Professional Documents

Culture Documents

Contractor Ledger

Contractor Ledger

Uploaded by

Muhammad Riaz0 ratings0% found this document useful (0 votes)

10 views12 pagesOriginal Title

Contractor Ledger (1)

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views12 pagesContractor Ledger

Contractor Ledger

Uploaded by

Muhammad RiazCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 12

Contractor Ledger

1. Records amount due to or recoverable from the contractors and

amounts actually paid to him or recovered from him

2. Maintained in Division on Form 43

3. One account is kept for one contractor irrespective of the number of

contractors undertaken by him

4. Personal account must be opened in the ledger for a contractor

whether or not a formal contract has been entered unless the work or

supply entrusted to him is unimportant and no payment is made except

on first and final bill

5. If only materials are issued to the contractor or any payment is made on

his behalf ledger account must be opened.

Column 4 “Advance payment”

corresponds to figure “D” in the running account bill

Column 5 “Secure Advance”

corresponds to figure “E” in the running account bill

(Net advance paid “+” and amount recovered “-”)

Column 6 --- “other transactions”---

Posting in this column may be made as:-

i) In case of running account bill------ figure “G” should be posted i.e.

5(b) + 8 (a)

ii) In case of first and final bill------ no entry should be made unless a

recovery is made from contractor on any account.

iii) In other cases: the amount paid or recovered from the contractor

should be entered in terms of value

a) Value of material issued “+” recovered “-”

b) Fine for bad work----- when levied “+” when recovered “-”

c) Amount withheld “-” amount released “+”

d) Expenditure incurred on contractor’s cost “+”, when recovered “-”

Column 8--- Debit

In case of running account bills---

figure “H” should be posted i.e. amount of checque plus recoveries

creditable to other works / head of accounts

i.e. H = 8 (b) + 8 (c)

In other cases amount payable to the contractor is posted.

Column 9--- Credit

In case of running account bills---

figure “F” should be posted

In other cases amount payable to the contractor is posted.

Column 10--- “Total value of work / supply” refer to---

Figure “A” of the contractor’s bill

Note:

Ledger account should be closed and balanced monthly

After closing, the personal account should be detailed so as to show

the amounts outstanding in the three suspense accounts i.e. advance

payment , secured advance and other transactions

Divisional Accountant should ensure the correctness of the

contractor’s ledger

Important Points

(i) Column 8 (-) column 9 = column 4 + column 5 + column 6

i.e. H – F = D + E + (-) G

(ii) In case the contractor delays receiving the payment of his bill for more

than one month after the bill has been passed, the amount due to him

may be credited to Public Works Deposits

(iii) In case the contractor has been overpaid, then the net amount

recoverable may be debited to Miscellaneous Public Works Advances.

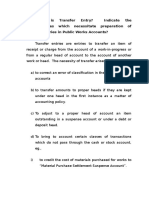

Transactions that do not form part of the contractor ledger.

1. If the contractor bill has been prepared and passed for payment but

has not yet been paid.

2. Fine for delay

3. Security deposits

4. Hire charges of T&P

5. Recoveries pertaining to other divisions.

6. First and final bill

7. Material issued to contractor where the contractor for labour only

1st running bill paid to contractor for work “X” as per following details.:

Value of work done & measured = Rs 35000; secured advance = Rs

17,000, advance payment = Rs 10,000; security deposit @ 10% and

income tax @ 2%

Advance Secured Mob: Other Name Debit Credit Total work

Payment advance advance transactions

4(D) 5 (E) 5a (E1) 6 (G) 7 8 (H) 9 (F) 10 (A)

10,000 17,000 - 0 X 62,000 35,000 35,000

Now check: - column 8 – column 9 = column 4 + column 5 + column 5a

- column 6

Another method (short cut)

Column 4, D = 10,000

Column 5, E = 17,000

Column 5a E1 = 0

Column 6, G = 0

Column 9, F = 35,000

Column 10, A =

Column 8, H = D + E + -G + F = 10,000 + 17000 – 0 +35,000 = 62,000

Paid 2nd running bill in respect of work “A” as per following details:

Value of work done upto date = Rs 49,000; advance payment made in 1 st

running bill recovered = Rs 13,000; secured advance made in 1 st running

bill recovered = Rs 19,000; advance payment made in 2 nd running bill = Rs

9,000; secured advance given now = Rs 14,000; value of work done in 1 st

running bill = Rs 26,000; income tax @ 2% and security deposit @ 10 %;

cost of cement issued = Rs 7,200; fine for delay = Rs 800; fine for bad work

= Rs 1,200

Post the contractor ledger.

Advance Secured Mob: Other Name Debit Credit Total work

Payment advance advance transactions

4(D) 5 (E) 5a (E1) 6 (G) 8 (H) 9 (F) 10 (A)

- - 0 7,200 7,200 - -

- - 0 1,200 1,200 - -

- 4,000 - 5,000 -8,400 5,600 23,000 49,000

You might also like

- Cpwa Mock TestDocument11 pagesCpwa Mock TestSamrat MukherjeeNo ratings yet

- Public Finance Sem III Syba PDFDocument11 pagesPublic Finance Sem III Syba PDFMuskanNo ratings yet

- Cpwa Code - Suspense AccountsDocument9 pagesCpwa Code - Suspense AccountskuldeepNo ratings yet

- Contractor's Ledger 1Document4 pagesContractor's Ledger 1Fareha RiazNo ratings yet

- CPWD EssayDocument71 pagesCPWD Essayshekarj50% (2)

- Automatic Knife Opening Acknowledgement FormDocument1 pageAutomatic Knife Opening Acknowledgement FormJNRifleworksNo ratings yet

- Notes 3 Accounts Exam AnsDocument11 pagesNotes 3 Accounts Exam AnsAYUSH MAURYANo ratings yet

- MCQ CPWA Code Chapter-10Document14 pagesMCQ CPWA Code Chapter-10Biswajit JenaNo ratings yet

- Mock Test AccountsDocument7 pagesMock Test AccountsJINTO SEBASTIANNo ratings yet

- Multiple Choice Questions Chapters 1Document18 pagesMultiple Choice Questions Chapters 1Veronica BaileyNo ratings yet

- Cost Accounting: - K. M. MiraniDocument19 pagesCost Accounting: - K. M. MiraniVivek RatanNo ratings yet

- Forest Accounts MCQDocument12 pagesForest Accounts MCQAJAY DIMRINo ratings yet

- GFR 2017Document4 pagesGFR 2017Faiyaz SheikhNo ratings yet

- MCQ Accounts For 10+2 TS Grewal SirDocument66 pagesMCQ Accounts For 10+2 TS Grewal SirYash ChhabraNo ratings yet

- Notes of Double Entry System and Journal EntryDocument35 pagesNotes of Double Entry System and Journal Entryjune100% (1)

- MCQ Principles of Accounting-1Document21 pagesMCQ Principles of Accounting-1Sharad ChafleNo ratings yet

- Pwa MCQDocument7 pagesPwa MCQSureshNo ratings yet

- SAS PC 16 - Accounts of Divisional OfficersDocument30 pagesSAS PC 16 - Accounts of Divisional OfficersMukesh100% (1)

- MCQ Financial AccountingDocument4 pagesMCQ Financial AccountingKhushal JunejaNo ratings yet

- Earned Leave ApplicationDocument2 pagesEarned Leave ApplicationSouvik DattaNo ratings yet

- ELEMENTS OF BOOK-KEEPING II EditedDocument150 pagesELEMENTS OF BOOK-KEEPING II EditedGifty Asuquo100% (1)

- Chapter - 12 Manufacturing Account - MCQDocument3 pagesChapter - 12 Manufacturing Account - MCQNRKNo ratings yet

- Sas Main Exam 2018 Pc14Document2 pagesSas Main Exam 2018 Pc14Gotta Patti HouseNo ratings yet

- PC 22 Point Wise - MSO (Audit) - 1Document19 pagesPC 22 Point Wise - MSO (Audit) - 1manoj sainiNo ratings yet

- SR - No Form Name of Form RemarksDocument4 pagesSR - No Form Name of Form RemarksDEVI SINGH MEENANo ratings yet

- Computer (WWW - Qmaths.in)Document11 pagesComputer (WWW - Qmaths.in)Vivek RatanNo ratings yet

- MSO Chapter 8 & 9 ObjDocument22 pagesMSO Chapter 8 & 9 ObjsantaNo ratings yet

- Bac 411 Class Illustration Testacy DistributionDocument5 pagesBac 411 Class Illustration Testacy DistributionRuth Nyawira100% (1)

- PC 8 Answer: Capsule 1Document1 pagePC 8 Answer: Capsule 1Vivek RatanNo ratings yet

- Constitution For Sas 123Document25 pagesConstitution For Sas 123Manoj SainiNo ratings yet

- Goods-And-Services-Tax-Gst Solved MCQs (Set-4)Document8 pagesGoods-And-Services-Tax-Gst Solved MCQs (Set-4)Ayushi BhardwajNo ratings yet

- Chapter 22 CPWD ACCOUNTS CODEDocument26 pagesChapter 22 CPWD ACCOUNTS CODEarulraj1971No ratings yet

- View Answer Correct Answer: (A) Convention of ConservatismDocument145 pagesView Answer Correct Answer: (A) Convention of ConservatismChinmay Sirasiya (che3kuu)No ratings yet

- BASIC Accounting MCQ FOR GOVT EXAMSDocument48 pagesBASIC Accounting MCQ FOR GOVT EXAMSßläcklìsètèdTȜèNo ratings yet

- 16.forest Accounts MCQ - AdditionalDocument5 pages16.forest Accounts MCQ - AdditionalSatya PrakashNo ratings yet

- MCQ On Accounting Concept and PrincipalDocument6 pagesMCQ On Accounting Concept and Principalmohit pandeyNo ratings yet

- Answer: BDocument15 pagesAnswer: BTrinh LêNo ratings yet

- CH8 TransferEntriesDocument20 pagesCH8 TransferEntriesshekarj100% (1)

- Bills of Exchange & Goods On Approval or Return Basis - Practice ProblemsDocument15 pagesBills of Exchange & Goods On Approval or Return Basis - Practice ProblemsrnbharathirajaNo ratings yet

- CPW FormsDocument163 pagesCPW Formssurendra kumarNo ratings yet

- Journal, Ledger MCQDocument7 pagesJournal, Ledger MCQSujan DangalNo ratings yet

- Bank Reconciliation StatementDocument16 pagesBank Reconciliation StatementBilal Ali SyedNo ratings yet

- PC 8 - Practice Set 1Document11 pagesPC 8 - Practice Set 1RAM KUMARNo ratings yet

- COST and COST ANALYSISDocument42 pagesCOST and COST ANALYSISLlona Jeramel MarieNo ratings yet

- Financial Accounting MCQs With AnswerDocument6 pagesFinancial Accounting MCQs With AnswerShahid NaikNo ratings yet

- 772 Question of CPWDDocument56 pages772 Question of CPWDvijai bharathramNo ratings yet

- CPWD Works ManualDocument426 pagesCPWD Works Manualraja niranjanNo ratings yet

- Civil Accounts ManualDocument33 pagesCivil Accounts Manualprem kumarNo ratings yet

- Top Senior Auditor Solved MCQs Past PapersDocument12 pagesTop Senior Auditor Solved MCQs Past PapersAli100% (1)

- Workshop On Defence Procurement Manual 2009wksp2-AnjulaDocument42 pagesWorkshop On Defence Procurement Manual 2009wksp2-Anjulaersachinpachori0% (1)

- PC-8 - Notes - RTI - Appropriation AccountsDocument11 pagesPC-8 - Notes - RTI - Appropriation AccountsARAVIND KNo ratings yet

- Far Problems and Exercises Part 4 With Answers - CompressDocument12 pagesFar Problems and Exercises Part 4 With Answers - CompressKathlene JaoNo ratings yet

- Intermediate Examination: Group IDocument26 pagesIntermediate Examination: Group IKetan ThakkarNo ratings yet

- Contract-Bills and AccountsDocument3 pagesContract-Bills and AccountsJulie DaniNo ratings yet

- ACC 230 Pre TestDocument2 pagesACC 230 Pre TestM ANo ratings yet

- Our Lady of The Pillar College Cauayan: Prelim Examination Accounting 1 &2Document8 pagesOur Lady of The Pillar College Cauayan: Prelim Examination Accounting 1 &2John Lloyd LlananNo ratings yet

- Basic Accounting ExamDocument8 pagesBasic Accounting ExamJollibee JollibeeeNo ratings yet

- Works AccountDocument143 pagesWorks AccountMuhammad RiazNo ratings yet

- Bac 101Document13 pagesBac 101Lhyn Cantal Calica0% (1)

- Quiz 1Document4 pagesQuiz 1Trisha EbonNo ratings yet

- Ch08 - Paymt of The ContractorDocument3 pagesCh08 - Paymt of The Contractorlok12143544No ratings yet

- Numerical Questions 1Document16 pagesNumerical Questions 1Muhammad Riaz100% (1)

- Numerical QuestionsDocument8 pagesNumerical QuestionsMuhammad RiazNo ratings yet

- DA DutiesDocument12 pagesDA DutiesMuhammad RiazNo ratings yet

- Contractor BillDocument4 pagesContractor BillMuhammad RiazNo ratings yet

- Organizational and Duties of PWD OfficersDocument92 pagesOrganizational and Duties of PWD OfficersMuhammad RiazNo ratings yet

- Suspense AccountDocument41 pagesSuspense AccountMuhammad RiazNo ratings yet

- Suspense Account 1Document42 pagesSuspense Account 1Muhammad RiazNo ratings yet

- Ishfaq Ahmed Lodhi Field Operator / Process Operator Attock Refinery Limited, PakistanDocument3 pagesIshfaq Ahmed Lodhi Field Operator / Process Operator Attock Refinery Limited, PakistanMuhammad RiazNo ratings yet

- True False 1Document18 pagesTrue False 1Muhammad RiazNo ratings yet

- Works AccountDocument143 pagesWorks AccountMuhammad RiazNo ratings yet

- True FalseDocument10 pagesTrue FalseMuhammad RiazNo ratings yet

- Works Building & General System of AccountDocument28 pagesWorks Building & General System of AccountMuhammad RiazNo ratings yet

- Bfad RequirementsDocument2 pagesBfad RequirementsAleli Bautista67% (3)

- Shopper Marketig DiageoDocument54 pagesShopper Marketig DiageoftelenaNo ratings yet

- (DSPACE) CodersTrust - Kaisary Jahan - 111 171 146Document32 pages(DSPACE) CodersTrust - Kaisary Jahan - 111 171 146Selim KhanNo ratings yet

- Esic Udc: Memory Based Question Paper 2019Document29 pagesEsic Udc: Memory Based Question Paper 2019Sona GuptaNo ratings yet

- Futures To Defer Taxes One of Your Most SophisticatedDocument1 pageFutures To Defer Taxes One of Your Most SophisticatedM Bilal SaleemNo ratings yet

- Code of EthicsDocument2 pagesCode of EthicsHimani sailabNo ratings yet

- Flash CourierDocument19 pagesFlash Couriereaglewatch99No ratings yet

- Esenbok City Estate EpeDocument3 pagesEsenbok City Estate EpeClifford PaNo ratings yet

- Practice+Test OverviewDocument2 pagesPractice+Test OverviewJuaymah MarieNo ratings yet

- 2023 08Document7 pages2023 08Priyanka NarwalNo ratings yet

- Milestone 2 CompressedDocument14 pagesMilestone 2 CompressedjulianayfutalanNo ratings yet

- Tax Circular Dated 27.2.18Document4 pagesTax Circular Dated 27.2.18Mahendra SharmaNo ratings yet

- Problems and Prospects of Private Investmsnt in Case of Sibu Sire DistrictsDocument41 pagesProblems and Prospects of Private Investmsnt in Case of Sibu Sire DistrictsChaltu ChemedaNo ratings yet

- Instant Download Calculus Hybrid 10th Edition Larson Test Bank PDF Full ChapterDocument32 pagesInstant Download Calculus Hybrid 10th Edition Larson Test Bank PDF Full ChapterJosephCraiggmax100% (9)

- Sonata SoftwareDocument232 pagesSonata SoftwareReTHINK INDIANo ratings yet

- A Friedman Doctrine-The Social Responsibility of Business Is To Increase Its ProfitsDocument7 pagesA Friedman Doctrine-The Social Responsibility of Business Is To Increase Its ProfitsVarun S UNo ratings yet

- Management PrerogativeDocument13 pagesManagement PrerogativeGracey Paulino100% (2)

- Chief Content Officer Job Description SampleDocument4 pagesChief Content Officer Job Description Samplesantu13No ratings yet

- MCQ Quantitative TechniquesDocument14 pagesMCQ Quantitative Techniquesajeet sharmaNo ratings yet

- International Human Resource Management 8Th Edition Peter Dowling Online Ebook Texxtbook Full Chapter PDFDocument69 pagesInternational Human Resource Management 8Th Edition Peter Dowling Online Ebook Texxtbook Full Chapter PDFalison.austin795100% (9)

- Gemini Air CargoDocument34 pagesGemini Air CargoMichael PietrobonoNo ratings yet

- Globalization in The Age of TrumpDocument17 pagesGlobalization in The Age of TrumpKyleNo ratings yet

- NSSF - Vacant Job Positions - November 2023Document53 pagesNSSF - Vacant Job Positions - November 2023johnfranc999No ratings yet

- Planned Maintenance ManualDocument2 pagesPlanned Maintenance Manualait mimouneNo ratings yet

- Summer Internship Report On Verka Milk Plant JalandharDocument45 pagesSummer Internship Report On Verka Milk Plant Jalandharsahilsahil92986No ratings yet

- Debit Credit Cards DBBLDocument11 pagesDebit Credit Cards DBBLImranNo ratings yet

- Footwear Market ResearchDocument2 pagesFootwear Market Research040415No ratings yet

- Research 1Document1 pageResearch 1api-297189035No ratings yet

- 2022list of LC - 0331 PDFDocument45 pages2022list of LC - 0331 PDFEden AguinaldoNo ratings yet