Qartpay

+91 987 058 1702

Private & Confidential Page 10

You might also like

- StatementDocument1 pageStatementfert cert100% (1)

- Online Payment Gateway Proposal MerchantDocument10 pagesOnline Payment Gateway Proposal MerchantVikinguddin Ahmed100% (3)

- A Single Solution For All Major Fiat Crypto Gateways.: Client Deck May 2021-© Safudex B.VDocument8 pagesA Single Solution For All Major Fiat Crypto Gateways.: Client Deck May 2021-© Safudex B.VjndfnsfklNo ratings yet

- BRD Online Parking System 4Document14 pagesBRD Online Parking System 4Ashish RawatNo ratings yet

- Hku Compfee 0000598476Document3 pagesHku Compfee 0000598476Hong_Kong_Bin_LadenNo ratings yet

- Rapido PaymentsDocument14 pagesRapido PaymentsHorrussNo ratings yet

- Webpay 170410200339Document125 pagesWebpay 170410200339jeyanthan88100% (2)

- Payment Gateway ModuleDocument5 pagesPayment Gateway ModulebansiiboyNo ratings yet

- PayU - Sales DeckDocument25 pagesPayU - Sales Deckarjun prajapatNo ratings yet

- Why Software Vendors Should Be PFsDocument11 pagesWhy Software Vendors Should Be PFsLuis F JaureguiNo ratings yet

- Readymade E Commerce Business PlanDocument24 pagesReadymade E Commerce Business PlanMohammed NizamNo ratings yet

- Payment Gateway: at Indiamart Intermesh LimitedDocument147 pagesPayment Gateway: at Indiamart Intermesh LimitedArchit Khandelwal67% (3)

- POS Training Outline PDFDocument8 pagesPOS Training Outline PDFkoba paNo ratings yet

- BN203 PaymentsDocument123 pagesBN203 PaymentsManish Grover100% (1)

- Ecommerce E Payments - Payment Gateway - Ebusiness Transaction ProcessingDocument19 pagesEcommerce E Payments - Payment Gateway - Ebusiness Transaction ProcessingJyotindra Zaveri E-Library100% (3)

- Account Activity Generated Through HBL MobileDocument4 pagesAccount Activity Generated Through HBL MobileMohammad ali HassanNo ratings yet

- Corporate Overview of PayUDocument26 pagesCorporate Overview of PayUGauravs100% (1)

- Signet PayDocument10 pagesSignet Paychakshina gupta100% (1)

- Airpay Proposal DetailDocument10 pagesAirpay Proposal DetailSooday JhaveriNo ratings yet

- Biztech SampleDocument4 pagesBiztech SamplesaimaNo ratings yet

- 4 A Guide To Payment Gateways PDFDocument3 pages4 A Guide To Payment Gateways PDFMishel Carrion lopezNo ratings yet

- Payment Gateway Setup Guide PDFDocument21 pagesPayment Gateway Setup Guide PDFOptimus SolutionsNo ratings yet

- Cabbash POS Proposal IIIDocument11 pagesCabbash POS Proposal IIIOghosa OsahenrhumwenNo ratings yet

- PaytmDocument20 pagesPaytmswati priyaNo ratings yet

- Payu PresentationDocument16 pagesPayu PresentationCristoduloLucian100% (1)

- Cashier POS Solutions Brochure PDFDocument9 pagesCashier POS Solutions Brochure PDFPuneet ParasharNo ratings yet

- Digital Payments IndiaDocument17 pagesDigital Payments IndiaPAUL JEFFERSON CLARENCE S PRC17MS1042No ratings yet

- Payment Gateways in IndiaDocument14 pagesPayment Gateways in IndiaDeepak SinghNo ratings yet

- Feature Presentation: Payment Gateway in Its Most Innovative & Advanced Form Ever!Document27 pagesFeature Presentation: Payment Gateway in Its Most Innovative & Advanced Form Ever!CCAvenue MarketingNo ratings yet

- Analysis of PayPal and PayoneerDocument6 pagesAnalysis of PayPal and PayoneerHashim IqbalNo ratings yet

- Why Do You Need A Payment Gateway For WebsiteDocument8 pagesWhy Do You Need A Payment Gateway For WebsiteAshrithaNo ratings yet

- Unit-4.4-Payment GatewaysDocument8 pagesUnit-4.4-Payment GatewaysShivam SinghNo ratings yet

- Payment Gateway ProposalDocument73 pagesPayment Gateway ProposalDavid Web100% (2)

- Bux - Multi-Wallet OverviewDocument29 pagesBux - Multi-Wallet OverviewEllen BrillantesNo ratings yet

- EBS Payment Gateway ProposalDocument8 pagesEBS Payment Gateway ProposalBarun SahaNo ratings yet

- AFTECH Payment Gateway White Paper 1Document23 pagesAFTECH Payment Gateway White Paper 1Solafide PasaribuNo ratings yet

- Vocalink - Solution - Overview-Oracle - Faster - Payments - GatewayDocument9 pagesVocalink - Solution - Overview-Oracle - Faster - Payments - GatewayMike XptoNo ratings yet

- VSoft Technologies Corporate BrochureDocument12 pagesVSoft Technologies Corporate BrochureVSoft Technologies100% (1)

- Mobikwik Integration GuideDocument36 pagesMobikwik Integration GuideSumithra Balakrishnan0% (1)

- Islamic Mutual Funds Presentation Part IDocument20 pagesIslamic Mutual Funds Presentation Part Itobyas.pearlNo ratings yet

- Merchant Integration GuideDocument29 pagesMerchant Integration Guideadnan21550% (2)

- B2B Payments and Fintech Guide 2019 - Innovations in The Way Businesses TransactDocument88 pagesB2B Payments and Fintech Guide 2019 - Innovations in The Way Businesses TransactnikNo ratings yet

- Regulatory Onboarding The Fenergo Way USDocument22 pagesRegulatory Onboarding The Fenergo Way USUtku CetinNo ratings yet

- Payment GatewaysDocument11 pagesPayment GatewaysAnmol Agarwal100% (1)

- Paytm Software Requirement Specification SrsDocument14 pagesPaytm Software Requirement Specification SrsAbdul Haseeb AttariNo ratings yet

- Bootstrapping A Business PptsDocument58 pagesBootstrapping A Business PptsDr Rizwana0% (1)

- Rapyd Network RulesDocument21 pagesRapyd Network RuleskalashnikoNo ratings yet

- Online Shopping DeliveryDocument8 pagesOnline Shopping DeliveryMuhammad NaeemNo ratings yet

- Blockchain in CrossDocument8 pagesBlockchain in CrossRahulNo ratings yet

- Mobile Payment Business Model Research Report FINALDocument34 pagesMobile Payment Business Model Research Report FINALvia_amiko0% (1)

- Feature Presentation: Payment Gateway in Its Most Innovative & Advanced Form Ever!Document27 pagesFeature Presentation: Payment Gateway in Its Most Innovative & Advanced Form Ever!CCAvenue MarketingNo ratings yet

- JP Morgan & Chase: IT Strategy and Key Success FactorsDocument8 pagesJP Morgan & Chase: IT Strategy and Key Success FactorsAbhiJeet SinghNo ratings yet

- Digital BankingDocument18 pagesDigital BankingMicah SmithNo ratings yet

- E-Commerce Business Plan Outline: by Bill Gregory, Regional Director Northwestern State University OSBDCDocument4 pagesE-Commerce Business Plan Outline: by Bill Gregory, Regional Director Northwestern State University OSBDCashu_scribd007No ratings yet

- Fintech Trends & Disruption in Financial Services CB InsightDocument29 pagesFintech Trends & Disruption in Financial Services CB InsightOxford Biochronometrics100% (1)

- A Practical 10 Step-Guide To Collateral Management: White Paper - February 2016Document10 pagesA Practical 10 Step-Guide To Collateral Management: White Paper - February 2016Constantine BelousNo ratings yet

- SAP Enterprise Blockchain Symposium OutputDocument216 pagesSAP Enterprise Blockchain Symposium OutputAxel KruseNo ratings yet

- PaymentRoadmap 2021 PDFDocument60 pagesPaymentRoadmap 2021 PDFviolet suNo ratings yet

- Real-time-Payment Bro WebDocument8 pagesReal-time-Payment Bro WebAtul LalitNo ratings yet

- SampleDocument1 pageSampleMahi Mahiuddin PalashNo ratings yet

- Curtze M 1868 Oresme-Algorismus Proportionum SDocument4 pagesCurtze M 1868 Oresme-Algorismus Proportionum SPradeep TheCyberTechNo ratings yet

- M013-Consumer Mathematics (Taxation)Document5 pagesM013-Consumer Mathematics (Taxation)Tan Jun YouNo ratings yet

- RR 3-98Document13 pagesRR 3-98Althea Angela GarciaNo ratings yet

- Tariff For Tuticorin CFS Operations: ExportsDocument4 pagesTariff For Tuticorin CFS Operations: ExportsFarmBoxer India ChinaGardentecNo ratings yet

- Overview of International Taxation & DTAA: Apt & Co LLPDocument49 pagesOverview of International Taxation & DTAA: Apt & Co LLPanon_127497276No ratings yet

- Bir 2306 FormDocument47 pagesBir 2306 FormTheresa Faye De GuzmanNo ratings yet

- Dezhao Li: Earnings StatementDocument1 pageDezhao Li: Earnings StatementAnna LiNo ratings yet

- The BaddiesDocument1 pageThe Baddies;parthNo ratings yet

- InvoiceDocument2 pagesInvoiceDeepak Singh100% (1)

- FT Partners Research - The Race To The Super App 2Document131 pagesFT Partners Research - The Race To The Super App 2uaksoyNo ratings yet

- Verify Copy: Non-Negotiable WaybillDocument5 pagesVerify Copy: Non-Negotiable WaybillmerrwonNo ratings yet

- Atty. Cleo D. Sabado-Andrada, Cpa, Mba, LLMDocument374 pagesAtty. Cleo D. Sabado-Andrada, Cpa, Mba, LLMIra Francia AlcazarNo ratings yet

- SreeDocument72 pagesSreeIbrahim MohammadNo ratings yet

- Junst2106036-Statement Huc0102 ContruccionDocument8 pagesJunst2106036-Statement Huc0102 Contruccioncarmen canturin cabreraNo ratings yet

- Hotel B - WiLda - LK Unit 2 Memelihara Catatan KeuanganDocument9 pagesHotel B - WiLda - LK Unit 2 Memelihara Catatan KeuanganNur Aqilah AzzahrahNo ratings yet

- Income Taxation - MidtermDocument5 pagesIncome Taxation - MidtermJalyn Jalando-onNo ratings yet

- EFL Statement 08sep2020 PDFDocument1 pageEFL Statement 08sep2020 PDFSuliano LalaNo ratings yet

- Ibs Seksyen 18, Shah Alam 1 31/01/24Document11 pagesIbs Seksyen 18, Shah Alam 1 31/01/24amalkomunis54No ratings yet

- Deletion of Account HoldersDocument1 pageDeletion of Account HoldersSophia ShafiNo ratings yet

- STMT 33720100010968 1662623773892Document15 pagesSTMT 33720100010968 1662623773892Raghav SharmaNo ratings yet

- Receipt For Your PaymentDocument2 pagesReceipt For Your PaymentMime MendozaNo ratings yet

- Bank Statement Apr2022 Jan2023 - WPW 14 26 - 004Document13 pagesBank Statement Apr2022 Jan2023 - WPW 14 26 - 004Adarsh RavindraNo ratings yet

- Account Statement 211021 200122Document37 pagesAccount Statement 211021 200122Prasad100% (1)

- RTGS & MessagingDocument26 pagesRTGS & MessagingVinay Pratap MishraNo ratings yet

- CV For Advocate 1Document2 pagesCV For Advocate 1Shekhar raazNo ratings yet

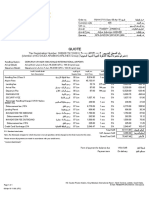

- Quote RUH-41711-1Document1 pageQuote RUH-41711-1حمزة دراغمةNo ratings yet