Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

9 viewsECN 481 (13), Policy Tools

ECN 481 (13), Policy Tools

Uploaded by

Sacin PatelThe document summarizes the main monetary policy tools used by the Federal Reserve: open market operations, the discount rate, and reserve ratios. Open market operations involve the Fed buying and selling bonds to inject or drain bank reserves from the system. The discount rate is the interest rate banks pay to borrow from the Fed. Reserve ratios determine how much banks must hold in reserves. The Fed uses these tools to target the federal funds rate, the interest rate at which banks lend reserves to each other, to influence overall monetary conditions.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You might also like

- KPIs-Bank of America Merrill Lynch White PaperDocument5 pagesKPIs-Bank of America Merrill Lynch White PaperGabriela Brito TeixeiraNo ratings yet

- MScFE 560 FM - Compiled - Notes - M2 PDFDocument21 pagesMScFE 560 FM - Compiled - Notes - M2 PDFtylerNo ratings yet

- History of Banking in IndiaDocument15 pagesHistory of Banking in Indiaaccesstariq90% (29)

- Negotiable Instruments Act, 1881 PDFDocument61 pagesNegotiable Instruments Act, 1881 PDFmackjbl100% (3)

- Government Policies and Financial Services (Commercial Banks)Document14 pagesGovernment Policies and Financial Services (Commercial Banks)Ahmed El KhateebNo ratings yet

- Tools of Monetary PolicyDocument23 pagesTools of Monetary PolicyNandiniNo ratings yet

- The Money Supply, Banking System, and Monetary Policy: Chapters 17 & 18Document39 pagesThe Money Supply, Banking System, and Monetary Policy: Chapters 17 & 18Dr-Shefali GargNo ratings yet

- Tools of Monetary Policy: Open - Market Operations Discount Rate Reserve RequirementsDocument15 pagesTools of Monetary Policy: Open - Market Operations Discount Rate Reserve RequirementsAngelica BeltranNo ratings yet

- FMI Chapter 5 Monetary PolicyDocument50 pagesFMI Chapter 5 Monetary PolicyroyalcrownscentNo ratings yet

- Lect 2498Document29 pagesLect 2498AmrNo ratings yet

- FM Qu and AnswerDocument11 pagesFM Qu and AnswerMikiyas AnberbirNo ratings yet

- Commodity Money 3iat Money Jank MoneyDocument11 pagesCommodity Money 3iat Money Jank MoneyRabia RabiNo ratings yet

- Government Policy: Monetary & Fiscal PolicyDocument27 pagesGovernment Policy: Monetary & Fiscal PolicyGeorgia HolstNo ratings yet

- Funds: Financial Terms Related To FundsDocument8 pagesFunds: Financial Terms Related To FundsGustavoNo ratings yet

- The Federal Reserve System and Monetary PolicyDocument20 pagesThe Federal Reserve System and Monetary PolicyBrithney ButalidNo ratings yet

- Session 14 Money, Banking and Monetary Policy IDocument37 pagesSession 14 Money, Banking and Monetary Policy ISourabh AgrawalNo ratings yet

- Ch-CM-Depository InstitutionsDocument59 pagesCh-CM-Depository InstitutionsUzzaam HaiderNo ratings yet

- TCHE 303 - Tutorial 10Document5 pagesTCHE 303 - Tutorial 10Bách Nguyễn XuânNo ratings yet

- Interest Rate Determination TopicsDocument6 pagesInterest Rate Determination TopicsGian ErickaNo ratings yet

- Unit 3: Commercial Bank Sources of Funds: 1. Transaction DepositsDocument9 pagesUnit 3: Commercial Bank Sources of Funds: 1. Transaction Depositsመስቀል ኃይላችን ነውNo ratings yet

- Topic 5 Money MarketsDocument21 pagesTopic 5 Money MarketsKelly Chan Yun JieNo ratings yet

- Conduct of Monetary Policy: Tools, Goals, Strategy, and TacticsDocument30 pagesConduct of Monetary Policy: Tools, Goals, Strategy, and TacticsNaheed SakhiNo ratings yet

- The Money Supply and The Federal Reserve SystemDocument18 pagesThe Money Supply and The Federal Reserve SystemYuri AnnisaNo ratings yet

- Conduct of Monetary Policy Goal and TargetsDocument12 pagesConduct of Monetary Policy Goal and TargetsSumra KhanNo ratings yet

- 6 Federal Reserve System and Monetary PolicyDocument20 pages6 Federal Reserve System and Monetary PolicyIrene OdatoNo ratings yet

- Meyer 5-3-2000Document7 pagesMeyer 5-3-2000JaphyNo ratings yet

- GSFM7223-Econs eBookExcerpts L7-Chap36Document9 pagesGSFM7223-Econs eBookExcerpts L7-Chap36Shavinya SudhakaranNo ratings yet

- Chapter 10: Monetary Policy: Bank Negara MalaysiaDocument20 pagesChapter 10: Monetary Policy: Bank Negara MalaysiaCHZE CHZI CHUAHNo ratings yet

- Econ 202: Chapter 14Document24 pagesEcon 202: Chapter 14Thomas WooNo ratings yet

- The Repo MarketDocument16 pagesThe Repo MarketmeetozaNo ratings yet

- Money Markets: For A Period Longer Than 1 Year, in Form of Both Debt & Equity)Document5 pagesMoney Markets: For A Period Longer Than 1 Year, in Form of Both Debt & Equity)api-19893912No ratings yet

- Monetary System: Dr. Katherine Sauer A Citizen's Guide To Economics ECO 1040Document32 pagesMonetary System: Dr. Katherine Sauer A Citizen's Guide To Economics ECO 1040Katherine SauerNo ratings yet

- Chapter 4 - Activities and Charactristics Under Depository InstitutionsDocument7 pagesChapter 4 - Activities and Charactristics Under Depository Institutionssonchaenyoung2No ratings yet

- Lecture 21 (19th Jan, 2009)Document16 pagesLecture 21 (19th Jan, 2009)sana ziaNo ratings yet

- Rates and ConceptsDocument7 pagesRates and ConceptsRaul JainNo ratings yet

- Tools of Monetary PolicyCh15Document9 pagesTools of Monetary PolicyCh15Rija Murtaza SayeedNo ratings yet

- Chapter 3 Interest Rates and Security ValuationDocument5 pagesChapter 3 Interest Rates and Security ValuationJan Pearl HinampasNo ratings yet

- CH 15Document19 pagesCH 15rabi_kungleNo ratings yet

- Chapter 29/30: Monetary PolicyDocument14 pagesChapter 29/30: Monetary PolicyEri BuwonoNo ratings yet

- A New Frontier Monetary Policy With Ample Reserves SEDocument7 pagesA New Frontier Monetary Policy With Ample Reserves SEMike ClaytonNo ratings yet

- Monetary PolicyDocument23 pagesMonetary PolicyMayurRawoolNo ratings yet

- Term PaperDocument8 pagesTerm PaperKetema AsfawNo ratings yet

- Tute-9 FMTDocument6 pagesTute-9 FMTHiền NguyễnNo ratings yet

- Chapter 2Document28 pagesChapter 2mokeNo ratings yet

- 7 Mutual FundDocument5 pages7 Mutual FundI love strawberry berry berry strawberryNo ratings yet

- CHAPTER 4 NarrativeDocument5 pagesCHAPTER 4 NarrativeJoyce Anne GarduqueNo ratings yet

- Liquidity RiskDocument18 pagesLiquidity RiskMuhammad AsadNo ratings yet

- Business Cycles: DR - James Manalel Professor, SMSDocument36 pagesBusiness Cycles: DR - James Manalel Professor, SMSnoorakohNo ratings yet

- Central Bank Deposits Federal Reserve BankDocument2 pagesCentral Bank Deposits Federal Reserve Bankarvin cleinNo ratings yet

- Fis Act As More Attractive To Investors Than Are The Claims Directly Issued by CorporationsDocument11 pagesFis Act As More Attractive To Investors Than Are The Claims Directly Issued by CorporationsQuyen Tran ThaoNo ratings yet

- Eco U8 and 10Document7 pagesEco U8 and 10mehak vardhanNo ratings yet

- Fed and Financial PolicyDocument2 pagesFed and Financial PolicyjosephjbucciNo ratings yet

- Chapter 7Document53 pagesChapter 7Baby KhorNo ratings yet

- Economic Development CHAPTER 14Document39 pagesEconomic Development CHAPTER 14Angelica BeltranNo ratings yet

- Money in A Modern Economy: By-Sanskriti Kesarwani Roll No. - 22/COM) 120Document13 pagesMoney in A Modern Economy: By-Sanskriti Kesarwani Roll No. - 22/COM) 120SanskritiNo ratings yet

- Mac CH 14Document25 pagesMac CH 14karim kobeissiNo ratings yet

- Non Bank OperationsDocument78 pagesNon Bank OperationschingNo ratings yet

- Check Negotiable Instrument Check Promissory Note DrawerDocument7 pagesCheck Negotiable Instrument Check Promissory Note DrawerghnyerNo ratings yet

- Definition of The Federal Funds RateDocument7 pagesDefinition of The Federal Funds RateNguyễn DungNo ratings yet

- Economic Module 17Document6 pagesEconomic Module 17PatrickNo ratings yet

- Lecture Notes On Money, Banking, and Financial MarketsDocument5 pagesLecture Notes On Money, Banking, and Financial MarketsQoumal HashmiNo ratings yet

- Fund ManagementDocument12 pagesFund ManagementstabrezhassanNo ratings yet

- Important Notes For Midterm 2Document11 pagesImportant Notes For Midterm 2Abass Bayo-AwoyemiNo ratings yet

- White Paper Auriga Smart AtmsDocument2 pagesWhite Paper Auriga Smart AtmsirwinohNo ratings yet

- Maybank AR2021 Corporate Book PDFDocument132 pagesMaybank AR2021 Corporate Book PDFPankaj DuttNo ratings yet

- Paper 3Document15 pagesPaper 3Dhrisha GadaNo ratings yet

- Builder - Tom CartierDocument112 pagesBuilder - Tom CartierzhuorancaiNo ratings yet

- 1999-Loyalty of On-Line Bank CustomersDocument12 pages1999-Loyalty of On-Line Bank Customersanashj2No ratings yet

- FYBBI Sem 1 SyllabusDocument7 pagesFYBBI Sem 1 SyllabusSunil RawatNo ratings yet

- Contacting Us: WWW - Ukba.homeoffice - Gov.ukDocument11 pagesContacting Us: WWW - Ukba.homeoffice - Gov.ukSARFRAZ ALINo ratings yet

- Resume S.arvindkumar 2009 IIM IndoreDocument1 pageResume S.arvindkumar 2009 IIM Indoreficky_iitdNo ratings yet

- Post COVID-19 SME Financing Constraints and The Credit Guarantee Scheme Solution in Spain: A NoteDocument19 pagesPost COVID-19 SME Financing Constraints and The Credit Guarantee Scheme Solution in Spain: A Noteإمحمد السنوسي القزيريNo ratings yet

- G.R. No. 195166Document13 pagesG.R. No. 195166Abby EvangelistaNo ratings yet

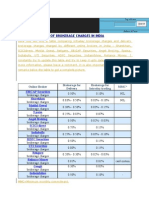

- Investo Blog: Comparison Table of Brokerage Charges in IndiaDocument16 pagesInvesto Blog: Comparison Table of Brokerage Charges in Indiajatin_ahuja03No ratings yet

- Mark To Market - AccountingDocument11 pagesMark To Market - Accountinggabby209No ratings yet

- Global Finance With Electronic Banking - Prelim ExamDocument5 pagesGlobal Finance With Electronic Banking - Prelim ExamAlfonso Joel GonzalesNo ratings yet

- Statement Nov 23 XXXXXXXX1574Document14 pagesStatement Nov 23 XXXXXXXX1574Arun SinghNo ratings yet

- Negotiable Instruments Law - Crossed ChecksDocument3 pagesNegotiable Instruments Law - Crossed ChecksWendy CassidyNo ratings yet

- CRM HSBCDocument26 pagesCRM HSBCRavi Shankar100% (1)

- Liverpool Owners Set For High Court Fight: Seismic Hearing TodayDocument32 pagesLiverpool Owners Set For High Court Fight: Seismic Hearing TodayCity A.M.No ratings yet

- Bank DataDocument9 pagesBank DataAnonymous KvNac2YIkNo ratings yet

- Top 100 Graduate Employers: Company Name Type of Business Website AddressDocument3 pagesTop 100 Graduate Employers: Company Name Type of Business Website AddressdanielbqNo ratings yet

- AlpenTimesJuly8 PDFDocument40 pagesAlpenTimesJuly8 PDFAnonymous uhxWDUGNo ratings yet

- American International University-Bangladesh (AIUB) Department of Computer Science Software Quality and Testing Fall 2021-2022Document4 pagesAmerican International University-Bangladesh (AIUB) Department of Computer Science Software Quality and Testing Fall 2021-2022Juairah RahmanNo ratings yet

- Account StatementDocument8 pagesAccount Statementmayank911No ratings yet

- Company ProfileDocument8 pagesCompany ProfilejanardhanvnNo ratings yet

- Ftcash's Product Sheet For DSAs & Connectors (As On 13th Oct'23)Document10 pagesFtcash's Product Sheet For DSAs & Connectors (As On 13th Oct'23)rohinidhebe1No ratings yet

- Wykład V.L.SmithDocument20 pagesWykład V.L.SmithprnoxxxNo ratings yet

- Chris Gildea ResumeDocument2 pagesChris Gildea Resumeapi-34165897No ratings yet

ECN 481 (13), Policy Tools

ECN 481 (13), Policy Tools

Uploaded by

Sacin Patel0 ratings0% found this document useful (0 votes)

9 views17 pagesThe document summarizes the main monetary policy tools used by the Federal Reserve: open market operations, the discount rate, and reserve ratios. Open market operations involve the Fed buying and selling bonds to inject or drain bank reserves from the system. The discount rate is the interest rate banks pay to borrow from the Fed. Reserve ratios determine how much banks must hold in reserves. The Fed uses these tools to target the federal funds rate, the interest rate at which banks lend reserves to each other, to influence overall monetary conditions.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes the main monetary policy tools used by the Federal Reserve: open market operations, the discount rate, and reserve ratios. Open market operations involve the Fed buying and selling bonds to inject or drain bank reserves from the system. The discount rate is the interest rate banks pay to borrow from the Fed. Reserve ratios determine how much banks must hold in reserves. The Fed uses these tools to target the federal funds rate, the interest rate at which banks lend reserves to each other, to influence overall monetary conditions.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views17 pagesECN 481 (13), Policy Tools

ECN 481 (13), Policy Tools

Uploaded by

Sacin PatelThe document summarizes the main monetary policy tools used by the Federal Reserve: open market operations, the discount rate, and reserve ratios. Open market operations involve the Fed buying and selling bonds to inject or drain bank reserves from the system. The discount rate is the interest rate banks pay to borrow from the Fed. Reserve ratios determine how much banks must hold in reserves. The Fed uses these tools to target the federal funds rate, the interest rate at which banks lend reserves to each other, to influence overall monetary conditions.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 17

Monetary Policy Tools

Instruments that initiate monetary

policy

Open Market Operations

The Discount Rate

Reserve Ratios

Open Market Operations

Defined as the buying or selling of

bonds by the Federal Reserve in the

open market.

Expansionary -- Fed buys bonds (injects

reserves)

Contractionary -- Fed sells bonds

(drains reserves)

Done at the Federal Reserve Bank of

New York

Open Market Operations:

How They’re Actually Done

Example -- Federal Reserve buys a

$1000 bond from Salomon

Brothers and pays with a check.

The check in turn is deposited in

checkable deposits at Chase,

which is Salomon Brothers bank.

Balance Sheet Portrayal

Salomon Brothers

Bonds -$1000

D +$1000

Chase

R +$1000 D +$1000

Federal Reserve Bank of NY

Bonds +$1000 R +$1000

Characteristics of

Open Market Operations

Sometimes done for temporary

periods

(Fed) Repurchase Agreement -- Fed

buys bond with agreement to sell it

back.

Matched-Sale Purchase -- Fed sells

bond with agreement to buy it back.

Open Market Operations --

An Effective Policy Tool

Occurs at the initiative of the Fed.

Fed is in complete control.

They are flexible: Fed can do small or

large amounts.

They are reversible: Fed can undo policy

mistakes.

Very low-key policy instrument: difficult

to tell what Fed has done.

The Discount Rate (iDISC)

Defined as the rate of interest

charged to banks that borrow from

the Federal Reserve.

Expansionary -- Fed lowers

discount rate.

Contractionary -- Fed raises

discount rate.

Effects of

Discount Rate Changes

Example -- Effect of Decrease in the

Discount Rate (iDISC).

iDISC DL M2

Increase in discount rate has the

reverse effect.

Types of Discount

Window Borrowing

Primary Credit -- borrowing for

short-term reserve adjustments.

Seasonal Credit -- borrowing for

seasonal needs.

Secondary Credit -- large, longer-

term borrowing for banks facing

financial difficulties.

Discount Rate Policy --

Characteristics

DL done at the discretion of banks, not

the Fed.

Discount Window can be abused by

banks, borrowing for profit (actively or

passively).

Sometimes is regarded as signal of

monetary policy, “the announcement

effect.”

Discount Rate Policy --

Its Diminished Role

Larger volume of borrowing from other

sources -- Federal Funds, RPs,

Eurodollars banks hardly use the

Federal Reserve for short-term reserve

adjustments.

Announcement effect now involves the

Federal Funds rate target.

Recent change in procedure (generally):

iDISC = Target iFF + 0.5%.

Reserve Ratios (rD, rT)

Designed to change the amount of

required reserves.

Expansionary Policy -- Fed lowers

reserve ratios.

Contractionary Policy -- Fed raises

reserve ratios.

Affects M2 by changing the multiplier.

Characteristics of

Reserve Ratio Policy

rT = 0 for Savings and Time

Deposits (including MMDAs)

DIDMCA Uniform Reserve

Requirements (based upon deposit

size)

Reserve Ratio Policy --

Rarely Used

Too blunt -- needs tiny changes for

reasonable adjustments in money

growth.

Too Disruptive -- affects all banks

balance sheets.

The Market For

Bank Reserves

Demand for Reserves (RD) -- Banks

wishing to borrow reserves in the

Federal Funds market, generally in

response to loan demand.

Downward sloping curve when plotted

against iFF, (i.e. iFF RD). It can shift

rightward (increase in demand) or

leftward (decrease in demand).

Supply of Reserves -- Banks offering

reserves to the Federal Funds market

+ the Federal Reserve changing

reserves using open market

operations.

Upward sloping curve when plotted

against iFF, (i.e. iFF RS). It can

shift rightward (increase in supply)

or leftward (decrease in supply).

Determination of

the Federal Funds Rate

The Federal Funds Rate (iFF) is

determined by equilibrium in the market

for bank reserves (where RD = RS).

The Federal Funds Rate changes due to

shifts in the Demand for Bank Reserves

or the Supply of Bank Reserves.

You might also like

- KPIs-Bank of America Merrill Lynch White PaperDocument5 pagesKPIs-Bank of America Merrill Lynch White PaperGabriela Brito TeixeiraNo ratings yet

- MScFE 560 FM - Compiled - Notes - M2 PDFDocument21 pagesMScFE 560 FM - Compiled - Notes - M2 PDFtylerNo ratings yet

- History of Banking in IndiaDocument15 pagesHistory of Banking in Indiaaccesstariq90% (29)

- Negotiable Instruments Act, 1881 PDFDocument61 pagesNegotiable Instruments Act, 1881 PDFmackjbl100% (3)

- Government Policies and Financial Services (Commercial Banks)Document14 pagesGovernment Policies and Financial Services (Commercial Banks)Ahmed El KhateebNo ratings yet

- Tools of Monetary PolicyDocument23 pagesTools of Monetary PolicyNandiniNo ratings yet

- The Money Supply, Banking System, and Monetary Policy: Chapters 17 & 18Document39 pagesThe Money Supply, Banking System, and Monetary Policy: Chapters 17 & 18Dr-Shefali GargNo ratings yet

- Tools of Monetary Policy: Open - Market Operations Discount Rate Reserve RequirementsDocument15 pagesTools of Monetary Policy: Open - Market Operations Discount Rate Reserve RequirementsAngelica BeltranNo ratings yet

- FMI Chapter 5 Monetary PolicyDocument50 pagesFMI Chapter 5 Monetary PolicyroyalcrownscentNo ratings yet

- Lect 2498Document29 pagesLect 2498AmrNo ratings yet

- FM Qu and AnswerDocument11 pagesFM Qu and AnswerMikiyas AnberbirNo ratings yet

- Commodity Money 3iat Money Jank MoneyDocument11 pagesCommodity Money 3iat Money Jank MoneyRabia RabiNo ratings yet

- Government Policy: Monetary & Fiscal PolicyDocument27 pagesGovernment Policy: Monetary & Fiscal PolicyGeorgia HolstNo ratings yet

- Funds: Financial Terms Related To FundsDocument8 pagesFunds: Financial Terms Related To FundsGustavoNo ratings yet

- The Federal Reserve System and Monetary PolicyDocument20 pagesThe Federal Reserve System and Monetary PolicyBrithney ButalidNo ratings yet

- Session 14 Money, Banking and Monetary Policy IDocument37 pagesSession 14 Money, Banking and Monetary Policy ISourabh AgrawalNo ratings yet

- Ch-CM-Depository InstitutionsDocument59 pagesCh-CM-Depository InstitutionsUzzaam HaiderNo ratings yet

- TCHE 303 - Tutorial 10Document5 pagesTCHE 303 - Tutorial 10Bách Nguyễn XuânNo ratings yet

- Interest Rate Determination TopicsDocument6 pagesInterest Rate Determination TopicsGian ErickaNo ratings yet

- Unit 3: Commercial Bank Sources of Funds: 1. Transaction DepositsDocument9 pagesUnit 3: Commercial Bank Sources of Funds: 1. Transaction Depositsመስቀል ኃይላችን ነውNo ratings yet

- Topic 5 Money MarketsDocument21 pagesTopic 5 Money MarketsKelly Chan Yun JieNo ratings yet

- Conduct of Monetary Policy: Tools, Goals, Strategy, and TacticsDocument30 pagesConduct of Monetary Policy: Tools, Goals, Strategy, and TacticsNaheed SakhiNo ratings yet

- The Money Supply and The Federal Reserve SystemDocument18 pagesThe Money Supply and The Federal Reserve SystemYuri AnnisaNo ratings yet

- Conduct of Monetary Policy Goal and TargetsDocument12 pagesConduct of Monetary Policy Goal and TargetsSumra KhanNo ratings yet

- 6 Federal Reserve System and Monetary PolicyDocument20 pages6 Federal Reserve System and Monetary PolicyIrene OdatoNo ratings yet

- Meyer 5-3-2000Document7 pagesMeyer 5-3-2000JaphyNo ratings yet

- GSFM7223-Econs eBookExcerpts L7-Chap36Document9 pagesGSFM7223-Econs eBookExcerpts L7-Chap36Shavinya SudhakaranNo ratings yet

- Chapter 10: Monetary Policy: Bank Negara MalaysiaDocument20 pagesChapter 10: Monetary Policy: Bank Negara MalaysiaCHZE CHZI CHUAHNo ratings yet

- Econ 202: Chapter 14Document24 pagesEcon 202: Chapter 14Thomas WooNo ratings yet

- The Repo MarketDocument16 pagesThe Repo MarketmeetozaNo ratings yet

- Money Markets: For A Period Longer Than 1 Year, in Form of Both Debt & Equity)Document5 pagesMoney Markets: For A Period Longer Than 1 Year, in Form of Both Debt & Equity)api-19893912No ratings yet

- Monetary System: Dr. Katherine Sauer A Citizen's Guide To Economics ECO 1040Document32 pagesMonetary System: Dr. Katherine Sauer A Citizen's Guide To Economics ECO 1040Katherine SauerNo ratings yet

- Chapter 4 - Activities and Charactristics Under Depository InstitutionsDocument7 pagesChapter 4 - Activities and Charactristics Under Depository Institutionssonchaenyoung2No ratings yet

- Lecture 21 (19th Jan, 2009)Document16 pagesLecture 21 (19th Jan, 2009)sana ziaNo ratings yet

- Rates and ConceptsDocument7 pagesRates and ConceptsRaul JainNo ratings yet

- Tools of Monetary PolicyCh15Document9 pagesTools of Monetary PolicyCh15Rija Murtaza SayeedNo ratings yet

- Chapter 3 Interest Rates and Security ValuationDocument5 pagesChapter 3 Interest Rates and Security ValuationJan Pearl HinampasNo ratings yet

- CH 15Document19 pagesCH 15rabi_kungleNo ratings yet

- Chapter 29/30: Monetary PolicyDocument14 pagesChapter 29/30: Monetary PolicyEri BuwonoNo ratings yet

- A New Frontier Monetary Policy With Ample Reserves SEDocument7 pagesA New Frontier Monetary Policy With Ample Reserves SEMike ClaytonNo ratings yet

- Monetary PolicyDocument23 pagesMonetary PolicyMayurRawoolNo ratings yet

- Term PaperDocument8 pagesTerm PaperKetema AsfawNo ratings yet

- Tute-9 FMTDocument6 pagesTute-9 FMTHiền NguyễnNo ratings yet

- Chapter 2Document28 pagesChapter 2mokeNo ratings yet

- 7 Mutual FundDocument5 pages7 Mutual FundI love strawberry berry berry strawberryNo ratings yet

- CHAPTER 4 NarrativeDocument5 pagesCHAPTER 4 NarrativeJoyce Anne GarduqueNo ratings yet

- Liquidity RiskDocument18 pagesLiquidity RiskMuhammad AsadNo ratings yet

- Business Cycles: DR - James Manalel Professor, SMSDocument36 pagesBusiness Cycles: DR - James Manalel Professor, SMSnoorakohNo ratings yet

- Central Bank Deposits Federal Reserve BankDocument2 pagesCentral Bank Deposits Federal Reserve Bankarvin cleinNo ratings yet

- Fis Act As More Attractive To Investors Than Are The Claims Directly Issued by CorporationsDocument11 pagesFis Act As More Attractive To Investors Than Are The Claims Directly Issued by CorporationsQuyen Tran ThaoNo ratings yet

- Eco U8 and 10Document7 pagesEco U8 and 10mehak vardhanNo ratings yet

- Fed and Financial PolicyDocument2 pagesFed and Financial PolicyjosephjbucciNo ratings yet

- Chapter 7Document53 pagesChapter 7Baby KhorNo ratings yet

- Economic Development CHAPTER 14Document39 pagesEconomic Development CHAPTER 14Angelica BeltranNo ratings yet

- Money in A Modern Economy: By-Sanskriti Kesarwani Roll No. - 22/COM) 120Document13 pagesMoney in A Modern Economy: By-Sanskriti Kesarwani Roll No. - 22/COM) 120SanskritiNo ratings yet

- Mac CH 14Document25 pagesMac CH 14karim kobeissiNo ratings yet

- Non Bank OperationsDocument78 pagesNon Bank OperationschingNo ratings yet

- Check Negotiable Instrument Check Promissory Note DrawerDocument7 pagesCheck Negotiable Instrument Check Promissory Note DrawerghnyerNo ratings yet

- Definition of The Federal Funds RateDocument7 pagesDefinition of The Federal Funds RateNguyễn DungNo ratings yet

- Economic Module 17Document6 pagesEconomic Module 17PatrickNo ratings yet

- Lecture Notes On Money, Banking, and Financial MarketsDocument5 pagesLecture Notes On Money, Banking, and Financial MarketsQoumal HashmiNo ratings yet

- Fund ManagementDocument12 pagesFund ManagementstabrezhassanNo ratings yet

- Important Notes For Midterm 2Document11 pagesImportant Notes For Midterm 2Abass Bayo-AwoyemiNo ratings yet

- White Paper Auriga Smart AtmsDocument2 pagesWhite Paper Auriga Smart AtmsirwinohNo ratings yet

- Maybank AR2021 Corporate Book PDFDocument132 pagesMaybank AR2021 Corporate Book PDFPankaj DuttNo ratings yet

- Paper 3Document15 pagesPaper 3Dhrisha GadaNo ratings yet

- Builder - Tom CartierDocument112 pagesBuilder - Tom CartierzhuorancaiNo ratings yet

- 1999-Loyalty of On-Line Bank CustomersDocument12 pages1999-Loyalty of On-Line Bank Customersanashj2No ratings yet

- FYBBI Sem 1 SyllabusDocument7 pagesFYBBI Sem 1 SyllabusSunil RawatNo ratings yet

- Contacting Us: WWW - Ukba.homeoffice - Gov.ukDocument11 pagesContacting Us: WWW - Ukba.homeoffice - Gov.ukSARFRAZ ALINo ratings yet

- Resume S.arvindkumar 2009 IIM IndoreDocument1 pageResume S.arvindkumar 2009 IIM Indoreficky_iitdNo ratings yet

- Post COVID-19 SME Financing Constraints and The Credit Guarantee Scheme Solution in Spain: A NoteDocument19 pagesPost COVID-19 SME Financing Constraints and The Credit Guarantee Scheme Solution in Spain: A Noteإمحمد السنوسي القزيريNo ratings yet

- G.R. No. 195166Document13 pagesG.R. No. 195166Abby EvangelistaNo ratings yet

- Investo Blog: Comparison Table of Brokerage Charges in IndiaDocument16 pagesInvesto Blog: Comparison Table of Brokerage Charges in Indiajatin_ahuja03No ratings yet

- Mark To Market - AccountingDocument11 pagesMark To Market - Accountinggabby209No ratings yet

- Global Finance With Electronic Banking - Prelim ExamDocument5 pagesGlobal Finance With Electronic Banking - Prelim ExamAlfonso Joel GonzalesNo ratings yet

- Statement Nov 23 XXXXXXXX1574Document14 pagesStatement Nov 23 XXXXXXXX1574Arun SinghNo ratings yet

- Negotiable Instruments Law - Crossed ChecksDocument3 pagesNegotiable Instruments Law - Crossed ChecksWendy CassidyNo ratings yet

- CRM HSBCDocument26 pagesCRM HSBCRavi Shankar100% (1)

- Liverpool Owners Set For High Court Fight: Seismic Hearing TodayDocument32 pagesLiverpool Owners Set For High Court Fight: Seismic Hearing TodayCity A.M.No ratings yet

- Bank DataDocument9 pagesBank DataAnonymous KvNac2YIkNo ratings yet

- Top 100 Graduate Employers: Company Name Type of Business Website AddressDocument3 pagesTop 100 Graduate Employers: Company Name Type of Business Website AddressdanielbqNo ratings yet

- AlpenTimesJuly8 PDFDocument40 pagesAlpenTimesJuly8 PDFAnonymous uhxWDUGNo ratings yet

- American International University-Bangladesh (AIUB) Department of Computer Science Software Quality and Testing Fall 2021-2022Document4 pagesAmerican International University-Bangladesh (AIUB) Department of Computer Science Software Quality and Testing Fall 2021-2022Juairah RahmanNo ratings yet

- Account StatementDocument8 pagesAccount Statementmayank911No ratings yet

- Company ProfileDocument8 pagesCompany ProfilejanardhanvnNo ratings yet

- Ftcash's Product Sheet For DSAs & Connectors (As On 13th Oct'23)Document10 pagesFtcash's Product Sheet For DSAs & Connectors (As On 13th Oct'23)rohinidhebe1No ratings yet

- Wykład V.L.SmithDocument20 pagesWykład V.L.SmithprnoxxxNo ratings yet

- Chris Gildea ResumeDocument2 pagesChris Gildea Resumeapi-34165897No ratings yet