Professional Documents

Culture Documents

Assessing A New Venture's Financial Strength and Viability: ©2010 Pearson Education

Assessing A New Venture's Financial Strength and Viability: ©2010 Pearson Education

Uploaded by

Ayesha LatifCopyright:

Available Formats

You might also like

- Allahabad BankDocument103 pagesAllahabad BankPiyush Gehlot0% (1)

- Chapter 2 - Measuring Income To Assess PerformanceDocument4 pagesChapter 2 - Measuring Income To Assess PerformanceArmanNo ratings yet

- Assessing A New Venture's Financial Strength and ViabilityDocument32 pagesAssessing A New Venture's Financial Strength and Viabilitydedila nachar50% (2)

- ENTP 08 - Assessing A New Venture - S Financial Strength and ViabilityDocument30 pagesENTP 08 - Assessing A New Venture - S Financial Strength and ViabilityHARIS ZAFARNo ratings yet

- Assessing A New Venture's Financial Strength and Viability: Bruce R. Barringer R. Duane IrelandDocument195 pagesAssessing A New Venture's Financial Strength and Viability: Bruce R. Barringer R. Duane IrelandLei OsNo ratings yet

- Assessing A New Venture's Financial Strength and Viability: Bruce R. Barringer R. Duane IrelandDocument36 pagesAssessing A New Venture's Financial Strength and Viability: Bruce R. Barringer R. Duane IrelandGhulam MustafaNo ratings yet

- Assessingg A New Ventures Fin StrengthDocument35 pagesAssessingg A New Ventures Fin Strengthrizwanriz78No ratings yet

- CH 8 FeasibiltyDocument36 pagesCH 8 FeasibiltyDalia ElarabyNo ratings yet

- Small Business & Entrepreneurship - Chapter 8Document36 pagesSmall Business & Entrepreneurship - Chapter 8Muhammad Zulhilmi Wak JongNo ratings yet

- Barringer - Ent6 - 08 - TaggedDocument77 pagesBarringer - Ent6 - 08 - Taggedbananshii16No ratings yet

- Assessing A New Venture's Financial Strength and ViabilityDocument35 pagesAssessing A New Venture's Financial Strength and ViabilityBuraq KhanNo ratings yet

- Chap 8 Financial Strength and ViabilityDocument34 pagesChap 8 Financial Strength and ViabilityWaqar IjazNo ratings yet

- Group 4 - Assessing A New Venture's Financial Strength and ViabilityDocument34 pagesGroup 4 - Assessing A New Venture's Financial Strength and ViabilityBuraq KhanNo ratings yet

- Barringer E3 PPT 08Document35 pagesBarringer E3 PPT 08jtopuNo ratings yet

- Financial Management NotesDocument10 pagesFinancial Management NotesTrixie SalasibarNo ratings yet

- Env 8 - PPTDocument49 pagesEnv 8 - PPTDeeksha HRNo ratings yet

- Topic 8Document36 pagesTopic 8Felicia TangNo ratings yet

- Financial Plan: Ventures 4Document25 pagesFinancial Plan: Ventures 4sadia.No ratings yet

- Financial ManagementDocument29 pagesFinancial ManagementJonelle Morris-DawkinsNo ratings yet

- Entrepreneurship: Successfully Launching New Ventures, 2/e: Bruce R. Barringer R. Duane IrelandDocument32 pagesEntrepreneurship: Successfully Launching New Ventures, 2/e: Bruce R. Barringer R. Duane IrelandM.JAHANZAIB100% (1)

- Ch5 DR - EzzDocument57 pagesCh5 DR - Ezzعمران تركيNo ratings yet

- The Role of Managerial FinanceDocument37 pagesThe Role of Managerial FinanceMalak W.No ratings yet

- The Role of Managerial FinanceDocument37 pagesThe Role of Managerial Financelayan123456No ratings yet

- Chapter 8 COMM 320Document10 pagesChapter 8 COMM 320Erick GellisNo ratings yet

- Completed ProjectDocument64 pagesCompleted ProjectPuneeth ArNo ratings yet

- Financial AnalysisDocument19 pagesFinancial AnalysisMANANSH KULSHRESHTHNo ratings yet

- Chapter-8 Assessing A New Venture's Financial Strength and ViabilityDocument53 pagesChapter-8 Assessing A New Venture's Financial Strength and ViabilityHtet Pyae ZawNo ratings yet

- Cash Flow StatementDocument103 pagesCash Flow StatementMBA BoysNo ratings yet

- Cash Flow Final PrintDocument61 pagesCash Flow Final PrintGeddada DineshNo ratings yet

- Chapter - I 1.1 Introduction To The StudyDocument91 pagesChapter - I 1.1 Introduction To The StudyNaresh KumarNo ratings yet

- M01 Gitman50803X 14 MF C01Document52 pagesM01 Gitman50803X 14 MF C01RaniaNo ratings yet

- Objectives of Corporate Finance: - Aaditya DesaiDocument19 pagesObjectives of Corporate Finance: - Aaditya DesaiPRIYA RATHORENo ratings yet

- The Role of Managerial FinanceDocument44 pagesThe Role of Managerial Financelouise carinoNo ratings yet

- Olin Finance Club Interview Questions & AnswersDocument20 pagesOlin Finance Club Interview Questions & AnswersSriram ThwarNo ratings yet

- The Role of Managerial FinanceDocument44 pagesThe Role of Managerial FinanceRa'fat JalladNo ratings yet

- Section 1-CH.1Document36 pagesSection 1-CH.1mtfm2004No ratings yet

- Entrepreneurship Chapter 8 NotesDocument4 pagesEntrepreneurship Chapter 8 NotesJamal ArshadNo ratings yet

- FM 1Document7 pagesFM 1Rohini rs nairNo ratings yet

- Financial ch1pdfDocument42 pagesFinancial ch1pdfx72bgysvcwNo ratings yet

- M03 Gitman50803X 14 MF C03Document73 pagesM03 Gitman50803X 14 MF C03Burhan AzharNo ratings yet

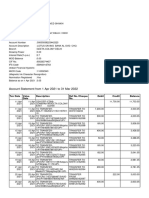

- Newton Media Supplies LTDDocument2 pagesNewton Media Supplies LTDYashmi BhanderiNo ratings yet

- Financing and FundingDocument37 pagesFinancing and Fundingmaryam farooqNo ratings yet

- Working Capital at Zuari Cement: Working Capital Management Is One of The Key Areas of Financial DecisionDocument5 pagesWorking Capital at Zuari Cement: Working Capital Management Is One of The Key Areas of Financial DecisionVardhan BujjiNo ratings yet

- SFM-chapter 1Document24 pagesSFM-chapter 1animut silesheNo ratings yet

- Financial Management Module 8Document17 pagesFinancial Management Module 8Armand RoblesNo ratings yet

- Cash Flow and Financial PlanningDocument15 pagesCash Flow and Financial Planninglayan123456No ratings yet

- Financial Management PPT1Document16 pagesFinancial Management PPT1Erika BernardinoNo ratings yet

- Winter Semester 2023-24 - MGT2006 - TH - AP2023246000029 - 2024-01-18 - Reference-Material-IDocument19 pagesWinter Semester 2023-24 - MGT2006 - TH - AP2023246000029 - 2024-01-18 - Reference-Material-Isujithsai2004No ratings yet

- Fraser-Ormiston 9e PPT Ch06Document72 pagesFraser-Ormiston 9e PPT Ch06Shihab HasanNo ratings yet

- CHAPTER - 1 Corporate Finance Notes (Prakash Kumar)Document9 pagesCHAPTER - 1 Corporate Finance Notes (Prakash Kumar)Prakash KumarNo ratings yet

- Fin02 - Financial Statement and ReportsDocument41 pagesFin02 - Financial Statement and ReportsGenieffer Kate Gulfo100% (1)

- Review of FS Preparation Analysis and Interpretation 6Document17 pagesReview of FS Preparation Analysis and Interpretation 6Christian Jasper M. LigsonNo ratings yet

- Business Finance: Introduction To Financial ManagementDocument50 pagesBusiness Finance: Introduction To Financial ManagementAce BautistaNo ratings yet

- Main EditeddddDocument73 pagesMain Editeddddammukhan khanNo ratings yet

- Financial ManagementDocument26 pagesFinancial ManagementHILLARY SHINGIRAI MAPIRANo ratings yet

- 1.three Major Functions of Financial Manager? How Are They Related To The Goal of A Business Organization?Document15 pages1.three Major Functions of Financial Manager? How Are They Related To The Goal of A Business Organization?Imtiaz PiasNo ratings yet

- Analysis of Financial Statements: Jian XiaoDocument115 pagesAnalysis of Financial Statements: Jian XiaoLim Mei SuokNo ratings yet

- Financial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessFrom EverandFinancial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessNo ratings yet

- Basics of Share and DebentureDocument14 pagesBasics of Share and DebentureChaman SinghNo ratings yet

- Group 5 Gruppo Florence Spa WordDocument13 pagesGroup 5 Gruppo Florence Spa Wordaidashirali1No ratings yet

- Section 3 of The NLRC Rules of Procedure, As Amended, ClearlyDocument5 pagesSection 3 of The NLRC Rules of Procedure, As Amended, ClearlyDe Lima RJNo ratings yet

- Direct and Indirect TaxesDocument14 pagesDirect and Indirect Taxeskratika singhNo ratings yet

- CSR PolicyDocument1 pageCSR Policybhupendra1988No ratings yet

- English - LATAM Candidate Prep MaterialsDocument25 pagesEnglish - LATAM Candidate Prep MaterialsDaniel Diniz MarquesNo ratings yet

- Hingna Road, Wanadongri, Nagpur - 441 110Document2 pagesHingna Road, Wanadongri, Nagpur - 441 110Prasad AurangabadkarNo ratings yet

- Mayank Sip Report FinalDocument47 pagesMayank Sip Report FinalMoann JhaNo ratings yet

- Statement 22Document14 pagesStatement 22Saud ShaikhNo ratings yet

- DENR Citizen Charter 2023 1st EditionDocument259 pagesDENR Citizen Charter 2023 1st EditionBoniel HBNo ratings yet

- Part I FFRDocument99 pagesPart I FFRUmang DagaNo ratings yet

- Review Session 2 Merch and ManuDocument17 pagesReview Session 2 Merch and Manualyanna alanoNo ratings yet

- Chapter 2. Supply Chain Performance: Achieving Strategic Fit and ScopeDocument45 pagesChapter 2. Supply Chain Performance: Achieving Strategic Fit and ScopeAldhabby100% (2)

- Value Line PublishingDocument11 pagesValue Line PublishingIrka Dewi Tanemaru100% (3)

- SAIC-W-2086 In-Process Welding Inspection PDFDocument5 pagesSAIC-W-2086 In-Process Welding Inspection PDFkarioke mohaNo ratings yet

- Analytical Model To Achieve Marketing Objectives - BCG MatrixDocument13 pagesAnalytical Model To Achieve Marketing Objectives - BCG MatrixBinod AryalNo ratings yet

- Architectural Design of Compute and Storage Clouds: Unit - IiiDocument13 pagesArchitectural Design of Compute and Storage Clouds: Unit - Iii0901IO201015 ANKIT PATELNo ratings yet

- Question 9 15Document20 pagesQuestion 9 15wakjiraworku9No ratings yet

- ACI 121R-98 - Quality Management System For Concrete ConstructionDocument9 pagesACI 121R-98 - Quality Management System For Concrete Constructioncurt volvoNo ratings yet

- Robert Heller's: Business MasterclassesDocument7 pagesRobert Heller's: Business MasterclassesasrankaNo ratings yet

- Project 1 Briefing - SN Department - SEM2 - 1516Document33 pagesProject 1 Briefing - SN Department - SEM2 - 1516Akhmal HaziqNo ratings yet

- Progress Life: Where IsawayofDocument142 pagesProgress Life: Where IsawayofTejasree SaiNo ratings yet

- Vdoit TechnologyDocument7 pagesVdoit TechnologyvdoitseoNo ratings yet

- The Multi Billion Dollar Industry You Can Make Money From EasilyDocument34 pagesThe Multi Billion Dollar Industry You Can Make Money From EasilyJoshuaNo ratings yet

- Sandvik Exchange ProgramsDocument4 pagesSandvik Exchange ProgramsBenjamin MurphyNo ratings yet

- Journal Review Report 15%Document2 pagesJournal Review Report 15%Nuur AshikienNo ratings yet

- Company Wise Selected List-2020Document14 pagesCompany Wise Selected List-2020LakshmiNo ratings yet

- How To Make A Survey Questionnaire For ThesisDocument8 pagesHow To Make A Survey Questionnaire For Thesisfjd14f56100% (2)

- 1: What Forces Have Led To The Boom in Entrepreneurship in The U.S. and Across The Globe?Document6 pages1: What Forces Have Led To The Boom in Entrepreneurship in The U.S. and Across The Globe?Samiir AhmedNo ratings yet

- Payment Instruction Form (Pif) : ManilaDocument1 pagePayment Instruction Form (Pif) : ManilaMartir NyeberaNo ratings yet

Assessing A New Venture's Financial Strength and Viability: ©2010 Pearson Education

Assessing A New Venture's Financial Strength and Viability: ©2010 Pearson Education

Uploaded by

Ayesha LatifOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assessing A New Venture's Financial Strength and Viability: ©2010 Pearson Education

Assessing A New Venture's Financial Strength and Viability: ©2010 Pearson Education

Uploaded by

Ayesha LatifCopyright:

Available Formats

Assessing a New Venture’s

Financial Strength and

Viability

©2010 Pearson Education

Chapter Objectives

1 of 2

1. Explain the two functions of the financial

management of a firm.

2. Identify the four main financial objectives of

entrepreneurial ventures.

3. Explain the difference between historical and pro

forma financial statements.

4. Explain the purpose of an income statement.

5. Explain the purpose of a balance sheet.

©2010 Pearson Education

Chapter Objectives

2 of 2

6. Explain the purpose of a statement of cash flows.

7. Discuss how financial ratios are used to analyze and

interpret a firm’s financial statements.

8. Discuss the role of forecasts in projecting a firm's future

income and expenses.

9. Explain what a completely new firm bases its forecasts

on.

10. Explain what is meant by the term percent of sales

method.

©2010 Pearson Education

Financial Management

1 of 2

• Financial Management

– Financial management deals with two things: raising

money and managing a company’s finances in a way that

achieves the highest rate of return

– This chapter focuses on raising money. This chapter

focuses primarily on:

• How a new venture tracks its financial progress through preparing,

analyzing, and maintaining past financial statements.

• How a new venture forecasts future income and expenses by

preparing pro forma (or projected) financial statements.

©2010 Pearson Education

Financial Management

2 of 2

The financial management of a firm deals with questions

such as the following on an ongoing basis:

• How are we doing? Are we making or losing money?

• How much cash do we have on hand?

• Do we have enough cash to meet our short-term obligations?

• How efficiently are we utilizing our assets?

• How does our growth and net profits compare to those of our industry peers?

• Where will the funds we need for capital improvements come from?

• Are there ways we can partner with other firms to share risk and reduce the

amount of cash we need?

• Overall, are we in good shape financially?

©2010 Pearson Education

Financial Objectives of a Firm

1 of 3

©2010 Pearson Education

Financial Objectives of a Firm

2 of 3

• Profitability

– Is the ability to earn a profit.

• Many start-ups are not profitable during their first one to three years

while they are training employees and building their brands.

• However, a firm must become profitable to remain viable and

provide a return to its owners.

• Liquidity

– Is a company’s ability to meet its short-term financial

obligations.

• Even if a firm is profitable, it is often a challenge to keep enough

money in the bank to meet its routine obligations in a timely manner.

©2010 Pearson Education

Financial Objectives of a Firm

3 of 3

• Efficiency

– Is how productively a firm utilizes its assets relative to its

revenue and its profits.

• Southwest Airlines, for example, uses its assets very productively.

Its turnaround time, or the time its airplanes sit on the ground while

they are being unloaded and reloaded, is the lowest in the airline

industry.

• Stability

– Is the strength and vigor of the firm’s overall financial

posture.

• For a firm to be stable, it must not only earn a profit and remain

liquid but also keep its debt in check.

©2010 Pearson Education

The Process of Financial Management

1 of 4

• Importance of Financial Statements

– To assess whether its financial objectives are being met,

firms rely heavily on analysis of financial statements.

• A financial statement is a written report that quantitatively

describes a firm’s financial health.

• The income statement, the balance sheet, and the statement of cash

flows are the financial statements entrepreneurs use most

commonly.

• Forecasts

– Are an estimate of a firm’s future income and expenses,

based on past performance, its current circumstances, and

its future plans.

©2010 Pearson Education

The Process of Financial Management

2 of 4

• Forecasts (continued)

– New ventures typically base their forecasts on an estimate

of sales and then on industry averages or the experiences of

similar start-ups regarding the cost of goods sold and other

expenses.

• Budgets

– Are itemized forecasts of a company’s income, expenses,

and capital needs and are also an important tool for

financial planning and control.

©2010 Pearson Education

The Process of Financial Management

3 of 4

• Financial Ratios

– Depict relationships between items on a firm’s financial

statements.

– An analysis of its financial ratios helps a firm determine

whether it is meeting its financial objectives and how it

stakes up against industry peers.

• Importance of Financial Management

– Many experienced entrepreneurs stress the importance of

keeping on top of the financial management of the firm.

©2010 Pearson Education

The Process of Financial Management

4 of 4

©2010 Pearson Education

Financial Statements

• Historical Financial Statements

– Reflect past performance and are usually prepared on a

quarterly and annual basis.

• Publicly traded firms are required by the SEC to prepare financial

statements and make them available to the public.

• Pro Forms Financial Statements

– Are projections for future periods based on forecasts and

are typically completed for two to three years in the future.

• Pro forma financial statements are strictly planning tools and are

not required by the SEC.

©2010 Pearson Education

Importance of Keeping Good Records

The first step towards prudent financial management is keeping

good records.

©2010 Pearson Education

New Venture Fitness Drinks

• New Venture Fitness Drinks

– To illustrate how financial statements are prepared, we

used New Venture Fitness Drinks, the fictitious sports

drink company introduced in Chapter 3.

• New Venture Fitness Drinks has been in business for five years.

• Targeting sports enthusiasts, the company sells a line of nutritional

fitness drinks.

• The company’s strategy is to place small restaurants, similar to

smoothie restaurants, near large outdoor sports complexes.

• The company is profitable and is growing at a rate of 25% per year.

©2010 Pearson Education

Historical Financial Statements

Three types of historical financial statements

Financial Statement Purpose

Reflects the results of the operations of a firm over a

Income Statement specified period of time. It records all the revenues and

expenses for the given period and shows whether the

firm is making a profit or is experience a loss.

Balance Sheet Is a snapshot of a company’s assets, liabilities, and

owners’ equity at a specific point in time.

Summarizes the changes in a firm’s cash position for

Statement of cash flows a specified period of time and details why the

changes occurred.

©2010 Pearson Education

Historical Income Statements

©2010 Pearson Education

Historical Balance Sheets

1 of 2

©2010 Pearson Education

Historical Balance Sheets

2 of 2

Liabilities and Shareholder’s Equity

©2010 Pearson Education

Table :Statement of Cash Flows: The Indirect

Method

©2010 Pearson Education

Historical Statement of Cash Flows

©2010 Pearson Education

Ratio Analysis

• Ratio Analysis

– The most practical way to interpret or make sense of a

firm’s historical financial statements is through ratio

analysis, as shown in the next slide.

• Comparing a Firm’s Financial Results to Industry

Norms

– Comparing a firm’s financial results to industry norms

helps a firm determine how it stakes up against its

competitors and if there are any financial “red flags”

requiring attention.

©2010 Pearson Education

Historical Ratio Analysis

©2010 Pearson Education

Forecasts

1 of 4

• Forecasts

– The analysis of a firm’s historical financial statements are

followed by the preparation of forecasts.

– Forecasts are predictions of a firm’s future sales, expenses,

income, and capital expenditures.

• A firm’s forecasts provide the basis for its pro forma financial

statements.

• A well-developed set of pro forma financial statements helps a firm

create accurate budgets, build financial plans, and manage its

finances in a proactive rather than a reactive manner.

©2010 Pearson Education

You might also like

- Allahabad BankDocument103 pagesAllahabad BankPiyush Gehlot0% (1)

- Chapter 2 - Measuring Income To Assess PerformanceDocument4 pagesChapter 2 - Measuring Income To Assess PerformanceArmanNo ratings yet

- Assessing A New Venture's Financial Strength and ViabilityDocument32 pagesAssessing A New Venture's Financial Strength and Viabilitydedila nachar50% (2)

- ENTP 08 - Assessing A New Venture - S Financial Strength and ViabilityDocument30 pagesENTP 08 - Assessing A New Venture - S Financial Strength and ViabilityHARIS ZAFARNo ratings yet

- Assessing A New Venture's Financial Strength and Viability: Bruce R. Barringer R. Duane IrelandDocument195 pagesAssessing A New Venture's Financial Strength and Viability: Bruce R. Barringer R. Duane IrelandLei OsNo ratings yet

- Assessing A New Venture's Financial Strength and Viability: Bruce R. Barringer R. Duane IrelandDocument36 pagesAssessing A New Venture's Financial Strength and Viability: Bruce R. Barringer R. Duane IrelandGhulam MustafaNo ratings yet

- Assessingg A New Ventures Fin StrengthDocument35 pagesAssessingg A New Ventures Fin Strengthrizwanriz78No ratings yet

- CH 8 FeasibiltyDocument36 pagesCH 8 FeasibiltyDalia ElarabyNo ratings yet

- Small Business & Entrepreneurship - Chapter 8Document36 pagesSmall Business & Entrepreneurship - Chapter 8Muhammad Zulhilmi Wak JongNo ratings yet

- Barringer - Ent6 - 08 - TaggedDocument77 pagesBarringer - Ent6 - 08 - Taggedbananshii16No ratings yet

- Assessing A New Venture's Financial Strength and ViabilityDocument35 pagesAssessing A New Venture's Financial Strength and ViabilityBuraq KhanNo ratings yet

- Chap 8 Financial Strength and ViabilityDocument34 pagesChap 8 Financial Strength and ViabilityWaqar IjazNo ratings yet

- Group 4 - Assessing A New Venture's Financial Strength and ViabilityDocument34 pagesGroup 4 - Assessing A New Venture's Financial Strength and ViabilityBuraq KhanNo ratings yet

- Barringer E3 PPT 08Document35 pagesBarringer E3 PPT 08jtopuNo ratings yet

- Financial Management NotesDocument10 pagesFinancial Management NotesTrixie SalasibarNo ratings yet

- Env 8 - PPTDocument49 pagesEnv 8 - PPTDeeksha HRNo ratings yet

- Topic 8Document36 pagesTopic 8Felicia TangNo ratings yet

- Financial Plan: Ventures 4Document25 pagesFinancial Plan: Ventures 4sadia.No ratings yet

- Financial ManagementDocument29 pagesFinancial ManagementJonelle Morris-DawkinsNo ratings yet

- Entrepreneurship: Successfully Launching New Ventures, 2/e: Bruce R. Barringer R. Duane IrelandDocument32 pagesEntrepreneurship: Successfully Launching New Ventures, 2/e: Bruce R. Barringer R. Duane IrelandM.JAHANZAIB100% (1)

- Ch5 DR - EzzDocument57 pagesCh5 DR - Ezzعمران تركيNo ratings yet

- The Role of Managerial FinanceDocument37 pagesThe Role of Managerial FinanceMalak W.No ratings yet

- The Role of Managerial FinanceDocument37 pagesThe Role of Managerial Financelayan123456No ratings yet

- Chapter 8 COMM 320Document10 pagesChapter 8 COMM 320Erick GellisNo ratings yet

- Completed ProjectDocument64 pagesCompleted ProjectPuneeth ArNo ratings yet

- Financial AnalysisDocument19 pagesFinancial AnalysisMANANSH KULSHRESHTHNo ratings yet

- Chapter-8 Assessing A New Venture's Financial Strength and ViabilityDocument53 pagesChapter-8 Assessing A New Venture's Financial Strength and ViabilityHtet Pyae ZawNo ratings yet

- Cash Flow StatementDocument103 pagesCash Flow StatementMBA BoysNo ratings yet

- Cash Flow Final PrintDocument61 pagesCash Flow Final PrintGeddada DineshNo ratings yet

- Chapter - I 1.1 Introduction To The StudyDocument91 pagesChapter - I 1.1 Introduction To The StudyNaresh KumarNo ratings yet

- M01 Gitman50803X 14 MF C01Document52 pagesM01 Gitman50803X 14 MF C01RaniaNo ratings yet

- Objectives of Corporate Finance: - Aaditya DesaiDocument19 pagesObjectives of Corporate Finance: - Aaditya DesaiPRIYA RATHORENo ratings yet

- The Role of Managerial FinanceDocument44 pagesThe Role of Managerial Financelouise carinoNo ratings yet

- Olin Finance Club Interview Questions & AnswersDocument20 pagesOlin Finance Club Interview Questions & AnswersSriram ThwarNo ratings yet

- The Role of Managerial FinanceDocument44 pagesThe Role of Managerial FinanceRa'fat JalladNo ratings yet

- Section 1-CH.1Document36 pagesSection 1-CH.1mtfm2004No ratings yet

- Entrepreneurship Chapter 8 NotesDocument4 pagesEntrepreneurship Chapter 8 NotesJamal ArshadNo ratings yet

- FM 1Document7 pagesFM 1Rohini rs nairNo ratings yet

- Financial ch1pdfDocument42 pagesFinancial ch1pdfx72bgysvcwNo ratings yet

- M03 Gitman50803X 14 MF C03Document73 pagesM03 Gitman50803X 14 MF C03Burhan AzharNo ratings yet

- Newton Media Supplies LTDDocument2 pagesNewton Media Supplies LTDYashmi BhanderiNo ratings yet

- Financing and FundingDocument37 pagesFinancing and Fundingmaryam farooqNo ratings yet

- Working Capital at Zuari Cement: Working Capital Management Is One of The Key Areas of Financial DecisionDocument5 pagesWorking Capital at Zuari Cement: Working Capital Management Is One of The Key Areas of Financial DecisionVardhan BujjiNo ratings yet

- SFM-chapter 1Document24 pagesSFM-chapter 1animut silesheNo ratings yet

- Financial Management Module 8Document17 pagesFinancial Management Module 8Armand RoblesNo ratings yet

- Cash Flow and Financial PlanningDocument15 pagesCash Flow and Financial Planninglayan123456No ratings yet

- Financial Management PPT1Document16 pagesFinancial Management PPT1Erika BernardinoNo ratings yet

- Winter Semester 2023-24 - MGT2006 - TH - AP2023246000029 - 2024-01-18 - Reference-Material-IDocument19 pagesWinter Semester 2023-24 - MGT2006 - TH - AP2023246000029 - 2024-01-18 - Reference-Material-Isujithsai2004No ratings yet

- Fraser-Ormiston 9e PPT Ch06Document72 pagesFraser-Ormiston 9e PPT Ch06Shihab HasanNo ratings yet

- CHAPTER - 1 Corporate Finance Notes (Prakash Kumar)Document9 pagesCHAPTER - 1 Corporate Finance Notes (Prakash Kumar)Prakash KumarNo ratings yet

- Fin02 - Financial Statement and ReportsDocument41 pagesFin02 - Financial Statement and ReportsGenieffer Kate Gulfo100% (1)

- Review of FS Preparation Analysis and Interpretation 6Document17 pagesReview of FS Preparation Analysis and Interpretation 6Christian Jasper M. LigsonNo ratings yet

- Business Finance: Introduction To Financial ManagementDocument50 pagesBusiness Finance: Introduction To Financial ManagementAce BautistaNo ratings yet

- Main EditeddddDocument73 pagesMain Editeddddammukhan khanNo ratings yet

- Financial ManagementDocument26 pagesFinancial ManagementHILLARY SHINGIRAI MAPIRANo ratings yet

- 1.three Major Functions of Financial Manager? How Are They Related To The Goal of A Business Organization?Document15 pages1.three Major Functions of Financial Manager? How Are They Related To The Goal of A Business Organization?Imtiaz PiasNo ratings yet

- Analysis of Financial Statements: Jian XiaoDocument115 pagesAnalysis of Financial Statements: Jian XiaoLim Mei SuokNo ratings yet

- Financial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessFrom EverandFinancial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessNo ratings yet

- Basics of Share and DebentureDocument14 pagesBasics of Share and DebentureChaman SinghNo ratings yet

- Group 5 Gruppo Florence Spa WordDocument13 pagesGroup 5 Gruppo Florence Spa Wordaidashirali1No ratings yet

- Section 3 of The NLRC Rules of Procedure, As Amended, ClearlyDocument5 pagesSection 3 of The NLRC Rules of Procedure, As Amended, ClearlyDe Lima RJNo ratings yet

- Direct and Indirect TaxesDocument14 pagesDirect and Indirect Taxeskratika singhNo ratings yet

- CSR PolicyDocument1 pageCSR Policybhupendra1988No ratings yet

- English - LATAM Candidate Prep MaterialsDocument25 pagesEnglish - LATAM Candidate Prep MaterialsDaniel Diniz MarquesNo ratings yet

- Hingna Road, Wanadongri, Nagpur - 441 110Document2 pagesHingna Road, Wanadongri, Nagpur - 441 110Prasad AurangabadkarNo ratings yet

- Mayank Sip Report FinalDocument47 pagesMayank Sip Report FinalMoann JhaNo ratings yet

- Statement 22Document14 pagesStatement 22Saud ShaikhNo ratings yet

- DENR Citizen Charter 2023 1st EditionDocument259 pagesDENR Citizen Charter 2023 1st EditionBoniel HBNo ratings yet

- Part I FFRDocument99 pagesPart I FFRUmang DagaNo ratings yet

- Review Session 2 Merch and ManuDocument17 pagesReview Session 2 Merch and Manualyanna alanoNo ratings yet

- Chapter 2. Supply Chain Performance: Achieving Strategic Fit and ScopeDocument45 pagesChapter 2. Supply Chain Performance: Achieving Strategic Fit and ScopeAldhabby100% (2)

- Value Line PublishingDocument11 pagesValue Line PublishingIrka Dewi Tanemaru100% (3)

- SAIC-W-2086 In-Process Welding Inspection PDFDocument5 pagesSAIC-W-2086 In-Process Welding Inspection PDFkarioke mohaNo ratings yet

- Analytical Model To Achieve Marketing Objectives - BCG MatrixDocument13 pagesAnalytical Model To Achieve Marketing Objectives - BCG MatrixBinod AryalNo ratings yet

- Architectural Design of Compute and Storage Clouds: Unit - IiiDocument13 pagesArchitectural Design of Compute and Storage Clouds: Unit - Iii0901IO201015 ANKIT PATELNo ratings yet

- Question 9 15Document20 pagesQuestion 9 15wakjiraworku9No ratings yet

- ACI 121R-98 - Quality Management System For Concrete ConstructionDocument9 pagesACI 121R-98 - Quality Management System For Concrete Constructioncurt volvoNo ratings yet

- Robert Heller's: Business MasterclassesDocument7 pagesRobert Heller's: Business MasterclassesasrankaNo ratings yet

- Project 1 Briefing - SN Department - SEM2 - 1516Document33 pagesProject 1 Briefing - SN Department - SEM2 - 1516Akhmal HaziqNo ratings yet

- Progress Life: Where IsawayofDocument142 pagesProgress Life: Where IsawayofTejasree SaiNo ratings yet

- Vdoit TechnologyDocument7 pagesVdoit TechnologyvdoitseoNo ratings yet

- The Multi Billion Dollar Industry You Can Make Money From EasilyDocument34 pagesThe Multi Billion Dollar Industry You Can Make Money From EasilyJoshuaNo ratings yet

- Sandvik Exchange ProgramsDocument4 pagesSandvik Exchange ProgramsBenjamin MurphyNo ratings yet

- Journal Review Report 15%Document2 pagesJournal Review Report 15%Nuur AshikienNo ratings yet

- Company Wise Selected List-2020Document14 pagesCompany Wise Selected List-2020LakshmiNo ratings yet

- How To Make A Survey Questionnaire For ThesisDocument8 pagesHow To Make A Survey Questionnaire For Thesisfjd14f56100% (2)

- 1: What Forces Have Led To The Boom in Entrepreneurship in The U.S. and Across The Globe?Document6 pages1: What Forces Have Led To The Boom in Entrepreneurship in The U.S. and Across The Globe?Samiir AhmedNo ratings yet

- Payment Instruction Form (Pif) : ManilaDocument1 pagePayment Instruction Form (Pif) : ManilaMartir NyeberaNo ratings yet