Professional Documents

Culture Documents

Auditing Profession - Development and Key Issues: Nik Mohd Hasyudeen Yusoff President Malaysian Institute of Accountants

Auditing Profession - Development and Key Issues: Nik Mohd Hasyudeen Yusoff President Malaysian Institute of Accountants

Uploaded by

Jithu Philip0 ratings0% found this document useful (0 votes)

48 views16 pagesThis document discusses the auditing profession in Malaysia, global developments, audit quality review, and moving forward issues. It provides statistics on auditors and audit firms in Malaysia. Important elements that determine audit quality are discussed, including auditors, firms, standards, and oversight. Global efforts aim to converge auditing standards and address SME needs. In Malaysia, the MIA conducts practice reviews while an Audit Oversight Board will oversee listed company audits. Maintaining high audit quality remains important as businesses globalize and regulators become more involved in oversight.

Original Description:

Original Title

auditing-profession-global-development-and-key-issues-1223680424739032-9

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses the auditing profession in Malaysia, global developments, audit quality review, and moving forward issues. It provides statistics on auditors and audit firms in Malaysia. Important elements that determine audit quality are discussed, including auditors, firms, standards, and oversight. Global efforts aim to converge auditing standards and address SME needs. In Malaysia, the MIA conducts practice reviews while an Audit Oversight Board will oversee listed company audits. Maintaining high audit quality remains important as businesses globalize and regulators become more involved in oversight.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

48 views16 pagesAuditing Profession - Development and Key Issues: Nik Mohd Hasyudeen Yusoff President Malaysian Institute of Accountants

Auditing Profession - Development and Key Issues: Nik Mohd Hasyudeen Yusoff President Malaysian Institute of Accountants

Uploaded by

Jithu PhilipThis document discusses the auditing profession in Malaysia, global developments, audit quality review, and moving forward issues. It provides statistics on auditors and audit firms in Malaysia. Important elements that determine audit quality are discussed, including auditors, firms, standards, and oversight. Global efforts aim to converge auditing standards and address SME needs. In Malaysia, the MIA conducts practice reviews while an Audit Oversight Board will oversee listed company audits. Maintaining high audit quality remains important as businesses globalize and regulators become more involved in oversight.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 16

Auditing Profession –

Development and Key Issues

Nik Mohd Hasyudeen Yusoff

President

Malaysian Institute of Accountants

Agenda

• The auditing profession in Malaysia

• Global development

• Audit quality review

• Moving forward issues

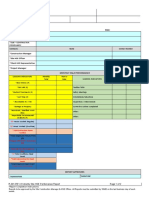

The auditing profession in Malaysia

• As at 30 June 2008:

▫ 2,436 accountants holding public practice certificate

▫ 1,348 firms are registered as audit firms

▫ 650 firms provide other accountancy services

• License to audit companies incorporated under the

Companies Act, 1965, is issued by the Ministry of

Finance to:

▫ Members of MIA holding public practice certificate

▫ Have no less than 3 years working experience in auditing

▫ Demonstrate capabilities during an interview process

The auditing profession in Malaysia

• Important elements in determining the performance

and quality of audit services include:

▫ The auditors

▫ The firms

▫ The legislative framework

▫ Standards relating to auditing

▫ The oversight of the quality of audit

The auditing profession in Malaysia

• The auditors should:

▫ Uphold professional values and standards

Integrity, Objectivity, Due Care, Independent

▫ Possess updated knowledge regarding auditing

Auditing standards

Accounting standards

Industry knowledge and experience

Legislative framework

▫ Have the necessary skills which need to be applied in

performing the audit

Global business environment

Web based business environment

Skills to apply principle-based standards

The auditing profession in Malaysia

• The firms should:

▫ Put in place framework, processes and procedures to

comply with auditing and quality control standards as

well as the applicable legislative framework

▫ Uphold professional values and standards

▫ Have the capacity to accept audit engagements before

doing so

The auditing profession in Malaysia

• The legislative framework in Malaysia includes,

among others, the followings:

▫ Financial Reporting Standards

▫ Companies Act

▫ Conditions on the Audit License

▫ Accountants Act

▫ Capital Market and Services Act

▫ Bursa Malaysia Listing Requirements

▫ Banking and Financial Institution Act

The auditing profession in Malaysia

• The standards relating to auditing are:

▫ MIA By-Laws, particularly on auditors independence

▫ International Standards on Auditing adopted in

Malaysia

▫ International Standards on Quality Control

▫ Practice guides issued by MIA

Global development

• Issues regarding audit quality has been the focus for

a long time

• International Auditing and Assurance Standards

Board (IAASB) is the body that sets auditing

standards for global adoption (www.ifac.org/iaasb)

• Oversee by the Public Interest Oversight Board

(POIB)

• Convergence of auditing standards is part of the IFAC

agenda

Global development

• IFAC is in support of a single auditing standard globally

and a separate standard for SME is not foreseeable

• Guidance on how ISAs to be applied in the context of

SME was recently issued

• The focus of IAASB 2009-2011 strategy would be:

▫ Development of standards

▫ Monitoring and facilitating adoption of the standards

▫ Responding to concerns about the implementation of the

standards

• The planned activities of IAASB would be directed

towards the effective operation of the world capital

markets and the needs of SMEs and SMPs

Global development

• Proposed revision of standards on Review

Engagements to provide alternative in jurisdiction

where audit for small companies are not mandatory

• A response towards the call for a separate auditing

standards for SMEs by SMPs

• IAASB recently issued an Audit Practice Alert

regarding the audit of fair value accounting

estimates under the current situation in the market

where the level of uncertainty is very high

Global development

• International Forum of Independent Audit Regulators

(IFIAR – www.ifiar.org) serves the protection of public

interest through enhancement of audit quality

• Share knowledge of audit market environment and

practical experience of independent audit regulatory

activity

• Provide the contact point for other international bodies

which have interest on audit quality

• It is now a global expectation that auditors of public

interest entities are regulated by a body which is

independent from the accounting profession

Audit quality review

• Practice review in Malaysia is conducted by MIA through its

Practice Review Department

• The reviewers are the staff of MIA, not a peer review

approach

• It is part of MIA’s commitment towards the protection of

public interest through the assurance of audit quality

• MIA Practice Review Committee’s Term of Reference:

▫ To oversee the implementation of the Practice Review

Programme.

▫ To consider and approve the review reports as presented by the

management centre (Practice Review Department).

▫ To provide guidance to the management centre and address any

concern which may arise in relation to the implementation of the

Practice Review Programme

Audit quality review

• The practice review process includes:

▫ Firms would be randomly for practice review

▫ The selected firms to perform a self-assessment on their

compliance with the relevant standards and legislative

framework

▫ The MIA practice review team would review the quality control

and internal control practices as well implementation of audit

standards by each partners within the firm

▫ The findings of the practice review would be agreed upon

between the practice review team and the partners of the firm

▫ A report would be table at the Practice Review Committee for

decision and action

▫ Opportunity would normally be given for firms to improve their

audit quality before disciplinary actions are taken

Audit quality review

• Among the recent development in Malaysia with respect

to review of audit quality are:

▫ The government had announced the setting up of the Audit

Oversight Board to oversee audit quality of auditors

auditing public listed companies and other public interest

entities

▫ The focus of AOB would be to review audit work,

investigate specific audit failures and conduct enforcement

actions against auditors who fail to comply with the

standards

▫ The MIA would continue to set and adopt auditing and

ethics standards, but the AOB would have the residual

power to adopt if MIA fails to do so

Moving forward issues

• The expectation on the quality of audit would remain

high in view of the interest of the investors on the

audited financial statement

• Audit quality goes beyond the competency of individual

auditor but depends on the capacity and professional

values adopted by the auditing firms

• As the business environment gets more globalised and

complex, auditing would be more challenging and the

quality of the people involved in audit would be very

important to maintain audit quality

• External agencies outside the accounting profession

would be more involved in the audit quality issues

You might also like

- Corporate Governance Multiple ChoiceDocument12 pagesCorporate Governance Multiple ChoiceOrda OrdaNo ratings yet

- Comprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeFrom EverandComprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeRating: 5 out of 5 stars5/5 (1)

- 01 Alison 9001Document34 pages01 Alison 9001Thant AungNo ratings yet

- The PWC Audit - 011704 PresentationDocument34 pagesThe PWC Audit - 011704 PresentationSalman Ahmed100% (1)

- Iso 14001Document3 pagesIso 14001abdul haseeb AslamNo ratings yet

- Certified Internal Auditor (CIA) Sunway TESDocument6 pagesCertified Internal Auditor (CIA) Sunway TESSunway University50% (4)

- 1 Quality Assessment Manual Chapter 1Document10 pages1 Quality Assessment Manual Chapter 1Tono Gitu100% (2)

- Filipino Sa Piling Larangan (4.1)Document43 pagesFilipino Sa Piling Larangan (4.1)Lalisa Ameler67% (24)

- Precision ReadingDocument11 pagesPrecision ReadingSharyl Plan SarominesNo ratings yet

- 5e Lesson Plan PlantsDocument4 pages5e Lesson Plan Plantsapi-540015241100% (1)

- Badri Rai v. State of Bihar, AIR 1958 SC 953: FactsDocument5 pagesBadri Rai v. State of Bihar, AIR 1958 SC 953: FactsDrsika100% (2)

- Practitoner S Session 1 The Audit Oversight BoardDocument26 pagesPractitoner S Session 1 The Audit Oversight BoardNa DanNo ratings yet

- Regulatory Framework of AuditingDocument18 pagesRegulatory Framework of AuditingSohaib BilalNo ratings yet

- Topic 4 - System of Quality ControlDocument16 pagesTopic 4 - System of Quality ControlSteph VillarosaNo ratings yet

- Auditing: Integral To The EconomyDocument47 pagesAuditing: Integral To The EconomyPei WangNo ratings yet

- The Professional StandardsWFADocument20 pagesThe Professional StandardsWFAMary Rose ArguellesNo ratings yet

- PrE-002-THE PROFESSIONAL STANDARDSDocument47 pagesPrE-002-THE PROFESSIONAL STANDARDSLaezelie PalajeNo ratings yet

- 3 Audit ProcessDocument66 pages3 Audit ProcessSabiriene HaroonNo ratings yet

- Internal Audit STNDDocument44 pagesInternal Audit STNDvmmalviyaNo ratings yet

- The Institute of Chartered Accountants of IndiaDocument44 pagesThe Institute of Chartered Accountants of IndiaAshima GuptaNo ratings yet

- Audit Oversight BoardDocument29 pagesAudit Oversight BoardMohd SazmanNo ratings yet

- Auditing Standards GRDocument36 pagesAuditing Standards GRK SinghNo ratings yet

- AA - Spring 2021 13 Quality ControlDocument13 pagesAA - Spring 2021 13 Quality ControlSarim AhmadNo ratings yet

- ISO 9001 Benefits To An OrganisationDocument28 pagesISO 9001 Benefits To An OrganisationkrishnamythriNo ratings yet

- AQMF For SAS Probationers 20210415103450Document25 pagesAQMF For SAS Probationers 20210415103450Mohamed AtefNo ratings yet

- Logistics Quality ManagementDocument93 pagesLogistics Quality ManagementjbnickafNo ratings yet

- KCB BANK - Sustainability-Report-Strategy-003Document6 pagesKCB BANK - Sustainability-Report-Strategy-003afyanixyzNo ratings yet

- Session 2 - QAR Audit Methodology Manual - IsQMDocument49 pagesSession 2 - QAR Audit Methodology Manual - IsQMRheneir MoraNo ratings yet

- Informasi Dan Kontrol AuditDocument58 pagesInformasi Dan Kontrol AuditJodi PakpahanNo ratings yet

- Quality Management of Audit Work - ISQM 1&2Document12 pagesQuality Management of Audit Work - ISQM 1&2Cassie HowardNo ratings yet

- ISO Management Systems: Guidance On Understanding The Benefits of An ISO Management SystemDocument31 pagesISO Management Systems: Guidance On Understanding The Benefits of An ISO Management SystemSaid SakrNo ratings yet

- Informe Auditoria InglesDocument10 pagesInforme Auditoria InglesMARICIELO YOLANDA BUITRON CAHUASNo ratings yet

- Nirav Modi ScamDocument16 pagesNirav Modi ScamAbhishek ChoudharyNo ratings yet

- Systems & Performance Improvement Methodology PDFDocument32 pagesSystems & Performance Improvement Methodology PDFsalanziNo ratings yet

- Iso 9001 Implementation PlanDocument8 pagesIso 9001 Implementation PlanPaul Ryan100% (3)

- ISO Management SystemsDocument31 pagesISO Management SystemsLucianMateescu100% (1)

- Presentation of Expertise Training CourseDocument74 pagesPresentation of Expertise Training CourseOmnia HassanNo ratings yet

- At 03Document6 pagesAt 03Mitch PacienteNo ratings yet

- Chapter SevenDocument22 pagesChapter SevenFT Geeyah TahirNo ratings yet

- Quality Assessment Manual Chapter 2Document16 pagesQuality Assessment Manual Chapter 2Zau SengNo ratings yet

- Proposal Farmafood Company (IMS)Document21 pagesProposal Farmafood Company (IMS)Departed MoonNo ratings yet

- Auditing: Integral To The Economy: Chapter 1Document48 pagesAuditing: Integral To The Economy: Chapter 1Alain Fung Land MakNo ratings yet

- Unit-4 Quality Management SystemsDocument31 pagesUnit-4 Quality Management SystemsFarshan SulaimanNo ratings yet

- Resume CA TejashreeDocument2 pagesResume CA Tejashreearchana.pawar123No ratings yet

- Chapter 03 IA and CG 2017 Azian LatestDocument25 pagesChapter 03 IA and CG 2017 Azian LatestNORAZIAN HUSSINNo ratings yet

- 01 Rittenberg PPT Ch1Document48 pages01 Rittenberg PPT Ch1Isabel HigginsNo ratings yet

- QM CH3Document61 pagesQM CH3Tole DelúxëNo ratings yet

- Week 3 PlanningDocument38 pagesWeek 3 Planningptnyagortey91No ratings yet

- Chapter 4 Audit Organization and ManagementDocument7 pagesChapter 4 Audit Organization and ManagementSteffany RoqueNo ratings yet

- L4-Organizational Structure of BanksDocument26 pagesL4-Organizational Structure of BanksShameel IrshadNo ratings yet

- Interview QuestionsDocument7 pagesInterview QuestionsSufyan KhanNo ratings yet

- Audit Theory ISA 220 Quicknotes IDocument1 pageAudit Theory ISA 220 Quicknotes Imarckfelipe8No ratings yet

- Regulation Within The Firm: By: Karluz Mhore D. Trugo, CPADocument24 pagesRegulation Within The Firm: By: Karluz Mhore D. Trugo, CPAJoyce Anne GarduqueNo ratings yet

- AQM-II Fujitsu Case StudyDocument21 pagesAQM-II Fujitsu Case StudySiddharth JhaNo ratings yet

- Audit Planning Lecture 6 NewDocument24 pagesAudit Planning Lecture 6 Newpadjetey00No ratings yet

- Corporate Governance Rating Agencies ParametersDocument9 pagesCorporate Governance Rating Agencies ParametersPrachi AggarwalNo ratings yet

- Internal Audit Key Performance IndicatorsDocument21 pagesInternal Audit Key Performance IndicatorsHenry James Nepomuceno100% (1)

- Risk Assesment 1 MOHDocument12 pagesRisk Assesment 1 MOHGukan DoniNo ratings yet

- AC341 FA1 - 2022-23 Student HandoutDocument103 pagesAC341 FA1 - 2022-23 Student Handoutparminder0011No ratings yet

- B Plan TurkeyDocument10 pagesB Plan TurkeyhughesacountingNo ratings yet

- Auditing Manual Volume IDocument48 pagesAuditing Manual Volume IElena PanainteNo ratings yet

- PPT1-Auditing Integral To The EconomyDocument34 pagesPPT1-Auditing Integral To The EconomyEvelyn Purnama SariNo ratings yet

- Managing The Internal Auditing ActivityDocument32 pagesManaging The Internal Auditing Activityoliver50% (2)

- ISO 9001:2015 Internal Audits Made Easy: Tools, Techniques, and Step-by-Step Guidelines for Successful Internal AuditsFrom EverandISO 9001:2015 Internal Audits Made Easy: Tools, Techniques, and Step-by-Step Guidelines for Successful Internal AuditsNo ratings yet

- The Art and Science of Auditing: Principles, Practices, and InsightsFrom EverandThe Art and Science of Auditing: Principles, Practices, and InsightsNo ratings yet

- Abuda Et Al. SIMs Effect On The Mathematics Achievement of SARDOSDocument11 pagesAbuda Et Al. SIMs Effect On The Mathematics Achievement of SARDOSBenAbudaNo ratings yet

- Parent Involvment-Geaneria GreenDocument9 pagesParent Involvment-Geaneria Greenapi-488086646100% (1)

- MEHWISH English AssignmentDocument5 pagesMEHWISH English AssignmenttehseenullahNo ratings yet

- Zoheb Khan: Sales & BDM / Reservations / Guest RelationsDocument2 pagesZoheb Khan: Sales & BDM / Reservations / Guest RelationsAbhishek aby5No ratings yet

- Hamilton vs. Jefferson NotesDocument6 pagesHamilton vs. Jefferson NotesJess ReynoldsNo ratings yet

- A Report On A Published Feasibility Study: Project Development and ResearchDocument63 pagesA Report On A Published Feasibility Study: Project Development and ResearchVerum PuerNo ratings yet

- BDBL AssignmentDocument9 pagesBDBL AssignmentSamira IslamNo ratings yet

- Mountain Province State Polytechnic College: Vision Course SyllabusDocument5 pagesMountain Province State Polytechnic College: Vision Course SyllabusArnold Leand BatulNo ratings yet

- Handwriting Difficulties and Their Assessment in Young Adults With DCD: Extension of The DASH For 17-To 25-Year-OldsDocument8 pagesHandwriting Difficulties and Their Assessment in Young Adults With DCD: Extension of The DASH For 17-To 25-Year-OldsMarilyn BucahchanNo ratings yet

- Effect of Organizational Structure On The Performance of OrganizationDocument40 pagesEffect of Organizational Structure On The Performance of OrganizationArren Khan100% (1)

- 11 Heirs of Mendoza v. ES Trucking and Forwarders, G.R. No. 243237, February 17, 2020Document14 pages11 Heirs of Mendoza v. ES Trucking and Forwarders, G.R. No. 243237, February 17, 2020RozaiineNo ratings yet

- A Pathway To Equitable Math Instruction AgencyDocument15 pagesA Pathway To Equitable Math Instruction AgencyThePoliticalHatNo ratings yet

- Labour Law FD, 2113Document20 pagesLabour Law FD, 2113Pb 29 Speaker 1No ratings yet

- 3 Phases of Education Elementary Education (Upto Age of 20 Years)Document3 pages3 Phases of Education Elementary Education (Upto Age of 20 Years)jiasd bvdseNo ratings yet

- Work Experience: Art, Science, Technology and CommunityDocument2 pagesWork Experience: Art, Science, Technology and CommunityDivya MaheshNo ratings yet

- Application Form - UkDocument19 pagesApplication Form - UktungolcildNo ratings yet

- Mandatory Reporting Fields Date:: R-001-REV.01-Montly Site HSE Performance Report Page 1 of 2Document2 pagesMandatory Reporting Fields Date:: R-001-REV.01-Montly Site HSE Performance Report Page 1 of 2Ravelle JacquireNo ratings yet

- Course Syllabus - Problem AreasDocument5 pagesCourse Syllabus - Problem AreasAna MarieNo ratings yet

- Is Organic Food Really A Better OptionDocument5 pagesIs Organic Food Really A Better Optionapi-292000856No ratings yet

- 4 Plan GuidanceDocument1 page4 Plan GuidanceAntonio BogdanNo ratings yet

- Rakesh Front PagesDocument5 pagesRakesh Front PagesAnu GraphicsNo ratings yet

- Unit 1 Test Standar Level Answer KeyDocument2 pagesUnit 1 Test Standar Level Answer KeyRaquel Fernández Casatejada100% (1)

- Problem Based Learning PDFDocument1 pageProblem Based Learning PDFGerald John PazNo ratings yet

- Lesson 1: A Perspective On EnrepreneushipDocument4 pagesLesson 1: A Perspective On EnrepreneushipJaja MikaelaNo ratings yet

- Template Rps Toeic For AeccDocument3 pagesTemplate Rps Toeic For AeccAli Akbar RafsanNo ratings yet