Professional Documents

Culture Documents

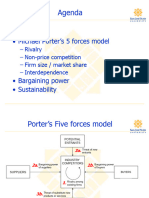

Five Forces Model: Michael Porter's

Five Forces Model: Michael Porter's

Uploaded by

Tarsh Kumar RautCopyright:

Available Formats

You might also like

- Case Interview Frameworks - IGotAnOffer PDFDocument12 pagesCase Interview Frameworks - IGotAnOffer PDF이재민No ratings yet

- Guide To Understand VOD DistributionDocument4 pagesGuide To Understand VOD DistributionDabhekar ShreepadNo ratings yet

- 5C's and 4 P'S: Customers Company Competitors Collaborators ContextDocument26 pages5C's and 4 P'S: Customers Company Competitors Collaborators ContextRohit ChourasiaNo ratings yet

- 961 Beer Case PDFDocument22 pages961 Beer Case PDFayunda utariNo ratings yet

- Consumer Behavior Project HICO Ice CreamDocument26 pagesConsumer Behavior Project HICO Ice CreamMuhammad Jahanzeb Aamir33% (3)

- S3 S4 Industry and Environmental AnalysisDocument19 pagesS3 S4 Industry and Environmental Analysisst123314No ratings yet

- Strategic Market ManagementDocument16 pagesStrategic Market ManagementNoor Ul Ain AnwarNo ratings yet

- OS Preparatory 16-18 BacthDocument14 pagesOS Preparatory 16-18 BacthRajeev MehtaNo ratings yet

- Indian Footwear Industry AnalysisDocument14 pagesIndian Footwear Industry AnalysisnishankNo ratings yet

- Indian Footwear Industry AnalysisDocument14 pagesIndian Footwear Industry AnalysisnishankNo ratings yet

- 1.deciding Where You Want Your Business To Go, And: Basically, STRATEGY Is About Two ThingsDocument44 pages1.deciding Where You Want Your Business To Go, And: Basically, STRATEGY Is About Two ThingsMohammed AkhtarNo ratings yet

- External Environment ANALYSIS (Competitive Analysis)Document13 pagesExternal Environment ANALYSIS (Competitive Analysis)Putri AnisaNo ratings yet

- Porter's Five Forces: Barriers To EntryDocument2 pagesPorter's Five Forces: Barriers To EntryNimish JoshiNo ratings yet

- Case Study FrameworksDocument29 pagesCase Study FrameworksФранческо ЛеньямеNo ratings yet

- S3 - Template For Export PlanDocument15 pagesS3 - Template For Export PlanUyen Nhi LeNo ratings yet

- Stockmarket - Valuation and Analysis: Alexander Gilles, CFADocument18 pagesStockmarket - Valuation and Analysis: Alexander Gilles, CFAFahd_VNo ratings yet

- Session - IV Environmental Analysis + NetflixDocument11 pagesSession - IV Environmental Analysis + NetflixArnab ChakrabortyNo ratings yet

- Fundamentals of Industry AnalysisDocument21 pagesFundamentals of Industry AnalysisSamridh AgarwalNo ratings yet

- Lecture 6 - Industry Structure, 5 Forces Model and Stake Holders AnalysisDocument37 pagesLecture 6 - Industry Structure, 5 Forces Model and Stake Holders AnalysisRaven NguyenNo ratings yet

- Porter's 5 FDocument1 pagePorter's 5 Fnileshgupta11112756No ratings yet

- Market Overview - Five Forces Analysis - PESTEL Analysis - SWOT Analysis - ConclusionDocument8 pagesMarket Overview - Five Forces Analysis - PESTEL Analysis - SWOT Analysis - ConclusionnishankNo ratings yet

- Chapter-3 Strategy AnalysisDocument7 pagesChapter-3 Strategy Analysismukulful2008No ratings yet

- Competitive Structure of IndustriesDocument28 pagesCompetitive Structure of IndustriesSATAYAMNo ratings yet

- Porter Five Forces of Nano by RVDocument14 pagesPorter Five Forces of Nano by RVRahul VermaNo ratings yet

- Industry & Market AttractivenessDocument20 pagesIndustry & Market Attractivenessaparabi311No ratings yet

- 4 Industry AnalysisDocument17 pages4 Industry AnalysisAmna AroojNo ratings yet

- Where To Play & How To Win Case Interview GuideDocument18 pagesWhere To Play & How To Win Case Interview GuideAnonymous GL6svDNo ratings yet

- Disposable Diaper Industry - Group 9Document8 pagesDisposable Diaper Industry - Group 9Kartik NarayanaNo ratings yet

- Competitive Advantage: Author-Michael Porter Group No - 3Document50 pagesCompetitive Advantage: Author-Michael Porter Group No - 3rohanNo ratings yet

- Bharti Airtel v1Document40 pagesBharti Airtel v1Anuya KadamNo ratings yet

- Industry Analysis:: The FundamentalsDocument13 pagesIndustry Analysis:: The FundamentalsChhavi KhuranaNo ratings yet

- Porter's Five-Forces Analysis MatrixDocument1 pagePorter's Five-Forces Analysis Matrixgogo stillsmokingNo ratings yet

- CH 04Document17 pagesCH 04Praveen BVSNo ratings yet

- Module 5Document30 pagesModule 5HafezFaridNo ratings yet

- Porter 5 ForcesDocument6 pagesPorter 5 Forcesapi-3716002100% (3)

- PorterDocument12 pagesPortersalesmuliamakmurNo ratings yet

- Industry AnalysisDocument21 pagesIndustry AnalysisHasan NabeelNo ratings yet

- KFC & Fast Food Industry: Strategic ManagementDocument15 pagesKFC & Fast Food Industry: Strategic ManagementsoftycoonNo ratings yet

- Disposable Diaper Industry: Case AnalysisDocument8 pagesDisposable Diaper Industry: Case AnalysisaabfjabfuagfuegbfNo ratings yet

- I. Industry and Competitive AnalysisDocument10 pagesI. Industry and Competitive AnalysisAnkitaNo ratings yet

- Competitor Analysis1Document15 pagesCompetitor Analysis1malatheshNo ratings yet

- IBA2.3.1 FiveForcesaDocument9 pagesIBA2.3.1 FiveForcesaLuísa Oliveira Machado BuenoNo ratings yet

- Chapter 5Document41 pagesChapter 5Muhammad Saddam SofyandiNo ratings yet

- 6 Forces - Markets, Industry Rivalry, Buyers and Sellers 2023Document8 pages6 Forces - Markets, Industry Rivalry, Buyers and Sellers 2023michaelsstrongNo ratings yet

- Session 2 Competitive Strategies-1Document28 pagesSession 2 Competitive Strategies-1meebvkNo ratings yet

- Industry Analysis Example 04Document20 pagesIndustry Analysis Example 04Chutkoi FerozNo ratings yet

- Mahindra &mahindra - A Strategic Perspective: Group 5Document30 pagesMahindra &mahindra - A Strategic Perspective: Group 5sumon.dasNo ratings yet

- Where To Play How To Win - V2Document17 pagesWhere To Play How To Win - V2SahitraNo ratings yet

- Ch02-Managing Industry Competition - Global StrategyDocument54 pagesCh02-Managing Industry Competition - Global StrategyNguyễn Phương ThảoNo ratings yet

- Class4 Spring 2021 TopostDocument21 pagesClass4 Spring 2021 TopostMahin AliNo ratings yet

- Industry AnalysisDocument14 pagesIndustry AnalysisJorge Humberto Chambi VillarroelNo ratings yet

- 2 SM 2021-22 Industry StructureDocument13 pages2 SM 2021-22 Industry StructureRashish GuptaNo ratings yet

- 2 - ACS - 2021-22 - Recap - Industry Structure AnalysisDocument13 pages2 - ACS - 2021-22 - Recap - Industry Structure AnalysisAakash VermaNo ratings yet

- IT Success!: Towards a New Model for Information TechnologyFrom EverandIT Success!: Towards a New Model for Information TechnologyRating: 3 out of 5 stars3/5 (1)

- Investing with Intelligent ETFs: Strategies for Profiting from the New Breed of SecuritiesFrom EverandInvesting with Intelligent ETFs: Strategies for Profiting from the New Breed of SecuritiesNo ratings yet

- Credit Securitisations and Derivatives: Challenges for the Global MarketsFrom EverandCredit Securitisations and Derivatives: Challenges for the Global MarketsNo ratings yet

- Enterprise Application Integration: A Wiley Tech BriefFrom EverandEnterprise Application Integration: A Wiley Tech BriefRating: 2 out of 5 stars2/5 (1)

- Valuing Services in Trade: A Toolkit for Competitiveness DiagnosticsFrom EverandValuing Services in Trade: A Toolkit for Competitiveness DiagnosticsNo ratings yet

- Management Consulting and International Business S PDFDocument15 pagesManagement Consulting and International Business S PDFsamaNo ratings yet

- Literature Review On Problem GamblingDocument5 pagesLiterature Review On Problem Gamblingafmzyywqyfolhp100% (1)

- Bisleri SWOTDocument81 pagesBisleri SWOTAbhijit PharandeNo ratings yet

- Marketing Assignment: Kanwar Kasana (NC28)Document4 pagesMarketing Assignment: Kanwar Kasana (NC28)kanwarNo ratings yet

- IBS301m - International Business Strategy - Session 11 - 13Document15 pagesIBS301m - International Business Strategy - Session 11 - 13Nguyen Trung Hau K14 FUG CTNo ratings yet

- Presentation Title: Marketing Research ProjectDocument27 pagesPresentation Title: Marketing Research ProjectDeepali AgrawalNo ratings yet

- Business Math Single Trade DiscountDocument19 pagesBusiness Math Single Trade DiscountJenette D CervantesNo ratings yet

- Chapter 6Document25 pagesChapter 6syafikaabdullahNo ratings yet

- Children Attitude Toward TVC in PakDocument7 pagesChildren Attitude Toward TVC in Pakkashif salmanNo ratings yet

- Signed Off Entrepreneurship12q2 Mod7 Forecasting Revenues and Costs Department v3Document26 pagesSigned Off Entrepreneurship12q2 Mod7 Forecasting Revenues and Costs Department v3Juliana Renz BlamNo ratings yet

- SourcingDocument4 pagesSourcingNawaz KhanNo ratings yet

- CASE 1 - OpmanDocument8 pagesCASE 1 - OpmanMacris GalvezNo ratings yet

- Cost Sheet Analysis: Dabur India Limited.: Submitted byDocument15 pagesCost Sheet Analysis: Dabur India Limited.: Submitted byVipul BhagatNo ratings yet

- 1) The Differences Between Good and Services: Goods MeaningDocument3 pages1) The Differences Between Good and Services: Goods MeaningSAMAYAM KALYAN KUMARNo ratings yet

- The Impact of Motivation To Travel and Choice Destination Among University StudentsDocument43 pagesThe Impact of Motivation To Travel and Choice Destination Among University Studentsmulabbi brianNo ratings yet

- Marketing Research Course OutlineDocument3 pagesMarketing Research Course OutlinetortomatoNo ratings yet

- Content MarketingDocument20 pagesContent MarketingRenif RaeNo ratings yet

- Micro Teaching Brands & Brand ManagementDocument18 pagesMicro Teaching Brands & Brand ManagementDithaNo ratings yet

- C.MGT Relevant of Chapter 2 STBCDocument12 pagesC.MGT Relevant of Chapter 2 STBCNahum DaichaNo ratings yet

- NIRMADocument3 pagesNIRMAPushkar KumarNo ratings yet

- Conducting A Feasibility Study and Crafting A Business PlanDocument25 pagesConducting A Feasibility Study and Crafting A Business PlanOhona islamNo ratings yet

- Review For Final Exam Logistic and SCMDocument3 pagesReview For Final Exam Logistic and SCMNguyên BảoNo ratings yet

- Chapter 23 Perfect CompetitionDocument1 pageChapter 23 Perfect CompetitionKathleen CornistaNo ratings yet

- Senior Field Sales Account Manager in Chicago IL Resume Thomas PapanDocument2 pagesSenior Field Sales Account Manager in Chicago IL Resume Thomas PapanThomasPapanNo ratings yet

- Gurus To QualityDocument8 pagesGurus To QualityDarl YabutNo ratings yet

- Myntra Case Study: Presented By-Team 16Document9 pagesMyntra Case Study: Presented By-Team 16Chirag Ronak DasNo ratings yet

- Polytechnic University of The Philippines Pulilan, Bulacan CampusDocument7 pagesPolytechnic University of The Philippines Pulilan, Bulacan CampusJocelle RomanNo ratings yet

- Tourism Marketing ExercisesDocument13 pagesTourism Marketing ExercisesLester MojadoNo ratings yet

Five Forces Model: Michael Porter's

Five Forces Model: Michael Porter's

Uploaded by

Tarsh Kumar RautOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Five Forces Model: Michael Porter's

Five Forces Model: Michael Porter's

Uploaded by

Tarsh Kumar RautCopyright:

Available Formats

Threat of substitutes (1.

6/5)

•

Michael Porter’s •

High availability of close substitutes.--

Low consumer switching cost.-

•

Five Forces Model •

Relative price & performance of substitutes.=

Profitability of substitutes.-

Bargaining power of suppliers

Barriers to entry (3.4/5)

•

Rivalry among competitors (3.8/5) (2.8/5)

Attractive economies of scale.+

• Number of market players.++ • Number of suppliers.+

• Product differentiation via shape, size,

• High industry growth.+ • Availability of substitute.+

color, quantity etc.=

• Low switching cost from one company to • Supplier's threat of forward

• High brand identity.=

another.- integration.- -

• High capital investment.-

• Moderate product differentiation.= • Industry’s threat of backward

• Huge availability of distribution channels.+

• High intensity of competitive rivalry.++ integration.-

+

• Industry’s dependency on suppliers.=

Power of buyers (3.2/5)

• High no. of buyers.=

• Buyer’s switching cost and aggressive

marketing strategies.+

• Availability of substitutes for the industry’s

Colour codes products.++

<2.5 • Backward integration of buyer.-

2.5-3.5 • Bulk purchase of products.- Symbols and Weightage:

3.5> (++) : 5 | (+) : 4 | (=) : 3 | (-) : 2 | (--) : 1

Overall Assessment

• High volume & Low margin industry.

• High competition and effective substitution

effect.

• Highly admirable sector in Indian economy.

FMCG Industry

• FDI and other future trends

Overall Assessment

6

5

5

4.5

3.8

4 4

3.4

3.2

3.5 3

2.8

3

2

2.5

2 1.6 1

1.5 0

Threat of new Rivalry among Power of Power of Threat of Overall

1

entrants competitores substitutes Attractiveness

0.5 buyers suppliers

FMCG Industry Overall

0 assessment

Rivalry Among Threat of Barriers to Entry Bargaining power Power of Buyers

Competitiors Substitutes of suppliers

You might also like

- Case Interview Frameworks - IGotAnOffer PDFDocument12 pagesCase Interview Frameworks - IGotAnOffer PDF이재민No ratings yet

- Guide To Understand VOD DistributionDocument4 pagesGuide To Understand VOD DistributionDabhekar ShreepadNo ratings yet

- 5C's and 4 P'S: Customers Company Competitors Collaborators ContextDocument26 pages5C's and 4 P'S: Customers Company Competitors Collaborators ContextRohit ChourasiaNo ratings yet

- 961 Beer Case PDFDocument22 pages961 Beer Case PDFayunda utariNo ratings yet

- Consumer Behavior Project HICO Ice CreamDocument26 pagesConsumer Behavior Project HICO Ice CreamMuhammad Jahanzeb Aamir33% (3)

- S3 S4 Industry and Environmental AnalysisDocument19 pagesS3 S4 Industry and Environmental Analysisst123314No ratings yet

- Strategic Market ManagementDocument16 pagesStrategic Market ManagementNoor Ul Ain AnwarNo ratings yet

- OS Preparatory 16-18 BacthDocument14 pagesOS Preparatory 16-18 BacthRajeev MehtaNo ratings yet

- Indian Footwear Industry AnalysisDocument14 pagesIndian Footwear Industry AnalysisnishankNo ratings yet

- Indian Footwear Industry AnalysisDocument14 pagesIndian Footwear Industry AnalysisnishankNo ratings yet

- 1.deciding Where You Want Your Business To Go, And: Basically, STRATEGY Is About Two ThingsDocument44 pages1.deciding Where You Want Your Business To Go, And: Basically, STRATEGY Is About Two ThingsMohammed AkhtarNo ratings yet

- External Environment ANALYSIS (Competitive Analysis)Document13 pagesExternal Environment ANALYSIS (Competitive Analysis)Putri AnisaNo ratings yet

- Porter's Five Forces: Barriers To EntryDocument2 pagesPorter's Five Forces: Barriers To EntryNimish JoshiNo ratings yet

- Case Study FrameworksDocument29 pagesCase Study FrameworksФранческо ЛеньямеNo ratings yet

- S3 - Template For Export PlanDocument15 pagesS3 - Template For Export PlanUyen Nhi LeNo ratings yet

- Stockmarket - Valuation and Analysis: Alexander Gilles, CFADocument18 pagesStockmarket - Valuation and Analysis: Alexander Gilles, CFAFahd_VNo ratings yet

- Session - IV Environmental Analysis + NetflixDocument11 pagesSession - IV Environmental Analysis + NetflixArnab ChakrabortyNo ratings yet

- Fundamentals of Industry AnalysisDocument21 pagesFundamentals of Industry AnalysisSamridh AgarwalNo ratings yet

- Lecture 6 - Industry Structure, 5 Forces Model and Stake Holders AnalysisDocument37 pagesLecture 6 - Industry Structure, 5 Forces Model and Stake Holders AnalysisRaven NguyenNo ratings yet

- Porter's 5 FDocument1 pagePorter's 5 Fnileshgupta11112756No ratings yet

- Market Overview - Five Forces Analysis - PESTEL Analysis - SWOT Analysis - ConclusionDocument8 pagesMarket Overview - Five Forces Analysis - PESTEL Analysis - SWOT Analysis - ConclusionnishankNo ratings yet

- Chapter-3 Strategy AnalysisDocument7 pagesChapter-3 Strategy Analysismukulful2008No ratings yet

- Competitive Structure of IndustriesDocument28 pagesCompetitive Structure of IndustriesSATAYAMNo ratings yet

- Porter Five Forces of Nano by RVDocument14 pagesPorter Five Forces of Nano by RVRahul VermaNo ratings yet

- Industry & Market AttractivenessDocument20 pagesIndustry & Market Attractivenessaparabi311No ratings yet

- 4 Industry AnalysisDocument17 pages4 Industry AnalysisAmna AroojNo ratings yet

- Where To Play & How To Win Case Interview GuideDocument18 pagesWhere To Play & How To Win Case Interview GuideAnonymous GL6svDNo ratings yet

- Disposable Diaper Industry - Group 9Document8 pagesDisposable Diaper Industry - Group 9Kartik NarayanaNo ratings yet

- Competitive Advantage: Author-Michael Porter Group No - 3Document50 pagesCompetitive Advantage: Author-Michael Porter Group No - 3rohanNo ratings yet

- Bharti Airtel v1Document40 pagesBharti Airtel v1Anuya KadamNo ratings yet

- Industry Analysis:: The FundamentalsDocument13 pagesIndustry Analysis:: The FundamentalsChhavi KhuranaNo ratings yet

- Porter's Five-Forces Analysis MatrixDocument1 pagePorter's Five-Forces Analysis Matrixgogo stillsmokingNo ratings yet

- CH 04Document17 pagesCH 04Praveen BVSNo ratings yet

- Module 5Document30 pagesModule 5HafezFaridNo ratings yet

- Porter 5 ForcesDocument6 pagesPorter 5 Forcesapi-3716002100% (3)

- PorterDocument12 pagesPortersalesmuliamakmurNo ratings yet

- Industry AnalysisDocument21 pagesIndustry AnalysisHasan NabeelNo ratings yet

- KFC & Fast Food Industry: Strategic ManagementDocument15 pagesKFC & Fast Food Industry: Strategic ManagementsoftycoonNo ratings yet

- Disposable Diaper Industry: Case AnalysisDocument8 pagesDisposable Diaper Industry: Case AnalysisaabfjabfuagfuegbfNo ratings yet

- I. Industry and Competitive AnalysisDocument10 pagesI. Industry and Competitive AnalysisAnkitaNo ratings yet

- Competitor Analysis1Document15 pagesCompetitor Analysis1malatheshNo ratings yet

- IBA2.3.1 FiveForcesaDocument9 pagesIBA2.3.1 FiveForcesaLuísa Oliveira Machado BuenoNo ratings yet

- Chapter 5Document41 pagesChapter 5Muhammad Saddam SofyandiNo ratings yet

- 6 Forces - Markets, Industry Rivalry, Buyers and Sellers 2023Document8 pages6 Forces - Markets, Industry Rivalry, Buyers and Sellers 2023michaelsstrongNo ratings yet

- Session 2 Competitive Strategies-1Document28 pagesSession 2 Competitive Strategies-1meebvkNo ratings yet

- Industry Analysis Example 04Document20 pagesIndustry Analysis Example 04Chutkoi FerozNo ratings yet

- Mahindra &mahindra - A Strategic Perspective: Group 5Document30 pagesMahindra &mahindra - A Strategic Perspective: Group 5sumon.dasNo ratings yet

- Where To Play How To Win - V2Document17 pagesWhere To Play How To Win - V2SahitraNo ratings yet

- Ch02-Managing Industry Competition - Global StrategyDocument54 pagesCh02-Managing Industry Competition - Global StrategyNguyễn Phương ThảoNo ratings yet

- Class4 Spring 2021 TopostDocument21 pagesClass4 Spring 2021 TopostMahin AliNo ratings yet

- Industry AnalysisDocument14 pagesIndustry AnalysisJorge Humberto Chambi VillarroelNo ratings yet

- 2 SM 2021-22 Industry StructureDocument13 pages2 SM 2021-22 Industry StructureRashish GuptaNo ratings yet

- 2 - ACS - 2021-22 - Recap - Industry Structure AnalysisDocument13 pages2 - ACS - 2021-22 - Recap - Industry Structure AnalysisAakash VermaNo ratings yet

- IT Success!: Towards a New Model for Information TechnologyFrom EverandIT Success!: Towards a New Model for Information TechnologyRating: 3 out of 5 stars3/5 (1)

- Investing with Intelligent ETFs: Strategies for Profiting from the New Breed of SecuritiesFrom EverandInvesting with Intelligent ETFs: Strategies for Profiting from the New Breed of SecuritiesNo ratings yet

- Credit Securitisations and Derivatives: Challenges for the Global MarketsFrom EverandCredit Securitisations and Derivatives: Challenges for the Global MarketsNo ratings yet

- Enterprise Application Integration: A Wiley Tech BriefFrom EverandEnterprise Application Integration: A Wiley Tech BriefRating: 2 out of 5 stars2/5 (1)

- Valuing Services in Trade: A Toolkit for Competitiveness DiagnosticsFrom EverandValuing Services in Trade: A Toolkit for Competitiveness DiagnosticsNo ratings yet

- Management Consulting and International Business S PDFDocument15 pagesManagement Consulting and International Business S PDFsamaNo ratings yet

- Literature Review On Problem GamblingDocument5 pagesLiterature Review On Problem Gamblingafmzyywqyfolhp100% (1)

- Bisleri SWOTDocument81 pagesBisleri SWOTAbhijit PharandeNo ratings yet

- Marketing Assignment: Kanwar Kasana (NC28)Document4 pagesMarketing Assignment: Kanwar Kasana (NC28)kanwarNo ratings yet

- IBS301m - International Business Strategy - Session 11 - 13Document15 pagesIBS301m - International Business Strategy - Session 11 - 13Nguyen Trung Hau K14 FUG CTNo ratings yet

- Presentation Title: Marketing Research ProjectDocument27 pagesPresentation Title: Marketing Research ProjectDeepali AgrawalNo ratings yet

- Business Math Single Trade DiscountDocument19 pagesBusiness Math Single Trade DiscountJenette D CervantesNo ratings yet

- Chapter 6Document25 pagesChapter 6syafikaabdullahNo ratings yet

- Children Attitude Toward TVC in PakDocument7 pagesChildren Attitude Toward TVC in Pakkashif salmanNo ratings yet

- Signed Off Entrepreneurship12q2 Mod7 Forecasting Revenues and Costs Department v3Document26 pagesSigned Off Entrepreneurship12q2 Mod7 Forecasting Revenues and Costs Department v3Juliana Renz BlamNo ratings yet

- SourcingDocument4 pagesSourcingNawaz KhanNo ratings yet

- CASE 1 - OpmanDocument8 pagesCASE 1 - OpmanMacris GalvezNo ratings yet

- Cost Sheet Analysis: Dabur India Limited.: Submitted byDocument15 pagesCost Sheet Analysis: Dabur India Limited.: Submitted byVipul BhagatNo ratings yet

- 1) The Differences Between Good and Services: Goods MeaningDocument3 pages1) The Differences Between Good and Services: Goods MeaningSAMAYAM KALYAN KUMARNo ratings yet

- The Impact of Motivation To Travel and Choice Destination Among University StudentsDocument43 pagesThe Impact of Motivation To Travel and Choice Destination Among University Studentsmulabbi brianNo ratings yet

- Marketing Research Course OutlineDocument3 pagesMarketing Research Course OutlinetortomatoNo ratings yet

- Content MarketingDocument20 pagesContent MarketingRenif RaeNo ratings yet

- Micro Teaching Brands & Brand ManagementDocument18 pagesMicro Teaching Brands & Brand ManagementDithaNo ratings yet

- C.MGT Relevant of Chapter 2 STBCDocument12 pagesC.MGT Relevant of Chapter 2 STBCNahum DaichaNo ratings yet

- NIRMADocument3 pagesNIRMAPushkar KumarNo ratings yet

- Conducting A Feasibility Study and Crafting A Business PlanDocument25 pagesConducting A Feasibility Study and Crafting A Business PlanOhona islamNo ratings yet

- Review For Final Exam Logistic and SCMDocument3 pagesReview For Final Exam Logistic and SCMNguyên BảoNo ratings yet

- Chapter 23 Perfect CompetitionDocument1 pageChapter 23 Perfect CompetitionKathleen CornistaNo ratings yet

- Senior Field Sales Account Manager in Chicago IL Resume Thomas PapanDocument2 pagesSenior Field Sales Account Manager in Chicago IL Resume Thomas PapanThomasPapanNo ratings yet

- Gurus To QualityDocument8 pagesGurus To QualityDarl YabutNo ratings yet

- Myntra Case Study: Presented By-Team 16Document9 pagesMyntra Case Study: Presented By-Team 16Chirag Ronak DasNo ratings yet

- Polytechnic University of The Philippines Pulilan, Bulacan CampusDocument7 pagesPolytechnic University of The Philippines Pulilan, Bulacan CampusJocelle RomanNo ratings yet

- Tourism Marketing ExercisesDocument13 pagesTourism Marketing ExercisesLester MojadoNo ratings yet