Professional Documents

Culture Documents

Payback Period: Keown, Martin, Petty - Chapter 9 1

Payback Period: Keown, Martin, Petty - Chapter 9 1

Uploaded by

Yvonne Marie Davila0 ratings0% found this document useful (0 votes)

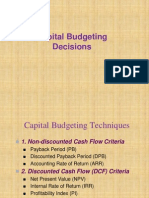

108 views8 pagesThe document defines payback period as the number of years needed to recover the initial cash outlay of a capital budgeting project. It provides an example of a project with an initial cash outlay of $16,000 and cash flows over 5 years, calculating the payback period as 3.2 years. It also provides an example of calculating net present value (NPV) for a project with an initial cash outlay of $60,000 and cash flows over 5 years at a required rate of return of 15%, resulting in a positive NPV of $764.

Original Description:

Original Title

Slides Capital Budgeting - Part 25

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document defines payback period as the number of years needed to recover the initial cash outlay of a capital budgeting project. It provides an example of a project with an initial cash outlay of $16,000 and cash flows over 5 years, calculating the payback period as 3.2 years. It also provides an example of calculating net present value (NPV) for a project with an initial cash outlay of $60,000 and cash flows over 5 years at a required rate of return of 15%, resulting in a positive NPV of $764.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

108 views8 pagesPayback Period: Keown, Martin, Petty - Chapter 9 1

Payback Period: Keown, Martin, Petty - Chapter 9 1

Uploaded by

Yvonne Marie DavilaThe document defines payback period as the number of years needed to recover the initial cash outlay of a capital budgeting project. It provides an example of a project with an initial cash outlay of $16,000 and cash flows over 5 years, calculating the payback period as 3.2 years. It also provides an example of calculating net present value (NPV) for a project with an initial cash outlay of $60,000 and cash flows over 5 years at a required rate of return of 15%, resulting in a positive NPV of $764.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 8

Payback Period

Number of years needed to recover the initial

cash outlay of a capital-budgeting project

Decision Rule: Project feasible or desirable if

the payback period is less than or equal to the

firm’s maximum desired payback period.

Keown, Martin, Petty - Chapter 9 1

Payback Period Example

Example: Project with an initial cash outlay of $16,000

with following free cash flows for 5 years.

YEAR CASH FLOW ACCUM.CASH

FLOWS

1 $ 8,000 $8,000

2 4,000 12,000

3 3,000 15,000

4 5,000 20,000

5 10,000

Payback = 3years + (16,000-15,000) / 5,000

= 3.2 years

Keown, Martin, Petty - Chapter 9 2

NPV Example

Example: Project with an initial cash outlay of $60,000

with following free cash flows for 5 years.

Yr FCF Yr FCF

Initial outlay -60,000 3 13,000

1 25,000 4 12,000

2 24,000 5 11,000

The firm has a 15% required rate of return.

Keown, Martin, Petty - Chapter 9 3

NPV in Excel

Input cash flows for initial outlay and

inflows in cells A1 to A6

In cell A7 type the following formula:

=A1+npv(.15,a2:a6)

Excel will give the NPV = $764

Keown, Martin, Petty - Chapter 9 4

Internal Rate of Return or IRR

IRR is the discount rate that equates the

present value of a project’s future net

cash flows with the project’s initial cash

outlay

Decision Rule:

If IRR > Required rate of return, accept

IF IRR < Required rate of return, reject

Keown, Martin, Petty - Chapter 9 5

IRR and NPV

If NPV is positive, IRR will be greater

than the required rate of return

If NPV is negative, IRR will be less than

required rate of return

If NPV = 0, IRR is the required rate of

return.

Keown, Martin, Petty - Chapter 9 6

IRR Example

Initial Outlay: $3,817

Cash flows:

Yr.1=$1,000, Yr. 2=$2,000, Yr. 3=$3,000

Discount rate NPV

15% $4,356

20% $3,958

22% $3,817

IRR is 22% because the NPV equals the initial

cash outlay

Keown, Martin, Petty - Chapter 9 7

IRR in Excel

Input cash flows for initial outlay and

inflows in cells A1 to A4

In cell A5 type the following formula:

=IRR(A1:A4)

Excel will give the IRR = 22%

Keown, Martin, Petty - Chapter 9 8

You might also like

- Chapter 1. Introduction To FIMDocument55 pagesChapter 1. Introduction To FIMHiếu Nhi TrịnhNo ratings yet

- Introduction To Managerial AccountingDocument19 pagesIntroduction To Managerial Accountingdubbs21100% (2)

- Intraday Trading Tips and Tricks - Part 2Document6 pagesIntraday Trading Tips and Tricks - Part 2Chandramouli Konduru100% (1)

- Chapter 26Document26 pagesChapter 26sumesh1980No ratings yet

- 4-Capital Budgeting TechniquesDocument20 pages4-Capital Budgeting TechniquesnoortiaNo ratings yet

- Power Point MF ch.9Document65 pagesPower Point MF ch.9Mariam HashimNo ratings yet

- Chapter 10Document22 pagesChapter 10danishamir086No ratings yet

- Capital RationingDocument24 pagesCapital RationingKhalid MahmoodNo ratings yet

- FCF 9th Edition Chapter 09Document43 pagesFCF 9th Edition Chapter 09AlmayayaNo ratings yet

- Ec 12Document27 pagesEc 12RAJA FAHEEMNo ratings yet

- Chap 025Document42 pagesChap 025Eslam SamyNo ratings yet

- Error CDocument20 pagesError CkleeNo ratings yet

- Lecture 5 502 Example SolutionsDocument9 pagesLecture 5 502 Example SolutionsJohn SmithNo ratings yet

- Investment Decision CriteriaDocument71 pagesInvestment Decision CriteriaBitu GuptaNo ratings yet

- Chapter 10 SolutionsDocument21 pagesChapter 10 SolutionsFranco Ambunan Regino75% (8)

- Problem Set4 Ch09 and Ch10-SolutionsDocument6 pagesProblem Set4 Ch09 and Ch10-SolutionszainebkhanNo ratings yet

- Chapter 9 PDFDocument29 pagesChapter 9 PDFYhunie Nhita Itha50% (2)

- Chapter 10 SolutionsDocument9 pagesChapter 10 Solutionsaroddddd23No ratings yet

- Ghana Technology University College/Anhalt University Corporate Finance and InvestmentDocument39 pagesGhana Technology University College/Anhalt University Corporate Finance and InvestmentSeth BrakoNo ratings yet

- New Microsoft Word DocumentDocument10 pagesNew Microsoft Word DocumentMashud RiadNo ratings yet

- Investment Appraisal TechniquesDocument14 pagesInvestment Appraisal TechniquesIan MutukuNo ratings yet

- Review For Midterm (Project Mana) 102021Document37 pagesReview For Midterm (Project Mana) 102021Tam MinhNo ratings yet

- Project Budgeting TechniqueDocument15 pagesProject Budgeting Techniquesshahriar2001No ratings yet

- Solutions: First Group Moeller-Corporate FinanceDocument13 pagesSolutions: First Group Moeller-Corporate Financelefteris82No ratings yet

- Solutions: First Group Moeller-Corporate FinanceDocument13 pagesSolutions: First Group Moeller-Corporate FinancejwbkunNo ratings yet

- Capital BudgetingDocument7 pagesCapital BudgetingKazi Abdullah Susam0% (1)

- Additional Topic 6-Capital RationingDocument25 pagesAdditional Topic 6-Capital RationingJon Loh Soon WengNo ratings yet

- Ventura, Mary Mickaella R - Chapter9 (No.4,5,7,8,9,10,16)Document4 pagesVentura, Mary Mickaella R - Chapter9 (No.4,5,7,8,9,10,16)Mary VenturaNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingMahedi HasanNo ratings yet

- Corporate Finance Tutorial 3 - SolutionsDocument16 pagesCorporate Finance Tutorial 3 - Solutionsandy033003No ratings yet

- CHAPTER 17 - AnswerDocument7 pagesCHAPTER 17 - AnswerKlare HayeNo ratings yet

- Powerpoint MasDocument25 pagesPowerpoint MasMatthew TiuNo ratings yet

- EEF - Capital Budgeting - 2020-21Document31 pagesEEF - Capital Budgeting - 2020-21salkr30720No ratings yet

- Net Present Value and Capital Budgeting: Only Cash Flow Is RelevantDocument20 pagesNet Present Value and Capital Budgeting: Only Cash Flow Is RelevantadextNo ratings yet

- Answers To Warm-Up Exercises: AnswerDocument21 pagesAnswers To Warm-Up Exercises: AnswerMeyzla Ativa HuslikNo ratings yet

- Business Case AnalysissampleDocument7 pagesBusiness Case AnalysissamplenowhorezNo ratings yet

- Chapter Four: Project SelectionDocument50 pagesChapter Four: Project SelectionNeway Alem100% (1)

- FIN5FMA Tutorial 4 SolutionsDocument5 pagesFIN5FMA Tutorial 4 SolutionsMaruko ChanNo ratings yet

- Principles of Finance Work BookDocument53 pagesPrinciples of Finance Work BookNicole MartinezNo ratings yet

- Investment Appraisal - MethodsDocument6 pagesInvestment Appraisal - MethodsTawanda BlackwatchNo ratings yet

- Chapter 5 SummaryDocument24 pagesChapter 5 SummaryDY CMM GRCNo ratings yet

- Investment DecDocument29 pagesInvestment DecSajal BasuNo ratings yet

- Capital Budgeting TechniquesDocument57 pagesCapital Budgeting TechniquesAlethea DsNo ratings yet

- Corporate Finance 3Document6 pagesCorporate Finance 3Zahid HasanNo ratings yet

- Chapter 4 Investment Appraisal Methods 2Document62 pagesChapter 4 Investment Appraisal Methods 2JesterdanceNo ratings yet

- Capital Budgeting: FIN 502: Managerial FinanceDocument35 pagesCapital Budgeting: FIN 502: Managerial Financekazimshahgee100% (5)

- Capital Budgeting DecisionsDocument44 pagesCapital Budgeting Decisionsarunadhana2004No ratings yet

- Capital BudgetingDocument5 pagesCapital Budgetingshafiqul84No ratings yet

- Chapter 6 Net Present ValueDocument20 pagesChapter 6 Net Present ValueAhmed AlfaitoryNo ratings yet

- Capital BudgetingDocument18 pagesCapital BudgetingRamesh KalwaniyaNo ratings yet

- ACTIVITY 5 CBE Module 4Document5 pagesACTIVITY 5 CBE Module 4Christian John Resabal BiolNo ratings yet

- Investment Appraisal Techniques 2Document24 pagesInvestment Appraisal Techniques 2Jul 480wesh100% (1)

- Capital Budgeting TechniquesDocument48 pagesCapital Budgeting TechniquesMuslimNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!From EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!No ratings yet

- Slides Capital Budgeting5Document60 pagesSlides Capital Budgeting5Yvonne Marie DavilaNo ratings yet

- Module 5 Packet: AE 19 - Financial ManagementDocument13 pagesModule 5 Packet: AE 19 - Financial ManagementYvonne Marie DavilaNo ratings yet

- 11 MODULE 4 For AE 19Document14 pages11 MODULE 4 For AE 19Yvonne Marie DavilaNo ratings yet

- 11 MODULE 3 For AE 19Document26 pages11 MODULE 3 For AE 19Yvonne Marie DavilaNo ratings yet

- Arañez Accounting Advance Partnership: Formation Problem 3Document3 pagesArañez Accounting Advance Partnership: Formation Problem 3Cyra JimenezNo ratings yet

- Postgraduate PG - Mcom - Semester 1 - 2018 - December - Cost and Management Accounting CbcgsDocument4 pagesPostgraduate PG - Mcom - Semester 1 - 2018 - December - Cost and Management Accounting CbcgshareshNo ratings yet

- Attachment Summary - Cash Flow Statement PDFDocument5 pagesAttachment Summary - Cash Flow Statement PDFUnmesh MitraNo ratings yet

- GMMpaperDocument13 pagesGMMpaperCardoso PenhaNo ratings yet

- Ratio Analysis of Banking Reports (HBL, UBL, MCB Etc)Document42 pagesRatio Analysis of Banking Reports (HBL, UBL, MCB Etc)Fahad Khan80% (20)

- Cambridge O Level: 7115/12 Business StudiesDocument12 pagesCambridge O Level: 7115/12 Business Studiesnajla nistharNo ratings yet

- Topic 2 Interim Financial ReportingDocument78 pagesTopic 2 Interim Financial ReportingAaron MañacapNo ratings yet

- Bakiao Ba120 Case StudyDocument3 pagesBakiao Ba120 Case StudyFLORY VIC LIWACAT BAKIAONo ratings yet

- Accounting For Special Transactions - (Problems)Document44 pagesAccounting For Special Transactions - (Problems)Liz RegaladoNo ratings yet

- Intro Financial Management PresentationDocument17 pagesIntro Financial Management PresentationSoothing BlendNo ratings yet

- Millennium Global: Acquisition of Cebu Canning CorpDocument4 pagesMillennium Global: Acquisition of Cebu Canning CorpBusinessWorldNo ratings yet

- Valuation of GoodwillDocument16 pagesValuation of GoodwillManas Maheshwari100% (1)

- (Template) Updates in Financial Reporting StandardsDocument8 pages(Template) Updates in Financial Reporting StandardsRocel Avery SacroNo ratings yet

- Financial Ratio Analyses and Their Implications To ManagementDocument46 pagesFinancial Ratio Analyses and Their Implications To ManagementPrinsesa EsguerraNo ratings yet

- The Statement of Profit or Loss and Other Comprehensive IncomeDocument6 pagesThe Statement of Profit or Loss and Other Comprehensive IncomePam CayabyabNo ratings yet

- Required:: (Do Not Round Your Intermediate Calculations.)Document8 pagesRequired:: (Do Not Round Your Intermediate Calculations.)My Vo KieuNo ratings yet

- BK7101 - Kingston UniversityDocument14 pagesBK7101 - Kingston UniversityDivya JoshiNo ratings yet

- Profit Sheet Illuminati Arun Bhatt 2021-22 2Document94 pagesProfit Sheet Illuminati Arun Bhatt 2021-22 2Karan singhNo ratings yet

- Chapter 8 For StudentDocument33 pagesChapter 8 For StudentKhánh Đoan NgôNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Gita ThoughtsNo ratings yet

- Final Research PaperDocument8 pagesFinal Research Paperapi-291512694No ratings yet

- Screenshot 2023-08-27 at 11.56.55 AMDocument34 pagesScreenshot 2023-08-27 at 11.56.55 AMShajid HassanNo ratings yet

- Afn 2 PDFDocument5 pagesAfn 2 PDFLovely Ann ReyesNo ratings yet

- CH 4 - Business ModelDocument3 pagesCH 4 - Business ModelShivani ShahNo ratings yet

- Buffett Klarman and Grahm On MR Market PDFDocument9 pagesBuffett Klarman and Grahm On MR Market PDFJohn Hadriano Mellon FundNo ratings yet

- Into To Treasury & Risk Management - FinalDocument21 pagesInto To Treasury & Risk Management - FinalGaurav AgrawalNo ratings yet

- Technical AnalysisDocument97 pagesTechnical AnalysisMasoom Tekwani100% (1)

- (John Tuld) : Professional ExperienceDocument2 pages(John Tuld) : Professional Experienceدولت ابد مدت Devlet-i Aliyye-i OsmâniyyeNo ratings yet