Professional Documents

Culture Documents

279 - Fin Management 12 Cost of Capital

279 - Fin Management 12 Cost of Capital

Uploaded by

irma makharoblidzeCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Case Study No.4Document1 pageCase Study No.4sasiganthNo ratings yet

- Efficient Diversification: Bodie, Kane, and Marcus Eleventh EditionDocument39 pagesEfficient Diversification: Bodie, Kane, and Marcus Eleventh Editionirma makharoblidzeNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- L'Oreal Study CaseDocument18 pagesL'Oreal Study Casegadis fazrina rasam100% (1)

- 137 - Gatt, Gats, TripsDocument6 pages137 - Gatt, Gats, Tripsirma makharoblidze100% (1)

- 5.1 Rates of Return: Holding-Period Return (HPR)Document31 pages5.1 Rates of Return: Holding-Period Return (HPR)irma makharoblidzeNo ratings yet

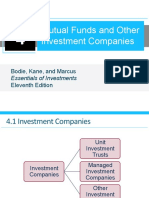

- Mutual Funds and Other Investment Companies: Bodie, Kane, and Marcus Eleventh EditionDocument23 pagesMutual Funds and Other Investment Companies: Bodie, Kane, and Marcus Eleventh Editionirma makharoblidzeNo ratings yet

- Accounts Receivable and Inventory ManagementDocument54 pagesAccounts Receivable and Inventory Managementirma makharoblidzeNo ratings yet

- Treaty of GiorgievskDocument1 pageTreaty of Giorgievskirma makharoblidzeNo ratings yet

- 137 - Avoidance of Double TaxationDocument7 pages137 - Avoidance of Double Taxationirma makharoblidzeNo ratings yet

- 279 - Fin Management 8 NPV and InvestmentDocument17 pages279 - Fin Management 8 NPV and Investmentirma makharoblidzeNo ratings yet

- Financial Accounting: Conceptual FrameworkDocument50 pagesFinancial Accounting: Conceptual Frameworkirma makharoblidzeNo ratings yet

- Financial Accounting: Internal Control, Cash, and ReceivablesDocument75 pagesFinancial Accounting: Internal Control, Cash, and Receivablesirma makharoblidzeNo ratings yet

- 150 Harrison FAIFRS11e Inppt 04Document43 pages150 Harrison FAIFRS11e Inppt 04irma makharoblidzeNo ratings yet

- Financial Accounting: Recording Business TransactionsDocument64 pagesFinancial Accounting: Recording Business Transactionsirma makharoblidzeNo ratings yet

- 150 Harrison FAIFRS11e Inppt 04Document43 pages150 Harrison FAIFRS11e Inppt 04irma makharoblidzeNo ratings yet

- 150 Harrison FAIFRS11e Inppt 03Document55 pages150 Harrison FAIFRS11e Inppt 03irma makharoblidzeNo ratings yet

- Financial Accounting: LiabilitiesDocument90 pagesFinancial Accounting: Liabilitiesirma makharoblidzeNo ratings yet

- 8949 - Business Law Unit 11 Money LauderingDocument4 pages8949 - Business Law Unit 11 Money Lauderingirma makharoblidzeNo ratings yet

- 736 - Text 2 THE WISDOM OF CROWDS c1 Inside Reading Term 2Document9 pages736 - Text 2 THE WISDOM OF CROWDS c1 Inside Reading Term 2irma makharoblidzeNo ratings yet

- 8949 - Women in BusinessDocument4 pages8949 - Women in Businessirma makharoblidzeNo ratings yet

- 8949 - Across CultureDocument4 pages8949 - Across Cultureirma makharoblidzeNo ratings yet

- 736 - Text 1 BLINK c1 Inside Reading Term 2 Decisions PDFDocument7 pages736 - Text 1 BLINK c1 Inside Reading Term 2 Decisions PDFirma makharoblidzeNo ratings yet

- Double Taxation ReliefDocument10 pagesDouble Taxation ReliefJeeva Antony VictoriaNo ratings yet

- Finance WC AnkurDocument67 pagesFinance WC AnkurshobhnaNo ratings yet

- FM AppleDocument12 pagesFM AppleREJISH MATHEWNo ratings yet

- Core Assets DefinitionDocument7 pagesCore Assets Definitionako akoNo ratings yet

- Abm 1-W6.M2.T1.L2Document5 pagesAbm 1-W6.M2.T1.L2mbiloloNo ratings yet

- Lesson 5 - Organization and RegistrationDocument17 pagesLesson 5 - Organization and RegistrationClifford BatucalNo ratings yet

- Balance Sheet: Equity and LiabilitiesDocument1 pageBalance Sheet: Equity and LiabilitiessfdwhjNo ratings yet

- Results Based LeadershipDocument10 pagesResults Based LeadershipJonathan LimNo ratings yet

- Case Comment On Vivek Narayan SharmaDocument11 pagesCase Comment On Vivek Narayan SharmaG P60 MOOTER 1No ratings yet

- Mahaweli ACT PDFDocument15 pagesMahaweli ACT PDFNamal ChathurangaNo ratings yet

- Environmental Product Declaration: in Accordance With ISO 14025 and EN 15804 ForDocument13 pagesEnvironmental Product Declaration: in Accordance With ISO 14025 and EN 15804 ForLaichul MachfudhorNo ratings yet

- GXX - 0002 TableDocument63 pagesGXX - 0002 TableSupratim RayNo ratings yet

- Organizational Management: Submitted ToDocument5 pagesOrganizational Management: Submitted ToSehar WaleedNo ratings yet

- Enumerating The AssetsDocument11 pagesEnumerating The AssetsShikha Dubey0% (1)

- Mining Valuation: Three Steps Beyond A Static DCF Model: FeatureDocument4 pagesMining Valuation: Three Steps Beyond A Static DCF Model: Feature2fercepolNo ratings yet

- Ara 511 Urban Design SpecsDocument4 pagesAra 511 Urban Design Specsjudd macombNo ratings yet

- Capital Structure Self Correction ProblemsDocument53 pagesCapital Structure Self Correction ProblemsTamoor BaigNo ratings yet

- A Guide To Global Citizenship THE 2019 Cbi Index: Special Report August/September 2019Document36 pagesA Guide To Global Citizenship THE 2019 Cbi Index: Special Report August/September 2019ArunNo ratings yet

- Intern Report - Sanima BankDocument11 pagesIntern Report - Sanima BankRajan ParajuliNo ratings yet

- 3.3.6 Mod EvaluationDocument6 pages3.3.6 Mod EvaluationWelshfyn ConstantinoNo ratings yet

- Cost of Capital NotesDocument6 pagesCost of Capital NotesAmy100% (1)

- Paf FormDocument4 pagesPaf FormFauzi LyandaNo ratings yet

- Chapter 14Document52 pagesChapter 14Pia SurilNo ratings yet

- CH 18Document9 pagesCH 18MBASTUDENTPUPNo ratings yet

- Materials For The Training!!! - Salaries and Benefits PresentationDocument12 pagesMaterials For The Training!!! - Salaries and Benefits PresentationJana DamnjanovicNo ratings yet

- MBA-AFM Theory QBDocument18 pagesMBA-AFM Theory QBkanikaNo ratings yet

- Intended Learning Outcomes: Principles of Customs Administration LESSON 1: Profile of The Bureau of CustomsDocument10 pagesIntended Learning Outcomes: Principles of Customs Administration LESSON 1: Profile of The Bureau of CustomsAbdurahman shuaibNo ratings yet

- Repayment Notification 123583047 2014-12-16Document2 pagesRepayment Notification 123583047 2014-12-16MiguelThaxNo ratings yet

279 - Fin Management 12 Cost of Capital

279 - Fin Management 12 Cost of Capital

Uploaded by

irma makharoblidzeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

279 - Fin Management 12 Cost of Capital

279 - Fin Management 12 Cost of Capital

Uploaded by

irma makharoblidzeCopyright:

Available Formats

Cost of Capital

what exactly is the WACC?

The WACC is the minimum return a company needs to earn to satisfy all of its investors,

including stockholders, bondholders, and preferred stockholders

This is the cost of capital for the firm as a whole, and it can be interpreted as the required

return on the overall firm.

(C) 2007 Prentice Hall, Inc. 1-1

Required Return versus Cost of

Capital

The key fact to grasp is that the cost of capital associated with an investment

depends on the risk of that investment

The cost of capital depends primarily on the use of the funds, not the source.

We know that the particular mixture of debt and equity a firm chooses to employ—its capital

structure—is a managerial variable

in particular, we will assume that the firm has a fixed debt−equity ratio that it maintains.

This ratio reflects the firm’s target capital structure

In other words, a firm’s cost of capital will reflect both its cost of debt capital and its cost of

equity capital

(C) 2007 Prentice Hall, Inc. 1-2

THE COST OF EQUITY

dividend growth model approach

This section discusses two approaches to determining the cost of equity: the dividend

growth model approach and the security market line, or SML, approach.

cost of equity The return that equity investors require on their investment in

the firm.

P0 = D0 * (1 + g)/ RE − g = D1/RE − g

RE = D1/P0 + g

dividend of $4 per share last year. The stock currently sells for $60 per share. You estimate

that the dividend will grow steadily at 6%

D1 = D0 . (1 + g) = $4 . 1.06 = $4.24

RE = D1/P0 + g = $4.24/60 + .06= 13.07%

Estimate for g, the growth rate. There are essentially two ways of doing this: (1) use

historical growth rates or (2) use analysts’ forecasts of future growth rates

Advantages and Disadvantages of the Approach:

The primary advantage of the dividend growth model approach is its simplicity. But there

are a number of associated practical problems and disadvantages

First and foremost, the dividend growth model is obviously only applicable to companies

that pay dividends

A second problem is that - the estimated cost of equity is very sensitive to the estimated

growth rate 1-3

Finally, - this approach really does not explicitly consider risk

THE COST OF EQUITY

(The SML Approach)

Relationship between systematic risk and expected return in financial markets, is usually

called the security market line, or SML

E(RE) = Rf + βE×[E(RM) − Rf]

To make the SML approach consistent with the dividend growth model, we will drop the Es denoting

expectations and henceforth write the required return from the SML, RE, as:

RE= Rf + βE×(RM− Rf)

RAmazon= Rf + βAmazon×(RM− Rf)=.05% +1.41 ×7%=9.92%

The SML approach has two primary advantages.

First: It explicitly adjusts for risk.

Second: It is applicable to companies other than just those with steady dividend growth

There are Disadvantages, of course. The SML approach requires that two things be

estimated, the market risk premium and the beta coefficient

(C) 2007 Prentice Hall, Inc. 1-4

THE COSTS OF DEBT AND

PREFERRED STOCK

The cost of debt is the return that the firm’s creditors demand on new

borrowing

cost of debt is simply the interest rate the firm must pay on new borrowing, and

we can observe interest rates in the financial markets

cost of preferred stock is simply equal to the dividend yield on the preferred stock.

The cost of preferred stock, RP, is thus:

RP= D/P0

Alternatively, preferred stocks are rated in much the same way as bonds, so the

cost of preferred stock can be estimated by observing the required returns

(C) 2007 Prentice Hall, Inc. 1-5

Taxes and the Weighted Average

Cost of Capital

Now that we have the costs associated with the main sources of capital the

firm employs, we need to worry about the specific mix

V=E+D

100% = E/V + D/V

These percentages can be interpreted just like portfolio weights, and they are often called

the capital structure weights

If we are determining the discount rate appropriate to those cash flows, then the discount

rate also needs to be expressed on an after tax basis. - RD * (1 − TC)=

The capital structure weights along with the cost of equity and the after tax cost of

debt

The result of this is the weighted average cost of capital, or WACC.

WACC = (E/V) * RE + (D/V) * RD * (1 − TC)

The WACC is the overall return the firm must earn on its existing assets to

maintain the value of its stock.

WACC = (E/V) * RE + (P/V) * RP + (D/V) * RD * (1 − TC)

WACC = (E/V) * RE + (D/V) * RD * (1 − TC) = .75 . 20% + .25 . 10% . (1 − .34)

= 16.65% and we can use it as discount rate.

(C) 2007 Prentice Hall, Inc. 1-6

Company valuation

(C) 2007 Prentice Hall, Inc. 1-7

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Case Study No.4Document1 pageCase Study No.4sasiganthNo ratings yet

- Efficient Diversification: Bodie, Kane, and Marcus Eleventh EditionDocument39 pagesEfficient Diversification: Bodie, Kane, and Marcus Eleventh Editionirma makharoblidzeNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- L'Oreal Study CaseDocument18 pagesL'Oreal Study Casegadis fazrina rasam100% (1)

- 137 - Gatt, Gats, TripsDocument6 pages137 - Gatt, Gats, Tripsirma makharoblidze100% (1)

- 5.1 Rates of Return: Holding-Period Return (HPR)Document31 pages5.1 Rates of Return: Holding-Period Return (HPR)irma makharoblidzeNo ratings yet

- Mutual Funds and Other Investment Companies: Bodie, Kane, and Marcus Eleventh EditionDocument23 pagesMutual Funds and Other Investment Companies: Bodie, Kane, and Marcus Eleventh Editionirma makharoblidzeNo ratings yet

- Accounts Receivable and Inventory ManagementDocument54 pagesAccounts Receivable and Inventory Managementirma makharoblidzeNo ratings yet

- Treaty of GiorgievskDocument1 pageTreaty of Giorgievskirma makharoblidzeNo ratings yet

- 137 - Avoidance of Double TaxationDocument7 pages137 - Avoidance of Double Taxationirma makharoblidzeNo ratings yet

- 279 - Fin Management 8 NPV and InvestmentDocument17 pages279 - Fin Management 8 NPV and Investmentirma makharoblidzeNo ratings yet

- Financial Accounting: Conceptual FrameworkDocument50 pagesFinancial Accounting: Conceptual Frameworkirma makharoblidzeNo ratings yet

- Financial Accounting: Internal Control, Cash, and ReceivablesDocument75 pagesFinancial Accounting: Internal Control, Cash, and Receivablesirma makharoblidzeNo ratings yet

- 150 Harrison FAIFRS11e Inppt 04Document43 pages150 Harrison FAIFRS11e Inppt 04irma makharoblidzeNo ratings yet

- Financial Accounting: Recording Business TransactionsDocument64 pagesFinancial Accounting: Recording Business Transactionsirma makharoblidzeNo ratings yet

- 150 Harrison FAIFRS11e Inppt 04Document43 pages150 Harrison FAIFRS11e Inppt 04irma makharoblidzeNo ratings yet

- 150 Harrison FAIFRS11e Inppt 03Document55 pages150 Harrison FAIFRS11e Inppt 03irma makharoblidzeNo ratings yet

- Financial Accounting: LiabilitiesDocument90 pagesFinancial Accounting: Liabilitiesirma makharoblidzeNo ratings yet

- 8949 - Business Law Unit 11 Money LauderingDocument4 pages8949 - Business Law Unit 11 Money Lauderingirma makharoblidzeNo ratings yet

- 736 - Text 2 THE WISDOM OF CROWDS c1 Inside Reading Term 2Document9 pages736 - Text 2 THE WISDOM OF CROWDS c1 Inside Reading Term 2irma makharoblidzeNo ratings yet

- 8949 - Women in BusinessDocument4 pages8949 - Women in Businessirma makharoblidzeNo ratings yet

- 8949 - Across CultureDocument4 pages8949 - Across Cultureirma makharoblidzeNo ratings yet

- 736 - Text 1 BLINK c1 Inside Reading Term 2 Decisions PDFDocument7 pages736 - Text 1 BLINK c1 Inside Reading Term 2 Decisions PDFirma makharoblidzeNo ratings yet

- Double Taxation ReliefDocument10 pagesDouble Taxation ReliefJeeva Antony VictoriaNo ratings yet

- Finance WC AnkurDocument67 pagesFinance WC AnkurshobhnaNo ratings yet

- FM AppleDocument12 pagesFM AppleREJISH MATHEWNo ratings yet

- Core Assets DefinitionDocument7 pagesCore Assets Definitionako akoNo ratings yet

- Abm 1-W6.M2.T1.L2Document5 pagesAbm 1-W6.M2.T1.L2mbiloloNo ratings yet

- Lesson 5 - Organization and RegistrationDocument17 pagesLesson 5 - Organization and RegistrationClifford BatucalNo ratings yet

- Balance Sheet: Equity and LiabilitiesDocument1 pageBalance Sheet: Equity and LiabilitiessfdwhjNo ratings yet

- Results Based LeadershipDocument10 pagesResults Based LeadershipJonathan LimNo ratings yet

- Case Comment On Vivek Narayan SharmaDocument11 pagesCase Comment On Vivek Narayan SharmaG P60 MOOTER 1No ratings yet

- Mahaweli ACT PDFDocument15 pagesMahaweli ACT PDFNamal ChathurangaNo ratings yet

- Environmental Product Declaration: in Accordance With ISO 14025 and EN 15804 ForDocument13 pagesEnvironmental Product Declaration: in Accordance With ISO 14025 and EN 15804 ForLaichul MachfudhorNo ratings yet

- GXX - 0002 TableDocument63 pagesGXX - 0002 TableSupratim RayNo ratings yet

- Organizational Management: Submitted ToDocument5 pagesOrganizational Management: Submitted ToSehar WaleedNo ratings yet

- Enumerating The AssetsDocument11 pagesEnumerating The AssetsShikha Dubey0% (1)

- Mining Valuation: Three Steps Beyond A Static DCF Model: FeatureDocument4 pagesMining Valuation: Three Steps Beyond A Static DCF Model: Feature2fercepolNo ratings yet

- Ara 511 Urban Design SpecsDocument4 pagesAra 511 Urban Design Specsjudd macombNo ratings yet

- Capital Structure Self Correction ProblemsDocument53 pagesCapital Structure Self Correction ProblemsTamoor BaigNo ratings yet

- A Guide To Global Citizenship THE 2019 Cbi Index: Special Report August/September 2019Document36 pagesA Guide To Global Citizenship THE 2019 Cbi Index: Special Report August/September 2019ArunNo ratings yet

- Intern Report - Sanima BankDocument11 pagesIntern Report - Sanima BankRajan ParajuliNo ratings yet

- 3.3.6 Mod EvaluationDocument6 pages3.3.6 Mod EvaluationWelshfyn ConstantinoNo ratings yet

- Cost of Capital NotesDocument6 pagesCost of Capital NotesAmy100% (1)

- Paf FormDocument4 pagesPaf FormFauzi LyandaNo ratings yet

- Chapter 14Document52 pagesChapter 14Pia SurilNo ratings yet

- CH 18Document9 pagesCH 18MBASTUDENTPUPNo ratings yet

- Materials For The Training!!! - Salaries and Benefits PresentationDocument12 pagesMaterials For The Training!!! - Salaries and Benefits PresentationJana DamnjanovicNo ratings yet

- MBA-AFM Theory QBDocument18 pagesMBA-AFM Theory QBkanikaNo ratings yet

- Intended Learning Outcomes: Principles of Customs Administration LESSON 1: Profile of The Bureau of CustomsDocument10 pagesIntended Learning Outcomes: Principles of Customs Administration LESSON 1: Profile of The Bureau of CustomsAbdurahman shuaibNo ratings yet

- Repayment Notification 123583047 2014-12-16Document2 pagesRepayment Notification 123583047 2014-12-16MiguelThaxNo ratings yet