Professional Documents

Culture Documents

Bus Tax Chap 2

Bus Tax Chap 2

Uploaded by

David Lijauco0 ratings0% found this document useful (0 votes)

18 views11 pagesVAT stands for Value Added Tax and is a type of sales tax levied on the sale of goods, services or properties, as well as importation, in the Philippines at rates from 0% to 12% added to the selling price. Certain sales are exempt from VAT including the sale or importation of agricultural, livestock, poultry, and marine food products in their original state for human consumption. The Bureau of Internal Revenue has clarified that only raw cane sugar is exempt from VAT, while the sale of marinated fish is subject to VAT. Educational services provided by private or public educational institutions are also exempt from VAT.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentVAT stands for Value Added Tax and is a type of sales tax levied on the sale of goods, services or properties, as well as importation, in the Philippines at rates from 0% to 12% added to the selling price. Certain sales are exempt from VAT including the sale or importation of agricultural, livestock, poultry, and marine food products in their original state for human consumption. The Bureau of Internal Revenue has clarified that only raw cane sugar is exempt from VAT, while the sale of marinated fish is subject to VAT. Educational services provided by private or public educational institutions are also exempt from VAT.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

18 views11 pagesBus Tax Chap 2

Bus Tax Chap 2

Uploaded by

David LijaucoVAT stands for Value Added Tax and is a type of sales tax levied on the sale of goods, services or properties, as well as importation, in the Philippines at rates from 0% to 12% added to the selling price. Certain sales are exempt from VAT including the sale or importation of agricultural, livestock, poultry, and marine food products in their original state for human consumption. The Bureau of Internal Revenue has clarified that only raw cane sugar is exempt from VAT, while the sale of marinated fish is subject to VAT. Educational services provided by private or public educational institutions are also exempt from VAT.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 11

Chapter 2 Value Added Tax

VAT stands for Value Added Tax. VAT is a type of sales tax which is levied

on consumption on the sale of goods, services or properties, as well as

importation, in the Philippines. To simplify, it means that a certain tax

rate (0% to 12%) is added up to the selling price of a goods or services

sold. It is also imposed on imported goods from abroad.

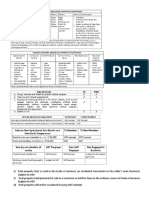

VAT EXEMPT SALES (Sec 109, NIRC)

A. Sale or importation of agricultural, livestock, poultry, and marine food

products in their “original state”, Provided, that the food is generally used for

human consumption.

Examples:

Livestock or poultry does not include fighting cocks, racehorses, zoo animals

and other animals generally considered as pets.

Polished and/or husked rice, corn grits, raw cane sugar and molasses, ordinary

salt and copra shall be considered as agricultural products in their original state.

Bagasse is not included in the exemption provided for under this section.

Continuation

THE Bureau of Internal Revenue (BIR) has clarified that only “raw

cane sugar,” or muscovado sugar, is exempt from the value-added

tax (VAT) pursuant to Section 109 of the Tax Code.

Sale of Marinated Fish

Sale of marinated fish IS NOT Exempt from VAT. Laws granting

exemption from tax are CONSTRUED strictly against the taxpayer.

Exemption from tax must be clearly stated.

B. Sale or importation of fertilizers, seeds, seedlings and fingerlings, fish,

prawn, livestock and poultry feeds, including ingredients, used in the

manufacture of finished feeds except specialty feeds.

Specialty feeds refers to food for race horses, fighting cocks, aquarium

fish, zoo animals and other animatgls generally considered as pets.

VAT

C. Importation of personal and household effects belonging to residents

of the Philippines returning from abroad and non-resident citizens

coming to resettle in the Philippines.

D. Importation of professional instruments and implements, wearing

apparel, domestic animals, and personal household effects except

machinery and other goods use in the manufacture and merchandise of

any kind in commercial quantity belonging to persons coming to settle in

the Philippines.

Belonging to persons coming to settle in the Philippines for their own

use and not for sale, barter and exchange. When the person before 90

days of their arrival upon the production of evidence satisfactory to the

Commissioner that such person are actually coming to settle in the

Philippines and that change is bane fide

VAT

Exception to VAT

Importation of any vehicle, vessel, aircraft, machinery, other goods for

use in the manufacture and merchandise of any kind in commercial

quantity.

E. Services subject to Percentage Tax under Title V of the Tax Code.

F. Services by agricultural contract growers and milling for others of

palay into corn rice, corn into grits and sugar cane into raw sugar.

“Agricultural contract growers” refers to those persons producing

for other poultry, livestock or other agricultural and marine food

products in their original state.

VAT

G. Medical, Dental, Hospital and Veterinary Services except those

rendered by professional;

Laboratories are exempted. If the hospital or clinic operates a pharmacy,

it is subject to VAT

Subject to VAT – Professionals

1. Medical practitioners

2. CPAs

3. Insurance Agents (Life and Non-Life)

4. Other professionals Practitioners required

VAT

H. Educational services rendered by private educational institutions,

duly accredited by the Department of Education (DepEd), the

Commissions on Higher Education (CHED) the Technical Education and

Skills Development Authority (TESDA) and those rendered by the

government educational institutions;

“Educational services” shall refer to academic, technical or vocational

education provided by private educational institutions duly accredited

by the DepEd, the CHED and TESDA and those rendered by government

educational institutions.

VAT

I. Services rendered by individuals pursuant to an employer-employee

relationship.

J. Services rendered by regional or area headquarters established in the

Philippines by multinational corporations which act as supervisory,

communications and coordinating centers for their affiliates,

subsidiaries or branches in the Asia-Pacific Region and do not earn or

derive income from the Philippines.

K. Transactions which exempt under international agreements to which

the Philippines is a signatory under special laws,

Except those under Presidential Decree No. 529 that grant Petroleum

Exploration Concessionaires exemption from Custom Duty and Tax of

Importation Machinery required for their Exploration Operation.

VAT

L. Importation by agricultural cooperatives of direct farm inputs,

machineries and equipment, including spare parts thereof, to be used

directly and exclusively in the production and/or processing of their

produce.

Sales by Agricultural To Members To Non Members

Cooperatives

Sale of cooperatives own

Produce (processed or original) Exempt Exempt

Other than produce Exempt VAT

*Exempt if referring to agricultural food products at its original state

VAT

VAT

M. Gross Receipts from lending activities by credit or multi-purpose

cooperatives duly registered with Cooperative Department Authority.

GROSS RECEIPTSTAX

Gross receipt from lending activities to its members Exempt

Gross Receipts from Lending Activities to nonmembers Exempt

From NON-Lending activities subject to VAT (members or Non-members)

N. Sales by non-agricultural, non-electric and non-credit cooperatives.

Provided, that the share capital contribution of each member does not

exceed Fifteen thousand pesos (P15,000) and regardless of the

aggregate capital and net surplus ratably distributed among the

members.

VAT

Gross Receipts/sales by From Members From Non Members

Electric cooperatives VAT VAT

Agricultural Cooperatives Table 8-2 Table 8-2

Lending Activities Table 8-3 Table 8-3

Non-agri, non-elec

non-lending

• Contribution per member <- 15K EXEMPT EXEMPT

• Contribution per member >15K VAT VAT

O. Export sales by person who are not VAT-registered;

By A NVP VAT Exempt

Export Sales

By a VAT Reg Vatable Zero rated sales

You might also like

- VAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDocument103 pagesVAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDGAENo ratings yet

- MyLegalWhiz - Counter-AffidavitDocument4 pagesMyLegalWhiz - Counter-AffidavitDevilleres Eliza DenNo ratings yet

- Urban Air Final PaperDocument11 pagesUrban Air Final Paperapi-351944806No ratings yet

- Taxation 2 Midterm NotesDocument42 pagesTaxation 2 Midterm NotesTet Legaspi100% (1)

- Vat Exempt SalesDocument4 pagesVat Exempt SalesEmma Mariz GarciaNo ratings yet

- Chapter 2 Tax 2Document7 pagesChapter 2 Tax 2Hazel Jane EsclamadaNo ratings yet

- Reliance Communications Limited: Car Lease Policy: To Hire/OwnDocument28 pagesReliance Communications Limited: Car Lease Policy: To Hire/OwnleeladonNo ratings yet

- Donors and VatDocument179 pagesDonors and VatGlino ClaudioNo ratings yet

- B. Introduction To VAT FinalDocument102 pagesB. Introduction To VAT FinalNatalie SerranoNo ratings yet

- Introduction To Business TaxesDocument32 pagesIntroduction To Business TaxesGracelle Mae Oraller100% (2)

- Vat NotesDocument11 pagesVat NotesStephen CabalteraNo ratings yet

- Tax3. Lecture 1 - Value Added Tax SCDocument40 pagesTax3. Lecture 1 - Value Added Tax SCsuzyshii 888No ratings yet

- 12 Value Added Taxes 1Document91 pages12 Value Added Taxes 1Vince ManahanNo ratings yet

- Introduction To Business Taxation, Exclusions and Other Percentage TaxDocument20 pagesIntroduction To Business Taxation, Exclusions and Other Percentage TaxDharel GannabanNo ratings yet

- MODULE 2 Value Added TaxDocument21 pagesMODULE 2 Value Added TaxLenson NatividadNo ratings yet

- LawDocument43 pagesLawMARIANo ratings yet

- Donors and VatDocument179 pagesDonors and VatLayca Clarice Germino BrimbuelaNo ratings yet

- Tax 30222Document5 pagesTax 30222Ronariza BondocNo ratings yet

- Chapter 8 - VAT - Part 1 - LatestDocument38 pagesChapter 8 - VAT - Part 1 - Latestargene.malubayNo ratings yet

- VAT (Chapter 8 Compilation of Summary)Document36 pagesVAT (Chapter 8 Compilation of Summary)Dianne LontacNo ratings yet

- Vat Exempt TransactionDocument7 pagesVat Exempt TransactionFatima Zaida JahaniNo ratings yet

- Tax 302 - Vat-Exempt TransactionsDocument6 pagesTax 302 - Vat-Exempt TransactionsiBEAYNo ratings yet

- Value Added Tax: A. Business TaxesDocument3 pagesValue Added Tax: A. Business TaxesNerish PlazaNo ratings yet

- Handouts 56Document11 pagesHandouts 56Omar CabayagNo ratings yet

- TAX-302 (VAT-Exempt Transactions) PDFDocument5 pagesTAX-302 (VAT-Exempt Transactions) PDFclara san miguelNo ratings yet

- Vat Exempt Transactions: Page 3 of 6Document4 pagesVat Exempt Transactions: Page 3 of 6Lei Anne GatdulaNo ratings yet

- TAXATION 2 Chapter 9 Exempt SalesDocument5 pagesTAXATION 2 Chapter 9 Exempt SalesKim Cristian MaañoNo ratings yet

- TAX 302 VAT Exempt Transactions 1Document6 pagesTAX 302 VAT Exempt Transactions 1Jeen JeenNo ratings yet

- Business Taxation 1Document81 pagesBusiness Taxation 1Prince Isaiah Jacob100% (1)

- TAX-302 (VAT-Exempt Transactions)Document7 pagesTAX-302 (VAT-Exempt Transactions)Edith DalidaNo ratings yet

- 6 VatDocument159 pages6 VatClaire diane CraveNo ratings yet

- Lesson 9Document22 pagesLesson 9Iris Lavigne RojoNo ratings yet

- Adzu Tax02 A Learning Packet 2 Value Added TaxDocument9 pagesAdzu Tax02 A Learning Packet 2 Value Added TaxJustine Paul Pangasi-an100% (1)

- Added: ValueDocument49 pagesAdded: ValueFearl Hazel Languido BerongesNo ratings yet

- Subject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptDocument32 pagesSubject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptNikka SanzNo ratings yet

- Value Added TaxDocument114 pagesValue Added TaxDa Yani ChristeeneNo ratings yet

- Tax Consequences: No Output Tax Allowed and Seller IsDocument12 pagesTax Consequences: No Output Tax Allowed and Seller IsXerez SingsonNo ratings yet

- Business Taxes: Certified Accounting Technician NIAT Office 2015Document33 pagesBusiness Taxes: Certified Accounting Technician NIAT Office 2015Anonymous Lz2qH7No ratings yet

- Domondon Reviewer - Tax 2Document38 pagesDomondon Reviewer - Tax 2Mar DevelosNo ratings yet

- VAT Exempt SalesDocument5 pagesVAT Exempt SalesNEstandaNo ratings yet

- Jude Feliciano: What Are VAT Exempt Transactions in The Philippines?Document10 pagesJude Feliciano: What Are VAT Exempt Transactions in The Philippines?Michelle NacisNo ratings yet

- VAT-Exempt TransactionsDocument38 pagesVAT-Exempt TransactionsAkemiNo ratings yet

- BA 303 Notes 2Document19 pagesBA 303 Notes 2gwyneth dian belotendosNo ratings yet

- To Print TaxDocument13 pagesTo Print TaxVee SyNo ratings yet

- VatDocument13 pagesVatJohn Derek GarreroNo ratings yet

- Answers - Business Taxation - Exempt Sales (Chapter 4)Document3 pagesAnswers - Business Taxation - Exempt Sales (Chapter 4)Gino CajoloNo ratings yet

- Bsa2105 FS2021 Vat Da22412Document7 pagesBsa2105 FS2021 Vat Da22412ela kikayNo ratings yet

- (G5 P2) VatDocument76 pages(G5 P2) VatFiliusdeiNo ratings yet

- Chapter21 1Document13 pagesChapter21 1Rachel Pepito BaladjayNo ratings yet

- Vat ReviewDocument4 pagesVat ReviewVensen FuentesNo ratings yet

- 04 Vat Exempt TransactionsDocument4 pages04 Vat Exempt TransactionsJaneLayugCabacunganNo ratings yet

- Vat Exempt SalesDocument8 pagesVat Exempt SalesGelai AtienzaNo ratings yet

- VAT Group 3Document39 pagesVAT Group 3Andrea GranilNo ratings yet

- Vat Exempt TransactionDocument3 pagesVat Exempt TransactionDe Leon Patricia A.No ratings yet

- Tax Ch6 VAT BinaluyoDocument6 pagesTax Ch6 VAT Binaluyomavrhyck.21No ratings yet

- TAX 2 2024 ActivitiesDocument5 pagesTAX 2 2024 ActivitiesJenny Mae MercadoNo ratings yet

- VAT Exempt SalesDocument29 pagesVAT Exempt SalesNEstandaNo ratings yet

- DomondonDocument40 pagesDomondonCharles TamNo ratings yet

- Module 8 - Value Added TaxDocument28 pagesModule 8 - Value Added TaxKyrah Angelica DionglayNo ratings yet

- Chapter 2 VAT in ImportationDocument51 pagesChapter 2 VAT in ImportationIvy TejadaNo ratings yet

- Preferential TaxationDocument2 pagesPreferential TaxationPrankyJellyNo ratings yet

- Impact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesFrom EverandImpact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesNo ratings yet

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesFrom EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesNo ratings yet

- Miami Dade Tangible Property 20 159220 2023 Annual BillDocument1 pageMiami Dade Tangible Property 20 159220 2023 Annual Billp13607091No ratings yet

- Introduction To Business TaxDocument7 pagesIntroduction To Business TaxDrew BanlutaNo ratings yet

- InvoiceDocument1 pageInvoiceSɅGɅR ɅROЯɅNo ratings yet

- Bar Bending InvoiceDocument1 pageBar Bending InvoicePrasoon sysmindNo ratings yet

- Illinois Tool Works Inc.: FORM 10-KDocument112 pagesIllinois Tool Works Inc.: FORM 10-KMark Francis CosingNo ratings yet

- Fullpaper-Dr Jason NG Wei JianDocument16 pagesFullpaper-Dr Jason NG Wei JianfarishasbiNo ratings yet

- Korai Traders Final ReportDocument14 pagesKorai Traders Final ReportKorai KhanNo ratings yet

- Local Government Code of 1991Document115 pagesLocal Government Code of 1991Kyla100% (1)

- Business Plan For The Small Construction FirmDocument31 pagesBusiness Plan For The Small Construction FirmAlvie Borromeo Valiente100% (1)

- Test Bank For Medical Surgical Nursing Patient Centered Collaborative Care 8th Edition IgnataviciusDocument36 pagesTest Bank For Medical Surgical Nursing Patient Centered Collaborative Care 8th Edition Ignataviciustetrazosubaud0q5f100% (46)

- CL Cup 2018 (AUD, TAX, RFBT)Document4 pagesCL Cup 2018 (AUD, TAX, RFBT)sophiaNo ratings yet

- Lecture Note 3 - Globalization and Role of MNCSDocument64 pagesLecture Note 3 - Globalization and Role of MNCSgydoiNo ratings yet

- Cambridge A As Level Economics Syllabus 2014Document32 pagesCambridge A As Level Economics Syllabus 2014Lavanya TheviNo ratings yet

- Sub. Code 7Bcoe1ADocument11 pagesSub. Code 7Bcoe1AVELAVAN ARUNADEVINo ratings yet

- ATTOCK CEMENT Report by Faiza SiddiqueDocument26 pagesATTOCK CEMENT Report by Faiza SiddiqueEkta IoBMNo ratings yet

- Using "Beyond The Quick Fix Model" Identify The Challenges of PTCL and Suggest As OD Consultant For The Development of This OrganizationDocument17 pagesUsing "Beyond The Quick Fix Model" Identify The Challenges of PTCL and Suggest As OD Consultant For The Development of This OrganizationSamiullah SarwarNo ratings yet

- The Political Environment: A Critical ConcernDocument42 pagesThe Political Environment: A Critical ConcernabraamNo ratings yet

- Withholding TaxDocument18 pagesWithholding Taxraju aws100% (1)

- II Mcom - CTLP - Mcq's - II MidDocument7 pagesII Mcom - CTLP - Mcq's - II MidChakravarti ChakriNo ratings yet

- Taxation Assignment 7 PDFDocument4 pagesTaxation Assignment 7 PDFKNVS Siva KumarNo ratings yet

- DHL Husen 250922Document3 pagesDHL Husen 250922radarNo ratings yet

- Ajay Kumar - Taxation in Mauryan Period PDFDocument5 pagesAjay Kumar - Taxation in Mauryan Period PDFAnkush GuptaNo ratings yet

- The Effect of Rising Income Inequality On Taxation and Public Expenditures: Evidence From U.S. Municipalities and SCHOOL DISTRICTS, 1970-2000Document12 pagesThe Effect of Rising Income Inequality On Taxation and Public Expenditures: Evidence From U.S. Municipalities and SCHOOL DISTRICTS, 1970-2000Marcos Ludwig CorreaNo ratings yet

- Pas 41 AgricultureDocument28 pagesPas 41 AgricultureKristine TiuNo ratings yet

- GEE 1: The Entrepreneurial Mind: Course DescriptionDocument3 pagesGEE 1: The Entrepreneurial Mind: Course DescriptionJemalyn De Guzman TuringanNo ratings yet

- A2. Lembar Kerja Jurnal PT POLINES JAYADocument5 pagesA2. Lembar Kerja Jurnal PT POLINES JAYANovita Enjelita100% (1)

- LSB2605 2023 1 AssignmentsDocument2 pagesLSB2605 2023 1 AssignmentsNokwazi GumedeNo ratings yet