Professional Documents

Culture Documents

Insurance Presentation

Insurance Presentation

Uploaded by

Manish Mishra0 ratings0% found this document useful (0 votes)

33 views15 pagesAn insurance agent plays a key role in an insurance company by selling policies and building the company. Good agents have strong sales skills, understand human psychology, and have extensive knowledge of insurance products, competitors, and the financial market. They work systematically to increase both income and client base over time. Under IRDA regulations, agents must provide full information to clients, understand products thoroughly, and adhere to the code of conduct regarding things like disclosing commissions. Agents contribute significantly to the growth of insurance firms in India.

Original Description:

Original Title

insurance presentation

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAn insurance agent plays a key role in an insurance company by selling policies and building the company. Good agents have strong sales skills, understand human psychology, and have extensive knowledge of insurance products, competitors, and the financial market. They work systematically to increase both income and client base over time. Under IRDA regulations, agents must provide full information to clients, understand products thoroughly, and adhere to the code of conduct regarding things like disclosing commissions. Agents contribute significantly to the growth of insurance firms in India.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

33 views15 pagesInsurance Presentation

Insurance Presentation

Uploaded by

Manish MishraAn insurance agent plays a key role in an insurance company by selling policies and building the company. Good agents have strong sales skills, understand human psychology, and have extensive knowledge of insurance products, competitors, and the financial market. They work systematically to increase both income and client base over time. Under IRDA regulations, agents must provide full information to clients, understand products thoroughly, and adhere to the code of conduct regarding things like disclosing commissions. Agents contribute significantly to the growth of insurance firms in India.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 15

Role of Agent

: INTRODUCTION :

An agent is a primary source for procurement of

Insurance business and as such his role is the corner

stone for building a solid edifice of any life insurance

organization. To effect a good quality of life insurance

sale.

ATTRIBUTES OF INSURANCE AGENTS-

He will possess excellent and proven salesmanship

skill.

He will have knowledge of human nature and

psychology.

He will have a sound knowledge of that product, his

institution, his competitors and entire financial

market.

He will have a regular and systematic business

production with a time- bound plan.

He will have an increasing and decent income

and increasing clients.

• He will derive enormous job

satisfaction.

•His public recognition in the institution will

also be enlightened by qualifying for special

honors like MDRT etc.

CONTRIBUTIONS OF AGENTS IN LIFE INSURANCE

CORPORATION (THE GIANT INSURANCE CO. IN INDIA):

In Life Insurance Corporation the year 2001-2002

recorded a phenomenal growth of 137% in first

premium income. The Sum Assured under new

policies sold registered a growth rate of 54% and the

number of policies sold grew by 16%. The ratio of

first insurance to total business completed for the year

2002-03 comes to 80.15% & 67.71% in respect of

NOP & SA respectively.

ROLE OF AGENTS UNDER IRDA REGULATION

Full information must be provided to the

proponent at the point of sale to enable him to

decide on the best cover or plan to minimize

instances of .cooling off. by the proponents.

•An agent should be well versed in all the plans,

the selling points and also be equipped to assess he

needs of the clients.

•Adherence to the prescribed Code of Conduct for

agents is of crucial importance. Agents must,

therefore, familiarize themselves with provisions of

the Code of Conduct.

Agents must provide the office with the accurate

information about the prospect for a fair

assessment of the risk involved. The agents.

confidential report must, therefore, be completed

very carefully

• Agents must also possess adequate knowledge of

policy servicing and claim settlement procedures so

that the policyholders can be guided Correctly.

•Submission of proposal forms and proposal deposit

to the branch office immediately to avoid delays and

to enable the office to take timely decisions.

A leaflet or brochure containing relevant

features of the plan that is being sold should be

available with the agents.

Rules and regulation for insurance

agent:-

Identify himself and the insurance company of

whom he is an insurance agent;

•disclose his licence to the prospect on demand;

•disseminate the requisite information in respect of

insurance products offered for sale by his insurer

and take into account the needs of the prospect

while recommending a specific insurance plan;

disclose the scales of commission in respect of

the insurance product offered for sale, if asked

by the prospect;

indicate the premium to be charged by the

insurer for the insurance product offered for

sale;

explain to the prospect the nature of

information required in the proposal form by

the insurer, and also the importance of

disclosure of material information in the

purchase of an insurance contract;

inform promptly the prospect about the

acceptance or rejection of the proposal by the

insurer;

obtain the requisite documents at the time of

filing the proposal form with the insurer; and

other documents subsequently asked for by the

insurer for completion of the proposal;

render necessary assistance to the

policyholders or claimants or beneficiaries in

complying with the requirements for settlement

of claims by the insurer;

Some of the reasons why the insurance agents lie

to prospective customers are.

Insurance agents are only bothered about

commission that they will be getting once they

get the deal done.

They do not have the full knowledge of the

product that they are selling hence they end up

giving false information to the customer.

They are afraid of the awkward questions that

the customer can shoot at them While they are

explaining about the product to customer.

They are under the pressure of their boss and

are trying to reach the sales targets.

IRDA New Guidelines For Life Insurance

Agents

The rate of commissions to the agents should

also be unique in all insurance companies.

The trail commission is require because at

present in Unit Link Insurance Plans policies

are having surrender value of 96% after

payment of 3 years premium and many

customers opt for non paying the future

premiums.

There should be restriction on the expense

ratio of the Insurance Companies on the basis

of their fund size.

The other charges like policy administration

charges, fund management charges should also

be identical for all the companies.

Active insurance agents should be treated after

completing minimum 3 years agency business.

There should be certain criteria of Minimum

laps of policies for such agents

To encourage the full-time and regular insurance

agents they should be paid trail commissions on the

Assets under Management on regular basis at certain

percentage say @ 0.5% yearly, on the total Assets

under Management on monthly basis, to meet the

agency expenses.

The insurance business brought in by the outgoing

agents should be transferred to such full-time

insurance agents who will provide after sales services

to the existing customers and they should get renewal

commissions for their services and it should also be

treated as part of Asset Under Management for

calculation of trail commissions.

You might also like

- Marketing Mix in Insurance IndustryDocument4 pagesMarketing Mix in Insurance Industryanon-49388690% (30)

- Microeconomics - Tutorial Practice Attempt 1Document6 pagesMicroeconomics - Tutorial Practice Attempt 1Kelyn KokNo ratings yet

- 7 Steps To Success in Selling Life InsuranceDocument140 pages7 Steps To Success in Selling Life InsurancePraveen Chaturvedi60% (5)

- UGA RMIN 4000 Exam 3 Study GuideDocument30 pagesUGA RMIN 4000 Exam 3 Study GuideBrittany Danielle ThompsonNo ratings yet

- Business Interruption: Coverage, Claims, and Recovery, 2nd EditionFrom EverandBusiness Interruption: Coverage, Claims, and Recovery, 2nd EditionNo ratings yet

- Chapter 3Document10 pagesChapter 3Ajay PawarNo ratings yet

- Chapter - 5 - Insurance Intermediaries1568157534206075349Document34 pagesChapter - 5 - Insurance Intermediaries1568157534206075349Mahima MaharjanNo ratings yet

- Baf) 1Document8 pagesBaf) 1mesfinabera180No ratings yet

- Selling Process of The Insurance ProductsDocument35 pagesSelling Process of The Insurance ProductsAshish AgarwalNo ratings yet

- Insurance Company Operations: By:Marya SholevarDocument40 pagesInsurance Company Operations: By:Marya SholevarSaad MajeedNo ratings yet

- Chapter4 141022095335 Conversion Gate02Document40 pagesChapter4 141022095335 Conversion Gate02NarenBistaNo ratings yet

- Poi Unit-D (2) Customer ServiceDocument16 pagesPoi Unit-D (2) Customer ServiceEHOUMAN JEAN JACQUES EBAHNo ratings yet

- Answer For Marketing of Financial Services AssignmentDocument7 pagesAnswer For Marketing of Financial Services AssignmentBhupesh Vrat AryaNo ratings yet

- Various Types of Life Insurance PoliciesDocument6 pagesVarious Types of Life Insurance PoliciesEdward GrahamNo ratings yet

- 3Document15 pages3gech95465195No ratings yet

- Customer Relationship ManagementDocument88 pagesCustomer Relationship Managementphanindra_madasu0% (1)

- Unit-5: Functions of InsuranceDocument10 pagesUnit-5: Functions of InsuranceYITBAREKNo ratings yet

- Consumer Satisfaction in Tata AIGDocument66 pagesConsumer Satisfaction in Tata AIGtulasinad123100% (1)

- Assign 1Document11 pagesAssign 1Rakshi BegumNo ratings yet

- Marketing of InsuranceDocument22 pagesMarketing of InsuranceshrenikNo ratings yet

- Insurance As Career PDFDocument12 pagesInsurance As Career PDFInsurance as CareerNo ratings yet

- Chapter 5Document15 pagesChapter 5mark sanadNo ratings yet

- Introduction of The Company: Companies, Insurance Which Issue and Sell Products That Insure Against FinancialDocument10 pagesIntroduction of The Company: Companies, Insurance Which Issue and Sell Products That Insure Against FinancialShariful Huq Khan RomelNo ratings yet

- A Practical Guide To Insurance Broker Compensation and Potential Conflicts PDFDocument7 pagesA Practical Guide To Insurance Broker Compensation and Potential Conflicts PDFNooni Rinyaphat100% (1)

- Insurance Company OperationDocument35 pagesInsurance Company OperationADALIA BEATRIZ ONGNo ratings yet

- FPA Job DescriptionDocument2 pagesFPA Job DescriptionntcthNo ratings yet

- 595unit 5 Insurance IntermediariesDocument28 pages595unit 5 Insurance IntermediariesBajra VinayaNo ratings yet

- 1 - Product:: ChildsuranceDocument9 pages1 - Product:: Childsurancesanket sunilNo ratings yet

- 7Ps of Insurance Service Marketing by Mayak Pareek and Shikhar KantDocument14 pages7Ps of Insurance Service Marketing by Mayak Pareek and Shikhar KantMAYANK PAREEKNo ratings yet

- Textbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterFrom EverandTextbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterNo ratings yet

- Under WritingDocument18 pagesUnder Writingfrnds4everzNo ratings yet

- Analysis and InterpretationDocument36 pagesAnalysis and Interpretationpratikmehra18No ratings yet

- Insurance OperationsDocument5 pagesInsurance OperationssimplyrochNo ratings yet

- Business Environmental StudyDocument7 pagesBusiness Environmental StudyshiteshsinghhNo ratings yet

- Insurance Risk - CIPLC - DraftDocument10 pagesInsurance Risk - CIPLC - DraftEmmanuelNo ratings yet

- Marketing Mix For Insurance IndustryDocument7 pagesMarketing Mix For Insurance IndustryReema NegiNo ratings yet

- Underwriting in Insurance: Maharaja Agrasen Institute of Management StudiesDocument18 pagesUnderwriting in Insurance: Maharaja Agrasen Institute of Management Studiesfrnds4everzNo ratings yet

- Unit 3 InsuranceDocument29 pagesUnit 3 InsuranceNikita ShekhawatNo ratings yet

- IRDA ACT AssignmentDocument5 pagesIRDA ACT AssignmentSuraj ChandraNo ratings yet

- Role of Insurance AgentDocument55 pagesRole of Insurance AgentKanishk Gupta100% (1)

- Marketing Mix Insurance SectorDocument4 pagesMarketing Mix Insurance SectorSantosh Pradhan100% (1)

- Insurance Resume DatabaseDocument4 pagesInsurance Resume Databaseafjwdryfaveezn100% (2)

- Market Segmentation For Insurance: Users of Insurance Service: Marketing Information SystemDocument10 pagesMarket Segmentation For Insurance: Users of Insurance Service: Marketing Information SystemTejal GuptaNo ratings yet

- Marketing Mix in Insurance IndustryDocument4 pagesMarketing Mix in Insurance Industryrajnsab0% (1)

- AUDITINGDocument6 pagesAUDITINGVISAYANA JACQUELINENo ratings yet

- Underwriting InsuranceDocument77 pagesUnderwriting InsuranceChazzy f ChazzyNo ratings yet

- Business Insurance Marketing PlanDocument44 pagesBusiness Insurance Marketing PlanfeyselNo ratings yet

- Insurance Brokerage Business Plan TemplateDocument6 pagesInsurance Brokerage Business Plan Templateprkn26yeNo ratings yet

- Nationwide Insurance ResumeDocument4 pagesNationwide Insurance Resumevdwmomrmd100% (1)

- Life Insurance Underwriter ResumeDocument7 pagesLife Insurance Underwriter Resumebdg9hkj6100% (2)

- How Relevant Are Material Fact To Be Informed by Insurers To The Clients and Different ChannelsDocument14 pagesHow Relevant Are Material Fact To Be Informed by Insurers To The Clients and Different ChannelsDeo KumarNo ratings yet

- II Yr BBA Unit 2 Agent and InsuranceDocument12 pagesII Yr BBA Unit 2 Agent and InsuranceB.Com (BI) CommerceNo ratings yet

- Final Year Project For MCom in Manufacturing PencilDocument73 pagesFinal Year Project For MCom in Manufacturing PencilPadmaja MenonNo ratings yet

- Marketing Is A PhilosophyDocument5 pagesMarketing Is A PhilosophySourabh A UgargolNo ratings yet

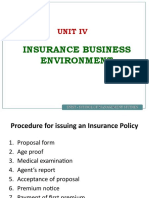

- Unit Iv: Insurance Business EnvironmentDocument20 pagesUnit Iv: Insurance Business Environmentmtechvlsitd labNo ratings yet

- Wir 2007Document48 pagesWir 2007joofowNo ratings yet

- Insurance Documentation: Proposal FormDocument3 pagesInsurance Documentation: Proposal FormMaulik PanchmatiaNo ratings yet

- Role and Responsibility of Insurance Agent and BrokerDocument33 pagesRole and Responsibility of Insurance Agent and BrokerJaime DaliuagNo ratings yet

- Insurance Company ProposalDocument3 pagesInsurance Company ProposalMartinNo ratings yet

- Determinants of Dividend Policy in Saudi Listed CompaniesDocument10 pagesDeterminants of Dividend Policy in Saudi Listed CompaniesChickenrock TangerangNo ratings yet

- How ESG Engagement Creates Value For Investors and CompaniesDocument33 pagesHow ESG Engagement Creates Value For Investors and Companiesbenothmene.skandeerNo ratings yet

- Tanga Cement Annual Summary Report 2017 OnlineDocument20 pagesTanga Cement Annual Summary Report 2017 OnlineedgarmerchanNo ratings yet

- Cash Management-ProblemsDocument2 pagesCash Management-ProblemsNagma ParmarNo ratings yet

- Sba 101Document23 pagesSba 101alexNo ratings yet

- Process Capacity Management - OM - FINALDocument13 pagesProcess Capacity Management - OM - FINALRAVI SONKARNo ratings yet

- Banking Structure in India Banking:: 1.central Bank 3.specialized Bank 4.cooperative BankDocument5 pagesBanking Structure in India Banking:: 1.central Bank 3.specialized Bank 4.cooperative BankKandaroliNo ratings yet

- AllergenDocument2 pagesAllergenAgronomist ahmed hassanNo ratings yet

- NOTES FOR CONTEMPORARY - FullDocument30 pagesNOTES FOR CONTEMPORARY - FullMridulGuptaNo ratings yet

- CapelloDocument23 pagesCapelloreissitamu1No ratings yet

- Process Costing TheoryDocument2 pagesProcess Costing TheoryNicoleNo ratings yet

- Case Study 2 - AccountingDocument5 pagesCase Study 2 - AccountingThrowaway TwoNo ratings yet

- Online Shopping Website: Electronics and Communication EngineeringDocument10 pagesOnline Shopping Website: Electronics and Communication EngineeringRohit RanaNo ratings yet

- Chore CommitteeDocument4 pagesChore CommitteeSumit Koundal100% (1)

- Tuition-Free CollegeDocument13 pagesTuition-Free CollegejunNo ratings yet

- Shree Krishna Trading Cowh: Terms &conditionsemensDocument2 pagesShree Krishna Trading Cowh: Terms &conditionsemensGeorge GNo ratings yet

- NCR NegoSale Batch 15207 041524Document38 pagesNCR NegoSale Batch 15207 041524jazzleNo ratings yet

- APM Chapter 1 NotesDocument6 pagesAPM Chapter 1 NotesMichelle LeitsteinNo ratings yet

- Annual Report FY 17Document130 pagesAnnual Report FY 17Tanya GrewalNo ratings yet

- Directors Loan and Tax ImplicationsDocument2 pagesDirectors Loan and Tax ImplicationsMary SmithNo ratings yet

- Financial Times Europe - 03-06-2021Document18 pagesFinancial Times Europe - 03-06-2021HoangNo ratings yet

- Chapter Five DSFDocument15 pagesChapter Five DSFtame kibruNo ratings yet

- Course Outline For Bba 2023Document3 pagesCourse Outline For Bba 2023prissatal85No ratings yet

- Swot, Pestel and Porter's Five Forces AnalysisDocument13 pagesSwot, Pestel and Porter's Five Forces AnalysisAnil BiswalNo ratings yet

- New List of Bonded Officials FormDocument1 pageNew List of Bonded Officials FormJholly JumadayNo ratings yet

- What Is CapitalismDocument5 pagesWhat Is CapitalismAifel Joy Dayao FranciscoNo ratings yet

- Sample Responses To Booking EnquiriesDocument6 pagesSample Responses To Booking EnquiriesSakha DewaNo ratings yet

- Exercise No. 3Document2 pagesExercise No. 3Quenny RasNo ratings yet

- Managing Strategy Operations and Partnerships 1773803 194477557Document32 pagesManaging Strategy Operations and Partnerships 1773803 194477557Gontla Sai SrijaNo ratings yet