Professional Documents

Culture Documents

Standard Costs For Control: Direct Material and Direct Labour

Standard Costs For Control: Direct Material and Direct Labour

Uploaded by

Thương Đỗ0 ratings0% found this document useful (0 votes)

5 views33 pagesádf

Original Title

LangfieldSmith7e_PPT_ch10

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentádf

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

5 views33 pagesStandard Costs For Control: Direct Material and Direct Labour

Standard Costs For Control: Direct Material and Direct Labour

Uploaded by

Thương Đỗádf

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 33

Chapter 10

Standard costs for control:

direct material and direct

labour

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-1

Outline

• Controlling costs

• Setting standards

• Calculating standard cost variances

• Investigating significant variances

• Cost control through assigning responsibility

• Standard costing and behaviour

• Standard costs for product costing

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-2

Controlling costs

• Businesses are ‘in control’ when

operations plan and achieve objectives

• Control systems provide regular

information to assist in control

• Necessary requirements for control

– A predetermined performance level

– A measure of actual performance

– A comparison between standard

performance and actual performance (cont.)

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-3

Control systems: a thermostat

If the actual temperature rises above the preset or standard

temperature, the thermostat activates the cooling mechanism to

bring the temperature back to 22°C

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-4

Standard costing

• Standard costing is a part of the

budgetary control system

– A predetermined or standard cost is

developed

– The actual cost incurred in the

product process is measured

– The actual cost is compared to the

standard cost to determine a standard

cost variance

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-5

Standard cost variances

• Used to evaluate actual performance

and control costs

• Standard costs can be developed for

direct material, direct labour and

overheads

• When cost variances are significant the

cause of the variance must be

investigated

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-6

Setting standards

• A variety of methods may be used to

set cost standards

− Analysis of historical data

− Engineering methods

• Participation by managers/employees

in standard setting may lead to greater

commitment to meeting those

standards

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-7

Analysis of historical data

• May provide a good basis for predicting

future costs

• Often need to adjust predictions to

reflect price or technological changes

• Minor changes can make historical

costs irrelevant

• Historical costs may embody past

inefficiencies

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-8

Engineering methods

• The focus is on what the product should

cost in the future

– How much material should be required and

how much direct labour should be used

– Time and motion studies can determine

how long each step in a production

process should take

• In practice, both historical cost analysis

and engineering methods may be used

together

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-9

Perfection standards

• Reflect minimum attainable costs under

nearly perfect operating conditions

– Assumes peak efficiency, the lowest material

and labour prices, the use of the best quality

materials and no production disruptions

• Motivational impact?

– Motivation to achieve lowest cost possible

– May discourage employees from working hard

as standards unlikely to be achieved

– May encourage employees to sacrifice

product quality to achieve low costs

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-10

Practical standards

• Practical standards are the minimum

attainable costs under normal operating

conditions

− allowances made for downtime and wastage

• Motivational impact?

– May encourage more positive attitudes

towards targets

– May encourage inefficiency and waste

– Can build continuous improvement into

standards to make them more demanding

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-11

Benchmarking of costs

• May involve:

– Identifying companies that have the best

cost performance

– Assessing their level of costs

– Identifying the cost performance gap

• Identifies areas needing to improve cost

performance

• Cost standards may be formulated to

achieve external performance standards

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-12

Direct material standards

• Standard material quantity

– The total amount of direct material

required to produce one unit of product

• Standard material price

– The total delivered cost of direct material

required to produce one unit of product

– Based on ordering a certain quality of

material in specific order quantities from a

specified supplier

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-13

Direct labour standards

• Standard direct labour

– The number of labour hours normally

needed to manufacture one unit of product

• Standard labour rate

– The total hourly cost of wages, including

on-costs

On-costs are extra salary-related costs that all

companies have to pay and are usually treated

as part of the cost of labour

(cont.)

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-14

Direct labour standards

Actual costs for moleskin pants

R.M. Williams, September

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-15

Standard costs given

actual output

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-16

Direct material variances

• Direct material price variance

– A measure of the effect on cost of

purchasing at a price that is different

from standard

= PQ(AP – SP)

where PQ = quantity purchased

AP = actual price

SP = standard price

(cont.)

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-17

Direct material variances (cont.)

• Direct material quantity variance

– A measure of the effect on cost of using a

different quantity of material in production

compared with the standard quantity that

should have been used

= SP(AQ – SQ)

where SP = standard price

AQ = actual quantity used

SQ = standard quantity used,

given actual output

(cont.)

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-18

Direct material variances (cont.)

• Direct material price variance can be

calculated using the quantity of

materials used in production (AQ)

rather than the quantity of materials

purchased (PQ)

= AQ(AP – SP)

where AQ = actual quantity of material

used in production

AP = actual price

(cont.)

SP = standard price

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-19

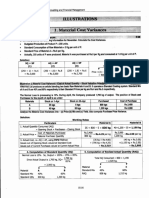

Direct material price and quantity

variances, R.M. Williams

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-20

Direct labour variances

• Direct labour rate variance

– A measure of the effect on cost of paying a

different labour rate, compared with

standard

= AH(AR – SR)

where AH = actual hours used

AR = actual rate per hour

SR = standard rate per hour

(cont.)

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-21

Direct labour variances (cont.)

• Direct labour efficiency variance

– The effect on cost of using a different

number of direct labour hours, compared

with the standard hours that should have

been used for the actual production output

= SR(AH – SH)

where AH = actual hours used

SH = standard hours allowed,

given actual output

SR = standard rate per hour

(cont.)

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-22

Direct labour rate and efficiency

variances, R.M. Williams

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-23

Investigating significant

variances

• Management by exception

– Only significant cost variances are

reported and investigated

• Which variances are significant?

– Size of variance

– Recurring variances

– Trends

– Controllability of the variance (cont.)

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-24

Investigating significant

variances (cont.)

• Favourable and unfavourable variances

warrant similar investigation

– May reveal efficiencies and new improved

practices

– May mean that the standard is too loose

• Investigating variances may include

– Talking with managers and employees

– Writing reports to explain variances and

recommend corrective actions

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-25

A statistical approach to

variance investigation

• There may be many reasons for standard

cost variances

• May be caused by random fluctuations

which may not require correction

• Statistical control charts plot standard

cost variances across time and compare

them with a critical value

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-26

Statistical control chart for direct

labour efficiency variance,

R.M. Williams, January to June

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-27

Costs and benefits of

investigation

• Costs include

– Time spent investigating the problem

– Disruption to the production process

– Cost of implementing corrective actions

• Benefits may include

– Reduced costs if the cause of the variance is

eliminated

– Improved work practices

• Management skills and experience allows

managers to weigh up these considerations

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-28

Cost control through

assigning responsibility

• Cost control is accomplished through the

efforts of individual managers and employees

• Managers are held responsible for achieving

certain cost standards

• Interactions between variances make it

difficult to assign responsibility

– Not all favourable variances are desirable

– Unfavourable variances do not always indicate a

problem

– Source of the variance may lie elsewhere

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-29

Standard costing and behaviour

• Standards should not be set by

management accountants alone

– Not experts in areas such as material usage

and labour rates

– Managers may have better working

knowledge

– Managers controlling processes should

participate in settings standards

• Behavioural response to incentives

– Negative and positive responses

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-30

Standard costs for product costing

• Standard costing system

– All inventories are recorded at standard

cost

• Variances are closed off at the end of

the accounting period

– To cost of goods sold expense

– Prorate variances between work in process

inventory, finished goods inventory and cost

of goods sold

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-31

Flow of costs through

manufacturing accounts

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-32

Summary

• Standard costing systems can be

used for cost control

• Cost variances can be calculated for

direct material and direct labour

• Decision rules will guide which cost

variances need to be investigated

• Variance reporting can form part of a

responsibility accounting system

• Standard costs can be used for

external reporting purposes

Copyright © 2015 McGraw-Hill Education (Australia) Pty Ltd

Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7e 10-33

You might also like

- Group 13 Harsh Electricals COGS Exercise and BEPDocument12 pagesGroup 13 Harsh Electricals COGS Exercise and BEPShoaib100% (3)

- Chapter 18 TestbankDocument44 pagesChapter 18 TestbankHuu LuatNo ratings yet

- Introduction To Business Processes: Multiple Choice QuestionsDocument162 pagesIntroduction To Business Processes: Multiple Choice QuestionsHuu Luat100% (1)

- Cost Management: Don R. Hansen Maryanne M. MowenDocument80 pagesCost Management: Don R. Hansen Maryanne M. MowenNurul Meutia SalsabilaNo ratings yet

- E7-39 Comparing ABC and Plantwide Overhead Cost Assigments: Setup Hours Oven HoursDocument3 pagesE7-39 Comparing ABC and Plantwide Overhead Cost Assigments: Setup Hours Oven HoursDhiva Rianitha Manurung100% (1)

- Standard Costs For Control: Flexible Budgets and Manufacturing OverheadDocument29 pagesStandard Costs For Control: Flexible Budgets and Manufacturing OverheadHuu LuatNo ratings yet

- Standard Costs For Control: Flexible Budgets and Manufacturing OverheadDocument29 pagesStandard Costs For Control: Flexible Budgets and Manufacturing OverheadThương ĐỗNo ratings yet

- A Closer Look at Overhead Costs: Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7eDocument32 pagesA Closer Look at Overhead Costs: Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7eBành Đức HảiNo ratings yet

- LangfieldSmith7e PPT ch02Document29 pagesLangfieldSmith7e PPT ch02Thanh UyênNo ratings yet

- Activity-Based Costing: Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7eDocument33 pagesActivity-Based Costing: Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7eThương ĐỗNo ratings yet

- CH 04Document33 pagesCH 04Phát TNNo ratings yet

- Chapter 7 A Closer Look at OverheadsDocument32 pagesChapter 7 A Closer Look at OverheadsNeha BegumNo ratings yet

- CH 03Document37 pagesCH 03Phát TN0% (1)

- LangfieldSmith7e PPT ch20Document33 pagesLangfieldSmith7e PPT ch20Hằng Ngô Thị ThuNo ratings yet

- LangfieldSmith7e PPT ch15Document32 pagesLangfieldSmith7e PPT ch15Hằng Ngô Thị ThuNo ratings yet

- LangfieldSmith7e PPT ch16Document36 pagesLangfieldSmith7e PPT ch16Hằng Ngô Thị ThuNo ratings yet

- Cost Volume Profit Analysis: Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7eDocument28 pagesCost Volume Profit Analysis: Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7eTuyen ThanhNo ratings yet

- Session 2 - CHPT 2Document30 pagesSession 2 - CHPT 2Amina Omar AliNo ratings yet

- Financial Performance Reports and Transfer Pricing: Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7eDocument31 pagesFinancial Performance Reports and Transfer Pricing: Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7eBành Đức HảiNo ratings yet

- Chapter 20Document35 pagesChapter 20Ira MalaNo ratings yet

- CH 19Document30 pagesCH 19Phát TNNo ratings yet

- Standard Costing PDFDocument143 pagesStandard Costing PDFYsabelle VillavicencioNo ratings yet

- Topic 2 Management Accounting: Cost Terms and Concepts: Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7eDocument63 pagesTopic 2 Management Accounting: Cost Terms and Concepts: Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7eAtif Hazim100% (1)

- LangfieldSmith7e PPT Ch13Document33 pagesLangfieldSmith7e PPT Ch13Bành Đức HảiNo ratings yet

- LangfieldSmith7e PPT ch13Document33 pagesLangfieldSmith7e PPT ch13Hằng Ngô Thị ThuNo ratings yet

- LangfieldSmith7e PPT ch14Document29 pagesLangfieldSmith7e PPT ch14Hằng Ngô Thị ThuNo ratings yet

- Management Accounting: Information For Creating Value and Managing ResourcesDocument34 pagesManagement Accounting: Information For Creating Value and Managing ResourcesMuhdTaQiuNo ratings yet

- Session 2 - CHPT 3Document17 pagesSession 2 - CHPT 3Amina Omar AliNo ratings yet

- LangfieldSmith7e PPT ch21Document36 pagesLangfieldSmith7e PPT ch21Hằng Ngô Thị ThuNo ratings yet

- Budgeting Systems: Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7eDocument42 pagesBudgeting Systems: Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7ePhát TNNo ratings yet

- 3 - Hansen - CH 4.ppt-Dikonversi PDFDocument80 pages3 - Hansen - CH 4.ppt-Dikonversi PDFRamaNo ratings yet

- W 10 Pricing DecisionsDocument25 pagesW 10 Pricing DecisionsTalha GillNo ratings yet

- Contemporary Approaches To Measuring and Managing PerformanceDocument30 pagesContemporary Approaches To Measuring and Managing PerformancePrakash K100% (2)

- Chapter 10 SolutionsDocument68 pagesChapter 10 SolutionsMasha LankNo ratings yet

- A Closer Look at Overhead CostsDocument5 pagesA Closer Look at Overhead CostsDung NguyenNo ratings yet

- Chapter 4 CostDocument40 pagesChapter 4 CostYoussif YassinNo ratings yet

- Manager and Accounting For ManagerDocument35 pagesManager and Accounting For ManagerrhagitaanggyNo ratings yet

- LangfieldSmith7e PPT ch19Document30 pagesLangfieldSmith7e PPT ch19Hằng Ngô Thị ThuNo ratings yet

- GE PPT Ch13 Lecture 2 Pricing Decisions & Cost ControlDocument53 pagesGE PPT Ch13 Lecture 2 Pricing Decisions & Cost ControlZoe Chan100% (1)

- Chapter 2 - Cost TermsDocument35 pagesChapter 2 - Cost TermsCarina Carollo MalinaoNo ratings yet

- Budgeting Systems: Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7eDocument32 pagesBudgeting Systems: Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7eHuu LuatNo ratings yet

- Chap 008Document90 pagesChap 008Adam OngNo ratings yet

- Chapter 10 - Standard Costs and The Balance ScorecardDocument101 pagesChapter 10 - Standard Costs and The Balance ScorecardAmy SIlverbergNo ratings yet

- 1-2 Cost Terms & PurposesDocument35 pages1-2 Cost Terms & PurposesCheng ChengNo ratings yet

- Chapters 8 and 9: Capital Budgeting: Ppts To Accompany Fundamentals of Corporate Finance 6E by Ross Et AlDocument42 pagesChapters 8 and 9: Capital Budgeting: Ppts To Accompany Fundamentals of Corporate Finance 6E by Ross Et AlAbel100% (1)

- An Introduction To Cost Terms and Purposes: © 2009 Pearson Prentice Hall. All Rights ReservedDocument30 pagesAn Introduction To Cost Terms and Purposes: © 2009 Pearson Prentice Hall. All Rights ReservednishulalwaniNo ratings yet

- GE Hca15 PPT ch02Document35 pagesGE Hca15 PPT ch02kkNo ratings yet

- Job CostingDocument68 pagesJob CostingIsauro Treviño PerezNo ratings yet

- LangfieldSmith7e PPT ch14Document29 pagesLangfieldSmith7e PPT ch14Nguyễn Mạnh QuânNo ratings yet

- Standard Costs and VariancesDocument103 pagesStandard Costs and VariancesMingmiin TeohNo ratings yet

- GNBCY Chap12 Standard Costs and Variances With Cover PageDocument110 pagesGNBCY Chap12 Standard Costs and Variances With Cover PageNang Kit SzeNo ratings yet

- Resources and Trade: The Heckscher-Ohlin Model: Eleventh EditionDocument24 pagesResources and Trade: The Heckscher-Ohlin Model: Eleventh EditionJonny FalentinoNo ratings yet

- Cost and Management AccountingDocument12 pagesCost and Management Accountingneha chodryNo ratings yet

- Standard Costing, Operational Performance Measures, and The Balanced ScorecardDocument69 pagesStandard Costing, Operational Performance Measures, and The Balanced ScorecardAcmad RedhoNo ratings yet

- Cost Accounting: Sixteenth Edition, Global EditionDocument34 pagesCost Accounting: Sixteenth Edition, Global EditionRania barabaNo ratings yet

- Ch. 4 Job-Order CostingDocument39 pagesCh. 4 Job-Order CostingdhfbbbbbbbbbbbbbbbbbhNo ratings yet

- © 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenDocument110 pages© 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenVahrul DavidNo ratings yet

- Variances - 6.1.23Document8 pagesVariances - 6.1.23Ejaz AhmadNo ratings yet

- Standard CostsDocument23 pagesStandard CostsZoya KhanNo ratings yet

- LN12 Keown33019306 08 LN12 GEDocument87 pagesLN12 Keown33019306 08 LN12 GEEnny HaryantiNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- How to Enhance Productivity Under Cost Control, Quality Control as Well as Time, in a Private or Public OrganizationFrom EverandHow to Enhance Productivity Under Cost Control, Quality Control as Well as Time, in a Private or Public OrganizationNo ratings yet

- Identifying Mura-Muri-Muda in the Manufacturing Stream: Toyota Production System ConceptsFrom EverandIdentifying Mura-Muri-Muda in the Manufacturing Stream: Toyota Production System ConceptsRating: 5 out of 5 stars5/5 (1)

- This Study Resource Was: Chapter 04 TestbankDocument4 pagesThis Study Resource Was: Chapter 04 TestbankHuu LuatNo ratings yet

- Test Bank 1Document3 pagesTest Bank 1Huu LuatNo ratings yet

- Process Costing EgDocument8 pagesProcess Costing EgHuu LuatNo ratings yet

- Test Bank 2Document7 pagesTest Bank 2Huu LuatNo ratings yet

- Budgeting Systems: Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7eDocument32 pagesBudgeting Systems: Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7eHuu LuatNo ratings yet

- Standard Costs For Control: Flexible Budgets and Manufacturing OverheadDocument29 pagesStandard Costs For Control: Flexible Budgets and Manufacturing OverheadHuu LuatNo ratings yet

- General Journal Date Account Titles and Explanation Debit CreditDocument17 pagesGeneral Journal Date Account Titles and Explanation Debit CreditHuu LuatNo ratings yet

- Net Income 38000 Non Cash ItemsDocument8 pagesNet Income 38000 Non Cash ItemsHuu LuatNo ratings yet

- Advanced Cases For Cfs - Testbank Case 1: 905,410 Tax Paid (Cash Payment) 2 Interest Paid (Cash Payments) 3Document10 pagesAdvanced Cases For Cfs - Testbank Case 1: 905,410 Tax Paid (Cash Payment) 2 Interest Paid (Cash Payments) 3Huu LuatNo ratings yet

- Opening Trial Balance Debit CreditDocument41 pagesOpening Trial Balance Debit CreditHuu LuatNo ratings yet

- Budgets MCQ - S - Past Exam QuestionsDocument24 pagesBudgets MCQ - S - Past Exam QuestionsAadhitya NarayananNo ratings yet

- Marginal CostingDocument22 pagesMarginal CostingbelladoNo ratings yet

- Essay AAS Supporting StatementsDocument2 pagesEssay AAS Supporting StatementsMartinho Savio Gonzaga SarmentoNo ratings yet

- Question 1Document8 pagesQuestion 1pjama2012No ratings yet

- Standard Costing and Variances - Questions For CAF-08Document19 pagesStandard Costing and Variances - Questions For CAF-08fareha riazNo ratings yet

- Mamun Act 360Document40 pagesMamun Act 360JUBAIR AHMEDNo ratings yet

- G5 - Case Study B2 IncDocument14 pagesG5 - Case Study B2 IncredbeardqtNo ratings yet

- Assignment - Standard Costing & Variance Analysis - PECASALESDocument4 pagesAssignment - Standard Costing & Variance Analysis - PECASALESMhekylha's AñepoNo ratings yet

- Systems Design: Process Costing: Chapter FourDocument73 pagesSystems Design: Process Costing: Chapter FourBS StudioNo ratings yet

- Case Study - LCL Costing & Decision Making - AnalysisDocument14 pagesCase Study - LCL Costing & Decision Making - AnalysisRavina SinghNo ratings yet

- Factory OverheadDocument7 pagesFactory OverheadRishab Jain 2027203No ratings yet

- Module 2 QuizDocument6 pagesModule 2 QuizjmjsoriaNo ratings yet

- Topic Outline For Topic 1 Introduction To Cost Accounting and Cost Information SystemsDocument9 pagesTopic Outline For Topic 1 Introduction To Cost Accounting and Cost Information SystemsJuliana BalbuenaNo ratings yet

- Process Costing Standard CostingDocument4 pagesProcess Costing Standard CostingNikki GarciaNo ratings yet

- MAS-05 Variable and Absorption CostingDocument8 pagesMAS-05 Variable and Absorption CostingKrizza MaeNo ratings yet

- BPP Price ListDocument3 pagesBPP Price Listuni3467173No ratings yet

- CV Template 0016Document1 pageCV Template 0016Amr mfaNo ratings yet

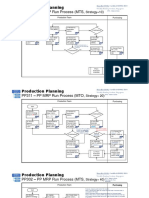

- PP301 - PP MRP Run Process (MTS,) : Production PlanningDocument6 pagesPP301 - PP MRP Run Process (MTS,) : Production Planningdnsptra_580883023No ratings yet

- Textbook Fair 1st Semester AY2017-18Document36 pagesTextbook Fair 1st Semester AY2017-18Ming Leung CHEUNGNo ratings yet

- Application of Derivative in Commerce and EconomicsDocument2 pagesApplication of Derivative in Commerce and EconomicsRohan SarafNo ratings yet

- Cost Systems: TermsDocument19 pagesCost Systems: TermsJames BarzoNo ratings yet

- Chap.13 Guerrero Job Order CostingDocument40 pagesChap.13 Guerrero Job Order CostingGeoff MacarateNo ratings yet

- Final Term Quiz 2 On Cost of Production Report - Average CostingDocument4 pagesFinal Term Quiz 2 On Cost of Production Report - Average CostingYhenuel Josh LucasNo ratings yet

- CVP - WWW - Ffqacca.co - CCDocument7 pagesCVP - WWW - Ffqacca.co - CCxxxfarahxxx100% (1)

- Module 1 Introduction To Managerial AccountingDocument30 pagesModule 1 Introduction To Managerial AccountingSophia Nichole ReconNo ratings yet

- Short and Comprehensive ProblemsDocument3 pagesShort and Comprehensive ProblemsAl-Ameen P. MacabaningNo ratings yet

- Standard CostingDocument23 pagesStandard CostingSiddhartha SharmaNo ratings yet

- Cash-In & Cash-Out (CashFlow CY2020)Document50 pagesCash-In & Cash-Out (CashFlow CY2020)Peter Fritz BoholstNo ratings yet