Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

23 viewsFinancial Forecasting: The Science and Art of Forecasting

Financial Forecasting: The Science and Art of Forecasting

Uploaded by

Vivekananda RFinancial forecasting involves determining the explicit forecast period, which is typically 10-15 years. The forecast should include a detailed 5-7 year forecast with complete financial statements, as well as a simplified forecast for the remaining years focusing on key variables. The process involves collecting historical data, integrating financial statements, building historical ratios, and reorganizing statements. Key steps are building a revenue forecast using top-down or bottom-up approaches, forecasting expenses and assets, reconciling the balance sheet, and calculating return on invested capital and free cash flow.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Samsung's European Innovation Team: Fueling Consumer-Driven GrowthDocument19 pagesSamsung's European Innovation Team: Fueling Consumer-Driven GrowthVivekananda RNo ratings yet

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- L2 Merchant AcquiringV1.0Document59 pagesL2 Merchant AcquiringV1.0Shweta AgrawalNo ratings yet

- Chapter08 KGWDocument24 pagesChapter08 KGWk_Dashy8465No ratings yet

- Forecasting Financial Statements and Financial PlanningDocument12 pagesForecasting Financial Statements and Financial PlanningBrian Daniel BayotNo ratings yet

- Finman2 - Financial Forecasting & PlanningDocument12 pagesFinman2 - Financial Forecasting & PlanningKeaster DiazNo ratings yet

- Financial ModelingDocument21 pagesFinancial ModelingLAMOUCHI RIMNo ratings yet

- A Framework For Financial Statement AnalysisDocument27 pagesA Framework For Financial Statement AnalysisAndrea Prado CondeNo ratings yet

- Forecasting Performance: The Explicit Forecast Period: InstructorsDocument24 pagesForecasting Performance: The Explicit Forecast Period: InstructorsAarushi SharmaNo ratings yet

- Financial StatementDocument54 pagesFinancial StatementAlvin FelicianoNo ratings yet

- BudgetingDocument9 pagesBudgetingGAMBOA, LIEZEL G.No ratings yet

- Financial Forecasting 1Document44 pagesFinancial Forecasting 1ABOOBAKKERNo ratings yet

- BudgetingDocument35 pagesBudgetingRisty Ridharty DimanNo ratings yet

- Budgetary Control: Resource PersonDocument72 pagesBudgetary Control: Resource PersonjainmohitpvtltdNo ratings yet

- Annual Report and Accounts ContentsDocument5 pagesAnnual Report and Accounts ContentsTwinkle SuriNo ratings yet

- FIN 302 Notes 1Document55 pagesFIN 302 Notes 1Tekego TlakaleNo ratings yet

- BSBFIM801 Task 2 TemplateDocument29 pagesBSBFIM801 Task 2 TemplateMahwish AmmadNo ratings yet

- Budget Classifications: Kundan GanvirDocument17 pagesBudget Classifications: Kundan GanvirSirajUlHaqNo ratings yet

- Study__Master_Gr12_Accounting_BudgetingDocument6 pagesStudy__Master_Gr12_Accounting_Budgetingsiqiniseko2106No ratings yet

- MODULE 6 Topic 1Document34 pagesMODULE 6 Topic 1Lowie Aldani SantosNo ratings yet

- CH3 Part2Document71 pagesCH3 Part2Yasmine Ben YedderNo ratings yet

- Chapter08 KGWDocument24 pagesChapter08 KGWMir Zain Ul HassanNo ratings yet

- Week6 - PresentationDocument10 pagesWeek6 - PresentationFarhan ThaibNo ratings yet

- Chapter 4 Budgeting For Planning and ControlDocument8 pagesChapter 4 Budgeting For Planning and ControlShem CasimiroNo ratings yet

- Management of Fiscal ResourcesDocument3 pagesManagement of Fiscal ResourcesLeandrow BacolodNo ratings yet

- Aplication of FSADocument43 pagesAplication of FSAshristy2026No ratings yet

- Chapter 8 Master BudgetDocument58 pagesChapter 8 Master BudgetAtif Saeed100% (3)

- Yuri Annisa-Olfa Resha - Int - Class - Financial StatementsDocument16 pagesYuri Annisa-Olfa Resha - Int - Class - Financial StatementsolfareshaaNo ratings yet

- Week 4 Lesson Sources of FundsDocument29 pagesWeek 4 Lesson Sources of Fundsjane caranguianNo ratings yet

- Budgets and Projected Financial Statements PreparationDocument26 pagesBudgets and Projected Financial Statements PreparationAngelNo ratings yet

- Chapter TwoDocument53 pagesChapter TwomathewosNo ratings yet

- Unit 13 - BudgetsDocument20 pagesUnit 13 - BudgetsAdeirehs Eyemarket BrissettNo ratings yet

- CHAPTER 2 Discussion Part 1 3Document22 pagesCHAPTER 2 Discussion Part 1 3jdNo ratings yet

- Common Size StatementsDocument16 pagesCommon Size Statementskanikabhateja7No ratings yet

- Financial Planning and ForecastingDocument24 pagesFinancial Planning and ForecastingsadikiNo ratings yet

- Profit Planning and BudgetingDocument53 pagesProfit Planning and BudgetingBhey PayumoNo ratings yet

- Financial Reporting and Analysis: Inam-Ul-HaqueDocument36 pagesFinancial Reporting and Analysis: Inam-Ul-HaqueinamNo ratings yet

- CBS FSR Day 2Document21 pagesCBS FSR Day 2Samarpan RoyNo ratings yet

- Budget Classification: Submitted by - AsifDocument14 pagesBudget Classification: Submitted by - AsifAsiFAliNo ratings yet

- SFAC No 5Document28 pagesSFAC No 5Clara Indira PurnamasariNo ratings yet

- B Plan Handout 12Document43 pagesB Plan Handout 12SmayandasNo ratings yet

- Business - Finance 2PPSDocument26 pagesBusiness - Finance 2PPSkalghamdi24No ratings yet

- 4 Profit Planning Budgeting PDFDocument85 pages4 Profit Planning Budgeting PDFNadie LrdNo ratings yet

- Master BudgetDocument5 pagesMaster BudgetNicole VinaraoNo ratings yet

- BusinessPLan ManagementDocument6 pagesBusinessPLan ManagementPrashant KumarNo ratings yet

- Analysis of Financial Statements: Jian XiaoDocument115 pagesAnalysis of Financial Statements: Jian XiaoLim Mei SuokNo ratings yet

- Budgeting: Sowmiya.D Siva Sankar .N. V Siva Kumar Shalini Senthil Kumar Sathya NarayananDocument32 pagesBudgeting: Sowmiya.D Siva Sankar .N. V Siva Kumar Shalini Senthil Kumar Sathya NarayananSiva ShankarNo ratings yet

- CBS FA Day 3Document28 pagesCBS FA Day 3Samarpan RoyNo ratings yet

- Unit 3 BudgetingDocument33 pagesUnit 3 BudgetingPrajapati ArjunNo ratings yet

- Lecture 9 - Budgeting Budgetary Control - JJDocument26 pagesLecture 9 - Budgeting Budgetary Control - JJTariq KhanNo ratings yet

- Finanical Reporting1Document45 pagesFinanical Reporting1satishNo ratings yet

- Financial Planning Tools and ConceptsDocument31 pagesFinancial Planning Tools and ConceptsBryan Sandaga58% (12)

- Profit & Loss Account Balance Sheet Assets & Liabilities Fee Invoicing Annual Accounts/Auditing Tax Matters Insurance MattersDocument12 pagesProfit & Loss Account Balance Sheet Assets & Liabilities Fee Invoicing Annual Accounts/Auditing Tax Matters Insurance MattersANSLEM ALBERTNo ratings yet

- Administrative Skills: Budgets in A Business Environment: ITLA 023Document22 pagesAdministrative Skills: Budgets in A Business Environment: ITLA 023TAN XIEW LINGNo ratings yet

- BudgetingDocument2 pagesBudgetingNameNo ratings yet

- Financial Plan: Ventures 4Document25 pagesFinancial Plan: Ventures 4sadia.No ratings yet

- IV.1 The Budgeting ProcessDocument22 pagesIV.1 The Budgeting ProcessKin SaysonNo ratings yet

- Chapter 10 - The Financial Plan PDFDocument21 pagesChapter 10 - The Financial Plan PDFzulkifli alimuddinNo ratings yet

- Preparation of Financial BudgetDocument10 pagesPreparation of Financial Budgetarshad rahmanNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Tutorial - 1: Corporate Finance (Sec E & F)Document16 pagesTutorial - 1: Corporate Finance (Sec E & F)Vivekananda RNo ratings yet

- Study Id72992 Sri-LankaDocument71 pagesStudy Id72992 Sri-LankaVivekananda RNo ratings yet

- DCF Case StudyDocument17 pagesDCF Case StudyVivekananda RNo ratings yet

- Importance of Macro EconomicsDocument9 pagesImportance of Macro EconomicsHaren ShylakNo ratings yet

- Tutorial 04Document8 pagesTutorial 04Waruna PrabhaswaraNo ratings yet

- Balance Sheet Britannia Industries LTD (BRIT IN) - StandardizedDocument12 pagesBalance Sheet Britannia Industries LTD (BRIT IN) - Standardizedarchit sahayNo ratings yet

- Agritourism Market Rising Trends, Scope and Growth Analysis 2019-2025Document17 pagesAgritourism Market Rising Trends, Scope and Growth Analysis 2019-2025Klariz PatacsilNo ratings yet

- INDUSTRY ANALYSIS For Strategic PlanDocument6 pagesINDUSTRY ANALYSIS For Strategic PlanMerylle Shayne GustiloNo ratings yet

- RRL About Financial ProblemDocument3 pagesRRL About Financial ProblemHarry Styles100% (1)

- S5 AsymmInfoDocument2 pagesS5 AsymmInfosashaNo ratings yet

- Six Sigma: High Quality Can Lower Costs and Raise Customer SatisfactionDocument5 pagesSix Sigma: High Quality Can Lower Costs and Raise Customer SatisfactionsukhpreetbachhalNo ratings yet

- Ias 33 - EpsDocument26 pagesIas 33 - Epsnissiem10% (1)

- Chapter Sixteen: ConsumptionDocument21 pagesChapter Sixteen: Consumptionsherina niheNo ratings yet

- On December 1 2014 Boline Distributing Company Had The FollowingDocument1 pageOn December 1 2014 Boline Distributing Company Had The Followingtrilocksp SinghNo ratings yet

- THETAN ARENA ROI CALCU - JQCryptoDocument10 pagesTHETAN ARENA ROI CALCU - JQCryptoMikhail Roy Dela CruzNo ratings yet

- Southern Innovator Magazine From 2011 To 2012: A Compilation of Documents From The Magazine's Early YearsDocument25 pagesSouthern Innovator Magazine From 2011 To 2012: A Compilation of Documents From The Magazine's Early YearsDavid SouthNo ratings yet

- Chopra Scm6 Inppt 14Document56 pagesChopra Scm6 Inppt 14Alaa Al HarbiNo ratings yet

- Competitor Analysis Chapter 4Document23 pagesCompetitor Analysis Chapter 4Md.Yousuf AkashNo ratings yet

- Standard Ceramic Dividend PolicyDocument23 pagesStandard Ceramic Dividend PolicyEmon HossainNo ratings yet

- Cboec e 2021 02297Document3 pagesCboec e 2021 02297RatanaRoulNo ratings yet

- Example Subsidiary Journals FACDocument3 pagesExample Subsidiary Journals FACNonhlanhla DlaminiNo ratings yet

- Standard Costing and Variance AnalysisDocument30 pagesStandard Costing and Variance AnalysisPhool Chandra Chaudhary50% (2)

- Personal Time OffDocument3 pagesPersonal Time OffDaniel RhamesNo ratings yet

- Assignment: Submitted By: Muhammed Mashboob RMDocument6 pagesAssignment: Submitted By: Muhammed Mashboob RMMashboob R.MNo ratings yet

- Demand and Supply of Kellogs CornflakesDocument16 pagesDemand and Supply of Kellogs CornflakesAravind Menøn EdapillyNo ratings yet

- Question Paper: National AssemblyDocument2 pagesQuestion Paper: National AssemblyeNCA.comNo ratings yet

- CV With Photo 02Document1 pageCV With Photo 02munsifmohmand11No ratings yet

- The Digital Divide and Its Impact On Economic DevelopmentDocument2 pagesThe Digital Divide and Its Impact On Economic DevelopmentntanirudaNo ratings yet

- Wangsa Company Profile Full DocumentDocument101 pagesWangsa Company Profile Full DocumentNugroho CWNo ratings yet

- Value Chain AnalysisDocument4 pagesValue Chain AnalysisdanishNo ratings yet

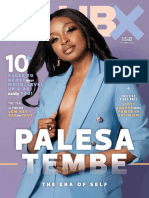

- ClubX - October 2022Document78 pagesClubX - October 2022LeonardoNo ratings yet

- Concierge Service Business PlanDocument35 pagesConcierge Service Business PlanTamer KhattabNo ratings yet

Financial Forecasting: The Science and Art of Forecasting

Financial Forecasting: The Science and Art of Forecasting

Uploaded by

Vivekananda R0 ratings0% found this document useful (0 votes)

23 views6 pagesFinancial forecasting involves determining the explicit forecast period, which is typically 10-15 years. The forecast should include a detailed 5-7 year forecast with complete financial statements, as well as a simplified forecast for the remaining years focusing on key variables. The process involves collecting historical data, integrating financial statements, building historical ratios, and reorganizing statements. Key steps are building a revenue forecast using top-down or bottom-up approaches, forecasting expenses and assets, reconciling the balance sheet, and calculating return on invested capital and free cash flow.

Original Description:

Original Title

Session 3 Forecasting Background

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinancial forecasting involves determining the explicit forecast period, which is typically 10-15 years. The forecast should include a detailed 5-7 year forecast with complete financial statements, as well as a simplified forecast for the remaining years focusing on key variables. The process involves collecting historical data, integrating financial statements, building historical ratios, and reorganizing statements. Key steps are building a revenue forecast using top-down or bottom-up approaches, forecasting expenses and assets, reconciling the balance sheet, and calculating return on invested capital and free cash flow.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

23 views6 pagesFinancial Forecasting: The Science and Art of Forecasting

Financial Forecasting: The Science and Art of Forecasting

Uploaded by

Vivekananda RFinancial forecasting involves determining the explicit forecast period, which is typically 10-15 years. The forecast should include a detailed 5-7 year forecast with complete financial statements, as well as a simplified forecast for the remaining years focusing on key variables. The process involves collecting historical data, integrating financial statements, building historical ratios, and reorganizing statements. Key steps are building a revenue forecast using top-down or bottom-up approaches, forecasting expenses and assets, reconciling the balance sheet, and calculating return on invested capital and free cash flow.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 6

Financial Forecasting

The science and art of forecasting

The Principles

The beginning

• Before forecasting individual line items, one must determine how many years to

forecast and how detailed the forecast should be.

• The explicit forecast period must be long enough for the company to reach a

steady state.

• Normally, in practice, the explicit forecast period (not applicable for startups)

could be 10-15 years. It may be even longer for cyclical companies or those

experiencing rapid growth.

• Split the forecast period:

• Detailed 5-7 year forecast, with complete financial statements with as many links to real

variables as possible (e.g., unit volume, cost per unit, price per unit etc.)

• A simplified forecast for the remaining years, focusing on a few key variables, such as

revenue growth, margins, and capital turnover.

The preparation for forecasting

• Collect raw historical data

• Financial statements, notes to accounts, audit report

• Integrate financial statements

• As a general rule, operating and nonoperating items should not be aggregated within the

same line item.

• The P&L should be linked with the Balance Sheet through retained earnings. Similarly link

Cash flow statement with P&L and Balance Sheet.

• Build historical financial ratios

• This step will help forecast future ratios to prepare forward financial statements

• Reorganize financial statements

• Reorganise the financial statements to key line items to forecast the long-end of the

forecast horizon and calculate important indicators (e.g., NOPLAT, Invested capital)

The nuts and Bolts

• Build Revenue Forecast

• Estimate future revenues by using either a top-down (market-based) or a bottom-up

(customer-based) approach. Bottom-up approach may also include product-wise /region-wise

forecast

• One may use predictive analytics for this purpose

• Past trend

• Correlation approach

• Determinants approach

• Geographical diversification

• Product mix

• Give extra emphasis to revenue forecast.

• Forecast the income statement

• Use appropriate economic drivers to forecast operating expenses, depreciation, S,G&A. For example, COGS

(as % of revenue)

The nuts and Bolts

• Forecast the Balance Sheet

• Forecast operating working capital, PPE, Intangible assets, and nonoperating assets

• Reconcile the balance sheet with investor funds

• Complete the balance sheet by computing retained earnings and forecasting other

equity items.

• Use excess cash and/or net debt to balance the balance sheet

• Calculate ROIC and FCF

• Calculate ROIC to ensure forecasts are consistent with economic principles, industry

dynamics, and the company’s ability to compete.

• To complete the forecast, calculate free cash flow (FCF) as the basis for valuation.

Future FCF should be calculated the same way as historical FCF.

You might also like

- Samsung's European Innovation Team: Fueling Consumer-Driven GrowthDocument19 pagesSamsung's European Innovation Team: Fueling Consumer-Driven GrowthVivekananda RNo ratings yet

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- L2 Merchant AcquiringV1.0Document59 pagesL2 Merchant AcquiringV1.0Shweta AgrawalNo ratings yet

- Chapter08 KGWDocument24 pagesChapter08 KGWk_Dashy8465No ratings yet

- Forecasting Financial Statements and Financial PlanningDocument12 pagesForecasting Financial Statements and Financial PlanningBrian Daniel BayotNo ratings yet

- Finman2 - Financial Forecasting & PlanningDocument12 pagesFinman2 - Financial Forecasting & PlanningKeaster DiazNo ratings yet

- Financial ModelingDocument21 pagesFinancial ModelingLAMOUCHI RIMNo ratings yet

- A Framework For Financial Statement AnalysisDocument27 pagesA Framework For Financial Statement AnalysisAndrea Prado CondeNo ratings yet

- Forecasting Performance: The Explicit Forecast Period: InstructorsDocument24 pagesForecasting Performance: The Explicit Forecast Period: InstructorsAarushi SharmaNo ratings yet

- Financial StatementDocument54 pagesFinancial StatementAlvin FelicianoNo ratings yet

- BudgetingDocument9 pagesBudgetingGAMBOA, LIEZEL G.No ratings yet

- Financial Forecasting 1Document44 pagesFinancial Forecasting 1ABOOBAKKERNo ratings yet

- BudgetingDocument35 pagesBudgetingRisty Ridharty DimanNo ratings yet

- Budgetary Control: Resource PersonDocument72 pagesBudgetary Control: Resource PersonjainmohitpvtltdNo ratings yet

- Annual Report and Accounts ContentsDocument5 pagesAnnual Report and Accounts ContentsTwinkle SuriNo ratings yet

- FIN 302 Notes 1Document55 pagesFIN 302 Notes 1Tekego TlakaleNo ratings yet

- BSBFIM801 Task 2 TemplateDocument29 pagesBSBFIM801 Task 2 TemplateMahwish AmmadNo ratings yet

- Budget Classifications: Kundan GanvirDocument17 pagesBudget Classifications: Kundan GanvirSirajUlHaqNo ratings yet

- Study__Master_Gr12_Accounting_BudgetingDocument6 pagesStudy__Master_Gr12_Accounting_Budgetingsiqiniseko2106No ratings yet

- MODULE 6 Topic 1Document34 pagesMODULE 6 Topic 1Lowie Aldani SantosNo ratings yet

- CH3 Part2Document71 pagesCH3 Part2Yasmine Ben YedderNo ratings yet

- Chapter08 KGWDocument24 pagesChapter08 KGWMir Zain Ul HassanNo ratings yet

- Week6 - PresentationDocument10 pagesWeek6 - PresentationFarhan ThaibNo ratings yet

- Chapter 4 Budgeting For Planning and ControlDocument8 pagesChapter 4 Budgeting For Planning and ControlShem CasimiroNo ratings yet

- Management of Fiscal ResourcesDocument3 pagesManagement of Fiscal ResourcesLeandrow BacolodNo ratings yet

- Aplication of FSADocument43 pagesAplication of FSAshristy2026No ratings yet

- Chapter 8 Master BudgetDocument58 pagesChapter 8 Master BudgetAtif Saeed100% (3)

- Yuri Annisa-Olfa Resha - Int - Class - Financial StatementsDocument16 pagesYuri Annisa-Olfa Resha - Int - Class - Financial StatementsolfareshaaNo ratings yet

- Week 4 Lesson Sources of FundsDocument29 pagesWeek 4 Lesson Sources of Fundsjane caranguianNo ratings yet

- Budgets and Projected Financial Statements PreparationDocument26 pagesBudgets and Projected Financial Statements PreparationAngelNo ratings yet

- Chapter TwoDocument53 pagesChapter TwomathewosNo ratings yet

- Unit 13 - BudgetsDocument20 pagesUnit 13 - BudgetsAdeirehs Eyemarket BrissettNo ratings yet

- CHAPTER 2 Discussion Part 1 3Document22 pagesCHAPTER 2 Discussion Part 1 3jdNo ratings yet

- Common Size StatementsDocument16 pagesCommon Size Statementskanikabhateja7No ratings yet

- Financial Planning and ForecastingDocument24 pagesFinancial Planning and ForecastingsadikiNo ratings yet

- Profit Planning and BudgetingDocument53 pagesProfit Planning and BudgetingBhey PayumoNo ratings yet

- Financial Reporting and Analysis: Inam-Ul-HaqueDocument36 pagesFinancial Reporting and Analysis: Inam-Ul-HaqueinamNo ratings yet

- CBS FSR Day 2Document21 pagesCBS FSR Day 2Samarpan RoyNo ratings yet

- Budget Classification: Submitted by - AsifDocument14 pagesBudget Classification: Submitted by - AsifAsiFAliNo ratings yet

- SFAC No 5Document28 pagesSFAC No 5Clara Indira PurnamasariNo ratings yet

- B Plan Handout 12Document43 pagesB Plan Handout 12SmayandasNo ratings yet

- Business - Finance 2PPSDocument26 pagesBusiness - Finance 2PPSkalghamdi24No ratings yet

- 4 Profit Planning Budgeting PDFDocument85 pages4 Profit Planning Budgeting PDFNadie LrdNo ratings yet

- Master BudgetDocument5 pagesMaster BudgetNicole VinaraoNo ratings yet

- BusinessPLan ManagementDocument6 pagesBusinessPLan ManagementPrashant KumarNo ratings yet

- Analysis of Financial Statements: Jian XiaoDocument115 pagesAnalysis of Financial Statements: Jian XiaoLim Mei SuokNo ratings yet

- Budgeting: Sowmiya.D Siva Sankar .N. V Siva Kumar Shalini Senthil Kumar Sathya NarayananDocument32 pagesBudgeting: Sowmiya.D Siva Sankar .N. V Siva Kumar Shalini Senthil Kumar Sathya NarayananSiva ShankarNo ratings yet

- CBS FA Day 3Document28 pagesCBS FA Day 3Samarpan RoyNo ratings yet

- Unit 3 BudgetingDocument33 pagesUnit 3 BudgetingPrajapati ArjunNo ratings yet

- Lecture 9 - Budgeting Budgetary Control - JJDocument26 pagesLecture 9 - Budgeting Budgetary Control - JJTariq KhanNo ratings yet

- Finanical Reporting1Document45 pagesFinanical Reporting1satishNo ratings yet

- Financial Planning Tools and ConceptsDocument31 pagesFinancial Planning Tools and ConceptsBryan Sandaga58% (12)

- Profit & Loss Account Balance Sheet Assets & Liabilities Fee Invoicing Annual Accounts/Auditing Tax Matters Insurance MattersDocument12 pagesProfit & Loss Account Balance Sheet Assets & Liabilities Fee Invoicing Annual Accounts/Auditing Tax Matters Insurance MattersANSLEM ALBERTNo ratings yet

- Administrative Skills: Budgets in A Business Environment: ITLA 023Document22 pagesAdministrative Skills: Budgets in A Business Environment: ITLA 023TAN XIEW LINGNo ratings yet

- BudgetingDocument2 pagesBudgetingNameNo ratings yet

- Financial Plan: Ventures 4Document25 pagesFinancial Plan: Ventures 4sadia.No ratings yet

- IV.1 The Budgeting ProcessDocument22 pagesIV.1 The Budgeting ProcessKin SaysonNo ratings yet

- Chapter 10 - The Financial Plan PDFDocument21 pagesChapter 10 - The Financial Plan PDFzulkifli alimuddinNo ratings yet

- Preparation of Financial BudgetDocument10 pagesPreparation of Financial Budgetarshad rahmanNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Tutorial - 1: Corporate Finance (Sec E & F)Document16 pagesTutorial - 1: Corporate Finance (Sec E & F)Vivekananda RNo ratings yet

- Study Id72992 Sri-LankaDocument71 pagesStudy Id72992 Sri-LankaVivekananda RNo ratings yet

- DCF Case StudyDocument17 pagesDCF Case StudyVivekananda RNo ratings yet

- Importance of Macro EconomicsDocument9 pagesImportance of Macro EconomicsHaren ShylakNo ratings yet

- Tutorial 04Document8 pagesTutorial 04Waruna PrabhaswaraNo ratings yet

- Balance Sheet Britannia Industries LTD (BRIT IN) - StandardizedDocument12 pagesBalance Sheet Britannia Industries LTD (BRIT IN) - Standardizedarchit sahayNo ratings yet

- Agritourism Market Rising Trends, Scope and Growth Analysis 2019-2025Document17 pagesAgritourism Market Rising Trends, Scope and Growth Analysis 2019-2025Klariz PatacsilNo ratings yet

- INDUSTRY ANALYSIS For Strategic PlanDocument6 pagesINDUSTRY ANALYSIS For Strategic PlanMerylle Shayne GustiloNo ratings yet

- RRL About Financial ProblemDocument3 pagesRRL About Financial ProblemHarry Styles100% (1)

- S5 AsymmInfoDocument2 pagesS5 AsymmInfosashaNo ratings yet

- Six Sigma: High Quality Can Lower Costs and Raise Customer SatisfactionDocument5 pagesSix Sigma: High Quality Can Lower Costs and Raise Customer SatisfactionsukhpreetbachhalNo ratings yet

- Ias 33 - EpsDocument26 pagesIas 33 - Epsnissiem10% (1)

- Chapter Sixteen: ConsumptionDocument21 pagesChapter Sixteen: Consumptionsherina niheNo ratings yet

- On December 1 2014 Boline Distributing Company Had The FollowingDocument1 pageOn December 1 2014 Boline Distributing Company Had The Followingtrilocksp SinghNo ratings yet

- THETAN ARENA ROI CALCU - JQCryptoDocument10 pagesTHETAN ARENA ROI CALCU - JQCryptoMikhail Roy Dela CruzNo ratings yet

- Southern Innovator Magazine From 2011 To 2012: A Compilation of Documents From The Magazine's Early YearsDocument25 pagesSouthern Innovator Magazine From 2011 To 2012: A Compilation of Documents From The Magazine's Early YearsDavid SouthNo ratings yet

- Chopra Scm6 Inppt 14Document56 pagesChopra Scm6 Inppt 14Alaa Al HarbiNo ratings yet

- Competitor Analysis Chapter 4Document23 pagesCompetitor Analysis Chapter 4Md.Yousuf AkashNo ratings yet

- Standard Ceramic Dividend PolicyDocument23 pagesStandard Ceramic Dividend PolicyEmon HossainNo ratings yet

- Cboec e 2021 02297Document3 pagesCboec e 2021 02297RatanaRoulNo ratings yet

- Example Subsidiary Journals FACDocument3 pagesExample Subsidiary Journals FACNonhlanhla DlaminiNo ratings yet

- Standard Costing and Variance AnalysisDocument30 pagesStandard Costing and Variance AnalysisPhool Chandra Chaudhary50% (2)

- Personal Time OffDocument3 pagesPersonal Time OffDaniel RhamesNo ratings yet

- Assignment: Submitted By: Muhammed Mashboob RMDocument6 pagesAssignment: Submitted By: Muhammed Mashboob RMMashboob R.MNo ratings yet

- Demand and Supply of Kellogs CornflakesDocument16 pagesDemand and Supply of Kellogs CornflakesAravind Menøn EdapillyNo ratings yet

- Question Paper: National AssemblyDocument2 pagesQuestion Paper: National AssemblyeNCA.comNo ratings yet

- CV With Photo 02Document1 pageCV With Photo 02munsifmohmand11No ratings yet

- The Digital Divide and Its Impact On Economic DevelopmentDocument2 pagesThe Digital Divide and Its Impact On Economic DevelopmentntanirudaNo ratings yet

- Wangsa Company Profile Full DocumentDocument101 pagesWangsa Company Profile Full DocumentNugroho CWNo ratings yet

- Value Chain AnalysisDocument4 pagesValue Chain AnalysisdanishNo ratings yet

- ClubX - October 2022Document78 pagesClubX - October 2022LeonardoNo ratings yet

- Concierge Service Business PlanDocument35 pagesConcierge Service Business PlanTamer KhattabNo ratings yet