Professional Documents

Culture Documents

TAX Lecture 5-A Gross Income Inclusions

TAX Lecture 5-A Gross Income Inclusions

Uploaded by

Gabriel Gonzales0 ratings0% found this document useful (0 votes)

2 views26 pagesThe document defines gross income and exclusions from gross income for income tax purposes. It discusses different types of income like salaries, dividends, capital gains, and losses. It provides examples of determining taxable income for individuals and corporations based on ordinary income and capital gains or losses depending on how long assets are held. The treatment of capital gains and losses differs for individuals versus corporations. Net capital losses can be carried over to future years.

Original Description:

Original Title

TAX Lecture 5-A Gross Income Inclusions_3c98fcda99e699d3d4c281ce472db0ae

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document defines gross income and exclusions from gross income for income tax purposes. It discusses different types of income like salaries, dividends, capital gains, and losses. It provides examples of determining taxable income for individuals and corporations based on ordinary income and capital gains or losses depending on how long assets are held. The treatment of capital gains and losses differs for individuals versus corporations. Net capital losses can be carried over to future years.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views26 pagesTAX Lecture 5-A Gross Income Inclusions

TAX Lecture 5-A Gross Income Inclusions

Uploaded by

Gabriel GonzalesThe document defines gross income and exclusions from gross income for income tax purposes. It discusses different types of income like salaries, dividends, capital gains, and losses. It provides examples of determining taxable income for individuals and corporations based on ordinary income and capital gains or losses depending on how long assets are held. The treatment of capital gains and losses differs for individuals versus corporations. Net capital losses can be carried over to future years.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 26

GROSS INCOME :

INCLUSIONS AND

EXCLUSIONS/

ORDINARY AND CAPITAL

GAINS & LOSSES

By: Prof. Anita B. Catolico

For Income Tax Purposes:

INCOME – defined as the gain derived from

capital, from labor, or from both, provided it be

understood to include profit or gain through a sale

of an asset.

Income:

Interestor Dividend - from capital

Salaries or Commissions – from labor

Income of a building contractor – from capital and

labor

Sale of property with a cost of P100,000 for

P120,000 – Income from gain on sale of P20,000.

Gross Income means all Income from

whatever Source

A. Compensation

B. From business or exercise of profession

C. Gains from sale of property

D. Interests

E. Rents

F. Royalties

G. Dividends

H. Prizes and Winnings

I. Pensions

K. Partner’s distributive share from the net income

of the general professional partnership

EXCLUSIONS FROM GROSS

INCOME UNDER THE REVENUE

CODE:

A. Proceeds of life insurance policies paid to the

beneficiaries upon death of the insured

B. Amount received by the insured as a return of

the premiums paid

C. Value of property acquired by gift or descent

(inheritance). However, income from such

property will be included in gross income.

D. Amounts received through accident or health

insurance

E. Retirement benefits

The retiring employee has been in the service of the

same employer for at least 10 years.

The employee is not less than 50 years of age at the

time of retirement

Employee can receive the benefit of exclusion only

once

F. Benefits received from the SSS

G. Benefits from GSIS

H. Prizes and awards in recognition of religious,

charitable, scientific, or civic achievement only if

recipient is selected without any action on his part

to enter the contest.

I. 13th Month pay not exceeding P90,000.

INCOME FROM CAMPAIGN

CONTRIBUTIONS

Not included in the taxable income of the

candidate to whom they are given. Candidate must

file with the Comelec a Statement of Expenditures,

if not the entire amount shall be subject to income

tax. Unutilized campaign contributions shall be

subject to income tax.

GAINS & LOSSES FROM SALES

OF ASSETS

A TAXPAYERMUST KNOW WHETHER THE

ASSET SOLD WAS HELD AS ORDINARY

ASSET OR AS CAPITAL ASSET BECAUSE OF

THE SPECIAL RULES ON GAINS & LOSSES

ON SALES OF CAPITAL ASSETS.

CAPITAL ASSET IS

1. PROPERTY NOT RELATED TO THE

TAXPAYER’S BUSINESS, AND

2. PROPERTY RELATED TO THE TAXPAYER’S

BUSINESS BUT HELD ONLY AS INVESTMENT.

SO…these are NOT capital assets

Inventory for sale by a merchandiser

Real estate for sale by a real estate dealer

Land on which the factory stands

ORDINARYOR CAPITAL??

1. SECURITIES HELD AS INVESTMENT

2. INVENTORY OF RAW MATERIALS OR

FINISHED GOODS

3. OFFICE EQUIPMENT

4. LAND USED IN BUSINESS

5. RESIDENTIAL HOUSE

6. FAMILY PLEASURE YACHT

7. LAND FOR SALE BY A REAL ESTATE

DEALER

8. PERSONAL ART COLLECTION

9. FAMILY VACATION HOUSE

10. CAR USE IN BUSINESS AND FOR

PERSONAL USE

ORDINARY AND CAPITAL GAINS

AND LOSSES WITH NO CAPITAL

GAIN TAXES

ORDINARY GAINS & LOSSES:

SELLING PRICE PXX

LESS:EXPENSES OF SALE XX PXX

LESS:

COST PXX

EXPENSES OF ACQUISITION XX XX

GAIN OR LOSS ON THE SALE PXX

RULES ON CAPITAL

GAINS/LOSSES

CORPORATION INDIVIDUAL

THE CAPITAL GAIN OR LOSS THE CAPITAL GAIN OR LOSS

SHALL ALWAYS BE SHALL BE CONSIDERED AT:

CONSIDERED AT 100% 100% - IF THE ASSET WAS

REGARDLESS OF THE HELD FOR NOT MORE THAN

LENGTH OF THE HOLDING 12 MONTHS

PERIOD OF THE ASSET 50% - IF MORE THAN 12 MOS.

CAPITAL LOSSES ARE CAPITAL LOSSES ARE

DEDUCTIBLE ONLY TO THE DEDUCTIBLE ONLY TO THE

EXTENT OF CAPITAL GAINS EXTENT OF CAPITAL GAINS

NET CAPITAL LOSS CARRY- NET CAPITAL LOSS CARRY-

OVER IS NOT AVAILABLE OVER IS AVAILABLE

ILLUSTRATION:

NET INCOME FROM BUSINESS P230,000

DIVIDENDS FROM A CORP. 20,000

GAIN ON SALE OF ORD. ASSET 10,000

GAIN ON SALE OF CAPITAL ASSET

HELF FOR 6 MONTHS 2,000

LOSS ON SALE OF CAPITAL ASSET

HELF FOR 13 MONTHS 3,000

LOSS ON SALE OF ORDINARY ASSET 14,000

TAXABLE INCOME : (MR. A)

NET INCOME FROM BUSINESS P230,000

DIVIDENDS INCOME 20,000

GAIN ON SALE OF ORD. ASSET 10,000

LOSS ON SALE OF ORDINARY ASSET 14,000 ( 4,000)

ORDINARY NET INCOME P246,000

GAIN ON SALE OF CAPITAL ASSET

HELF FOR 6 MONTHS (100%) 2,000

LOSS ON SALE OF CAPITAL ASSET

HELF FOR 13 MONTHS (3,000X50%) (1,500)

NET CAPITAL GAIN 500

TAXABLE INCOME P246,500

MR. B:

200A 200B

NET INCOME -PROFESSION P 90,000 P 78,000

INTEREST FROM NOTES OF 2,000 4,000

CLIENTS

CAPITAL GAIN ON ASSETS:

PAINTING HELD FOR 10 MOS. 30,000

JEWELRY HELD FOR 2 YRS. 40,000

CAPITAL LOSS ON BONDS 70,000

HELD FOR 3 YRS.

200A 200B

NET INCOME -PROFESSION P 90,000 P 78,000

INTEREST INCOME 2,000 4,000

ORDINARY NET INCOME P 92,000 P 82,000

CAPITAL GAIN (100%) P 30,000

CAPITAL GAIN (50%) P 20,000

CAPITAL LOSS (50%) (35,000)

NET CAPITAL LOSS (P 5,000)

NET CAPITAL LOSS CARRY- (5,000)

OVER FROM 200A

NET CAPITAL GAIN _________ P 15,000

TAXABLE INCOME P 92,000 P 97,000

MR.C :

200A 200B

NET INCOME-BUSINESS P 80,000 P 90,000

INTEREST FROM NOTES OF 4,000 2,000

CLIENTS

CAPITAL GAIN ON ASSETS 50,000

HELD FOR 3 YRS.

CAPITAL GAIN ON JEWELRY 70,000

HELD FOR 10 MONTHS

CAPITAL LOSS ON BONDS 120,000

HELD FOR 4 MONTHS

MR. C

200A 200B

NET INCOME-BUSINESS P 80,000 P 90,000

INTEREST INCOME 4,000 2,000

ORDINARY NET INCOME P 84,000 P 92,000

CAPITAL GAIN (50%) P 25,000

CAPITAL GAIN (100%) P 70,000

CAPITAL LOSS (100%) (120,000)

NET CAPITAL LOSS (P 95,000)

NET CAPITAL LOSS CARRY- (70,000)

OVER FROM 200A

NET CAPITAL GAIN _________ P 0___

TAXABLE INCOME P 84,000 P 92,000

ABC CORP.

ORDINARY NET INCOME P52,000

GAIN ON SALE OF CAPITAL ASSET HELD

FOR 10 MONTHS 2,000

GAIN ON SALE OF CAPITAL ASSET HELD

FOR 18 MONTHS 2,000

LOSS ON SALE OF CAPITAL ASSET HELD

FOR 6 MONTHS 1,100

LOSS ON SALE OF CAPITAL ASSET HELD

FOR 20 MONTHS 2,000

IN THE PRECEEDING YEAR IT HAD A NET CAPITAL

LOSS OF P1,500 AND A TAXABALE INCOME OF P60,000.

ORDINARY NET INCOME P 52,000

CAPITAL GAINS:

ASSET HELD FOR 10 MOS. (100%) P 2,000

ASSET HELD FOR 18 MOS. (100%) P 2,000

TOTAL CAPITAL GAINS P 4,000

CAPITAL LOSSES:

ASSET HELD FOR 6 MOS. (100%) P1,100

ASSET HELD FOR 20 MOS. (100%) 2,000 3,100 900

TAXABLE INCOME P 52,900

READY???

HAY SALAMAT!!!

You might also like

- Taxation - Corporation - Quizzer - 2018Document4 pagesTaxation - Corporation - Quizzer - 2018Kenneth Bryan Tegerero Tegio100% (4)

- Al Ries - Focus - The Future of Your Company Depends On It (1997, HarperBusiness) - Libgen - LiDocument324 pagesAl Ries - Focus - The Future of Your Company Depends On It (1997, HarperBusiness) - Libgen - LiLucian GomoescuNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Statement 1: Confirmation Number Is The Control Number Issued by Authorized AgentDocument55 pagesStatement 1: Confirmation Number Is The Control Number Issued by Authorized AgentNah HamzaNo ratings yet

- Taxation - Gross Income - Quizzer - 2018 - MayDocument5 pagesTaxation - Gross Income - Quizzer - 2018 - MayKenneth Bryan Tegerero TegioNo ratings yet

- Income Tax Quiz AnswerDocument4 pagesIncome Tax Quiz AnswerMarco Alejandro Ibay100% (1)

- The ENTREPRENEURIAL MIND Course Outline 1Document2 pagesThe ENTREPRENEURIAL MIND Course Outline 1Gabriel GonzalesNo ratings yet

- Final and Capital Gains TaxDocument7 pagesFinal and Capital Gains TaxElla Marie LopezNo ratings yet

- Responsibility AccountingDocument10 pagesResponsibility AccountingCheny MabiniNo ratings yet

- Tax On Individuals Quiz - ProblemsDocument3 pagesTax On Individuals Quiz - ProblemsJP Mirafuentes100% (1)

- Finals Quiz 1 Dealings in Properties Answer KeyDocument6 pagesFinals Quiz 1 Dealings in Properties Answer KeyMjhaye100% (1)

- Chap 8 Distribution ManagementDocument30 pagesChap 8 Distribution ManagementAntonio B ManaoisNo ratings yet

- Amazon Offer of Employment 4 SR VP IntlDocument3 pagesAmazon Offer of Employment 4 SR VP IntlMohammad Yusuf Shamshad100% (1)

- Rules in Holding Period in Capital GainsDocument39 pagesRules in Holding Period in Capital GainsTrine De LeonNo ratings yet

- Tax Reviewer 3Document4 pagesTax Reviewer 3tooru oikawaNo ratings yet

- Week 11 Dealings in Property 1Document45 pagesWeek 11 Dealings in Property 1Arellano Rhovic R.No ratings yet

- Dealings in PropertiesDocument6 pagesDealings in PropertieserespemaychisagangNo ratings yet

- BAM 031 Income Taxation 2nd Periodical Exam With AKDocument8 pagesBAM 031 Income Taxation 2nd Periodical Exam With AKbrmo.amatorio.uiNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Cases On Taxation For Individualss AnswersDocument11 pagesCases On Taxation For Individualss AnswersMitchie Faustino100% (2)

- Ea - TaxDocument8 pagesEa - TaxKc SevillaNo ratings yet

- Metrillo - Comprehensive ProbDocument12 pagesMetrillo - Comprehensive ProbLordCelene C MagyayaNo ratings yet

- SOL QUIZ RIT II and IIIDocument68 pagesSOL QUIZ RIT II and IIIouia iooNo ratings yet

- IA3 Chapter 12 21Document12 pagesIA3 Chapter 12 21ZicoNo ratings yet

- Sources of Income 2016 2017 2018Document5 pagesSources of Income 2016 2017 2018Chabby ChabbyNo ratings yet

- TAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireDocument15 pagesTAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireGrace Love Yzyry LuNo ratings yet

- Average Quiz Set ADocument5 pagesAverage Quiz Set AMarvin AndresNo ratings yet

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #4)Document10 pagesFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #4)marygraceomacNo ratings yet

- Individual Taxation Assignment 2 - 1868900521Document2 pagesIndividual Taxation Assignment 2 - 1868900521Jaylyn BacolonNo ratings yet

- Taaaaax PDFDocument40 pagesTaaaaax PDFAnne Marieline BuenaventuraNo ratings yet

- Capital AssadasdasetsDocument5 pagesCapital Assadasdasetsaki_0915296457No ratings yet

- AE23 Capital BudgetingDocument4 pagesAE23 Capital BudgetingCheska AgrabioNo ratings yet

- Responsibility AccountingDocument6 pagesResponsibility Accountingrodell pabloNo ratings yet

- 8.6 Assignment - Regular Income Tax On CorporationsDocument3 pages8.6 Assignment - Regular Income Tax On CorporationsRoselyn LumbaoNo ratings yet

- Income Taxation Capital AssetDocument93 pagesIncome Taxation Capital AssetGelyn Cruz100% (1)

- TX 201Document4 pagesTX 201Pau SantosNo ratings yet

- 03 Income Taxation For Individuals Sample ProblemsDocument15 pages03 Income Taxation For Individuals Sample ProblemsclaraNo ratings yet

- Problems 1st PartDocument17 pagesProblems 1st PartValentin JallaisNo ratings yet

- Tax QuizDocument3 pagesTax QuizLora Mae JuanitoNo ratings yet

- Additional Income Tax QuizzerDocument3 pagesAdditional Income Tax QuizzerJolina Mancera0% (1)

- TAXDocument20 pagesTAXkate trishaNo ratings yet

- CourseheroDocument3 pagesCourseheronumber oneNo ratings yet

- 84881793Document6 pages84881793Joel Christian MascariñaNo ratings yet

- Tax INDIVIDUALPre-Board NCPARDocument6 pagesTax INDIVIDUALPre-Board NCPARlorenceabad07100% (1)

- 93-09 - Capital AssetsDocument8 pages93-09 - Capital AssetsJuan Miguel UngsodNo ratings yet

- Midterm Review Fabm 2: Horizontal AnalysisDocument29 pagesMidterm Review Fabm 2: Horizontal AnalysisKheanne Loise San LuisNo ratings yet

- Q7 Dealings in PropertiesDocument5 pagesQ7 Dealings in PropertiesNhajNo ratings yet

- True FalseDocument2 pagesTrue FalseCarlo ParasNo ratings yet

- INCOTAX - Multiple Choices - Problems Part 1Document3 pagesINCOTAX - Multiple Choices - Problems Part 1Harvey100% (1)

- Final Tax On Passive Income2Document7 pagesFinal Tax On Passive Income2Ivy Rica AyapanaNo ratings yet

- Set Off WorkingDocument4 pagesSet Off WorkingEngr. Md. Ishtiak HossainNo ratings yet

- c2 2Document3 pagesc2 2Kath LeynesNo ratings yet

- Final On Passive Income Grcbarbin2Document6 pagesFinal On Passive Income Grcbarbin2Joneric RamosNo ratings yet

- Seatwork - 1. Which of The Following Does Not Affect The Owner's Equity?Document4 pagesSeatwork - 1. Which of The Following Does Not Affect The Owner's Equity?Rochelle Joyce CosmeNo ratings yet

- 4BSA TAX SET A No Answer PDFDocument10 pages4BSA TAX SET A No Answer PDFLayca Clarice BrimbuelaNo ratings yet

- Reales Tax Rev Computation ExerciseDocument4 pagesReales Tax Rev Computation ExerciseJethroret RealesNo ratings yet

- Basic Principles of TaxationDocument18 pagesBasic Principles of TaxationAlexandra Nicole IsaacNo ratings yet

- Testbanks ROI, Residual Income, EVADocument42 pagesTestbanks ROI, Residual Income, EVAJadeNo ratings yet

- Midterm Exam Principles of Taxation and Income TaxationDocument6 pagesMidterm Exam Principles of Taxation and Income TaxationKitagawa, Misia Sophia Jan B.No ratings yet

- Gross Income Quiz With Answer KeyDocument10 pagesGross Income Quiz With Answer KeyMylene AlfantaNo ratings yet

- Regular Income Tax SeatworkDocument1 pageRegular Income Tax SeatworkJean Diane JoveloNo ratings yet

- c2 7Document3 pagesc2 7Kath LeynesNo ratings yet

- Taxation - Final ExamDocument4 pagesTaxation - Final ExamKenneth Bryan Tegerero Tegio100% (1)

- Module 1 GERPHDocument17 pagesModule 1 GERPHGabriel GonzalesNo ratings yet

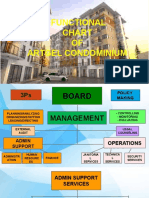

- Functional Chart OF Artgel CondominiumDocument8 pagesFunctional Chart OF Artgel CondominiumGabriel GonzalesNo ratings yet

- Tañala Manning TableDocument16 pagesTañala Manning TableGabriel GonzalesNo ratings yet

- Buatlah Data Akuntansi Perusahaan Baru Dengan Keterangan Pada Tabel Berikut Dan Simpan Di D:/NIM/Praktikum 8Document10 pagesBuatlah Data Akuntansi Perusahaan Baru Dengan Keterangan Pada Tabel Berikut Dan Simpan Di D:/NIM/Praktikum 8Ribka RosariNo ratings yet

- Pharmaceutical Quality System ASQ Granite StateSection 20120315Document31 pagesPharmaceutical Quality System ASQ Granite StateSection 20120315aquilesamparoNo ratings yet

- SSRN Id3098765Document8 pagesSSRN Id3098765Pedro LacerdaNo ratings yet

- Boa Tos RFBTDocument6 pagesBoa Tos RFBTMr. CopernicusNo ratings yet

- Introduction To Company PDFDocument8 pagesIntroduction To Company PDFhasan alNo ratings yet

- NP Contract 1 - 1277125131Document5 pagesNP Contract 1 - 1277125131manisha sharmaNo ratings yet

- ABC CostingDocument17 pagesABC CostingnehaNo ratings yet

- Annex 19Document2 pagesAnnex 19hetalsangoiNo ratings yet

- Introduction To Management Unit 1Document47 pagesIntroduction To Management Unit 1roberaakNo ratings yet

- Capital Market PDFDocument12 pagesCapital Market PDFAyush BhadauriaNo ratings yet

- Home Financial Ratio Analysis Profitability RatioDocument2 pagesHome Financial Ratio Analysis Profitability RatioEllaine Pearl Almilla100% (1)

- Project Report of Oriental Bank of Commerce.Document58 pagesProject Report of Oriental Bank of Commerce.Chandrakant80% (15)

- Advantages of Jigs and FixturesDocument2 pagesAdvantages of Jigs and FixturesharicoolestNo ratings yet

- Partnership - TheoriesDocument1 pagePartnership - TheoriesBrian Christian VillaluzNo ratings yet

- Chapter 3, Process CostingDocument10 pagesChapter 3, Process CostingArianne Marie OmoNo ratings yet

- Designing The Communications Mix For ServicesDocument12 pagesDesigning The Communications Mix For ServicesUtsav Mahendra100% (1)

- Entreprenurship: VariousDocument18 pagesEntreprenurship: VariousPavan GRNo ratings yet

- Project Report On Head and Shoulders Shampoo Marketing EssayDocument8 pagesProject Report On Head and Shoulders Shampoo Marketing EssayletsdoitmailboxNo ratings yet

- BCMDocument2 pagesBCMLloyd DyNo ratings yet

- MRF - AR 2016-17 Low Res Full 4 PDFDocument184 pagesMRF - AR 2016-17 Low Res Full 4 PDFkrishNo ratings yet

- Sample Research ProposalsDocument4 pagesSample Research ProposalsJasmin PaduaNo ratings yet

- Shoppers Stop ErpDocument4 pagesShoppers Stop Erpabhay_155841071No ratings yet

- CF 26051Document20 pagesCF 26051sdfdsfNo ratings yet

- ORGMAN Lesson 3Document3 pagesORGMAN Lesson 3Ann Sherley Baynosa SottoNo ratings yet

- EFTPK0638L Master Buy AgreementDocument13 pagesEFTPK0638L Master Buy AgreementdevNo ratings yet

- The Role of Project Management and Governance in Strategy ImplementationDocument23 pagesThe Role of Project Management and Governance in Strategy ImplementationRexrgisNo ratings yet

- Quality ControlDocument51 pagesQuality ControlOprisor CostinNo ratings yet