Professional Documents

Culture Documents

Free Cash Flow Valuation: Instructor: Abdul Rasheed Narejo, CFA

Free Cash Flow Valuation: Instructor: Abdul Rasheed Narejo, CFA

Uploaded by

Fahad NaseemOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Free Cash Flow Valuation: Instructor: Abdul Rasheed Narejo, CFA

Free Cash Flow Valuation: Instructor: Abdul Rasheed Narejo, CFA

Uploaded by

Fahad NaseemCopyright:

Available Formats

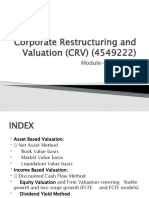

Chapter 4

Free Cash Flow Valuation

Instructor: Abdul Rasheed Narejo, CFA

SZABIST: Security Analysis – Jan-Apr 2011

Chapter 4 Discounted Cash Flow Valuation

A good business and a good investment are two different

things

WARREN BUFFET

What the wise does in the beginning, fool do in the end

WARREN BUFFET

SZABIST: Security Analysis – Jan-Apr 2011 2

Chapter 4 Discounted Cash Flow Valuation

Dividends & Cash Flow Valuation

• In the strictest sense, the only cash flow that an investor will receive from an

equity investment in a publicly traded firm is the dividend that will be paid on

the stock.

• Actual dividends, however, are set by the managers of the firm and may be

much lower than the potential dividends (that could have been paid out)

– managers are conservative and try to smooth out dividends

– managers like to hold on to cash to meet unforeseen future contingencies and

investment opportunities

• When actual dividends are less than potential dividends, using a model that

focuses only on dividends will under state the true value of the equity in a firm.

– Unlike dividend discount model, free cash flow models takes into considers all the

cash flows available to company’s shareholders

SZABIST: Security Analysis – Jan-Apr 2011 3

Chapter 4 Discounted Cash Flow Valuation

Measuring Potential Dividends

• Some analysts assume that the earnings of a firm represent its potential

dividends. This cannot be true for several reasons:

– Earnings are not cash flows, since there are both non-cash revenues and expenses in

the earnings calculation

– Even if earnings were cash flows, a firm that paid its earnings out as dividends would

not be investing in new assets and thus could not grow

– Valuation models, where earnings are discounted back to the present, will over

estimate the value of the equity in the firm

• The potential dividends of a firm are the cash flows left over after the firm has

made any “investments” it needs to make to create future growth and net debt

repayments (debt repayments - new debt issues)

SZABIST: Security Analysis – Jan-Apr 2011 4

Chapter 4 Discounted Cash Flow Valuation

Measuring Potential Dividends

• Accounting rules categorize expenses into operating and capital expenses. In

theory, operating expenses are expenses that create earnings only in the

current period, whereas capital expenses are those that will create earnings

over future periods as well. Operating expenses are netted against revenues to

arrive at operating income.

– There are anomalies in the way in which this principle is applied. Research and

development expenses are treated as operating expenses, when they are in fact

designed to create products in future periods.

• Capital expenditures, while not shown as operating expenses in the period in

which they are made, are depreciated or amortized over their estimated life.

This depreciation and amortization expense is a noncash charge when it does

occur.

• The net cash flow from capital expenditures can be then be written as:

Net Capital Expenditures = Capital Expenditures – Depreciation

SZABIST: Security Analysis – Jan-Apr 2011 5

Chapter 4 Discounted Cash Flow Valuation

When to use Free Cash Flow model

• Analysts like to use free cash flow (FCFF or FCFE) whenever one or more of the

following conditions is present:

– The company does not pay dividends

– The company paid dividends but dividends paid differ significantly from company’s

capacity to pay dividends

– Free cash flows align with profitability within a reasonable forecast period

– Investor takes control perspective

• If company’s capital structure (debt/equity ratio) is relatively stable, using FCFE

rather than FCFF is more simple.

• FCFF model is often chosen

– A leveraged company with negative FCFE

– A levered company with changing capital structure

SZABIST: Security Analysis – Jan-Apr 2011 6

Chapter 4 Discounted Cash Flow Valuation

Definition of FCFF & FCFE

• Free cash flow to the firm (FCFF) is the cash flow available to company’s

suppliers of capital (Debt + Equity) after,

– All operating expenses (including taxes) has been paid

– Necessary investment in working capital (e.g. inventory) and fixed assets (e.g.

equipment) has been made

– FCFF is cash flow from operations minus capex

• Free cash flow to equity (FCFE) is the cash flow available to company’s holders

of common equity after,

– All operating expenses, interest and principal payments have been made

– Necessary investment in working capital (e.g. inventory) and fixed assets (e.g.

equipment) has been made

– FCFE is FCFF less interest and principal payment on debt

SZABIST: Security Analysis – Jan-Apr 2011 7

Chapter 4 Discounted Cash Flow Valuation

Discounting the Free Cash Flow

SZABIST: Security Analysis – Jan-Apr 2011 8

Chapter 4 Discounted Cash Flow Valuation

Single Stage FCFF / FCFE Model

SZABIST: Security Analysis – Jan-Apr 2011 9

Chapter 4 Discounted Cash Flow Valuation

Computing FCFE from Net Income

SZABIST: Security Analysis – Jan-Apr 2011 10

Chapter 4 Discounted Cash Flow Valuation

Working Capital Effect

• In accounting terms, the working capital is the difference between current

assets (inventory, cash and accounts receivable) and current liabilities (accounts

payables, short term debt and debt due within the next year)

• A cleaner definition of working capital from a cash flow perspective is the

difference between non-cash current assets (inventory and accounts

receivable) and non-debt current liabilities (accounts payable). Any investment

in this measure of working capital ties up cash.

• Therefore, any increases (decreases) in working capital will reduce (increase)

cash flows in that period.

• When forecasting future growth, it is important to forecast the effects of such

growth on working capital needs, and building these effects into the cash flows.

SZABIST: Security Analysis – Jan-Apr 2011 11

Chapter 4 Discounted Cash Flow Valuation

Working Capital Effect

• Changes in non-cash working capital from year to year tend to be volatile. A far

better estimate of non-cash working capital needs, looking forward, can be

estimated by looking at non-cash working capital as a proportion of revenues.

• Some firms have negative non-cash working capital. Assuming that this will

continue into the future will generate positive cash flows for the firm. While

this is indeed feasible for a period of time, it is not forever. Thus, it is better

that non-cash working capital needs be set to zero, when it is negative.

SZABIST: Security Analysis – Jan-Apr 2011 12

Chapter 4 Discounted Cash Flow Valuation

Example: Working Capital

SZABIST: Security Analysis – Jan-Apr 2011 13

Chapter 4 Discounted Cash Flow Valuation

Example: International Industries (2009-10)

000’s 2010 2009

Non-cash Current Assets 8,687,670 3,932,323

Non-debt Current Liabilities 769,067 810,379

Working Capital 7,918,603 3,121,944

SZABIST: Security Analysis – Jan-Apr 2011 14

Chapter 4 Discounted Cash Flow Valuation

Key inputs for valuation

• Discount Rate

– Cost of Equity, in valuing equity

– Cost of Capital, in valuing the firm

• Cash Flows

– Cash Flows to Equity

– Cash Flows to Firm

• Growth (to get future cash flows)

– Growth in Equity Earnings

– Growth in Firm Earnings (Operating Income)

SZABIST: Security Analysis – Jan-Apr 2011 15

Chapter 4 Discounted Cash Flow Valuation

Estimating inputs: Discount Rate

• Critical ingredient in discounted cashflow valuation. Errors in estimating the

discount rate or mismatching cashflows and discount rates can lead to serious

errors in valuation.

• At an intuitive level, the discount rate used should be consistent with both the

riskiness and the type of cashflow being discounted.

– Equity versus Firm: If the cash flows being discounted are cash flows to equity, the

appropriate discount rate is a cost of equity. If the cash flows are cash flows to the

firm, the appropriate discount rate is the cost of capital.

– Currency: The currency in which the cash flows are estimated should also be the

currency in which the discount rate is estimated.

– Nominal versus Real: If the cash flows being discounted are nominal cash flows (i.e.,

reflect expected inflation), the discount rate should be nominal

SZABIST: Security Analysis – Jan-Apr 2011 16

Chapter 4 Discounted Cash Flow Valuation

Cost of Equity

• Estimating Risk Free Rate

– Risk Free Security (GoP)

• Estimating Equity Risk Premium

– Historical average

• Estimating Beta

SZABIST: Security Analysis – Jan-Apr 2011 17

Chapter 4 Discounted Cash Flow Valuation

Cost of Capital

• It will depend upon:

– (a) the components of financing: Debt, Equity or Preferred stock

– (b) the cost of each component

• In summary, the cost of capital is the cost of each component weighted by its

relative market value.

• WACC = ke (E/(D+E)) + kd (D/(D+E))

SZABIST: Security Analysis – Jan-Apr 2011 18

Chapter 4 Discounted Cash Flow Valuation

Cost of Debt

• The cost of debt is the market interest rate that the firm has to pay on its

borrowing. It will depend upon three components-

– (a) The general level of interest rates

– (b) The default premium

– (c) The firm's tax rate

SZABIST: Security Analysis – Jan-Apr 2011 19

Chapter 4 Discounted Cash Flow Valuation

What the cost of debt is not..

• The cost of debt is

– the rate at which the company can borrow at today

– corrected for the tax benefit it gets for interest payments.

• Cost of debt = kd = Interest Rate on Debt (1 - Tax rate)

• The cost of debt is not

– the interest rate at which the company obtained the debt it has on its Books.

SZABIST: Security Analysis – Jan-Apr 2011 20

Chapter 4 Discounted Cash Flow Valuation

Estimating Cost of Debt

• If the firm has bonds outstanding, and the bonds are traded, the yield to

maturity on a long-term, straight (no special features) bond can be used as the

interest rate.

• If the firm is rated, use the rating and a typical default spread on bonds with

that rating to estimate the cost of debt.

• If the firm is not rated,

– and it has recently borrowed long term from a bank, use the interest rate on the

borrowing or

– estimate a synthetic rating for the company, and use the synthetic rating to arrive at a

default spread and a cost of debt

• The cost of debt has to be estimated in the same currency as the cost of equity

and the cash flows in the valuation.

SZABIST: Security Analysis – Jan-Apr 2011 21

Chapter 4 Discounted Cash Flow Valuation

Calculating weights of each component

• Calculate the weights of each component

• Use target/average debt weights rather than project-specific weights.

• Use market value weights for debt and equity.

– The cost of capital is a measure of how much it would cost you to go out and raise the

financing to acquire the business you are valuing today.

• Since you have to pay market prices for debt and equity, the cost of capital is

better estimated using market value weights.

– Book values are often misleading and outdated.

SZABIST: Security Analysis – Jan-Apr 2011 22

Chapter 4 Discounted Cash Flow Valuation

Calculating weights of each component

• Estimating Market Value Weights

• Market Value of Equity should include the following

– Market Value of Shares outstanding

– Market Value of Warrants outstanding

– Market Value of Conversion Option in Convertible Bonds

• Market Value of Debt is more difficult to estimate because few firms have only

publicly traded debt. There are two solutions:

– Assume book value of debt is equal to market value

– Estimate the market value of debt from the book value

SZABIST: Security Analysis – Jan-Apr 2011 23

Chapter 4 Discounted Cash Flow Valuation

Profit & Loss statement

Rs Mil 2009 2010

Net Revenue 1,000 1,100

Less: cost of Goods Sold 750 825

= Gross Profit 250 275

Less: Selling & Admin Expenses 50 55

Plus: Other Operating Income 10 10

Less: Other Operating expenses 20 25

Operating Profit (EBIT) 210 235

Interest Expense 50 45

Profit Before Tax (PBT) 160 190

Tax expense @ 40% 64 76

Profit After Tax 96 114

EPS @ 10mn shares O/S 9.6 11.4

Dividend 6.4

SZABIST: Security Analysis – Jan-Apr 2011 24

Chapter 4 Discounted Cash Flow Valuation

Balance Sheet

Rs Mil 2009 2010 Rs Mil 2009 2010

Assets Liabilities & Equity

Gross: Property, Plant 700 725 Paid up Capital 100 100

& Equipment

Accumulated 200 250 Reserves 200 250

Depreciation Shareholders Equity 300 350

Net: Property, plant & 500 475

equipment Long Term Loan 200 150

Stores & spares 15 20 Accounts payables 40 50

Stock in Trade 25 30 Current Maturity of 50 50

Long term Loans

Trade debt 25 30 Trade debt

Cash & equivalent 25 45 Short term finance 0 0

Current Assets 90 115 Current Liability 90 100

Total Assets 590 590 Total Liability 590 600

SZABIST: Security Analysis – Jan-Apr 2011 25

Chapter 4 Discounted Cash Flow Valuation

Cash Flow Statement

2010

Operating Cash Flow

Net Profit 114

Add: Depreciation 50

Less: Net increase in stores & spares -10

Less: Increase in trade debts -5

Add: increase in accounts payable +10

= Operating Cash Flow =159

Less: Capex -25

Free Cash Flow to Firm =134

Less: Change in Net Debt -50

= Free Cash Flow to Equity =84

Less: Dividend 64

= Change in Cash & Equivalents 20

SZABIST: Security Analysis – Jan-Apr 2011 26

Chapter 4 Discounted Cash Flow Valuation

Formula for Free Cash Flow to Equity

SZABIST: Security Analysis – Jan-Apr 2011 27

Chapter 4 Discounted Cash Flow Valuation

Free Cash Flow to Equity

2010

Net Profit 114

Add: Depreciation 50

Less: Change in Working Capital -5

Less: Capex -25

Less: Debt Payment -50

= Free Cash Flow to Equity 84

SZABIST: Security Analysis – Jan-Apr 2011 28

Chapter 4 Discounted Cash Flow Valuation

Example: Estimating FCFE for Disney

• Net Income=$ 1,533 Million

• Capital spending = $ 1,746 Million

• Depreciation per Share = $ 1,134 Million

• Non-cash Working capital Change = $ 477 Million

• Net Debt Payment = $ 325 Million

• Estimating FCFE (1997):

– Net Income $1,533 Mil

+ Depreciation $1,134 Mil

– Capex $1,746 Mil

– Chg. Working Capital $477 Mil

– Debt Repayment $325 Mil

= Free CF to Equity $119 Mil

SZABIST: Security Analysis – Jan-Apr 2011 29

Chapter 4 Discounted Cash Flow Valuation

Example: Estimating FCFE for FFC

Rs Million 2009 2010

Free Cash Flow to Equity 2010

Net Income 11,029

Net income 11,029

Depreciation 1,194

+ Depreciation 1,194

Capex 3,314

-Capex -3,314

Non-cash Current Assets 4,300 4,014

- Change in WC +3,527

Non-interest Current 9,820 13,041

Liabilities - Debt Payment +5,377

Working Capital -5,500 -9027 FCFE 17,813

Total Debt 12,613 17,990

SZABIST: Security Analysis – Jan-Apr 2011 30

Chapter 4 Discounted Cash Flow Valuation

Value of Equity, EV, Debt & Investments

Enterprise Value (EV) = Value of equity + Value of Debt – Excess Cash/ Investments

Value of Equity = FCFE0 (1 + g ) / (r – g) => discounted value of FCFE

Value of Firm (EV) = FCFF 0 (1+g) / (r – g) => discounted value of FCFF

Value of Equity = Value of Firm – Value of Debt + Excess Cash / Investments

Assets Liabilites & Equity

Property, Plant & Equipment 50 Equity 40

Investments 25 Debt 35

Current Assets 25 Current Liabilities 25

Total 100 Total 100

SZABIST: Security Analysis – Jan-Apr 2011 31

Chapter 4 Discounted Cash Flow Valuation

Computing FCFF/FCFE from Net income

Free cash Flow to Firm Free Cash Flow to Equity

= Net Income = Net Income

Plus: Non-cash charges (Depreciation) Plus: Non-cash charges (Depreciation)

Plus: Interest expense (1 – tax) Less: Fixed Capital Expenditure

Less: Fixed Capital Expenditure Less: Increase in working Capital

Less: Increase in working Capital Plus: Increase in Debt

FCFE = FCFF – Interest (1 – Tax) + Net borrowing

FCFF = FCFE + Interest (1 – Tax) – Net borrowing

SZABIST: Security Analysis – Jan-Apr 2011 32

Chapter 4 Discounted Cash Flow Valuation

Computing FCFF/FCFE from Operating Cash Flow

Free cash Flow to Firm Free Cash Flow to Equity

= Operating Cash Flow = Net Income

Plus: Interest expense (1 – tax) Plus: Increase in Debt

Less: Fixed Capital Expenditure Less: Fixed Capital Expenditure

FCFE = FCFF – Interest (1 – Tax) + Net borrowing

FCFF = FCFE + Interest (1 – Tax) – Net borrowing

SZABIST: Security Analysis – Jan-Apr 2011 33

Chapter 4 Discounted Cash Flow Valuation

Computing FCFF/FCFE from EBIT

Free cash Flow to Firm Free Cash Flow to Equity

= EBIT (1 – tax) = EBIT ( 1 – tax)

Plus : Non-cash charges (depreciation) Plus : Non-cash charges (depreciation)

Less: Fixed Capital Expenditure Plus: Interest expense (tax)

Less: Increase in working Capital Less: Increase in working Capital

Plus increase in debt

FCFE = FCFF – Interest (1 – tax) + Net borrowing)

SZABIST: Security Analysis – Jan-Apr 2011 34

Chapter 4 Discounted Cash Flow Valuation

Computing FCFF/FCFE from EBITDA

Free cash Flow to Firm Free Cash Flow to Equity

= EBITDA (1 – tax) = EBITDA (1 – tax)

Plus: Depreciation (tax) Plus: Depreciation (tax)

Less: Fixed Capital Expenditure Less: Fixed Capital Expenditure

Less: Increase in working Capital Less: Increase in working Capital

Less: Interest (1-tax)

Plus: Net borrowing

FCFE = FCFF – Interest (1 – tax) + Net borrowing)

SZABIST: Security Analysis – Jan-Apr 2011 35

Chapter 4 Discounted Cash Flow Valuation

Example 2

• Find FCFF /FCFE

– Net Income $285 Mil

– depreciation rate $180 Mil

– Capex $349 Mil

– Change in working capital 661 – 623 = $38

– Interest Expense $130 Mil

– Tax Rate 40%

– Increase in Debt $50 Mil

• Find FCFF /FCFE

• FCFE = Net Profit + Depreciation – Capex – Increase in Working Capital + Debt Issue

– = 285 + 180 – 349 – 38 + 50 = $128 Mil

• FCFF = Net Profit + Interest ( 1 – Tax) + Depreciation – Capex – Increase in Working Capital

– = 285 + 130 (1-40%) + 180 – 349 – 38 = $156 Mil

SZABIST: Security Analysis – Jan-Apr 2011 36

Chapter 4 Discounted Cash Flow Valuation

SZABIST: Security Analysis – Jan-Apr 2011 37

You might also like

- Chcccs023 - Ageing Sab v3.2 TheoryDocument32 pagesChcccs023 - Ageing Sab v3.2 TheoryKanchan Adhikari38% (8)

- ZAHAV: A World of Israeli Cooking by Michael Solomonov and Steven CookDocument7 pagesZAHAV: A World of Israeli Cooking by Michael Solomonov and Steven CookHoughton Mifflin Harcourt Cookbooks40% (5)

- Solution Manual For Financial Statements Analysis Subramanyam Wild 11th EditionDocument48 pagesSolution Manual For Financial Statements Analysis Subramanyam Wild 11th EditionKatrinaYoungqtoki100% (88)

- Aswath Damodaran Financial Statement AnalysisDocument18 pagesAswath Damodaran Financial Statement Analysisshamapant7955100% (2)

- Financial Planning and ForecastingDocument28 pagesFinancial Planning and ForecastingSara Ghulam Muhammed SheikhaNo ratings yet

- Discounted Cash Flow Method Group 3Document44 pagesDiscounted Cash Flow Method Group 3Zariah GtNo ratings yet

- Ch-7 Approaches of Business ValuationDocument46 pagesCh-7 Approaches of Business ValuationManan SuchakNo ratings yet

- Chapter 4 DCFDocument107 pagesChapter 4 DCFVienne MaceNo ratings yet

- Free Cash Flows FCFF & FcfeDocument56 pagesFree Cash Flows FCFF & FcfeYagyaaGoyalNo ratings yet

- ValuationDocument11 pagesValuationManoj GautamNo ratings yet

- Slides - Session 5Document49 pagesSlides - Session 5Murte BolaNo ratings yet

- Enterprise DCF Model: Module-2Document57 pagesEnterprise DCF Model: Module-2DevikaNo ratings yet

- Chapter 06: Understanding Cash Flow StatementsDocument23 pagesChapter 06: Understanding Cash Flow StatementsSadia RahmanNo ratings yet

- Enterprise DCF Model: Module-2Document56 pagesEnterprise DCF Model: Module-2Devika Rani100% (1)

- Cash Flow Forecasts: P.V. ViswanathDocument16 pagesCash Flow Forecasts: P.V. Viswanathferkoss78No ratings yet

- UNIT-V BEFA Note.Document12 pagesUNIT-V BEFA Note.N. RAMANA REDDYNo ratings yet

- Equity Research QsDocument12 pagesEquity Research QsIpsita PatraNo ratings yet

- Financial Management 2Document17 pagesFinancial Management 2Anurag JhaNo ratings yet

- Free Cash Flow ValuationDocument27 pagesFree Cash Flow ValuationShaikh Saifullah KhalidNo ratings yet

- Summary ValuationDocument25 pagesSummary ValuationsMNo ratings yet

- FCFEDocument11 pagesFCFEShreya ShahNo ratings yet

- Chapter 7 - Cash Flow AnalysisDocument18 pagesChapter 7 - Cash Flow AnalysisulfaNo ratings yet

- Business Case DevelopmentDocument78 pagesBusiness Case DevelopmenttltiedeNo ratings yet

- L2 CFA Notes 1Document64 pagesL2 CFA Notes 1simmbNo ratings yet

- Tbbell Document 398download PDF Solution Manual For Financial Statement Analysis 10Th Edition by Subramanyam Online Ebook Full ChapterDocument73 pagesTbbell Document 398download PDF Solution Manual For Financial Statement Analysis 10Th Edition by Subramanyam Online Ebook Full Chapterthomas.west869100% (4)

- FSA 4202 Short Notes - Part 1Document15 pagesFSA 4202 Short Notes - Part 1dpw9586tp9No ratings yet

- NotesFMF FinalDocument52 pagesNotesFMF FinalKyrelle Mae LozadaNo ratings yet

- New-Venture ValuationDocument7 pagesNew-Venture ValuationBurhan Al MessiNo ratings yet

- 1 Financial Statements Cash Flows and TaxesDocument13 pages1 Financial Statements Cash Flows and TaxesAyanleke Julius OluwaseunfunmiNo ratings yet

- Unit II - Fund Flow StatementDocument10 pagesUnit II - Fund Flow Statementsubhash dalviNo ratings yet

- 4-Limitations of Valuation Models PDFDocument41 pages4-Limitations of Valuation Models PDFFlovgrNo ratings yet

- Income Based Valuation - l3Document14 pagesIncome Based Valuation - l3Kristene Romarate DaelNo ratings yet

- Estimation of Working CapitalDocument12 pagesEstimation of Working CapitalsnehalgaikwadNo ratings yet

- Basic Concepts: Scope and Objectives of Financial ManagementDocument31 pagesBasic Concepts: Scope and Objectives of Financial Managementjosh1360No ratings yet

- BAB 7 Cash Flow AnalyisisDocument19 pagesBAB 7 Cash Flow AnalyisisMaun GovillianNo ratings yet

- Financial ManagementDocument50 pagesFinancial ManagementLEO FRAGGERNo ratings yet

- 11 - Funds Flow AnalysisDocument6 pages11 - Funds Flow AnalysisMantu KumarNo ratings yet

- Financial Project Appraisal and Cash Flow AnalysisDocument16 pagesFinancial Project Appraisal and Cash Flow AnalysisGemechis BekeleNo ratings yet

- BAW 4614 Advanced Financial Accounting ReportingDocument32 pagesBAW 4614 Advanced Financial Accounting ReportingTEE YAN YING UnknownNo ratings yet

- Cash Flow and Financial PlanningDocument15 pagesCash Flow and Financial Planninglayan123456No ratings yet

- Shareholder Value Creation: An OverviewDocument5 pagesShareholder Value Creation: An OverviewggeettNo ratings yet

- Corporate FinanceDocument16 pagesCorporate FinanceBot RiverNo ratings yet

- Valuation MethodsDocument21 pagesValuation Methodsbluisss100% (1)

- Discounted Cash Flows MethodDocument22 pagesDiscounted Cash Flows Methodjoahn.rocreo1234No ratings yet

- Important Sites: Reports WWW - Evolutiiondesk.in - For All NSE AMFI Mock Tests ReportsDocument8 pagesImportant Sites: Reports WWW - Evolutiiondesk.in - For All NSE AMFI Mock Tests ReportsroushnaNo ratings yet

- Financial Statement Analysis 11th Edition Subramanyam Solutions ManualDocument48 pagesFinancial Statement Analysis 11th Edition Subramanyam Solutions Manualginkgoforciblyw4p100% (37)

- Financial Statement Analysis 11Th Edition Subramanyam Solutions Manual Full Chapter PDFDocument67 pagesFinancial Statement Analysis 11Th Edition Subramanyam Solutions Manual Full Chapter PDFvanbernie75nn6100% (13)

- Chapter 3 - CASH FLOW ANALYSIS - SVDocument28 pagesChapter 3 - CASH FLOW ANALYSIS - SVrachel.thuynguynNo ratings yet

- Discounted Cash Flows MethodDocument36 pagesDiscounted Cash Flows Methodjoahn.rocreo1234No ratings yet

- Cash and Fund Flow StatementDocument6 pagesCash and Fund Flow StatementAsma SaeedNo ratings yet

- Chapter 3 - Cash Flow Analysis - SVDocument26 pagesChapter 3 - Cash Flow Analysis - SVNguyen LienNo ratings yet

- Business Finance II A Lecture 3 March 08, 2021Document16 pagesBusiness Finance II A Lecture 3 March 08, 2021AhsanNo ratings yet

- Financial Statements, Tools and BudgetsDocument20 pagesFinancial Statements, Tools and BudgetsVanessa Mae AguilarNo ratings yet

- Analyzing and Interpreting Financial StatementsDocument44 pagesAnalyzing and Interpreting Financial StatementsHazim Abualola100% (1)

- Free Cash FlowDocument31 pagesFree Cash FlowKaranvir Gupta100% (1)

- Roles of Finance - SlidesDocument77 pagesRoles of Finance - SlidesCrizziaNo ratings yet

- Corpuz, Aily Bsbafm2 2 - ReviewquestionsDocument5 pagesCorpuz, Aily Bsbafm2 2 - ReviewquestionsAily CorpuzNo ratings yet

- FM ProjectDocument18 pagesFM ProjectRkenterpriseNo ratings yet

- FA - IAS 7 Statement of Cash FlowsDocument69 pagesFA - IAS 7 Statement of Cash FlowsMomiAbbas0069No ratings yet

- Session 5 - Financial Statement AnalysisDocument42 pagesSession 5 - Financial Statement AnalysisVaibhav JainNo ratings yet

- Valuation Mergers and AcquisitionDocument41 pagesValuation Mergers and AcquisitionSubrahmanya Sringeri100% (1)

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- 65 263 1 PBDocument11 pages65 263 1 PBChinedu Martins OranefoNo ratings yet

- Recruitment & Selection PolicyDocument7 pagesRecruitment & Selection PolicyAnonymous CmDManNo ratings yet

- Course Notes Handbook RSADocument80 pagesCourse Notes Handbook RSAjaeNo ratings yet

- Arens14e ch20 PPTDocument30 pagesArens14e ch20 PPTkabirakhan2007No ratings yet

- BG Construction POW.R1V6Document13 pagesBG Construction POW.R1V6Deepum HalloomanNo ratings yet

- Code of Ethics and Professional ResponsibilityDocument6 pagesCode of Ethics and Professional ResponsibilityEunice Panopio LopezNo ratings yet

- Https Ecf - Njb.uscourts - Gov Cgi-Bin DKTRPTDocument2 pagesHttps Ecf - Njb.uscourts - Gov Cgi-Bin DKTRPTBill Singh100% (1)

- Sushil - Poudel - Resume SampleDocument1 pageSushil - Poudel - Resume SampleSushil PaudelNo ratings yet

- Chapter 4 Operation of Travel AgentDocument26 pagesChapter 4 Operation of Travel AgentJanella LlamasNo ratings yet

- GT Writing Task 1Document41 pagesGT Writing Task 1mahmudshaownNo ratings yet

- Datuk Seri Anwar Bin Ibrahim V Utusan Melayu (M) BHD & AnorDocument82 pagesDatuk Seri Anwar Bin Ibrahim V Utusan Melayu (M) BHD & AnorAnonymous YessNo ratings yet

- There Sentences - Null ObjectsDocument44 pagesThere Sentences - Null ObjectsMissC0RANo ratings yet

- Airport Markings Flash CardsDocument12 pagesAirport Markings Flash CardsrohokaNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- DT Ratcfull Sig 55 Sce MetaDocument3 pagesDT Ratcfull Sig 55 Sce MetaPrashant JumanalNo ratings yet

- Impact of Social Media Marketing On Brand Image of Fastfood Chain in Sariaya, QuezonDocument37 pagesImpact of Social Media Marketing On Brand Image of Fastfood Chain in Sariaya, QuezonGlydel Anne C. LincalioNo ratings yet

- Narrative 1Document6 pagesNarrative 1Babiejoy Beltran AceloNo ratings yet

- Efficient Market HypothesisDocument2 pagesEfficient Market HypothesisSAMEEKSHA SUDHINDRA HOSKOTE 2133361No ratings yet

- Pak-India Arms RaceDocument9 pagesPak-India Arms RacesaleembaripatujoNo ratings yet

- Ammonite WorksheetDocument2 pagesAmmonite WorksheetDerrick Scott FullerNo ratings yet

- Gilgit-Baltistan: Administrative TerritoryDocument12 pagesGilgit-Baltistan: Administrative TerritoryRizwan689No ratings yet

- List of Technical Agencies (TA) Empanelled Under SFURTI SchemeDocument10 pagesList of Technical Agencies (TA) Empanelled Under SFURTI SchemeRa ManNo ratings yet

- Module-1-Introduction To HRM and Manpower PlanningDocument20 pagesModule-1-Introduction To HRM and Manpower PlanningManuNo ratings yet

- The Silk Road: ¿What Is It?Document2 pagesThe Silk Road: ¿What Is It?Harold Stiven HERNANDEZ RAYONo ratings yet

- Narrative Text Xipa3 - 12Document2 pagesNarrative Text Xipa3 - 12HNFNo ratings yet

- Synechron Corporate Apartments GuidelinesDocument4 pagesSynechron Corporate Apartments GuidelinesSree KrithNo ratings yet

- What You See Is Not What You Get: A Man-in-the-Middle Attack Applied To Video ChannelsDocument20 pagesWhat You See Is Not What You Get: A Man-in-the-Middle Attack Applied To Video ChannelsAlessandro VisintinNo ratings yet

- A Concept Paper On Drug AddictionDocument1 pageA Concept Paper On Drug AddictionMirasol SarmientoNo ratings yet