Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

11 viewsCapital Budgeting Cash Flow

Capital Budgeting Cash Flow

Uploaded by

Muhammad Fikri RahadianCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- BDHCH 9Document37 pagesBDHCH 9tzsyxxwht100% (1)

- Chapter 11Document29 pagesChapter 11Fathan Mubina92% (12)

- Doosan TT Series CNCDocument7 pagesDoosan TT Series CNCRevolusiSoekarnoNo ratings yet

- 2600, 2400, 2300 FOGGERS: User'S ManualDocument2 pages2600, 2400, 2300 FOGGERS: User'S Manualver_at_work100% (1)

- Foundations of Finance: Tenth Edition, Global EditionDocument59 pagesFoundations of Finance: Tenth Edition, Global EditionSemih AYBASTINo ratings yet

- Capital BudgetDocument46 pagesCapital BudgetJohn Rick DayondonNo ratings yet

- Chapter 5 - Developing Project CashflowsDocument33 pagesChapter 5 - Developing Project CashflowsEhsanullah RahmatiNo ratings yet

- CAPITAL BUDGETING Deals With Analyzing The Profitability And/or Liquidity of A Given Project ProposalDocument6 pagesCAPITAL BUDGETING Deals With Analyzing The Profitability And/or Liquidity of A Given Project ProposalVal SarateNo ratings yet

- Hongkong Capital BudgetDocument77 pagesHongkong Capital BudgetZoloft Zithromax ProzacNo ratings yet

- Session 78 - Cashflows of Capital BudgetingDocument32 pagesSession 78 - Cashflows of Capital Budgeting11219203nguyen.nhungNo ratings yet

- 11 Zutter Smart MFBrief 15e ch11Document72 pages11 Zutter Smart MFBrief 15e ch11My videos My videoNo ratings yet

- Capital Budgeting 2022Document7 pagesCapital Budgeting 2022ChrysNo ratings yet

- Cash Flow Statement: 1 Presented by Anita Singhal 1Document25 pagesCash Flow Statement: 1 Presented by Anita Singhal 1anita singhalNo ratings yet

- CHP 11Document45 pagesCHP 11Khaled A. M. El-sherifNo ratings yet

- Capital BudgetingDocument34 pagesCapital BudgetingvijayluckeyNo ratings yet

- CHAPTER FIVE MGT Capital BugdeingDocument18 pagesCHAPTER FIVE MGT Capital Bugdeingnewaybeyene5No ratings yet

- MAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingDocument12 pagesMAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingSadia AbidNo ratings yet

- CHAPTER 2 (A) - Analyzing Project Cash FlowsDocument70 pagesCHAPTER 2 (A) - Analyzing Project Cash FlowsSarnisha Murugeshwaran (Shazzisha)No ratings yet

- Lec 1 After Mid TermDocument9 pagesLec 1 After Mid TermsherygafaarNo ratings yet

- Kelompok 2: Capital Budgeting Cash FlowDocument11 pagesKelompok 2: Capital Budgeting Cash FlowBidari DhaifinaNo ratings yet

- Exam 2 SolutionsDocument5 pagesExam 2 Solutions123xxNo ratings yet

- CAPBUDDocument10 pagesCAPBUDVitany Gyn Cabalfin TraifalgarNo ratings yet

- Session 06Document27 pagesSession 06Jaya RoyNo ratings yet

- Financial Management - Cost of Investment & Net Returns: Katrine Celine C. Gutierrez, CPADocument4 pagesFinancial Management - Cost of Investment & Net Returns: Katrine Celine C. Gutierrez, CPAJerichoNo ratings yet

- CHAPTER FIVE FM EdittedDocument26 pagesCHAPTER FIVE FM EdittedGemechis LemaNo ratings yet

- Cap Budgeting-Cash FlowsDocument55 pagesCap Budgeting-Cash FlowsthinkestanNo ratings yet

- Ch20 - Guan CM - AISEDocument38 pagesCh20 - Guan CM - AISEIassa MarcelinaNo ratings yet

- MBS Corporate Finance 2023 Slide Set 3Document104 pagesMBS Corporate Finance 2023 Slide Set 3PGNo ratings yet

- Project Cash FlowsDocument28 pagesProject Cash FlowsNandhini NallasamyNo ratings yet

- Chapters 8 and 9: Capital Budgeting: Ppts To Accompany Fundamentals of Corporate Finance 6E by Ross Et AlDocument42 pagesChapters 8 and 9: Capital Budgeting: Ppts To Accompany Fundamentals of Corporate Finance 6E by Ross Et AlAbel100% (1)

- S7-Capital BudgetingDocument78 pagesS7-Capital BudgetingShaheer BaigNo ratings yet

- Income Based Valuation - l3Document14 pagesIncome Based Valuation - l3Kristene Romarate DaelNo ratings yet

- Lecture 8Document28 pagesLecture 8Hồng LêNo ratings yet

- FINA 5120 - Fall (1) 2022 - Session 4 (With Answers) - Capital Budgeting - 26aug22Document69 pagesFINA 5120 - Fall (1) 2022 - Session 4 (With Answers) - Capital Budgeting - 26aug22Yilin YANGNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingNiña FajardoNo ratings yet

- L2 - Capital BudgetingDocument53 pagesL2 - Capital BudgetingZhenyi ZhuNo ratings yet

- CPALE Syllabus Covere1Document7 pagesCPALE Syllabus Covere1Rian EsperanzaNo ratings yet

- CHAPTER 2-Capital BudgetingDocument13 pagesCHAPTER 2-Capital BudgetingAndualem ZenebeNo ratings yet

- Week 5 - Slides Capital BudgetingDocument44 pagesWeek 5 - Slides Capital BudgetingAmelia MatherNo ratings yet

- Lecture Notes Section 5Document18 pagesLecture Notes Section 5Marc OurfaliNo ratings yet

- AccountingDocument26 pagesAccountingHaris AliNo ratings yet

- Cash Flow EstimationDocument36 pagesCash Flow EstimationVenus Tumbaga100% (1)

- MF 2 Capital Budgeting DecisionsDocument71 pagesMF 2 Capital Budgeting Decisionsarun yadavNo ratings yet

- Toaz - Info Chapter 11 PRDocument45 pagesToaz - Info Chapter 11 PRtaponic390No ratings yet

- Foundations of Finance: Tenth Edition, Global EditionDocument55 pagesFoundations of Finance: Tenth Edition, Global EditionSemih AYBASTINo ratings yet

- CH09 PPT MLDocument127 pagesCH09 PPT MLXianFa WongNo ratings yet

- Lecture 11Document62 pagesLecture 11lilyblooms.atlasNo ratings yet

- Ch11 - Capital Budgeting Cash Flows (G)Document30 pagesCh11 - Capital Budgeting Cash Flows (G)NerissaNo ratings yet

- Capital BudgetingDocument4 pagesCapital Budgetingprincessjaminelizardo9No ratings yet

- Acc 121 - Capital BudgetingDocument7 pagesAcc 121 - Capital BudgetingCin DyNo ratings yet

- AE24 Lesson 6: Analysis of Capital Investment DecisionsDocument17 pagesAE24 Lesson 6: Analysis of Capital Investment DecisionsMajoy BantocNo ratings yet

- Chapter 4Document18 pagesChapter 4Amjad J AliNo ratings yet

- 3 Statement & DCF ModelDocument17 pages3 Statement & DCF ModelarjunNo ratings yet

- Investment Appraisal Taxation, InflationDocument8 pagesInvestment Appraisal Taxation, InflationJiya RajputNo ratings yet

- 3 Statement & DCF ModelDocument17 pages3 Statement & DCF ModelArjun KhoslaNo ratings yet

- Additional Aspects in Capital BudgetingDocument12 pagesAdditional Aspects in Capital BudgetingDebashishNo ratings yet

- Estimation of Project Cash FlowsDocument16 pagesEstimation of Project Cash FlowssanjayttmNo ratings yet

- Capital Budgeting: DefinitionsDocument3 pagesCapital Budgeting: DefinitionsHelen TuberaNo ratings yet

- Caledonia Products FIN370Document8 pagesCaledonia Products FIN370huskergirlNo ratings yet

- Pfm15e Im Ch11Document40 pagesPfm15e Im Ch11vdav hadhNo ratings yet

- Credit TransactionsDocument29 pagesCredit TransactionsGabrielle Louise de Peralta0% (1)

- Bezier Curves For CowardsDocument7 pagesBezier Curves For Cowardsmuldermaster100% (1)

- How To Get Work Items From Workflow in Your Outlook Inbox PDFDocument9 pagesHow To Get Work Items From Workflow in Your Outlook Inbox PDFismailimran09No ratings yet

- R4ADocument23 pagesR4AJamailla MelendrezNo ratings yet

- Exercise On Chapter 8 Science Form 3Document3 pagesExercise On Chapter 8 Science Form 3Sasi RekaNo ratings yet

- Chapter 16Document30 pagesChapter 16Rajashekhar B BeedimaniNo ratings yet

- Prima h4 SBBDocument2 pagesPrima h4 SBBcosty_transNo ratings yet

- A Clinician's Guide To Cost-Effectiveness Analysis: Annals of Internal Medicine. 1990 113:147-154Document8 pagesA Clinician's Guide To Cost-Effectiveness Analysis: Annals of Internal Medicine. 1990 113:147-154dsjervisNo ratings yet

- MBA 111 - ControllingDocument39 pagesMBA 111 - ControllingJhoia BesinNo ratings yet

- Data Sheet SCLFP48100 3U Rev 2Document2 pagesData Sheet SCLFP48100 3U Rev 2hermantoNo ratings yet

- PLAN 423 - Module 3Document35 pagesPLAN 423 - Module 3ABCD EFGNo ratings yet

- HLW8012 User Manual: Work Phone:0755 29650970Document11 pagesHLW8012 User Manual: Work Phone:0755 29650970Abhishek GuptaNo ratings yet

- Boyce ODEch 2 S 1 P 32Document1 pageBoyce ODEch 2 S 1 P 32Charbel KaddoumNo ratings yet

- Optimizing A Battery Energy Storage System For Primary Frequency ControlDocument8 pagesOptimizing A Battery Energy Storage System For Primary Frequency Controlrdj00No ratings yet

- Fisa Technica Fibran20mmDocument6 pagesFisa Technica Fibran20mmFlorin RazvanNo ratings yet

- 03 eLMS Quiz 1Document1 page03 eLMS Quiz 1jaehan834No ratings yet

- 2023 SHRM Model RevisionDocument4 pages2023 SHRM Model RevisionPadmaja NaiduNo ratings yet

- Smart Lighting System Using Raspberry PIDocument9 pagesSmart Lighting System Using Raspberry PIChristosTsilionisNo ratings yet

- Unix BasicsDocument15 pagesUnix BasicsNancyNo ratings yet

- Mini Project Qos Analysis of WiMAxDocument60 pagesMini Project Qos Analysis of WiMAxAbdirihman100% (2)

- FortiSIEM 5.1 Study Guide-OnlineDocument461 pagesFortiSIEM 5.1 Study Guide-OnlineAlma AguilarNo ratings yet

- How To View and Interpret The Turnitin Similarity Score and Originality ReportsDocument5 pagesHow To View and Interpret The Turnitin Similarity Score and Originality ReportsRT LeeNo ratings yet

- Concert: Certified Installer Plus - Enterprise Solutions Partner (Cip-Esp)Document2 pagesConcert: Certified Installer Plus - Enterprise Solutions Partner (Cip-Esp)AndresNo ratings yet

- CSR Business Ethics in IBDocument10 pagesCSR Business Ethics in IBBhavya NagdaNo ratings yet

- Updating Your Device Via Wialon EN PDFDocument16 pagesUpdating Your Device Via Wialon EN PDFДмитрий ДмитриевичNo ratings yet

- SF AERO Skills Map Aircraft Maintenance Track PDFDocument50 pagesSF AERO Skills Map Aircraft Maintenance Track PDFrehannstNo ratings yet

- Optimization of The Setup Position of A Workpiece For Five-Axis Machining To Reduce Machining TimeDocument13 pagesOptimization of The Setup Position of A Workpiece For Five-Axis Machining To Reduce Machining TimeHungTranNo ratings yet

- MT6781 Android ScatterDocument34 pagesMT6781 Android ScatterOliver FischerNo ratings yet

Capital Budgeting Cash Flow

Capital Budgeting Cash Flow

Uploaded by

Muhammad Fikri Rahadian0 ratings0% found this document useful (0 votes)

11 views12 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

11 views12 pagesCapital Budgeting Cash Flow

Capital Budgeting Cash Flow

Uploaded by

Muhammad Fikri RahadianCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 12

Perhitungan Capital Budgeting Cash Flows

dengan Konsep Time Value of Money

Copyright © 2019 Pearson Education, Ltd. All Rights Reserved.

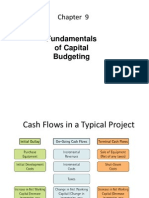

Project Cash Flows

• Major Cash Flow Types

– Initial Investment

The incremental cash flows for a project at time zero

– Operating Cash Flows

The net incremental after-tax cash flows occurring each period

during the project’s life

– Terminal Cash Flows

The net after-tax cash flow occurring in the final year of the

project

Copyright © 2019 Pearson Education, Ltd. All Rights Reserved.

Project Cash Flows

• Replacement versus Expansion Decisions

– Expansion decisions include investments designed to

increase the capacity of a factory, to launch a product in a

new market, or to open a new location

Identifying incremental cash flows along with developing net

cash flow estimates is relatively straightforward

– Replacement decisions are perhaps even more common

The firm must decide whether to replace some asset that it

already owns with a new asset

Identifying incremental cash flows for these sorts of investment

projects is more complicated because the firm must compare

the cash flows that result from the new investment to the cash

flows that would have occurred if no investment had been

made

Copyright © 2019 Pearson Education, Ltd. All Rights Reserved.

Relevant Net Cash Flows for Replacement

Decisions

Copyright © 2019 Pearson Education, Ltd. All Rights Reserved.

Project Cash Flows

• Sunk Costs and Opportunity Costs

– Sunk Costs

Cash outlays that have already been made (past outlays) and

cannot be recovered, whether or not the firm follows through

and makes an investment

Sunk costs are irrelevant and should not be included in a

project’s incremental cash flows

– Opportunity Costs

Cash flows that could have been realized from the best

alternative use of an owned asset

Opportunity costs are relevant and should be included as part

of the cash flow projections when determining a project’s net

cash flows

Copyright © 2019 Pearson Education, Ltd. All Rights Reserved.

Finding the Initial Investment

• Installed Cost of the New Asset

– Cost of the New Asset

The cash outflow necessary to acquire a new asset

– Installation Costs

Any added costs that are necessary to place the new asset

into operation

– Installed Cost of the New Asset

The cost of the new asset plus its installation costs; equals the

asset’s depreciable value

Copyright © 2019 Pearson Education, Ltd. All Rights Reserved.

The Basic Format for Determining

Initial Investment

(1) Installed cost of the new asset =

Cost of the new asset

+ Installation costs

(2) After-tax proceeds from the sale of the old asset =

Proceeds from the sale of the old asset

±Tax on the sale of the old asset

(3) Change in net working capital

Initial Investment = (1) − (2) ± (3)

Copyright © 2019 Pearson Education, Ltd. All Rights Reserved.

Finding the Initial Investment

• Change in Net Working Capital

– Net Working Capital

The difference between the firm’s current assets and its

current liabilities

– Change in Net Working Capital

The difference between the change in current assets and the

change in current liabilities

Copyright © 2019 Pearson Education, Ltd. All Rights Reserved.

Example

Danson Company is expanding. Analysts expect that the

changes summarized in Table 11.3 will occur and will be

maintained over the life of the expansion. Current assets will

increase by $22,000, and current liabilities will increase by

$9,000, resulting in a $13,000 increase in net working capital.

This increase in net working capital is part of the initial cash

outflow required to begin the expansion project, so we treat it

as a cash outflow in calculating the initial investment.

Copyright © 2019 Pearson Education, Ltd. All Rights Reserved.

Calculation of Change in Net Working

Capital for Danson Company

Current account Change in balance Blank

Cash + $ 4,000 Blank

Accounts receivable + 10,000 Blank

Inventories + 8,000 Blank

(1) Current assets Blank + $22,000

Accounts payable + $ 7,000 Blank

Expense accruals + 2,000 Blank

(2) Current liabilities Blank + $ 9,000

Change in net working capital= (1) − (2) Blank + $13,000

Copyright © 2019 Pearson Education, Ltd. All Rights Reserved.

Calculation of Operating Cash Flows Using

the Income Statement Format

Revenue

− Expenses (excluding depreciation and interest)

Earnings before interest, taxes, depreciation, and amortization (EBITDA)

− Depreciation

Earnings before interest and taxes (EBIT)

− Taxes (rate = T)

Net operating profit after taxes [NOPAT = EBIT × (1 − T)]

+ Depreciation

Operating cash flows (OCF) (same as OCF in Equation 4.3)

Copyright © 2019 Pearson Education, Ltd. All Rights Reserved.

Finding the Terminal Cash Flow

After-tax proceeds from the sale of the new machine Blank Blank

Proceeds from the sale of the new machine $50,000 Blank

− Tax on sale of the new machine 6,300 Blank

Total after-tax proceeds: new machine Blank $43,700

− After-tax proceeds from the sale of the old machine Blank Blank

Proceeds from the sale of the old machine $10,000 Blank

− Tax on the sale of the old machine 2,100 Blank

Total after-tax proceeds: old machine Blank 7,900

+ Change in net working capital Blank 17,000

Terminal cash flow Blank $52,800

Copyright © 2019 Pearson Education, Ltd. All Rights Reserved.

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- BDHCH 9Document37 pagesBDHCH 9tzsyxxwht100% (1)

- Chapter 11Document29 pagesChapter 11Fathan Mubina92% (12)

- Doosan TT Series CNCDocument7 pagesDoosan TT Series CNCRevolusiSoekarnoNo ratings yet

- 2600, 2400, 2300 FOGGERS: User'S ManualDocument2 pages2600, 2400, 2300 FOGGERS: User'S Manualver_at_work100% (1)

- Foundations of Finance: Tenth Edition, Global EditionDocument59 pagesFoundations of Finance: Tenth Edition, Global EditionSemih AYBASTINo ratings yet

- Capital BudgetDocument46 pagesCapital BudgetJohn Rick DayondonNo ratings yet

- Chapter 5 - Developing Project CashflowsDocument33 pagesChapter 5 - Developing Project CashflowsEhsanullah RahmatiNo ratings yet

- CAPITAL BUDGETING Deals With Analyzing The Profitability And/or Liquidity of A Given Project ProposalDocument6 pagesCAPITAL BUDGETING Deals With Analyzing The Profitability And/or Liquidity of A Given Project ProposalVal SarateNo ratings yet

- Hongkong Capital BudgetDocument77 pagesHongkong Capital BudgetZoloft Zithromax ProzacNo ratings yet

- Session 78 - Cashflows of Capital BudgetingDocument32 pagesSession 78 - Cashflows of Capital Budgeting11219203nguyen.nhungNo ratings yet

- 11 Zutter Smart MFBrief 15e ch11Document72 pages11 Zutter Smart MFBrief 15e ch11My videos My videoNo ratings yet

- Capital Budgeting 2022Document7 pagesCapital Budgeting 2022ChrysNo ratings yet

- Cash Flow Statement: 1 Presented by Anita Singhal 1Document25 pagesCash Flow Statement: 1 Presented by Anita Singhal 1anita singhalNo ratings yet

- CHP 11Document45 pagesCHP 11Khaled A. M. El-sherifNo ratings yet

- Capital BudgetingDocument34 pagesCapital BudgetingvijayluckeyNo ratings yet

- CHAPTER FIVE MGT Capital BugdeingDocument18 pagesCHAPTER FIVE MGT Capital Bugdeingnewaybeyene5No ratings yet

- MAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingDocument12 pagesMAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingSadia AbidNo ratings yet

- CHAPTER 2 (A) - Analyzing Project Cash FlowsDocument70 pagesCHAPTER 2 (A) - Analyzing Project Cash FlowsSarnisha Murugeshwaran (Shazzisha)No ratings yet

- Lec 1 After Mid TermDocument9 pagesLec 1 After Mid TermsherygafaarNo ratings yet

- Kelompok 2: Capital Budgeting Cash FlowDocument11 pagesKelompok 2: Capital Budgeting Cash FlowBidari DhaifinaNo ratings yet

- Exam 2 SolutionsDocument5 pagesExam 2 Solutions123xxNo ratings yet

- CAPBUDDocument10 pagesCAPBUDVitany Gyn Cabalfin TraifalgarNo ratings yet

- Session 06Document27 pagesSession 06Jaya RoyNo ratings yet

- Financial Management - Cost of Investment & Net Returns: Katrine Celine C. Gutierrez, CPADocument4 pagesFinancial Management - Cost of Investment & Net Returns: Katrine Celine C. Gutierrez, CPAJerichoNo ratings yet

- CHAPTER FIVE FM EdittedDocument26 pagesCHAPTER FIVE FM EdittedGemechis LemaNo ratings yet

- Cap Budgeting-Cash FlowsDocument55 pagesCap Budgeting-Cash FlowsthinkestanNo ratings yet

- Ch20 - Guan CM - AISEDocument38 pagesCh20 - Guan CM - AISEIassa MarcelinaNo ratings yet

- MBS Corporate Finance 2023 Slide Set 3Document104 pagesMBS Corporate Finance 2023 Slide Set 3PGNo ratings yet

- Project Cash FlowsDocument28 pagesProject Cash FlowsNandhini NallasamyNo ratings yet

- Chapters 8 and 9: Capital Budgeting: Ppts To Accompany Fundamentals of Corporate Finance 6E by Ross Et AlDocument42 pagesChapters 8 and 9: Capital Budgeting: Ppts To Accompany Fundamentals of Corporate Finance 6E by Ross Et AlAbel100% (1)

- S7-Capital BudgetingDocument78 pagesS7-Capital BudgetingShaheer BaigNo ratings yet

- Income Based Valuation - l3Document14 pagesIncome Based Valuation - l3Kristene Romarate DaelNo ratings yet

- Lecture 8Document28 pagesLecture 8Hồng LêNo ratings yet

- FINA 5120 - Fall (1) 2022 - Session 4 (With Answers) - Capital Budgeting - 26aug22Document69 pagesFINA 5120 - Fall (1) 2022 - Session 4 (With Answers) - Capital Budgeting - 26aug22Yilin YANGNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingNiña FajardoNo ratings yet

- L2 - Capital BudgetingDocument53 pagesL2 - Capital BudgetingZhenyi ZhuNo ratings yet

- CPALE Syllabus Covere1Document7 pagesCPALE Syllabus Covere1Rian EsperanzaNo ratings yet

- CHAPTER 2-Capital BudgetingDocument13 pagesCHAPTER 2-Capital BudgetingAndualem ZenebeNo ratings yet

- Week 5 - Slides Capital BudgetingDocument44 pagesWeek 5 - Slides Capital BudgetingAmelia MatherNo ratings yet

- Lecture Notes Section 5Document18 pagesLecture Notes Section 5Marc OurfaliNo ratings yet

- AccountingDocument26 pagesAccountingHaris AliNo ratings yet

- Cash Flow EstimationDocument36 pagesCash Flow EstimationVenus Tumbaga100% (1)

- MF 2 Capital Budgeting DecisionsDocument71 pagesMF 2 Capital Budgeting Decisionsarun yadavNo ratings yet

- Toaz - Info Chapter 11 PRDocument45 pagesToaz - Info Chapter 11 PRtaponic390No ratings yet

- Foundations of Finance: Tenth Edition, Global EditionDocument55 pagesFoundations of Finance: Tenth Edition, Global EditionSemih AYBASTINo ratings yet

- CH09 PPT MLDocument127 pagesCH09 PPT MLXianFa WongNo ratings yet

- Lecture 11Document62 pagesLecture 11lilyblooms.atlasNo ratings yet

- Ch11 - Capital Budgeting Cash Flows (G)Document30 pagesCh11 - Capital Budgeting Cash Flows (G)NerissaNo ratings yet

- Capital BudgetingDocument4 pagesCapital Budgetingprincessjaminelizardo9No ratings yet

- Acc 121 - Capital BudgetingDocument7 pagesAcc 121 - Capital BudgetingCin DyNo ratings yet

- AE24 Lesson 6: Analysis of Capital Investment DecisionsDocument17 pagesAE24 Lesson 6: Analysis of Capital Investment DecisionsMajoy BantocNo ratings yet

- Chapter 4Document18 pagesChapter 4Amjad J AliNo ratings yet

- 3 Statement & DCF ModelDocument17 pages3 Statement & DCF ModelarjunNo ratings yet

- Investment Appraisal Taxation, InflationDocument8 pagesInvestment Appraisal Taxation, InflationJiya RajputNo ratings yet

- 3 Statement & DCF ModelDocument17 pages3 Statement & DCF ModelArjun KhoslaNo ratings yet

- Additional Aspects in Capital BudgetingDocument12 pagesAdditional Aspects in Capital BudgetingDebashishNo ratings yet

- Estimation of Project Cash FlowsDocument16 pagesEstimation of Project Cash FlowssanjayttmNo ratings yet

- Capital Budgeting: DefinitionsDocument3 pagesCapital Budgeting: DefinitionsHelen TuberaNo ratings yet

- Caledonia Products FIN370Document8 pagesCaledonia Products FIN370huskergirlNo ratings yet

- Pfm15e Im Ch11Document40 pagesPfm15e Im Ch11vdav hadhNo ratings yet

- Credit TransactionsDocument29 pagesCredit TransactionsGabrielle Louise de Peralta0% (1)

- Bezier Curves For CowardsDocument7 pagesBezier Curves For Cowardsmuldermaster100% (1)

- How To Get Work Items From Workflow in Your Outlook Inbox PDFDocument9 pagesHow To Get Work Items From Workflow in Your Outlook Inbox PDFismailimran09No ratings yet

- R4ADocument23 pagesR4AJamailla MelendrezNo ratings yet

- Exercise On Chapter 8 Science Form 3Document3 pagesExercise On Chapter 8 Science Form 3Sasi RekaNo ratings yet

- Chapter 16Document30 pagesChapter 16Rajashekhar B BeedimaniNo ratings yet

- Prima h4 SBBDocument2 pagesPrima h4 SBBcosty_transNo ratings yet

- A Clinician's Guide To Cost-Effectiveness Analysis: Annals of Internal Medicine. 1990 113:147-154Document8 pagesA Clinician's Guide To Cost-Effectiveness Analysis: Annals of Internal Medicine. 1990 113:147-154dsjervisNo ratings yet

- MBA 111 - ControllingDocument39 pagesMBA 111 - ControllingJhoia BesinNo ratings yet

- Data Sheet SCLFP48100 3U Rev 2Document2 pagesData Sheet SCLFP48100 3U Rev 2hermantoNo ratings yet

- PLAN 423 - Module 3Document35 pagesPLAN 423 - Module 3ABCD EFGNo ratings yet

- HLW8012 User Manual: Work Phone:0755 29650970Document11 pagesHLW8012 User Manual: Work Phone:0755 29650970Abhishek GuptaNo ratings yet

- Boyce ODEch 2 S 1 P 32Document1 pageBoyce ODEch 2 S 1 P 32Charbel KaddoumNo ratings yet

- Optimizing A Battery Energy Storage System For Primary Frequency ControlDocument8 pagesOptimizing A Battery Energy Storage System For Primary Frequency Controlrdj00No ratings yet

- Fisa Technica Fibran20mmDocument6 pagesFisa Technica Fibran20mmFlorin RazvanNo ratings yet

- 03 eLMS Quiz 1Document1 page03 eLMS Quiz 1jaehan834No ratings yet

- 2023 SHRM Model RevisionDocument4 pages2023 SHRM Model RevisionPadmaja NaiduNo ratings yet

- Smart Lighting System Using Raspberry PIDocument9 pagesSmart Lighting System Using Raspberry PIChristosTsilionisNo ratings yet

- Unix BasicsDocument15 pagesUnix BasicsNancyNo ratings yet

- Mini Project Qos Analysis of WiMAxDocument60 pagesMini Project Qos Analysis of WiMAxAbdirihman100% (2)

- FortiSIEM 5.1 Study Guide-OnlineDocument461 pagesFortiSIEM 5.1 Study Guide-OnlineAlma AguilarNo ratings yet

- How To View and Interpret The Turnitin Similarity Score and Originality ReportsDocument5 pagesHow To View and Interpret The Turnitin Similarity Score and Originality ReportsRT LeeNo ratings yet

- Concert: Certified Installer Plus - Enterprise Solutions Partner (Cip-Esp)Document2 pagesConcert: Certified Installer Plus - Enterprise Solutions Partner (Cip-Esp)AndresNo ratings yet

- CSR Business Ethics in IBDocument10 pagesCSR Business Ethics in IBBhavya NagdaNo ratings yet

- Updating Your Device Via Wialon EN PDFDocument16 pagesUpdating Your Device Via Wialon EN PDFДмитрий ДмитриевичNo ratings yet

- SF AERO Skills Map Aircraft Maintenance Track PDFDocument50 pagesSF AERO Skills Map Aircraft Maintenance Track PDFrehannstNo ratings yet

- Optimization of The Setup Position of A Workpiece For Five-Axis Machining To Reduce Machining TimeDocument13 pagesOptimization of The Setup Position of A Workpiece For Five-Axis Machining To Reduce Machining TimeHungTranNo ratings yet

- MT6781 Android ScatterDocument34 pagesMT6781 Android ScatterOliver FischerNo ratings yet