Professional Documents

Culture Documents

Project Management Project Management

Project Management Project Management

Uploaded by

Swapnil Patil0 ratings0% found this document useful (0 votes)

7 views11 pagesThis document discusses working capital management. It defines working capital as the capital required for financing short-term assets like cash, inventory, and receivables. Maintaining adequate working capital is important for business solvency, securing loans, paying expenses, and taking advantage of discounts. The document outlines methods for calculating working capital requirements and key ratios used to evaluate working capital management, such as current ratio, receivables turnover, and inventory turnover.

Original Description:

Original Title

ramesh

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses working capital management. It defines working capital as the capital required for financing short-term assets like cash, inventory, and receivables. Maintaining adequate working capital is important for business solvency, securing loans, paying expenses, and taking advantage of discounts. The document outlines methods for calculating working capital requirements and key ratios used to evaluate working capital management, such as current ratio, receivables turnover, and inventory turnover.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views11 pagesProject Management Project Management

Project Management Project Management

Uploaded by

Swapnil PatilThis document discusses working capital management. It defines working capital as the capital required for financing short-term assets like cash, inventory, and receivables. Maintaining adequate working capital is important for business solvency, securing loans, paying expenses, and taking advantage of discounts. The document outlines methods for calculating working capital requirements and key ratios used to evaluate working capital management, such as current ratio, receivables turnover, and inventory turnover.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 11

Project Management

Working

Capital

Management

Under the Guidance of:- Prepared By:-

Prof.Prajwalit.P.Jain. RameshVyas.

Introduction

Working capital typically means the firm’s holding

of current or short-term assets such as cash,

receivables, inventory and marketable securities.

These items are also referred to as circulating capital.

“Circulating capital means current assets of a company

that are changed in the ordinary course of business

from one form to another, as for example, from cash

to inventories, inventories to receivables, receivable

to cash”

Definition

Working Capital refers to that part of the firm’s capital,

which is required for financing short-term or current assets

such a cash marketable securities, debtors and inventories.

Funds required for short term purposes or day to day

expenses are working capital.

Funds thus, invested in current assets keep revolving fast

and are constantly converted into cash and this cash flow

out again in exchange for other current assets.

The Needs and Importance of Net Working

Capital

It is a qualitative concept which indicates firm’s ability to

meet its operating expenses and short term liabilities.

It indicates the margin of protection available to the short

term creditors.

Indicator of financial soundness of an enterprise.

Its use for the purchase of raw material.

Its use to pay wages & salaries.

To incur day to day expenses and overhead costs.

To provide credit facilities to the customer.

Net WC is refered as working capital.

Advantages of Adequate WC:-

Maintains solvency of business.

Helps in creating & maintaining goodwill.

Helps in arranging loans from banks & others on easy and

favourable terms.

Ensures regular supply of raw materials.

Regular payment of salaries, wages & other day to day

commitment.

Disadvantages of Inadequate WC:-

A concern which has inadequate WC cannot pay its short term

liabilities in time. Thus, loose its reputation & shall not be able

to get good credit facilities.

Cannot buy its requirements in bulk & cannot avail of

discounts etc.

Firm cannot pay its day to day expenses and it create

inefficiency.

Becomes impossible to use efficiently fixed assets due to non

availability of liquid funds.

Management of working capital

Concerned with to manage the current

assets, the current liabilities and the inter-

relationship that exists between them.

Working Capital Management Policies of a

firm have a great effect on its profitability,

liquidity and structural health of the

organization

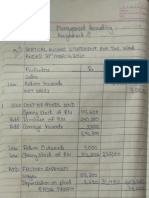

Proforma - Working Capital

Related to Trading Concern

STATEMENT OF WORKING CAPITAL REQUIREMENTS

Particulars Amt (Rs.)

Current Assets

(i) Cash and Bank balance ----

(ii) Receivables ----

(iii) Stocks ----

(iv)Advance Payments if any ----

xxxxx

Less : Current Liabilities

(i) Creditors -----

(ii) Lag in payment of expenses -----

(iii) Outstanding Liabilities -----

xxxx

WORKING CAPITAL ( CA – CL ) xxx

Add : Provision / Margin for Contingencies -----

NET WORKING CAPITAL REQUIRED XXX

Related to Manufacturing concern

STATEMENT OF WORKING CAPITAL REQUIREMENTS

Particulars Amt(Rs.)

Current Assets

(i) Stock of R M -----

(ii)Work-in-progress :- (a) Raw Materials -----

(b) Direct Labour -----

(c) Overheads -----

iii) Stock of Finished Goods :- (a) Raw Materials -----

(b) Direct Labour -----

(c) Overheads -----

(iv) Sundry Debtors:- (a) Raw Materials -----

(b) Direct Labour -----

(c) Overheads -----

(v) Payments in Advance -----

(iv) Balance of Cash and Bank -----

(vii) Any other item -----

Less : Current Liabilities

(i) Creditors -----

(ii) Lag in payment of expenses -----

(iii) Any other -----

WORKING CAPITAL ( CA – CL ) xxxx

Add : Provision / Margin for Contingencies -----

NET WORKING CAPITAL REQUIRED XXX

Ratios associated with WC

Stock Turnover Ratio (Times) COGS

Average Stock

Stock Turnover Ratio (Days) Average Stock x 365

COGS

Receivables Turnover Ratio (Times) Net Credit Sales

Average Accounts Receivable

Average Receivables Period (Days) Avg. A/C Receivable x 365

Net Credit Sales

Payables Turnover Ratio (Times) Net Credit Purchases

Average Accounts Payable

Average Payables Period (Days) Avg. A/C Payable x 365

Net Credit Purchase

Current Ratio Current Assets

Current Liabilities

Quick Ratio CA – Stock

Current Liabilities

Working Capital Turnover Ratio Net Sales

Net Working Capital

Thank You…….

You might also like

- 20 Year Intrinsic ValueDocument27 pages20 Year Intrinsic ValueCaleb100% (2)

- Kelompok 17 Stocks and SharesDocument6 pagesKelompok 17 Stocks and SharesishmidaNo ratings yet

- Financial Management - 1 PDFDocument85 pagesFinancial Management - 1 PDFKingNo ratings yet

- Igcse Accounting Capital Revenue Expenditure PDFDocument2 pagesIgcse Accounting Capital Revenue Expenditure PDFSiddarthNo ratings yet

- Chapter 18. CH 18-06 Build A ModelDocument4 pagesChapter 18. CH 18-06 Build A ModelNguyễn Thu PhươngNo ratings yet

- Working Capital ManagementDocument20 pagesWorking Capital ManagementHarshita ChoudharyNo ratings yet

- Kamal Kant Sharma MBA 02313703920 FMDocument22 pagesKamal Kant Sharma MBA 02313703920 FMKANISHKA SHARMANo ratings yet

- Overview of Working Capital Management (WCM)Document30 pagesOverview of Working Capital Management (WCM)NameNo ratings yet

- Chapter 1Document30 pagesChapter 1Nowshad AyubNo ratings yet

- Managementof Working CapitalDocument31 pagesManagementof Working CapitalSuperintending Engineer Quality Assurance UnitNo ratings yet

- Key Words: Multiple Choice QuestionsDocument7 pagesKey Words: Multiple Choice QuestionsMOHAMMED AMIN SHAIKHNo ratings yet

- Working Capital ManagementDocument62 pagesWorking Capital ManagementAditya B raghavNo ratings yet

- CH 1 Financial Statements of CompanyDocument25 pagesCH 1 Financial Statements of CompanyDHANISHI PATELNo ratings yet

- Working Capital Management: By: Rohit KumarDocument12 pagesWorking Capital Management: By: Rohit KumarRohit MbaNo ratings yet

- Working CapitalDocument35 pagesWorking Capitalthatwas legitnessNo ratings yet

- MA 2.1-Financial StatementDocument57 pagesMA 2.1-Financial Statementvini2710100% (1)

- Lecture 3Document14 pagesLecture 3Lol 123No ratings yet

- UntitledDocument9 pagesUntitledLincoln SoetzenbergNo ratings yet

- Management Accounting Chapter 4Document17 pagesManagement Accounting Chapter 4Sonia BhavnaniNo ratings yet

- Working Capital FinancingDocument2 pagesWorking Capital FinancingNandini jagdish RaulaNo ratings yet

- Question June - 2010Document8 pagesQuestion June - 2010pawan kumar MaheshwariNo ratings yet

- Cma FormatDocument13 pagesCma FormatPrateek RastogiNo ratings yet

- Format of CFADocument7 pagesFormat of CFAAditya KulkarniNo ratings yet

- Working Capital Manageme NTDocument66 pagesWorking Capital Manageme NTPrateek BhandariNo ratings yet

- Basic Accounting Financial AnalysisDocument439 pagesBasic Accounting Financial AnalysisBuilding Substance PodNo ratings yet

- Unit 3 & 4 - Accountingformanager - AnanduDocument46 pagesUnit 3 & 4 - Accountingformanager - Ananducraziestidiot31No ratings yet

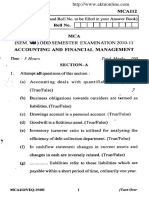

- HT TP: //qpa Pe R.W But .Ac .In: 2010-11 Management AccountingDocument7 pagesHT TP: //qpa Pe R.W But .Ac .In: 2010-11 Management AccountingFitness FreakNo ratings yet

- Financial Statement & Its AnalysisDocument6 pagesFinancial Statement & Its AnalysisDivanshi PrajapatiNo ratings yet

- Cash Flow Statements....Document34 pagesCash Flow Statements....Nishant SinghNo ratings yet

- cash flow statementDocument14 pagescash flow statementharshitsharma42069No ratings yet

- Caiib FM Mod D MCQDocument7 pagesCaiib FM Mod D MCQSanjeev GuptaNo ratings yet

- Project Report For Bank LoanDocument11 pagesProject Report For Bank LoanSubbaravamma JaruguNo ratings yet

- Journal Entries: Internal ReconstructionDocument6 pagesJournal Entries: Internal ReconstructionTaoos AnsariNo ratings yet

- Accounting and Financial Management 2010-11Document7 pagesAccounting and Financial Management 2010-11Ashish AgarwalNo ratings yet

- Adobe Scan 19 Feb 2023Document7 pagesAdobe Scan 19 Feb 2023Aman JainNo ratings yet

- Small Scale IndustriesDocument15 pagesSmall Scale IndustriesSumit KumarNo ratings yet

- Workbook Developed by K C Vaid, DGM, Sidbi, MumbaiDocument11 pagesWorkbook Developed by K C Vaid, DGM, Sidbi, MumbaiRajesh BogulNo ratings yet

- 8.1 Cash Flows - Format - Solution - Part 3Document51 pages8.1 Cash Flows - Format - Solution - Part 3Hasif YusofNo ratings yet

- Fund Flow StatementDocument21 pagesFund Flow StatementSarvagya GuptaNo ratings yet

- (Ri) Trade Payables: 1.1 Explain The Tollowing TermsDocument7 pages(Ri) Trade Payables: 1.1 Explain The Tollowing TermsMurali KrishnaNo ratings yet

- Estimation of Required Working CapitalDocument4 pagesEstimation of Required Working CapitalNizana p sNo ratings yet

- Assessment of Working Capital Requirements Form Ii: Operating StatementDocument6 pagesAssessment of Working Capital Requirements Form Ii: Operating Statementmonirba48No ratings yet

- Additional Notes-Statement of Cash FlowDocument13 pagesAdditional Notes-Statement of Cash FlowdaminbalqisNo ratings yet

- Reachmee P&L and BL-Financial 21-22 UpdateDocument7 pagesReachmee P&L and BL-Financial 21-22 UpdateGST BACANo ratings yet

- Paper5 Set1 NDocument7 pagesPaper5 Set1 NSanchit ShrivastavaNo ratings yet

- CBSE Class 12 Acc Notes Financial Statements of A CompanyDocument16 pagesCBSE Class 12 Acc Notes Financial Statements of A CompanyDevanshi Agarwal100% (1)

- Accounting 2021 U1 P1 PDFDocument10 pagesAccounting 2021 U1 P1 PDFStephano OlliviereNo ratings yet

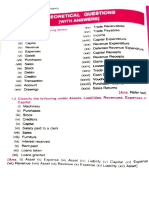

- This Study Resource Was: Fundamentals of Accounting - Multiple Choice Questions (MCQ) With AnswersDocument8 pagesThis Study Resource Was: Fundamentals of Accounting - Multiple Choice Questions (MCQ) With AnswersFunny idolNo ratings yet

- 1board Paper-2022-XIDocument8 pages1board Paper-2022-XIdikshaupadhyay8a42069No ratings yet

- Basic Terms AccountsDocument3 pagesBasic Terms Accountsniyabiby08No ratings yet

- Unit-4 Liquidity DecisionsDocument35 pagesUnit-4 Liquidity DecisionsGrubber grubNo ratings yet

- Paper5 SolutionDocument24 pagesPaper5 Solutionanusreetapadar1No ratings yet

- DCF Valuations NotesDocument35 pagesDCF Valuations NotesChantell KatlegoNo ratings yet

- Adobe Scan 8 Jan 2023Document2 pagesAdobe Scan 8 Jan 2023charvi.22052No ratings yet

- P2mys 2008 Jun ADocument12 pagesP2mys 2008 Jun A--bolabolaNo ratings yet

- Working Capital Management: Presented BY Yamuna Sagar & Aman Kumar Ii-SemDocument28 pagesWorking Capital Management: Presented BY Yamuna Sagar & Aman Kumar Ii-SemRavindra Kumar YadavNo ratings yet

- Time: 3 Hours Max. Marks: 100 Note: Be Precise in Your Answer. in Case of Numerical Problem Assume Data Wherever Not ProvidedDocument2 pagesTime: 3 Hours Max. Marks: 100 Note: Be Precise in Your Answer. in Case of Numerical Problem Assume Data Wherever Not ProvidedPrashant SharmaNo ratings yet

- CHAPT.4-theory WORKING CAPITAL MANAGEMENTDocument4 pagesCHAPT.4-theory WORKING CAPITAL MANAGEMENTShahina KhanNo ratings yet

- Introduction To Corporate FinanceDocument18 pagesIntroduction To Corporate FinanceGauri SinglaNo ratings yet

- Annexure D: Report For The - (I/II/III/IV) Quarter Ended - Period Covered by The Report: - (3/6/9/12) MonthsDocument7 pagesAnnexure D: Report For The - (I/II/III/IV) Quarter Ended - Period Covered by The Report: - (3/6/9/12) MonthsNarendra Ku MalikNo ratings yet

- FM - CHP 3 - Extra QDocument35 pagesFM - CHP 3 - Extra QGopalNo ratings yet

- Presentation On Working Capital: by M.P. DeivikaranDocument31 pagesPresentation On Working Capital: by M.P. DeivikaranmajidNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Chapter 20 - MenbiDocument41 pagesChapter 20 - MenbiMayadianaSugondo100% (1)

- Capital Adequacy Ratio - ReportDocument11 pagesCapital Adequacy Ratio - ReportAllex JackNo ratings yet

- Sekai 09Document1 pageSekai 09Micaela EncinasNo ratings yet

- Deloitte CH en Audit Lease Modifications Extending The Lease TermDocument25 pagesDeloitte CH en Audit Lease Modifications Extending The Lease TermnanaNo ratings yet

- ITR-3 Form PDFDocument28 pagesITR-3 Form PDFPankaj Kumar KesarwaniNo ratings yet

- J Crew LBODocument15 pagesJ Crew LBOTom HoughNo ratings yet

- CMA ExamDocument34 pagesCMA Examtimmy457No ratings yet

- CFA Level 1, June, 2016 - Study Plan PDFDocument3 pagesCFA Level 1, June, 2016 - Study Plan PDFHàXuânBảoNo ratings yet

- Management Accounting Assignment - 1Document4 pagesManagement Accounting Assignment - 1anvesha khillarNo ratings yet

- Statement of Cost of Good Sold (Aquino)Document9 pagesStatement of Cost of Good Sold (Aquino)John cookNo ratings yet

- Answer KeysDocument35 pagesAnswer Keyspayos manuelNo ratings yet

- Corporations - Spring 2008Document117 pagesCorporations - Spring 2008herewegoNo ratings yet

- DATEV Account Chart: Standard Chart of Accounts SKR 04 Valid For 2015Document29 pagesDATEV Account Chart: Standard Chart of Accounts SKR 04 Valid For 2015Elizabeth Sánchez LeónNo ratings yet

- Vanguard VXUSDocument180 pagesVanguard VXUSRaka AryawanNo ratings yet

- 4100.05.A. Overview of Partnership RulesDocument11 pages4100.05.A. Overview of Partnership Rulesgerarde moretNo ratings yet

- Tax Free Exchange v3Document2 pagesTax Free Exchange v3Lara YuloNo ratings yet

- Activity - Translation of Foreign Currency Financial Statements (PAS 21 & PAS 29)Document1 pageActivity - Translation of Foreign Currency Financial Statements (PAS 21 & PAS 29)PaupauNo ratings yet

- Client Portfolio Statement: %mkvalDocument2 pagesClient Portfolio Statement: %mkvalMonjur MorshedNo ratings yet

- Level II Alt Summary SlidesDocument25 pagesLevel II Alt Summary SlidesRaabiyaal IshaqNo ratings yet

- Curriculum Vitae: Hendy Atmadja JL - Galur Selatan No.19 Rt/w.002/03 Jakarta 10530 Phone: 0812-9054-9661 0878-263-6766Document3 pagesCurriculum Vitae: Hendy Atmadja JL - Galur Selatan No.19 Rt/w.002/03 Jakarta 10530 Phone: 0812-9054-9661 0878-263-6766Intan WidyawatiNo ratings yet

- Mas 2 - 1304 Financial Management: Capital BudgetingDocument9 pagesMas 2 - 1304 Financial Management: Capital BudgetingVel JuneNo ratings yet

- How To Prepare A Cash Flow StatementDocument8 pagesHow To Prepare A Cash Flow StatementSudhakar Chalamalla100% (1)

- Dino Miranda 2022Document7 pagesDino Miranda 2022Sander D. PeraNo ratings yet

- L'Oreal DF 2006Document161 pagesL'Oreal DF 2006JORGENo ratings yet

- Chapter 3 QuizDocument31 pagesChapter 3 QuizIrene Mae BeldaNo ratings yet

- XPetrosea Newsrelease Disclosure of Information 270623Document2 pagesXPetrosea Newsrelease Disclosure of Information 270623Galaxy Zfold3No ratings yet