Professional Documents

Culture Documents

CH 5 Cost by GW

CH 5 Cost by GW

Uploaded by

Wudneh Amare0 ratings0% found this document useful (0 votes)

8 views10 pagesVariable costing and absorption costing are two common methods of costing inventories. Variable costing includes only variable manufacturing costs in inventory, while absorption costing includes both variable and fixed manufacturing costs. Absorption costing is required for external reporting and taxes, while variable costing is used internally. The key difference is that variable costing excludes fixed manufacturing overhead from inventory costs, treating it as a period expense instead.

Original Description:

variable and absorption costing

Original Title

ch 5 cost by gw

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentVariable costing and absorption costing are two common methods of costing inventories. Variable costing includes only variable manufacturing costs in inventory, while absorption costing includes both variable and fixed manufacturing costs. Absorption costing is required for external reporting and taxes, while variable costing is used internally. The key difference is that variable costing excludes fixed manufacturing overhead from inventory costs, treating it as a period expense instead.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

8 views10 pagesCH 5 Cost by GW

CH 5 Cost by GW

Uploaded by

Wudneh AmareVariable costing and absorption costing are two common methods of costing inventories. Variable costing includes only variable manufacturing costs in inventory, while absorption costing includes both variable and fixed manufacturing costs. Absorption costing is required for external reporting and taxes, while variable costing is used internally. The key difference is that variable costing excludes fixed manufacturing overhead from inventory costs, treating it as a period expense instead.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 10

CHAPTER 5

INCOME EFFECT OF ALTERNATIVE PRODUCT COSTING METHODS

5.1. Variable and Absorption Costing

The two most common methods of costing

inventories in manufacturing companies are

variable costing and absorption costing.

Variable Costing

Cont….

• Variable costing is a method of inventory costing in

which all variable manufacturing costs (direct and

indirect) are included as inventoriable costs.

• All fixed manufacturing costs are excluded from

inventoriable costs and are instead treated as costs

of the period in which they are incurred.

• Note that variable costing is a less-than-perfect

term to describe this inventory-costing method,

because only variable manufacturing costs are

inventoried; variable non-manufacturing costs are

still treated as period costs and are expensed.

Cont….

•Another common term used to describe this method is

direct costing. This is also a misnomer because variable

costing considers variable manufacturing overhead (an

indirect cost) as inventoriable, while excluding direct

marketing costs.

Absorption Costing

• Absorption costing is a method of inventory costing in

which all variable manufacturing costs and all fixed

manufacturing costs are included as inventoriable costs.

• That is, inventory “absorbs” all manufacturing costs.

For example, job costing system is absorption costing.

Cont…

•Under both variable costing and absorption costing,

all variable manufacturing costs are inventoriable

costs and all nonmanufacturing costs in the value

chain (such as research and development and

marketing), whether variable or fixed, are period costs

and are recorded as expenses when incurred.

Comparing Variable and Absorption Costing

• Absorption costing is required for external financial

reports and for tax reporting.

• Under absorption costing, product costs include all

manufacturing costs:

Cont…

Direct materials.

Direct labor.

Variable manufacturing overhead.

Fixed manufacturing overhead.

• Under absorption costing, the following costs are

treated as period expenses and are excluded from

product costs:

• Variable selling and administrative costs.

• Fixed selling and administrative costs

Cont…

• Variable costing is an alternative for internal

management reports.

• Under variable costing, product costs include only

the variable manufacturing costs:

– Direct materials.

– Direct labor (unless fixed).

– Variable manufacturing overhead.

Cont….

• Under variable costing, the following costs are

treated as period expenses and are excluded

from product costs:

– Fixed manufacturing overhead.

– Variable selling and administrative costs.

– Fixed selling and administrative costs.

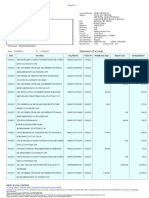

Example

Solution

THANK

YOU

You might also like

- Icaew Cfab BTF 2018 Sample ExamDocument24 pagesIcaew Cfab BTF 2018 Sample ExamAnonymous ulFku1vNo ratings yet

- TEMPLATE - Deed of Assignment of Stock Subscription With Assumption of ObligationDocument4 pagesTEMPLATE - Deed of Assignment of Stock Subscription With Assumption of ObligationClang SantosNo ratings yet

- Solution MC Installment LiquidationDocument5 pagesSolution MC Installment LiquidationHoney OrdoñoNo ratings yet

- Presentation On Absorption and Variable CostingDocument11 pagesPresentation On Absorption and Variable CostingAnusha MaharjanNo ratings yet

- 01 Cost Acounting12 (Autosaved)Document89 pages01 Cost Acounting12 (Autosaved)Haryson NyobuyaNo ratings yet

- CA01 VariableCostingFDocument114 pagesCA01 VariableCostingFVenise Balia33% (3)

- SSGC Internship ReportDocument68 pagesSSGC Internship ReportMohammad AliNo ratings yet

- Acc - 565 - PH Fed12 Corp Partnr EstDocument160 pagesAcc - 565 - PH Fed12 Corp Partnr EstLaKessica B. Kates-CarterNo ratings yet

- Marginal Costing Unit IIIDocument22 pagesMarginal Costing Unit IIIAarchi SinghNo ratings yet

- HR Accounting Unit 2Document12 pagesHR Accounting Unit 2Cassidy DonahueNo ratings yet

- Mas - Absorption and Variable Costing PDFDocument11 pagesMas - Absorption and Variable Costing PDFNicole Anne M. ManansalaNo ratings yet

- Marginal Costing TheoryDocument16 pagesMarginal Costing TheoryGabriel BelmonteNo ratings yet

- UNIT 3 Absorption Variable CostingDocument19 pagesUNIT 3 Absorption Variable Costingannabelle albaoNo ratings yet

- Conclusion: FocusDocument2 pagesConclusion: FocussudarshanNo ratings yet

- Chapter 1: Marginal Costing & Profit PlanningDocument32 pagesChapter 1: Marginal Costing & Profit PlanningSwatiNo ratings yet

- Finacial and Managerial Act Chapter 5-7Document59 pagesFinacial and Managerial Act Chapter 5-7solomon asefaNo ratings yet

- Cost Concepts and ClassificationsDocument22 pagesCost Concepts and ClassificationsgraceNo ratings yet

- MAS-05 Variable and Absorption CostingDocument8 pagesMAS-05 Variable and Absorption CostingKrizza MaeNo ratings yet

- Temp 2Document29 pagesTemp 2KIMBERLY MUKAMBANo ratings yet

- Module 2 - Introduction To Cost ConceptsDocument51 pagesModule 2 - Introduction To Cost Conceptskaizen4apexNo ratings yet

- Variable and Absoption CostingDocument19 pagesVariable and Absoption Costingmehnaz kNo ratings yet

- Topic 2 - Cost and Cost SystemDocument28 pagesTopic 2 - Cost and Cost SystemTân Nguyên100% (1)

- Variable Costing: A Tool For ManagementDocument12 pagesVariable Costing: A Tool For ManagementAl BastiNo ratings yet

- Managerial Acctg Topic Module 2Document18 pagesManagerial Acctg Topic Module 2RYE IGNERNo ratings yet

- Cost Accounting IDocument147 pagesCost Accounting IBilisummaa LammiiNo ratings yet

- TOPIC 5 AccountingDocument4 pagesTOPIC 5 Accountingllorcaire100% (1)

- Cost Concepts and ClassificationDocument3 pagesCost Concepts and ClassificationPrincess PilNo ratings yet

- Cost Concepts and ClassificationDocument3 pagesCost Concepts and ClassificationPrincess PilNo ratings yet

- Chapter Four: Introduction To Cost and Managerial AccountingDocument38 pagesChapter Four: Introduction To Cost and Managerial AccountingSelam TsigieNo ratings yet

- Costing: Approaches and TechniquesDocument51 pagesCosting: Approaches and TechniquescolinNo ratings yet

- CA01 VariableCostingFDocument114 pagesCA01 VariableCostingFAries Gonzales CaraganNo ratings yet

- Project Cost Management - CHAPTER 5-Part IDocument29 pagesProject Cost Management - CHAPTER 5-Part IYonas AbebeNo ratings yet

- Absorption and Variable CostingDocument11 pagesAbsorption and Variable CostingalliahnahNo ratings yet

- Managerial Accounting - An OverviewDocument29 pagesManagerial Accounting - An OverviewZoiba EkramNo ratings yet

- Topic 2 - Cost and Cost SystemDocument65 pagesTopic 2 - Cost and Cost Systemnguyennauy25042003No ratings yet

- BEC Notes Chapter 5Document6 pagesBEC Notes Chapter 5cpacfa100% (10)

- Variable and Absoption Costing PDFDocument69 pagesVariable and Absoption Costing PDFKaren AlonsagayNo ratings yet

- Chapter 5Document15 pagesChapter 5Genanew AbebeNo ratings yet

- Class - Marginal CostingDocument45 pagesClass - Marginal CostingAMBIKA MALIKNo ratings yet

- Managerial and Financial AccountingDocument42 pagesManagerial and Financial AccountingRodrigo de Oliveira LeiteNo ratings yet

- Cost Concepts & Classification ShailajaDocument30 pagesCost Concepts & Classification ShailajaPankaj VyasNo ratings yet

- Topic 3 Variable Costing and Absorption CostingDocument3 pagesTopic 3 Variable Costing and Absorption CostingdigididoghakdogNo ratings yet

- Cost Accounting 1Document89 pagesCost Accounting 1Isaack MgeniNo ratings yet

- CA01 VariableCostingFDocument114 pagesCA01 VariableCostingFSadile May KayeNo ratings yet

- Costman ReviewerDocument4 pagesCostman ReviewerHoney MuliNo ratings yet

- Marginal Costing and Absorption Costing: Department OF Accounting ACC322 - Advanced Cost AccountingDocument34 pagesMarginal Costing and Absorption Costing: Department OF Accounting ACC322 - Advanced Cost AccountingDavid ONo ratings yet

- Cost Accounting CH 1Document29 pagesCost Accounting CH 1Mohd Azhari Hani SurayaNo ratings yet

- Part Two: Management Accounting: Chapter Four Cost Volume Profit (CVP) AnalysisDocument112 pagesPart Two: Management Accounting: Chapter Four Cost Volume Profit (CVP) AnalysisSintayehu MeseleNo ratings yet

- CA Notes2Document3 pagesCA Notes2jeyoon13No ratings yet

- Chapter 3 - Product CostingDocument6 pagesChapter 3 - Product Costingchelsea kayle licomes fuentesNo ratings yet

- CH 8Document19 pagesCH 8Isra' I. SweilehNo ratings yet

- 04 Absorption Vs Variable CostingDocument4 pages04 Absorption Vs Variable CostingBanna SplitNo ratings yet

- Chapter Four Basic Cost AccountingDocument34 pagesChapter Four Basic Cost AccountingBettyNo ratings yet

- PDF Topic 2 COST CONCEPT AND CLASSIFICATIONDocument53 pagesPDF Topic 2 COST CONCEPT AND CLASSIFICATIONJessaNo ratings yet

- Definition of Standard CostingDocument18 pagesDefinition of Standard CostingHimanshu PachoriNo ratings yet

- Marginal CostingDocument41 pagesMarginal CostingaayanyohaanNo ratings yet

- Chapter 5Document13 pagesChapter 5abraha gebruNo ratings yet

- Atp 106 LPM Accounting - Topic 6 - Costing and BudgetingDocument17 pagesAtp 106 LPM Accounting - Topic 6 - Costing and BudgetingTwain JonesNo ratings yet

- Topic 1 Application of Cost Concepts To The Decision Making ProcessDocument69 pagesTopic 1 Application of Cost Concepts To The Decision Making ProcessMaryam MalieNo ratings yet

- Cost Analysis of Any Product or ServiceDocument27 pagesCost Analysis of Any Product or ServiceAayushiNo ratings yet

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDocument25 pagesBasic Cost Management Concepts and Accounting For Mass Customization OperationsCherry Velle TangogNo ratings yet

- Cost Classification or Cost Flow in An OrgaizationDocument8 pagesCost Classification or Cost Flow in An OrgaizationvaloruroNo ratings yet

- Chapter 8 Absorption and Variable Costing and Inventory ManagementDocument49 pagesChapter 8 Absorption and Variable Costing and Inventory ManagementNatanael PakpahanNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- CH Ii Business StatDocument27 pagesCH Ii Business StatWudneh AmareNo ratings yet

- New Ch1 ORDocument15 pagesNew Ch1 ORWudneh AmareNo ratings yet

- Chapter 2-IDocument20 pagesChapter 2-IWudneh AmareNo ratings yet

- CH 5Document59 pagesCH 5Wudneh Amare0% (1)

- CH 3Document25 pagesCH 3Wudneh AmareNo ratings yet

- CH 4Document21 pagesCH 4Wudneh AmareNo ratings yet

- Aa A Aa A Aa A: Chapter TwoDocument20 pagesAa A Aa A Aa A: Chapter TwoWudneh AmareNo ratings yet

- Linear Equations and Its Application: Chapter One EquationDocument13 pagesLinear Equations and Its Application: Chapter One EquationWudneh AmareNo ratings yet

- Mathematics Final Exam WudnehDocument5 pagesMathematics Final Exam WudnehWudneh AmareNo ratings yet

- CH 4 Cost by GWDocument34 pagesCH 4 Cost by GWWudneh AmareNo ratings yet

- CH 2 Cost by G.WDocument13 pagesCH 2 Cost by G.WWudneh AmareNo ratings yet

- EmiratesDocument11 pagesEmiratesVivek DwivediNo ratings yet

- January TribuneDocument16 pagesJanuary TribuneAnonymous KMKk9Msn5No ratings yet

- Ace Hardware Indonesia TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesAce Hardware Indonesia TBK.: Company Report: January 2019 As of 31 January 2019Mochamad Kamal IhsanNo ratings yet

- Taxes During The Spanish PeriodDocument21 pagesTaxes During The Spanish PeriodJannah Fate100% (1)

- Basic Concepts in AuditingDocument29 pagesBasic Concepts in Auditinganon_672065362100% (1)

- Essay AudDocument2 pagesEssay AudKimberly LiwanagNo ratings yet

- Pdic Foreclosed Properties Public Auction October 25 2016Document4 pagesPdic Foreclosed Properties Public Auction October 25 2016G DNo ratings yet

- Equity: S&P Merval Index (In USD)Document2 pagesEquity: S&P Merval Index (In USD)Brian BarriosNo ratings yet

- 2020 Inspection Grant Thornton LLP: (Headquartered in Chicago, Illinois)Document24 pages2020 Inspection Grant Thornton LLP: (Headquartered in Chicago, Illinois)Jason BramwellNo ratings yet

- MS-44N (Various Topics in MS)Document6 pagesMS-44N (Various Topics in MS)juleslovefenNo ratings yet

- Evans Analytics2e PPT 11Document63 pagesEvans Analytics2e PPT 11qun100% (1)

- Assets Contributed by The Partners To A Partnership Business Should Be Initially Measured in The Partnership Books atDocument15 pagesAssets Contributed by The Partners To A Partnership Business Should Be Initially Measured in The Partnership Books atBerna MortejoNo ratings yet

- Area Code AO Type Range Code AO No.: Signature of The DeclarantDocument2 pagesArea Code AO Type Range Code AO No.: Signature of The DeclarantRakesh DuttaNo ratings yet

- SFP 1 and 2 AccountingDocument13 pagesSFP 1 and 2 AccountingAlissa MayNo ratings yet

- Hospicemd Data From Elner PDFDocument2 pagesHospicemd Data From Elner PDFLisette TrujilloNo ratings yet

- 5 6066385334139093151 PDFDocument24 pages5 6066385334139093151 PDFhvmandaliaNo ratings yet

- Intership Report On CitibankDocument26 pagesIntership Report On Citibankmoonmanj100% (2)

- ResortDocument11 pagesResortSherwin Dannog100% (1)

- Dissertation Néjia MoumenDocument378 pagesDissertation Néjia MoumenDhahri Tarek100% (1)

- The Homeowners Guide To A Winning FC Defense-1Document107 pagesThe Homeowners Guide To A Winning FC Defense-1Helpin HandNo ratings yet

- Hyundai Motor India (Hmil) Interview Call LetterDocument3 pagesHyundai Motor India (Hmil) Interview Call LetterJaydeep PawarNo ratings yet

- 3.2 Mat112 Markup and Markdown Answer SchemeDocument5 pages3.2 Mat112 Markup and Markdown Answer SchemeNisha CDNo ratings yet

- W8 Instructions PDFDocument15 pagesW8 Instructions PDFKrisdenNo ratings yet

- GK - Gov Act 2019Document38 pagesGK - Gov Act 2019Glenn GalvezNo ratings yet

- Acct Statement - XX6261 - 29112022Document21 pagesAcct Statement - XX6261 - 29112022atulNo ratings yet