Professional Documents

Culture Documents

Proof of Cash: Two-Date Bank Reconcilation

Proof of Cash: Two-Date Bank Reconcilation

Uploaded by

Karlo D. Recla0 ratings0% found this document useful (0 votes)

68 views8 pagesThis document discusses two-date bank reconciliation, which involves reconciling a company's book balance with its bank balance over two periods, usually the previous and current month. It outlines the key steps as computing the beginning and ending book balances by adding debits and subtracting credits, computing the beginning and ending bank balances by adding credits and subtracting debits, and reconciling differences by tracking deposits in transit and outstanding checks between the periods. An example reconciliation is provided to illustrate matching the adjusted book and bank balances.

Original Description:

Original Title

Proof of Cash

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses two-date bank reconciliation, which involves reconciling a company's book balance with its bank balance over two periods, usually the previous and current month. It outlines the key steps as computing the beginning and ending book balances by adding debits and subtracting credits, computing the beginning and ending bank balances by adding credits and subtracting debits, and reconciling differences by tracking deposits in transit and outstanding checks between the periods. An example reconciliation is provided to illustrate matching the adjusted book and bank balances.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

68 views8 pagesProof of Cash: Two-Date Bank Reconcilation

Proof of Cash: Two-Date Bank Reconcilation

Uploaded by

Karlo D. ReclaThis document discusses two-date bank reconciliation, which involves reconciling a company's book balance with its bank balance over two periods, usually the previous and current month. It outlines the key steps as computing the beginning and ending book balances by adding debits and subtracting credits, computing the beginning and ending bank balances by adding credits and subtracting debits, and reconciling differences by tracking deposits in transit and outstanding checks between the periods. An example reconciliation is provided to illustrate matching the adjusted book and bank balances.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 8

PROOF OF CASH

TWO-DATE BANK RECONCILATION

Two-date bank reconciliation

it literally involves two dates (beginning & ending balance)

usually, previous month and current month

Usually omitted information in solving two-dates bank reconciliation

1. Book balance – beginning & ending

2. Bank balance – beginning & ending

3. Deposits in transit – beginning and ending

4. Outstanding checks – beginning and ending

Computation of book

Balance per book – beg xx balance

Add: Book debits during the xx

month •Book debits – refers to cash receipts or all items

debited to the cash in bank account

Total xx

•Book credits – refers to cash disbursement or all

Less: Book credits during xx items credited to the cash in bank account

the month

Balance per book - end of xx

the month

Computation of bank

Balance per bank – beg xx balance

Add: Bank credits during the month xx

•Bank credits – refers to all items credited to the

account of the depositor which include deposits

Total xx acknowledge by the bank and credit memos.

Less: Bank debits during the month xx

•Bank debit – refers to all items debited to the

Balance per bank - end of the month xx account of the depositor which include checks

paid bank and debit memos

Computation of

Deposits in transit– beg xx deposits in

Add: Cash receipts deposited during the month

Total deposits to be acknowledge by the bank

xx

xx transit

Less: Deposits acknowledge by the bank during the xx

month

Deposits in transits - end of the month xx

Outstanding checks – beg xx Computation of

Add: Checks drawn by the

depositor during the month

xx

outstanding

Total checks to be paid by the bank xx checks

Less: Checks paid by the bank xx

during the month

Outstanding checks- end of the xx

month

Illustration

Cash in Bank per ledger

Balance per January 31 P50,000

Book debits for February including the January CM for note 200,000

collected of P15,000

Book credits for February, including NSF check of P5,000 180,000

and service charge of P1,000

Bank statements for February

Bank credits for February, including CM for note collected P84,000

of P20,000 and deposit in transit of P40,000.

Bank debits for February, including NSF checks of P10,000 130,000

and January outstanding checks of P65,000

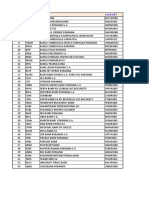

January 31, 2022 Receipts Disbursements February 28, 2022

Balance per book 50,000 200,000 180,000 70,000

Note collected:

January 15,000 (15,000)

February 20,000 20,000

NSF checks:

January (5,000) (5,000)

February 10,000 (10,000)

Service charge:

January (1,000) (1,000)

Adjusted book balance 59,000 205,000 184,000 80,000

Balance per bank 84,000 170,000 130,000 124,000

Deposit in transit:

January 40,000 (40,000)

February 75,000 75,000

Outstanding checks

January (65,000) (65,000)

February 119,000 (119,000)

Adjusted bank balance 59,000 205,000 184,000 80,000

You might also like

- Usa No VBVDocument4 pagesUsa No VBVKilo100% (6)

- Correspondent Banks ListDocument120 pagesCorrespondent Banks ListSauban AhmedNo ratings yet

- DatabaseDocument3 pagesDatabaseJesicaNo ratings yet

- Accounting Test Bank - Bank ReconciliationDocument2 pagesAccounting Test Bank - Bank ReconciliationAyesha RGNo ratings yet

- FSDocument11 pagesFSKarlo D. Recla100% (1)

- BangkoDocument2 pagesBangkojasteja100% (1)

- India 2019 RM Headcount League Table - Asian Private Banker PDFDocument3 pagesIndia 2019 RM Headcount League Table - Asian Private Banker PDFvjNo ratings yet

- Aud ReconDocument8 pagesAud ReconShaine PacsonNo ratings yet

- Cash and Cash Equivalents 1Document15 pagesCash and Cash Equivalents 1Micko LagundinoNo ratings yet

- This Study Resource Was: (Stale Check)Document2 pagesThis Study Resource Was: (Stale Check)Lyca Mae CubangbangNo ratings yet

- Problem 1Document13 pagesProblem 1Ghaill CruzNo ratings yet

- Cash and Cash Equivalents Handouts (1084)Document7 pagesCash and Cash Equivalents Handouts (1084)dian12 parksoohNo ratings yet

- Answer Key Far Assessment Questionairre 1Document22 pagesAnswer Key Far Assessment Questionairre 1Johnfree VallinasNo ratings yet

- Pakam, Khiezna E. Bsac-1b Assignment 3-FarDocument5 pagesPakam, Khiezna E. Bsac-1b Assignment 3-FarKhiezna PakamNo ratings yet

- Proof of Cash or Four Column ReconciliationDocument5 pagesProof of Cash or Four Column ReconciliationSB19 ChicKENNo ratings yet

- Estimation of Doubtful Accounts (Chapter 5)Document12 pagesEstimation of Doubtful Accounts (Chapter 5)chingNo ratings yet

- Proof of CashDocument20 pagesProof of CashKristen StewartNo ratings yet

- Receivables ProblemsDocument5 pagesReceivables ProblemsAbbygailNo ratings yet

- Vallix QuestionnairesDocument14 pagesVallix QuestionnairesKathleen LucasNo ratings yet

- 02 FAR02 Accounting-for-ReceivablesDocument3 pages02 FAR02 Accounting-for-ReceivablesBea GarciaNo ratings yet

- Proof of Cash Problem 3-1Document5 pagesProof of Cash Problem 3-1Coleen Lara SedillesNo ratings yet

- PRACTICE SET-Inventories (Problems)Document8 pagesPRACTICE SET-Inventories (Problems)polxrixNo ratings yet

- 1 Cash and Cash EquivalentsDocument3 pages1 Cash and Cash EquivalentsJohn Aries Reyes100% (1)

- Loan Receivable and Receivable Financing PDFDocument3 pagesLoan Receivable and Receivable Financing PDFgenesis serominesNo ratings yet

- Intermediate Accounting I - Cash and Cash EquivalentsDocument2 pagesIntermediate Accounting I - Cash and Cash EquivalentsJoovs Joovho0% (1)

- Internal Controls Over Cash and Accounting For Petty Cash Fund123Document3 pagesInternal Controls Over Cash and Accounting For Petty Cash Fund123rufamaegarcia07No ratings yet

- Far Review - Notes and Receivable AssessmentDocument6 pagesFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenNo ratings yet

- Conceptual Framework For Financial ReportingDocument8 pagesConceptual Framework For Financial ReportingsmlingwaNo ratings yet

- 9201 - Partnership FormationDocument4 pages9201 - Partnership FormationBrian Dave OrtizNo ratings yet

- ACC 101 - 3rd QuizDocument3 pagesACC 101 - 3rd QuizAdyangNo ratings yet

- Homework On Presentation of Financial Statements (Ias 1)Document4 pagesHomework On Presentation of Financial Statements (Ias 1)Jazehl Joy ValdezNo ratings yet

- Aud. Prob.Document16 pagesAud. Prob.Ria Alanis CastilloNo ratings yet

- Ia1 5a Investments 15 FVDocument55 pagesIa1 5a Investments 15 FVJm SevallaNo ratings yet

- FAR Test BankDocument34 pagesFAR Test BankRaamah DadhwalNo ratings yet

- Proof of CashDocument2 pagesProof of CashAiden Pats80% (5)

- Proof of CashDocument5 pagesProof of CashMa. Clara AlfonsoNo ratings yet

- Parcor QuizbowlDocument38 pagesParcor QuizbowlKrestyl Ann GabaldaNo ratings yet

- CASH FLOW STATEMENTS - Quiz 3Document2 pagesCASH FLOW STATEMENTS - Quiz 3JyNo ratings yet

- Activity 4 Bank Reconciliation PDFDocument4 pagesActivity 4 Bank Reconciliation PDFSharmin ReulaNo ratings yet

- Proof of CashDocument1 pageProof of CashEmma Mariz GarciaNo ratings yet

- Practice Problems - Notes and Loans Receivable: General InstructionsDocument2 pagesPractice Problems - Notes and Loans Receivable: General Instructionseia aieNo ratings yet

- Bank Reconciliation Statement (BRS)Document28 pagesBank Reconciliation Statement (BRS)Bhupesh KumarNo ratings yet

- Intermediate Accounting 1: Brief Discussion On Notes Receivable and Other Receivable ConceptsDocument26 pagesIntermediate Accounting 1: Brief Discussion On Notes Receivable and Other Receivable ConceptsMckenzieNo ratings yet

- Bank Reconciliation LectureDocument17 pagesBank Reconciliation LectureClazther Mendez100% (1)

- Chapter 4 - Partnership LiquidationDocument4 pagesChapter 4 - Partnership LiquidationMikaella BengcoNo ratings yet

- Chapter 2 Accounting 300 Exam ReviewDocument2 pagesChapter 2 Accounting 300 Exam Reviewagm25No ratings yet

- Cash and Cash Equivalents TheoriesDocument5 pagesCash and Cash Equivalents Theoriesjane dillanNo ratings yet

- Lecture Notes On Receivable FinancingDocument5 pagesLecture Notes On Receivable Financingjudel ArielNo ratings yet

- Reviewer in Intermediate Accounting (Midterm)Document9 pagesReviewer in Intermediate Accounting (Midterm)Czarhiena SantiagoNo ratings yet

- Acc-106 Sas 3Document12 pagesAcc-106 Sas 3hello millieNo ratings yet

- Basic Accounting For CorporationDocument12 pagesBasic Accounting For CorporationBrian Christian VillaluzNo ratings yet

- Intacc 1 Cash and Cash Equivalents-1Document10 pagesIntacc 1 Cash and Cash Equivalents-1randel10caneteNo ratings yet

- ReceivablesDocument31 pagesReceivablesKate MercadoNo ratings yet

- Three Methods of Estimating Doubtful AccountsDocument8 pagesThree Methods of Estimating Doubtful AccountsJay Lou PayotNo ratings yet

- Receivable FinancingDocument20 pagesReceivable FinancingYassi CurtisNo ratings yet

- Activity 3. FS Analysis..Document3 pagesActivity 3. FS Analysis..Astrid BuenacosaNo ratings yet

- Cash, Cash Equivalent and Bank ReconDocument7 pagesCash, Cash Equivalent and Bank ReconPrincess ReyesNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument6 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionAIENNA GABRIELLE FABRO100% (1)

- AP - Loans & ReceivablesDocument11 pagesAP - Loans & ReceivablesDiane PascualNo ratings yet

- Computation For Formation of PartnershipDocument10 pagesComputation For Formation of PartnershipErille Julianne (Rielianne)No ratings yet

- Comlaw Prequalifying SolManDocument10 pagesComlaw Prequalifying SolManAnj SueloNo ratings yet

- Unit IA ID. Rematch Unit Drill On Cash and Cash Equivalents Petty Cash Bank Recon Proof of Cash 1Document5 pagesUnit IA ID. Rematch Unit Drill On Cash and Cash Equivalents Petty Cash Bank Recon Proof of Cash 1MARK JHEN SALANGNo ratings yet

- Chapter 111213Document8 pagesChapter 111213Angel Alejo Acoba0% (1)

- Chapter 2 Bank Reconciliation (Gatdc)Document20 pagesChapter 2 Bank Reconciliation (Gatdc)Joan LeonorNo ratings yet

- Lecture No.3 Proof of CashDocument2 pagesLecture No.3 Proof of Cashdelrosario.kenneth996No ratings yet

- Week - 5 Proof of Cash FinalDocument26 pagesWeek - 5 Proof of Cash FinalChengg JainarNo ratings yet

- 04 Mas - CVPDocument8 pages04 Mas - CVPKarlo D. ReclaNo ratings yet

- CWKARLDocument9 pagesCWKARLKarlo D. ReclaNo ratings yet

- True or FalseDocument3 pagesTrue or FalseKarlo D. ReclaNo ratings yet

- Smarts - Fs AnalysisDocument11 pagesSmarts - Fs AnalysisKarlo D. ReclaNo ratings yet

- Ar&Inventory ManagementDocument10 pagesAr&Inventory ManagementKarlo D. ReclaNo ratings yet

- GP Variance SmartsDocument6 pagesGP Variance SmartsKarlo D. ReclaNo ratings yet

- Ar ManagementDocument6 pagesAr ManagementKarlo D. ReclaNo ratings yet

- Exam 44Document5 pagesExam 44Karlo D. Recla100% (2)

- 01 MAS - Management Acctg.Document8 pages01 MAS - Management Acctg.Karlo D. ReclaNo ratings yet

- 02 MAS - Cost ConceptDocument10 pages02 MAS - Cost ConceptKarlo D. ReclaNo ratings yet

- Chapter 08Document2 pagesChapter 08Karlo D. ReclaNo ratings yet

- 02 MAS - Cost ConceptDocument10 pages02 MAS - Cost ConceptKarlo D. ReclaNo ratings yet

- Chapter 08Document2 pagesChapter 08Karlo D. ReclaNo ratings yet

- Test Bank Chapter 3 Cost Volume Profit ADocument4 pagesTest Bank Chapter 3 Cost Volume Profit AKarlo D. ReclaNo ratings yet

- Test Bank For Managerial Accounting 7thDocument7 pagesTest Bank For Managerial Accounting 7thKarlo D. ReclaNo ratings yet

- Monthly Registration Statistics - December 2018 PDFDocument3 pagesMonthly Registration Statistics - December 2018 PDFBernewsAdminNo ratings yet

- UNIONPAYDocument3 pagesUNIONPAYCfu CdanNo ratings yet

- Ibs Bandar Baru Bangi 1 31/07/22Document5 pagesIbs Bandar Baru Bangi 1 31/07/22NOR AKBARIAH BINTI ARIFIN KPM-GuruNo ratings yet

- State Bank of India, Mumbai Metro Circle: General Manager-I, StateDocument75 pagesState Bank of India, Mumbai Metro Circle: General Manager-I, Statenarasimha nNo ratings yet

- Mint ABC 2019 Attendee ListDocument15 pagesMint ABC 2019 Attendee ListVikram33% (3)

- Bank User Charges PDFDocument1 pageBank User Charges PDFMani Rathinam RajamaniNo ratings yet

- SBI PO ResultDocument6 pagesSBI PO ResultgelcodoNo ratings yet

- Sungai Kayan Plantation Company No 47 Jalan Ajibah Abol 93400 KUCHINGDocument1 pageSungai Kayan Plantation Company No 47 Jalan Ajibah Abol 93400 KUCHING林本No ratings yet

- DataDocument4 pagesDataWahyu KurniawanNo ratings yet

- Ifcb2009 37Document176 pagesIfcb2009 37Annamalai NagappanNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument12 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHemant BilliardsNo ratings yet

- Indian Banking Sector: History, Types,& Challenging FactorsDocument14 pagesIndian Banking Sector: History, Types,& Challenging Factorsrahulims4345980% (1)

- Indikasi Harga Bonds Calculator Permata - 30 Juni 2022Document1 pageIndikasi Harga Bonds Calculator Permata - 30 Juni 2022Hero Von LionNo ratings yet

- Fund Vintage Commitment Returns ROIDocument4 pagesFund Vintage Commitment Returns ROIJonas BrandonNo ratings yet

- Stat Is e Fek 20190228Document124 pagesStat Is e Fek 20190228Fadel Khalif MuhammadNo ratings yet

- Capitalism's Achilles Heel (Urdu Version)Document9 pagesCapitalism's Achilles Heel (Urdu Version)Hidaya_Books100% (3)

- SN Name of The Organization Type: Bank, Financial & Insurance InstitutionDocument24 pagesSN Name of The Organization Type: Bank, Financial & Insurance InstitutionKalpana GurungNo ratings yet

- Bank CodesDocument3 pagesBank CodesGesen CuaNo ratings yet

- Statement of Axis Account No:922010035421074 For The Period (From: 01-05-2022 To: 19-11-2022)Document17 pagesStatement of Axis Account No:922010035421074 For The Period (From: 01-05-2022 To: 19-11-2022)Rohit KumarNo ratings yet

- No Bank Fund Name ROIDocument2 pagesNo Bank Fund Name ROIYannah HidalgoNo ratings yet

- Received Copy LogDocument4 pagesReceived Copy LogRegine LetchejanNo ratings yet

- Banci Din RomaniaDocument1 pageBanci Din Romaniaflorin74No ratings yet

- Final Result IOB ClerkDocument11 pagesFinal Result IOB Clerkkumarrahul1234No ratings yet

- RO10 ProposalDocument21 pagesRO10 ProposalDan EnicaNo ratings yet

- DD - ONLINE - CMS - NLedger-3 - 2024-03-19T093230.209Document4 pagesDD - ONLINE - CMS - NLedger-3 - 2024-03-19T093230.209zamroniNo ratings yet