Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

31 viewsFinancial Accounting Reporting (Fundamentals) : Chapter 5: Books of Accounts & Double-Entry System (FAR By: Millan)

Financial Accounting Reporting (Fundamentals) : Chapter 5: Books of Accounts & Double-Entry System (FAR By: Millan)

Uploaded by

Aldeguer Joy PenetranteThis chapter discusses the books of accounts and double-entry system used in financial accounting. It identifies the two main books of accounts as the journal and ledger. The journal is used to record initial transactions while the ledger classifies transactions into accounts. The chapter also explains the double-entry system which requires equal debits and credits for every transaction based on the duality and equilibrium concepts. It provides examples of journal and ledger formats and discusses the rules for identifying normal balances and contra/adjunct accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Financial Accounting-Short Answers Revision NotesDocument26 pagesFinancial Accounting-Short Answers Revision Notesfathimathabasum100% (8)

- Solution Manual For Essentials of Corporate Finance by ParrinoDocument21 pagesSolution Manual For Essentials of Corporate Finance by Parrinoa8651304130% (1)

- 8 Accounting Books Journal and LedgersDocument17 pages8 Accounting Books Journal and LedgersJc Coronacion100% (3)

- Accounting 1 Module 9 - The Books of Accounts - Journals Part 1Document19 pagesAccounting 1 Module 9 - The Books of Accounts - Journals Part 1Blanche MargateNo ratings yet

- Financial AccountingDocument1 pageFinancial AccountingCindy The GoddessNo ratings yet

- CH-2 Financial Accounting ConceptsDocument40 pagesCH-2 Financial Accounting Conceptsnemik007No ratings yet

- What Is JournalizsdfvingDocument12 pagesWhat Is JournalizsdfvingJames BlackNo ratings yet

- Fabm1 Q3 L6 FinalDocument36 pagesFabm1 Q3 L6 Finalbfsng5bcffNo ratings yet

- FABM1 Quarter 1 Week 5Document27 pagesFABM1 Quarter 1 Week 5FERNANDO TAMZ2003No ratings yet

- FABM Q3 L5. SLEM 5 - W5 - 2S - Q3 - Books of AccountsDocument14 pagesFABM Q3 L5. SLEM 5 - W5 - 2S - Q3 - Books of AccountsSophia MagdaraogNo ratings yet

- Inter - AcctDocument11 pagesInter - AcctAizha NarioNo ratings yet

- Chapter 1Document8 pagesChapter 1Trisha SinghNo ratings yet

- What Is AccountsDocument9 pagesWhat Is AccountsRishi_Sachdev_6020No ratings yet

- Accounting ProcessDocument5 pagesAccounting Process23unnimolNo ratings yet

- Far ReviewerDocument4 pagesFar ReviewerliliumNo ratings yet

- Mefa Iv 1Document23 pagesMefa Iv 120-M-140 HrushikeshNo ratings yet

- TLE10-books of AccountsDocument12 pagesTLE10-books of AccountsRoda ReyesNo ratings yet

- Module 2 Accounting Information System Analyzing Business Transactions 2Document9 pagesModule 2 Accounting Information System Analyzing Business Transactions 2barbasheramaeashleyNo ratings yet

- Accountancy Notes-Jayakumar SirDocument31 pagesAccountancy Notes-Jayakumar SirSouvik Aich100% (1)

- Bba 1sem Financial Accounting Important NotesDocument38 pagesBba 1sem Financial Accounting Important Notestyagiujjwal59No ratings yet

- 4TH Reviewer (Fabm)Document13 pages4TH Reviewer (Fabm)Jihane TanogNo ratings yet

- Co 1 Fabm 1Document23 pagesCo 1 Fabm 1Eddie MabaleNo ratings yet

- Acctg. Ed 1 - Unit2 Module 5 Books of Accounts and Double-Entry SystemDocument15 pagesAcctg. Ed 1 - Unit2 Module 5 Books of Accounts and Double-Entry SystemAngel Justine BernardoNo ratings yet

- Topic 1 Book of AccountsDocument5 pagesTopic 1 Book of AccountsRey ViloriaNo ratings yet

- Journal or Day BookDocument42 pagesJournal or Day BookRaviSankar100% (1)

- Actg 5 PDFDocument30 pagesActg 5 PDFHo Ming LamNo ratings yet

- Basic Accounting p3Document5 pagesBasic Accounting p3Hazzelle DumaleNo ratings yet

- Fundamentals of Accountancy, Business and Management 2: FinalDocument8 pagesFundamentals of Accountancy, Business and Management 2: FinalBryanNo ratings yet

- 2896-1633338148384-HND AP W5 Computerized Accounting Systems PDFDocument27 pages2896-1633338148384-HND AP W5 Computerized Accounting Systems PDFUdari KaluarachchiNo ratings yet

- Acctg. Ed 1 - Module5Document11 pagesAcctg. Ed 1 - Module5Chen HaoNo ratings yet

- Module 4 - Accounting For Business Transactions Part IIDocument13 pagesModule 4 - Accounting For Business Transactions Part IIMJ San PedroNo ratings yet

- Steps in The Accounting Cycle: ACCTG 101 Chapter 6: Business Transactions & Their Analysis Learning ObjectivesDocument1 pageSteps in The Accounting Cycle: ACCTG 101 Chapter 6: Business Transactions & Their Analysis Learning ObjectivesShemara AlonzoNo ratings yet

- Accounting 复习提纲Document73 pagesAccounting 复习提纲Ming wangNo ratings yet

- IFA Chapter 2Document17 pagesIFA Chapter 2Suleyman TesfayeNo ratings yet

- Matter Must Exist. Transactions Must Be Supported by Documents Which Prove That The Transaction Did in Fact OccurDocument7 pagesMatter Must Exist. Transactions Must Be Supported by Documents Which Prove That The Transaction Did in Fact OccurDanica MamontayaoNo ratings yet

- 2.2 - LedgerDocument3 pages2.2 - LedgerABHAYNo ratings yet

- Accounting Cycle StepsDocument3 pagesAccounting Cycle Stepsjewelmir100% (1)

- Accounts (1) FinalDocument28 pagesAccounts (1) FinalManan MullickNo ratings yet

- Principle of AccountingDocument4 pagesPrinciple of AccountingMahabub Alam100% (1)

- Chapter 1 Introduction To AccountingDocument17 pagesChapter 1 Introduction To Accountingpriyam.200409No ratings yet

- The Accounting CycleDocument3 pagesThe Accounting CyclekyncjsNo ratings yet

- Bca Fam Unit 2Document21 pagesBca Fam Unit 2ayushsingh96510No ratings yet

- 1Q) What Is Accounting State Its ObjectivesDocument9 pages1Q) What Is Accounting State Its ObjectivesMd FerozNo ratings yet

- LedgerDocument6 pagesLedgerclean makeNo ratings yet

- Source Document: The Accounting Process (The Accounting Cycle)Document4 pagesSource Document: The Accounting Process (The Accounting Cycle)rap_rrc75No ratings yet

- Wa0054.Document16 pagesWa0054.blahblah69No ratings yet

- Accounting NotesDocument22 pagesAccounting NotesSrikanth Vasantada67% (3)

- Accounting BooksDocument30 pagesAccounting BooksAshley Keith CadizNo ratings yet

- Unit - 1 (Hotel Accounts)Document19 pagesUnit - 1 (Hotel Accounts)Joseph Kiran ReddyNo ratings yet

- Book of Accounts WD ActivityDocument3 pagesBook of Accounts WD ActivityChristopher SelebioNo ratings yet

- Chapter 6 Books of AccountingDocument21 pagesChapter 6 Books of AccountingAina Charisse DizonNo ratings yet

- General AccountingDocument94 pagesGeneral Accountingswaroopbaskey2100% (1)

- Accountancy Class 11 Introduction To AccountancyDocument3 pagesAccountancy Class 11 Introduction To AccountancyCONTRALITE VERICONNo ratings yet

- 320 Accountancy Eng Lesson6Document17 pages320 Accountancy Eng Lesson6Hitesh MishraNo ratings yet

- 4 and 5 Unit BEFADocument91 pages4 and 5 Unit BEFAGangula Praneeth ReddyNo ratings yet

- ACCT6174 - Introduction To Financial Accounting: Week 1 Accounting in ActionDocument24 pagesACCT6174 - Introduction To Financial Accounting: Week 1 Accounting in ActionFatimatuz ZahroNo ratings yet

- Business and FinanceDocument21 pagesBusiness and Financeabelu habite neriNo ratings yet

- Answer: Book-Keeping Is Mainly Concerned With Record Keeping orDocument7 pagesAnswer: Book-Keeping Is Mainly Concerned With Record Keeping orRisha RoyNo ratings yet

- 2 - Account - IBBIDocument33 pages2 - Account - IBBIRajwinder Singh Bansal100% (1)

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- IBT 401 - Chapter 1Document30 pagesIBT 401 - Chapter 1Aldeguer Joy PenetranteNo ratings yet

- IBT 401 - Chapter 3Document26 pagesIBT 401 - Chapter 3Aldeguer Joy PenetranteNo ratings yet

- ACCTG - 1 - Chapter 1 & 2Document39 pagesACCTG - 1 - Chapter 1 & 2Aldeguer Joy PenetranteNo ratings yet

- Financial Accounting Reporting (Fundamentals) : Chapter 3: The Accounting Equation (FAR By: Millan)Document19 pagesFinancial Accounting Reporting (Fundamentals) : Chapter 3: The Accounting Equation (FAR By: Millan)Aldeguer Joy PenetranteNo ratings yet

- Chapter 1 SummaryDocument11 pagesChapter 1 SummaryMiaNo ratings yet

- Massy Annual Report 2017 Executive StatementsDocument16 pagesMassy Annual Report 2017 Executive StatementsVidNo ratings yet

- Internal ControlsDocument3 pagesInternal ControlsMarcelita RejusoNo ratings yet

- 2 - Acronime UzualeDocument8 pages2 - Acronime Uzualealexandru.ghiniaNo ratings yet

- 18-01-19 EnMS Tools (DBKU Satok) 2.0 (Version 1)Document119 pages18-01-19 EnMS Tools (DBKU Satok) 2.0 (Version 1)Emil Enzo Rosainie100% (1)

- FInance and Accounts ManualDocument129 pagesFInance and Accounts ManualPalaniyandi KuppanNo ratings yet

- P2P DesignDocument10 pagesP2P DesignAvinash PatilNo ratings yet

- March13.2012 - B House Body Urges TRB To Collect PNCC's P4 Billion Unpaid Concession FeesDocument1 pageMarch13.2012 - B House Body Urges TRB To Collect PNCC's P4 Billion Unpaid Concession Feespribhor2No ratings yet

- Governance 13 16Document28 pagesGovernance 13 16Lea Lyn FuasanNo ratings yet

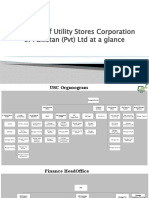

- Structure of Utility Stores Corporation of Pakistan (PVT) LTD at A GlanceDocument9 pagesStructure of Utility Stores Corporation of Pakistan (PVT) LTD at A GlanceMuhammad UsmanNo ratings yet

- Week 13 Exercise With AnswersDocument10 pagesWeek 13 Exercise With Answersmaria fernNo ratings yet

- Curriculum Vitae Syed Vikhar Ahmed: Narayan Das Jhawar & Co, Chartered AccountantsDocument3 pagesCurriculum Vitae Syed Vikhar Ahmed: Narayan Das Jhawar & Co, Chartered AccountantsbakkyshahNo ratings yet

- DMGT 304Document52 pagesDMGT 304NIKHIL RANA 108No ratings yet

- Rendell Company CaseDocument13 pagesRendell Company Caseasramasaja50% (2)

- Mock Exam WileyDocument43 pagesMock Exam WileyAshief AhmedNo ratings yet

- Mcqs Audit - PRTC2Document16 pagesMcqs Audit - PRTC2jpbluejnNo ratings yet

- Income Tax Inspector (ITI)Document6 pagesIncome Tax Inspector (ITI)AshishNo ratings yet

- QUESTIONDocument2 pagesQUESTIONYash MathurNo ratings yet

- Annual Report of Hittco 2015 16 PDFDocument78 pagesAnnual Report of Hittco 2015 16 PDFANILNo ratings yet

- PWC IFRS 18 SummaryDocument6 pagesPWC IFRS 18 SummaryMohammad IslamNo ratings yet

- PWC Anti Money Laundering 2016 PDFDocument671 pagesPWC Anti Money Laundering 2016 PDFPraveen KumarNo ratings yet

- Barlev Et Al. - 2007 - Reevaluation of RevaluationsDocument26 pagesBarlev Et Al. - 2007 - Reevaluation of RevaluationsSri HastutiNo ratings yet

- Deepthi Prakash: Logistic CoordinatorDocument4 pagesDeepthi Prakash: Logistic CoordinatorAbhishek aby5No ratings yet

- Types of Audit AssignmentDocument21 pagesTypes of Audit AssignmentKanika GoelNo ratings yet

- CSR Disclosures AseanDocument33 pagesCSR Disclosures AseanChristine ViernesNo ratings yet

- ACCOUNTING 5 QUIZ Edited by LuisitoDocument14 pagesACCOUNTING 5 QUIZ Edited by LuisitoRuzuiNo ratings yet

- Types of AuditingDocument7 pagesTypes of AuditingGhulam Mustafa100% (1)

- PTD Newsletter Issue 3 Final.Document11 pagesPTD Newsletter Issue 3 Final.PavithraNo ratings yet

- Book Category WiseDocument64 pagesBook Category WiseImran Khan SharNo ratings yet

Financial Accounting Reporting (Fundamentals) : Chapter 5: Books of Accounts & Double-Entry System (FAR By: Millan)

Financial Accounting Reporting (Fundamentals) : Chapter 5: Books of Accounts & Double-Entry System (FAR By: Millan)

Uploaded by

Aldeguer Joy Penetrante0 ratings0% found this document useful (0 votes)

31 views20 pagesThis chapter discusses the books of accounts and double-entry system used in financial accounting. It identifies the two main books of accounts as the journal and ledger. The journal is used to record initial transactions while the ledger classifies transactions into accounts. The chapter also explains the double-entry system which requires equal debits and credits for every transaction based on the duality and equilibrium concepts. It provides examples of journal and ledger formats and discusses the rules for identifying normal balances and contra/adjunct accounts.

Original Description:

Original Title

ACCTG_1 - Chapter 5 & 6

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis chapter discusses the books of accounts and double-entry system used in financial accounting. It identifies the two main books of accounts as the journal and ledger. The journal is used to record initial transactions while the ledger classifies transactions into accounts. The chapter also explains the double-entry system which requires equal debits and credits for every transaction based on the duality and equilibrium concepts. It provides examples of journal and ledger formats and discusses the rules for identifying normal balances and contra/adjunct accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

31 views20 pagesFinancial Accounting Reporting (Fundamentals) : Chapter 5: Books of Accounts & Double-Entry System (FAR By: Millan)

Financial Accounting Reporting (Fundamentals) : Chapter 5: Books of Accounts & Double-Entry System (FAR By: Millan)

Uploaded by

Aldeguer Joy PenetranteThis chapter discusses the books of accounts and double-entry system used in financial accounting. It identifies the two main books of accounts as the journal and ledger. The journal is used to record initial transactions while the ledger classifies transactions into accounts. The chapter also explains the double-entry system which requires equal debits and credits for every transaction based on the duality and equilibrium concepts. It provides examples of journal and ledger formats and discusses the rules for identifying normal balances and contra/adjunct accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 20

FINANCIAL ACCOUNTING

&

REPORTING

(Fundamentals)

Chapter 5: Books of Accounts & Double-

entry System (FAR by: Millan)

Chapter 5

Books of Accounts and Double-entry

System

Learning Ojectives

1. Identify the uses of the two books of

accounts.

2. Illustrate the format of general and special

journals.

3. Illustrate the format of general and subsidiary

ledgers.

The Books of Accounts

1. Journal (General and Special)

2. Ledger (General and Subsidiary)

Journal

The journal, also called the “book of original

entries,” is the accounting record where business

transactions are first recorded.

1. Special Journal – is used to record transactions

with similar nature (e.g., Sales journal,

Purchases journal, Cash receipts journal, and

Cash disbursements journal)

2. General Journal – All other transactions that

cannot be recorded in the special journals are

recorded in the general journal.

Ledger

• The ledger is used to classify the effects of

business transactions on the accounts. It is

also called the “book of final entries.”

1. General ledger – contains all the accounts

appearing in the trial balance.

2. Subsidiary ledger – provides a breakdown

of the balances of controlling accounts.

Format of the General Journal

Formats of the Ledgers

Double-entry System

• Concept of duality – each transaction is

recorded in two parts – debit and credit

• Concept of equilibrium – each transaction is

recorded in terms of equal debits and

credits.

Normal balances of accounts

Rules of Debits and Credits

Contra and Adjunct accounts

• Contra accounts are presented in the

financial statements as deduction to their

related accounts.

• Adjunct accounts are presented in the

financial statements as addition to their

related accounts.

Chapter 6

Business Transactions & Their Analysis

Learning Objectives

1. Describe the nature and give examples of

business transactions.

2. Identify the different types of business

documents.

3. Analyze common business transactions using

the rules of debit and credit.

Steps in the Accounting cycle

1. Identifying and analyzing

2. Journalizing

3. Posting

4. Unadjusted trial balance

5. Adjusting entries

6. Adjusted trial balance (and/or Worksheet)

7. Financial statements

8. Closing entries

9. Post-closing trial balance

10. Reversing entries

Identifying and analyzing transactions and events

• Only accountable events are recorded.

Accountable events are those that affect the

assets, liabilities, equity, income or expenses

of the business.

• Accountable events are normally identified

from source documents, such as sales

invoice, official receipts, delivery receipts,

and the like.

Types of Events

1. External events – are transactions that

involve the business and another external

party.

2. Internal events – are events that do not

involve an external party.

Journalizing

Journalizing refers to recording an identified

accountable event in the journal by means of a

journal entry.

Simple and Compound journal entries

• Simple journal entry – contains a single debit

and a single credit element.

• Compound journal entry – contains two or

more debits or credits.

END

You might also like

- Financial Accounting-Short Answers Revision NotesDocument26 pagesFinancial Accounting-Short Answers Revision Notesfathimathabasum100% (8)

- Solution Manual For Essentials of Corporate Finance by ParrinoDocument21 pagesSolution Manual For Essentials of Corporate Finance by Parrinoa8651304130% (1)

- 8 Accounting Books Journal and LedgersDocument17 pages8 Accounting Books Journal and LedgersJc Coronacion100% (3)

- Accounting 1 Module 9 - The Books of Accounts - Journals Part 1Document19 pagesAccounting 1 Module 9 - The Books of Accounts - Journals Part 1Blanche MargateNo ratings yet

- Financial AccountingDocument1 pageFinancial AccountingCindy The GoddessNo ratings yet

- CH-2 Financial Accounting ConceptsDocument40 pagesCH-2 Financial Accounting Conceptsnemik007No ratings yet

- What Is JournalizsdfvingDocument12 pagesWhat Is JournalizsdfvingJames BlackNo ratings yet

- Fabm1 Q3 L6 FinalDocument36 pagesFabm1 Q3 L6 Finalbfsng5bcffNo ratings yet

- FABM1 Quarter 1 Week 5Document27 pagesFABM1 Quarter 1 Week 5FERNANDO TAMZ2003No ratings yet

- FABM Q3 L5. SLEM 5 - W5 - 2S - Q3 - Books of AccountsDocument14 pagesFABM Q3 L5. SLEM 5 - W5 - 2S - Q3 - Books of AccountsSophia MagdaraogNo ratings yet

- Inter - AcctDocument11 pagesInter - AcctAizha NarioNo ratings yet

- Chapter 1Document8 pagesChapter 1Trisha SinghNo ratings yet

- What Is AccountsDocument9 pagesWhat Is AccountsRishi_Sachdev_6020No ratings yet

- Accounting ProcessDocument5 pagesAccounting Process23unnimolNo ratings yet

- Far ReviewerDocument4 pagesFar ReviewerliliumNo ratings yet

- Mefa Iv 1Document23 pagesMefa Iv 120-M-140 HrushikeshNo ratings yet

- TLE10-books of AccountsDocument12 pagesTLE10-books of AccountsRoda ReyesNo ratings yet

- Module 2 Accounting Information System Analyzing Business Transactions 2Document9 pagesModule 2 Accounting Information System Analyzing Business Transactions 2barbasheramaeashleyNo ratings yet

- Accountancy Notes-Jayakumar SirDocument31 pagesAccountancy Notes-Jayakumar SirSouvik Aich100% (1)

- Bba 1sem Financial Accounting Important NotesDocument38 pagesBba 1sem Financial Accounting Important Notestyagiujjwal59No ratings yet

- 4TH Reviewer (Fabm)Document13 pages4TH Reviewer (Fabm)Jihane TanogNo ratings yet

- Co 1 Fabm 1Document23 pagesCo 1 Fabm 1Eddie MabaleNo ratings yet

- Acctg. Ed 1 - Unit2 Module 5 Books of Accounts and Double-Entry SystemDocument15 pagesAcctg. Ed 1 - Unit2 Module 5 Books of Accounts and Double-Entry SystemAngel Justine BernardoNo ratings yet

- Topic 1 Book of AccountsDocument5 pagesTopic 1 Book of AccountsRey ViloriaNo ratings yet

- Journal or Day BookDocument42 pagesJournal or Day BookRaviSankar100% (1)

- Actg 5 PDFDocument30 pagesActg 5 PDFHo Ming LamNo ratings yet

- Basic Accounting p3Document5 pagesBasic Accounting p3Hazzelle DumaleNo ratings yet

- Fundamentals of Accountancy, Business and Management 2: FinalDocument8 pagesFundamentals of Accountancy, Business and Management 2: FinalBryanNo ratings yet

- 2896-1633338148384-HND AP W5 Computerized Accounting Systems PDFDocument27 pages2896-1633338148384-HND AP W5 Computerized Accounting Systems PDFUdari KaluarachchiNo ratings yet

- Acctg. Ed 1 - Module5Document11 pagesAcctg. Ed 1 - Module5Chen HaoNo ratings yet

- Module 4 - Accounting For Business Transactions Part IIDocument13 pagesModule 4 - Accounting For Business Transactions Part IIMJ San PedroNo ratings yet

- Steps in The Accounting Cycle: ACCTG 101 Chapter 6: Business Transactions & Their Analysis Learning ObjectivesDocument1 pageSteps in The Accounting Cycle: ACCTG 101 Chapter 6: Business Transactions & Their Analysis Learning ObjectivesShemara AlonzoNo ratings yet

- Accounting 复习提纲Document73 pagesAccounting 复习提纲Ming wangNo ratings yet

- IFA Chapter 2Document17 pagesIFA Chapter 2Suleyman TesfayeNo ratings yet

- Matter Must Exist. Transactions Must Be Supported by Documents Which Prove That The Transaction Did in Fact OccurDocument7 pagesMatter Must Exist. Transactions Must Be Supported by Documents Which Prove That The Transaction Did in Fact OccurDanica MamontayaoNo ratings yet

- 2.2 - LedgerDocument3 pages2.2 - LedgerABHAYNo ratings yet

- Accounting Cycle StepsDocument3 pagesAccounting Cycle Stepsjewelmir100% (1)

- Accounts (1) FinalDocument28 pagesAccounts (1) FinalManan MullickNo ratings yet

- Principle of AccountingDocument4 pagesPrinciple of AccountingMahabub Alam100% (1)

- Chapter 1 Introduction To AccountingDocument17 pagesChapter 1 Introduction To Accountingpriyam.200409No ratings yet

- The Accounting CycleDocument3 pagesThe Accounting CyclekyncjsNo ratings yet

- Bca Fam Unit 2Document21 pagesBca Fam Unit 2ayushsingh96510No ratings yet

- 1Q) What Is Accounting State Its ObjectivesDocument9 pages1Q) What Is Accounting State Its ObjectivesMd FerozNo ratings yet

- LedgerDocument6 pagesLedgerclean makeNo ratings yet

- Source Document: The Accounting Process (The Accounting Cycle)Document4 pagesSource Document: The Accounting Process (The Accounting Cycle)rap_rrc75No ratings yet

- Wa0054.Document16 pagesWa0054.blahblah69No ratings yet

- Accounting NotesDocument22 pagesAccounting NotesSrikanth Vasantada67% (3)

- Accounting BooksDocument30 pagesAccounting BooksAshley Keith CadizNo ratings yet

- Unit - 1 (Hotel Accounts)Document19 pagesUnit - 1 (Hotel Accounts)Joseph Kiran ReddyNo ratings yet

- Book of Accounts WD ActivityDocument3 pagesBook of Accounts WD ActivityChristopher SelebioNo ratings yet

- Chapter 6 Books of AccountingDocument21 pagesChapter 6 Books of AccountingAina Charisse DizonNo ratings yet

- General AccountingDocument94 pagesGeneral Accountingswaroopbaskey2100% (1)

- Accountancy Class 11 Introduction To AccountancyDocument3 pagesAccountancy Class 11 Introduction To AccountancyCONTRALITE VERICONNo ratings yet

- 320 Accountancy Eng Lesson6Document17 pages320 Accountancy Eng Lesson6Hitesh MishraNo ratings yet

- 4 and 5 Unit BEFADocument91 pages4 and 5 Unit BEFAGangula Praneeth ReddyNo ratings yet

- ACCT6174 - Introduction To Financial Accounting: Week 1 Accounting in ActionDocument24 pagesACCT6174 - Introduction To Financial Accounting: Week 1 Accounting in ActionFatimatuz ZahroNo ratings yet

- Business and FinanceDocument21 pagesBusiness and Financeabelu habite neriNo ratings yet

- Answer: Book-Keeping Is Mainly Concerned With Record Keeping orDocument7 pagesAnswer: Book-Keeping Is Mainly Concerned With Record Keeping orRisha RoyNo ratings yet

- 2 - Account - IBBIDocument33 pages2 - Account - IBBIRajwinder Singh Bansal100% (1)

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- IBT 401 - Chapter 1Document30 pagesIBT 401 - Chapter 1Aldeguer Joy PenetranteNo ratings yet

- IBT 401 - Chapter 3Document26 pagesIBT 401 - Chapter 3Aldeguer Joy PenetranteNo ratings yet

- ACCTG - 1 - Chapter 1 & 2Document39 pagesACCTG - 1 - Chapter 1 & 2Aldeguer Joy PenetranteNo ratings yet

- Financial Accounting Reporting (Fundamentals) : Chapter 3: The Accounting Equation (FAR By: Millan)Document19 pagesFinancial Accounting Reporting (Fundamentals) : Chapter 3: The Accounting Equation (FAR By: Millan)Aldeguer Joy PenetranteNo ratings yet

- Chapter 1 SummaryDocument11 pagesChapter 1 SummaryMiaNo ratings yet

- Massy Annual Report 2017 Executive StatementsDocument16 pagesMassy Annual Report 2017 Executive StatementsVidNo ratings yet

- Internal ControlsDocument3 pagesInternal ControlsMarcelita RejusoNo ratings yet

- 2 - Acronime UzualeDocument8 pages2 - Acronime Uzualealexandru.ghiniaNo ratings yet

- 18-01-19 EnMS Tools (DBKU Satok) 2.0 (Version 1)Document119 pages18-01-19 EnMS Tools (DBKU Satok) 2.0 (Version 1)Emil Enzo Rosainie100% (1)

- FInance and Accounts ManualDocument129 pagesFInance and Accounts ManualPalaniyandi KuppanNo ratings yet

- P2P DesignDocument10 pagesP2P DesignAvinash PatilNo ratings yet

- March13.2012 - B House Body Urges TRB To Collect PNCC's P4 Billion Unpaid Concession FeesDocument1 pageMarch13.2012 - B House Body Urges TRB To Collect PNCC's P4 Billion Unpaid Concession Feespribhor2No ratings yet

- Governance 13 16Document28 pagesGovernance 13 16Lea Lyn FuasanNo ratings yet

- Structure of Utility Stores Corporation of Pakistan (PVT) LTD at A GlanceDocument9 pagesStructure of Utility Stores Corporation of Pakistan (PVT) LTD at A GlanceMuhammad UsmanNo ratings yet

- Week 13 Exercise With AnswersDocument10 pagesWeek 13 Exercise With Answersmaria fernNo ratings yet

- Curriculum Vitae Syed Vikhar Ahmed: Narayan Das Jhawar & Co, Chartered AccountantsDocument3 pagesCurriculum Vitae Syed Vikhar Ahmed: Narayan Das Jhawar & Co, Chartered AccountantsbakkyshahNo ratings yet

- DMGT 304Document52 pagesDMGT 304NIKHIL RANA 108No ratings yet

- Rendell Company CaseDocument13 pagesRendell Company Caseasramasaja50% (2)

- Mock Exam WileyDocument43 pagesMock Exam WileyAshief AhmedNo ratings yet

- Mcqs Audit - PRTC2Document16 pagesMcqs Audit - PRTC2jpbluejnNo ratings yet

- Income Tax Inspector (ITI)Document6 pagesIncome Tax Inspector (ITI)AshishNo ratings yet

- QUESTIONDocument2 pagesQUESTIONYash MathurNo ratings yet

- Annual Report of Hittco 2015 16 PDFDocument78 pagesAnnual Report of Hittco 2015 16 PDFANILNo ratings yet

- PWC IFRS 18 SummaryDocument6 pagesPWC IFRS 18 SummaryMohammad IslamNo ratings yet

- PWC Anti Money Laundering 2016 PDFDocument671 pagesPWC Anti Money Laundering 2016 PDFPraveen KumarNo ratings yet

- Barlev Et Al. - 2007 - Reevaluation of RevaluationsDocument26 pagesBarlev Et Al. - 2007 - Reevaluation of RevaluationsSri HastutiNo ratings yet

- Deepthi Prakash: Logistic CoordinatorDocument4 pagesDeepthi Prakash: Logistic CoordinatorAbhishek aby5No ratings yet

- Types of Audit AssignmentDocument21 pagesTypes of Audit AssignmentKanika GoelNo ratings yet

- CSR Disclosures AseanDocument33 pagesCSR Disclosures AseanChristine ViernesNo ratings yet

- ACCOUNTING 5 QUIZ Edited by LuisitoDocument14 pagesACCOUNTING 5 QUIZ Edited by LuisitoRuzuiNo ratings yet

- Types of AuditingDocument7 pagesTypes of AuditingGhulam Mustafa100% (1)

- PTD Newsletter Issue 3 Final.Document11 pagesPTD Newsletter Issue 3 Final.PavithraNo ratings yet

- Book Category WiseDocument64 pagesBook Category WiseImran Khan SharNo ratings yet