Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

38 viewsWhat Is A CRR Rate

What Is A CRR Rate

Uploaded by

sunilkumart7The Cash Reserve Ratio (CRR) is the amount of funds that banks have to keep with the Reserve Bank of India (RBI). By increasing the CRR rate, the RBI can drain excess money from the banking system as banks will have lower available balances. The RBI recently increased the CRR rate, repo rate, and reverse repo rate to control inflation while supporting economic growth. The increases aim to absorb excess cash from banks and signal the RBI's shift from an accommodative to a tighter monetary policy stance.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You might also like

- Microsoft FSI Checklist AzureDocument54 pagesMicrosoft FSI Checklist AzureJess EstradaNo ratings yet

- MCB 2020Document5 pagesMCB 2020Muhammad Sufyan Imtiaz100% (3)

- 20140118053700Document3 pages20140118053700Jalal GogginsNo ratings yet

- AnubhavbaseratepptDocument12 pagesAnubhavbaseratepptChandan SinghNo ratings yet

- Mehul Banking Article 1-1Document13 pagesMehul Banking Article 1-1Mehul ShahNo ratings yet

- Basic TermsDocument4 pagesBasic TermsmohitgaandhiNo ratings yet

- KartikDocument29 pagesKartikChandan SinghNo ratings yet

- Repo Rate NotesDocument7 pagesRepo Rate NotesAmol DhumalNo ratings yet

- Rbi NotesDocument5 pagesRbi NotesprincebanswarNo ratings yet

- All Banking Related Questions PDF - Exampundit - SatishDocument49 pagesAll Banking Related Questions PDF - Exampundit - SatishRaj DubeyNo ratings yet

- UntitledDocument3 pagesUntitledAaa NbbNo ratings yet

- Latest RBI Bank Rates in Indian Banking - AUGUST 2018: SLR Rate, CRRDocument2 pagesLatest RBI Bank Rates in Indian Banking - AUGUST 2018: SLR Rate, CRRNiyati SoodNo ratings yet

- Repo RateDocument5 pagesRepo RateSweta SinghNo ratings yet

- Bank RatesDocument18 pagesBank RatesPriyanka MarathaNo ratings yet

- CRR of Bank Alflah: What Is Bank Rate?Document3 pagesCRR of Bank Alflah: What Is Bank Rate?Mirza HuzaifaNo ratings yet

- Bank RateDocument4 pagesBank RateAnonymous Ne9hTRNo ratings yet

- RBI Credit PolicyDocument1 pageRBI Credit Policysangya01No ratings yet

- Key Differences Between Repo Rate Vs Bank RateDocument3 pagesKey Differences Between Repo Rate Vs Bank RateyuvrajsaviyadavNo ratings yet

- Cash Reserve RatioDocument2 pagesCash Reserve RatioKrishna Mund ChoudharyNo ratings yet

- Four Weapons of The RBI-1Document14 pagesFour Weapons of The RBI-1yashjadhav08No ratings yet

- Monetary Policy, Objective, InstrumentsDocument6 pagesMonetary Policy, Objective, InstrumentsChiragDahiyaNo ratings yet

- Hat Is SLRDocument5 pagesHat Is SLRIndu GuptaNo ratings yet

- Notes in Imp TermsDocument2 pagesNotes in Imp TermsPoonam SharmaNo ratings yet

- A Quick Guide To Four Important Monetary Terms (Part 1) - by Prof. Simply SimpleDocument10 pagesA Quick Guide To Four Important Monetary Terms (Part 1) - by Prof. Simply SimpleMangesh NabarNo ratings yet

- Banking RatesDocument2 pagesBanking RatesRakesh VermaNo ratings yet

- SLR & CRR and CasaDocument3 pagesSLR & CRR and CasaBalaraman Gnanam.sNo ratings yet

- Current RateDocument2 pagesCurrent RatesumitbabaNo ratings yet

- Submitted By:-Sugandh Kr. Choudhary. R1813-B41 10805900Document15 pagesSubmitted By:-Sugandh Kr. Choudhary. R1813-B41 10805900Sugandh Kr ChoudharyNo ratings yet

- What Is Base RateDocument2 pagesWhat Is Base RateJyothsna PolimatiNo ratings yet

- Bank RatesDocument3 pagesBank RatesJamessapna BondNo ratings yet

- Base RateDocument2 pagesBase Ratebhavi kocharNo ratings yet

- Cash Reserve RatioDocument6 pagesCash Reserve RatioAmitesh RoyNo ratings yet

- Assignment of Buisness Enviroment MGT 511: TOPIC: Changes in Monetary Policy On Banking Sector or IndustryDocument9 pagesAssignment of Buisness Enviroment MGT 511: TOPIC: Changes in Monetary Policy On Banking Sector or IndustryRohit VermaNo ratings yet

- What Is Monetary PolicyDocument5 pagesWhat Is Monetary PolicyBhagat DeepakNo ratings yet

- Macro Economics: Monetary & Fiscal Policy InstrumentsDocument27 pagesMacro Economics: Monetary & Fiscal Policy InstrumentsACRNo ratings yet

- Mid Quarter Policy Review by RBIDocument1 pageMid Quarter Policy Review by RBIsavitashrivastava123No ratings yet

- Monetary PolicyDocument5 pagesMonetary PolicySahaya Arul.M.No ratings yet

- News of The Week 2Document17 pagesNews of The Week 2mehtarahul999No ratings yet

- Difference Between Bank Rate and Repo Rate: What Is A CRR Rate?Document9 pagesDifference Between Bank Rate and Repo Rate: What Is A CRR Rate?anjanashNo ratings yet

- Structure and Functions of Reserve Bank of IndiaDocument35 pagesStructure and Functions of Reserve Bank of IndiashivaNo ratings yet

- RBI Policy Terms For Aam AadmiDocument2 pagesRBI Policy Terms For Aam AadmiSPIMYSNo ratings yet

- Explain Various Quantitative Instruments of Monetary Policy Which Are Undertaken To Control InflationDocument4 pagesExplain Various Quantitative Instruments of Monetary Policy Which Are Undertaken To Control Inflationanvesha khillarNo ratings yet

- What Is SLR, CRR, Bank Rate, Repo and Reverse Repos and Difference Between CRR and SLR?Document2 pagesWhat Is SLR, CRR, Bank Rate, Repo and Reverse Repos and Difference Between CRR and SLR?ArunkumarNo ratings yet

- A New Rate, Called The Base Rate, Must Be Used To Price All LendingDocument3 pagesA New Rate, Called The Base Rate, Must Be Used To Price All LendingSangram PandaNo ratings yet

- Repo and Reverse RepoDocument17 pagesRepo and Reverse RepoD>RNo ratings yet

- Repo (Repurchase) RateDocument2 pagesRepo (Repurchase) RaterohitvasishtNo ratings yet

- Ruhi Agrawal Assignment (Banking)Document32 pagesRuhi Agrawal Assignment (Banking)Shraddha GawadeNo ratings yet

- GurprrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrDocument8 pagesGurprrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrAarif Lateef GilkarNo ratings yet

- Quantitative Measures of HDFC Bank & Definition: ND THDocument3 pagesQuantitative Measures of HDFC Bank & Definition: ND THKarina ManafNo ratings yet

- Bank Rates': Submitted by Rudra Sayak Sardar Pooja Kumari Aarti Singh Shresth Kotish Geetashri PinguaDocument11 pagesBank Rates': Submitted by Rudra Sayak Sardar Pooja Kumari Aarti Singh Shresth Kotish Geetashri PinguaShresth KotishNo ratings yet

- WHAT IS SLR? What Is CRR? What Is Rate?, What Are Repo and Reverse Repos? What Is Difference Between CRR and SLR?Document4 pagesWHAT IS SLR? What Is CRR? What Is Rate?, What Are Repo and Reverse Repos? What Is Difference Between CRR and SLR?prk1234No ratings yet

- Measures Taken by RBI To Control InflationDocument6 pagesMeasures Taken by RBI To Control InflationKshitij MishraNo ratings yet

- Monetary Policy ToolsDocument2 pagesMonetary Policy ToolsSudhir ShanklaNo ratings yet

- What Is Bank Rate?Document2 pagesWhat Is Bank Rate?Narender HoodaNo ratings yet

- CCCCC C C C CCDocument5 pagesCCCCC C C C CCDona BanerjeeNo ratings yet

- What Is Bank RateDocument4 pagesWhat Is Bank RateKamal GuptaNo ratings yet

- Banking InterviewDocument30 pagesBanking InterviewJaya JamdhadeNo ratings yet

- L1 BankingDocument38 pagesL1 BankingdjroytatanNo ratings yet

- Financial IndicatorsDocument20 pagesFinancial Indicatorsmajid_khan_4No ratings yet

- Meaning of CRR & SLRDocument4 pagesMeaning of CRR & SLRGaurav100% (1)

- Banking Case StudyDocument9 pagesBanking Case Studyainesh_mukherjeeNo ratings yet

- Opportunities in Industry For Chartered AccounDocument26 pagesOpportunities in Industry For Chartered Accounswapnil_mehta_5No ratings yet

- AIFinanceBanking Report WQ PDFDocument41 pagesAIFinanceBanking Report WQ PDFTrishala PandeyNo ratings yet

- Dividend Decision (India Bulls)Document9 pagesDividend Decision (India Bulls)Balakrishna ChakaliNo ratings yet

- Zimbabwe Booklet May 2013Document143 pagesZimbabwe Booklet May 2013Loretta WiseNo ratings yet

- MGT307 Project V FIN C (BNB) - 1Document11 pagesMGT307 Project V FIN C (BNB) - 1Rajesh MongerNo ratings yet

- Sbi Po PT - 18Document6 pagesSbi Po PT - 18Rovin AshbelNo ratings yet

- MSC Finance Full Time Financial Markets and Institutions Assignment ReportDocument4 pagesMSC Finance Full Time Financial Markets and Institutions Assignment ReportLumumba KuyelaNo ratings yet

- CAS Tally TRAINING MaterialDocument39 pagesCAS Tally TRAINING MaterialTesfa HunderaNo ratings yet

- HSBC 220222-Annual-Report-And-Accounts-2021Document181 pagesHSBC 220222-Annual-Report-And-Accounts-2021shiyun chuNo ratings yet

- Indian Overseas Bank FinalDocument39 pagesIndian Overseas Bank FinalDeepak Singh PundirNo ratings yet

- Soumil Final Project PDFDocument56 pagesSoumil Final Project PDFSoumil SoganiNo ratings yet

- Project Report (Devlopment Sector) - Rural DevlopmentDocument41 pagesProject Report (Devlopment Sector) - Rural DevlopmentDebasis MuduliNo ratings yet

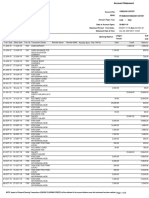

- Estmt - 2023 06 12Document8 pagesEstmt - 2023 06 12skstro.cNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument38 pagesInstructions / Checklist For Filling KYC FormJeyakumar ANo ratings yet

- Registered Office: 3 CIN: L17110MH1973PLC019786: Floor, Maker Chambers IV, 222, Nariman Point, Mumbai 400 021Document2 pagesRegistered Office: 3 CIN: L17110MH1973PLC019786: Floor, Maker Chambers IV, 222, Nariman Point, Mumbai 400 021corona virusNo ratings yet

- Chap 1. Financial Management 1.1 Finance and Related DisciplineDocument13 pagesChap 1. Financial Management 1.1 Finance and Related DisciplineBarkkha MakhijaNo ratings yet

- Marketing Policy, Products & Services of Standard Chartered BankDocument19 pagesMarketing Policy, Products & Services of Standard Chartered BankMd Khurshed AlamNo ratings yet

- Stanbic IBTC Mutual Funds Account Opening Pack FEB 2017Document8 pagesStanbic IBTC Mutual Funds Account Opening Pack FEB 2017titooluwaNo ratings yet

- Statements 9261Document6 pagesStatements 9261Jaun Tew Theory PhuorrNo ratings yet

- Form No 31 EnglishDocument4 pagesForm No 31 EnglishRahul KumarNo ratings yet

- 2012 Business Banking Trust Trends ReportDocument42 pages2012 Business Banking Trust Trends ReportpankajpandeylkoNo ratings yet

- 17 8th English Term 1 Sura Guide 2019 2020 Sample Materials English MediumDocument35 pages17 8th English Term 1 Sura Guide 2019 2020 Sample Materials English Mediumisharin k100% (1)

- Ibt Unit 1-2-3 FullDocument54 pagesIbt Unit 1-2-3 Fulldolly arora100% (1)

- Essay About E-BankingDocument7 pagesEssay About E-BankingDauri MedinaNo ratings yet

- Islamic Leasing DocumentDocument19 pagesIslamic Leasing DocumentJasonKestNo ratings yet

- Real Number Assignment 3. ChalanDocument3 pagesReal Number Assignment 3. ChalanMohammed Mubashir PPNo ratings yet

- Cho Zin Oo MBFDocument71 pagesCho Zin Oo MBFNah Ooth WazNo ratings yet

What Is A CRR Rate

What Is A CRR Rate

Uploaded by

sunilkumart70 ratings0% found this document useful (0 votes)

38 views8 pagesThe Cash Reserve Ratio (CRR) is the amount of funds that banks have to keep with the Reserve Bank of India (RBI). By increasing the CRR rate, the RBI can drain excess money from the banking system as banks will have lower available balances. The RBI recently increased the CRR rate, repo rate, and reverse repo rate to control inflation while supporting economic growth. The increases aim to absorb excess cash from banks and signal the RBI's shift from an accommodative to a tighter monetary policy stance.

Original Description:

Original Title

What is a CRR rate

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Cash Reserve Ratio (CRR) is the amount of funds that banks have to keep with the Reserve Bank of India (RBI). By increasing the CRR rate, the RBI can drain excess money from the banking system as banks will have lower available balances. The RBI recently increased the CRR rate, repo rate, and reverse repo rate to control inflation while supporting economic growth. The increases aim to absorb excess cash from banks and signal the RBI's shift from an accommodative to a tighter monetary policy stance.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

38 views8 pagesWhat Is A CRR Rate

What Is A CRR Rate

Uploaded by

sunilkumart7The Cash Reserve Ratio (CRR) is the amount of funds that banks have to keep with the Reserve Bank of India (RBI). By increasing the CRR rate, the RBI can drain excess money from the banking system as banks will have lower available balances. The RBI recently increased the CRR rate, repo rate, and reverse repo rate to control inflation while supporting economic growth. The increases aim to absorb excess cash from banks and signal the RBI's shift from an accommodative to a tighter monetary policy stance.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 8

What is a CRR rate?

Cash reserve Ratio (CRR) is the amount of

funds that the banks have to keep with

RBI. If RBI decides to increase the

percent of this, the available amount with

the banks comes down. RBI is using this

method (increase of CRR rate), to drain

out the excessive money from the banks.

The Reserve Bank of India today hiked short-

term lending and borrowing rates and the

portion of money banks deposit with it by 25

basis points each, in a move aimed at

controlling the inflation spiral without choking

growth.

The apex bank hiked its repo, reverse repo

(overnight lending and borrowing rates) to

5.25 per cent and 3.75 per cent, respectively,

while the Cash Reserve Ratio, or the portion

of deposits banks park with RBI, to 6 per

centin line with analysts’ expectations.

The hike in CRR, which will come into

effect from April 24, will absorb Rs. 12,500-

crore excess cash from the banking

system. Banks have already indicated that

they may not pass on the increased cost to

the borrowers immediately as liquidity still

remains sufficient in the system.

RBI began exiting its accommodative

policy stance in January by hiking CRR to

5.75 per cent and the short term rates by

0.25 per cent each in March.

What is PLR?

This is a banking terminology mostly used by RBI

to issue guidelines to commercial banks.It is

minimum " Prime Lending Rate " at which credit

line is offered to prime borrowers by banks.The

current Prime Lending Rate (PLR) with effect from

Jul 13, 2009 is 14.00% p.a.

The interest rate that commercial banks

charge their best, most credit-worthy customers.

Generally a bank's best customers consist of large

corporations.

The rate is determined by the Federal Reserve's decision to

raise or lower prevailing interest rates for short-term

borrowing. Though some banks charge their best

customers more and some less than the official prime rate,

the rate tends to become standard across the banking

industry when a major bank moves its prime up or down.

The rate is a key interest rate, since loans to less-

creditworthy customers are often tied to the prime rate. For

example, a Blue Chip company may borrow at a prime rate

of 5%, but a less-well-established small business may

borrow from the same bank at prime plus 2, or 7%. Many

consumer loans, such as home equity, automobile,

mortgage, and credit card loans, are tied to the prime rate.

Although the major bank prime rate is the definitive "best

rate" reference point, many banks, particularly those in

outlying regions, have a two-tier system, whereby smaller

companies of top credit standing may borrow at an even

lower rate.

“There is clear evidence of demand side pressures

building up...with the recovery now firmly in place,

we need to move in a calibrated manner in the

direction of normalizing our policy instruments,” the

RBI said.

Announcing the policy measure, the central bank

said it would closely monitor the price situation in

the economy and would take further action as

warranted.

The central bank, which has visibly shifted its policy

priority to inflation from growth, also warned that

with growth expected to accelerate next year,

capacity constraints are likely to put additional

pressure on prices and “there was a need that

demand side inflation does not become entrenched.”

What is repo rate by RBI of

India?

Whenever the banks have any shortage of funds

they can borrow it from RBI. Repo rate is the rate at which

our banks borrow rupees from RBI. A reduction in the repo

rate will help banks to get money at a cheaper rate. When

the repo rate increases borrowing from RBI becomes more

expensive.

The rate charged by RBI for its Repo operations is

5.75% and Reverse Repo rate is 3.25%.

When RBI lends money to bankers against

approved securities for meeting their day to day

requirements or to fill short term gap.It takes approved

securities as securityand lends money.These types of

operations are generally for overnight operations.

the repo rate is the rate that the reserve bank lends

money to commercial banks

What is reverse repo rate?

This is the rate at which the RBI borrows funds from

banks when it wants to suck out liquidity in the

economy. It is the rate RBI offers to the banks for

parking their surplus funds.

Difference between the repo rate and reverse repo

rate?

The reverse repo rate is the rate at which banks park

their short-term excess liquidity with the Central Bank,

while the repo rate is the rate at which the Central

Bank pumps in short-term liquidity...

You might also like

- Microsoft FSI Checklist AzureDocument54 pagesMicrosoft FSI Checklist AzureJess EstradaNo ratings yet

- MCB 2020Document5 pagesMCB 2020Muhammad Sufyan Imtiaz100% (3)

- 20140118053700Document3 pages20140118053700Jalal GogginsNo ratings yet

- AnubhavbaseratepptDocument12 pagesAnubhavbaseratepptChandan SinghNo ratings yet

- Mehul Banking Article 1-1Document13 pagesMehul Banking Article 1-1Mehul ShahNo ratings yet

- Basic TermsDocument4 pagesBasic TermsmohitgaandhiNo ratings yet

- KartikDocument29 pagesKartikChandan SinghNo ratings yet

- Repo Rate NotesDocument7 pagesRepo Rate NotesAmol DhumalNo ratings yet

- Rbi NotesDocument5 pagesRbi NotesprincebanswarNo ratings yet

- All Banking Related Questions PDF - Exampundit - SatishDocument49 pagesAll Banking Related Questions PDF - Exampundit - SatishRaj DubeyNo ratings yet

- UntitledDocument3 pagesUntitledAaa NbbNo ratings yet

- Latest RBI Bank Rates in Indian Banking - AUGUST 2018: SLR Rate, CRRDocument2 pagesLatest RBI Bank Rates in Indian Banking - AUGUST 2018: SLR Rate, CRRNiyati SoodNo ratings yet

- Repo RateDocument5 pagesRepo RateSweta SinghNo ratings yet

- Bank RatesDocument18 pagesBank RatesPriyanka MarathaNo ratings yet

- CRR of Bank Alflah: What Is Bank Rate?Document3 pagesCRR of Bank Alflah: What Is Bank Rate?Mirza HuzaifaNo ratings yet

- Bank RateDocument4 pagesBank RateAnonymous Ne9hTRNo ratings yet

- RBI Credit PolicyDocument1 pageRBI Credit Policysangya01No ratings yet

- Key Differences Between Repo Rate Vs Bank RateDocument3 pagesKey Differences Between Repo Rate Vs Bank RateyuvrajsaviyadavNo ratings yet

- Cash Reserve RatioDocument2 pagesCash Reserve RatioKrishna Mund ChoudharyNo ratings yet

- Four Weapons of The RBI-1Document14 pagesFour Weapons of The RBI-1yashjadhav08No ratings yet

- Monetary Policy, Objective, InstrumentsDocument6 pagesMonetary Policy, Objective, InstrumentsChiragDahiyaNo ratings yet

- Hat Is SLRDocument5 pagesHat Is SLRIndu GuptaNo ratings yet

- Notes in Imp TermsDocument2 pagesNotes in Imp TermsPoonam SharmaNo ratings yet

- A Quick Guide To Four Important Monetary Terms (Part 1) - by Prof. Simply SimpleDocument10 pagesA Quick Guide To Four Important Monetary Terms (Part 1) - by Prof. Simply SimpleMangesh NabarNo ratings yet

- Banking RatesDocument2 pagesBanking RatesRakesh VermaNo ratings yet

- SLR & CRR and CasaDocument3 pagesSLR & CRR and CasaBalaraman Gnanam.sNo ratings yet

- Current RateDocument2 pagesCurrent RatesumitbabaNo ratings yet

- Submitted By:-Sugandh Kr. Choudhary. R1813-B41 10805900Document15 pagesSubmitted By:-Sugandh Kr. Choudhary. R1813-B41 10805900Sugandh Kr ChoudharyNo ratings yet

- What Is Base RateDocument2 pagesWhat Is Base RateJyothsna PolimatiNo ratings yet

- Bank RatesDocument3 pagesBank RatesJamessapna BondNo ratings yet

- Base RateDocument2 pagesBase Ratebhavi kocharNo ratings yet

- Cash Reserve RatioDocument6 pagesCash Reserve RatioAmitesh RoyNo ratings yet

- Assignment of Buisness Enviroment MGT 511: TOPIC: Changes in Monetary Policy On Banking Sector or IndustryDocument9 pagesAssignment of Buisness Enviroment MGT 511: TOPIC: Changes in Monetary Policy On Banking Sector or IndustryRohit VermaNo ratings yet

- What Is Monetary PolicyDocument5 pagesWhat Is Monetary PolicyBhagat DeepakNo ratings yet

- Macro Economics: Monetary & Fiscal Policy InstrumentsDocument27 pagesMacro Economics: Monetary & Fiscal Policy InstrumentsACRNo ratings yet

- Mid Quarter Policy Review by RBIDocument1 pageMid Quarter Policy Review by RBIsavitashrivastava123No ratings yet

- Monetary PolicyDocument5 pagesMonetary PolicySahaya Arul.M.No ratings yet

- News of The Week 2Document17 pagesNews of The Week 2mehtarahul999No ratings yet

- Difference Between Bank Rate and Repo Rate: What Is A CRR Rate?Document9 pagesDifference Between Bank Rate and Repo Rate: What Is A CRR Rate?anjanashNo ratings yet

- Structure and Functions of Reserve Bank of IndiaDocument35 pagesStructure and Functions of Reserve Bank of IndiashivaNo ratings yet

- RBI Policy Terms For Aam AadmiDocument2 pagesRBI Policy Terms For Aam AadmiSPIMYSNo ratings yet

- Explain Various Quantitative Instruments of Monetary Policy Which Are Undertaken To Control InflationDocument4 pagesExplain Various Quantitative Instruments of Monetary Policy Which Are Undertaken To Control Inflationanvesha khillarNo ratings yet

- What Is SLR, CRR, Bank Rate, Repo and Reverse Repos and Difference Between CRR and SLR?Document2 pagesWhat Is SLR, CRR, Bank Rate, Repo and Reverse Repos and Difference Between CRR and SLR?ArunkumarNo ratings yet

- A New Rate, Called The Base Rate, Must Be Used To Price All LendingDocument3 pagesA New Rate, Called The Base Rate, Must Be Used To Price All LendingSangram PandaNo ratings yet

- Repo and Reverse RepoDocument17 pagesRepo and Reverse RepoD>RNo ratings yet

- Repo (Repurchase) RateDocument2 pagesRepo (Repurchase) RaterohitvasishtNo ratings yet

- Ruhi Agrawal Assignment (Banking)Document32 pagesRuhi Agrawal Assignment (Banking)Shraddha GawadeNo ratings yet

- GurprrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrDocument8 pagesGurprrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrAarif Lateef GilkarNo ratings yet

- Quantitative Measures of HDFC Bank & Definition: ND THDocument3 pagesQuantitative Measures of HDFC Bank & Definition: ND THKarina ManafNo ratings yet

- Bank Rates': Submitted by Rudra Sayak Sardar Pooja Kumari Aarti Singh Shresth Kotish Geetashri PinguaDocument11 pagesBank Rates': Submitted by Rudra Sayak Sardar Pooja Kumari Aarti Singh Shresth Kotish Geetashri PinguaShresth KotishNo ratings yet

- WHAT IS SLR? What Is CRR? What Is Rate?, What Are Repo and Reverse Repos? What Is Difference Between CRR and SLR?Document4 pagesWHAT IS SLR? What Is CRR? What Is Rate?, What Are Repo and Reverse Repos? What Is Difference Between CRR and SLR?prk1234No ratings yet

- Measures Taken by RBI To Control InflationDocument6 pagesMeasures Taken by RBI To Control InflationKshitij MishraNo ratings yet

- Monetary Policy ToolsDocument2 pagesMonetary Policy ToolsSudhir ShanklaNo ratings yet

- What Is Bank Rate?Document2 pagesWhat Is Bank Rate?Narender HoodaNo ratings yet

- CCCCC C C C CCDocument5 pagesCCCCC C C C CCDona BanerjeeNo ratings yet

- What Is Bank RateDocument4 pagesWhat Is Bank RateKamal GuptaNo ratings yet

- Banking InterviewDocument30 pagesBanking InterviewJaya JamdhadeNo ratings yet

- L1 BankingDocument38 pagesL1 BankingdjroytatanNo ratings yet

- Financial IndicatorsDocument20 pagesFinancial Indicatorsmajid_khan_4No ratings yet

- Meaning of CRR & SLRDocument4 pagesMeaning of CRR & SLRGaurav100% (1)

- Banking Case StudyDocument9 pagesBanking Case Studyainesh_mukherjeeNo ratings yet

- Opportunities in Industry For Chartered AccounDocument26 pagesOpportunities in Industry For Chartered Accounswapnil_mehta_5No ratings yet

- AIFinanceBanking Report WQ PDFDocument41 pagesAIFinanceBanking Report WQ PDFTrishala PandeyNo ratings yet

- Dividend Decision (India Bulls)Document9 pagesDividend Decision (India Bulls)Balakrishna ChakaliNo ratings yet

- Zimbabwe Booklet May 2013Document143 pagesZimbabwe Booklet May 2013Loretta WiseNo ratings yet

- MGT307 Project V FIN C (BNB) - 1Document11 pagesMGT307 Project V FIN C (BNB) - 1Rajesh MongerNo ratings yet

- Sbi Po PT - 18Document6 pagesSbi Po PT - 18Rovin AshbelNo ratings yet

- MSC Finance Full Time Financial Markets and Institutions Assignment ReportDocument4 pagesMSC Finance Full Time Financial Markets and Institutions Assignment ReportLumumba KuyelaNo ratings yet

- CAS Tally TRAINING MaterialDocument39 pagesCAS Tally TRAINING MaterialTesfa HunderaNo ratings yet

- HSBC 220222-Annual-Report-And-Accounts-2021Document181 pagesHSBC 220222-Annual-Report-And-Accounts-2021shiyun chuNo ratings yet

- Indian Overseas Bank FinalDocument39 pagesIndian Overseas Bank FinalDeepak Singh PundirNo ratings yet

- Soumil Final Project PDFDocument56 pagesSoumil Final Project PDFSoumil SoganiNo ratings yet

- Project Report (Devlopment Sector) - Rural DevlopmentDocument41 pagesProject Report (Devlopment Sector) - Rural DevlopmentDebasis MuduliNo ratings yet

- Estmt - 2023 06 12Document8 pagesEstmt - 2023 06 12skstro.cNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument38 pagesInstructions / Checklist For Filling KYC FormJeyakumar ANo ratings yet

- Registered Office: 3 CIN: L17110MH1973PLC019786: Floor, Maker Chambers IV, 222, Nariman Point, Mumbai 400 021Document2 pagesRegistered Office: 3 CIN: L17110MH1973PLC019786: Floor, Maker Chambers IV, 222, Nariman Point, Mumbai 400 021corona virusNo ratings yet

- Chap 1. Financial Management 1.1 Finance and Related DisciplineDocument13 pagesChap 1. Financial Management 1.1 Finance and Related DisciplineBarkkha MakhijaNo ratings yet

- Marketing Policy, Products & Services of Standard Chartered BankDocument19 pagesMarketing Policy, Products & Services of Standard Chartered BankMd Khurshed AlamNo ratings yet

- Stanbic IBTC Mutual Funds Account Opening Pack FEB 2017Document8 pagesStanbic IBTC Mutual Funds Account Opening Pack FEB 2017titooluwaNo ratings yet

- Statements 9261Document6 pagesStatements 9261Jaun Tew Theory PhuorrNo ratings yet

- Form No 31 EnglishDocument4 pagesForm No 31 EnglishRahul KumarNo ratings yet

- 2012 Business Banking Trust Trends ReportDocument42 pages2012 Business Banking Trust Trends ReportpankajpandeylkoNo ratings yet

- 17 8th English Term 1 Sura Guide 2019 2020 Sample Materials English MediumDocument35 pages17 8th English Term 1 Sura Guide 2019 2020 Sample Materials English Mediumisharin k100% (1)

- Ibt Unit 1-2-3 FullDocument54 pagesIbt Unit 1-2-3 Fulldolly arora100% (1)

- Essay About E-BankingDocument7 pagesEssay About E-BankingDauri MedinaNo ratings yet

- Islamic Leasing DocumentDocument19 pagesIslamic Leasing DocumentJasonKestNo ratings yet

- Real Number Assignment 3. ChalanDocument3 pagesReal Number Assignment 3. ChalanMohammed Mubashir PPNo ratings yet

- Cho Zin Oo MBFDocument71 pagesCho Zin Oo MBFNah Ooth WazNo ratings yet