Professional Documents

Culture Documents

CHAPTER 5 Intermediate Acctng

CHAPTER 5 Intermediate Acctng

Uploaded by

Tessang Onongen0 ratings0% found this document useful (0 votes)

15 views46 pagesThe document discusses two-date bank reconciliation, which involves reconciling a bank account as of two different dates. It explains that the procedures are the same as a one-date reconciliation if all the necessary data is available. If data is missing, formulas are provided to calculate the beginning and ending book balances, bank balances, deposits in transit, and outstanding checks for the reconciliation of both dates. An illustrative example is also provided to demonstrate how to apply the formulas.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses two-date bank reconciliation, which involves reconciling a bank account as of two different dates. It explains that the procedures are the same as a one-date reconciliation if all the necessary data is available. If data is missing, formulas are provided to calculate the beginning and ending book balances, bank balances, deposits in transit, and outstanding checks for the reconciliation of both dates. An illustrative example is also provided to demonstrate how to apply the formulas.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

15 views46 pagesCHAPTER 5 Intermediate Acctng

CHAPTER 5 Intermediate Acctng

Uploaded by

Tessang OnongenThe document discusses two-date bank reconciliation, which involves reconciling a bank account as of two different dates. It explains that the procedures are the same as a one-date reconciliation if all the necessary data is available. If data is missing, formulas are provided to calculate the beginning and ending book balances, bank balances, deposits in transit, and outstanding checks for the reconciliation of both dates. An illustrative example is also provided to demonstrate how to apply the formulas.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 46

CHAPTER 10

PROOF OF CASH

Ninia C. Pauig-Lumauan, MBA, CPA

1st Semester 2020-2021

Lyceum of Aparri

Intermediate Accounting Part 1

TWO DATE BANK RECONCILIATION

• The bank reconciliation is so called “two

date” because it literally involves two dates.

• The procedures followed for a one-date

reconciliation are the same for a two-date

reconciliation.

• A two date reconciliation becomes

complicated only when certain facts or data

are omitted, hence, the necessity for

computing them.

Intermediate Accounting Part 1

TWO DATE BANK RECONCILIATION

• But if all the facts are available, then

reconciliation statements will simply be

prepared as of the two dates required.

• Among others, the omitted information

may be any one or a combination of the

following:

a. Book Balance Beginning and Ending

b. Bank Balance Beginning and Ending

c. Deposits in Transit Beginning and Ending

d. Outstanding Checks Beginning and Ending

Intermediate Accounting Part 1

TWO DATE BANK RECONCILIATION

• If the ending balances are not given, the

following formulas may help.

• If beginning balances are omitted, the

formulas should simply be reversed or just

work back.

COMPUTATION OF BOOK BALANCE

Balance Per Book, Beginning of the month xxx

Add: Book debits during the month xxx

Total xxx

Less: Book credits during the month xxx

Balance Per Book, End of Month xxx

Intermediate Accounting Part 1

TWO DATE BANK RECONCILIATION

• Book debits refer to cash receipts or all

items debited to the cash in bank

account.

• Book credits refer to cash disbursements

or all items credited to the cash in bank

account.

• In a T-Account Form, the cash in bank may

CASH IN BANK

appear as

Balance – beginning

follows:xxx Book Credits xxx

Book debits xxx Balance - Ending xxx

Intermediate Accounting Part 1

TWO DATE BANK RECONCILIATION

COMPUTATION OF BANK BALANCE

Balance Per Bank, Beginning of the month xxx

Add: Bank credits during the month xxx

Total xxx

Less: Bank debits during the month xxx

Balance Per Bank, End of Month xxx

• Bank credits refer to all items credited to the

account of the depositor which include deposits

acknowledged by the bank and credit memos.

In the absence of any statement to the

contrary, bank credits are assumed to be

deposits acknowledged by the bank.

Intermediate Accounting Part 1

TWO DATE BANK RECONCILIATION

• Bank debits refer to all items debited to the

account of the depositor which include checks

paid by the bank and debit memos.

In the absence of any statement to the

contrary, bank debits are assumed to be

checks paid by the bank.

• In a T-Account Form, the cash in bank may

appear as follows:

COMPANY X

Bank debits xxx Balance – Beginning xxx

Balance, ending xxx Bank Credits xxx

Intermediate Accounting Part 1

TWO DATE BANK RECONCILIATION

COMPUTATION OF DEPOSITS IN TRANSIT

Deposits in Transit-beginning of month xxx

Add: Cash receipts deposited during the month xxx

Total deposits acknowledged by the bank xxx

Less: Deposits acknowledged by bank during month xxx

Deposits in Transit-End of Month xxx

COMPUTATION OF OUTSTANDING CHECKS

Outstanding Checks – Beginning of month xxx

Add: Checks drawn by depositor during the month xxx

Total Checks paid by bank xxx

Less: Checks paid by bank during the month xxx

Outstanding Checks – End of Month xxx

Intermediate Accounting Part 1

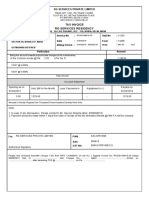

ILLUSTRATIVE EXAMPLE

CASH IN BANK PER LEDGER

Balance, January 31 50,000

Book debits for February, including January CM for note

collected of P 15,000. 200,000

Book credits for February, including NSF check of P 5,000 and

service charge of P 1,000 for January 180,000

BANK STATEMENT FOR FEBRUARY

Balance, January 31 84,000

Bank credits for February, including CM for note collected of

P 20,000 and January deposit in transit of P 40,000 170,000

Bank debits for February, including NSF check of P 10,000 and

January outstanding check of P 65,000 130,000

Intermediate Accounting Part 1

ILLUSTRATIVE EXAMPLE

• The bank reconciliation for the month of January

can easily be prepared because all the necessary

data are available:

Balance Per Book, January 31 50,000

Add: Note collected by bank in January 15,000

Total 65,000

Less: NSF Check for January -5,000

Service Charge for January -1,000 -6,000

Adjusted Book Balance 59,000

vvvvvvv

Balance Per Bank, January 31 84,000

Add: Deposit in Transit for January 40,000

Total 124,000

Less: Outstanding Checks for January -65,000

Adjusted Bank Balance 59,000

vvvvvvv

Intermediate Accounting Part 1

ILLUSTRATIVE EXAMPLE

• The bank reconciliation for the month of

February requires computation of balance

per book, balance per bank, deposits in

transit and outstanding checks.

COMPUTATION OF BOOK BALANCE

Balance per book, January 31 50,000

Add: Book debits during February 200,000

Total 250,000

Less: Book credits during February 180,000

Balance Per Book, February 28 70,000

vvvvvv

Intermediate Accounting Part 1

ILLUSTRATIVE EXAMPLE

COMPUTATION OF BANK BALANCE

Balance per bank, January 31 84,000

Add: Bank credits during February 170,000

Total 254,000

Less: Bank debits during February 130,000

Balance Per Bank, February 28 124,000

vvvvvvv

Intermediate Accounting Part 1

ILLUSTRATIVE EXAMPLE

COMPUTATION OF DEPOSITS IN TRANSIT

Deposits in transit, January 31 40,000

Add: Cash receipts deposited during February:

Book debits 200,000

Less: January CM for note collected 15,000 185,000

Total 225,000

Less: Deposits acknowledge by Bank in February:

Bank Credits 170,000

Less: February CM for note collected 20,000 150,000

Deposits in transit, February 28 75,000

vvvvvv

•The January CM of P 15,000 is deducted from the

book debits of P 200,000 because this item is a

cash receipt not representing deposit for the

month of February. Intermediate Accounting Part 1

ILLUSTRATIVE EXAMPLE

• All items debited to the cash in bank account

which do not represent deposits should be

deducted from the book debits total to arrive

at the cash receipts deposited.

• In the absence of any statement to the

contrary, book debits are assumed to be cash

receipts deposited.

• The February CM of P 20,000 for note

collected is deducted from the bank credits

because this is not a deposit.

Intermediate Accounting Part 1

ILLUSTRATIVE EXAMPLE

• All items credited to the depositor’s

account which do not represent deposits

should be deducted from the bank credits

to determine the deposits acknowledged

by bank.

• Bank credits are assumed to be deposits

acknowledged by bank in the absence of

any statement to the contrary.

Intermediate Accounting Part 1

ILLUSTRATIVE EXAMPLE

COMPUTATION OF OUTSTANDING CHECKS

Outstanding Checks, January 31 65,000

Add: Checks drawn by depositor during February:

Book credits 180,000

Less: January DMs 6,000 174,000

Total 239,000

Less: Checks paid by Bank during February:

Bank Debits 130,000

Less: February NSF 10,000 120,000

Outstanding Checks, February 28 119,000

vvvvvvv

•The January DMs of P 6,000 is deducted from the

book credits, because they are cash disbursements

not representing checks.

Intermediate Accounting Part 1

ILLUSTRATIVE EXAMPLE

• All items not representing checks credited to the

cash in bank account which do not represent

deposits should be deducted from the book

credits total to arrive at the checks drawn by the

depositor.

• But as a rule, all book credits in the absence of

any statement to the contrary are assumed to be

checks issued.

• The February DM for NSF of P 10,000 is deducted

from the bank debits because this is not a bank

disbursement representing a check paid.

Intermediate Accounting Part 1

ILLUSTRATIVE EXAMPLE

• All items debited to the account of the

depositor not representing checks paid

should be deducted from the bank debits

total to arrive at the checks paid by the

bank.

• But as a rule, all bank debits in the

absence of any statement to the contrary

are assumed to be checks paid by the

bank.

Intermediate Accounting Part 1

ILLUSTRATIVE EXAMPLE

COMPANY X

BANK RECONCILIATION

February 28

Balance Per Book 70,000

Add: Note Collected by bank in February 20,000

Total 90,000

Less: NSF Check for February -10,000

Adjusted Book Balance 80,000

vvvvvv

Balance Per Bank 124,000

Add: Deposits in transit for February 75,000

Total 199,000

Less: Outstanding Checks for February -119,000

Adjusted Bank Balance 80,000

vvvvvv

Intermediate Accounting Part 1

PROOF OF CASH

• A proof of cash is an expanded

reconciliation in that it includes proof of

receipts and disbursements.

• This approach may be useful in

discovering possible discrepancies in

handling cash particularly when cash

receipts have been recorded but have

not been deposited.

Intermediate Accounting Part 1

PROOF OF CASH

• There are three forms of proof of cash,

namely:

a. Adjusted balance method

b. Book to bank method

c. Bank to book method

• In all the three forms, a 4 - column

worksheet is necessary, although under

the adjusted balance method, an 8 -

column worksheet maybe required.

Intermediate Accounting Part 1

ILLUSTRATIVE EXAMPLE

• For our illustration, let us summarize the

dataSUMMARY

used in the two-date reconciliation.

January 31 February 28

Balance per book 50,000 70,000

Balance per bank 84,000 124,000

Book debits 200,000

Book credits 180,000

Bank debits 130,000

Bank credits 170,000

Deposits in Transit 40,000 75,000

Outstanding Checks 65,000 119,000

NSF Check 5,000 10,000

Service Charge 1,000 -

Note collected by bank 15,000 20,000

Intermediate Accounting Part 1

GENERAL COMMENTS

• The book debits and credits and the bank

debits and credits for January are not

listed anymore because they are not

necessary. The proof of cash pertains to

the receipts and disbursements for the

current month of February.

a. The January 31 and February 28

columns require further explanation.

They represent the usual reconciliations

discussed earlier.

Intermediate Accounting Part 1

GENERAL COMMENTS

b. The receipts and disbursements columns

pertain to the current month of February.

Actually, the proof of cash is a reconciliation

of the receipts and disbursements for the

current period.

c. The proof of cash, following the adjusted

balance method, means that the book receipts

and disbursements, and the bank receipts and

disbursements for the current month are

adjusted to equal the correct receipts and

disbursements for the current month.

Intermediate Accounting Part 1

ADJUSTED BALANCE METHOD

COMPANY X

PROOF OF CASH

For the month of February

January 31 Receipts Disbursements February 28

Balance Per Book 50,000 200,000 180,000 70,000

Note Collected:

January 15,000 -15,000

February 20,000 20,000

NSF Check:

January -5,000 -5,000

February 10,000 -10,000

Service Charge:

January -1,000 -1,000

Adjusted Book Balance 59,000 205,000 184,000 80,000

vvvvvv vvvvvvv vvvvvvv vvvvvv

Intermediate Accounting Part 1

ADJUSTED BALANCE METHOD

COMPANY X

PROOF OF CASH

For the month of February

January 31 Receipts Disbursements February

28

Balance Per Bank 84,000 170,000 130,000 124,000

Deposits in Transit:

January 40,000 -40,000

February 75,000 75,000

Outstanding Checks:

January -65,000 -65,000

February 119,000 -119,000

Adjusted Book 59,000 205,000 184,000 80,000

Balance vvvvvv vvvvvvv vvvvvvv vvvvvv

Intermediate Accounting Part 1

COMMENTS ON THE BOOK ITEMS

a. Credit memos of the previous month do not affect

the bank receipts for the current month but

increased the book receipts for the current month,

because the credit memos for the previous month

are recorded only by the depositor during the

current month.

Consequently, the book receipts for the current

month are overstated in relation to the correct

receipts for the current month. Hence, the credit

memos of the previous month are deducted from

the book receipts for the current month. Thus, the

January note collected amounting to P 15,000 is

deducted from theIntermediate

February book receipts.

Accounting Part 1

COMMENTS ON THE BOOK ITEMS

b. Credit memos of the current month already

increased the bank receipts for the current month

but have no effect on the book receipts for the

current month because the credit memos of the

current month are not yet recorded by the depositor

during the current month.

Consequently, the book receipts for the current

month are understated in relation to the correct

receipts for the current month. Hence, credit memos

of the current month are added to the book receipts

for the current month. Thus, the February note

collected, amounting to P 20,000 is added to the

February book receipts.

Intermediate Accounting Part 1

COMMENTS ON THE BOOK ITEMS

c. Debit memos of the previous month do not affect the

bank disbursements for the current month but increased

the book disbursements for the current month, because

the debit memos for the previous month are recorded

only by the depositor during the current month.

Consequently, the book disbursements for the current

month are overstated in relation to the correct

disbursements for the current month. Hence, the debit

memos of the previous month are deducted from the

book disbursements for the current month. Thus, the

January NSF of P 5,000 and January service charge of P

1,000 are deducted from the February book

disbursements.

Intermediate Accounting Part 1

COMMENTS ON THE BOOK ITEMS

d. Debit memos of the current month already increased

bank disbursements for the current month but have

no effect on the book disbursements for the current

month because the debit memos of the current

month are not yet recorded by the depositor.

Consequently, the book disbursements for the

current month are understated in relation to the

correct disbursements for the current month. Hence,

debit memos of the current month are added to the

book disbursements for the current month. Thus,

the February NSF of P 10,000 is added to the

February book disbursements.

Intermediate Accounting Part 1

COMMENTS ON THE BANK ITEMS

a. Deposits in transit of previous month do not

affect book receipts for the current month but

increased bank receipts for the current month

because the deposits are recorded only by the

bank during the current month.

Consequently, bank deposits for the current

month are overstated in relation to the correct

receipts for the current month. Hence, deposits

in transit of the previous month are deducted

from the bank receipts for the current month.

Thus, January deposit in transit of P 40,000 is

deducted from the February bank receipts.

Intermediate Accounting Part 1

COMMENTS ON THE BANK ITEMS

b. Deposits in transit of the current month already

increased book receipts but have no effect on the

bank receipts for the current month because the

deposits are not yet recorded by the bank during

the current month.

Consequently, the bank receipts for the current

month are understated in relation to the correct

receipts for the current month. Hence, deposits

in transit of the current month are added to the

bank receipts of the current month. Thus, the

February deposit in transit of P 75,000 is added to

the February bank receipts.

Intermediate Accounting Part 1

COMMENTS ON THE BANK ITEMS

c. Outstanding checks of the previous month do not

affect book disbursements but increased the bank

disbursements for the current month because the

outstanding checks of the previous month are paid

only by the bank during the current month.

Consequently, bank disbursements for the current

month are overstated in relation to the correct

disbursements for the current month. Hence,

outstanding checks of the previous month are

deducted from the bank disbursements for the

current month. Thus, January outstanding check of

P 65,000 is deducted from the February bank

disbursements.

Intermediate Accounting Part 1

COMMENTS ON THE BANK ITEMS

d. Outstanding checks of the current month increased

book disbursements for the current month but

have no effect on the bank disbursements for the

current month because the checks are not yet paid

by the bank during the current month.

Consequently, the bank disbursements for the

current month are understated in relation to the

correct disbursements for the current month.

Hence, outstanding checks of the current month

are added to the bank disbursements for the

current month. Thus, the February outstanding

check of P 119,000 is added to the February bank

disbursements. Intermediate Accounting Part 1

BOOK TO BANK METHOD

COMPANY X

PROOF OF CASH

For the month of February

January 31 Receipts Disbursements February 28

Balance Per Book 50,000 200,000 180,000 70,000

Note Collected:

January 15,000 -15,000

February 20,000 20,000

NSF Check:

January -5,000 -5,000

February 10,000 -10,000

Service Charge:

January -1,000 -1,000

Deposits in Transit:

January -40,000 40,000

February -75,000 -75,000

Outstanding Checks:

January 65,000 65,000

February -119,000 119,000

Balance Per Bank 84,000 170,000 130,000 124,000

vvvvvv vvvvvvv vvvvvvv vvvvvvv

Intermediate Accounting Part 1

COMMENTS

a. The book reconciling items – note collected,

NSF, and service charge are treated in the

same manner following the adjusted balance

method.

b. The bank reconciling items – deposit in

transit and outstanding check are treated in

the “reverse”.

c. The book to bank proof of cash means that

the book receipts and disbursements are

adjusted to equal the bank receipts and

disbursements.

Intermediate Accounting Part 1

COMMENTS

d. Deposits in transit of previous month do not

affect the book receipts for the current month

but increased the bank receipts for the current

month.

Consequently, the book receipts for the current

month are understated in relation to the bank

receipts for the current month. Hence, deposits

in transit of the previous month are added to

the book receipts for the current month. Thus,

the January deposit in transit of P 40,000 is

added to the February book receipts.

Intermediate Accounting Part 1

COMMENTS

e. Deposits in transit of the current month

increased the book receipts for the current

month but have no effect on the bank receipts

for the current month. Consequently, the

book receipts for the current month are

overstated in relation to the bank receipts for

the current month. Hence, deposits in transit

of the current month are deducted from the

book receipts for the current month. Thus,

the February deposit in transit of P 75,000 is

deducted from the February book receipts.

Intermediate Accounting Part 1

COMMENTS

f. Outstanding checks of the previous month do not

affect the book disbursements for the current

month but increased the bank disbursements for

the current month. Consequently, the book

disbursements for the current month are

understated in relation to the bank

disbursements for the current month. Hence,

outstanding checks of the previous month are

added to the book disbursements for the current

month. Thus, the January outstanding check of P

65,000 is added to the February book

disbursements.

Intermediate Accounting Part 1

COMMENTS

g. Outstanding checks of the current month

increased the book disbursements for the current

month but have no effect yet on the bank

disbursements for the current month.

Consequently, the book disbursements for the

current month are overstated in relation to the

bank disbursements for the current month.

Hence, outstanding checks of the current month

are deducted from the book disbursements for

the current month. Thus, the February

outstanding check of P 119,000 is deducted from

the February book disbursements.

Intermediate Accounting Part 1

BANK TO BOOK METHOD

COMPANY X

PROOF OF CASH

For the month of February

January 31 Receipts Disbursements February 28

Balance Per Bank 84,000 170,000 130,000 124,000

Deposits in Transit:

January 40,000 -40,000

February 75,000 75,000

Outstanding Checks:

January -65,000 -65,000

February 119,000 -119,000

Note Collected:

January -15,000 15,000

February -20,000 -20,000

NSF Check:

January 5,000 5,000

February -10,000 10,000

Service Charge:

January 1,000 1,000

Balance Per Bank 50,000 200,000 180,000 70,000

vvvvvv vvvvvvv vvvvvvv vvvvvv

Intermediate Accounting Part 1

COMMENTS

a. The bank reconciling items – deposit in transit

and outstanding check are treated in the same

manner following the adjusted balance

method.

b. The book reconciling items – note collected,

NSF, and service charge are treated in the

“reverse”.

c. The bank to book proof of cash means that

the receipts and disbursements for the current

month are adjusted to equal the book receipts

and disbursements for the current month.

Intermediate Accounting Part 1

COMMENTS

d. Credit memos of previous month do not

affect the bank receipts for the current

month but increased the book receipts for

the current month. Consequently, the bank

receipts for the current month are

understated in relation to the book receipts

for the current month. Hence, the credit

memos of the previous month are added to

the bank receipts for the current month.

Thus, the January note collected of P15,000

is added to the February bank receipts.

Intermediate Accounting Part 1

COMMENTS

e. Credit memos of the current month increased

the bank receipts for the current month but

have no effect yet on the book receipts for the

current month. Consequently, the bank

receipts of the current month are overstated

in relation to the book receipts of the current

month. Hence, the credit memos of the

current month are deducted from the bank

receipts for the current month. Thus, the

February note collected of P 20,000 is

deducted from the February bank receipts.

Intermediate Accounting Part 1

COMMENTS

f. Debit memos of previous month do not affect

the bank disbursements for the current month

but increased the book disbursements for the

current month. Consequently, the bank

disbursements for the current month are

understated in relation to the book

disbursements for the current month. Hence,

the debit memos of previous month are added

to the bank disbursements for the current

month. Thus, the January NSF of P 5,000 and the

January service charge of P 1,000 are added to

the February bank disbursements.

Intermediate Accounting Part 1

COMMENTS

g. Debit memos of current month increased the

bank disbursements for the current month but

have no effect yet on the book disbursements

for the current month. Consequently, the bank

disbursements for the current month are

overstated in relation to the book

disbursements for the current month. Hence,

the debit memos of current month are

deducted from the bank disbursements for the

current month. Thus, the February NSF of P

10,000 is deducted from the February bank

disbursements for the current month.

Intermediate Accounting Part 1

You might also like

- Solving Problem. LearningsDocument6 pagesSolving Problem. LearningsTessang OnongenNo ratings yet

- Cash and Cash EquivalentsDocument28 pagesCash and Cash EquivalentsGlaiza GiganteNo ratings yet

- Garments Sector in Bangladesh Past, Present & FutureDocument21 pagesGarments Sector in Bangladesh Past, Present & Futuretaijulshadin100% (2)

- Kitkat Nestle Palm Oil Crisis ManagementDocument16 pagesKitkat Nestle Palm Oil Crisis ManagementVăn NhânnNo ratings yet

- Non State RegionalismDocument10 pagesNon State RegionalismAllen Torio100% (4)

- LearnEnglish Reading B2 The Sharing Economy PDFDocument4 pagesLearnEnglish Reading B2 The Sharing Economy PDFKhaled MohmedNo ratings yet

- Review of Related LiteratureDocument7 pagesReview of Related LiteratureRhoxette Pedroza81% (27)

- IDC: Predictive Analytics and ROIDocument10 pagesIDC: Predictive Analytics and ROIAmrit SharmaNo ratings yet

- Implementing Iso 9001 2008 in The Construction Industry PDFDocument4 pagesImplementing Iso 9001 2008 in The Construction Industry PDFjbjuanzonNo ratings yet

- Week - 5 Proof of Cash FinalDocument26 pagesWeek - 5 Proof of Cash FinalChengg JainarNo ratings yet

- Proof of Cash: Two-Date Bank ReconcilationDocument8 pagesProof of Cash: Two-Date Bank ReconcilationKarlo D. ReclaNo ratings yet

- Lecture No.3 Proof of CashDocument2 pagesLecture No.3 Proof of Cashdelrosario.kenneth996No ratings yet

- Chapter 9 Proof of CashDocument48 pagesChapter 9 Proof of CashDidik DidiksterNo ratings yet

- (Studocu) Int Acc Chapter 3 - Valix, Robles, Empleo, MillanDocument4 pages(Studocu) Int Acc Chapter 3 - Valix, Robles, Empleo, MillanHufana, Shelley100% (1)

- Proof of Cash Illustrative Example - DiscussionDocument11 pagesProof of Cash Illustrative Example - DiscussionAdyangNo ratings yet

- The Bank ReconciliationDocument3 pagesThe Bank ReconciliationAhmed SroorNo ratings yet

- Four Balances To Reconcile in Proof of CashDocument16 pagesFour Balances To Reconcile in Proof of Cashkrisha milloNo ratings yet

- BANK RECONCILIATION NotesDocument9 pagesBANK RECONCILIATION NotesNicole DomingoNo ratings yet

- ACCOUNTING 102 - Topic #3 "Proof of Cash"Document4 pagesACCOUNTING 102 - Topic #3 "Proof of Cash"CLEAR MELODY VILLARANNo ratings yet

- Bank Reconciliation: Financial Accounting & Reporting 1Document20 pagesBank Reconciliation: Financial Accounting & Reporting 1Malvin Roix OrenseNo ratings yet

- Cfas CashDocument5 pagesCfas CashGeelyka MarquezNo ratings yet

- (P21,000-P12,000) (P20,000 - P2,000)Document8 pages(P21,000-P12,000) (P20,000 - P2,000)Shaine PacsonNo ratings yet

- ACC 124 HO 5 Bank Reconciliation and Proof of Cash - 0Document4 pagesACC 124 HO 5 Bank Reconciliation and Proof of Cash - 0Lily Scarlett ChìnNo ratings yet

- Aud ReconDocument8 pagesAud ReconShaine PacsonNo ratings yet

- Gerald N. Roman Bsba FM 2-C Financial Analysis and ReportingDocument3 pagesGerald N. Roman Bsba FM 2-C Financial Analysis and ReportingGerald Noveda RomanNo ratings yet

- Bank ReconciliationDocument26 pagesBank ReconciliationQuennie Kate RomeroNo ratings yet

- Proof of CashDocument35 pagesProof of CashNekaNo ratings yet

- Proof of Cash+2-1Document35 pagesProof of Cash+2-1Eunice FulgencioNo ratings yet

- Gerald N. Roman Bsba FM 2-C Financial Analysis and ReportingDocument4 pagesGerald N. Roman Bsba FM 2-C Financial Analysis and ReportingGerald Noveda RomanNo ratings yet

- Financial Accounting Part 1: Cash & Cash EquivalentDocument7 pagesFinancial Accounting Part 1: Cash & Cash EquivalentHillary Grace VeronaNo ratings yet

- Bank Reconciliation: Irene Mae C. Guerra, CPADocument25 pagesBank Reconciliation: Irene Mae C. Guerra, CPAjeams vidalNo ratings yet

- Finals FABM2 Lesson 2 Bank ReconciliationDocument4 pagesFinals FABM2 Lesson 2 Bank ReconciliationJasmine VelosoNo ratings yet

- Basic Reconciliation StatementsDocument41 pagesBasic Reconciliation StatementsBeverly EroyNo ratings yet

- Bank ReconcilationDocument9 pagesBank ReconcilationJohnpaul FloranzaNo ratings yet

- Module 8Document3 pagesModule 8Rainielle Sy DulatreNo ratings yet

- Balance Per Books, End. XX XX: Add: Credit Memos (CM)Document7 pagesBalance Per Books, End. XX XX: Add: Credit Memos (CM)Misiah Paradillo JangaoNo ratings yet

- Cash and Cash EquivalentsDocument28 pagesCash and Cash EquivalentsJericho PedragosaNo ratings yet

- Cashandcashequivalents 121005200311 Phpapp01Document28 pagesCashandcashequivalents 121005200311 Phpapp01Ian Pol FiestaNo ratings yet

- Fabm2 q2 m3 Bank Reconciliation EditedDocument29 pagesFabm2 q2 m3 Bank Reconciliation EditedMaria anjilu VillanuevaNo ratings yet

- Bank ReconciliationDocument13 pagesBank ReconciliationStudent Core GroupNo ratings yet

- 2nd QTR Week 8 Fabm 2 Bank ReconDocument9 pages2nd QTR Week 8 Fabm 2 Bank ReconHannah Grace ManagasNo ratings yet

- Worksheet 3 Q2 Acctg. 2 - 1 31Document14 pagesWorksheet 3 Q2 Acctg. 2 - 1 31Allan TaripeNo ratings yet

- INTERMEDIATE ACCOUNTING I Bank ReconciliationDocument3 pagesINTERMEDIATE ACCOUNTING I Bank ReconciliationMark Navida AgunaNo ratings yet

- Bank ReconciliationDocument14 pagesBank Reconciliationnicolettecatamio015No ratings yet

- CH08 Bank ReconciliationDocument12 pagesCH08 Bank ReconciliationRose DionioNo ratings yet

- Chapter 1 Cash and Internal ControlDocument57 pagesChapter 1 Cash and Internal ControlSampanna ShresthaNo ratings yet

- FABM2-MODULE 9 - With ActivitiesDocument7 pagesFABM2-MODULE 9 - With ActivitiesROWENA MARAMBANo ratings yet

- Chapter 04Document7 pagesChapter 04SHANTANU KHARENo ratings yet

- Fabm2 q2 Module 3 Bank ReconDocument13 pagesFabm2 q2 Module 3 Bank ReconLady Hara100% (1)

- Two-Date Bank ReconDocument5 pagesTwo-Date Bank Reconrhiz cyrelle calanoNo ratings yet

- Preparing Bank Reconciliation Statement:: Recording in Cash BookDocument3 pagesPreparing Bank Reconciliation Statement:: Recording in Cash BookGhulam MehboobNo ratings yet

- Far 102 - Cash - Bank Reconciliation PDFDocument3 pagesFar 102 - Cash - Bank Reconciliation PDFPatty LapuzNo ratings yet

- Bank ReconciliationDocument2 pagesBank Reconciliationsamm yuuNo ratings yet

- Bank Recon Review 1Document13 pagesBank Recon Review 1CYCY CyraNo ratings yet

- CHAPTER 10 Intermediate Acctng 1Document49 pagesCHAPTER 10 Intermediate Acctng 1Tessang OnongenNo ratings yet

- Bank ReconciliationDocument64 pagesBank ReconciliationmarkjohnmagcalengNo ratings yet

- Two-Date Bank ReconciliationDocument5 pagesTwo-Date Bank Reconciliationsweet ecstacyNo ratings yet

- Chapter 4 Financial AssetsDocument54 pagesChapter 4 Financial AssetsAddisalem MesfinNo ratings yet

- Chapter 2 Bank ReconciliationDocument10 pagesChapter 2 Bank ReconciliationZeo AlcantaraNo ratings yet

- Chapter 3 Bank Recon Lecture StudentDocument5 pagesChapter 3 Bank Recon Lecture StudentAshlene CruzNo ratings yet

- 03 Bank ReconciliationDocument5 pages03 Bank ReconciliationalteregoNo ratings yet

- Proof of CashDocument20 pagesProof of CashSexy LipsNo ratings yet

- Module 1C - Bank ReconciliationDocument4 pagesModule 1C - Bank ReconciliationtoshirohanamaruNo ratings yet

- Bank ReconciliationDocument24 pagesBank ReconciliationTenshi ChanNo ratings yet

- Bank Reconciliation1Document18 pagesBank Reconciliation1Kim Ella50% (2)

- Basic Reconciliation StatementDocument13 pagesBasic Reconciliation StatementEaster Adina-LumangNo ratings yet

- Lesson 8 - Bank Reconciliation StatementDocument18 pagesLesson 8 - Bank Reconciliation StatementLio MelNo ratings yet

- Mathwo - Activies. Tessie Mae O. PagtamaDocument5 pagesMathwo - Activies. Tessie Mae O. PagtamaTessang OnongenNo ratings yet

- CHAPTER 10 Intermediate Acctng 1Document49 pagesCHAPTER 10 Intermediate Acctng 1Tessang OnongenNo ratings yet

- CHAPTER 12 Intermediate Acctng 1Document57 pagesCHAPTER 12 Intermediate Acctng 1Tessang OnongenNo ratings yet

- CHAPTER 14 Intermediate Acctng 1Document40 pagesCHAPTER 14 Intermediate Acctng 1Tessang OnongenNo ratings yet

- CHAPTER 7 Intermediate Acctng 1Document36 pagesCHAPTER 7 Intermediate Acctng 1Tessang OnongenNo ratings yet

- CHAPTER 13 Intermediate Acctng 1Document66 pagesCHAPTER 13 Intermediate Acctng 1Tessang OnongenNo ratings yet

- CHAPTER 6 Intermediate Acctng 1Document54 pagesCHAPTER 6 Intermediate Acctng 1Tessang OnongenNo ratings yet

- CHAPTER 11 Intermediate Acctng 1Document32 pagesCHAPTER 11 Intermediate Acctng 1Tessang OnongenNo ratings yet

- CHAPTER 8 Intermediate Acctng 1Document58 pagesCHAPTER 8 Intermediate Acctng 1Tessang OnongenNo ratings yet

- CHAPTER 1 Intermediate Acctg 1Document58 pagesCHAPTER 1 Intermediate Acctg 1Tessang OnongenNo ratings yet

- Cash and Cash Equivalents: Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriDocument66 pagesCash and Cash Equivalents: Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriTessang OnongenNo ratings yet

- 3515 Aparri, Cagayan: Archdiocese of Tuguegarao Lyceum of Aparri High School, Nursing, Criminology, Computer ScienceDocument1 page3515 Aparri, Cagayan: Archdiocese of Tuguegarao Lyceum of Aparri High School, Nursing, Criminology, Computer ScienceTessang OnongenNo ratings yet

- CHAPTER 9 Intermediate Acctng 1Document46 pagesCHAPTER 9 Intermediate Acctng 1Tessang OnongenNo ratings yet

- Bank Reconciliation: Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriDocument60 pagesBank Reconciliation: Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriTessang OnongenNo ratings yet

- 3515 Aparri, Cagayan: Archdiocese of Tuguegarao Lyceum of Aparri High School, Nursing, Criminology, Computer ScienceDocument1 page3515 Aparri, Cagayan: Archdiocese of Tuguegarao Lyceum of Aparri High School, Nursing, Criminology, Computer ScienceTessang OnongenNo ratings yet

- CHAPTER 15 Intermediate Acctng 1Document58 pagesCHAPTER 15 Intermediate Acctng 1Tessang OnongenNo ratings yet

- The Accounting Process (Part 1) : Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriDocument46 pagesThe Accounting Process (Part 1) : Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriTessang OnongenNo ratings yet

- The Accounting Process (Part 2) : Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriDocument47 pagesThe Accounting Process (Part 2) : Ninia C. Pauig-Lumauan, MBA, CPA Lyceum of AparriTessang OnongenNo ratings yet

- ETHICS - TESSIE - MAE - PAGTAMA BSA - 01 - (Week 3 and 4)Document2 pagesETHICS - TESSIE - MAE - PAGTAMA BSA - 01 - (Week 3 and 4)Tessang Onongen100% (1)

- ETHICS - TESSIE - MAE - PAGTAMA BSA - 01 - (Week 1 and 2)Document2 pagesETHICS - TESSIE - MAE - PAGTAMA BSA - 01 - (Week 1 and 2)Tessang OnongenNo ratings yet

- General Ethics Preliminary Examination: 3515 Aparri, CagayanDocument3 pagesGeneral Ethics Preliminary Examination: 3515 Aparri, CagayanTessang Onongen100% (1)

- Economics Higher Level Paper 1: 2213-5103 3 Pages © International Baccalaureate Organization 2013Document3 pagesEconomics Higher Level Paper 1: 2213-5103 3 Pages © International Baccalaureate Organization 2013JustNo ratings yet

- As Unjust Benefit: Exploitation Which Is Discussed BelowDocument3 pagesAs Unjust Benefit: Exploitation Which Is Discussed BelowJamshed IqbalNo ratings yet

- LGAF Annual Report EnglDocument92 pagesLGAF Annual Report EnglSaiVinoth Panneerselvam MNo ratings yet

- Globalization PPT - 1Document32 pagesGlobalization PPT - 1Hope LoveNo ratings yet

- Globalization BbaDocument9 pagesGlobalization BbaDisha JainNo ratings yet

- Eurekahedge Report - March 2017Document45 pagesEurekahedge Report - March 2017Mon Sour CalaunanNo ratings yet

- What Has Happened?Document5 pagesWhat Has Happened?navinnaithaniNo ratings yet

- Import Export Document & Export Order ProcessDocument14 pagesImport Export Document & Export Order Processapi-372709083% (12)

- Month End Closing ChecklistDocument4 pagesMonth End Closing ChecklistSanjeev AroraNo ratings yet

- Verbal Comprehension Free Test: AssessmentdayDocument21 pagesVerbal Comprehension Free Test: AssessmentdayAbdul Laura CondulaNo ratings yet

- AAResumeDocument1 pageAAResumelhikind3488No ratings yet

- Role of RBI Under Banking Regulation Act, 1949Document11 pagesRole of RBI Under Banking Regulation Act, 1949Jay Ram100% (1)

- Forest Planting 1893Document266 pagesForest Planting 1893OceanNo ratings yet

- TYB - Practical Questions - Final PDFDocument321 pagesTYB - Practical Questions - Final PDFChandana RajasriNo ratings yet

- Letter To WSCC Board of DirectorsDocument2 pagesLetter To WSCC Board of DirectorsKING 5 NewsNo ratings yet

- S1-17-Mba ZC416-L16Document43 pagesS1-17-Mba ZC416-L16AbiNo ratings yet

- J-1203 April 2019 PDFDocument1 pageJ-1203 April 2019 PDFRohtash SinghNo ratings yet

- 2Document5 pages2altamarcapitalNo ratings yet

- AIAG CQI-15 Special Process: Welding System Assessment Mabuchi Motor Mexico, S.A.De C.VDocument30 pagesAIAG CQI-15 Special Process: Welding System Assessment Mabuchi Motor Mexico, S.A.De C.VLuis AldanaNo ratings yet

- Chapter Twelve: Developing The E-Business Design: Strategy FormulationDocument20 pagesChapter Twelve: Developing The E-Business Design: Strategy FormulationVickeySumitDebbarmaNo ratings yet

- Asset Liability Management PDFDocument9 pagesAsset Liability Management PDFSavyasaachi ManjrekarNo ratings yet

- Finance For International BusinessDocument19 pagesFinance For International BusinessHuy NgoNo ratings yet

- Saudi Construction Rates - 2021Document4 pagesSaudi Construction Rates - 2021BobNo ratings yet