Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

15 viewsModule 2 II - Oversubscription of Shares Worked Example

Module 2 II - Oversubscription of Shares Worked Example

Uploaded by

MinalCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Deed of Absolute SaleDocument3 pagesDeed of Absolute Saleramel4uNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Free Money Utilizing YOUR Treasury Direct Accounts Birth CertificateStrawman TrustBond - UnderstandiDocument30 pagesFree Money Utilizing YOUR Treasury Direct Accounts Birth CertificateStrawman TrustBond - Understandilerosenoir100% (11)

- 3 Case Lombardo 2011 - Cross-Cultural Challenges For A Global Maritime Enterprise - StudentsDocument12 pages3 Case Lombardo 2011 - Cross-Cultural Challenges For A Global Maritime Enterprise - StudentshussainNo ratings yet

- Sugar Methodology PDFDocument12 pagesSugar Methodology PDFDeepak DharmarajNo ratings yet

- Lecture 1 What Is Employment Relations?'Document3 pagesLecture 1 What Is Employment Relations?'MinalNo ratings yet

- Week 4 Notes Management and Employer RepresentativeDocument4 pagesWeek 4 Notes Management and Employer RepresentativeMinalNo ratings yet

- Test 1Document2 pagesTest 1MinalNo ratings yet

- Week 3 Notes The StateDocument5 pagesWeek 3 Notes The StateMinalNo ratings yet

- This Study Resource Was: Level Type of ExplanationDocument7 pagesThis Study Resource Was: Level Type of ExplanationMinalNo ratings yet

- Week 1 Notes Employment RelationsDocument4 pagesWeek 1 Notes Employment RelationsMinalNo ratings yet

- Mefa Ece 2-1Document8 pagesMefa Ece 2-1vamsibu50% (2)

- Velasquez V Solid Bank CorpDocument12 pagesVelasquez V Solid Bank CorpDandolph TanNo ratings yet

- Buy Side Manda Playbook For WebDocument10 pagesBuy Side Manda Playbook For WebRoss TookieNo ratings yet

- Asia Pacific Shopping Center Definition Standard Proposal PDFDocument18 pagesAsia Pacific Shopping Center Definition Standard Proposal PDFwitanti nur utamiNo ratings yet

- Overcurrent Relays: Digsilent Powerfactory Standard Relay Library Version 14Document11 pagesOvercurrent Relays: Digsilent Powerfactory Standard Relay Library Version 14CARHUAMACA PASCUAL mh0% (1)

- Maxed Out FloorplanDocument1 pageMaxed Out FloorplaneoqdinizadaNo ratings yet

- Arabtec Holding and EmaarDocument5 pagesArabtec Holding and EmaarUmair AijazNo ratings yet

- US Internal Revenue Service: F1040a - 1991Document2 pagesUS Internal Revenue Service: F1040a - 1991IRSNo ratings yet

- Information Systems, Ninth EditionDocument55 pagesInformation Systems, Ninth EditionjakalolaNo ratings yet

- Benefits of SMEDDocument8 pagesBenefits of SMEDRashmi_Mahavar_674367% (3)

- Exchange Rate Management SystemsDocument3 pagesExchange Rate Management SystemsMonalisa PadhyNo ratings yet

- TIEP Application TemplatesDocument6 pagesTIEP Application TemplatesactivatedcarbonsolutionsNo ratings yet

- General ElectricDocument8 pagesGeneral ElectricAnjali Daisy100% (1)

- Empretec and (Indian) State Governments, Mind-Maps PDFDocument6 pagesEmpretec and (Indian) State Governments, Mind-Maps PDFTausif AhmedNo ratings yet

- Itt Automotive: Global Manufacturing Strategy (1994)Document25 pagesItt Automotive: Global Manufacturing Strategy (1994)Varun Chandel100% (1)

- Gilbert R. Hufana: Professor, Law 139 Insurance LawDocument20 pagesGilbert R. Hufana: Professor, Law 139 Insurance Lawgilberthufana446877No ratings yet

- i-ROOMZ Nakshatra-LRDocument1 pagei-ROOMZ Nakshatra-LRsharadNo ratings yet

- 2016 Power Services Catalog PDFDocument134 pages2016 Power Services Catalog PDFLéandre Ettekri NDRINo ratings yet

- Reply To EnquiryDocument16 pagesReply To EnquiryLalaPuspitaNo ratings yet

- ITIL ConceptDocument57 pagesITIL Conceptsumanpk133100% (1)

- Scale of ProductionDocument9 pagesScale of ProductionOnindya MitraNo ratings yet

- Definition of Kind of Business (Kob)Document5 pagesDefinition of Kind of Business (Kob)yandexNo ratings yet

- Abu Dhabi - Vol2Document200 pagesAbu Dhabi - Vol2sven100% (3)

- Annexure To The Joining Letter - C InitiateDocument5 pagesAnnexure To The Joining Letter - C Initiatekanna1808No ratings yet

- Rainbow CatalougeDocument5 pagesRainbow Catalougeapi-257794235No ratings yet

Module 2 II - Oversubscription of Shares Worked Example

Module 2 II - Oversubscription of Shares Worked Example

Uploaded by

Minal0 ratings0% found this document useful (0 votes)

15 views7 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

15 views7 pagesModule 2 II - Oversubscription of Shares Worked Example

Module 2 II - Oversubscription of Shares Worked Example

Uploaded by

MinalCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 7

Shareholders’ Equity

Podcast #2 - Oversubscription of Shares Worked Example

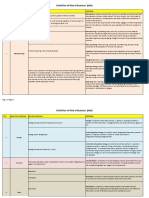

Worked Example – Oversubscription of

Shares

In July 2019, Mooloolaba Ltd calls for public subscriptions for 10 million

shares.

The issue price per share is $1.20, to be paid in three parts, these being

$0.50 on application, $0.40 within one month of the shares being

allotted and $0.30 within two months of the first and final call, with the

call for final payment being payable on 1 September 2019.

By the end of July, when applications close, applications have been

received for 12 million shares; that is, two million in excess of the

amount to be allotted.

Solution

NOTES:

Shares available for subscription 10000000 #

Share capital $ 12000000 Date Account Dr Cr Workings

1-31 Jul Bank trust 6000000

Price per share 1.20 Application 6000000 12m x $0.50

Application 0.50

0.40 Within one month 1-Aug Application 5000000

0.30 1-Sep-19 Share capital 5000000 10m x $0.50

Allotment 4000000 10m x $0.40

Call 3000000 10m shares x $0.30

Shares available for subscription 10000000 # Share capital 70000000 12m - 5m

Applications were received 12000000

Oversubscription of number of shares 2000000 Application 1000000 Balance = 0

Allotment 1000000 Balance = 3m

Oversubscription ($ value) 1,000,000

Cash at bank 6000000

Bank trust 6000000 Balance = 0

30-Aug Cash at bank 3000000

Allotment 3000000 Balance = 0

1-Sep Cash at bank 3000000

Call 3000000 Balance = 0

Assets Liabilities Owner's equity

Cash at bank = 12,000,000 Share capital = 12,000,000

Solution

1–31 July 2019

Dr Bank trust 6 000 000

Cr Application 6 000 000

Solution (continued)

We will assume that the excess funds are used to offset the amount due on allotment ($0.40 per share), and that all subscribers will receive an allotment of

shares on a pro rata basis.

1 August 2019

Dr Application 5 000 000

Cr Share capital 5 000 000

(to allot the shares as partly paid to $0.50)

Dr Allotment 4 000 000

Dr Call 3 000 000

Cr Share capital 7 000 000

Dr Application 1 000 000

Cr Allotment 1 000 000

Dr Cash at bank 6 000 000

Cr Bank trust 6 000 000

Solution (continued)

30 August 2019

Dr Cash at bank 3 000 000

Cr Allotment 3 000 000

(to recognise the receipt of amounts due on allotment)

It is assumed that all amounts due on allotment are paid.

1 September 2019

Dr Cash at bank 3 000 000

Cr Call 3 000 000

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Deed of Absolute SaleDocument3 pagesDeed of Absolute Saleramel4uNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Free Money Utilizing YOUR Treasury Direct Accounts Birth CertificateStrawman TrustBond - UnderstandiDocument30 pagesFree Money Utilizing YOUR Treasury Direct Accounts Birth CertificateStrawman TrustBond - Understandilerosenoir100% (11)

- 3 Case Lombardo 2011 - Cross-Cultural Challenges For A Global Maritime Enterprise - StudentsDocument12 pages3 Case Lombardo 2011 - Cross-Cultural Challenges For A Global Maritime Enterprise - StudentshussainNo ratings yet

- Sugar Methodology PDFDocument12 pagesSugar Methodology PDFDeepak DharmarajNo ratings yet

- Lecture 1 What Is Employment Relations?'Document3 pagesLecture 1 What Is Employment Relations?'MinalNo ratings yet

- Week 4 Notes Management and Employer RepresentativeDocument4 pagesWeek 4 Notes Management and Employer RepresentativeMinalNo ratings yet

- Test 1Document2 pagesTest 1MinalNo ratings yet

- Week 3 Notes The StateDocument5 pagesWeek 3 Notes The StateMinalNo ratings yet

- This Study Resource Was: Level Type of ExplanationDocument7 pagesThis Study Resource Was: Level Type of ExplanationMinalNo ratings yet

- Week 1 Notes Employment RelationsDocument4 pagesWeek 1 Notes Employment RelationsMinalNo ratings yet

- Mefa Ece 2-1Document8 pagesMefa Ece 2-1vamsibu50% (2)

- Velasquez V Solid Bank CorpDocument12 pagesVelasquez V Solid Bank CorpDandolph TanNo ratings yet

- Buy Side Manda Playbook For WebDocument10 pagesBuy Side Manda Playbook For WebRoss TookieNo ratings yet

- Asia Pacific Shopping Center Definition Standard Proposal PDFDocument18 pagesAsia Pacific Shopping Center Definition Standard Proposal PDFwitanti nur utamiNo ratings yet

- Overcurrent Relays: Digsilent Powerfactory Standard Relay Library Version 14Document11 pagesOvercurrent Relays: Digsilent Powerfactory Standard Relay Library Version 14CARHUAMACA PASCUAL mh0% (1)

- Maxed Out FloorplanDocument1 pageMaxed Out FloorplaneoqdinizadaNo ratings yet

- Arabtec Holding and EmaarDocument5 pagesArabtec Holding and EmaarUmair AijazNo ratings yet

- US Internal Revenue Service: F1040a - 1991Document2 pagesUS Internal Revenue Service: F1040a - 1991IRSNo ratings yet

- Information Systems, Ninth EditionDocument55 pagesInformation Systems, Ninth EditionjakalolaNo ratings yet

- Benefits of SMEDDocument8 pagesBenefits of SMEDRashmi_Mahavar_674367% (3)

- Exchange Rate Management SystemsDocument3 pagesExchange Rate Management SystemsMonalisa PadhyNo ratings yet

- TIEP Application TemplatesDocument6 pagesTIEP Application TemplatesactivatedcarbonsolutionsNo ratings yet

- General ElectricDocument8 pagesGeneral ElectricAnjali Daisy100% (1)

- Empretec and (Indian) State Governments, Mind-Maps PDFDocument6 pagesEmpretec and (Indian) State Governments, Mind-Maps PDFTausif AhmedNo ratings yet

- Itt Automotive: Global Manufacturing Strategy (1994)Document25 pagesItt Automotive: Global Manufacturing Strategy (1994)Varun Chandel100% (1)

- Gilbert R. Hufana: Professor, Law 139 Insurance LawDocument20 pagesGilbert R. Hufana: Professor, Law 139 Insurance Lawgilberthufana446877No ratings yet

- i-ROOMZ Nakshatra-LRDocument1 pagei-ROOMZ Nakshatra-LRsharadNo ratings yet

- 2016 Power Services Catalog PDFDocument134 pages2016 Power Services Catalog PDFLéandre Ettekri NDRINo ratings yet

- Reply To EnquiryDocument16 pagesReply To EnquiryLalaPuspitaNo ratings yet

- ITIL ConceptDocument57 pagesITIL Conceptsumanpk133100% (1)

- Scale of ProductionDocument9 pagesScale of ProductionOnindya MitraNo ratings yet

- Definition of Kind of Business (Kob)Document5 pagesDefinition of Kind of Business (Kob)yandexNo ratings yet

- Abu Dhabi - Vol2Document200 pagesAbu Dhabi - Vol2sven100% (3)

- Annexure To The Joining Letter - C InitiateDocument5 pagesAnnexure To The Joining Letter - C Initiatekanna1808No ratings yet

- Rainbow CatalougeDocument5 pagesRainbow Catalougeapi-257794235No ratings yet