Professional Documents

Culture Documents

The Stock Market, The Theory of Rational Expectations, and The Efficient Market Hypothesis

The Stock Market, The Theory of Rational Expectations, and The Efficient Market Hypothesis

Uploaded by

Lân ÀaCopyright:

Available Formats

You might also like

- Module 2 Interest and Money Time RelationshipsDocument29 pagesModule 2 Interest and Money Time RelationshipsBenj Paulo Andres83% (6)

- 7 - The Stock MarketDocument20 pages7 - The Stock MarketcihtanbioNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 07Document38 pagesMultinational Business Finance 12th Edition Slides Chapter 07Alli Tobba100% (1)

- Equity ValuationDocument49 pagesEquity ValuationArmanbekAlkinNo ratings yet

- Acc. No.: Boulton's Toy EmporiumDocument5 pagesAcc. No.: Boulton's Toy EmporiumMisty TranquilNo ratings yet

- The Stock Market, The Theory of Rational Expectations, and The Efficient Market HypothesisDocument31 pagesThe Stock Market, The Theory of Rational Expectations, and The Efficient Market HypothesischooisinNo ratings yet

- B01032 - Chapter 07 - The Stock Market, The Theory of Rational Expectations and The Efficient Market HypothesisDocument14 pagesB01032 - Chapter 07 - The Stock Market, The Theory of Rational Expectations and The Efficient Market HypothesisDương Thị Kim HiềnNo ratings yet

- Handout CH07 Mish11 EMBFMDocument8 pagesHandout CH07 Mish11 EMBFMhungtr8923No ratings yet

- Corporate FinanceDocument19 pagesCorporate FinanceElegi ZuhriNo ratings yet

- The Stock Market, The Theory of Rational Expectations, and The Efficient Market HypothesisDocument20 pagesThe Stock Market, The Theory of Rational Expectations, and The Efficient Market HypothesisMelissa MayNo ratings yet

- Week 6 - Effifcient Market TheoryDocument60 pagesWeek 6 - Effifcient Market TheoryOtgoo HNo ratings yet

- Monetary Policy Reporting 7Document16 pagesMonetary Policy Reporting 7Flores Jevie VargasNo ratings yet

- Mishkin - Chapter 7 - MarkupDocument39 pagesMishkin - Chapter 7 - MarkupJeet JainNo ratings yet

- Chapter 07Document49 pagesChapter 07LEE JIA XINo ratings yet

- CH10 ... Capital Markets & The Pricing of RiskDocument50 pagesCH10 ... Capital Markets & The Pricing of RiskMariam AlraeesiNo ratings yet

- CH 10Document24 pagesCH 10Kurnia Afrilia Erka PNo ratings yet

- CH 10Document24 pagesCH 10Kurnia Afrilia Erka PNo ratings yet

- The Stock Market, The Theory of Rational Expectations, and The Efficient Market HypothesisDocument34 pagesThe Stock Market, The Theory of Rational Expectations, and The Efficient Market HypothesisHarshit MasterNo ratings yet

- EXCHANGE RATE DETERMINATION 30112023 114303am 12052024 073235pmDocument15 pagesEXCHANGE RATE DETERMINATION 30112023 114303am 12052024 073235pmFatima QureshiNo ratings yet

- Chapter 6Document2 pagesChapter 6Lina Levvenia RatanamNo ratings yet

- Week 5 Chapter Outline: Stock Valuation and RiskDocument43 pagesWeek 5 Chapter Outline: Stock Valuation and RiskSaniyaNo ratings yet

- Lecture 4 - Equity ValuationDocument45 pagesLecture 4 - Equity Valuationchenzhi fanNo ratings yet

- 157 53715 EA416 2012 1 2 1 Ch6Document44 pages157 53715 EA416 2012 1 2 1 Ch6Khaleeq AhmedNo ratings yet

- CHP 10.Document21 pagesCHP 10.Kurnia Afrilia Erka PNo ratings yet

- Stock Valuation and Risk: Financial Markets and Institutions, 7e, Jeff MaduraDocument33 pagesStock Valuation and Risk: Financial Markets and Institutions, 7e, Jeff MaduraRASHID PERVEZNo ratings yet

- 05 Valuing Stocks and Assesing Risk - YPSDocument44 pages05 Valuing Stocks and Assesing Risk - YPSMaulanaNo ratings yet

- Reading 25 - Return ConceptsDocument12 pagesReading 25 - Return ConceptsJuan MatiasNo ratings yet

- Common Stock ValuationDocument34 pagesCommon Stock ValuationSatria DeniNo ratings yet

- Cost of Equity - IMIDocument54 pagesCost of Equity - IMIEeshank KarnwalNo ratings yet

- Stocks and Their ValuationDocument17 pagesStocks and Their ValuationSafaet Rahman SiyamNo ratings yet

- Chapter 07 International Parity ConditionsDocument49 pagesChapter 07 International Parity ConditionsWen Qi WongNo ratings yet

- Part Two: Fundamentals of Financial MarketsDocument38 pagesPart Two: Fundamentals of Financial MarketsĐỗ Thanh SơnNo ratings yet

- Corporate Finance - YCH1GUDocument10 pagesCorporate Finance - YCH1GUwerner.marton.bNo ratings yet

- This Study Resource WasDocument4 pagesThis Study Resource Wasnaura syahdaNo ratings yet

- Stock Valuation DocuDocument4 pagesStock Valuation DocuCelestiaNo ratings yet

- Balance Sheet Valuation Methods: Book Value MeasureDocument43 pagesBalance Sheet Valuation Methods: Book Value MeasureodvutNo ratings yet

- Stock Market Basics and Stock Pricing: Mishkin CH 7 - Part A Page 151-159 Plus Supplementary Lecture NotesDocument20 pagesStock Market Basics and Stock Pricing: Mishkin CH 7 - Part A Page 151-159 Plus Supplementary Lecture NotesraviNo ratings yet

- Chapter 8 2023Document34 pagesChapter 8 2023dhaanh200104No ratings yet

- Chapter 9 - RDocument37 pagesChapter 9 - RCFANo ratings yet

- FINC4101 Investment Analysis: Instructor: Dr. Leng Ling Topic: Equity ValuationDocument48 pagesFINC4101 Investment Analysis: Instructor: Dr. Leng Ling Topic: Equity Valuationsteffuts100% (1)

- Part Two: Fundamentals of Financial MarketsDocument36 pagesPart Two: Fundamentals of Financial Marketsanon_355962815No ratings yet

- Lec 4+5 - Chapter 7&9Document66 pagesLec 4+5 - Chapter 7&9The flying peguine CụtNo ratings yet

- BBM2009 SaigonISB CF Lecture 6 AccessibleDocument28 pagesBBM2009 SaigonISB CF Lecture 6 AccessibleLe Tuong MinhNo ratings yet

- YhjhtyfyhfghfhfhfjhgDocument10 pagesYhjhtyfyhfghfhfhfjhgbabylovelylovelyNo ratings yet

- 15 - Will The Real P e Please Stand UpDocument3 pages15 - Will The Real P e Please Stand UpOuwehand OrgNo ratings yet

- Stock ValuationDocument16 pagesStock ValuationHassaan NasirNo ratings yet

- Chap7 - Stock Valuation - PPimanDocument18 pagesChap7 - Stock Valuation - PPimanBẢO NGUYỄN QUỐCNo ratings yet

- The Meaning and Measurement of Risk and Return: All Rights ReservedDocument35 pagesThe Meaning and Measurement of Risk and Return: All Rights ReservednikowawaNo ratings yet

- International Parity ConditionsDocument45 pagesInternational Parity ConditionsSylvia Al-a'maNo ratings yet

- 2022 ICM Part 3Document61 pages2022 ICM Part 3amkamo99No ratings yet

- Bekaert 2e SM Ch10Document11 pagesBekaert 2e SM Ch10Xinyi Kimmy LiangNo ratings yet

- Finance 1Document19 pagesFinance 1Tom BolhoodNo ratings yet

- What Do Interest Rates Mean and What Is Their Role in Valuation?Document28 pagesWhat Do Interest Rates Mean and What Is Their Role in Valuation?Afaq AhmedNo ratings yet

- Fundamental AnalysisDocument2 pagesFundamental AnalysisHemant SarangNo ratings yet

- FM14e SM Ch07Document31 pagesFM14e SM Ch07Taha FatimaNo ratings yet

- Fin 310 Lecture 5 - Risk & Return Diversification Portfolio Theory CAPM APTDocument92 pagesFin 310 Lecture 5 - Risk & Return Diversification Portfolio Theory CAPM APTYaonik HimmatramkaNo ratings yet

- Intro To Banking ch.6 Part 1Document10 pagesIntro To Banking ch.6 Part 1SherifEl-ShaarawiNo ratings yet

- Security Analysis: Learning Objective Fundamental AnalysisDocument0 pagesSecurity Analysis: Learning Objective Fundamental AnalysisGunjan Resurrected RanjanNo ratings yet

- Bonds and Their ValuationDocument7 pagesBonds and Their ValuationRoyce Maenard EstanislaoNo ratings yet

- Far Eastern University: Bonds Are Classified Into Four Main TypesDocument7 pagesFar Eastern University: Bonds Are Classified Into Four Main TypesAleah Jehan AbuatNo ratings yet

- Quantum Strategy II: Winning Strategies of Professional InvestmentFrom EverandQuantum Strategy II: Winning Strategies of Professional InvestmentNo ratings yet

- Quantum Strategy: Winning Strategies of Professional InvestmentFrom EverandQuantum Strategy: Winning Strategies of Professional InvestmentNo ratings yet

- Bill Hwang IndictmentDocument40 pagesBill Hwang IndictmentZerohedge100% (2)

- BilledStatements 7979 27-02-24 22.58Document2 pagesBilledStatements 7979 27-02-24 22.58jagadeshpandu16No ratings yet

- Iibf Jaiib ApplicationDocument4 pagesIibf Jaiib Applicationreachtorajan700No ratings yet

- DB Quiz-2007Document4 pagesDB Quiz-2007harlequin007No ratings yet

- Rep. Planters Bank V Agana SR Mar. 3, 1997 Hermosisima, J. Recit-Ready VersionDocument3 pagesRep. Planters Bank V Agana SR Mar. 3, 1997 Hermosisima, J. Recit-Ready VersionGabe Ruaro100% (1)

- AIS Chapter 1 Lecture NotesDocument28 pagesAIS Chapter 1 Lecture NotesNhi Ho50% (4)

- Free ZCFX PDFDocument50 pagesFree ZCFX PDFAnderson Bragagnolo100% (2)

- Labuan IBFC Business Guide2Document102 pagesLabuan IBFC Business Guide2iori42No ratings yet

- Growth StrategyDocument25 pagesGrowth StrategyJoyce Anne P. BandaNo ratings yet

- Musharakah: 'Musharakah' Is A Word of Arabic Origin Which LiterallyDocument10 pagesMusharakah: 'Musharakah' Is A Word of Arabic Origin Which LiterallySaqlain KhanNo ratings yet

- Act202 Project Final Tea Stall Docx Determine Cost BudgetDocument17 pagesAct202 Project Final Tea Stall Docx Determine Cost BudgetFahad ChowdhuryNo ratings yet

- Corp Law Outline 5 - 2020Document4 pagesCorp Law Outline 5 - 2020Effy SantosNo ratings yet

- FM6 Financial Reporting and Analysis SyllabusDocument15 pagesFM6 Financial Reporting and Analysis SyllabusLloyd CatonNo ratings yet

- Coal Outlook 2019 - Webinar Alumni Tambang ITB - Sandro H S PDFDocument32 pagesCoal Outlook 2019 - Webinar Alumni Tambang ITB - Sandro H S PDFhipsterzNo ratings yet

- The Four Dimensions of Public Financial ManagementDocument9 pagesThe Four Dimensions of Public Financial ManagementInternational Consortium on Governmental Financial Management100% (2)

- Maths McqsDocument10 pagesMaths McqsafeeraNo ratings yet

- Financial Performance Analysis of Islamic Bank in Bangladesh: A Case Study On Al-Arafah Islami Bank LimitedDocument9 pagesFinancial Performance Analysis of Islamic Bank in Bangladesh: A Case Study On Al-Arafah Islami Bank LimitedPremier PublishersNo ratings yet

- Sap AssetDocument105 pagesSap AssetMithun Roy100% (2)

- Cyprus Holding CompaniesDocument2 pagesCyprus Holding CompanieskalinovskayaNo ratings yet

- Budgeting, Capital Structure, and Working Capital ManagementDocument11 pagesBudgeting, Capital Structure, and Working Capital Managementritu paudelNo ratings yet

- Budget Cycle (Budget Accountability) TEAM 1Document43 pagesBudget Cycle (Budget Accountability) TEAM 1Patrick LanceNo ratings yet

- Limits ChartsDocument6 pagesLimits ChartsveenamadhurimeduriNo ratings yet

- Exam 14 February 2020 Questions and AnswersDocument6 pagesExam 14 February 2020 Questions and AnswersCielo DecilloNo ratings yet

- La Taxonomia NIIF para PYMES Ilustrada 2015Document43 pagesLa Taxonomia NIIF para PYMES Ilustrada 2015Jose HernandezNo ratings yet

- 2011 Omgeo CTM Prod Rel Info Docs x4 PDFDocument28 pages2011 Omgeo CTM Prod Rel Info Docs x4 PDFsdonthy_gmailNo ratings yet

- Carmax, Inc.: Sector: Consumer Industry: Automotive RetailDocument2 pagesCarmax, Inc.: Sector: Consumer Industry: Automotive RetailRoshan DhongadeNo ratings yet

- SparcDocument80 pagesSparcPriyanka KumarNo ratings yet

- AM Organisational Overview of GEMS PDFDocument26 pagesAM Organisational Overview of GEMS PDFAmit SharmaNo ratings yet

The Stock Market, The Theory of Rational Expectations, and The Efficient Market Hypothesis

The Stock Market, The Theory of Rational Expectations, and The Efficient Market Hypothesis

Uploaded by

Lân ÀaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Stock Market, The Theory of Rational Expectations, and The Efficient Market Hypothesis

The Stock Market, The Theory of Rational Expectations, and The Efficient Market Hypothesis

Uploaded by

Lân ÀaCopyright:

Available Formats

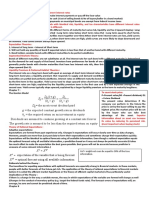

Chapter 3

The Stock Market, the Theory of Rational

Expectations,

and the Efficient Market Hypothesis

7-1 © 2013 Pearson Education, Inc. All rights reserved.

Objectives

Calculate the price of common stock

Recognise the impact of new information on

stock prises

Compare and contrast adaptive expectation and

rational expectations

Identify and explain the implications of the

efficient market hypothesis for financial markets

Summarize the reasons why behavioral finance

suggests that the efficient market hypothesis

may not hold.

7-2 © 2013 Pearson Education, Inc. All rights reserved.

Contents

Computing the Price of Common Stock

How the Market Sets Prices

An application

The Theory of Rational Expectations

The Efficient Market Hypothesis: Rational

Expectations in Financial Markets

Some applications

Why the Efficient Market Hypothesis Does Not

Imply that Financial Markets are Efficient

Overview of Behavioral Finance

7-3 © 2013 Pearson Education, Inc. All rights reserved.

Computing the Price of Common

Stock

The One-Period Valuation Model

Div1 P1

P0

(1 ke ) (1 ke )

P0 = the current price of the stock

Div1 = the dividend paid at the end of year 1

ke = the required return on investment in equity

P1 = the sale price of the stock at the end of the first period

7-4 © 2013 Pearson Education, Inc. All rights reserved.

Computing the Price of Common

Stock (cont’d)

The Generalized Dividend Valuation Model

The value of stock today is the present value of all future cash flows

D1 D2 Dn Pn

P0 ...

(1 ke ) (1 ke )

1 2

(1 ke ) n

(1 ke ) n

If Pn is far in the future, it will not affect P0

Dt

P0

t 1 (1 ke )t

The price of the stock is determined only by the present value of

the future dividend stream

7-5 © 2013 Pearson Education, Inc. All rights reserved.

Computing the Price of Common

Stock (cont’d)

The Gordon Growth Model

D0 (1 g) D1

P0

(ke g) (ke g)

D0 = the most recent dividend paid

g = the expected constant growth rate in dividends

ke = the required return on an investment in equity

Dividends are assumed to continue growing at a constant rate forever

The growth rate is assumed to be less than the required return on equity

7-6 © 2013 Pearson Education, Inc. All rights reserved.

How the Market Sets Prices

• The price is set by the buyer willing to pay

the highest price

• The market price will be set by the buyer

who can take best advantage of the asset

• Superior information about an asset can

increase its value by reducing its perceived

risk

7-7 © 2013 Pearson Education, Inc. All rights reserved.

How the Market Sets Prices

(cont’d)

AB corp. stock: - market analysts expect the firm to grow at 3%

indefinitely;

- Expected to pay a $2 dividend next year.

•You: uncertain about dividend stream and accuracy of the estimated

growth rate => require a return of 15%.

•Jenifer: has a little bit of information => require a return of 12%.

•Bud: knows certainty what the future of the firm actually looks like =>

require a return of 10%.

Investor Discount Stock price

You 15% $ 16,67

Jenifer 12% $ 22,22

Bud 10% $ 28,57

7-8 © 2013 Pearson Education, Inc. All rights reserved.

How the Market Sets Prices

(cont’d)

• Information is important for individuals to

value each asset.

• When new information is released about a

firm, expectations and prices change.

• Market participants constantly receive

information and revise their expectations, so

stock prices change frequently.

7-9 © 2013 Pearson Education, Inc. All rights reserved.

Application: The Global Financial

Crisis and the Stock Market

• Financial crisis that started in August 2007

led to one of the worst bear markets in 50

years.

• Downward revision of growth prospects: ↓g.

• Increased uncertainty: ↑ke

• Gordon model predicts a drop in stock

prices.

Homework:Use Gordon model to explain how

monetary policy effect stock prices.

7-10 © 2013 Pearson Education, Inc. All rights reserved.

The Theory of Rational

Expectations

• Adaptive expectations hypothesis:

– Expectations are formed from past experience

only.

– Changes in expectations will occur slowly over

time as data changes.

– Has been faulted:

+ People use more than just past data on a single variable to

form their expectations

+ People often change their expectations quickly in the light of

new information.

7-11 © 2013 Pearson Education, Inc. All rights reserved.

The Theory of Rational

Expectations (cont’d)

• Expectations will be identical to optimal forecasts

using all available information

• Even though a rational expectation equals the

optimal forecast using all available information, a

prediction based on it may not always be perfectly

accurate

– It takes too much effort to make the expectation the best

guess possible

– Best guess will not be accurate because predictor is

unaware of some relevant information

7-12 © 2013 Pearson Education, Inc. All rights reserved.

The Theory of Rational

Expectations (cont’d)

Formal Statement of the Theory

X e X of

X e expectation of the variable that is being forecast

X of = optimal forecast using all available information

7-13 © 2013 Pearson Education, Inc. All rights reserved.

The Theory of Rational

Expectations (cont’d)

Rationale Behind the Theory

- The incentives for equating expectations with optimal

forecasts are especially strong in financial markets. In

these markets, people with better forecasts of the

future get rich.

-The application of the theory of rational expectations

to financial markets (where it is called the efficient

market hypothesis or the theory of efficient capital

markets) is thus particularly useful

-…

7-14 © 2013 Pearson Education, Inc. All rights reserved.

The Theory of Rational

Expectations (cont’d)

Implications of the Theory

• If there is a change in the way a variable moves,

the way in which expectations of the variable are

formed will change as well

– Changes in the conduct of monetary policy (e.g. target the

federal funds rate)

• The forecast errors of expectations will, on average,

be zero and cannot be predicted ahead of time.

7-15 © 2013 Pearson Education, Inc. All rights reserved.

The Efficient Market Hypothesis:

Rational Expectations in Financial

Markets (Eugene Fama – The Nobel Prize in economics)

The efficient market hypothesis is based on the assumption that

prices of securities in financial markets fully reflect all available

information.

Recall

The rate of return from holding a security equals the sum of the capital

gain on the security, plus any cash payments divided by the

initial purchase price of the security.

Pt 1 Pt C

R

Pt

R = the rate of return on the security

Pt 1 = price of the security at time t + 1, the end of the holding period

Pt = price of the security at time t , the beginning of the holding period

C = cash payment (coupon or dividend) made during the holding period

7-16 © 2013 Pearson Education, Inc. All rights reserved.

The Efficient Market Hypothesis:

Rational Expectations in Financial

Markets (cont’d)

At the beginning of the period, we know Pt and C.

Pt+1 is unknown and we must form an expectation of it.

The expected return then is

t 1 Pt C

e

P

R e

Pt forecasts using all currently

Expectations of future prices are equal to optimal

available information so

e

t 1

of

t 1 P P R R

e of

Supply and Demand analysis states Re will equal the equilibrium return R*, so Rof =

R*

7-17 © 2013 Pearson Education, Inc. All rights reserved.

The Efficient Market Hypothesis:

Rational Expectations in Financial

Markets (cont’d)

• Current prices in a financial market will be set so

that the optimal forecast of a security’s return using

all available information equals the security’s

equilibrium return =>

• In an efficient market, a security’s price fully

reflects all available information

7-18 © 2013 Pearson Education, Inc. All rights reserved.

The Efficient Market Hypothesis:

Rational Expectations in Financial

Markets (cont’d)

Rationale Behind the Hypothesis

R of R* Pt R of

R of R* Pt R of

until

R of R*

In an efficient market, all unexploited profit opportunities will

be eliminated

7-19 © 2013 Pearson Education, Inc. All rights reserved.

Application: How Valuable are

Published Reports by Investment

Advisors?

• Information in newspapers and in the published

reports of investment advisers is readily available to

many market participants and is already reflected in

market prices

• So acting on this information will not yield

abnormally high returns, on average

• The empirical evidence for the most part confirms

that recommendations from investment advisers

cannot help us outperform the general market

7-20 © 2013 Pearson Education, Inc. All rights reserved.

Application: Efficient Market

Prescription for the Investor

• Recommendations from investment advisors cannot

help us outperform the market

• A hot tip is probably information already contained

in the price of the stock

• Stock prices respond to announcements only when

the information is new and unexpected

• A “buy and hold” strategy is the most sensible

strategy for the small investor

7-21 © 2013 Pearson Education, Inc. All rights reserved.

Why the Efficient Market Hypothesis

Does Not Imply that Financial Markets

are Efficient

• Some financial economists believe all prices are

always correct and reflect market fundamentals

(items that have a direct impact on future income

streams of the securities) and so financial markets

are efficient

• However, prices in markets like the stock market

are unpredictable- This casts serious doubt on the

stronger view that financial markets are efficient

7-22 © 2013 Pearson Education, Inc. All rights reserved.

Behavioral Finance

• The lack of short selling (causing over-priced

stocks) may be explained by loss aversion

• The large trading volume may be explained by

investor overconfidence

• Stock market bubbles may be explained by

overconfidence and social contagion

7-23 © 2013 Pearson Education, Inc. All rights reserved.

You might also like

- Module 2 Interest and Money Time RelationshipsDocument29 pagesModule 2 Interest and Money Time RelationshipsBenj Paulo Andres83% (6)

- 7 - The Stock MarketDocument20 pages7 - The Stock MarketcihtanbioNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 07Document38 pagesMultinational Business Finance 12th Edition Slides Chapter 07Alli Tobba100% (1)

- Equity ValuationDocument49 pagesEquity ValuationArmanbekAlkinNo ratings yet

- Acc. No.: Boulton's Toy EmporiumDocument5 pagesAcc. No.: Boulton's Toy EmporiumMisty TranquilNo ratings yet

- The Stock Market, The Theory of Rational Expectations, and The Efficient Market HypothesisDocument31 pagesThe Stock Market, The Theory of Rational Expectations, and The Efficient Market HypothesischooisinNo ratings yet

- B01032 - Chapter 07 - The Stock Market, The Theory of Rational Expectations and The Efficient Market HypothesisDocument14 pagesB01032 - Chapter 07 - The Stock Market, The Theory of Rational Expectations and The Efficient Market HypothesisDương Thị Kim HiềnNo ratings yet

- Handout CH07 Mish11 EMBFMDocument8 pagesHandout CH07 Mish11 EMBFMhungtr8923No ratings yet

- Corporate FinanceDocument19 pagesCorporate FinanceElegi ZuhriNo ratings yet

- The Stock Market, The Theory of Rational Expectations, and The Efficient Market HypothesisDocument20 pagesThe Stock Market, The Theory of Rational Expectations, and The Efficient Market HypothesisMelissa MayNo ratings yet

- Week 6 - Effifcient Market TheoryDocument60 pagesWeek 6 - Effifcient Market TheoryOtgoo HNo ratings yet

- Monetary Policy Reporting 7Document16 pagesMonetary Policy Reporting 7Flores Jevie VargasNo ratings yet

- Mishkin - Chapter 7 - MarkupDocument39 pagesMishkin - Chapter 7 - MarkupJeet JainNo ratings yet

- Chapter 07Document49 pagesChapter 07LEE JIA XINo ratings yet

- CH10 ... Capital Markets & The Pricing of RiskDocument50 pagesCH10 ... Capital Markets & The Pricing of RiskMariam AlraeesiNo ratings yet

- CH 10Document24 pagesCH 10Kurnia Afrilia Erka PNo ratings yet

- CH 10Document24 pagesCH 10Kurnia Afrilia Erka PNo ratings yet

- The Stock Market, The Theory of Rational Expectations, and The Efficient Market HypothesisDocument34 pagesThe Stock Market, The Theory of Rational Expectations, and The Efficient Market HypothesisHarshit MasterNo ratings yet

- EXCHANGE RATE DETERMINATION 30112023 114303am 12052024 073235pmDocument15 pagesEXCHANGE RATE DETERMINATION 30112023 114303am 12052024 073235pmFatima QureshiNo ratings yet

- Chapter 6Document2 pagesChapter 6Lina Levvenia RatanamNo ratings yet

- Week 5 Chapter Outline: Stock Valuation and RiskDocument43 pagesWeek 5 Chapter Outline: Stock Valuation and RiskSaniyaNo ratings yet

- Lecture 4 - Equity ValuationDocument45 pagesLecture 4 - Equity Valuationchenzhi fanNo ratings yet

- 157 53715 EA416 2012 1 2 1 Ch6Document44 pages157 53715 EA416 2012 1 2 1 Ch6Khaleeq AhmedNo ratings yet

- CHP 10.Document21 pagesCHP 10.Kurnia Afrilia Erka PNo ratings yet

- Stock Valuation and Risk: Financial Markets and Institutions, 7e, Jeff MaduraDocument33 pagesStock Valuation and Risk: Financial Markets and Institutions, 7e, Jeff MaduraRASHID PERVEZNo ratings yet

- 05 Valuing Stocks and Assesing Risk - YPSDocument44 pages05 Valuing Stocks and Assesing Risk - YPSMaulanaNo ratings yet

- Reading 25 - Return ConceptsDocument12 pagesReading 25 - Return ConceptsJuan MatiasNo ratings yet

- Common Stock ValuationDocument34 pagesCommon Stock ValuationSatria DeniNo ratings yet

- Cost of Equity - IMIDocument54 pagesCost of Equity - IMIEeshank KarnwalNo ratings yet

- Stocks and Their ValuationDocument17 pagesStocks and Their ValuationSafaet Rahman SiyamNo ratings yet

- Chapter 07 International Parity ConditionsDocument49 pagesChapter 07 International Parity ConditionsWen Qi WongNo ratings yet

- Part Two: Fundamentals of Financial MarketsDocument38 pagesPart Two: Fundamentals of Financial MarketsĐỗ Thanh SơnNo ratings yet

- Corporate Finance - YCH1GUDocument10 pagesCorporate Finance - YCH1GUwerner.marton.bNo ratings yet

- This Study Resource WasDocument4 pagesThis Study Resource Wasnaura syahdaNo ratings yet

- Stock Valuation DocuDocument4 pagesStock Valuation DocuCelestiaNo ratings yet

- Balance Sheet Valuation Methods: Book Value MeasureDocument43 pagesBalance Sheet Valuation Methods: Book Value MeasureodvutNo ratings yet

- Stock Market Basics and Stock Pricing: Mishkin CH 7 - Part A Page 151-159 Plus Supplementary Lecture NotesDocument20 pagesStock Market Basics and Stock Pricing: Mishkin CH 7 - Part A Page 151-159 Plus Supplementary Lecture NotesraviNo ratings yet

- Chapter 8 2023Document34 pagesChapter 8 2023dhaanh200104No ratings yet

- Chapter 9 - RDocument37 pagesChapter 9 - RCFANo ratings yet

- FINC4101 Investment Analysis: Instructor: Dr. Leng Ling Topic: Equity ValuationDocument48 pagesFINC4101 Investment Analysis: Instructor: Dr. Leng Ling Topic: Equity Valuationsteffuts100% (1)

- Part Two: Fundamentals of Financial MarketsDocument36 pagesPart Two: Fundamentals of Financial Marketsanon_355962815No ratings yet

- Lec 4+5 - Chapter 7&9Document66 pagesLec 4+5 - Chapter 7&9The flying peguine CụtNo ratings yet

- BBM2009 SaigonISB CF Lecture 6 AccessibleDocument28 pagesBBM2009 SaigonISB CF Lecture 6 AccessibleLe Tuong MinhNo ratings yet

- YhjhtyfyhfghfhfhfjhgDocument10 pagesYhjhtyfyhfghfhfhfjhgbabylovelylovelyNo ratings yet

- 15 - Will The Real P e Please Stand UpDocument3 pages15 - Will The Real P e Please Stand UpOuwehand OrgNo ratings yet

- Stock ValuationDocument16 pagesStock ValuationHassaan NasirNo ratings yet

- Chap7 - Stock Valuation - PPimanDocument18 pagesChap7 - Stock Valuation - PPimanBẢO NGUYỄN QUỐCNo ratings yet

- The Meaning and Measurement of Risk and Return: All Rights ReservedDocument35 pagesThe Meaning and Measurement of Risk and Return: All Rights ReservednikowawaNo ratings yet

- International Parity ConditionsDocument45 pagesInternational Parity ConditionsSylvia Al-a'maNo ratings yet

- 2022 ICM Part 3Document61 pages2022 ICM Part 3amkamo99No ratings yet

- Bekaert 2e SM Ch10Document11 pagesBekaert 2e SM Ch10Xinyi Kimmy LiangNo ratings yet

- Finance 1Document19 pagesFinance 1Tom BolhoodNo ratings yet

- What Do Interest Rates Mean and What Is Their Role in Valuation?Document28 pagesWhat Do Interest Rates Mean and What Is Their Role in Valuation?Afaq AhmedNo ratings yet

- Fundamental AnalysisDocument2 pagesFundamental AnalysisHemant SarangNo ratings yet

- FM14e SM Ch07Document31 pagesFM14e SM Ch07Taha FatimaNo ratings yet

- Fin 310 Lecture 5 - Risk & Return Diversification Portfolio Theory CAPM APTDocument92 pagesFin 310 Lecture 5 - Risk & Return Diversification Portfolio Theory CAPM APTYaonik HimmatramkaNo ratings yet

- Intro To Banking ch.6 Part 1Document10 pagesIntro To Banking ch.6 Part 1SherifEl-ShaarawiNo ratings yet

- Security Analysis: Learning Objective Fundamental AnalysisDocument0 pagesSecurity Analysis: Learning Objective Fundamental AnalysisGunjan Resurrected RanjanNo ratings yet

- Bonds and Their ValuationDocument7 pagesBonds and Their ValuationRoyce Maenard EstanislaoNo ratings yet

- Far Eastern University: Bonds Are Classified Into Four Main TypesDocument7 pagesFar Eastern University: Bonds Are Classified Into Four Main TypesAleah Jehan AbuatNo ratings yet

- Quantum Strategy II: Winning Strategies of Professional InvestmentFrom EverandQuantum Strategy II: Winning Strategies of Professional InvestmentNo ratings yet

- Quantum Strategy: Winning Strategies of Professional InvestmentFrom EverandQuantum Strategy: Winning Strategies of Professional InvestmentNo ratings yet

- Bill Hwang IndictmentDocument40 pagesBill Hwang IndictmentZerohedge100% (2)

- BilledStatements 7979 27-02-24 22.58Document2 pagesBilledStatements 7979 27-02-24 22.58jagadeshpandu16No ratings yet

- Iibf Jaiib ApplicationDocument4 pagesIibf Jaiib Applicationreachtorajan700No ratings yet

- DB Quiz-2007Document4 pagesDB Quiz-2007harlequin007No ratings yet

- Rep. Planters Bank V Agana SR Mar. 3, 1997 Hermosisima, J. Recit-Ready VersionDocument3 pagesRep. Planters Bank V Agana SR Mar. 3, 1997 Hermosisima, J. Recit-Ready VersionGabe Ruaro100% (1)

- AIS Chapter 1 Lecture NotesDocument28 pagesAIS Chapter 1 Lecture NotesNhi Ho50% (4)

- Free ZCFX PDFDocument50 pagesFree ZCFX PDFAnderson Bragagnolo100% (2)

- Labuan IBFC Business Guide2Document102 pagesLabuan IBFC Business Guide2iori42No ratings yet

- Growth StrategyDocument25 pagesGrowth StrategyJoyce Anne P. BandaNo ratings yet

- Musharakah: 'Musharakah' Is A Word of Arabic Origin Which LiterallyDocument10 pagesMusharakah: 'Musharakah' Is A Word of Arabic Origin Which LiterallySaqlain KhanNo ratings yet

- Act202 Project Final Tea Stall Docx Determine Cost BudgetDocument17 pagesAct202 Project Final Tea Stall Docx Determine Cost BudgetFahad ChowdhuryNo ratings yet

- Corp Law Outline 5 - 2020Document4 pagesCorp Law Outline 5 - 2020Effy SantosNo ratings yet

- FM6 Financial Reporting and Analysis SyllabusDocument15 pagesFM6 Financial Reporting and Analysis SyllabusLloyd CatonNo ratings yet

- Coal Outlook 2019 - Webinar Alumni Tambang ITB - Sandro H S PDFDocument32 pagesCoal Outlook 2019 - Webinar Alumni Tambang ITB - Sandro H S PDFhipsterzNo ratings yet

- The Four Dimensions of Public Financial ManagementDocument9 pagesThe Four Dimensions of Public Financial ManagementInternational Consortium on Governmental Financial Management100% (2)

- Maths McqsDocument10 pagesMaths McqsafeeraNo ratings yet

- Financial Performance Analysis of Islamic Bank in Bangladesh: A Case Study On Al-Arafah Islami Bank LimitedDocument9 pagesFinancial Performance Analysis of Islamic Bank in Bangladesh: A Case Study On Al-Arafah Islami Bank LimitedPremier PublishersNo ratings yet

- Sap AssetDocument105 pagesSap AssetMithun Roy100% (2)

- Cyprus Holding CompaniesDocument2 pagesCyprus Holding CompanieskalinovskayaNo ratings yet

- Budgeting, Capital Structure, and Working Capital ManagementDocument11 pagesBudgeting, Capital Structure, and Working Capital Managementritu paudelNo ratings yet

- Budget Cycle (Budget Accountability) TEAM 1Document43 pagesBudget Cycle (Budget Accountability) TEAM 1Patrick LanceNo ratings yet

- Limits ChartsDocument6 pagesLimits ChartsveenamadhurimeduriNo ratings yet

- Exam 14 February 2020 Questions and AnswersDocument6 pagesExam 14 February 2020 Questions and AnswersCielo DecilloNo ratings yet

- La Taxonomia NIIF para PYMES Ilustrada 2015Document43 pagesLa Taxonomia NIIF para PYMES Ilustrada 2015Jose HernandezNo ratings yet

- 2011 Omgeo CTM Prod Rel Info Docs x4 PDFDocument28 pages2011 Omgeo CTM Prod Rel Info Docs x4 PDFsdonthy_gmailNo ratings yet

- Carmax, Inc.: Sector: Consumer Industry: Automotive RetailDocument2 pagesCarmax, Inc.: Sector: Consumer Industry: Automotive RetailRoshan DhongadeNo ratings yet

- SparcDocument80 pagesSparcPriyanka KumarNo ratings yet

- AM Organisational Overview of GEMS PDFDocument26 pagesAM Organisational Overview of GEMS PDFAmit SharmaNo ratings yet