Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

102 viewsFinancial Integration: Largely Adopted From Aziakpono, 2007

Financial Integration: Largely Adopted From Aziakpono, 2007

Uploaded by

Fungai MukundiwaCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Movie Analysis AssignmentDocument3 pagesMovie Analysis AssignmentDawn Caldeira67% (3)

- Chapter 1 - Financial Reporting and Accounting Standards - Intermediate Accounting - IFRS Edition, 2nd EditionDocument41 pagesChapter 1 - Financial Reporting and Accounting Standards - Intermediate Accounting - IFRS Edition, 2nd EditionWihl Mathew ZalatarNo ratings yet

- Iec60383-1 (Ed4.0) en - D.img Insulators 80KNDocument62 pagesIec60383-1 (Ed4.0) en - D.img Insulators 80KNAdeel Zafar100% (2)

- 2520 RiseDocument173 pages2520 RiseJoseBrizziNo ratings yet

- Financial Globalisation.1Document7 pagesFinancial Globalisation.1Steeves DevaletNo ratings yet

- Managing Foreign Debt and Liquidity: India's Experience: Payments Chaired by DR C Rangarajan. The Committee RecommendedDocument6 pagesManaging Foreign Debt and Liquidity: India's Experience: Payments Chaired by DR C Rangarajan. The Committee RecommendedSaurav SinghNo ratings yet

- Lessons From The South African ExperienceDocument15 pagesLessons From The South African ExperienceEmir TermeNo ratings yet

- International Capital MovementDocument37 pagesInternational Capital MovementAnonymous tvdt6znW3No ratings yet

- Ifm Unit 1Document91 pagesIfm Unit 1Sachin D SalankeyNo ratings yet

- Capital Mobility in Developing CountriesDocument41 pagesCapital Mobility in Developing CountriesEmir TermeNo ratings yet

- Capital AccountDocument38 pagesCapital AccountSheetal IyerNo ratings yet

- Financial Sector Reforms and Capital Account ConvertibilityDocument33 pagesFinancial Sector Reforms and Capital Account Convertibilitynitish07singhNo ratings yet

- IRL 3109 - Lecture 6 (2020-12-10)Document26 pagesIRL 3109 - Lecture 6 (2020-12-10)nolissaNo ratings yet

- Managerial Economics 2003 Visit Us at Management - UmakantDocument15 pagesManagerial Economics 2003 Visit Us at Management - Umakantwelcome2jungleNo ratings yet

- Table 1: Policy RoadmapDocument1 pageTable 1: Policy RoadmapĐỗ Viết Hà TXA2HNNo ratings yet

- Financial Markets Integration in India: Asia-Pacific Development Journal Vol. 12, No. 2, December 2005Document18 pagesFinancial Markets Integration in India: Asia-Pacific Development Journal Vol. 12, No. 2, December 2005anon-392261No ratings yet

- RBI Speech On Capital Account ConvertibilityDocument12 pagesRBI Speech On Capital Account Convertibilitynisha vermaNo ratings yet

- Capital Account Convertibility IndiaDocument19 pagesCapital Account Convertibility IndiamanojbenNo ratings yet

- Changing Landscape of Finance in India During Last Decade: Finance and The EconomyDocument9 pagesChanging Landscape of Finance in India During Last Decade: Finance and The EconomyVidhi BansalNo ratings yet

- Afu 08504 - International Finance - Introduction and The ImsDocument18 pagesAfu 08504 - International Finance - Introduction and The ImsAbdulkarim Hamisi KufakunogaNo ratings yet

- FII Publication Paper1Document19 pagesFII Publication Paper1vinoo2926No ratings yet

- Financial LiberalizationDocument45 pagesFinancial LiberalizationazeemNo ratings yet

- The Inflow and Outflow of CapitalDocument4 pagesThe Inflow and Outflow of CapitalMohammad Shahjahan SiddiquiNo ratings yet

- Capital Account Convertibility in Bangladesh v2Document32 pagesCapital Account Convertibility in Bangladesh v2Nahid HawkNo ratings yet

- Sybaf FC CH-1Document40 pagesSybaf FC CH-1Chirag KararaNo ratings yet

- Fundamentals of International FinanceDocument11 pagesFundamentals of International FinanceChirag KotianNo ratings yet

- Presentation On International Financial ManagementDocument17 pagesPresentation On International Financial ManagementSukruth SNo ratings yet

- 06 Banking CH 6Document8 pages06 Banking CH 6sabit hussenNo ratings yet

- Financial Globalization in India - Renu KohliDocument14 pagesFinancial Globalization in India - Renu Kohlitanu dixitNo ratings yet

- CH 1 - Scope of International FinanceDocument7 pagesCH 1 - Scope of International Financepritesh_baidya269100% (3)

- Financial Development: Task-3Document4 pagesFinancial Development: Task-3Pragyal MathurNo ratings yet

- The Nature and Role of Financial SystemDocument25 pagesThe Nature and Role of Financial Systemkhajasai3236No ratings yet

- FM - Financial Development and Economic Growth 25042015Document10 pagesFM - Financial Development and Economic Growth 25042015NaDiaNo ratings yet

- Unit 2 IFM Final - MergedDocument30 pagesUnit 2 IFM Final - MergedTushar KhandelwalNo ratings yet

- This Research Paper Is Written by Naveed Iqbal ChaudhryDocument5 pagesThis Research Paper Is Written by Naveed Iqbal ChaudhryAleem MalikNo ratings yet

- Eco1 PDFDocument23 pagesEco1 PDFPeeyush SinghNo ratings yet

- Research Paper (Comparative Analysis of Global Financial Laws)Document17 pagesResearch Paper (Comparative Analysis of Global Financial Laws)Soumya SaranjiNo ratings yet

- Chapter 2Document39 pagesChapter 2Witness Wii MujoroNo ratings yet

- Multi 0 PageDocument57 pagesMulti 0 PageKatrina ReyesNo ratings yet

- IE 2 - Unit 1 - Financial Globalization in India - Renu KohliDocument14 pagesIE 2 - Unit 1 - Financial Globalization in India - Renu KohliTanya SinghNo ratings yet

- Билеты МВФО готовыеDocument15 pagesБилеты МВФО готовыеОльга ПономареваNo ratings yet

- International Financial Management PgapteDocument24 pagesInternational Financial Management PgapteAdison Growar SatyeNo ratings yet

- Afu 08504 - International Finance - Introduction and The ImsDocument18 pagesAfu 08504 - International Finance - Introduction and The ImsAbdulkarim Hamisi KufakunogaNo ratings yet

- Session 2Document27 pagesSession 2Vaibhav AggarwalNo ratings yet

- This Content Downloaded From 62.22.68.43 On Thu, 17 Feb 2022 10:11:15 UTCDocument43 pagesThis Content Downloaded From 62.22.68.43 On Thu, 17 Feb 2022 10:11:15 UTCnicodelrioNo ratings yet

- Relationship BTWN Inflation Exchange FluctuationDocument10 pagesRelationship BTWN Inflation Exchange FluctuationhajashaikNo ratings yet

- MODULE 1 - LEARNING MATERIAL Fundamentals of International FinanceDocument19 pagesMODULE 1 - LEARNING MATERIAL Fundamentals of International FinanceMICHELLE MILANANo ratings yet

- Vol22 Art2 PDFDocument21 pagesVol22 Art2 PDFIsmith PokhrelNo ratings yet

- Module 6 - Interntional Flow of FundsDocument4 pagesModule 6 - Interntional Flow of FundsMICHELLE MILANANo ratings yet

- FE Chapter 5Document43 pagesFE Chapter 5dehinnetagimasNo ratings yet

- ERP 2004 Chapter13Document14 pagesERP 2004 Chapter13ibraitsNo ratings yet

- Financial LiberalizationDocument46 pagesFinancial LiberalizationazeemNo ratings yet

- Bm318 Assignment 2Document9 pagesBm318 Assignment 2Mohd AdnanNo ratings yet

- Corporate Governance SystemDocument16 pagesCorporate Governance SystemRajib RoyNo ratings yet

- International Financial Management An OverviewDocument25 pagesInternational Financial Management An OverviewVinayrajNo ratings yet

- Financial IntegrationDocument46 pagesFinancial IntegrationSatish Babu NutakkiNo ratings yet

- Acc 414 International AccountingDocument177 pagesAcc 414 International AccountingEmmanuel AbolajiNo ratings yet

- Innovative International Financial Products & Markets & Future of International FinanceDocument25 pagesInnovative International Financial Products & Markets & Future of International FinanceJaiswar ManojNo ratings yet

- Socsci 10Document4 pagesSocsci 10Celestine MambulaoNo ratings yet

- PRELIM CW - The Global Economy3 - 2Document15 pagesPRELIM CW - The Global Economy3 - 2Xavier MacauyagNo ratings yet

- Economics of Globalization HMZDocument23 pagesEconomics of Globalization HMZMarioNo ratings yet

- ROLE OF International FINANCIAL MANAGEMENTDocument8 pagesROLE OF International FINANCIAL MANAGEMENTMihir GaurNo ratings yet

- Exam 2015 QuestionsDocument8 pagesExam 2015 QuestionsFungai MukundiwaNo ratings yet

- CFI5101201510 Financial Statement Analysis and PlanningDocument6 pagesCFI5101201510 Financial Statement Analysis and PlanningFungai MukundiwaNo ratings yet

- CFI5102201412 Advanced Corporate Financial StrategyDocument5 pagesCFI5102201412 Advanced Corporate Financial StrategyFungai MukundiwaNo ratings yet

- Attempt Four Questions, Three From Section A and One From Section B 3. Start The Solution To Each Full Question On A Fresh Page of The Answer SheetDocument3 pagesAttempt Four Questions, Three From Section A and One From Section B 3. Start The Solution To Each Full Question On A Fresh Page of The Answer SheetFungai MukundiwaNo ratings yet

- FNCE20005 Corporate Financial Decision MakingDocument12 pagesFNCE20005 Corporate Financial Decision MakingFungai MukundiwaNo ratings yet

- The Real Options Model of Land Value and Development Project ValuationDocument109 pagesThe Real Options Model of Land Value and Development Project ValuationFungai MukundiwaNo ratings yet

- Sensitivity Analysis: Methodology of Modeling DecisionsDocument18 pagesSensitivity Analysis: Methodology of Modeling DecisionsFungai MukundiwaNo ratings yet

- Financial Structure: Personal Referral Work Dr. I. BayaiDocument11 pagesFinancial Structure: Personal Referral Work Dr. I. BayaiFungai MukundiwaNo ratings yet

- Project Analysis Using Decision Trees and OptionsDocument16 pagesProject Analysis Using Decision Trees and OptionsFungai MukundiwaNo ratings yet

- Finance and Growth OverviewDocument26 pagesFinance and Growth OverviewFungai MukundiwaNo ratings yet

- Global Banking: Recent Developments & InsightsDocument37 pagesGlobal Banking: Recent Developments & InsightsFungai MukundiwaNo ratings yet

- CFI 5115 QuestionsDocument9 pagesCFI 5115 QuestionsFungai Mukundiwa0% (1)

- AmazonDocument4 pagesAmazonbonnieNo ratings yet

- Mario Erasmo (2012) - Death Antiquity and Its Legacy (Z-Library)Document194 pagesMario Erasmo (2012) - Death Antiquity and Its Legacy (Z-Library)dserranolozanoNo ratings yet

- Now Platform™: Single Data Model Multi-InstanceDocument3 pagesNow Platform™: Single Data Model Multi-InstanceMarcusViníciusNo ratings yet

- Unit 2 - BT MLH 12 - KeyDocument7 pagesUnit 2 - BT MLH 12 - KeyThao NguyenNo ratings yet

- Wealth InequalityDocument35 pagesWealth Inequalityahmad100% (1)

- No Exit by Jean Paul SatreDocument3 pagesNo Exit by Jean Paul SatretimpilahNo ratings yet

- "PROJECT K" MEETS "PROJECT A" - 2005 - The Arizona Project, Don Bolles and Bob Greene, Meets Project Klebnikov (By Richard Behar)Document15 pages"PROJECT K" MEETS "PROJECT A" - 2005 - The Arizona Project, Don Bolles and Bob Greene, Meets Project Klebnikov (By Richard Behar)Richard BeharNo ratings yet

- Loeb Classical Library Edition of Tacitus, 1925Document2 pagesLoeb Classical Library Edition of Tacitus, 1925Marco AntônioNo ratings yet

- NhaiDocument6 pagesNhairavindrarao_mNo ratings yet

- Aspire Issue 6Document41 pagesAspire Issue 6HelenNo ratings yet

- SDC Affiliation FORMDocument6 pagesSDC Affiliation FORMMrrobinNo ratings yet

- Old Exam AEDocument12 pagesOld Exam AEaaaaaNo ratings yet

- Project Horus by Anuraag RathDocument12 pagesProject Horus by Anuraag RatharNo ratings yet

- Electronic Banking ModelsDocument7 pagesElectronic Banking Modelserger88100% (1)

- Hindu Aikya Ghosha Haa Ninaadu Dyaa Digantaree - Corrected and MeaningDocument2 pagesHindu Aikya Ghosha Haa Ninaadu Dyaa Digantaree - Corrected and MeaningPiyush ShahNo ratings yet

- PDFDocument6 pagesPDFHarshada AhirraoNo ratings yet

- Inter-Semester Moot Court Competition - Luma - 1Document35 pagesInter-Semester Moot Court Competition - Luma - 1ajay upadhyayNo ratings yet

- Paul Andrew Mitchell Criminal ComplaiantDocument10 pagesPaul Andrew Mitchell Criminal Complaiantremenant2006No ratings yet

- Trial Advocacy Moot Problem ADocument47 pagesTrial Advocacy Moot Problem ALuvNo ratings yet

- List of Law FirmsDocument18 pagesList of Law FirmsReena ShauNo ratings yet

- Darden PDFDocument37 pagesDarden PDFRizal ApriyanNo ratings yet

- Webb vs. de LeonDocument22 pagesWebb vs. de LeonIyaNo ratings yet

- Complainant Vs Vs Respondent: en BancDocument6 pagesComplainant Vs Vs Respondent: en BancJinnelyn LiNo ratings yet

- 00 - King Lear AnalysisDocument11 pages00 - King Lear AnalysisViki VankaNo ratings yet

- CH 1 IntroDocument5 pagesCH 1 IntroJawad AhmadNo ratings yet

- Canadian Importers Database - HS6-620920-2021-11-20Document2 pagesCanadian Importers Database - HS6-620920-2021-11-20Nikunj SatraNo ratings yet

- XXXDocument2 pagesXXXtony alvaNo ratings yet

Financial Integration: Largely Adopted From Aziakpono, 2007

Financial Integration: Largely Adopted From Aziakpono, 2007

Uploaded by

Fungai Mukundiwa0 ratings0% found this document useful (0 votes)

102 views22 pagesOriginal Title

Financial Integration

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

102 views22 pagesFinancial Integration: Largely Adopted From Aziakpono, 2007

Financial Integration: Largely Adopted From Aziakpono, 2007

Uploaded by

Fungai MukundiwaCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 22

FINANCIAL INTEGRATION

Largely adopted from Aziakpono,

2007

Financial Integration: Definition

• International finance and economic

literature does not offer a unique

definition of financial integration.

• Financial openness, external financial

liberalization, financial globalization and

capital account liberalization have been

used in connection to financial

integration.

Edison et al. (2002)

“the degree to which an economy does not

restrict cross-border financial transactions”

Schmukler & Zoido-Lobaton (2001)

“the integration of a country’s local financial

system with international financial markets

and institutions”

• This integration typically requires

liberalization of the domestic financial sector

as well as the capital account.

Financial integration thus:

• Is when liberalized economies experience

an increase in cross-country capital

movement,

• Including active participation by local

borrowers and lenders in international

markets and

• A widespread use of international

financial intermediaries.

Prasad et al. (2003:4) financial globalization and

financial integration are different concepts.

• Financial globalization is an aggregate term

that refers to global linkages through cross-

border financial flows

• Financial integration refers to an individual

country’s linkages to international financial

markets

• Increasing financial globalization is associated

with rising financial integration on average

de jure and de facto financial integration

• de jure financial integration represents policies

associated with capital account liberalization.

• de facto financial integration represents actual

capital flows (Prasad et al. 2003:7).

• de facto financial integration is not a variable that a

country’s government can easily regulate.

– the degree of de facto financial integration might

still be high, if controls can be easily evaded.

– Countries with few restrictions have not

experienced significant capital flows = low de

facto fin integration

Pre-requisites for Financial Integration

• Removal of any administrative and

• Market-based restrictions on capital movement

across borders and

• The removal of regulatory, legal and tax

discrimination between foreign and domestic

suppliers of financial services (VonFurstenberg,

1998 and Brahmbhatt, 1998)

• Some restrictions are subtle eg ‘behind the border’

which limit foreign suppliers on Gvt procurement

eg, all suppliers must have bank accounts with

domestic banks.

Financial Integration Outcomes

Allows:

• Residents to move their funds and

• To hold financial assets abroad;

• Private firms to borrow freely in foreign financial

markets;

• Residents to make financial transactions in foreign

currencies;

• As well as non-residents to invest freely in domestic

markets (Esen, 2000:5).

• Thus capital account liberalisation or financial openness

leads to international capital mobility (see Edison et al.

2002:2-3)

Checks & Balances

Movement of Capital might not mean Financial

Integration (Prasad et al. 2004:9)

• de jure integration-restriction on capital flows

• de facto integration-realized capital flows

Based on these classifications, 4 outcomes are

possible:

1. Removal of restrictions on capital flows could lead

to a high level of actual capital flows (devpd states)

2. Capital account restriction may be ineffective in

controlling actual capital flows (L. America 70s &

80s) eg K flights in de jure closed to k flows.

…continuation

3. ‘liberalization without integration’ – few K

restrictions, but low K flows (most African states).

4. Closed capital accounts are also effectively closed

in terms of capital flows.

• Removal of legal restrictions on cross-border capital

flows is insufficient to achieve financial integration.

• Financial integration also requires freedom to trade

in financial services through both cross-border

provisions and foreign establishments (von

Furstenberg 1998:55).

Better Version

• Financial integration thus entails more

than just the freedom of individuals or

firms (both domestic and foreign) to

move their funds across-borders and to

make transactions in foreign currencies; it

also involves the cross border

penetrations of financial institutions

themselves.

• Such foreign involvement in a country’s intermediation

and financial system can help to bring a country’s

financial development up to international standards and

help mobilize domestic savings.

• This, as noted by von Furstenberg (1998:55), can

contribute to international financial integration without

appreciable net international flows of capital being

associated with a particular activity or their sum total.

• Thus, while restrictions to cross-border capital

movements could prevent financial integration,

elimination of such restrictions is not sufficient to

achieve it.

Institutional Prerequisites

• Introduction of standardized, internationally tradable

financial products and

• Of quotations and trading systems to the

development of international conventions, as well as

• The adoption of mutually recognized regulatory,

supervisory, large-value transfer and final-settlement

practices.

– Some of these systems and standards can result from

private laws and industry protocols, while

– Others call for the direct involvement of governments and

their international agents (see von Furstenberg, 1998:57 ).

…continuation

• Prasad et al. (2003:10) also recognize good

macroeconomic policies and good domestic governance

(which includes transparency of government operations

and a low level of corruption) as important factors in

investment flows from international mutual funds.

• the existence of mutual confidence and the ability to form

reputation capital and charter value to provide a firm

basis for trust in the suppliers of financial services and in

the appropriateness of their incentives are essential.

• existence of a transparent and efficient legal system and

quality law enforcement as well as respect for property

rights and good accounting standards.

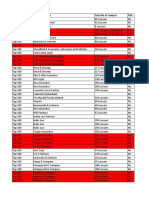

Measurement of Financial Integration

• Make own Notes (Rule Based Measures, IMF –

restriction measure, Quinn’s measure,

Outcome based measures, Quantity based

measures etc

Importance of Fin Integration

• There is a growing interest in regional

and global financial integration of which

developing African countries are not left

out.

• Economic theory suggests that financial

integration promotes economic growth

and enhances welfare

This is achieved through:

• Providing opportunities for more efficient allocation

of resources,

• Portfolio and risk diversification and

• Allowing higher profitability of investment, as well as

• By helping to promote domestic financial

development, especially in developing countries (see

World Bank 1997, Obstfeld 1998, Agenor 2003,

Gourinchas and Jeanne 2003, Prasad, Rogoff, Wei

and Kose 2004, Obstfeld and Taylor 2004, Klein

2005).

Down-side

• the risks of global financial integration outweigh the

benefits (Bhagwati 1998).

– ‘claims of enormous benefits from free capital

mobility are not persuasive’

– ‘substantial gains (from capital account

liberalization) have been asserted, not

demonstrated’

• free international capital flows have been

associated with a deterioration in economic

efficiency (as measured by growth and

unemployment) (Obstfeld & Taylor 2004:4)

• Rodrik (1999:30)

“openness to international capital flows

can be especially dangerous if the

appropriate controls, regulatory

apparatus and macroeconomic

frameworks are not in place”.

• controversy remains since the studies

obtained mixed results.

Empirics from Aziakpono (2006 ), Sander and

Kleimeier (2006) and Nielsen, et al. (2005)

showed that:

• by virtue of the official financial integration

arrangements, the financial systems in the

SACU countries are highly integrated.

• provide opportunities for risk-sharing,

domestic financial system development and

economic growth.

• there is still a wide disparity in the level of

development of their financial systems and their

economic performance.

ASSIGNMENT- GROUP B

Write an empirical paper showing the effect of

financial integration on economic performance of

SACU countries over a period ending 1970-2014

[50 marks]. Due last day of Block!

You might also like

- Movie Analysis AssignmentDocument3 pagesMovie Analysis AssignmentDawn Caldeira67% (3)

- Chapter 1 - Financial Reporting and Accounting Standards - Intermediate Accounting - IFRS Edition, 2nd EditionDocument41 pagesChapter 1 - Financial Reporting and Accounting Standards - Intermediate Accounting - IFRS Edition, 2nd EditionWihl Mathew ZalatarNo ratings yet

- Iec60383-1 (Ed4.0) en - D.img Insulators 80KNDocument62 pagesIec60383-1 (Ed4.0) en - D.img Insulators 80KNAdeel Zafar100% (2)

- 2520 RiseDocument173 pages2520 RiseJoseBrizziNo ratings yet

- Financial Globalisation.1Document7 pagesFinancial Globalisation.1Steeves DevaletNo ratings yet

- Managing Foreign Debt and Liquidity: India's Experience: Payments Chaired by DR C Rangarajan. The Committee RecommendedDocument6 pagesManaging Foreign Debt and Liquidity: India's Experience: Payments Chaired by DR C Rangarajan. The Committee RecommendedSaurav SinghNo ratings yet

- Lessons From The South African ExperienceDocument15 pagesLessons From The South African ExperienceEmir TermeNo ratings yet

- International Capital MovementDocument37 pagesInternational Capital MovementAnonymous tvdt6znW3No ratings yet

- Ifm Unit 1Document91 pagesIfm Unit 1Sachin D SalankeyNo ratings yet

- Capital Mobility in Developing CountriesDocument41 pagesCapital Mobility in Developing CountriesEmir TermeNo ratings yet

- Capital AccountDocument38 pagesCapital AccountSheetal IyerNo ratings yet

- Financial Sector Reforms and Capital Account ConvertibilityDocument33 pagesFinancial Sector Reforms and Capital Account Convertibilitynitish07singhNo ratings yet

- IRL 3109 - Lecture 6 (2020-12-10)Document26 pagesIRL 3109 - Lecture 6 (2020-12-10)nolissaNo ratings yet

- Managerial Economics 2003 Visit Us at Management - UmakantDocument15 pagesManagerial Economics 2003 Visit Us at Management - Umakantwelcome2jungleNo ratings yet

- Table 1: Policy RoadmapDocument1 pageTable 1: Policy RoadmapĐỗ Viết Hà TXA2HNNo ratings yet

- Financial Markets Integration in India: Asia-Pacific Development Journal Vol. 12, No. 2, December 2005Document18 pagesFinancial Markets Integration in India: Asia-Pacific Development Journal Vol. 12, No. 2, December 2005anon-392261No ratings yet

- RBI Speech On Capital Account ConvertibilityDocument12 pagesRBI Speech On Capital Account Convertibilitynisha vermaNo ratings yet

- Capital Account Convertibility IndiaDocument19 pagesCapital Account Convertibility IndiamanojbenNo ratings yet

- Changing Landscape of Finance in India During Last Decade: Finance and The EconomyDocument9 pagesChanging Landscape of Finance in India During Last Decade: Finance and The EconomyVidhi BansalNo ratings yet

- Afu 08504 - International Finance - Introduction and The ImsDocument18 pagesAfu 08504 - International Finance - Introduction and The ImsAbdulkarim Hamisi KufakunogaNo ratings yet

- FII Publication Paper1Document19 pagesFII Publication Paper1vinoo2926No ratings yet

- Financial LiberalizationDocument45 pagesFinancial LiberalizationazeemNo ratings yet

- The Inflow and Outflow of CapitalDocument4 pagesThe Inflow and Outflow of CapitalMohammad Shahjahan SiddiquiNo ratings yet

- Capital Account Convertibility in Bangladesh v2Document32 pagesCapital Account Convertibility in Bangladesh v2Nahid HawkNo ratings yet

- Sybaf FC CH-1Document40 pagesSybaf FC CH-1Chirag KararaNo ratings yet

- Fundamentals of International FinanceDocument11 pagesFundamentals of International FinanceChirag KotianNo ratings yet

- Presentation On International Financial ManagementDocument17 pagesPresentation On International Financial ManagementSukruth SNo ratings yet

- 06 Banking CH 6Document8 pages06 Banking CH 6sabit hussenNo ratings yet

- Financial Globalization in India - Renu KohliDocument14 pagesFinancial Globalization in India - Renu Kohlitanu dixitNo ratings yet

- CH 1 - Scope of International FinanceDocument7 pagesCH 1 - Scope of International Financepritesh_baidya269100% (3)

- Financial Development: Task-3Document4 pagesFinancial Development: Task-3Pragyal MathurNo ratings yet

- The Nature and Role of Financial SystemDocument25 pagesThe Nature and Role of Financial Systemkhajasai3236No ratings yet

- FM - Financial Development and Economic Growth 25042015Document10 pagesFM - Financial Development and Economic Growth 25042015NaDiaNo ratings yet

- Unit 2 IFM Final - MergedDocument30 pagesUnit 2 IFM Final - MergedTushar KhandelwalNo ratings yet

- This Research Paper Is Written by Naveed Iqbal ChaudhryDocument5 pagesThis Research Paper Is Written by Naveed Iqbal ChaudhryAleem MalikNo ratings yet

- Eco1 PDFDocument23 pagesEco1 PDFPeeyush SinghNo ratings yet

- Research Paper (Comparative Analysis of Global Financial Laws)Document17 pagesResearch Paper (Comparative Analysis of Global Financial Laws)Soumya SaranjiNo ratings yet

- Chapter 2Document39 pagesChapter 2Witness Wii MujoroNo ratings yet

- Multi 0 PageDocument57 pagesMulti 0 PageKatrina ReyesNo ratings yet

- IE 2 - Unit 1 - Financial Globalization in India - Renu KohliDocument14 pagesIE 2 - Unit 1 - Financial Globalization in India - Renu KohliTanya SinghNo ratings yet

- Билеты МВФО готовыеDocument15 pagesБилеты МВФО готовыеОльга ПономареваNo ratings yet

- International Financial Management PgapteDocument24 pagesInternational Financial Management PgapteAdison Growar SatyeNo ratings yet

- Afu 08504 - International Finance - Introduction and The ImsDocument18 pagesAfu 08504 - International Finance - Introduction and The ImsAbdulkarim Hamisi KufakunogaNo ratings yet

- Session 2Document27 pagesSession 2Vaibhav AggarwalNo ratings yet

- This Content Downloaded From 62.22.68.43 On Thu, 17 Feb 2022 10:11:15 UTCDocument43 pagesThis Content Downloaded From 62.22.68.43 On Thu, 17 Feb 2022 10:11:15 UTCnicodelrioNo ratings yet

- Relationship BTWN Inflation Exchange FluctuationDocument10 pagesRelationship BTWN Inflation Exchange FluctuationhajashaikNo ratings yet

- MODULE 1 - LEARNING MATERIAL Fundamentals of International FinanceDocument19 pagesMODULE 1 - LEARNING MATERIAL Fundamentals of International FinanceMICHELLE MILANANo ratings yet

- Vol22 Art2 PDFDocument21 pagesVol22 Art2 PDFIsmith PokhrelNo ratings yet

- Module 6 - Interntional Flow of FundsDocument4 pagesModule 6 - Interntional Flow of FundsMICHELLE MILANANo ratings yet

- FE Chapter 5Document43 pagesFE Chapter 5dehinnetagimasNo ratings yet

- ERP 2004 Chapter13Document14 pagesERP 2004 Chapter13ibraitsNo ratings yet

- Financial LiberalizationDocument46 pagesFinancial LiberalizationazeemNo ratings yet

- Bm318 Assignment 2Document9 pagesBm318 Assignment 2Mohd AdnanNo ratings yet

- Corporate Governance SystemDocument16 pagesCorporate Governance SystemRajib RoyNo ratings yet

- International Financial Management An OverviewDocument25 pagesInternational Financial Management An OverviewVinayrajNo ratings yet

- Financial IntegrationDocument46 pagesFinancial IntegrationSatish Babu NutakkiNo ratings yet

- Acc 414 International AccountingDocument177 pagesAcc 414 International AccountingEmmanuel AbolajiNo ratings yet

- Innovative International Financial Products & Markets & Future of International FinanceDocument25 pagesInnovative International Financial Products & Markets & Future of International FinanceJaiswar ManojNo ratings yet

- Socsci 10Document4 pagesSocsci 10Celestine MambulaoNo ratings yet

- PRELIM CW - The Global Economy3 - 2Document15 pagesPRELIM CW - The Global Economy3 - 2Xavier MacauyagNo ratings yet

- Economics of Globalization HMZDocument23 pagesEconomics of Globalization HMZMarioNo ratings yet

- ROLE OF International FINANCIAL MANAGEMENTDocument8 pagesROLE OF International FINANCIAL MANAGEMENTMihir GaurNo ratings yet

- Exam 2015 QuestionsDocument8 pagesExam 2015 QuestionsFungai MukundiwaNo ratings yet

- CFI5101201510 Financial Statement Analysis and PlanningDocument6 pagesCFI5101201510 Financial Statement Analysis and PlanningFungai MukundiwaNo ratings yet

- CFI5102201412 Advanced Corporate Financial StrategyDocument5 pagesCFI5102201412 Advanced Corporate Financial StrategyFungai MukundiwaNo ratings yet

- Attempt Four Questions, Three From Section A and One From Section B 3. Start The Solution To Each Full Question On A Fresh Page of The Answer SheetDocument3 pagesAttempt Four Questions, Three From Section A and One From Section B 3. Start The Solution To Each Full Question On A Fresh Page of The Answer SheetFungai MukundiwaNo ratings yet

- FNCE20005 Corporate Financial Decision MakingDocument12 pagesFNCE20005 Corporate Financial Decision MakingFungai MukundiwaNo ratings yet

- The Real Options Model of Land Value and Development Project ValuationDocument109 pagesThe Real Options Model of Land Value and Development Project ValuationFungai MukundiwaNo ratings yet

- Sensitivity Analysis: Methodology of Modeling DecisionsDocument18 pagesSensitivity Analysis: Methodology of Modeling DecisionsFungai MukundiwaNo ratings yet

- Financial Structure: Personal Referral Work Dr. I. BayaiDocument11 pagesFinancial Structure: Personal Referral Work Dr. I. BayaiFungai MukundiwaNo ratings yet

- Project Analysis Using Decision Trees and OptionsDocument16 pagesProject Analysis Using Decision Trees and OptionsFungai MukundiwaNo ratings yet

- Finance and Growth OverviewDocument26 pagesFinance and Growth OverviewFungai MukundiwaNo ratings yet

- Global Banking: Recent Developments & InsightsDocument37 pagesGlobal Banking: Recent Developments & InsightsFungai MukundiwaNo ratings yet

- CFI 5115 QuestionsDocument9 pagesCFI 5115 QuestionsFungai Mukundiwa0% (1)

- AmazonDocument4 pagesAmazonbonnieNo ratings yet

- Mario Erasmo (2012) - Death Antiquity and Its Legacy (Z-Library)Document194 pagesMario Erasmo (2012) - Death Antiquity and Its Legacy (Z-Library)dserranolozanoNo ratings yet

- Now Platform™: Single Data Model Multi-InstanceDocument3 pagesNow Platform™: Single Data Model Multi-InstanceMarcusViníciusNo ratings yet

- Unit 2 - BT MLH 12 - KeyDocument7 pagesUnit 2 - BT MLH 12 - KeyThao NguyenNo ratings yet

- Wealth InequalityDocument35 pagesWealth Inequalityahmad100% (1)

- No Exit by Jean Paul SatreDocument3 pagesNo Exit by Jean Paul SatretimpilahNo ratings yet

- "PROJECT K" MEETS "PROJECT A" - 2005 - The Arizona Project, Don Bolles and Bob Greene, Meets Project Klebnikov (By Richard Behar)Document15 pages"PROJECT K" MEETS "PROJECT A" - 2005 - The Arizona Project, Don Bolles and Bob Greene, Meets Project Klebnikov (By Richard Behar)Richard BeharNo ratings yet

- Loeb Classical Library Edition of Tacitus, 1925Document2 pagesLoeb Classical Library Edition of Tacitus, 1925Marco AntônioNo ratings yet

- NhaiDocument6 pagesNhairavindrarao_mNo ratings yet

- Aspire Issue 6Document41 pagesAspire Issue 6HelenNo ratings yet

- SDC Affiliation FORMDocument6 pagesSDC Affiliation FORMMrrobinNo ratings yet

- Old Exam AEDocument12 pagesOld Exam AEaaaaaNo ratings yet

- Project Horus by Anuraag RathDocument12 pagesProject Horus by Anuraag RatharNo ratings yet

- Electronic Banking ModelsDocument7 pagesElectronic Banking Modelserger88100% (1)

- Hindu Aikya Ghosha Haa Ninaadu Dyaa Digantaree - Corrected and MeaningDocument2 pagesHindu Aikya Ghosha Haa Ninaadu Dyaa Digantaree - Corrected and MeaningPiyush ShahNo ratings yet

- PDFDocument6 pagesPDFHarshada AhirraoNo ratings yet

- Inter-Semester Moot Court Competition - Luma - 1Document35 pagesInter-Semester Moot Court Competition - Luma - 1ajay upadhyayNo ratings yet

- Paul Andrew Mitchell Criminal ComplaiantDocument10 pagesPaul Andrew Mitchell Criminal Complaiantremenant2006No ratings yet

- Trial Advocacy Moot Problem ADocument47 pagesTrial Advocacy Moot Problem ALuvNo ratings yet

- List of Law FirmsDocument18 pagesList of Law FirmsReena ShauNo ratings yet

- Darden PDFDocument37 pagesDarden PDFRizal ApriyanNo ratings yet

- Webb vs. de LeonDocument22 pagesWebb vs. de LeonIyaNo ratings yet

- Complainant Vs Vs Respondent: en BancDocument6 pagesComplainant Vs Vs Respondent: en BancJinnelyn LiNo ratings yet

- 00 - King Lear AnalysisDocument11 pages00 - King Lear AnalysisViki VankaNo ratings yet

- CH 1 IntroDocument5 pagesCH 1 IntroJawad AhmadNo ratings yet

- Canadian Importers Database - HS6-620920-2021-11-20Document2 pagesCanadian Importers Database - HS6-620920-2021-11-20Nikunj SatraNo ratings yet

- XXXDocument2 pagesXXXtony alvaNo ratings yet