Professional Documents

Culture Documents

Auditing and Assurance Services

Auditing and Assurance Services

Uploaded by

des arellanoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auditing and Assurance Services

Auditing and Assurance Services

Uploaded by

des arellanoCopyright:

Available Formats

Auditing and Assurance Services

A Systematic Approach

Eleventh Edition

CHAPTER 5

Evidence and

Documentation

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education.

Learning Objective 05-1

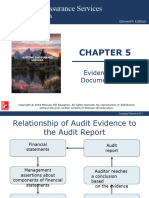

Relationship of Audit Evidence to

the Audit Report

Financial Audit

statements report

Management assertions Auditor reaches

about components of a conclusion based

financial statements on the evidence

Provide evidence on the

Audit

fairness of the

procedures

financial statements

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-2

Learning Objective 05-2

Management Assertions (1 of 2)

Occurrence

Completeness

Presentation

Assertions about classes of

transactions and events,

and related disclosures, for

Classification the period under audit Authorization

Cutoff Accuracy

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-3

Learning Objective 05-2

Management Assertions (2 of 2)

Rights and

Existence

Obligations

Assertions about

Presentation account balances, and Completeness

related disclosures, at

the period end

Accuracy,

Classification valuation, and

allocation

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-4

Learning Objective 05-2

TABLE 5-2 Summary of Management Assertions

by Category (1 of 2)

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-5

Learning Objective 05-2

TABLE 5-2 Summary of Management Assertions

by Category (2 of 2)

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-6

Learning Objective 05-3

Audit Evidence

The information used by the auditor in

arriving at the conclusions on which the

audit opinion is based.

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-7

Learning Objective 05-3

The Concepts of Audit Evidence

Nature of audit evidence

Sufficiency and appropriateness

of audit evidence

Evaluation of audit evidence

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-8

Learning Objective 05-3

Nature of Audit Evidence

Refers to the form or type of information

Accounting Records Other Information

• Records of initial entries and • Minutes of meetings

supporting records • Confirmations from third

• General and subsidiary ledgers, parties

journal entries, and other • Industry analysts’ reports

adjustments to financials not • Comparable data about

reflected in journal entries. competitors

• Work sheets and spreadsheets • Control Manuals

supporting cost allocations, • Information obtained by the

computations, reconciliations, auditor from inquiry,

and disclosures observation and inspection

• Contracts

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-9

Learning Objective 05-3

Sufficiency of Audit Evidence

Sufficiency is the measure of

the quantity of audit evidence.

Greater risk of Higher quality

misstatement requires audit evidence results

a higher quantity in a lower quantity

of audit evidence. of audit evidence.

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-10

Learning Objective 05-3

Appropriateness of Audit Evidence

Relevance

Appropriateness is a measure

of the quality of audit evidence.

Reliability

Independent source outside the entity

Effectiveness of internal control

Auditor’s direct personal knowledge

Documentary evidence

Original documents

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-11

Learning Objective 05-3

Knowledge Assessment

Which of the following sources of evidence are more reliable?

1. Inquiry of an accounts receivable clerk regarding the

accounts receivable balance – or – accounts receivable

confirmations sent to a sample of customers

2. Physical examination of lumber inventory performed by

the external auditor – or – physical examination of

inventory performed by internal auditors

(Stop and Think p. 135)

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-12

Learning Objective 05-3

Knowledge Assessment

Which of the following sources of evidence are more reliable?

1. Inquiry of an accounts receivable clerk regarding the

accounts receivable balance – or – Accounts receivable

confirmations sent to a sample of customers

2. Physical examination of lumber inventory

performed by the external auditor – or – Physical

examination of inventory performed by internal auditors

(Stop and Think p. 135)

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-13

Learning Objective 05-3

Evaluation of Audit Evidence

Proper evaluation of evidence

requires an understanding of the:

Types of evidence available.

Relative reliability of available evidence.

An auditor should be thorough in searching

for evidence and unbiased in its evaluation.

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-14

Learning Objective 05-4

Audit Procedures (1 of 2)

Specific acts

performed by the auditor

to gather evidence about

whether specific assertions

are being met.

Risk assessment Test of Substantive

procedures controls procedures

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-15

Learning Objective 05-4

Audit Procedures (2 of 2)

A set of audit procedures prepared to test assertions for

a component of the financial statements is referred to as

an audit program.

Audit Program for

Accounts Receivable

Management Assertions Example Audit Procedures

Existence Confirm accounts receivable.

Rights and obligations Inquire of management whether receivables

have been sold.

Completeness Agree total of accounts receivable subsidiary

ledger to accounts receivable control account.

Valuation or allocation Test the adequacy of the allowance for doubtful

accounts.

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-16

Learning Objective 05-4

Audit Procedures for Obtaining

Audit Evidence (1 of 7)

Inspection of records and documents

• Evidence obtained from external documents is more

reliable than evidence obtained from internal

documents

Vouching

(Occurrence)

Source Journal or

Documents Ledger

Tracing

(Completeness)

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-17

Learning Objective 05-4

Audit Procedures for Obtaining

Audit Evidence (2 of 7)

Inspection of tangible assets

• Physical examination of a tangible assets

Observation

• The process of watching a process or procedure being

performed by others

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-18

Learning Objective 05-4

Audit Procedures for Obtaining

Audit Evidence (3 of 7)

Inquiry

In conducting inquiry, the auditor should:

• Consider the knowledge, objectivity, experience,

responsibility, and qualifications of the individual to be

questioned

• Ask clear, concise, relevant questions

• Use open or closed questions appropriately

• Listen actively and effectively

• Consider the reactions and responses and ask follow-up

questions

• Evaluate responses

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-19

Learning Objective 05-4

Audit Procedures for Obtaining

Audit Evidence (4 of 7)

Confirmation

• Audit evidence obtained by the auditor as a direct

written response to the auditor from a third party

The reliability of evidence obtained through external

confirmations may be affected by factors such as:

The form of the confirmation.

Prior experience with the entity.

The nature of the information being confirmed.

The intended respondent.

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-20

Learning Objective 05-4

Audit Procedures for Obtaining

Audit Evidence (5 of 7)

Confirmation

Information Frequently

Source of Confirmation

Confirmed by Auditors

Cash balance Bank

Accounts receivable Individual customers

Inventory on consignment Consignee

Accounts payable Individual vendors

Bonds payable Bondholders/trustee

Common stock outstanding Registrar/transfer agent

Insurance coverage Insurance company

Collateral for loans Creditor

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-21

Learning Objective 05-4

Audit Procedures for Obtaining

Audit Evidence (6 of 7)

Recalculation

• Checking the mathematical accuracy of documents or

records

Reperformance

• The auditor’s independent execution of procedures or

controls that were originally performed by company

personnel

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-22

Learning Objective 05-4

Audit Procedures for Obtaining

Audit Evidence (7 of 7)

Analytical Procedures

• Evaluations of financial information made by a study

of plausible relationships among both financial and

nonfinancial data

Scanning

• Judgmentally review accounting data to identify

significant or unusual items to test

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-23

Learning Objective 05-5

TABLE 5-6 General Guidelines for Reliability

Hierarchy by Evidence Type

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-24

Learning Objective 05-6

FIGURE 5-3 Audit Testing Hierarchy: An Evidence Decision Process

for Testing Classes of Transactions or Significant Balances

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-25

Learning Objective 05-6

FIGURE 5-4 Filling the Assurance Bucket

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-26

Learning Objective 05-6

FIGURE 5-5 Accounts Payable Example of Filling

the Assurance Buckets for Each Assertion

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-27

Learning Objective 05-6

Knowledge Assessment

Consider the “assurance bucket” analogy. Why are some of

the buckets larger than others for particular assertions or

accounts?

(Review Question 5-12)

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-28

Learning Objective 05-7

Audit Documentation

The auditor’s record of the audit procedures

performed, relevant evidence obtained, and

conclusions reached.

Audit documentation (working papers) has three

functions:

1. To provide support for the audit report

2. To aid in the planning, performance, and

supervision of the audit

3. To provide a focal point for reviewing work of

subordinates; to provide a basis for quality

reviews

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-29

Learning Objective 05-7

Content of Audit Documentation (1 of 4)

Audit documentation should:

Demonstrate how the audit complied with

1 auditing and related professional practice

standards

Support the basis for the auditor’s conclusions

2 concerning each material financial statement

assertion

Demonstrate that the underlying accounting

3 records agreed or reconciled with the financial

statements

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-30

Learning Objective 05-7

Content of Audit Documentation (2 of 4)

Audit documentation should:

Include a written audit program detailing

4 auditing procedures necessary to accomplish

audit objectives

Enable a knowledgeable and experienced

5

reviewer to:

Understand the nature, timing,

Determine who performed and

extent, and results of audit

reviewed the work, as well as

procedures, evidence

the dates of the work and

obtained, and conclusions

reviews.

reached

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-31

Learning Objective 05-7

Content of Audit Documentation (3 of 4)

Most public accounting firms maintain

audit documentation in two types of files:

Permanent files Current files

• Corporate charter • Organization chart

• Important contracts • Terms of stock and bond

• Chart of accounts issues

• Internal control • Prior years’ analytical

documentation procedures (and results)

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-32

Learning Objective 05-7

Content of Audit Documentation (3 of 4)

Most public accounting firms maintain

audit documentation in two types of files:

Permanent files Current files

• Adjusting journal entries • Current financial

• Audit plan and programs statements and auditor’s

• Reclassification journal report

entries • Minutes of meetings

• Working trial balance • Working papers supporting

accounts

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-33

Learning Objective 05-8

Format of Audit Documentation

Entity name

Heading Title of the working paper

Entity’s year-end date

Indexing and Notations that provide a trail

from financial statements to audit

cross-referencing documents

Notations made next to work

Tick Marks paper items indicating

auditor/reviewer actions

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-34

Learning Objective 05-8

EXHIBIT 5-2 Example of Account Analysis

Working Paper

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-35

Learning Objective 05-8

Ownership of Audit Documentation,

Archiving, and Retention

Audit documentation should be organized so

that audit team members and others can find

evidence supporting financial statement accounts.

All audit documentation is the property of the

auditor, including documents prepared

by the entity at the auditor’s request.

The Sarbanes-Oxley Act of 2002 requires

audit documentation to be retained for a number of

years from the completion date of the engagement.

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-36

Learning Objective 05-9 (and 05-4)

Purposes of Analytical Procedures

Risk Used to assist the auditor to better

understand the business and to plan the

Assessment nature, timing, and extent of audit

Procedures procedures.

Substantive Used to obtain evidential matter about

Analytical particular assertions related to account

balances or classes of transactions.

Procedures

Final Used as an overall review of the financial

Analytical information in the final review stage of the

audit.

Procedures

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-37

Learning Objective 05-9

Types of Analytical Procedures

Trend Analysis

Ratio Analysis

Reasonableness

Analysis

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-38

Learning Objective 05-9

Figure 5-7 Substantive Analytical Procedures Decision Process

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-39

Learning Objective 05-9

Develop an Expectation (1 of 3)

Auditing standards require the auditor to have an expectation

whenever analytical procedures are used. An expectation can

be developed using a variety of information sources such as:

Financial and operating data

Budgets and forecasts

Industry publications

Competitor information

Management’s analyses

Analysts’ reports

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-40

Learning Objective 05-9

Develop an Expectation (2 of 3)

Precision – the quality of an expectation

Measure of:

• The potential effectiveness of an analytical procedure

• The degree of reliance that can be placed on the procedure

• How closely the expectation approximates the “correct” but unknown

amount

• The degree of desired precision differs with

the purpose of the analytical procedure. Detection Precision Extensiveness

Risk Required of Procedures

• A function of the materiality and required

detection risk for assertion being tested. LOW HIGH HIGH

• If the assertion being tested requires a low

level of detection risk, the expectation

needs to be very precise.

• The more precise the expectation, the

more extensive and expensive the audit

procedures (cost-benefit trade-off).

HIGH LOW LOW

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-41

Learning Objective 05-9

Develop an Expectation (3 of 3)

Four factors affect the precision of analytical

procedures:

• Disaggregation

• The plausibility and predictability of the

relationship being studied

• Data reliability

• Type of analytical procedures used to

form an expectation

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-42

Learning Objective 05-9

Define a Tolerable Difference

The size of the tolerable difference depends on:

the significance of the account

the desired degree of reliance on the substantive analytical

procedures

the level of disaggregation in the amount being tested

the precision of the expectation

Tolerable difference will usually be equal to the account’s

tolerable misstatement

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-43

Learning Objective 05-9

Compare the Expectation to the

Recorded Amount

Compare the expectation to the recorded

amount and investigate any differences

greater than the tolerable difference.

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-44

Learning Objective 05-9

Investigate Differences Greater Than

the Tolerable Difference (1 of 2)

Differences identified by substantive

analytical procedures indicate an increase

likelihood of misstatements

Explanations for significant differences observed

(substantive analytical procedures) must be followed

up and resolved through:

• Quantification

• Corroboration

• Evaluation

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-45

Learning Objective 05-9

Investigate Differences Greater Than

the Tolerable Difference (2 of 2)

Involves determining whether the explanation

Quantification or error can explain the observed difference

Auditors must corroborate explanations by

obtaining sufficient appropriate audit evidence

Corroboration linking the explanation to the difference and

substantiating that the information supporting

the explanation is reliable

Auditor should evaluate the results of the

substantive analytical procedures to conclude

Evaluation whether the desired level of assurance has

been achieved

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-46

Learning Objective 05-9

Investigate Differences for Risk Assessment

and Final Analytical Procedures

Risk Assessment Final Analytical

Procedure Differences Procedures Differences

(used in planning)

Corroborating evidence Corroborating evidence

is not required is required

If the auditor cannot find sufficient evidence within the

working papers, the auditor would formulate possible

explanations, conduct additional testing, and seek an

explanation from the entity’s personnel.

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-47

Learning Objective 05-9

Knowledge Assessment

The primary objective of final analytical procedures is to:

A. Obtain evidence from details tested to corroborate particular

assertions

B. Identify areas that represent specific risks relevant to the audit

C. Assist the auditor in assessing the validity of the conclusions

reached on the audit

D. Satisfy doubts when questions arise about an entity’s ability to

continue in existence

(MC Question 5-28)

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-48

Learning Objective 05-9

Knowledge Assessment

The primary objective of final analytical procedures is to:

A. Obtain evidence from details tested to corroborate particular

assertions

B. Identify areas that represent specific risks relevant to the audit

C. Assist the auditor in assessing the validity of the

conclusions reached on the audit

D. Satisfy doubts when questions arise about an entity’s ability to

continue in existence

(MC Question 5-28)

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-49

Learning Objective 05-10

Short-Term Liquidity Ratios

Short-term liquidity ratios indicate the entity’s

ability to meet its current obligations.

Operating

Current

Quick Ratio Cash Flow

Ratio

Ratio

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-50

Learning Objective 05-10

Activity Ratios

Activity ratios indicate how effectively the entity’s

assets are managed. Activity ratios may also be

effective in helping the auditor determine if these

accounts contain material misstatements.

Days

Receivables Outstanding

Turnover in Accounts

Receivable

Days of

Inventory

Inventory on

Turnover Hand

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-51

Learning Objective 05-10

Profitability Ratios

Profitability ratios indicate the entity’s success or

failure for a given period. Each ratio should be

interpreted by comparison to industry data.

Gross Profit

Profit Margin

Percentage

Return on Return on

Assets Equity

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-52

Learning Objective 05-10

Coverage Ratios

Coverage ratios provide information on the

long-term solvency of the entity. These ratios

give the auditor important information on the

ability of the entity to continue as a going

concern.

Times

Debt to

Interest

Equity

Earned

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution

without the prior written consent of McGraw-Hill Education. 5-53

You might also like

- Lawson Infor - Accounts Payable User GuideDocument326 pagesLawson Infor - Accounts Payable User GuideMona Aldarabie100% (4)

- Financial Forecasting: Chapter ThreeDocument46 pagesFinancial Forecasting: Chapter ThreeSanad Rousan100% (1)

- Solution Manual For Auditing Assurance SDocument22 pagesSolution Manual For Auditing Assurance SJillianne Jill100% (1)

- Acca F7Document73 pagesAcca F7taoyuan521100% (2)

- Level III of CFA Program Mock Exam 3 June, 2019 Revision 1Document65 pagesLevel III of CFA Program Mock Exam 3 June, 2019 Revision 1Yohan CruzNo ratings yet

- Consolidated Financial Statements: XYZ, Inc. Carrying Amounts Fair Values Fair Value Adjustments (FVA)Document3 pagesConsolidated Financial Statements: XYZ, Inc. Carrying Amounts Fair Values Fair Value Adjustments (FVA)mhar lon100% (2)

- Forensic AccountingDocument28 pagesForensic AccountingADITYA MAHAJAN63% (8)

- Messier 11e Chap05Document56 pagesMessier 11e Chap05Thanushasree VellaisamyNo ratings yet

- Chapter 1 MessierDocument37 pagesChapter 1 MessierbongzhiqiNo ratings yet

- Auditing and Assurance Services: The Financial Statement Auditing EnvironmentDocument38 pagesAuditing and Assurance Services: The Financial Statement Auditing EnvironmentIman NessaNo ratings yet

- Eilifsen 3rd Chap04 PPTDocument46 pagesEilifsen 3rd Chap04 PPTtahani almuqatiNo ratings yet

- Chapter Four: Audit Evidence and Audit DocumentationDocument26 pagesChapter Four: Audit Evidence and Audit DocumentationJohn Churchill Gil SaducosNo ratings yet

- Chapter Five: Audit Planning and Types of Audit TestsDocument42 pagesChapter Five: Audit Planning and Types of Audit TestsJade BelenNo ratings yet

- Chap04 Risk AssessmentDocument41 pagesChap04 Risk Assessmentdes arellanoNo ratings yet

- Chapter Four: Audit Evidence and Audit DocumentationDocument31 pagesChapter Four: Audit Evidence and Audit DocumentationJade BelenNo ratings yet

- Messier4ce PPT Ch01Document39 pagesMessier4ce PPT Ch01Tasnova AalamNo ratings yet

- Auditing8e PPT Ch04 W21 JMDocument16 pagesAuditing8e PPT Ch04 W21 JMMichael WangNo ratings yet

- Chapter 01Document16 pagesChapter 01GraceNo ratings yet

- Togdher University: Course: Audit Instructor: Abdihakim Tiyari (BA, MBA) Credit Hour: 3 HrsDocument36 pagesTogdher University: Course: Audit Instructor: Abdihakim Tiyari (BA, MBA) Credit Hour: 3 HrsCabdixakiim-Tiyari Cabdillaahi AadenNo ratings yet

- Audit Evidence and DocumentationDocument14 pagesAudit Evidence and DocumentationAlyssa Hallasgo-Lopez AtabeloNo ratings yet

- Auditing8e PPTDocument27 pagesAuditing8e PPTSubscription 126No ratings yet

- Chapter 07Document35 pagesChapter 07ERika PratiwiNo ratings yet

- Lect 1Document23 pagesLect 1kayk1leroyNo ratings yet

- Principles of Auditing and Other Assurance Services 19th Edition Whittington Solutions Manual 1Document36 pagesPrinciples of Auditing and Other Assurance Services 19th Edition Whittington Solutions Manual 1tammycontrerasgdaxwypisr96% (26)

- Acw 250 - AuditingDocument30 pagesAcw 250 - AuditingHemaram NaiduNo ratings yet

- Evidence and Documentation: © Mcgraw-Hill Education 2014Document45 pagesEvidence and Documentation: © Mcgraw-Hill Education 2014NaeemNo ratings yet

- Auditing and Assurance Services Louwers 6th Edition Solutions ManualDocument21 pagesAuditing and Assurance Services Louwers 6th Edition Solutions ManualStevania100% (35)

- Phillips PLL 6e Chap05Document38 pagesPhillips PLL 6e Chap05snsahaNo ratings yet

- Williams FinMan 19e Chap005 PPTDocument64 pagesWilliams FinMan 19e Chap005 PPTPedro ValdiviaNo ratings yet

- The Accounting Cycle: Reporting Financial ResultsDocument64 pagesThe Accounting Cycle: Reporting Financial ResultsLama KaedbeyNo ratings yet

- Chapter 2: Professional StandardsDocument34 pagesChapter 2: Professional StandardsJust SomeoneNo ratings yet

- CH 1Document101 pagesCH 1Faizan Bashir SidhuNo ratings yet

- Chapter 1-The Role of The Public Accountant in The EconomyDocument15 pagesChapter 1-The Role of The Public Accountant in The EconomyYeun NarinNo ratings yet

- Audit Planning and Materiality: Mcgraw-Hill/IrwinDocument118 pagesAudit Planning and Materiality: Mcgraw-Hill/IrwinMahmoud AhmedNo ratings yet

- Financial Statement Analysis 11th Edition Subramanyam Solutions Manual 1Document36 pagesFinancial Statement Analysis 11th Edition Subramanyam Solutions Manual 1ericsuttonybmqwiorsa100% (34)

- Lanen FCA 6e Chap01 PPTDocument44 pagesLanen FCA 6e Chap01 PPT林瑩No ratings yet

- Larson17ce - PPT - V1 - Ch07 (2023 - 01 - 09 00 - 10 - 56 UTC)Document91 pagesLarson17ce - PPT - V1 - Ch07 (2023 - 01 - 09 00 - 10 - 56 UTC)rbasaiti1No ratings yet

- Audit & Assurance: Suggested AnswersDocument9 pagesAudit & Assurance: Suggested AnswersMuhammad HussainNo ratings yet

- Financial Statement Analysis 11th Edition Subramanyam Solutions Manual 1Document55 pagesFinancial Statement Analysis 11th Edition Subramanyam Solutions Manual 1shaina100% (42)

- Accounting Cost ConceptsDocument57 pagesAccounting Cost ConceptsMelanie GraceNo ratings yet

- Lecture 1 - Overview of Auditing and Assurance ServiceDocument25 pagesLecture 1 - Overview of Auditing and Assurance ServiceNabila SedkiNo ratings yet

- Chapter01international 1Document20 pagesChapter01international 1Vince FerrerNo ratings yet

- Overview of Auditing PSA 120Document2 pagesOverview of Auditing PSA 120Krizel rochaNo ratings yet

- Solution Manual For Auditing and Assurance Services 8th Edition Timothy Louwers Penelope Bagley Allen Blay Jerry Strawser Jay ThibodeauDocument25 pagesSolution Manual For Auditing and Assurance Services 8th Edition Timothy Louwers Penelope Bagley Allen Blay Jerry Strawser Jay ThibodeauMarsha Johnson100% (36)

- Test Bank For Principles of Auditing and Other Assurance Services 19Th Edition Whittington Pany 0077804775 9780077804770 Full Chapter PDFDocument36 pagesTest Bank For Principles of Auditing and Other Assurance Services 19Th Edition Whittington Pany 0077804775 9780077804770 Full Chapter PDFellen.holt139100% (12)

- 5-Sales and Collection Business ProcessDocument24 pages5-Sales and Collection Business ProcessShaimer CintoNo ratings yet

- Messier 11e Chap18 Ppt-RevisedDocument43 pagesMessier 11e Chap18 Ppt-RevisedLoo Bee YeokNo ratings yet

- BLOCK - FFM - 18e - Chap002 - PPT - UpdatedDocument43 pagesBLOCK - FFM - 18e - Chap002 - PPT - UpdatedagNo ratings yet

- Auditing and Assurance Services: Seventeenth Edition, Global EditionDocument55 pagesAuditing and Assurance Services: Seventeenth Edition, Global EditionSin TungNo ratings yet

- Evidence and Documentation: © 2017 Mcgraw-Hill Education (Malaysia) SDN BHDDocument45 pagesEvidence and Documentation: © 2017 Mcgraw-Hill Education (Malaysia) SDN BHDSarannyaRajendraNo ratings yet

- Principles of Auditing and Other Assurance Services Whittington 19th Edition Test Bank download pdf full chapterDocument54 pagesPrinciples of Auditing and Other Assurance Services Whittington 19th Edition Test Bank download pdf full chaptermengyibassan100% (10)

- CAF-09 AA Solution (Final)Document8 pagesCAF-09 AA Solution (Final)ANo ratings yet

- Chapter 14 SlidesDocument26 pagesChapter 14 SlidesJc AdanNo ratings yet

- Chapter Seventeen: Completing The Audit EngagementDocument20 pagesChapter Seventeen: Completing The Audit Engagementcheapo printsNo ratings yet

- SMChap005 PDFDocument21 pagesSMChap005 PDFJeiel SaguiboNo ratings yet

- Actuarial Advice and Resultant Liabilities of AADocument20 pagesActuarial Advice and Resultant Liabilities of AASushant DabasNo ratings yet

- Arens AAS17 sm 05筆記版Document20 pagesArens AAS17 sm 05筆記版林芷瑜No ratings yet

- ACC415-Lec1 - Ch08Document39 pagesACC415-Lec1 - Ch08194098 194098No ratings yet

- Audit ExerciseDocument6 pagesAudit ExerciseAlodia Lulu SmileNo ratings yet

- Accounting in Business: © 2009 The Mcgraw-Hill Companies, Inc., All Rights ReservedDocument40 pagesAccounting in Business: © 2009 The Mcgraw-Hill Companies, Inc., All Rights ReservedAnh TranNo ratings yet

- Advanced Audit and Assurance 1Document29 pagesAdvanced Audit and Assurance 1k20b.lehoangvuNo ratings yet

- Lec. 05Document2 pagesLec. 05Bukhtawar ShabirNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2015: Part 1, Financial Planning, Performance and ControlFrom EverandWiley CMAexcel Learning System Exam Review 2015: Part 1, Financial Planning, Performance and ControlNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingFrom EverandWiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingNo ratings yet

- Chap04 Risk AssessmentDocument41 pagesChap04 Risk Assessmentdes arellanoNo ratings yet

- Chapter 10: Cash and Financial InvestmentsDocument13 pagesChapter 10: Cash and Financial Investmentsdes arellanoNo ratings yet

- Franchise Accounting PDF FreeDocument5 pagesFranchise Accounting PDF Freedes arellanoNo ratings yet

- 6process Costing Cost of Goods Sold InventoryDocument10 pages6process Costing Cost of Goods Sold Inventorydes arellanoNo ratings yet

- Acct 311 Exam 2 Practice: Attempt HistoryDocument27 pagesAcct 311 Exam 2 Practice: Attempt Historydes arellanoNo ratings yet

- Enron: The Accounting ScandalDocument20 pagesEnron: The Accounting Scandaldes arellanoNo ratings yet

- Thanks For Your Interest in RevDocument1 pageThanks For Your Interest in Revdes arellanoNo ratings yet

- A Comprehensive Review of Literature On Creative Accounting: Supriya Khaneja Vidhi BhargavaDocument16 pagesA Comprehensive Review of Literature On Creative Accounting: Supriya Khaneja Vidhi BhargavaShriya RamanNo ratings yet

- The Role of Managerial FinanceDocument42 pagesThe Role of Managerial Financemild incNo ratings yet

- Accounting Rate of ReturnDocument7 pagesAccounting Rate of ReturnMahesh RaoNo ratings yet

- Financial Accounting Waec PDFDocument5 pagesFinancial Accounting Waec PDFAndrew Tandoh100% (1)

- Far 2 Vol1 by Sir Jawad - 2022-08-03 10-11-29Document298 pagesFar 2 Vol1 by Sir Jawad - 2022-08-03 10-11-29Ar Sal AnNo ratings yet

- Gee Tem Group11 Bsed Math3aDocument17 pagesGee Tem Group11 Bsed Math3aVerly Cañada RepuelaNo ratings yet

- Assurance June 2013 ICABDocument1 pageAssurance June 2013 ICABSaiful IslamNo ratings yet

- Introductory AccountingDocument8 pagesIntroductory AccountingLIM HUI NI STUDENTNo ratings yet

- Tutorial Letter 101/3/2023: Financial Accounting Principles For Law PractitionersDocument16 pagesTutorial Letter 101/3/2023: Financial Accounting Principles For Law PractitionersKayleeNo ratings yet

- Dokumen - Pub Cost and Management Accounting I 9789387572423 9387572420Document748 pagesDokumen - Pub Cost and Management Accounting I 9789387572423 9387572420Sie Humas Septia Ardianti100% (1)

- Financial Analyst Resume PDFDocument1 pageFinancial Analyst Resume PDFjayeshrane2107100% (1)

- Tuition Fee Returning Students Payment Receipt LetterDocument1 pageTuition Fee Returning Students Payment Receipt LetterQuadri FataiNo ratings yet

- Chapter 9Document15 pagesChapter 9RBNo ratings yet

- Special JournalsDocument3 pagesSpecial JournalsGary MokuauNo ratings yet

- Doing Business in The UaeDocument24 pagesDoing Business in The UaeRahul MandalNo ratings yet

- Pre-Review Lecture: Cost-Volume-Profit AnalysisDocument24 pagesPre-Review Lecture: Cost-Volume-Profit AnalysisJao FloresNo ratings yet

- Solved The Statement of Cash Flows For The Year Ended DecemberDocument1 pageSolved The Statement of Cash Flows For The Year Ended DecemberAnbu jaromiaNo ratings yet

- Acfn 1031 Chapter One Introduction To Accounting & BusinessDocument62 pagesAcfn 1031 Chapter One Introduction To Accounting & BusinessKaleab ShimelsNo ratings yet

- Compliance With Aas: AAS NO SL NO Particulars Yes/No/Na RemarksDocument16 pagesCompliance With Aas: AAS NO SL NO Particulars Yes/No/Na RemarksGaurav SharmaNo ratings yet

- AP - Comprehensive ExamDocument10 pagesAP - Comprehensive ExamCharlesNo ratings yet

- 45 Journals Used in FT Research RankDocument2 pages45 Journals Used in FT Research RankSzymon KaczmarekNo ratings yet

- PAS 34 - INTERIM FINANCIAL REPTG LectureDocument17 pagesPAS 34 - INTERIM FINANCIAL REPTG LectureMon RamNo ratings yet

- MBA 687 Leaders Self EvaluationsDocument10 pagesMBA 687 Leaders Self EvaluationsAmit KumarNo ratings yet

- MBA 504 Ch4 SolutionsDocument25 pagesMBA 504 Ch4 SolutionsPiyush JainNo ratings yet

- IFRS SECRETS ENGLISH VERSION Complete Version PDFDocument95 pagesIFRS SECRETS ENGLISH VERSION Complete Version PDFIhab Al-AnabousiNo ratings yet

- Business Transactions and Their Analysis BSAIS 1A Group2Document25 pagesBusiness Transactions and Their Analysis BSAIS 1A Group2Marydelle De Austria-De GuiaNo ratings yet