Professional Documents

Culture Documents

L8 Remuneration

L8 Remuneration

Uploaded by

Маргарита БолдыреваCopyright:

Available Formats

You might also like

- Lessons from Private Equity Any Company Can UseFrom EverandLessons from Private Equity Any Company Can UseRating: 4.5 out of 5 stars4.5/5 (12)

- What Is CEO Talent Worth?Document7 pagesWhat Is CEO Talent Worth?Brian TayanNo ratings yet

- 4 Hoi and RobinDocument7 pages4 Hoi and RobinelizabetaangelovaNo ratings yet

- Director Optimal Pay Against Fat Cats in Taiwan: and Finance Research Vol. 4, No. 3 2015Document9 pagesDirector Optimal Pay Against Fat Cats in Taiwan: and Finance Research Vol. 4, No. 3 2015peter weinNo ratings yet

- Dividend Policy As Strategic Tool of Financing in Public Firms: Evidence From NigeriaDocument24 pagesDividend Policy As Strategic Tool of Financing in Public Firms: Evidence From Nigeriay_378602342No ratings yet

- 08 Chapter 1 - Managerial RemunerationDocument26 pages08 Chapter 1 - Managerial RemunerationMbaStudent56No ratings yet

- Determinants of Dividend Payout Ratios: Evidence From United StatesDocument7 pagesDeterminants of Dividend Payout Ratios: Evidence From United StatesSri Wahyuningsih AhmadNo ratings yet

- Subba ReddyDocument47 pagesSubba Reddyankitjaipur0% (1)

- Chap 8 - Executive Compensation and IncentivesDocument19 pagesChap 8 - Executive Compensation and IncentivesHM.No ratings yet

- Journal of Accounting and Economics 7Document35 pagesJournal of Accounting and Economics 7Ovilia Intan DoniarNo ratings yet

- DGYoung Dentist PresentationDocument103 pagesDGYoung Dentist PresentationD.WorkuNo ratings yet

- Distributions To Shareholders: Dividends and Repurchases: Batangas State UniversityDocument41 pagesDistributions To Shareholders: Dividends and Repurchases: Batangas State UniversityNicole AnditNo ratings yet

- Chapter 17 - Earnings Per Share and Retained Earnings PDFDocument59 pagesChapter 17 - Earnings Per Share and Retained Earnings PDFDaniela MacaveiuNo ratings yet

- 6818-Article Text-13380-1-10-20210226Document7 pages6818-Article Text-13380-1-10-20210226maruzaks123No ratings yet

- International Review of Economics and FinanceDocument16 pagesInternational Review of Economics and FinanceAYUNo ratings yet

- Is The Dividend Puzzle Solved - RDocument9 pagesIs The Dividend Puzzle Solved - RUyen TranNo ratings yet

- Rvunc Department of Management: Mba Program Course Title: Financial and Managerial Accounting Course Code: Mbad612Document3 pagesRvunc Department of Management: Mba Program Course Title: Financial and Managerial Accounting Course Code: Mbad612markosNo ratings yet

- Dividend Policy: Saurty Shekyn Das (1310709) BSC (Hons) Finance (Minor: Law) Dfa2002Y (3) Corporate Finance 20 April 2015Document9 pagesDividend Policy: Saurty Shekyn Das (1310709) BSC (Hons) Finance (Minor: Law) Dfa2002Y (3) Corporate Finance 20 April 2015Anonymous H2L7lwBs3No ratings yet

- The Relationship Between Dividend Payout and Financial Performance: Evidence From Top40 JSE FirmsDocument15 pagesThe Relationship Between Dividend Payout and Financial Performance: Evidence From Top40 JSE FirmsLouise Barik- بريطانية مغربيةNo ratings yet

- Matolcsy 2010Document19 pagesMatolcsy 2010amirhayat15No ratings yet

- Pledge (And Hedge) Allegiance To The CompanyDocument6 pagesPledge (And Hedge) Allegiance To The CompanyBrian TayanNo ratings yet

- Cesari 2015Document17 pagesCesari 2015Nicoara AdrianNo ratings yet

- Advances Research DocumentDocument12 pagesAdvances Research DocumentParvez AliNo ratings yet

- Developing Performance Incentives and Sustaining Engagement in A Volatile EnvironmentDocument42 pagesDeveloping Performance Incentives and Sustaining Engagement in A Volatile EnvironmentPrathamesh ParkarNo ratings yet

- American Accounting Association The Accounting ReviewDocument22 pagesAmerican Accounting Association The Accounting ReviewFTU.CS2 Nguyễn Hồ DanhNo ratings yet

- Dividend Policy: Firm Has 2 ChoicesDocument18 pagesDividend Policy: Firm Has 2 ChoicesRajat LoyaNo ratings yet

- The Role of Employees in Corporate GovernanceDocument19 pagesThe Role of Employees in Corporate Governancemanish byanjankarNo ratings yet

- Corm 1Document38 pagesCorm 1MAYURIKANo ratings yet

- C30CY Week 8 LectureDocument50 pagesC30CY Week 8 Lecturejohnshabin123No ratings yet

- C2A October 2011 Exam PDFDocument8 pagesC2A October 2011 Exam PDFJeff GundyNo ratings yet

- Nnadi Et Tanna 2011 Multivariate Analyses of Factors Affecting Dividend Policy of AcquiredDocument20 pagesNnadi Et Tanna 2011 Multivariate Analyses of Factors Affecting Dividend Policy of AcquiredismailNo ratings yet

- The Determinants of Dividend Policy: Evidence From Malaysian FirmsDocument20 pagesThe Determinants of Dividend Policy: Evidence From Malaysian FirmsIzzatieNo ratings yet

- Corm 1Document38 pagesCorm 1MAYURIKANo ratings yet

- Impact of Firm Specific Variables On Dividend Payout of Nepalese BanksDocument13 pagesImpact of Firm Specific Variables On Dividend Payout of Nepalese BanksMani ManandharNo ratings yet

- Healy-The Effect of Bonus Schemes On Accounting DecisionsDocument23 pagesHealy-The Effect of Bonus Schemes On Accounting DecisionsarfanysNo ratings yet

- 12 - 8 - Determinants of Dividend Payout in Private Insurance Companies of Ethiopia - PDFDocument7 pages12 - 8 - Determinants of Dividend Payout in Private Insurance Companies of Ethiopia - PDFYohanisNo ratings yet

- Total Shareholders' ReturnDocument32 pagesTotal Shareholders' ReturnAmmi JulianNo ratings yet

- International Journal in Multidisciplinary and Academic Research (SSIJMAR) Vol. 3, No. 1, February-March - 2014 (ISSN 2278 - 5973)Document16 pagesInternational Journal in Multidisciplinary and Academic Research (SSIJMAR) Vol. 3, No. 1, February-March - 2014 (ISSN 2278 - 5973)Siva KalimuthuNo ratings yet

- Stakeholders 2Document25 pagesStakeholders 2Sebastián Posada100% (1)

- Chap 001Document17 pagesChap 001Raju_RNO EnggNo ratings yet

- DividendDocument30 pagesDividendFaruqNo ratings yet

- Stock Buyback 4Document15 pagesStock Buyback 4sethNo ratings yet

- Assignment 14Document7 pagesAssignment 14Satishkumar NagarajNo ratings yet

- Corporate Finance in 30 Minutes: A Guide For Directors and ShareholdersDocument14 pagesCorporate Finance in 30 Minutes: A Guide For Directors and ShareholdersMarcelo Vieira100% (1)

- The Relationship Between Dividend Payout and Financial Performance: Evidence From Top40 JSE FirmsDocument16 pagesThe Relationship Between Dividend Payout and Financial Performance: Evidence From Top40 JSE Firmsmaruzaks123No ratings yet

- Finance QuestionsDocument6 pagesFinance QuestionsCream FamilyNo ratings yet

- Pensions As A Form of Executive Compensation: L G Y LDocument35 pagesPensions As A Form of Executive Compensation: L G Y LFabiana SeverianoNo ratings yet

- The Macro Impact of Short-Termism15420-4Document45 pagesThe Macro Impact of Short-Termism15420-4dk773No ratings yet

- Assignment - VALIDITY OF THE LINTNER MODEL ON MAURITIAN CAPITAL MARKET PDFDocument25 pagesAssignment - VALIDITY OF THE LINTNER MODEL ON MAURITIAN CAPITAL MARKET PDFSamba BahNo ratings yet

- Dividend PolicyDocument8 pagesDividend PolicyHarsh SethiaNo ratings yet

- Presentation On: Compensation ManagementDocument29 pagesPresentation On: Compensation Managementarun_aglNo ratings yet

- Journal of Corporate Finance: Naoya Mori, Naoshi IkedaDocument10 pagesJournal of Corporate Finance: Naoya Mori, Naoshi IkedaZahra BatoolNo ratings yet

- Pay Perf Report 110812Document25 pagesPay Perf Report 110812brandon-harris-6868No ratings yet

- 7 Myths of Corporate GovernanceDocument10 pages7 Myths of Corporate GovernanceJawad UmarNo ratings yet

- Dividend Policy, Agency Costs, and Earned EquityDocument35 pagesDividend Policy, Agency Costs, and Earned EquityhhhhhhhNo ratings yet

- R&D Investments and Dividend Payout: Evidence Concerning The Semi-Mandatory Dividend Policy in ChinaDocument37 pagesR&D Investments and Dividend Payout: Evidence Concerning The Semi-Mandatory Dividend Policy in ChinadeviundipNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- The Declaration of Dependence: Dividends in the Twenty-First CenturyFrom EverandThe Declaration of Dependence: Dividends in the Twenty-First CenturyNo ratings yet

- Outperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueFrom EverandOutperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueNo ratings yet

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.From EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.No ratings yet

- Bbi 2Document39 pagesBbi 2RESHMANo ratings yet

- Isda 2002 Master Agreement: Understanding The New Isda Documentation ConferenceDocument66 pagesIsda 2002 Master Agreement: Understanding The New Isda Documentation ConferencepapillonnnnNo ratings yet

- Corporate Governance (Baec0007) NewDocument46 pagesCorporate Governance (Baec0007) NewankitaaecsaxenaNo ratings yet

- Century Enka Limited: Analysis of Company's Financial StatementDocument24 pagesCentury Enka Limited: Analysis of Company's Financial StatementAnand PurohitNo ratings yet

- SM Prime Holdings Inc.: Integrated Annual Corporate Governance Report Analysis ReportDocument2 pagesSM Prime Holdings Inc.: Integrated Annual Corporate Governance Report Analysis Reportbelle crisNo ratings yet

- W1-Part 2-Additional-Ch 3-SaT-FIN 410Document7 pagesW1-Part 2-Additional-Ch 3-SaT-FIN 410Syed Aquib AbbasNo ratings yet

- Penerapan Sistem Pengendalian Internal Dengan CosoDocument17 pagesPenerapan Sistem Pengendalian Internal Dengan CosoFardian FardianNo ratings yet

- What Is Auditing ProcessDocument3 pagesWhat Is Auditing ProcessAizaButtNo ratings yet

- CJR English For BusinessDocument18 pagesCJR English For BusinessKristina SihombingNo ratings yet

- Various Committees On Corporate GovernanceDocument11 pagesVarious Committees On Corporate GovernanceFouzia imzNo ratings yet

- BAFI1018 International FinanceDocument109 pagesBAFI1018 International FinanceSteven NgNo ratings yet

- Lovello Annual Report 2021 22Document159 pagesLovello Annual Report 2021 22aribNo ratings yet

- Annual Report PT Pegadaian 2021Document536 pagesAnnual Report PT Pegadaian 2021bseptiyantoNo ratings yet

- Models of Corporate GovernanceDocument10 pagesModels of Corporate GovernanceNeil patrickNo ratings yet

- AccountabilityDocument15 pagesAccountabilityRavi SinghNo ratings yet

- Session 2. The COSO ERM Framework in DetailDocument18 pagesSession 2. The COSO ERM Framework in DetailManish AroraNo ratings yet

- Corporate Accounting Frauds 16112013Document27 pagesCorporate Accounting Frauds 16112013teammrauNo ratings yet

- Transportation 4-5-17Document39 pagesTransportation 4-5-17Punit Singh SardarNo ratings yet

- 7.1a Principal-Protected Notes: Trading Strategies Involving OptionsDocument14 pages7.1a Principal-Protected Notes: Trading Strategies Involving OptionsAnDy YiMNo ratings yet

- Agenda Item 1.4: IPSAS-IFRS Alignment Dashboard OverviewDocument23 pagesAgenda Item 1.4: IPSAS-IFRS Alignment Dashboard OverviewHadera TesfayNo ratings yet

- 20 ArrendamientosDocument87 pages20 ArrendamientosCarlos Eduardo LoveraNo ratings yet

- Code of Corporate Governance As Issued by Bangladesh Securities Exchange Commission in 2006 and Subsequent Modifications To Highlight Measures Aimed at Better Financial ManagementDocument4 pagesCode of Corporate Governance As Issued by Bangladesh Securities Exchange Commission in 2006 and Subsequent Modifications To Highlight Measures Aimed at Better Financial ManagementMahin KhanNo ratings yet

- Annual Report 2017-2018 PDFDocument90 pagesAnnual Report 2017-2018 PDFMuhmmad Sheikh AmanNo ratings yet

- Comparison Between HK Financial Reporting Standards and International Financial Reporting StandardsDocument29 pagesComparison Between HK Financial Reporting Standards and International Financial Reporting Standardsisaac2008100% (1)

- Takis Katsoulakos and Yannis KatsoulacosDocument15 pagesTakis Katsoulakos and Yannis KatsoulacosSebastianNo ratings yet

- Audit Committee, Internal Audit Function and Earnings Management: Evidence From JordanDocument19 pagesAudit Committee, Internal Audit Function and Earnings Management: Evidence From JordanNadeem TahaNo ratings yet

- KESC Annual-Report-2013Document197 pagesKESC Annual-Report-2013makhalidiNo ratings yet

- Bahan Metod 1Document7 pagesBahan Metod 1Gaura HarieNo ratings yet

- Naked OptionDocument3 pagesNaked OptionRayzwanRayzmanNo ratings yet

L8 Remuneration

L8 Remuneration

Uploaded by

Маргарита БолдыреваOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

L8 Remuneration

L8 Remuneration

Uploaded by

Маргарита БолдыреваCopyright:

Available Formats

Corporate Governance

L8 – Executive Remuneration

Dr. Dr. Petra Inwinkl

Steuerberaterin und Wirtschaftstreuhänderin

Department of Accounting, Innovation and Strategy,

Oskar-Morgenstern-Platz 1, 1090 Wien,

Room 04.338

Mobile: +43-664-60277-38125

DR. DR. PETRA INWINKL STB 1

Compulsory reading

Shleifer, A. and Vishny R.(1997), A Survey of Corporate Governance, Journal of

Finance, Vol. LII, No.2, C. Incentive Contracts

Obermann, & Velte. (2018). Determinants and consequences of executive

compensation-related shareholder activism and say-on-pay votes: A literature review

and research agenda. Journal of Accounting Literature, 40, 116-151.

EU Guidance on Executive Remuneration in the financial services sector

http://ec.europa.eu/internal_market/company/directors-remun/index_en.htm

Directive (EU) 2017/828 of the European Parliament and of the Council of 17 May 2017

amending Directive 2007/36/EC as regards the encouragement of long-term

shareholder engagement (Text with EEA relevance)

http://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32017L0828&from=EN

DR. DR. PETRA INWINKL STB 2

Executive compensation (remuneration)

Executive remuneration is one of the most important drivers of shareholder activism.

Executive compensation is usually structured in

fixed-cash salary,

incentive-based payments (variable compensation) and

other compensation, such as severance agreements.

1. Salary is able to reduce dissent because it is associated with lower overall payments.

2. Severance agreements, short-term bonuses, or other incentive-based payments are frequently opposed

by shareholders.

3. Other incentive-based payments class, disagreement is currently focused on equity compensation.

Equity compensation raises further concerns due to the level of dilution (loss of voting power), which is

linked to the value of the issued stocks or stock options (loss of money).

Dilution is usually measured as the sum of shares and options requested plus the sum of shares and

options already available in current plans, divided by the total number of outstanding.

Source: Obermann, & Velte. (2018). Determinants and consequences of executive compensation-related shareholder activism and say-on-pay votes: A literature review and research agenda. Journal of Accounting

Literature, 40, 116-151.

DR. DR. PETRA INWINKL STB 3

Pay-performance-sensitivity (PPS) ratios

Measurement of executive remuneration

there are specific pay-performance-sensitivity (PPS) ratios

Overall compensation structure

PPS is an important issue for investors

PPS proposals are used by shareholders when CEOs are excessively paid or managers use

their power in order to manage discretionary accruals in their favor.

Low PPS values increase SOP voting dissent, and intense shareholder oversight

However specific investors (e.g. labor unions), seem to have little ability or ambition to

challenge firms with inefficient compensation contracts.

They ignore those with higher abnormal CEO compensation.

Source: Obermann, & Velte. (2018). Determinants and consequences of executive compensation-related shareholder activism and say-on-pay votes: A literature review and research agenda. Journal of Accounting

Literature, 40, 116-151.

DR. DR. PETRA INWINKL STB 4

Total compensation

Total compensation is the most important reason for proxy vote dissent.

There is ample evidence that high total or excessive compensation attracts negative

voting reactions

In the USA and the UK , especially when the compensation is abnormally high.

In Australia, increased dissent is reported in times of higher payments.

When assessing the annual compensation, shareholders use the granted amount

rather than the payouts.

Reason: Equity payments have vesting periods, and contingency payments can

be subject to deferrals.

Source: Obermann, & Velte. (2018). Determinants and consequences of executive compensation-related shareholder activism and say-on-pay votes: A literature review and research agenda. Journal of Accounting Literature, 40, 116-

151.

DR. DR. PETRA INWINKL STB 5

CEO compensation

CEO compensation rose 940% from 1978 to 2018,

compared with a 12% rise in pay for the average

American worker during the same period,

according to the Economic Policy Institute.

In 2018, average CEO pay at the 350 biggest U.S.

companies was $17.2 million.

Chief executives at large companies make roughly

$278 for every $1 a typical worker earns´.

DR. DR. PETRA INWINKL STB 6

DR. DR. PETRA INWINKL STB 7

Waxman: I have a basic question for you. Is this fair?

Case of Lehman Brothers in USA

Richard Fuld (Lehman Brothers CEO) remuneration ($)

1993-2008

Compensation 500 000 000

Average annual salary in the USA 2008 ($)

41 335

How many years you would have to work to accumulate wealth earned by Richard Fuld in years 1993 - 2008?

Years

12 096

https://www.youtube.com/watch?v=0GGV3GGHD2Qhttps://www.theguardian.com/business/2008/oct/07/lehmanbrothers.banking

DR. DR. PETRA INWINKL STB 8

Development of reward systems

The idea:

◦ Shleifer, A. and Vishny R.(1997) discuss the agency problem when complete,

contingent contracts are infeasible. Do you remember the agency

theory we were discussing?

◦ Managers possess more information and expertise than shareholders.

◦ Managers typically end up with the residual rights of control, giving them

enormous latitude for self-interested behavior.

◦ In some cases, this results in managers taking highly inefficient actions, which cost

investors far more than the personal benefits to the managers.

DR. DR. PETRA INWINKL STB 9

Incentive contracts - Jensen and Meckling (1976),

Fama (1980)

Proposal:

Incentive component of pay should be substantial.

In this way, incentive contracts can induce managers to act

in investors' interests without encouraging blackmail.

Company failures of the past

show that this seems not to

be the appropriate solution

DR. DR. PETRA INWINKL STB 10

Development of reward systems

Performance-related pay is a generic term

for reward

Since the 80ies

In recent decades there has been a move

toward performance-related pay schemes

in many organizations.

This has lead to a situation where a

higher portion of the employees pay is

dependent on performance.

This should lead to efficiency savings.

DR. DR. PETRA INWINKL STB 11

Key elements of directors’

(executives’) remuneration

1) Base salary and benefits

(car with driver, housing,

healthcare, etc.)

2) Bonus payments

3) Stock options/long-term

options

4) Restricted share plans

(stock grants)

5) Termination payment

6) Pension payments

DR. DR. PETRA INWINKL STB 12 12

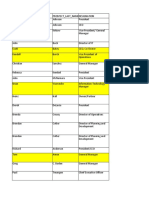

Management Board

Bayer Annual Report 2016

Board of Management Compensation (German Commercial Code)

Long-term stock-

Long-term variable cash based cash

Fixed annual Short-term variable compensation based on virtual compensation Aggregate

compensation Fringe benefits cash compensation1 Bayer shares (50% STI)2 (Aspire)3 compensation Pension service cost4

2015 2016 2015 2016 2015 2016 2015 2015 2016 2015 2016 2015 2016 2015 2016

No. of

€ thousand € thousand € thousand € thousand € thousand € thousand shares € thousand € thousand € thousand € thousand € thousand € thousand € thousand € thousand

Serving members of the

Board of Management as

of December 31, 2016

Werner Baumann

(Chairman)5 906 1 285 47 47 1 237 2 329 10 377 1 237 – 262 1 983 3 689 5 644 227 764

Liam Condon – 800 – 44 – 1 106 – – – – 1 624 – 3 574 – 330

Johannes Dietsch 725 750 44 83 917 978 7 698 917 – 210 1 522 2 813 3 333 220 318

Dr. Hartmut Klusik – 750 – 140 – 1 053 – – – – 1 522 – 3 465 – 316

Kemal Malik 725 775 40 35 917 1 050 7 698 917 – 210 1 573 2 809 3 433 222 318

Erica Mann – 750 – 182 – 798 – – – – 1 522 – 3 252 – 219

Dieter Weinand – 800 – 34 – 1 274 – – – – 1 623 – 3 731 – 240

Former members

Dr. Marijn Dekkers6 1 374 475 40 99 1 995 475 16 739 1 995 – 398 964 5 802 2 013 967 382

Michael König 725 – 36 – 917 – 7 698 917 – 210 – 2 805 – 211 –

Total 4 455 6 385 207 664 5 983 9 063 50 210 5 983 – 1 290 12 333 17 918 28 445 1 847 2 887

1 In line with the change in the compensation system for the members of the Board of Management, the entire amount of the STI is paid out in cash, starting with the STI for 2016. The 50:50 split of the STI into a cash payment and a grant of virtual Bayer shares blocked for three years was last

made for 2015.

2 The long-term variable cash compensation based on virtual Bayer shares was discontinued as of 2016.

3 Fair value at grant date; the figure for 2016 includes the new Aspire 2.0 tranche. For Dr. Marijn Dekkers, 4/12 of the grant amount for Aspire 2.0 is shown.

4 Including company contribution to Bayer-Pensionskasse VVaG, Rheinische Pensionskasse VVaG and to a pension fund outside Germany

5 The increased variable compensation for Werner Baumann in 2015 resulted mainly from his temporary duties as head of Bayer HealthCare in addition to his primary responsibilities as a member of the Board of Management.

6 Dr. Marijn Dekkers additionally received a severance payment of €4,341 thousand. This puts him in the same position as if he had held office until December 31, 2016, and had then retired.

DR. DR. PETRA INWINKL STB 13

Example of a problematic distribution structure

1) Base pay (salary)

2) Annual incentives

(short term incentives)

3) Long term incentives

"The only thing that's not possible is self-

regulation or the status quo.“ Michel Barnier on

Sep 24, 2012

DR. DR. PETRA INWINKL STB 14

What is

on EU

level on EU Guidance on executive remuneration

this topic?

2004: COMMISSION RECOMMENDATION 2004/913/EC

fostering an appropriate regime for the remuneration of directors of listed companies

2005: COMMISSION RECOMMENDATION 2005/162/EC

on the role of non-executive or supervisory directors of listed companies and on the

committees of the (supervisory) board

2009: COMMISSION RECOMMENDATION

complementing Recommendations 2004/913/EC and 2005/162/EC with regards to the regime for

the remuneration of directors of listed companies

EU Commission new guidelines for directors’ remunerations issued in 2009. However the

guidelines are non-binding

2009: COMMISSION RECOMMENDATION on remuneration Official discussion

policies in the financial services sector started already close

to 20 years ago

DR. DR. PETRA INWINKL STB 15

EU Guidance on executive remuneration

Recommendations contains four main provisions

Disclosure of company remuneration Prior shareholder approval

policies: of share-based

Clear and comprehensive remuneration schemes:

overview of company should be By way of a separate

provided to shareholders resolution at the annual

general meeting prior to the

adoption

Disclosure of individual directors’

The majority of member states follow

remuneration: the Commission’s Recommendation

Total remuneration & other benefits of regarding the approval of share-based

directors should be disclosed in detail in remuneration schemes by

shareholders at the general meeting.

the annual accounts or in the notes to This requirement is quite often

annual accounts implemented through law.

DR. DR. PETRA INWINKL STB 16

EU Guidance on executive remuneration

shareholders’ vote

vote on the ex post

remuneration policy remuneration reports

Cyprus, the Netherlands, Sweden,

Bulgaria, Hungary, Lithuania, Malta,

Lithuania, Spain, and the United

Romania, and Slovakia

Kingdom

result result

binding vote = approval needed by advisory vote

shareholders Directive (EU) 2017/828 of the European Parliament and of the Council of 17

May 2017 amending Directive 2007/36/EC as regards the encouragement of

long-term shareholder engagement (Text with EEA relevance)

DR. DR. PETRA INWINKL STB 17

EU Guidance on executive remuneration

2009: RECOMMENDATION on remuneration policies in the financial services sector

Based on the following issues:

DR. DR. PETRA INWINKL STB 18

Executive remuneration

Should a board member receive severance pay also in the case of serious fault?

Set a maximum 2 year limit of fixed component of director remuneration on severance pay

and ban severance pay in case of failure

Should there be a compensation limit in the amount of variable pay?

Require a balance between fixed & variable remuneration to strengthen the link between

performance and pay

Promote a long-term sustainability of companies through a balance between long and short term

performance for directors’ remuneration

How should non-executive board members be renumerated?

Non-executives should not receive share options as a remuneration to avoid conflict of interests

DR. DR. PETRA INWINKL STB 19

Executive remuneration

Further aspects of the recommendation

Allow companies to reclaim variable remuneration awarded which proved to be

manifestly misstated (clawback)

Extend certain disclosure requirement to improve shareholder oversight of

remuneration policies

Strengthen the role and operation of the remuneration committee

Ensure that shareholders attend general meetings

DR. DR. PETRA INWINKL STB 20

Banking Directive including remuneration issues

2010: Amendment of the Capital Requirement Directive review of remuneration

policies

Since 2014:

EU's bonus cap is one of the most high-profile rules approved by the 28-

country bloc following public anger over high pay at banks, many of which were

propped up by taxpayers in the wake of the 2008 financial crisis.

The rules limit bankers' bonuses to 100% of annual salary, or twice the annual

salary if shareholders explicitly approve.

DR. DR. PETRA INWINKL STB 21

Problem with directors pay disclosure

It is often difficult to identify the important information in the current directors' remuneration

reports.

The complexity of directors' pay makes it hard to disentangle what executives are actually

earning and to judge whether this is appropriate.

The quality of disclosure is insufficient.

This makes it

• time consuming

• costly to assess remuneration

• costly to assess remuneration to compare between companies

• costly to assess remuneration to compare between companies across borders.

DR. DR. PETRA INWINKL STB 22

Coming back to

SOP proposal effects – shareholder pressure

1. As SOP votes are not always binding

◦ executives could ignore low dissent votes

◦ A overall high level of support for SOP votes encourages

managers to increase their pay packages

Source: Obermann, & Velte. (2018). Determinants and consequences of executive compensation-related shareholder activism and say-on-pay votes: A literature review and

research agenda. Journal of Accounting Literature, 40, 116-151.

DR. DR. PETRA INWINKL STB 23

Conclusion executive compensation

Executive compensation is mostly affected by SOP voting dissent

◦ When facing shareholder disagreement

◦ firms reduce the growth of CEO compensation, total remuneration, decrease in

fixed salaries and make cuts in short-term bonus payments.

The reduction of compensation is more pronounced in companies with

overall poor market

operational

or abnormal compensation

Source: Obermann, & Velte. (2018). Determinants and consequences of executive compensation-related shareholder activism and say-on-pay votes: A literature review and

research agenda. Journal of Accounting Literature, 40, 116-151.

DR. DR. PETRA INWINKL STB 24

Your next step after this session

Repeat the information for this session

Watch and reflect on Additinal Video Seminar V9 & V10 – Legitimacy & Stewardship Theory

Solve Mini-Quiz 5

Prepare for the upcoming Midterm Quiz (16:00 – 17:00, 18.Nov.2021)

Prepare PPT slides & Discussion questions for Group Assignment – Part B and submit your

work by the deadline (23:59, 27.Nov.2021 & 28.Nov.2021)

DR. DR. PETRA INWINKL STB 25

Thank you for

your

participation!

Have a good

rest of the day

and all the

very best for

you!

Petra Inwinkl

Bildquelle: https://pixabay.com/service/terms/ (Stand 20.05.2020)

DR. DR. PETRA INWINKL STB 26

You might also like

- Lessons from Private Equity Any Company Can UseFrom EverandLessons from Private Equity Any Company Can UseRating: 4.5 out of 5 stars4.5/5 (12)

- What Is CEO Talent Worth?Document7 pagesWhat Is CEO Talent Worth?Brian TayanNo ratings yet

- 4 Hoi and RobinDocument7 pages4 Hoi and RobinelizabetaangelovaNo ratings yet

- Director Optimal Pay Against Fat Cats in Taiwan: and Finance Research Vol. 4, No. 3 2015Document9 pagesDirector Optimal Pay Against Fat Cats in Taiwan: and Finance Research Vol. 4, No. 3 2015peter weinNo ratings yet

- Dividend Policy As Strategic Tool of Financing in Public Firms: Evidence From NigeriaDocument24 pagesDividend Policy As Strategic Tool of Financing in Public Firms: Evidence From Nigeriay_378602342No ratings yet

- 08 Chapter 1 - Managerial RemunerationDocument26 pages08 Chapter 1 - Managerial RemunerationMbaStudent56No ratings yet

- Determinants of Dividend Payout Ratios: Evidence From United StatesDocument7 pagesDeterminants of Dividend Payout Ratios: Evidence From United StatesSri Wahyuningsih AhmadNo ratings yet

- Subba ReddyDocument47 pagesSubba Reddyankitjaipur0% (1)

- Chap 8 - Executive Compensation and IncentivesDocument19 pagesChap 8 - Executive Compensation and IncentivesHM.No ratings yet

- Journal of Accounting and Economics 7Document35 pagesJournal of Accounting and Economics 7Ovilia Intan DoniarNo ratings yet

- DGYoung Dentist PresentationDocument103 pagesDGYoung Dentist PresentationD.WorkuNo ratings yet

- Distributions To Shareholders: Dividends and Repurchases: Batangas State UniversityDocument41 pagesDistributions To Shareholders: Dividends and Repurchases: Batangas State UniversityNicole AnditNo ratings yet

- Chapter 17 - Earnings Per Share and Retained Earnings PDFDocument59 pagesChapter 17 - Earnings Per Share and Retained Earnings PDFDaniela MacaveiuNo ratings yet

- 6818-Article Text-13380-1-10-20210226Document7 pages6818-Article Text-13380-1-10-20210226maruzaks123No ratings yet

- International Review of Economics and FinanceDocument16 pagesInternational Review of Economics and FinanceAYUNo ratings yet

- Is The Dividend Puzzle Solved - RDocument9 pagesIs The Dividend Puzzle Solved - RUyen TranNo ratings yet

- Rvunc Department of Management: Mba Program Course Title: Financial and Managerial Accounting Course Code: Mbad612Document3 pagesRvunc Department of Management: Mba Program Course Title: Financial and Managerial Accounting Course Code: Mbad612markosNo ratings yet

- Dividend Policy: Saurty Shekyn Das (1310709) BSC (Hons) Finance (Minor: Law) Dfa2002Y (3) Corporate Finance 20 April 2015Document9 pagesDividend Policy: Saurty Shekyn Das (1310709) BSC (Hons) Finance (Minor: Law) Dfa2002Y (3) Corporate Finance 20 April 2015Anonymous H2L7lwBs3No ratings yet

- The Relationship Between Dividend Payout and Financial Performance: Evidence From Top40 JSE FirmsDocument15 pagesThe Relationship Between Dividend Payout and Financial Performance: Evidence From Top40 JSE FirmsLouise Barik- بريطانية مغربيةNo ratings yet

- Matolcsy 2010Document19 pagesMatolcsy 2010amirhayat15No ratings yet

- Pledge (And Hedge) Allegiance To The CompanyDocument6 pagesPledge (And Hedge) Allegiance To The CompanyBrian TayanNo ratings yet

- Cesari 2015Document17 pagesCesari 2015Nicoara AdrianNo ratings yet

- Advances Research DocumentDocument12 pagesAdvances Research DocumentParvez AliNo ratings yet

- Developing Performance Incentives and Sustaining Engagement in A Volatile EnvironmentDocument42 pagesDeveloping Performance Incentives and Sustaining Engagement in A Volatile EnvironmentPrathamesh ParkarNo ratings yet

- American Accounting Association The Accounting ReviewDocument22 pagesAmerican Accounting Association The Accounting ReviewFTU.CS2 Nguyễn Hồ DanhNo ratings yet

- Dividend Policy: Firm Has 2 ChoicesDocument18 pagesDividend Policy: Firm Has 2 ChoicesRajat LoyaNo ratings yet

- The Role of Employees in Corporate GovernanceDocument19 pagesThe Role of Employees in Corporate Governancemanish byanjankarNo ratings yet

- Corm 1Document38 pagesCorm 1MAYURIKANo ratings yet

- C30CY Week 8 LectureDocument50 pagesC30CY Week 8 Lecturejohnshabin123No ratings yet

- C2A October 2011 Exam PDFDocument8 pagesC2A October 2011 Exam PDFJeff GundyNo ratings yet

- Nnadi Et Tanna 2011 Multivariate Analyses of Factors Affecting Dividend Policy of AcquiredDocument20 pagesNnadi Et Tanna 2011 Multivariate Analyses of Factors Affecting Dividend Policy of AcquiredismailNo ratings yet

- The Determinants of Dividend Policy: Evidence From Malaysian FirmsDocument20 pagesThe Determinants of Dividend Policy: Evidence From Malaysian FirmsIzzatieNo ratings yet

- Corm 1Document38 pagesCorm 1MAYURIKANo ratings yet

- Impact of Firm Specific Variables On Dividend Payout of Nepalese BanksDocument13 pagesImpact of Firm Specific Variables On Dividend Payout of Nepalese BanksMani ManandharNo ratings yet

- Healy-The Effect of Bonus Schemes On Accounting DecisionsDocument23 pagesHealy-The Effect of Bonus Schemes On Accounting DecisionsarfanysNo ratings yet

- 12 - 8 - Determinants of Dividend Payout in Private Insurance Companies of Ethiopia - PDFDocument7 pages12 - 8 - Determinants of Dividend Payout in Private Insurance Companies of Ethiopia - PDFYohanisNo ratings yet

- Total Shareholders' ReturnDocument32 pagesTotal Shareholders' ReturnAmmi JulianNo ratings yet

- International Journal in Multidisciplinary and Academic Research (SSIJMAR) Vol. 3, No. 1, February-March - 2014 (ISSN 2278 - 5973)Document16 pagesInternational Journal in Multidisciplinary and Academic Research (SSIJMAR) Vol. 3, No. 1, February-March - 2014 (ISSN 2278 - 5973)Siva KalimuthuNo ratings yet

- Stakeholders 2Document25 pagesStakeholders 2Sebastián Posada100% (1)

- Chap 001Document17 pagesChap 001Raju_RNO EnggNo ratings yet

- DividendDocument30 pagesDividendFaruqNo ratings yet

- Stock Buyback 4Document15 pagesStock Buyback 4sethNo ratings yet

- Assignment 14Document7 pagesAssignment 14Satishkumar NagarajNo ratings yet

- Corporate Finance in 30 Minutes: A Guide For Directors and ShareholdersDocument14 pagesCorporate Finance in 30 Minutes: A Guide For Directors and ShareholdersMarcelo Vieira100% (1)

- The Relationship Between Dividend Payout and Financial Performance: Evidence From Top40 JSE FirmsDocument16 pagesThe Relationship Between Dividend Payout and Financial Performance: Evidence From Top40 JSE Firmsmaruzaks123No ratings yet

- Finance QuestionsDocument6 pagesFinance QuestionsCream FamilyNo ratings yet

- Pensions As A Form of Executive Compensation: L G Y LDocument35 pagesPensions As A Form of Executive Compensation: L G Y LFabiana SeverianoNo ratings yet

- The Macro Impact of Short-Termism15420-4Document45 pagesThe Macro Impact of Short-Termism15420-4dk773No ratings yet

- Assignment - VALIDITY OF THE LINTNER MODEL ON MAURITIAN CAPITAL MARKET PDFDocument25 pagesAssignment - VALIDITY OF THE LINTNER MODEL ON MAURITIAN CAPITAL MARKET PDFSamba BahNo ratings yet

- Dividend PolicyDocument8 pagesDividend PolicyHarsh SethiaNo ratings yet

- Presentation On: Compensation ManagementDocument29 pagesPresentation On: Compensation Managementarun_aglNo ratings yet

- Journal of Corporate Finance: Naoya Mori, Naoshi IkedaDocument10 pagesJournal of Corporate Finance: Naoya Mori, Naoshi IkedaZahra BatoolNo ratings yet

- Pay Perf Report 110812Document25 pagesPay Perf Report 110812brandon-harris-6868No ratings yet

- 7 Myths of Corporate GovernanceDocument10 pages7 Myths of Corporate GovernanceJawad UmarNo ratings yet

- Dividend Policy, Agency Costs, and Earned EquityDocument35 pagesDividend Policy, Agency Costs, and Earned EquityhhhhhhhNo ratings yet

- R&D Investments and Dividend Payout: Evidence Concerning The Semi-Mandatory Dividend Policy in ChinaDocument37 pagesR&D Investments and Dividend Payout: Evidence Concerning The Semi-Mandatory Dividend Policy in ChinadeviundipNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- The Declaration of Dependence: Dividends in the Twenty-First CenturyFrom EverandThe Declaration of Dependence: Dividends in the Twenty-First CenturyNo ratings yet

- Outperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueFrom EverandOutperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueNo ratings yet

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.From EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.No ratings yet

- Bbi 2Document39 pagesBbi 2RESHMANo ratings yet

- Isda 2002 Master Agreement: Understanding The New Isda Documentation ConferenceDocument66 pagesIsda 2002 Master Agreement: Understanding The New Isda Documentation ConferencepapillonnnnNo ratings yet

- Corporate Governance (Baec0007) NewDocument46 pagesCorporate Governance (Baec0007) NewankitaaecsaxenaNo ratings yet

- Century Enka Limited: Analysis of Company's Financial StatementDocument24 pagesCentury Enka Limited: Analysis of Company's Financial StatementAnand PurohitNo ratings yet

- SM Prime Holdings Inc.: Integrated Annual Corporate Governance Report Analysis ReportDocument2 pagesSM Prime Holdings Inc.: Integrated Annual Corporate Governance Report Analysis Reportbelle crisNo ratings yet

- W1-Part 2-Additional-Ch 3-SaT-FIN 410Document7 pagesW1-Part 2-Additional-Ch 3-SaT-FIN 410Syed Aquib AbbasNo ratings yet

- Penerapan Sistem Pengendalian Internal Dengan CosoDocument17 pagesPenerapan Sistem Pengendalian Internal Dengan CosoFardian FardianNo ratings yet

- What Is Auditing ProcessDocument3 pagesWhat Is Auditing ProcessAizaButtNo ratings yet

- CJR English For BusinessDocument18 pagesCJR English For BusinessKristina SihombingNo ratings yet

- Various Committees On Corporate GovernanceDocument11 pagesVarious Committees On Corporate GovernanceFouzia imzNo ratings yet

- BAFI1018 International FinanceDocument109 pagesBAFI1018 International FinanceSteven NgNo ratings yet

- Lovello Annual Report 2021 22Document159 pagesLovello Annual Report 2021 22aribNo ratings yet

- Annual Report PT Pegadaian 2021Document536 pagesAnnual Report PT Pegadaian 2021bseptiyantoNo ratings yet

- Models of Corporate GovernanceDocument10 pagesModels of Corporate GovernanceNeil patrickNo ratings yet

- AccountabilityDocument15 pagesAccountabilityRavi SinghNo ratings yet

- Session 2. The COSO ERM Framework in DetailDocument18 pagesSession 2. The COSO ERM Framework in DetailManish AroraNo ratings yet

- Corporate Accounting Frauds 16112013Document27 pagesCorporate Accounting Frauds 16112013teammrauNo ratings yet

- Transportation 4-5-17Document39 pagesTransportation 4-5-17Punit Singh SardarNo ratings yet

- 7.1a Principal-Protected Notes: Trading Strategies Involving OptionsDocument14 pages7.1a Principal-Protected Notes: Trading Strategies Involving OptionsAnDy YiMNo ratings yet

- Agenda Item 1.4: IPSAS-IFRS Alignment Dashboard OverviewDocument23 pagesAgenda Item 1.4: IPSAS-IFRS Alignment Dashboard OverviewHadera TesfayNo ratings yet

- 20 ArrendamientosDocument87 pages20 ArrendamientosCarlos Eduardo LoveraNo ratings yet

- Code of Corporate Governance As Issued by Bangladesh Securities Exchange Commission in 2006 and Subsequent Modifications To Highlight Measures Aimed at Better Financial ManagementDocument4 pagesCode of Corporate Governance As Issued by Bangladesh Securities Exchange Commission in 2006 and Subsequent Modifications To Highlight Measures Aimed at Better Financial ManagementMahin KhanNo ratings yet

- Annual Report 2017-2018 PDFDocument90 pagesAnnual Report 2017-2018 PDFMuhmmad Sheikh AmanNo ratings yet

- Comparison Between HK Financial Reporting Standards and International Financial Reporting StandardsDocument29 pagesComparison Between HK Financial Reporting Standards and International Financial Reporting Standardsisaac2008100% (1)

- Takis Katsoulakos and Yannis KatsoulacosDocument15 pagesTakis Katsoulakos and Yannis KatsoulacosSebastianNo ratings yet

- Audit Committee, Internal Audit Function and Earnings Management: Evidence From JordanDocument19 pagesAudit Committee, Internal Audit Function and Earnings Management: Evidence From JordanNadeem TahaNo ratings yet

- KESC Annual-Report-2013Document197 pagesKESC Annual-Report-2013makhalidiNo ratings yet

- Bahan Metod 1Document7 pagesBahan Metod 1Gaura HarieNo ratings yet

- Naked OptionDocument3 pagesNaked OptionRayzwanRayzmanNo ratings yet