Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

9 viewsPartnership and Corp Acctg: Journal Entries By: Prof. Verlita V. Mercullo, C.P.A

Partnership and Corp Acctg: Journal Entries By: Prof. Verlita V. Mercullo, C.P.A

Uploaded by

Maila LoquincioThis document discusses key concepts related to stockholders' equity, dividends, and journal entries. It covers:

1) Examples of journal entries for stockholders' equity transactions like issuing common stock and recording paid-in capital and subscribed capital.

2) How net income is distributed as dividends to shareholders in a corporation, but distributed directly to owners in a single-proprietorship or partnership.

3) The three important dates related to declaring and paying dividends: declaration date, record date, and payment date.

4) An illustration of journal entries to record the declaration and payment of dividends.

5) An example showing how preferred dividends are distributed before common dividends from

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Accounting II-Review Chapters12,13,14 (8thed)Document10 pagesAccounting II-Review Chapters12,13,14 (8thed)JacKFrost1889No ratings yet

- Financial Accounting11Document14 pagesFinancial Accounting11AleciafyNo ratings yet

- Advance Accounting 2 AnsDocument11 pagesAdvance Accounting 2 AnsKid bNo ratings yet

- Afar01 Joint Arrangements ReviewersDocument13 pagesAfar01 Joint Arrangements ReviewersPam G.No ratings yet

- Chapter 22 Retained Earnings DividendsDocument39 pagesChapter 22 Retained Earnings DividendstruthNo ratings yet

- Ac 1201 - Retained Earnings (Dividends)Document24 pagesAc 1201 - Retained Earnings (Dividends)Joseph Jason Kyle Baquero50% (2)

- Confra - Retained EarningsDocument30 pagesConfra - Retained EarningsCharles LapizNo ratings yet

- Quiz Chapter-2 Partnership-Operations 2020-EditionDocument7 pagesQuiz Chapter-2 Partnership-Operations 2020-EditionShaz NagaNo ratings yet

- Quiz 4 Ch7 Questions SentDocument2 pagesQuiz 4 Ch7 Questions SentLiandra AmorNo ratings yet

- Chapter (14) Corporations: Dividends, Retained Earnings, and Income Reporting DividendsDocument11 pagesChapter (14) Corporations: Dividends, Retained Earnings, and Income Reporting DividendsMondy MondyNo ratings yet

- Tutorial 1 - QSDocument6 pagesTutorial 1 - QSAzlinaZaidilNo ratings yet

- FABM2 LESSON 3 Statement of Changes in EquityDocument4 pagesFABM2 LESSON 3 Statement of Changes in EquityArjay CorderoNo ratings yet

- An Introduction To Accounting Module F1Document30 pagesAn Introduction To Accounting Module F1Jason Fry100% (1)

- Exercise - Part 3Document10 pagesExercise - Part 3lois martinNo ratings yet

- Change in PSR 2024 PDF SPCCDocument41 pagesChange in PSR 2024 PDF SPCCVaibhav RajNo ratings yet

- Chapter 15 - Supplementart QuestionsDocument2 pagesChapter 15 - Supplementart QuestionsRaj PatelNo ratings yet

- Allocating Cash Dividends Between Preferred and Co PDFDocument3 pagesAllocating Cash Dividends Between Preferred and Co PDFrockerNo ratings yet

- Acct511 Finals 2023Document2 pagesAcct511 Finals 2023Moses KollieNo ratings yet

- Chapter 22 - Retained EarningsDocument35 pagesChapter 22 - Retained Earningswala akong pake sayoNo ratings yet

- Week 3Document46 pagesWeek 3BookAddict721No ratings yet

- The RE Formula Is As Follows:: ProfitsDocument4 pagesThe RE Formula Is As Follows:: Profitserica lamsenNo ratings yet

- Corporation LectureDocument12 pagesCorporation Lecturejoyce jabileNo ratings yet

- 2017 Class 16 EquityDocument35 pages2017 Class 16 EquityChandra Sekhar ChittineniNo ratings yet

- Homework - SU3 Practical Reader QP - AS Complete - Q1 and 2Document29 pagesHomework - SU3 Practical Reader QP - AS Complete - Q1 and 2MphoNo ratings yet

- Year End Adjustments - Accruals & Prepayments: Woods, Chapter 28 Thomas, Chapter 13Document58 pagesYear End Adjustments - Accruals & Prepayments: Woods, Chapter 28 Thomas, Chapter 13Hendry Heng Wei XiangNo ratings yet

- ACCTG 101 Final Quiz: Requirement: Provide The Necessary Journal EntriesDocument5 pagesACCTG 101 Final Quiz: Requirement: Provide The Necessary Journal EntriesCaro, Christilyn L.No ratings yet

- Exercise Ni ValewDocument4 pagesExercise Ni ValewALMA MORENANo ratings yet

- ACCTG 4 Financial Accounting Theory and Practice Part 2: Lyceum-Northwestern UniversityDocument4 pagesACCTG 4 Financial Accounting Theory and Practice Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- FM-Dividend PolicyDocument9 pagesFM-Dividend PolicyMaxine SantosNo ratings yet

- Adjusting and Corporation Quiz 1Document13 pagesAdjusting and Corporation Quiz 1JEFFERSON CUTENo ratings yet

- Shareholders' Equity (Part 2) : Name: Date: Professor: Section: Score: QuizDocument3 pagesShareholders' Equity (Part 2) : Name: Date: Professor: Section: Score: QuizAriesJaved Godinez100% (1)

- Forms of DividendDocument24 pagesForms of Dividendsomanathbehera371No ratings yet

- IA3 Mod 4 REDocument12 pagesIA3 Mod 4 REjulia4razoNo ratings yet

- EXERCISES Other Long Term Investments in Financial AssetsDocument2 pagesEXERCISES Other Long Term Investments in Financial AssetsMeeka CalimagNo ratings yet

- Accounting For InvestmentDocument14 pagesAccounting For Investmentefe davidNo ratings yet

- Chapter 2 Exercises 1Document13 pagesChapter 2 Exercises 1Ana María Del CerroNo ratings yet

- M6 Temporary InvestmenDocument29 pagesM6 Temporary InvestmenLets Win VeNo ratings yet

- Tugas 12 Dividend and Retained EarningsDocument4 pagesTugas 12 Dividend and Retained EarningsLenrik AbcNo ratings yet

- Chapter 18-Practice ExsercisesDocument18 pagesChapter 18-Practice ExsercisesThiNo ratings yet

- Chapter 4Document37 pagesChapter 4mikeNo ratings yet

- FOA II 2nd AssignmentDocument5 pagesFOA II 2nd Assignmentshekaibsa38No ratings yet

- Group 6 (Ia Ii)Document8 pagesGroup 6 (Ia Ii)LexNo ratings yet

- Stock Splits, Stock Dividends and Treasury Stock: in DepthDocument44 pagesStock Splits, Stock Dividends and Treasury Stock: in DepthAkash BafnaNo ratings yet

- Problems On Retained EarningsDocument2 pagesProblems On Retained EarningsDecereen Pineda RodriguezaNo ratings yet

- Accountancy SQP PDFDocument21 pagesAccountancy SQP PDFSuyash YaduNo ratings yet

- W1-Unit 5 Assignment Brief V1.2 1 2Document11 pagesW1-Unit 5 Assignment Brief V1.2 1 2himanshusharma9435No ratings yet

- Chapter 22: Retained Earnings (Dividends)Document12 pagesChapter 22: Retained Earnings (Dividends)Illion IllionNo ratings yet

- Module 7 - Notes ReceivableDocument5 pagesModule 7 - Notes Receivablejustine cabanaNo ratings yet

- ParCor Corpo EQ Set ADocument3 pagesParCor Corpo EQ Set AMara LacsamanaNo ratings yet

- Interim Assessment 2 With Answer KeysDocument4 pagesInterim Assessment 2 With Answer KeyscaraaatbongNo ratings yet

- Quiz Chapter-11 She-Part-2 2021Document5 pagesQuiz Chapter-11 She-Part-2 2021Salma B. AbdullahNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/32shanti teckchandaniNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErine ContranoNo ratings yet

- Difficult Level Corpo-Drill3Document4 pagesDifficult Level Corpo-Drill3julsNo ratings yet

- CHAPTER 14 Non. 14Document6 pagesCHAPTER 14 Non. 14Ahmed AymanNo ratings yet

- Assessment Tasks Jan 5 and 7 2022 InocencioDocument8 pagesAssessment Tasks Jan 5 and 7 2022 Inocencioalianna johnNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Indus Motor Company LTD Ratio AnalysisDocument166 pagesIndus Motor Company LTD Ratio AnalysisAqeel IfthkharNo ratings yet

- Corporate Accounting P Radhika Full ChapterDocument67 pagesCorporate Accounting P Radhika Full Chapterbenjamin.adams101100% (8)

- Sawit-Sumbermas-Sarana TBK Billingual 31 Des 20 Released1617291310Document158 pagesSawit-Sumbermas-Sarana TBK Billingual 31 Des 20 Released1617291310Ade FajarNo ratings yet

- 10 - Dec 13-20 - GM - Q2 - WEEK5 - Illustrating Stocks and BondsDocument6 pages10 - Dec 13-20 - GM - Q2 - WEEK5 - Illustrating Stocks and Bondsraymond galagNo ratings yet

- 2233 - EN TNG Financial Statements 31-12-2015Document42 pages2233 - EN TNG Financial Statements 31-12-2015Nhật Linh LêNo ratings yet

- Chapter:-1: Introduction To Company AccountsDocument15 pagesChapter:-1: Introduction To Company AccountsVishal KNo ratings yet

- Summative TestDocument5 pagesSummative TestRichard de Leon0% (1)

- PBT1 Mock ExamDocument8 pagesPBT1 Mock ExamLee NguyenNo ratings yet

- FinolexDocument171 pagesFinolexAkash Nil ChatterjeeNo ratings yet

- HSBC Amfi Mock Test-2Document12 pagesHSBC Amfi Mock Test-2Ankit SharmaNo ratings yet

- Banas DairyDocument48 pagesBanas DairyTarun A JainNo ratings yet

- Multiple Choice Questions: Top of FormDocument96 pagesMultiple Choice Questions: Top of Formchanfa3851No ratings yet

- ACCA FR MJ19 Notes PDFDocument146 pagesACCA FR MJ19 Notes PDFMelissa VeroneNo ratings yet

- 4 Sources and Uses of Short Term and Long Term FundsDocument40 pages4 Sources and Uses of Short Term and Long Term FundsKenneth Kim Durban64% (14)

- Kunci Jawaban Black and WhiteDocument18 pagesKunci Jawaban Black and WhitefebrythiodorNo ratings yet

- Walter's Model Formula: Unit - Iv Part - C Problems and SolutionsDocument3 pagesWalter's Model Formula: Unit - Iv Part - C Problems and SolutionsHarihara PuthiranNo ratings yet

- Chapter 1 An Introduction To Accounting: Fundamental Financial Accounting Concepts, 10e (Edmonds)Document53 pagesChapter 1 An Introduction To Accounting: Fundamental Financial Accounting Concepts, 10e (Edmonds)brockNo ratings yet

- ACCT 100 - Principles of Financial AccountingDocument7 pagesACCT 100 - Principles of Financial AccountingHaseeb Nasir SheikhNo ratings yet

- Accounting Standard at A GlanceDocument20 pagesAccounting Standard at A GlanceKrushna MishraNo ratings yet

- Weekly Quiz 2Document30 pagesWeekly Quiz 2Emmmanuel ArthurNo ratings yet

- Edwards Lifesciences Corp (EW) : Financial and Strategic SWOT Analysis ReviewDocument36 pagesEdwards Lifesciences Corp (EW) : Financial and Strategic SWOT Analysis ReviewHITESH MAKHIJANo ratings yet

- CMAPart1F (Long Term Finance and Capital Structure) AnswersDocument43 pagesCMAPart1F (Long Term Finance and Capital Structure) AnswersKim Cristian MaañoNo ratings yet

- Flambeau Corporation Has Paid 60 Consecutive Quarterly Cash Dividends 15Document1 pageFlambeau Corporation Has Paid 60 Consecutive Quarterly Cash Dividends 15CharlotteNo ratings yet

- CEILLI MyCampus Revision Questions v1.0 (2023) PDFDocument16 pagesCEILLI MyCampus Revision Questions v1.0 (2023) PDFQistina IzharNo ratings yet

- UOB Annual Report 2007Document160 pagesUOB Annual Report 2007Patrick BernilNo ratings yet

- Sec Form 17 A - As of March 31, 2013Document248 pagesSec Form 17 A - As of March 31, 2013Amanoden Mala DimalutangNo ratings yet

- International Investing-1Document8 pagesInternational Investing-1hoangkhanhNo ratings yet

- Fsa Questions and SolutionsDocument11 pagesFsa Questions and SolutionsAnjali Betala KothariNo ratings yet

- Dlca 1.B/D 2.sale 3.interest 4.dish0n0ur Cheque 1.cash Received 2.reurn 0utward 3.bad Debts 4. C0ntra Entry 5.C/DDocument16 pagesDlca 1.B/D 2.sale 3.interest 4.dish0n0ur Cheque 1.cash Received 2.reurn 0utward 3.bad Debts 4. C0ntra Entry 5.C/DIqra HanifNo ratings yet

Partnership and Corp Acctg: Journal Entries By: Prof. Verlita V. Mercullo, C.P.A

Partnership and Corp Acctg: Journal Entries By: Prof. Verlita V. Mercullo, C.P.A

Uploaded by

Maila Loquincio0 ratings0% found this document useful (0 votes)

9 views9 pagesThis document discusses key concepts related to stockholders' equity, dividends, and journal entries. It covers:

1) Examples of journal entries for stockholders' equity transactions like issuing common stock and recording paid-in capital and subscribed capital.

2) How net income is distributed as dividends to shareholders in a corporation, but distributed directly to owners in a single-proprietorship or partnership.

3) The three important dates related to declaring and paying dividends: declaration date, record date, and payment date.

4) An illustration of journal entries to record the declaration and payment of dividends.

5) An example showing how preferred dividends are distributed before common dividends from

Original Description:

Original Title

Part-and-Corp-Final-PPT-1

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses key concepts related to stockholders' equity, dividends, and journal entries. It covers:

1) Examples of journal entries for stockholders' equity transactions like issuing common stock and recording paid-in capital and subscribed capital.

2) How net income is distributed as dividends to shareholders in a corporation, but distributed directly to owners in a single-proprietorship or partnership.

3) The three important dates related to declaring and paying dividends: declaration date, record date, and payment date.

4) An illustration of journal entries to record the declaration and payment of dividends.

5) An example showing how preferred dividends are distributed before common dividends from

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views9 pagesPartnership and Corp Acctg: Journal Entries By: Prof. Verlita V. Mercullo, C.P.A

Partnership and Corp Acctg: Journal Entries By: Prof. Verlita V. Mercullo, C.P.A

Uploaded by

Maila LoquincioThis document discusses key concepts related to stockholders' equity, dividends, and journal entries. It covers:

1) Examples of journal entries for stockholders' equity transactions like issuing common stock and recording paid-in capital and subscribed capital.

2) How net income is distributed as dividends to shareholders in a corporation, but distributed directly to owners in a single-proprietorship or partnership.

3) The three important dates related to declaring and paying dividends: declaration date, record date, and payment date.

4) An illustration of journal entries to record the declaration and payment of dividends.

5) An example showing how preferred dividends are distributed before common dividends from

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 9

PARTNERSHIP AND CORP ACCTG

Journal Entries

BY: PROF. VERLITA V. MERCULLO , C.P.A.

STOCKHOLDERS EQUITY

CAPITAL STOCK 1,000 SHARES @ 100 per share ( par

value )

25% SUBSCRIBED STOCK OF CAPITAL STOCK

25% X 1000 = 250 SHARES SUBSCRIBED

25% OF SUBSCRIBED IS PAID UP CAPITAL

25% x 250 = 62.5 SHARES

STOCKHOLDERS EQUITY

Common Stock Issued and Outstanding

( Capital Stock 1000 @ 100 par value)

Paid up Capital 62,500

Subscribed Capital 187,500

DIVIDENDS

STOCKHOLDERS EQUITY

( SINGLE PROP) NET INCOME = 100,000 GOES TO OWNER

(PARTNERSHIP-A AND B) MR. A 50K

MR. B 50K

CORPORATION = NET INCOME 100,000 ( IF NET INCOME WILLB

E SHARED TO STOCKHOLDERS, ITS CALLED DIVIDENDS

IN CORPORATION , NOT ALL NET INCOME IS SHARED TO

SHAREHOLDERS

NET INCOME IS SAVED TO RETAINED EARNINGS

STOCKHOLDERS EQUITY

YEAR Net income dividends retained

earnings

2018 100,000 0 100,000

2019 200,000 50,000 250,000

2020 250,000 100,000 400,000

550,000 150,000

• Dividends: payment to shareholder from the earnings of the corporation

• 3 important dates:

1. Date of Declaration- approval for payment of dividend

2. Date of Record - date stating that all those shareholders on date of record

are the only one entitled to dividends.

3. Date of Payment.- actual distribution.

Illustration:

The board of directors passed a resolution approving dividend on

1/04/2021, declaring a P10 dividend to shareholders on record. 2/4/2021,

and released on march 4/2021 10,000 shares common ( 10 x 10,000 )

Journal Entries:

1/04/2021 Retained Earnings 100,000

Dividends Payable 100,0000

2/04/2021 No entry

3/04/2021 Dividends Payable 100,000

Cash 100,000

• Dividends: payment to shareholder from the earnings of the corporation

• 3 important dates:

1. Date of Declaration- approval for payment of dividend

2. Date of Record - date stating that all those shareholders on date of record

are the only one entitled to dividends. ( 1/04/21 date of declaration ; 2/4/21 –

date of record – Mr. A sold his share on 2/5/21 to Mr. B

Mr. A is still the shareholder at the date of record which is 2/4/21

Mr. A sold his share on 2/3/21 to Mr. B

Mr.B is now the shareholders at the date of record 2/4/21 because Mr. B acquired the share on

2/3/21

3. Date of Payment.- actual distribution.

Illustration:

The board of directors passed a resolution approving dividend on 1/04/2021, declaring a P10

dividend to shareholders on record. 2/4/2021, and released on march 4/2021 10,000 shares

common

Journal Entries:

1/04/2021 Retained Earnings 100,000

Dividends Payable 100,0000

2/04/2021 No entry

3/04/2021 Dividends Payable 100,000

Cash 100,000

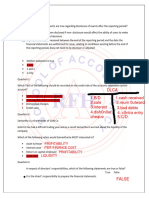

• Illustration:

• Year 4 Dividends Declared P100,000

No dividend declared on y 1, y2, y 3

Preferred share 6% par at P50 ( preferred share is the first shareholder to get

dividends )

Outstanding preferred share 5,000 shares = 250,000 ( 50 x 5,000)

Step 1. 6% x 250,000 P 15,000 ( preferred )

Step2. Balance to common 85,000 ( 100,000-15,000)

Dividends declared /paid P 100,000

THANK YOU

• Advance reading of modules

You might also like

- Accounting II-Review Chapters12,13,14 (8thed)Document10 pagesAccounting II-Review Chapters12,13,14 (8thed)JacKFrost1889No ratings yet

- Financial Accounting11Document14 pagesFinancial Accounting11AleciafyNo ratings yet

- Advance Accounting 2 AnsDocument11 pagesAdvance Accounting 2 AnsKid bNo ratings yet

- Afar01 Joint Arrangements ReviewersDocument13 pagesAfar01 Joint Arrangements ReviewersPam G.No ratings yet

- Chapter 22 Retained Earnings DividendsDocument39 pagesChapter 22 Retained Earnings DividendstruthNo ratings yet

- Ac 1201 - Retained Earnings (Dividends)Document24 pagesAc 1201 - Retained Earnings (Dividends)Joseph Jason Kyle Baquero50% (2)

- Confra - Retained EarningsDocument30 pagesConfra - Retained EarningsCharles LapizNo ratings yet

- Quiz Chapter-2 Partnership-Operations 2020-EditionDocument7 pagesQuiz Chapter-2 Partnership-Operations 2020-EditionShaz NagaNo ratings yet

- Quiz 4 Ch7 Questions SentDocument2 pagesQuiz 4 Ch7 Questions SentLiandra AmorNo ratings yet

- Chapter (14) Corporations: Dividends, Retained Earnings, and Income Reporting DividendsDocument11 pagesChapter (14) Corporations: Dividends, Retained Earnings, and Income Reporting DividendsMondy MondyNo ratings yet

- Tutorial 1 - QSDocument6 pagesTutorial 1 - QSAzlinaZaidilNo ratings yet

- FABM2 LESSON 3 Statement of Changes in EquityDocument4 pagesFABM2 LESSON 3 Statement of Changes in EquityArjay CorderoNo ratings yet

- An Introduction To Accounting Module F1Document30 pagesAn Introduction To Accounting Module F1Jason Fry100% (1)

- Exercise - Part 3Document10 pagesExercise - Part 3lois martinNo ratings yet

- Change in PSR 2024 PDF SPCCDocument41 pagesChange in PSR 2024 PDF SPCCVaibhav RajNo ratings yet

- Chapter 15 - Supplementart QuestionsDocument2 pagesChapter 15 - Supplementart QuestionsRaj PatelNo ratings yet

- Allocating Cash Dividends Between Preferred and Co PDFDocument3 pagesAllocating Cash Dividends Between Preferred and Co PDFrockerNo ratings yet

- Acct511 Finals 2023Document2 pagesAcct511 Finals 2023Moses KollieNo ratings yet

- Chapter 22 - Retained EarningsDocument35 pagesChapter 22 - Retained Earningswala akong pake sayoNo ratings yet

- Week 3Document46 pagesWeek 3BookAddict721No ratings yet

- The RE Formula Is As Follows:: ProfitsDocument4 pagesThe RE Formula Is As Follows:: Profitserica lamsenNo ratings yet

- Corporation LectureDocument12 pagesCorporation Lecturejoyce jabileNo ratings yet

- 2017 Class 16 EquityDocument35 pages2017 Class 16 EquityChandra Sekhar ChittineniNo ratings yet

- Homework - SU3 Practical Reader QP - AS Complete - Q1 and 2Document29 pagesHomework - SU3 Practical Reader QP - AS Complete - Q1 and 2MphoNo ratings yet

- Year End Adjustments - Accruals & Prepayments: Woods, Chapter 28 Thomas, Chapter 13Document58 pagesYear End Adjustments - Accruals & Prepayments: Woods, Chapter 28 Thomas, Chapter 13Hendry Heng Wei XiangNo ratings yet

- ACCTG 101 Final Quiz: Requirement: Provide The Necessary Journal EntriesDocument5 pagesACCTG 101 Final Quiz: Requirement: Provide The Necessary Journal EntriesCaro, Christilyn L.No ratings yet

- Exercise Ni ValewDocument4 pagesExercise Ni ValewALMA MORENANo ratings yet

- ACCTG 4 Financial Accounting Theory and Practice Part 2: Lyceum-Northwestern UniversityDocument4 pagesACCTG 4 Financial Accounting Theory and Practice Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- FM-Dividend PolicyDocument9 pagesFM-Dividend PolicyMaxine SantosNo ratings yet

- Adjusting and Corporation Quiz 1Document13 pagesAdjusting and Corporation Quiz 1JEFFERSON CUTENo ratings yet

- Shareholders' Equity (Part 2) : Name: Date: Professor: Section: Score: QuizDocument3 pagesShareholders' Equity (Part 2) : Name: Date: Professor: Section: Score: QuizAriesJaved Godinez100% (1)

- Forms of DividendDocument24 pagesForms of Dividendsomanathbehera371No ratings yet

- IA3 Mod 4 REDocument12 pagesIA3 Mod 4 REjulia4razoNo ratings yet

- EXERCISES Other Long Term Investments in Financial AssetsDocument2 pagesEXERCISES Other Long Term Investments in Financial AssetsMeeka CalimagNo ratings yet

- Accounting For InvestmentDocument14 pagesAccounting For Investmentefe davidNo ratings yet

- Chapter 2 Exercises 1Document13 pagesChapter 2 Exercises 1Ana María Del CerroNo ratings yet

- M6 Temporary InvestmenDocument29 pagesM6 Temporary InvestmenLets Win VeNo ratings yet

- Tugas 12 Dividend and Retained EarningsDocument4 pagesTugas 12 Dividend and Retained EarningsLenrik AbcNo ratings yet

- Chapter 18-Practice ExsercisesDocument18 pagesChapter 18-Practice ExsercisesThiNo ratings yet

- Chapter 4Document37 pagesChapter 4mikeNo ratings yet

- FOA II 2nd AssignmentDocument5 pagesFOA II 2nd Assignmentshekaibsa38No ratings yet

- Group 6 (Ia Ii)Document8 pagesGroup 6 (Ia Ii)LexNo ratings yet

- Stock Splits, Stock Dividends and Treasury Stock: in DepthDocument44 pagesStock Splits, Stock Dividends and Treasury Stock: in DepthAkash BafnaNo ratings yet

- Problems On Retained EarningsDocument2 pagesProblems On Retained EarningsDecereen Pineda RodriguezaNo ratings yet

- Accountancy SQP PDFDocument21 pagesAccountancy SQP PDFSuyash YaduNo ratings yet

- W1-Unit 5 Assignment Brief V1.2 1 2Document11 pagesW1-Unit 5 Assignment Brief V1.2 1 2himanshusharma9435No ratings yet

- Chapter 22: Retained Earnings (Dividends)Document12 pagesChapter 22: Retained Earnings (Dividends)Illion IllionNo ratings yet

- Module 7 - Notes ReceivableDocument5 pagesModule 7 - Notes Receivablejustine cabanaNo ratings yet

- ParCor Corpo EQ Set ADocument3 pagesParCor Corpo EQ Set AMara LacsamanaNo ratings yet

- Interim Assessment 2 With Answer KeysDocument4 pagesInterim Assessment 2 With Answer KeyscaraaatbongNo ratings yet

- Quiz Chapter-11 She-Part-2 2021Document5 pagesQuiz Chapter-11 She-Part-2 2021Salma B. AbdullahNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/32shanti teckchandaniNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErine ContranoNo ratings yet

- Difficult Level Corpo-Drill3Document4 pagesDifficult Level Corpo-Drill3julsNo ratings yet

- CHAPTER 14 Non. 14Document6 pagesCHAPTER 14 Non. 14Ahmed AymanNo ratings yet

- Assessment Tasks Jan 5 and 7 2022 InocencioDocument8 pagesAssessment Tasks Jan 5 and 7 2022 Inocencioalianna johnNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Indus Motor Company LTD Ratio AnalysisDocument166 pagesIndus Motor Company LTD Ratio AnalysisAqeel IfthkharNo ratings yet

- Corporate Accounting P Radhika Full ChapterDocument67 pagesCorporate Accounting P Radhika Full Chapterbenjamin.adams101100% (8)

- Sawit-Sumbermas-Sarana TBK Billingual 31 Des 20 Released1617291310Document158 pagesSawit-Sumbermas-Sarana TBK Billingual 31 Des 20 Released1617291310Ade FajarNo ratings yet

- 10 - Dec 13-20 - GM - Q2 - WEEK5 - Illustrating Stocks and BondsDocument6 pages10 - Dec 13-20 - GM - Q2 - WEEK5 - Illustrating Stocks and Bondsraymond galagNo ratings yet

- 2233 - EN TNG Financial Statements 31-12-2015Document42 pages2233 - EN TNG Financial Statements 31-12-2015Nhật Linh LêNo ratings yet

- Chapter:-1: Introduction To Company AccountsDocument15 pagesChapter:-1: Introduction To Company AccountsVishal KNo ratings yet

- Summative TestDocument5 pagesSummative TestRichard de Leon0% (1)

- PBT1 Mock ExamDocument8 pagesPBT1 Mock ExamLee NguyenNo ratings yet

- FinolexDocument171 pagesFinolexAkash Nil ChatterjeeNo ratings yet

- HSBC Amfi Mock Test-2Document12 pagesHSBC Amfi Mock Test-2Ankit SharmaNo ratings yet

- Banas DairyDocument48 pagesBanas DairyTarun A JainNo ratings yet

- Multiple Choice Questions: Top of FormDocument96 pagesMultiple Choice Questions: Top of Formchanfa3851No ratings yet

- ACCA FR MJ19 Notes PDFDocument146 pagesACCA FR MJ19 Notes PDFMelissa VeroneNo ratings yet

- 4 Sources and Uses of Short Term and Long Term FundsDocument40 pages4 Sources and Uses of Short Term and Long Term FundsKenneth Kim Durban64% (14)

- Kunci Jawaban Black and WhiteDocument18 pagesKunci Jawaban Black and WhitefebrythiodorNo ratings yet

- Walter's Model Formula: Unit - Iv Part - C Problems and SolutionsDocument3 pagesWalter's Model Formula: Unit - Iv Part - C Problems and SolutionsHarihara PuthiranNo ratings yet

- Chapter 1 An Introduction To Accounting: Fundamental Financial Accounting Concepts, 10e (Edmonds)Document53 pagesChapter 1 An Introduction To Accounting: Fundamental Financial Accounting Concepts, 10e (Edmonds)brockNo ratings yet

- ACCT 100 - Principles of Financial AccountingDocument7 pagesACCT 100 - Principles of Financial AccountingHaseeb Nasir SheikhNo ratings yet

- Accounting Standard at A GlanceDocument20 pagesAccounting Standard at A GlanceKrushna MishraNo ratings yet

- Weekly Quiz 2Document30 pagesWeekly Quiz 2Emmmanuel ArthurNo ratings yet

- Edwards Lifesciences Corp (EW) : Financial and Strategic SWOT Analysis ReviewDocument36 pagesEdwards Lifesciences Corp (EW) : Financial and Strategic SWOT Analysis ReviewHITESH MAKHIJANo ratings yet

- CMAPart1F (Long Term Finance and Capital Structure) AnswersDocument43 pagesCMAPart1F (Long Term Finance and Capital Structure) AnswersKim Cristian MaañoNo ratings yet

- Flambeau Corporation Has Paid 60 Consecutive Quarterly Cash Dividends 15Document1 pageFlambeau Corporation Has Paid 60 Consecutive Quarterly Cash Dividends 15CharlotteNo ratings yet

- CEILLI MyCampus Revision Questions v1.0 (2023) PDFDocument16 pagesCEILLI MyCampus Revision Questions v1.0 (2023) PDFQistina IzharNo ratings yet

- UOB Annual Report 2007Document160 pagesUOB Annual Report 2007Patrick BernilNo ratings yet

- Sec Form 17 A - As of March 31, 2013Document248 pagesSec Form 17 A - As of March 31, 2013Amanoden Mala DimalutangNo ratings yet

- International Investing-1Document8 pagesInternational Investing-1hoangkhanhNo ratings yet

- Fsa Questions and SolutionsDocument11 pagesFsa Questions and SolutionsAnjali Betala KothariNo ratings yet

- Dlca 1.B/D 2.sale 3.interest 4.dish0n0ur Cheque 1.cash Received 2.reurn 0utward 3.bad Debts 4. C0ntra Entry 5.C/DDocument16 pagesDlca 1.B/D 2.sale 3.interest 4.dish0n0ur Cheque 1.cash Received 2.reurn 0utward 3.bad Debts 4. C0ntra Entry 5.C/DIqra HanifNo ratings yet