Professional Documents

Culture Documents

Tax

Tax

Uploaded by

Rhyzlyn De Ocampo0 ratings0% found this document useful (0 votes)

15 views60 pagesThe document compares estate tax and donor's tax in the Philippines. Some key differences include:

1) Estate tax applies to the net estate of a deceased person, while donor's tax applies to net gifts exceeding P250,000 made by a living person.

2) Donor's tax returns are due within 30 days of donation, while estate tax allows an extension of up to 2 years to pay if settling the estate judicially.

3) Donor's tax applies to gifts of real property within the Philippines regardless of donor's citizenship, while estate tax rules vary depending on the citizenship of the deceased.

Original Description:

Original Title

tax-ppt

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document compares estate tax and donor's tax in the Philippines. Some key differences include:

1) Estate tax applies to the net estate of a deceased person, while donor's tax applies to net gifts exceeding P250,000 made by a living person.

2) Donor's tax returns are due within 30 days of donation, while estate tax allows an extension of up to 2 years to pay if settling the estate judicially.

3) Donor's tax applies to gifts of real property within the Philippines regardless of donor's citizenship, while estate tax rules vary depending on the citizenship of the deceased.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

15 views60 pagesTax

Tax

Uploaded by

Rhyzlyn De OcampoThe document compares estate tax and donor's tax in the Philippines. Some key differences include:

1) Estate tax applies to the net estate of a deceased person, while donor's tax applies to net gifts exceeding P250,000 made by a living person.

2) Donor's tax returns are due within 30 days of donation, while estate tax allows an extension of up to 2 years to pay if settling the estate judicially.

3) Donor's tax applies to gifts of real property within the Philippines regardless of donor's citizenship, while estate tax rules vary depending on the citizenship of the deceased.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 60

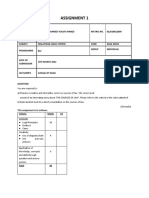

DISTINGUISHED OF ESTATE TAX

AND DONOR’S TAX

COMPARISONS BETWEEN ESTATE TAX AND DONORS TAX

(NRC AS AMENDED BY REPUBLIC ACT 10963 OTHERWISE

KNOWN AS TRAIN LAW)

TAX RATE 6% NET ESTATE 6% NET GIFTS IN EXCESS OF

P250,000

FILING AND PAYMENTS - WITHIN ONE (1) YEAR FROM

DEATH

- WITHIN 30 DAYS FROM DONATION

- NO EXTENSION TO FILE

- EXTENSION TO FILE; NOT MORE

THAN 30 DAYS - PAY AS YOU FILE

- NO EXTENSION FOR PAYMENT

- PAY AS YOU FILE

- WITH EXTENSION TO PAY; 2

YEARS (EXTRAJUDICIAL) 5 YEARS

(IF JUDICIAL)

SCOPE RC, NRC, RA-ON THE ESTATE

WITHIN AND WITHOUT NRA- ON

RC, NRC, RA-ON THE ESTATE

WITHIN AND WITHOUT NRA- ON

ESTATE WITHIN ESTATE WITHIN

PERSONAL PROPERTY REAL PROPERTY

AMOUNT OF P5,000 OR LESS MORE THAN REGARDLESS OF

DONATION P5,000 THE AMOUNT

FORM OF ORAL OR IN IN WRITING IN PUBLIC

DONATION WRITING DOCUMENT

*NOTARIZED*

CLASSIFICATION OF RESIDENT OR NON-RESIDENT ALIEN NON- RESIDENT ALIEN

PROPERTY CITIZEN (NO RECIPROCACY) (WITH RECIPROCACY)

REAL PROPERTY

WITHIN YES YES YES

WITHOUT YES NO NO

PERSONAL PROPERTY

TANGIBLE WITHIN YES YES YES

TANGIBLE WITHOUT YES NO NO

INTANGIBLE WITHIN YES YES NO

INTANGIBLE WITHOUT YES NO NO

SAM GAVE THE FOLLOWING

PROPERTIES TO VARIOUS

DONEES ON DECEMBER 25, 2018

REQUIREMENT: COMPUTE THE GROSS GIFT IF

ARA IS:

A. RESIDENT CITIZEN/RESIDENT ALIEN/ NON-

RESIDENT CITIZEN

B. NON RESIDENT ALIEN (W/O RECIPROCITY)

C. NON-RESIDENT ALIEN (W/ RECIPROCITY)

A.

GROSS GIFT P 13,895,000

B. NON RESIDENT ALIEN (W/O RECIPROCITY)

APARTMENT HOUSE IN NAGA CITY 8,000,000

CAR IN IRIGA CITY P 520,000

SAVINGS DEPOSIT WITH BPI P 50,000

ACCOUNTS RECEIVABLE, DEBTOR P 140,000

RESIDING IN THE PHILIPPINES

FRANCHISE EXERCISED IN THE P 120,000

PHILIPPINES

INVESTMENT IN LOVERS COMPANY, P 125,000

PARTNERSHIP IN PHILIPPINES

GROSS GIFT P 8,955,000

C. NON-RESIDENT ALIEN (W/RECIPROCITY)

APARTMENT HOUSE IN NAGA P 8,000,000

CAR IN IRIGA CITY P 520,000

GROSS GIFT P 8,520,000

NOTE!

EXEMPT DONATIONS UNDER

SPECIAL LAWS

INTERNATIONAL RICE RESEARCH INSTITUTE

PHILIPPINE-AMERICAN CULTURAL FOUNDATION

RAMON-MAGSAYSAY AWARD FOUNDATION

PHILIPPINE INVESTOR’S COMMISION

INTEGRATED BAR OF THE PHILIPPINES

DEVELOPMENT ACADEMY OF THE PHILIPPINES

AQUACULTURE DEPARTMENT OF THE SOUTHEAST ASIA FISHERIES DEVELOPMENT CENTER OF THE

PHILIPPINES

NATIONAL SOCIAL ACTION COUNCIL

INTRAMUROS ADMINISTRATION

SOUTHERN PHILIPPINES DEVELOPMENT FOUNDATION

NATIONAL MUSEUM

NATIONAL LIBRARY

NATIONAL HISTORICAL INSTITUTE

TASK FORCE ON HUMAN SETTLEMENT CONCSISTING OF EQUIPMENT, MATERIALS AND SERVICES

PUBLIC SCHOOLS IN ACCORDANCE WITH THE ADOPT-A-SCHOOL ACT OF 1998

ON FIRST DONATION IN THE CALENDAR YEAR:

GROSS GIFT XX

LESS: DEDUCTION FROM GROSS GIFT (XX)

NET GIFT = XX

LESS: EXEMPT GIFT (250,000)

TAXABLE NET GIFTS XX

TIMES THE APPLICABLE RATE %

DONOR’S TAX DUE AND PAYABLE = XX

LESS: TAX CREDIT (XX)

DONOR’S TAX PAYABLE =XX

ON SUBSEQUENT DONATIONS:

GROSS GIFT MADE IN THIS MONTH XX

LESS: DEDUCTIONS FROM GROSS GIFT (XX)

NET GIFTS, CURRENT = XX

ADD; ALL PRIOR NET GIFT W/IN THE YEAR XX

AGGREGIATE NET GIFTS = XX

LESS: EXEMPT GIFTS (250,000)

TAXABLE NET GIFTS XX

TIMES APPLICABLE TAX RATE %

DONOR’S TAX DUE = XX

LESS: DONOR’S TAX PAID ON PRIOR GIFTS (XX)

LESS: TAX CREDITS (XX)

DONOR’S TAX DUE AND PAYABLE = XX

A. ONLY ONE COUNTRY IS INVOLVED

NET GIFT (PER FOREIGN COUNTRY) X PHILIPPINE DONOR’S TAX

TOTAL NET GIFT

B. TWO OR MORE FOREIGN COUNTRY ARE

INVOLVED:

NET GIFT (PER FOREIGN COUNTRY) X PHILIPPINE DONOR’S TAX

TOTAL NET GIFT

LIMIT 2:

NET GIFT (ALL FOREIGN COUNTRIES) X PHILIPPINE DONOR’S TAX

TOTAL NET GIFT

SAMPLE PROBLEM

ANACLETO GAVE THE FOLLOWING DONATIONS TO:

02-14-18 – AZUCENA AMOUNTING TO P 190,000

06-01-18 – BRUSCO AMOUNTING TO P 160,000

10-13-18 – CARIZOSA AMOUNTING TO P 180,000

01-15-19 NATIONAL GOVERNMENT LAND DONATED FOR PUBLIC USE

WITH FV OF

P 700,000

05-15-19 – DALMACIO, LAND WITH FMV OF P 1,000,000 BUT MORTGAGE

FOR P 100,000 WHICH WAS ASSUMED BY THE DONEE

REQUIREMENT: COMPUTE FOR THE

TAX DUE ON EACH DONATION

02-14-18

GROSS GIFT P 190,000

LESS: EXEMPT GIFT (250,000)

TAXABLE NET GIFT (60,000)

DONOR’S TAX DUE EXEMPT

06-01-18

GROSS GIFT P 160,000

ADD: PRIOR NET GIFT 190,000

AGGREGATE NET GIFT 350,000

LESS: EXEMPT TAX GIFTS (250,000)

TAXABLE NET GIFTS 100,000

X DONOR’S TAX RATES * 6%

DONOR’S TAX DUE 6,000

10-13-18

GROSS GIFT P 180,000

ADD: PRIOR NET GIFT 350,000

AGGREGATE NET GIFT 530,000

LESS: EXEMPT TAX GIFTS (250,000)

TAXABLE NET GIFTS 280,000

X DONOR’S TAX RATES * 6%

DONOR’S TAX DUE 16,800

TAX DUE THEREON 16,800

LESS: TAX DUE ON 06-01-18 6,000

TAX DUE ON 10-13-18 P 10,800

*or simply, 180,000*6%= 10,800

01-05-19

GROSS GIFT 700,000

DEDUCT: GOVT (700,000)

NET GIFT

05-15-19

GROSS GIFT 1,000,000

LESS: DDT FROM GROSS PROFIT 100,000

NET GIFTS, CURRENT 900,000

ADD: PRIOR NET GIFT W/IN THE YEAR -

AGGREGATE NET GIFTS 900,000

LESS: EXEMPT GIFTS (250,000)

TAXABLE NET GIFTS 650,000

TIMES APPLIXATION TAX RATE 6%

DONOR’S TAX DUE 39,000

LESS: DONOR’S TAX PAID ON PRIOR -

GIFTS

LESS: TAX CREDITS -

DONOR’S TAX DUE AND PAYABLE 05-

15-19

P 39,000

MR. & MRS. K MADE THE FOLLOWING DONATIONS

1-25-19 – TO L, THEIR LEGITIMATE SON, A CAR WORTH P 800,000 WITH P200, 000 MORTGAGE,

½ WAS ASSUMED BY THE DONEE. (SILENT AS TO WHO OWNS THE CAR, CONSIDERED AS

CONJUGAL PROPERTY)

5-31-19- TO M, BROTHER OF MR.K, HIS CAPITAL PROPERTY WORTH P 500,000 ON ACCOUNT

OF MARRIAGE 6 MOS. AGO

7-15-19- TO N, DAUGHTER OF MRS. K FROM A FORMER MARRIAGE ON ACCOUNT OF HER

MARRIAGE 18 MONTHS AGO, MRS. K’S PARAPHERNAL (EXCLUSIVE PROPERTY) WORTH

P 100,000

8-20-19- TO N, ON ACCOUNT OF THE SAME MARRIAGE, CONJUGAL CAR OF THE COUPLE

WORTH P 400,000, WITH P 200,000 UNPAID MORTGAGE, ½ WAS ASSUMED BY N. AND

P 500,000 WORTH OF LAND TO THEIR FOUR SONS ON ACCOUNT OF THEIR GRADUATION, 20%

OF WHICH WAS OWNED BY THEIR KUMPADRE WHO AGREED TO DONATE HIS SHARE THRU A

PUBLIC DOCUMENT.

1/25/2019 MR. K MRS. K

GROSS GIFT 800,000/2 400,000.00 400,000.00

LESS: DEDUCTIONS 200,000*50%/2 (50,000.00) (50,000.00)

NET GIFT 350,000.00 350,000.00

LESS: EXEMPT GIFT (250,000.00) (250,000.00)

TAXABLE NET 100,000.00 100,000.00

GIFTS

APPLICABLE RATE 6% 6%

DONOR’S TAX 1/25/2019 6,000.00 6,000.00

DUE AND

PAYABLE

5/31/2019 MR. K

GROSS GIFT 500,000.00

ADD: PRIOR NET 350,000.00

GIFT

AGGREGATE NET 850,000.00

GIFT

LESS TAX EXEMPT (250,000.00)

TAXABLE NET GIFT 600,000.00

DONOR’S RATE 6%

DONOR’S TAX DUE 36,000.00

AND PAYABLE

TAX DUE THEREON 36,000.00

LESS: TAX DUE ON 1- (6,000.00)

25-19

TAX DUE ON 5-31- 30,000.00

19

8-20-2019 MR.K MRS.K

GROSS GIFT

CAR 400,000/2 200,000.00 200,000.00

LAND 500,000*80%/2 200,000.00 200,000.00

TOTAL 400,000.00 400,000.00

LESS: MORTAGAGE 200,000*.5/2 (50,000.00) (50,000.00)

NET GIFT 350,000.00 350,000.00

ADD: PRIOR NET GIFT 850,000.00 450,000.00

AGGREGATE NET GIFT 1,200,000.00 800,000.00

LESS TAX EXEMPT (250,000.00) (250,000.00)

TAXABLE NET GIFT 950,000.00 550,000.00

DONOR’S RATE 6% 6%

DONOR’S TAX DUE AND 57,000.00 33,000.00

PAYABLE

LESS PRIOR TAX (36,000.00) (12,000.00)

PAYMENTS

DONOR’S TAX

PAYABLE 8-20-19

21,000.00 21,000.00

8-20-2019 KUMPADRE

GROSS GIFT 500,000*2 100,000.00

LESS: DEDUCTIONS -

NET GIFT 100,000.00

LESS: EXEMPT GIFT (250,000.00)

TAXABLE NET GIFTS (150,000.00)

DONOR’S TAX EXEMPT

DUE AND PAYABLE

You might also like

- (DAILY CALLER OBTAINED) - Banks 175 XMLDocument2 pages(DAILY CALLER OBTAINED) - Banks 175 XMLHenry RodgersNo ratings yet

- USA v. KellyDocument22 pagesUSA v. KellyBillboard100% (2)

- Donor's Tax and Foreign Tax Credit (Presentation Slides)Document5 pagesDonor's Tax and Foreign Tax Credit (Presentation Slides)Kez100% (1)

- Planse de Colorat SF NicolaeDocument5 pagesPlanse de Colorat SF NicolaeNatalia Corlean100% (3)

- Activity 3 Gross IncomeDocument16 pagesActivity 3 Gross IncomeAnne OlitoquitNo ratings yet

- 5Document11 pages5mariyha PalangganaNo ratings yet

- Donor's Tax Post QuizDocument12 pagesDonor's Tax Post QuizMichael Aquino0% (1)

- Introduction To Donor's Tax (Presentation Slides)Document22 pagesIntroduction To Donor's Tax (Presentation Slides)KezNo ratings yet

- Chapter 17 Donor's TaxDocument7 pagesChapter 17 Donor's TaxHazel Jane Esclamada100% (3)

- ERG 201 Donors Tax AnsDocument9 pagesERG 201 Donors Tax AnsbeayaoNo ratings yet

- Module 1 - Lesson 2 - Taxable Net Gift and Computation of Donor's Tax DueDocument6 pagesModule 1 - Lesson 2 - Taxable Net Gift and Computation of Donor's Tax Dueohmyme sungjaeNo ratings yet

- Donor's Tax & Estate TaxDocument28 pagesDonor's Tax & Estate TaxMae Manoelle LeonaNo ratings yet

- Quizzes SolutionDocument10 pagesQuizzes SolutionHerzeila BernardoNo ratings yet

- Donors TaxDocument8 pagesDonors Taxmaxine claire cutingNo ratings yet

- Module 1 Lesson 2Document8 pagesModule 1 Lesson 2Rich Ann Redondo VillanuevaNo ratings yet

- Activity 6Document4 pagesActivity 6Mystic LoverNo ratings yet

- Donor's TaxDocument15 pagesDonor's Taxyes it's kaiNo ratings yet

- Donor's TXDocument5 pagesDonor's TXdorie shane sta. mariaNo ratings yet

- ActivityDocument4 pagesActivityDom PaciaNo ratings yet

- Donors TaxDocument16 pagesDonors TaxNikkolae LibreaNo ratings yet

- HQ 2 Donors TaxationDocument12 pagesHQ 2 Donors TaxationDharel GannabanNo ratings yet

- Estate Tax Activities (Questions)Document4 pagesEstate Tax Activities (Questions)Christine Nathalie BalmesNo ratings yet

- Module 6 - Donor's TaxationDocument14 pagesModule 6 - Donor's TaxationLex Dela CruzNo ratings yet

- TAXATION 2 Chapter 7 Donors Tax PDFDocument6 pagesTAXATION 2 Chapter 7 Donors Tax PDFKim Cristian MaañoNo ratings yet

- 18.donors TaxDocument24 pages18.donors Taxsharen jill monteroNo ratings yet

- Tax 2Document14 pagesTax 2Carlo VillanNo ratings yet

- Income Taxation Part 2Document20 pagesIncome Taxation Part 2louise biancaNo ratings yet

- Gache, Rosette L. 3-BSA-1 Business Taxation Activity 7 P 6.1 Gross GiftsDocument5 pagesGache, Rosette L. 3-BSA-1 Business Taxation Activity 7 P 6.1 Gross GiftsMystic LoverNo ratings yet

- 91 12 Donors TaxDocument4 pages91 12 Donors TaxEl Gene Lois MontesNo ratings yet

- 598481Document10 pages598481btstanNo ratings yet

- Donors TaxDocument6 pagesDonors TaxMachi KomacineNo ratings yet

- Transfer Taxes (Donor'S Tax) : Jhoniel Sells To Ruzby His Land For An Amount of P5,000,000 (Current FMV) Which He Bought atDocument8 pagesTransfer Taxes (Donor'S Tax) : Jhoniel Sells To Ruzby His Land For An Amount of P5,000,000 (Current FMV) Which He Bought atKristina Casandra FernandezNo ratings yet

- Donors Tax Computation Under Train LawDocument8 pagesDonors Tax Computation Under Train LawJP PalamNo ratings yet

- Taxation Law Case DigestsDocument514 pagesTaxation Law Case DigestsCzarina Bantay67% (3)

- Donor's TaxDocument5 pagesDonor's TaxVernnNo ratings yet

- Lecture 3 - Donor's TaxDocument6 pagesLecture 3 - Donor's TaxLady Chen GordoveNo ratings yet

- Module 1 - Lesson 3 - Donor's Tax CreditDocument6 pagesModule 1 - Lesson 3 - Donor's Tax Creditohmyme sungjaeNo ratings yet

- Chapter 14 IllustrationsDocument8 pagesChapter 14 IllustrationsE.D.JNo ratings yet

- Excercises Chapter 4Document5 pagesExcercises Chapter 4Mar ChahinNo ratings yet

- Problems 3 PRELIM TASKDocument8 pagesProblems 3 PRELIM TASKJohn Francis RosasNo ratings yet

- Problems 3 Prelim TaskDocument8 pagesProblems 3 Prelim TaskJohn Francis Rosas100% (2)

- ModuleDocument6 pagesModuledennissabalberinojrNo ratings yet

- TAXATION 2 Chapter 5 Estate Tax Payable PDFDocument5 pagesTAXATION 2 Chapter 5 Estate Tax Payable PDFKim Cristian MaañoNo ratings yet

- Vanishing Deduction IllustrationDocument2 pagesVanishing Deduction IllustrationIvan Jester BautistaNo ratings yet

- Business Tax Activity 1Document10 pagesBusiness Tax Activity 1Michael AquinoNo ratings yet

- Module 2 DEDUCTION FROM GROSS ESTATE AND ESTATE TAX - Part 2Document33 pagesModule 2 DEDUCTION FROM GROSS ESTATE AND ESTATE TAX - Part 2Venice Marie ArroyoNo ratings yet

- Module 1 Lesson 5Document6 pagesModule 1 Lesson 5Rich Ann Redondo VillanuevaNo ratings yet

- Donor TaxDocument20 pagesDonor TaxJhon baal S. SetNo ratings yet

- Donors Tax Quiz Answers and SolutionsDocument14 pagesDonors Tax Quiz Answers and SolutionsRalph Lawrence Francisco BatangasNo ratings yet

- Final On Passive Income Grcbarbin2Document6 pagesFinal On Passive Income Grcbarbin2Joneric RamosNo ratings yet

- Chapter 2 - Donor's Tax (Notes)Document8 pagesChapter 2 - Donor's Tax (Notes)Angela Denisse FranciscoNo ratings yet

- Business TaxDocument19 pagesBusiness TaxMichael AquinoNo ratings yet

- Tax ComputationDocument10 pagesTax ComputationCZARINA AUDREY SILVANONo ratings yet

- Donors Taxation: Mr. James Dane T. AdayoDocument32 pagesDonors Taxation: Mr. James Dane T. AdayoMiko ArniñoNo ratings yet

- Notes To Transfer Taxes Under TRAIN LawDocument7 pagesNotes To Transfer Taxes Under TRAIN LawDustin PascuaNo ratings yet

- A.R. and N.R. Additional TopicsDocument10 pagesA.R. and N.R. Additional TopicsaleywaleyNo ratings yet

- DonationDocument31 pagesDonationJust JhexNo ratings yet

- RESA 41 - Tax First Preboard (May 2021) (Key Answer)Document17 pagesRESA 41 - Tax First Preboard (May 2021) (Key Answer)Aldrine CasilangNo ratings yet

- A Requirement On Management, Tax and Consultancy: Cyrra Q. Balignasay BSA-5Document14 pagesA Requirement On Management, Tax and Consultancy: Cyrra Q. Balignasay BSA-5Cyrra BalignasayNo ratings yet

- 10 Donors TaxDocument39 pages10 Donors TaxClaira LebrillaNo ratings yet

- CTT - Donor's TaxDocument8 pagesCTT - Donor's TaxMary Ann GalinatoNo ratings yet

- Donor's Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X". D N 0 1Document6 pagesDonor's Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X". D N 0 1JayAnnE.TugnonIINo ratings yet

- Cash Groceries/Sack of Rice Bonuses Rewards Health Incentives Others TotalDocument7 pagesCash Groceries/Sack of Rice Bonuses Rewards Health Incentives Others TotalRhyzlyn De OcampoNo ratings yet

- Cash Groceries/Sack of Rice Bonuses Rewards Health Incentives Others TotalDocument7 pagesCash Groceries/Sack of Rice Bonuses Rewards Health Incentives Others TotalRhyzlyn De OcampoNo ratings yet

- Research 1Document153 pagesResearch 1Rhyzlyn De OcampoNo ratings yet

- Module Strategic Management Strategic Financial Management 1Document108 pagesModule Strategic Management Strategic Financial Management 1Rhyzlyn De OcampoNo ratings yet

- Tax Outline 1Document13 pagesTax Outline 1Rhyzlyn De OcampoNo ratings yet

- Rafiq v. Munshilal, (1981)Document11 pagesRafiq v. Munshilal, (1981)Anand YadavNo ratings yet

- Go vs. BSP G.R. No. 178429, Oct. 23, 2009 (604 SCRA 322)Document5 pagesGo vs. BSP G.R. No. 178429, Oct. 23, 2009 (604 SCRA 322)Carlos JamesNo ratings yet

- Napocor Vs JocsonDocument2 pagesNapocor Vs JocsonMvv Villalon100% (1)

- Republic vs. Spouses RegultoDocument8 pagesRepublic vs. Spouses RegultoDanJalbunaNo ratings yet

- HONG LEONG FINANCE BHD V STAGHORN SDN BHDDocument18 pagesHONG LEONG FINANCE BHD V STAGHORN SDN BHDS N NAIR & PARTNERS NAIRNo ratings yet

- M Senthil Kumar Vs S Periyasamy On 18 January 2016Document7 pagesM Senthil Kumar Vs S Periyasamy On 18 January 2016samsungindian 2015No ratings yet

- Case-Mbushuu and Another Vs Republic - Death Penalty - 1994Document20 pagesCase-Mbushuu and Another Vs Republic - Death Penalty - 1994jonas msigala100% (5)

- Class 6 Unit 7 Fair PlayDocument3 pagesClass 6 Unit 7 Fair PlayThiagarajan KamananNo ratings yet

- Design LawDocument45 pagesDesign LawTrayana VladimirovaNo ratings yet

- Resolution On BDRRM 2018Document5 pagesResolution On BDRRM 2018BARANGAY MOLINO II100% (1)

- CollectionDocument3 pagesCollectionSteve ChanNo ratings yet

- Assignment 1 MLS 2022Document5 pagesAssignment 1 MLS 2022Ahmed YousifNo ratings yet

- Icfai Law School Icfai University, Dehradun: Hurt and Grievious Hurt Under Indian Penal CodeDocument23 pagesIcfai Law School Icfai University, Dehradun: Hurt and Grievious Hurt Under Indian Penal CodeShreya VermaNo ratings yet

- Consent Form - LatestDocument2 pagesConsent Form - LatestdivyaNo ratings yet

- Sri Lakshmi Saraswathi Textiles (Arni) Limited-Ad - RRDocument8 pagesSri Lakshmi Saraswathi Textiles (Arni) Limited-Ad - RRsuriya harishNo ratings yet

- Kidney For SaleDocument2 pagesKidney For SaletirtahadiNo ratings yet

- 125 - Art 16 Sec 3 EPG Construction Vs VigilarDocument1 page125 - Art 16 Sec 3 EPG Construction Vs VigilarZandra Andrea GlacitaNo ratings yet

- Filipinas Port Services Inc Vs Go Case DigestDocument2 pagesFilipinas Port Services Inc Vs Go Case Digestsally deeNo ratings yet

- European Administrative Law in The Constitutional TreatyDocument210 pagesEuropean Administrative Law in The Constitutional TreatyAndreea IrinaNo ratings yet

- 59th Campus Placement November 1 LowDocument8 pages59th Campus Placement November 1 Lowashok mNo ratings yet

- NTEU v. Trump Case No. 20-3078Document16 pagesNTEU v. Trump Case No. 20-3078FedSmith Inc.No ratings yet

- VOID AGREEMENTS Expressly DeclaredDocument3 pagesVOID AGREEMENTS Expressly DeclaredBharathi Priya.SNo ratings yet

- People's Trans East v. Doctors of New MillenniumDocument3 pagesPeople's Trans East v. Doctors of New MillenniumJayson RacalNo ratings yet

- עותק של דיבייט אנגלית עם תרגוםDocument2 pagesעותק של דיבייט אנגלית עם תרגוםeviatarNo ratings yet

- QB HWPRDocument6 pagesQB HWPRnagavenkat pedapatiNo ratings yet

- A. Jalil GharamiDocument17 pagesA. Jalil GharamiMohammad Abdul KhalequeNo ratings yet

- Sempron, Joesil Dianne C. Midterms: Conflict of LawsDocument7 pagesSempron, Joesil Dianne C. Midterms: Conflict of LawsJoesil Dianne SempronNo ratings yet