Professional Documents

Culture Documents

Net Estate & Estate Tax: Conjugal Partnership of Gains

Net Estate & Estate Tax: Conjugal Partnership of Gains

Uploaded by

Krestyl Ann Gabalda0 ratings0% found this document useful (0 votes)

64 views10 pagesThe document discusses the property regime of conjugal partnership of gains (CPG) under Philippine law. Under CPG, proceeds from the labor and industries of either spouse and fruits from their separate and common properties go into a common fund, divided equally upon dissolution. The gross estate of a married decedent under CPG includes: (1) exclusive properties brought separately or acquired separately; (2) conjugal properties acquired onerously or through labor/fruits during marriage; and (3) life insurance proceeds based on when/how premiums were paid. Claims against insolvent persons are exclusive or conjugal based on the underlying property. The net taxable estate is computed by deducting expenses, losses, previous taxes,

Original Description:

Original Title

Chapter 7 CPG

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the property regime of conjugal partnership of gains (CPG) under Philippine law. Under CPG, proceeds from the labor and industries of either spouse and fruits from their separate and common properties go into a common fund, divided equally upon dissolution. The gross estate of a married decedent under CPG includes: (1) exclusive properties brought separately or acquired separately; (2) conjugal properties acquired onerously or through labor/fruits during marriage; and (3) life insurance proceeds based on when/how premiums were paid. Claims against insolvent persons are exclusive or conjugal based on the underlying property. The net taxable estate is computed by deducting expenses, losses, previous taxes,

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

64 views10 pagesNet Estate & Estate Tax: Conjugal Partnership of Gains

Net Estate & Estate Tax: Conjugal Partnership of Gains

Uploaded by

Krestyl Ann GabaldaThe document discusses the property regime of conjugal partnership of gains (CPG) under Philippine law. Under CPG, proceeds from the labor and industries of either spouse and fruits from their separate and common properties go into a common fund, divided equally upon dissolution. The gross estate of a married decedent under CPG includes: (1) exclusive properties brought separately or acquired separately; (2) conjugal properties acquired onerously or through labor/fruits during marriage; and (3) life insurance proceeds based on when/how premiums were paid. Claims against insolvent persons are exclusive or conjugal based on the underlying property. The net taxable estate is computed by deducting expenses, losses, previous taxes,

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 10

Chapter 7:

Net Estate & Estate Tax:

Conjugal Partnership of Gains

INTRODUCTION

Marriage settlements may fix the property relations during the marriage within the

limits provided by the family code. The property relations between husband and wife

shall be governed in the following order:

By marriage settlements executed before marriage;

By the provision of the family code; and

By the local customs.

The future spouses may, in the marriage settlements agree upon the following regimes:

Absolute community

Conjugal partnership of gains

Complete separation of property

Any other regime

CONJUGAL PARTNERSHIP OF GAINS

This chapter shall deal with the net taxable estate and estate tax of spouses

whose property relations are governed by the system of conjugal partnership of

gains.

Under this regime, the husband and wife place in a common fund the

proceeds, products, fruits and income from their separate property and those

acquired by either or both spouses through their efforts and their chance.

Upon dissolution of the marriage or both of the partnership, the net gains or

benefits obtained by either or both spouses shall be divided equally between

them, unless otherwise agreed in the marriage settlements.

WHAT COMPOSED THE GROSS ESTATE

OF MARRIED DECEDENT UNDER CPG

1. Exclusive Property of the Decedent

The following shall be the exclusive property of each spouse:

Property which is brought to the marriage as his or her own;

Property which each acquired during the marriage by gratuitous Title;

Property which is acquired by right of redemption, by barter or by exchange with

property belonging to only one of the spouses; and

Property which is purchased with exclusive money of the wife or of the husband.

WHAT COMPOSED THE GROSS ESTATE

OF MARRIED DECEDENT UNDER CPG

2. Conjugal Property

Property acquired by onerous Title during the marriage at the expense of the common fund, whether the

acquisition be for the partnership, or for only one spouses.

Those obtained from the labor, industry, work or profession of either or both of the spouses.

The fruits, natural, industrial or civil, due or received during the marriage from the common property, as

well as the net fruits from the exclusive property, of each spouse.

The share of either spouse in the hidden treasure which the law awards to the finder or owner of the

property where the treasure is found

Those acquired through occupation such as fishing or hunting

Livestock existing upon the dissolution of the partnership in excess of the number of each kind brought to

the marriage by either spouse

Those which are acquired by chance, such as winning from gambling or betting.

WHAT COMPOSED THE GROSS ESTATE

OF MARRIED DECEDENT UNDER CPG

3. Proceeds of Life Insurance

Proceeds of life insurance policy payable to the insured’s estate may be conjugal or exclusive in

character. This time when the policy was taken and the source of premium payment shall determine

whether the proceeds are to form part of the gross estate of the decedent spouse.

If policy was taken before marriage, proceeds are exclusive and:

Premium are fully paid by the decedent spouse, proceeds are the exclusive property of the

decedent spouse.

Premiums are fully paid with the exclusive property of the surviving spouse, proceeds are the

exclusive property of the surviving spouse.

Premiums are partly paid with the exclusive and partly with the conjugal funds during the

marriage, proceeds shall likewise be proportionately exclusive and conjugal.

Proceeds are conjugal if it was taken during the marriage because it is presumed that the property

acquired during marriage is conjugal.

WHAT COMPOSED THE GROSS ESTATE

OF MARRIED DECEDENT UNDER CPG

4. Claims Against Insolvent Person

The inclusion of claims against insolvent person in the gross estate of the

decedent spouse as either exclusive or conjugal property will depend on the

nature of the claim whether it is for an exclusive or for a conjugal

property.

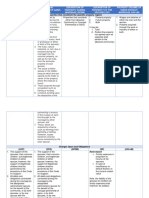

PRO-FORMA COMPUTATION TABLE OF NET TAXABLE

ESTATE

DEDUCTIONS FROM GROSS ESTATE

1. Expenses, Losses, Indebtedness, and Taxes

a. Funeral expense

b. Judicial expenses of testamentary/intestate proceedings

c. Claims against estate

d. Claims of the deceased against insolvent persons

e. Unpaid mortgages/indebtedness

f. Unpaid taxes

g. Casualty losses

2. Property Previously Taxed or Vanishing Deduction

3. Transfer for public use

4. Family Home

5. Standard deduction equivalent to P1,000,000.

6. Medical expenses

7. Amount received by the heirs under R.A. 4917

8. One-half net share of the surviving spouse in the conjugal partnership property

Gross Conjugal Estate-Charges against such conjugal estate=Net conjugal estate

Net Conjugal Estate/2= Net Share of Surviving Spouse

You might also like

- Table - Property RegimesDocument17 pagesTable - Property RegimesEamydnic Yap0% (1)

- Synthesis Outline + Essay TemplateDocument7 pagesSynthesis Outline + Essay TemplatefirdausNo ratings yet

- Chapter 6 StressDocument9 pagesChapter 6 StressSiti Sarah Zalikha Binti Umar BakiNo ratings yet

- Matrix of Property RegimeDocument4 pagesMatrix of Property RegimeVince Llamazares Lupango67% (3)

- TRANSFER TAX, Estate Tax 2Document9 pagesTRANSFER TAX, Estate Tax 2JunivenReyUmadhayNo ratings yet

- Tax2 Property RelationshipDocument28 pagesTax2 Property RelationshipMaine JavierNo ratings yet

- Absolute Community of Property vs. Conjugal Partnership of GainsDocument7 pagesAbsolute Community of Property vs. Conjugal Partnership of GainsJill LeaNo ratings yet

- Conjugal Partnership of GainsDocument7 pagesConjugal Partnership of GainsKnotsNautischeMeilenproStundeNo ratings yet

- Chapter 5 Gross Estate TaxDocument10 pagesChapter 5 Gross Estate TaxJohn Dominic Bobis ArtiagaNo ratings yet

- Research Work 2Document8 pagesResearch Work 2Marc CosepNo ratings yet

- Property Relationship Between SpousesDocument39 pagesProperty Relationship Between SpousesAlmeera KalidNo ratings yet

- Conjugal Partnership of GainsDocument15 pagesConjugal Partnership of GainsCGNo ratings yet

- Conjugal Partnership of GainsDocument10 pagesConjugal Partnership of GainsMikee RañolaNo ratings yet

- The Law On CONJUGAL PARTNERSHIP of GAINS of Properties in Simple Terms Shall Be Like ThisDocument6 pagesThe Law On CONJUGAL PARTNERSHIP of GAINS of Properties in Simple Terms Shall Be Like ThisfirstNo ratings yet

- Property Relations - Business & Transfer TaxesDocument16 pagesProperty Relations - Business & Transfer Taxescabangon sNo ratings yet

- The Conjugal Partnership of GainsDocument9 pagesThe Conjugal Partnership of GainsRyoNo ratings yet

- Tax 02-Lesson 04 - Property RelationsDocument27 pagesTax 02-Lesson 04 - Property RelationsMama MiyaNo ratings yet

- Matrix of Property RegimeDocument10 pagesMatrix of Property Regimealyssamaesana100% (4)

- Conjugal Partnership of Gains and Absolute Community of PropertyDocument1 pageConjugal Partnership of Gains and Absolute Community of PropertyRence Santos DabuNo ratings yet

- "Acquired by Right of Redemption" - Whoever Had The Rights Gets The Property Redeemed. The Source of Money Is Not ImportantDocument2 pages"Acquired by Right of Redemption" - Whoever Had The Rights Gets The Property Redeemed. The Source of Money Is Not ImportantM A J esty FalconNo ratings yet

- Acp V CPGDocument3 pagesAcp V CPGBenitez GheroldNo ratings yet

- Acp VS CPGDocument2 pagesAcp VS CPGNina NatividadNo ratings yet

- CPG Section 3 and Section 4Document8 pagesCPG Section 3 and Section 4Via Rhidda ImperialNo ratings yet

- Absolute Community - Conjugal Partnership of GainsDocument7 pagesAbsolute Community - Conjugal Partnership of GainsCris CalumbaNo ratings yet

- Distinction Between Absolute Community Property (Acp) and Conjugal Property of Gains (CPG)Document6 pagesDistinction Between Absolute Community Property (Acp) and Conjugal Property of Gains (CPG)Danielle Gumpad DolipasNo ratings yet

- BusTax - Chapter 4 MODULEDocument7 pagesBusTax - Chapter 4 MODULETimon CarandangNo ratings yet

- Conjugal PropertyDocument3 pagesConjugal PropertyMa Terresa TejadaNo ratings yet

- Regime of Separation of PropertyDocument4 pagesRegime of Separation of PropertyNoreen DelizoNo ratings yet

- 6 Gls Civil Law Review I Family Code PPP 6 Property Relations Part 2 Updated 14 October 2022Document47 pages6 Gls Civil Law Review I Family Code PPP 6 Property Relations Part 2 Updated 14 October 2022Ralph TiempoNo ratings yet

- ALEITHEIA - Persons and Family Relations Tables (Sta. Maria)Document8 pagesALEITHEIA - Persons and Family Relations Tables (Sta. Maria)adrixulet100% (1)

- Encumbrance Shall Be Valid. in Case of Foreclosure of TheDocument7 pagesEncumbrance Shall Be Valid. in Case of Foreclosure of TheChristy Tiu-FuaNo ratings yet

- Estate Tax PDFDocument35 pagesEstate Tax PDFRhea Mae Sa-onoyNo ratings yet

- Absolute Vs Conjugal Leg ResearchDocument10 pagesAbsolute Vs Conjugal Leg ResearchJeric ReiNo ratings yet

- Persons Table PDFDocument4 pagesPersons Table PDFAyra ArcillaNo ratings yet

- 606Document2 pages606Raynamae SalayaNo ratings yet

- Tax On Sale Exchange of Real PropertyDocument7 pagesTax On Sale Exchange of Real PropertyJudith Dela CruzNo ratings yet

- Property Relations and Donor's TaxDocument5 pagesProperty Relations and Donor's TaxjenNo ratings yet

- When It Is Agreed Upon The - When MS Is Not Executed - When The Regime of MSDocument2 pagesWhen It Is Agreed Upon The - When MS Is Not Executed - When The Regime of MSAlex M TabuacNo ratings yet

- Absolute Community of Property Conjugal Partnership of GainsDocument3 pagesAbsolute Community of Property Conjugal Partnership of GainsAleli Joyce BucuNo ratings yet

- Conjugal Partnership of GainsDocument2 pagesConjugal Partnership of GainsRomeo Obias Jr.No ratings yet

- Persons OutlineDocument12 pagesPersons OutlineMark Anthony ManuelNo ratings yet

- Appendix B - Property RegimesDocument2 pagesAppendix B - Property Regimesjade123_129No ratings yet

- Property RegimesDocument105 pagesProperty RegimesJet Ortiz100% (1)

- Estate TaxDocument5 pagesEstate Taxericamaecarpila0520No ratings yet

- Conjugal Partnership of GainsDocument7 pagesConjugal Partnership of Gainssheshe gamiaoNo ratings yet

- Conjugal Partnership of GainsDocument3 pagesConjugal Partnership of Gainskfv05No ratings yet

- Tax - Estate Tax MarriageDocument3 pagesTax - Estate Tax MarriageLouiseNo ratings yet

- PFR Table of Property RegimeDocument9 pagesPFR Table of Property RegimeKara Russanne Dawang Alawas100% (1)

- Conjugal Partnership of GainsDocument34 pagesConjugal Partnership of GainsDemi LewkNo ratings yet

- Transfer Taxes Estate Tax: Atty. JRS Umadhay's Tax ReviewerDocument9 pagesTransfer Taxes Estate Tax: Atty. JRS Umadhay's Tax ReviewerJunivenReyUmadhayNo ratings yet

- When Apply?: Difference of Conjugal Partnership From The System of Absolute CommunityDocument11 pagesWhen Apply?: Difference of Conjugal Partnership From The System of Absolute CommunityMemey C.No ratings yet

- Property Regimes TableDocument5 pagesProperty Regimes TableMa. Cheriña DionisioNo ratings yet

- Persons Acp CPGDocument13 pagesPersons Acp CPGkimuchosNo ratings yet

- Deductions From Gross EstateDocument3 pagesDeductions From Gross EstateMarc Eric Redondo100% (5)

- Property Regime TableDocument10 pagesProperty Regime TableYubert ViosNo ratings yet

- CHAPTER 7 Conjugal PartnershipDocument15 pagesCHAPTER 7 Conjugal PartnershipClaire BarbaNo ratings yet

- Find Your Freedom: Financial Planning for a Life on PurposeFrom EverandFind Your Freedom: Financial Planning for a Life on PurposeRating: 5 out of 5 stars5/5 (1)

- Module-1 GovtAcctgDocument8 pagesModule-1 GovtAcctgKrestyl Ann GabaldaNo ratings yet

- Article 1176-1185 FinalDocument37 pagesArticle 1176-1185 FinalKrestyl Ann Gabalda100% (1)

- Chips Not DoneDocument42 pagesChips Not DoneKrestyl Ann GabaldaNo ratings yet

- Rizal Place in Dapitan (Group 5)Document5 pagesRizal Place in Dapitan (Group 5)Krestyl Ann GabaldaNo ratings yet

- Bag o Na ChipsDocument45 pagesBag o Na ChipsKrestyl Ann GabaldaNo ratings yet

- Forms of Business Organization Learning ObjectivesDocument5 pagesForms of Business Organization Learning ObjectivesKrestyl Ann GabaldaNo ratings yet

- Parcor QuizbowlDocument38 pagesParcor QuizbowlKrestyl Ann GabaldaNo ratings yet

- Conceptual Framework and Accounting StandardsDocument4 pagesConceptual Framework and Accounting StandardsKrestyl Ann GabaldaNo ratings yet

- Cost AccountingDocument64 pagesCost AccountingKrestyl Ann GabaldaNo ratings yet

- Rizal Long QuizDocument2 pagesRizal Long QuizKrestyl Ann GabaldaNo ratings yet

- Activity With Youtube Video Shareholders Equity Part 1Document2 pagesActivity With Youtube Video Shareholders Equity Part 1Krestyl Ann GabaldaNo ratings yet

- Students Perception Towards Digital Payment System-A Study With A Special Reference To Mangalore UniversityDocument20 pagesStudents Perception Towards Digital Payment System-A Study With A Special Reference To Mangalore UniversityKrestyl Ann GabaldaNo ratings yet

- Accounting Research Method ACCTG 322 Jhoelyn MaguadDocument3 pagesAccounting Research Method ACCTG 322 Jhoelyn MaguadKrestyl Ann GabaldaNo ratings yet

- Tak - An NakoDocument30 pagesTak - An NakoKrestyl Ann GabaldaNo ratings yet

- PIS 2019 With VATDocument19 pagesPIS 2019 With VATKrestyl Ann GabaldaNo ratings yet

- HNDIT 1022 Web Design - New-PaperDocument6 pagesHNDIT 1022 Web Design - New-Paperravinduashan66No ratings yet

- Prop Design PacketDocument8 pagesProp Design Packetapi-236024657No ratings yet

- New Hardcore 3 Month Workout PlanDocument3 pagesNew Hardcore 3 Month Workout PlanCarmen Gonzalez LopezNo ratings yet

- PhysioEx Exercise 1 Activity 4Document3 pagesPhysioEx Exercise 1 Activity 4CLAUDIA ELISABET BECERRA GONZALESNo ratings yet

- LH - Elementary - Student's Book Answer KeyDocument34 pagesLH - Elementary - Student's Book Answer KeyАнастасия ДанилюкNo ratings yet

- History of The Stanford Watershed Model PDFDocument3 pagesHistory of The Stanford Watershed Model PDFchindy adsariaNo ratings yet

- SBC Code 301Document360 pagesSBC Code 301mennnamohsen81No ratings yet

- A Kinsha 2013Document698 pagesA Kinsha 2013alexander2beshkovNo ratings yet

- Al Ajurumiyah Hamzayusuf - TextDocument46 pagesAl Ajurumiyah Hamzayusuf - TextBest channelNo ratings yet

- Stacey Dunlap ResumeDocument3 pagesStacey Dunlap ResumestaceysdunlapNo ratings yet

- Shaping The Way We Teach English:: Successful Practices Around The WorldDocument5 pagesShaping The Way We Teach English:: Successful Practices Around The WorldCristina DiaconuNo ratings yet

- Birinci Pozisyon Notalar Ve IsimleriDocument3 pagesBirinci Pozisyon Notalar Ve IsimleriEmre KözNo ratings yet

- The Quiescent Benefits and Drawbacks of Coffee IntakeDocument6 pagesThe Quiescent Benefits and Drawbacks of Coffee IntakeVikram Singh ChauhanNo ratings yet

- Teacher Newsletter TemplateDocument1 pageTeacher Newsletter TemplateHart LJNo ratings yet

- Alaina Dauscher - Career Journal #01Document2 pagesAlaina Dauscher - Career Journal #01Alaina DauscherNo ratings yet

- Operational Framework of Community Organizing ProcessDocument18 pagesOperational Framework of Community Organizing ProcessJan Paul Salud LugtuNo ratings yet

- Vii-Philosophy of HPERD & SportsDocument4 pagesVii-Philosophy of HPERD & SportsAnonymous hHT0iOyQAz100% (1)

- Commuter Crossword Puzzles UpdatedDocument3 pagesCommuter Crossword Puzzles UpdatedChidinma UwadiaeNo ratings yet

- Emcee Script For Kindergarten Recognition (English) - 085301Document3 pagesEmcee Script For Kindergarten Recognition (English) - 085301Felinda ConopioNo ratings yet

- Free Online Course On PLS-SEM Using SmartPLS 3.0 - Moderator and MGADocument31 pagesFree Online Course On PLS-SEM Using SmartPLS 3.0 - Moderator and MGAAmit AgrawalNo ratings yet

- Design and Synthesis of Zinc (Ii) Complexes With Schiff Base Derived From 6-Aminopenicillanic Acid and Heterocyclic AldehydesDocument6 pagesDesign and Synthesis of Zinc (Ii) Complexes With Schiff Base Derived From 6-Aminopenicillanic Acid and Heterocyclic AldehydesIJAR JOURNALNo ratings yet

- The Law On Obligations and Contracts (Notes From Youtube) - PrelimDocument36 pagesThe Law On Obligations and Contracts (Notes From Youtube) - PrelimGwyneth ArabelaNo ratings yet

- HCI634K - Technical Data SheetDocument8 pagesHCI634K - Technical Data SheetQuynhNo ratings yet

- Unit 14 - Unemployment and Fiscal Policy - 1.0Document41 pagesUnit 14 - Unemployment and Fiscal Policy - 1.0Georgius Yeremia CandraNo ratings yet

- Babst Vs CA PDFDocument17 pagesBabst Vs CA PDFJustin YañezNo ratings yet

- Edo Mite GenealogiesDocument23 pagesEdo Mite GenealogiesPeace Matasavaii LeifiNo ratings yet

- Company Feasibility StudyDocument21 pagesCompany Feasibility StudyDesiree Raot RaotNo ratings yet

- Bac 1624 - ObeDocument4 pagesBac 1624 - ObeAmiee Laa PulokNo ratings yet