Professional Documents

Culture Documents

Cash and Cash Equivalents

Cash and Cash Equivalents

Uploaded by

PetrinaCopyright:

Available Formats

You might also like

- Coursebook Answers: Answers To Test Yourself QuestionsDocument6 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii73% (11)

- 2023 Grade 11 Written Report QPDocument5 pages2023 Grade 11 Written Report QPfiercestallionofficialNo ratings yet

- Construction Contract Template (NOT DOLE Registered)Document18 pagesConstruction Contract Template (NOT DOLE Registered)macebaileyNo ratings yet

- Pay Later StatementDocument2 pagesPay Later StatementDEKHO or SEEKHONo ratings yet

- Investment Portfolio Statement: CORINTSA SURVEYS AND PROJECTS (Pty) LTDocument3 pagesInvestment Portfolio Statement: CORINTSA SURVEYS AND PROJECTS (Pty) LTWisaniNo ratings yet

- Chapter 2 Cash and Cash Equivalents Exercises T3AY2021Document7 pagesChapter 2 Cash and Cash Equivalents Exercises T3AY2021Carl Vincent BarituaNo ratings yet

- Af As Chapter 8Document18 pagesAf As Chapter 8FarrukhsgNo ratings yet

- Incomplete Records and Single Entry: Where Cash Records Are AvailableDocument2 pagesIncomplete Records and Single Entry: Where Cash Records Are AvailableCupid CuteNo ratings yet

- GR 10 Acc T1 Week 2 ENGDocument7 pagesGR 10 Acc T1 Week 2 ENGAmal MohmoudNo ratings yet

- Errors, Correction, Control and Recon, ProvisionDocument11 pagesErrors, Correction, Control and Recon, ProvisionOwen Bawlor ManozNo ratings yet

- Single Entry and Incomplete RecordsDocument21 pagesSingle Entry and Incomplete RecordsPetrinaNo ratings yet

- AUD02 - 05 Audit of Cash and Cash EquivalentsDocument3 pagesAUD02 - 05 Audit of Cash and Cash EquivalentsMark BajacanNo ratings yet

- Financial Accounting ADocument137 pagesFinancial Accounting AlordNo ratings yet

- Special Exam-Prelims: Audit of Cash and Cash Equivalents Problem No. 1Document4 pagesSpecial Exam-Prelims: Audit of Cash and Cash Equivalents Problem No. 1Ma Yra YmataNo ratings yet

- Activity/Assignment #2 - Financial Models - Comparative DataDocument5 pagesActivity/Assignment #2 - Financial Models - Comparative DataNazzer NacuspagNo ratings yet

- The Four Types of Special JournalsDocument18 pagesThe Four Types of Special JournalsJob Castones100% (1)

- 2024 Accounting Grade 11 Learners Notes Session 1-5Document80 pages2024 Accounting Grade 11 Learners Notes Session 1-5t86663375No ratings yet

- ACC 1302 Incomplete RecordsDocument6 pagesACC 1302 Incomplete Recordsaustineodey33No ratings yet

- Cash and Cash Equivalents & Bank ReconciliationDocument20 pagesCash and Cash Equivalents & Bank ReconciliationHesil Jane DAGONDON100% (1)

- Accounting Content ManualDocument153 pagesAccounting Content Manualconstance nyoniNo ratings yet

- ACCOUNTING5Document9 pagesACCOUNTING5Natasha MugoniNo ratings yet

- 44 FdocDocument5 pages44 FdocGood LifeNo ratings yet

- 01.02.01 Cash and Cash Equivalents, Bank ReconciliationDocument16 pages01.02.01 Cash and Cash Equivalents, Bank ReconciliationBeverly BantagNo ratings yet

- Chapter 6 - Bank Reconciliation StatementDocument31 pagesChapter 6 - Bank Reconciliation StatementIrsamNo ratings yet

- Omar Muhktar Abusama Nov 19Document34 pagesOmar Muhktar Abusama Nov 19Garpt Kudasai100% (1)

- FS Accounting Grade 11 November 2022 P1 and MemoDocument23 pagesFS Accounting Grade 11 November 2022 P1 and MemoEsihle LwakheNo ratings yet

- Review Material ACC PRINTDocument11 pagesReview Material ACC PRINTtjcute125No ratings yet

- FS Accounting REVISION 2022 Grade 12 Paper 2Document273 pagesFS Accounting REVISION 2022 Grade 12 Paper 2Nonhlanhla NhlapoNo ratings yet

- Chapter 5 Incomplete RecordDocument20 pagesChapter 5 Incomplete RecordNUR ADLIN ZAFIRAH BINTI NORAZLI KTNNo ratings yet

- Ap9208 Cash 3Document4 pagesAp9208 Cash 3Onids AbayaNo ratings yet

- Result PDF Watermark Iic7NF6Document4 pagesResult PDF Watermark Iic7NF6mdyafi8084No ratings yet

- Incomplete Records: Calculation of Profit or Loss (Without Preparing Financial Statements)Document5 pagesIncomplete Records: Calculation of Profit or Loss (Without Preparing Financial Statements)Tawanda Tatenda Herbert100% (1)

- Cash Book and Bank Reconciliation 2Document8 pagesCash Book and Bank Reconciliation 2DavidNo ratings yet

- Result PDF Watermark Zlcg4xuDocument4 pagesResult PDF Watermark Zlcg4xuRene MendozaNo ratings yet

- Statement of Cash FlowsDocument28 pagesStatement of Cash FlowsseanakkigNo ratings yet

- BANK RECONCILIATION 2Document4 pagesBANK RECONCILIATION 2Cornelius Chiko MwansaNo ratings yet

- Cambridge IGCSE: Accounting 0452/13Document12 pagesCambridge IGCSE: Accounting 0452/13Shannon LimNo ratings yet

- Assignment 1. Your Client, A Successful Small Business, Has Never Given Much Attention To A SoundDocument6 pagesAssignment 1. Your Client, A Successful Small Business, Has Never Given Much Attention To A SoundThricia Mae Lorenzo IgnacioNo ratings yet

- GR 11 Acc T1 Week 2 Cred Recon ENGDocument6 pagesGR 11 Acc T1 Week 2 Cred Recon ENGethanmaistryNo ratings yet

- GENERAL ACCOUNTING-TRADE TEST - FKNokDocument4 pagesGENERAL ACCOUNTING-TRADE TEST - FKNokKENGNENo ratings yet

- Yates Logistics BofA SepDocument7 pagesYates Logistics BofA SepJonathan Seagull LivingstonNo ratings yet

- AP Module 2 - Audit of Revenue-Receipt CycleDocument8 pagesAP Module 2 - Audit of Revenue-Receipt CycleHannah Jane ToribioNo ratings yet

- Chapter 23 AnswersDocument9 pagesChapter 23 AnswersAnusree SivasamyNo ratings yet

- 2020 GR 10 r1&r2 Accounting Past PapersDocument18 pages2020 GR 10 r1&r2 Accounting Past PapersSamihah KajeeNo ratings yet

- Entrep Week 5Document25 pagesEntrep Week 5edward.mkl12345No ratings yet

- AUD 2023 2 Substantive Tests of Cash Prepaid Expenses and DeferredDocument4 pagesAUD 2023 2 Substantive Tests of Cash Prepaid Expenses and DeferredMary Rose CredoNo ratings yet

- Bank Rec HKALEDocument10 pagesBank Rec HKALEKwan Yin HoNo ratings yet

- Result PDF Watermark JU3YucaDocument4 pagesResult PDF Watermark JU3Yucamicffj12No ratings yet

- ICARE Preweek APDocument15 pagesICARE Preweek APjohn paulNo ratings yet

- ACCT2511 Topic 1 PASS Question Answers 2023 T1Document3 pagesACCT2511 Topic 1 PASS Question Answers 2023 T1KJSAdNo ratings yet

- Bank ReconcilationDocument9 pagesBank ReconcilationJohnpaul FloranzaNo ratings yet

- Tutorial 9 Q ReconciliationDocument12 pagesTutorial 9 Q ReconciliationJING ER LAUNo ratings yet

- 1st Activity Cash and Cash Equivalents Bank Reconciliation Proof of CashDocument7 pages1st Activity Cash and Cash Equivalents Bank Reconciliation Proof of CashSheidee ValienteNo ratings yet

- Debtors and Creditors GuideDocument6 pagesDebtors and Creditors Guidesammie celeNo ratings yet

- F5 Bafs 2 QueDocument13 pagesF5 Bafs 2 Queouo So方No ratings yet

- Statement 380312 Mar2024Document2 pagesStatement 380312 Mar2024Brittany EmillyNo ratings yet

- PDF Coursebook Chapter 4 Answers - CompressDocument6 pagesPDF Coursebook Chapter 4 Answers - CompressSama ZabadyNo ratings yet

- Bank Reconciliation 31 JANUARY 2013: Lesson DescriptionDocument3 pagesBank Reconciliation 31 JANUARY 2013: Lesson DescriptionNezer Byl P. VergaraNo ratings yet

- Bank Reconciliation StatementDocument18 pagesBank Reconciliation StatementAbisellyNo ratings yet

- Exercises On Cash PDFDocument6 pagesExercises On Cash PDFFely MaataNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- Business Entities 3Document13 pagesBusiness Entities 3PetrinaNo ratings yet

- River LTD (External Tutorial Question)Document1 pageRiver LTD (External Tutorial Question)PetrinaNo ratings yet

- Assignment 1 and 2 AFE3692 2023Document23 pagesAssignment 1 and 2 AFE3692 2023Petrina0% (1)

- General Deductions NotesDocument47 pagesGeneral Deductions NotesPetrinaNo ratings yet

- Auditing AssignmentDocument12 pagesAuditing AssignmentPetrinaNo ratings yet

- Specific Inclusions 24Document46 pagesSpecific Inclusions 24PetrinaNo ratings yet

- Unit 2 Interval Estimation-1Document31 pagesUnit 2 Interval Estimation-1PetrinaNo ratings yet

- Unit 4 Exam 2021 JuneDocument3 pagesUnit 4 Exam 2021 JunePetrinaNo ratings yet

- AAM3691Consolidated Semester AssessmentsDocument8 pagesAAM3691Consolidated Semester AssessmentsPetrinaNo ratings yet

- Oxygen CareDocument4 pagesOxygen CarePetrinaNo ratings yet

- AAM3692 Assignment 1 and 2Document17 pagesAAM3692 Assignment 1 and 2PetrinaNo ratings yet

- Class Excercise 1management AccountingDocument3 pagesClass Excercise 1management AccountingPetrinaNo ratings yet

- Assignments 1 and 2 ACL 3632Document16 pagesAssignments 1 and 2 ACL 3632PetrinaNo ratings yet

- B33C7F3C-F7A0-4F42-B984-CB921072326CDocument2 pagesB33C7F3C-F7A0-4F42-B984-CB921072326CPetrinaNo ratings yet

- Partnership - Changes in Ownership Structures (Galaxy Sports - Exercise)Document6 pagesPartnership - Changes in Ownership Structures (Galaxy Sports - Exercise)PetrinaNo ratings yet

- Partnership Class ExercisesDocument2 pagesPartnership Class ExercisesPetrinaNo ratings yet

- UNIT 2 Partnerships - Question Bank (2020)Document20 pagesUNIT 2 Partnerships - Question Bank (2020)Petrina100% (1)

- Management Accounting ExercisesDocument82 pagesManagement Accounting ExercisesPetrinaNo ratings yet

- Manufacturing Accounts in AccountingDocument32 pagesManufacturing Accounts in AccountingPetrinaNo ratings yet

- Study Guide For Close CorporationsDocument25 pagesStudy Guide For Close CorporationsPetrinaNo ratings yet

- Partnership - Liquidation (Powerpoint Presentation)Document21 pagesPartnership - Liquidation (Powerpoint Presentation)PetrinaNo ratings yet

- Manufacturing Accounts (Study Guide)Document17 pagesManufacturing Accounts (Study Guide)PetrinaNo ratings yet

- UNIT 4 Companies - Question Bank (2020)Document41 pagesUNIT 4 Companies - Question Bank (2020)PetrinaNo ratings yet

- UNIT 2 - Partnerships - Changes in Ownership StructursDocument19 pagesUNIT 2 - Partnerships - Changes in Ownership StructursPetrinaNo ratings yet

- UNIT 1 Partnerships - Question Bank (2020)Document13 pagesUNIT 1 Partnerships - Question Bank (2020)PetrinaNo ratings yet

- Summarized Notes On Close-CooperativesDocument31 pagesSummarized Notes On Close-CooperativesPetrinaNo ratings yet

- Chapter 4 - Microbiology and BiotechnologyDocument68 pagesChapter 4 - Microbiology and BiotechnologyPetrinaNo ratings yet

- Companies NotesDocument40 pagesCompanies NotesPetrinaNo ratings yet

- BSC410S-Basic Science 1 - 1ST Opp-Nov 17Document11 pagesBSC410S-Basic Science 1 - 1ST Opp-Nov 17PetrinaNo ratings yet

- Unit 1 - Introduction To PartnershipsDocument26 pagesUnit 1 - Introduction To PartnershipsPetrinaNo ratings yet

- Brochure OSH CONNECT 2020Document7 pagesBrochure OSH CONNECT 2020fauzi5878No ratings yet

- PCAB JV Application GuideDocument10 pagesPCAB JV Application GuideobaguecNo ratings yet

- 1021047119-Integrated Bill PDFDocument2 pages1021047119-Integrated Bill PDFPcrNo ratings yet

- Icmrm11 MemoryDocument272 pagesIcmrm11 MemoryAnas TounsiNo ratings yet

- Audit Through CBSDocument159 pagesAudit Through CBSInfotomathiNo ratings yet

- Special Journals Lecture No. 6Document25 pagesSpecial Journals Lecture No. 6Yuu100% (1)

- Huda Agreement To Sell FormatDocument3 pagesHuda Agreement To Sell FormatLive lifeNo ratings yet

- Ap820ach Pfizer ExampleDocument7 pagesAp820ach Pfizer ExampleravikanthpNo ratings yet

- Application For Certificate of Evidence' Under Section 131 of The Home Building ActDocument2 pagesApplication For Certificate of Evidence' Under Section 131 of The Home Building Actapi-3751980No ratings yet

- Test Information Release Order Form 2019-2020: Test Date Postmark Deadline Mail To: FeeDocument1 pageTest Information Release Order Form 2019-2020: Test Date Postmark Deadline Mail To: FeeSusan WerbNo ratings yet

- Carvetizer Purchase FormDocument1 pageCarvetizer Purchase FormKarl IskandarNo ratings yet

- Solution To Illustrative Problem On Petty Cash FundDocument3 pagesSolution To Illustrative Problem On Petty Cash FundHoy CrushNo ratings yet

- ERP Customize Integration With SBODocument3 pagesERP Customize Integration With SBOfuadNo ratings yet

- ds4194 PDFDocument3 pagesds4194 PDFBen DzhonsNo ratings yet

- Complaint For Specific PerformanceDocument6 pagesComplaint For Specific PerformanceJacquelyn RamosNo ratings yet

- Negotiable Instruments Act CHARTSDocument16 pagesNegotiable Instruments Act CHARTSJames power100% (4)

- SAP FI HighlightsDocument28 pagesSAP FI Highlightsejas.cbitNo ratings yet

- Lightricks™ Terms of Use: Arbitration Notice: This Agreement Contains A Mandatory Arbitration AgreementDocument19 pagesLightricks™ Terms of Use: Arbitration Notice: This Agreement Contains A Mandatory Arbitration AgreementCicer AmeeNo ratings yet

- Dma 5097 PDFDocument2 pagesDma 5097 PDFAnonymous GpfoR36pNo ratings yet

- MIDTERM EXAMINATION OBLICON Answer KeyDocument5 pagesMIDTERM EXAMINATION OBLICON Answer KeyTaj-Mahal KumpaNo ratings yet

- Intro To Financial ManagementDocument12 pagesIntro To Financial Managementwei hongNo ratings yet

- Marketing Anylytics - Final Business ProjectDocument18 pagesMarketing Anylytics - Final Business ProjectMUHAMMAD ARSHADNo ratings yet

- Uk Payment Markets SUMMARY 2020: June 2020Document8 pagesUk Payment Markets SUMMARY 2020: June 2020Ankit GuptaNo ratings yet

- Presidential DecreeDocument5 pagesPresidential DecreeLeanemae Candilado AgabonNo ratings yet

- QBO Prep Time 1Document9 pagesQBO Prep Time 1ENIDNo ratings yet

- Due Date Telephone No Amount Payable: Summary of Charges Usage History (6 Months)Document3 pagesDue Date Telephone No Amount Payable: Summary of Charges Usage History (6 Months)Amjath MohammedNo ratings yet

- Tax Deduction Authority: Purpose of This FormDocument1 pageTax Deduction Authority: Purpose of This FormRosamaria FranzeNo ratings yet

- Student Management System Project in C++Document1 pageStudent Management System Project in C++sanwalNo ratings yet

Cash and Cash Equivalents

Cash and Cash Equivalents

Uploaded by

PetrinaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash and Cash Equivalents

Cash and Cash Equivalents

Uploaded by

PetrinaCopyright:

Available Formats

CASH AND CASH EQUIVALENTS

C MBAHIJONA

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 1

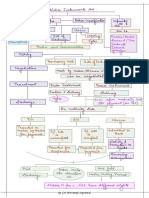

LEARNING OUTCOME

• Disclose transactions with the bank on the bank

statement;

• Update the two cash journals of the entity whose

books you are preparing;

• Reconcile the balance of the bank account with the

balance as per the bank statement;

• Prepare the petty cash journal;

• Show how cash and cash equivalents are disclosed in

the statement of financial position.

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 2

INTRODUCTION – CASH AND CASH

EQUIVALENTS

• The term cash and cash equivalents includes:

currency, coins, cheques received but not yet

deposited, petty cash, savings accounts, money

market accounts, and short-term, highly liquid

investments with a maturity of three months or less

at the time of purchase.

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 3

NATURE OF CASH AND CASH

EQUIVALENTS

• Cash can be defined as any legal means of payment which

can immediately be used as a means to pay someone else.

• Cash includes coins, notes, cheques, postal orders, credit

card vouchers and any deposits on demand.

• Cash equivalents are short-term highly liquid investments

which are readily convertible into cash.

1. Liquidity

Liquidity is the availability of cash for payment of claims

against the entity. Cash and cash deposits are liquid,

because they are immediately available for payment.

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 4

NATURE OF CASH AND CASH

EQUIVALENTS

• Cash is the most form of money, it is therefore the

primary legal tender in the economic system.

2. The primary liquid tender

• Cash is the most active asset in an entity.

• All expenses are eventually paid in cash either by

cheque or electronic transfer and all income is

received in cash.

• This implies that after each cash receipts or

payment, the liquidity of the entity changes.

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 5

NATURE OF CASH AND CASH

EQUIVALENTS

• When cash inflows exceeds the outflow, a cash

surplus is created, and surplus should be invested

if not needed for payment in the near future.

• When cash outflows exceeds the cash inflow, it may

be necessary for the entity to withdraw from

available investments or to borrow money to cover

the shortage.

• Money that is invested earns interest, and money

that is borrowed is charged interest.

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 6

NATURE OF CASH AND CASH

EQUIVALENTS

• Rate of interest on borrowed money is usually

higher than the rate of interest on investments. It is

therefore unwise to borrow money when

investments can be converted into cash.

• Due to the highly liquidity of cash, the risk of loss

through theft and fraud and other causes is high.

Management has a responsibility to ensure that

effective internal control measures over cash exist.

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 7

INTERNAL CONTROL OVER CASH

Nature of internal control over cash

• Internal control is defined as the process designed and effected

by those charged with governance to provide reasonable

assurance that company assets are safeguarded, records are

kept accurately and that financial reporting is done according

to applicable accounting standards.

• The purpose of internal control over cash is to ensure that all

cash that should be paid to an entity has been received and

recorded. The purpose of internal control is that all cash that

should be deposited in a bank account has been deposited and

that all cash payments have been duly authorised and verified.

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 8

USE OF BANK ACCOUNT

Opening of a bank account

• All entities that receive and disburse cash should open a

current account with a banking institution into which cash

can be deposited and out of which payments can be made. A

current account, also known as cheque account.

Bank Statement

• Banks provides a bank statement periodically to their clients.

The bank statement reflects all transactions of the clients’

accounts in the books of the bank; deposit made, cheques

paid and other debits and credits. The bank statement also

shows the daily balance of the account.

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 9

BANK RECONCILIATION STATEMENT

• Bank reconciliation statement is a statement which

details the differences between the cash book balance

and the bank statement balance after appropriate

adjustments have been made.

Reasons for differences in balances

The more the transactions an entity has with the bank,

the more these two balances do not correspond to each

other. The following are the most common causes of

differences between the balances shown in the records of

the entity and those of the bank.

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 10

BANK RECONCILIATION STATEMENT

• Items appearing in the entity’s books but not yet

reflected in the bank’s record like; outstanding cheques –

these are cheques that have been drawn by the entity,

but have not yet been presented to the bank for

payment.

• Deposits not yet credited by the bank

The bank’s books may show various items not yet

recorded by the entity like:

• Direct deposits made into the bank account of the entity

but have not yet been recorded by the entity.

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 11

BANK RECONCILIATION STATEMENT

• Charges for services rendered by the bank, bank

charges fees

• Interest charged on an overdrawn balance or

granted on a favourable balance.

• Commission on a cheques and cash deposit fees

• Unpaid cheques referred to drawer – R/D

• Bills recovered or paid by the bank on behalf of the

entity.

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 12

RECONCILIATION PROCEDURE -

EXAMPLE

• 01 May 2000, Ndeshi Shilongo started a trading

business, Shilongo Traders. Cash receipts Journal

for May 2000 of Shilongo Traders Reflected the

followings:

Doc No Date Details Analysis Bank

1 1 N. Shikongo - Cap 10 000 10 000

2 13 Cash Sales 1 450

3 14 Cash Sales 1 350 2 800

4 21 Cash Sales 900

5 24 R Charles - Rent 350 1 250

6 31 Cash Sales 850 850

14 900

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 13

RECONCILIATION PROCEDURE -

EXAMPLE

The bank statement for May 2022, received from the bank

reflects

Details

the

Fee

following:

Date Debit Credit Balance

N$ N$ N$ N$

Deposit 02 May 10 000 10 000

Deposit 15 May 2 800 12 800

Deposit 25 May 1 250 14 050

It obvious that the debit balance of the bank account of N$14

900 differs from the credit balance on the bank statement of

N$14 050. All the amounts have been reflected on the bank

statement except the deposit of N$850 on the 31 May 2022.

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 14

RECONCILIATION PROCEDURE -

EXAMPLE

The following is the bank reconciliation as at 31 May

2022:

Debit Credit

Debit (favourable) balance as per 14 900

bank account

Credit outstanding deposit 850

Credit (favourable) balance as per

bank statement 14 050

14 900 14 900

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 15

EXAMPLE 2

Cash book

19x9 Jan N$ 19x9 Jan N$

1 Bal b/d 320 10 C Mosa 110

16 R Lomas 160 20 McCarthy 90

24 V Van Zyl 140 28 Caledon 180

31 J Soames 470 30 Pienar 200

31 R Joorst 90 31 Balance c/d 600

1180 1180

Feb 1 Bal b/d 600

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 16

EXAMPLE 2

Bank Statement

19x9 Withdrawals Deposits Balance

Jan

1 Bal b/f 320

12 10627 110 210

16 Deposit 160 370

23 10628 90 280

24 Deposit 140 420

28 Dir. Debit Caledon 180 240

31 Dir. Credit R Joost 90 330

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 17

EXAMPLE 2

Required: Prepare bank reconciliation statement at

31 January 19x9.

Which balance is indicated as balance b/d in the

statement of financial position?

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 18

PETTY CASH JOURNAL

An entity needs to pay for certain smaller items such as

postage, wages of day workers, cleaning materials, teas

and coffee and toiletries. Therefore, the entity maintain a

petty cash float:

• Draw a cheque and cash the cheque for petty cash float;

• Petty cash float should be kept separate from other

money received by the entity.

• A separate journal is used to record petty cash

payments.

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 19

QUESTIONS

ANSWERS

24 August 2022 Fundamentals of Accounting - AFE3582 C Mbahijona 20

You might also like

- Coursebook Answers: Answers To Test Yourself QuestionsDocument6 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii73% (11)

- 2023 Grade 11 Written Report QPDocument5 pages2023 Grade 11 Written Report QPfiercestallionofficialNo ratings yet

- Construction Contract Template (NOT DOLE Registered)Document18 pagesConstruction Contract Template (NOT DOLE Registered)macebaileyNo ratings yet

- Pay Later StatementDocument2 pagesPay Later StatementDEKHO or SEEKHONo ratings yet

- Investment Portfolio Statement: CORINTSA SURVEYS AND PROJECTS (Pty) LTDocument3 pagesInvestment Portfolio Statement: CORINTSA SURVEYS AND PROJECTS (Pty) LTWisaniNo ratings yet

- Chapter 2 Cash and Cash Equivalents Exercises T3AY2021Document7 pagesChapter 2 Cash and Cash Equivalents Exercises T3AY2021Carl Vincent BarituaNo ratings yet

- Af As Chapter 8Document18 pagesAf As Chapter 8FarrukhsgNo ratings yet

- Incomplete Records and Single Entry: Where Cash Records Are AvailableDocument2 pagesIncomplete Records and Single Entry: Where Cash Records Are AvailableCupid CuteNo ratings yet

- GR 10 Acc T1 Week 2 ENGDocument7 pagesGR 10 Acc T1 Week 2 ENGAmal MohmoudNo ratings yet

- Errors, Correction, Control and Recon, ProvisionDocument11 pagesErrors, Correction, Control and Recon, ProvisionOwen Bawlor ManozNo ratings yet

- Single Entry and Incomplete RecordsDocument21 pagesSingle Entry and Incomplete RecordsPetrinaNo ratings yet

- AUD02 - 05 Audit of Cash and Cash EquivalentsDocument3 pagesAUD02 - 05 Audit of Cash and Cash EquivalentsMark BajacanNo ratings yet

- Financial Accounting ADocument137 pagesFinancial Accounting AlordNo ratings yet

- Special Exam-Prelims: Audit of Cash and Cash Equivalents Problem No. 1Document4 pagesSpecial Exam-Prelims: Audit of Cash and Cash Equivalents Problem No. 1Ma Yra YmataNo ratings yet

- Activity/Assignment #2 - Financial Models - Comparative DataDocument5 pagesActivity/Assignment #2 - Financial Models - Comparative DataNazzer NacuspagNo ratings yet

- The Four Types of Special JournalsDocument18 pagesThe Four Types of Special JournalsJob Castones100% (1)

- 2024 Accounting Grade 11 Learners Notes Session 1-5Document80 pages2024 Accounting Grade 11 Learners Notes Session 1-5t86663375No ratings yet

- ACC 1302 Incomplete RecordsDocument6 pagesACC 1302 Incomplete Recordsaustineodey33No ratings yet

- Cash and Cash Equivalents & Bank ReconciliationDocument20 pagesCash and Cash Equivalents & Bank ReconciliationHesil Jane DAGONDON100% (1)

- Accounting Content ManualDocument153 pagesAccounting Content Manualconstance nyoniNo ratings yet

- ACCOUNTING5Document9 pagesACCOUNTING5Natasha MugoniNo ratings yet

- 44 FdocDocument5 pages44 FdocGood LifeNo ratings yet

- 01.02.01 Cash and Cash Equivalents, Bank ReconciliationDocument16 pages01.02.01 Cash and Cash Equivalents, Bank ReconciliationBeverly BantagNo ratings yet

- Chapter 6 - Bank Reconciliation StatementDocument31 pagesChapter 6 - Bank Reconciliation StatementIrsamNo ratings yet

- Omar Muhktar Abusama Nov 19Document34 pagesOmar Muhktar Abusama Nov 19Garpt Kudasai100% (1)

- FS Accounting Grade 11 November 2022 P1 and MemoDocument23 pagesFS Accounting Grade 11 November 2022 P1 and MemoEsihle LwakheNo ratings yet

- Review Material ACC PRINTDocument11 pagesReview Material ACC PRINTtjcute125No ratings yet

- FS Accounting REVISION 2022 Grade 12 Paper 2Document273 pagesFS Accounting REVISION 2022 Grade 12 Paper 2Nonhlanhla NhlapoNo ratings yet

- Chapter 5 Incomplete RecordDocument20 pagesChapter 5 Incomplete RecordNUR ADLIN ZAFIRAH BINTI NORAZLI KTNNo ratings yet

- Ap9208 Cash 3Document4 pagesAp9208 Cash 3Onids AbayaNo ratings yet

- Result PDF Watermark Iic7NF6Document4 pagesResult PDF Watermark Iic7NF6mdyafi8084No ratings yet

- Incomplete Records: Calculation of Profit or Loss (Without Preparing Financial Statements)Document5 pagesIncomplete Records: Calculation of Profit or Loss (Without Preparing Financial Statements)Tawanda Tatenda Herbert100% (1)

- Cash Book and Bank Reconciliation 2Document8 pagesCash Book and Bank Reconciliation 2DavidNo ratings yet

- Result PDF Watermark Zlcg4xuDocument4 pagesResult PDF Watermark Zlcg4xuRene MendozaNo ratings yet

- Statement of Cash FlowsDocument28 pagesStatement of Cash FlowsseanakkigNo ratings yet

- BANK RECONCILIATION 2Document4 pagesBANK RECONCILIATION 2Cornelius Chiko MwansaNo ratings yet

- Cambridge IGCSE: Accounting 0452/13Document12 pagesCambridge IGCSE: Accounting 0452/13Shannon LimNo ratings yet

- Assignment 1. Your Client, A Successful Small Business, Has Never Given Much Attention To A SoundDocument6 pagesAssignment 1. Your Client, A Successful Small Business, Has Never Given Much Attention To A SoundThricia Mae Lorenzo IgnacioNo ratings yet

- GR 11 Acc T1 Week 2 Cred Recon ENGDocument6 pagesGR 11 Acc T1 Week 2 Cred Recon ENGethanmaistryNo ratings yet

- GENERAL ACCOUNTING-TRADE TEST - FKNokDocument4 pagesGENERAL ACCOUNTING-TRADE TEST - FKNokKENGNENo ratings yet

- Yates Logistics BofA SepDocument7 pagesYates Logistics BofA SepJonathan Seagull LivingstonNo ratings yet

- AP Module 2 - Audit of Revenue-Receipt CycleDocument8 pagesAP Module 2 - Audit of Revenue-Receipt CycleHannah Jane ToribioNo ratings yet

- Chapter 23 AnswersDocument9 pagesChapter 23 AnswersAnusree SivasamyNo ratings yet

- 2020 GR 10 r1&r2 Accounting Past PapersDocument18 pages2020 GR 10 r1&r2 Accounting Past PapersSamihah KajeeNo ratings yet

- Entrep Week 5Document25 pagesEntrep Week 5edward.mkl12345No ratings yet

- AUD 2023 2 Substantive Tests of Cash Prepaid Expenses and DeferredDocument4 pagesAUD 2023 2 Substantive Tests of Cash Prepaid Expenses and DeferredMary Rose CredoNo ratings yet

- Bank Rec HKALEDocument10 pagesBank Rec HKALEKwan Yin HoNo ratings yet

- Result PDF Watermark JU3YucaDocument4 pagesResult PDF Watermark JU3Yucamicffj12No ratings yet

- ICARE Preweek APDocument15 pagesICARE Preweek APjohn paulNo ratings yet

- ACCT2511 Topic 1 PASS Question Answers 2023 T1Document3 pagesACCT2511 Topic 1 PASS Question Answers 2023 T1KJSAdNo ratings yet

- Bank ReconcilationDocument9 pagesBank ReconcilationJohnpaul FloranzaNo ratings yet

- Tutorial 9 Q ReconciliationDocument12 pagesTutorial 9 Q ReconciliationJING ER LAUNo ratings yet

- 1st Activity Cash and Cash Equivalents Bank Reconciliation Proof of CashDocument7 pages1st Activity Cash and Cash Equivalents Bank Reconciliation Proof of CashSheidee ValienteNo ratings yet

- Debtors and Creditors GuideDocument6 pagesDebtors and Creditors Guidesammie celeNo ratings yet

- F5 Bafs 2 QueDocument13 pagesF5 Bafs 2 Queouo So方No ratings yet

- Statement 380312 Mar2024Document2 pagesStatement 380312 Mar2024Brittany EmillyNo ratings yet

- PDF Coursebook Chapter 4 Answers - CompressDocument6 pagesPDF Coursebook Chapter 4 Answers - CompressSama ZabadyNo ratings yet

- Bank Reconciliation 31 JANUARY 2013: Lesson DescriptionDocument3 pagesBank Reconciliation 31 JANUARY 2013: Lesson DescriptionNezer Byl P. VergaraNo ratings yet

- Bank Reconciliation StatementDocument18 pagesBank Reconciliation StatementAbisellyNo ratings yet

- Exercises On Cash PDFDocument6 pagesExercises On Cash PDFFely MaataNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- Business Entities 3Document13 pagesBusiness Entities 3PetrinaNo ratings yet

- River LTD (External Tutorial Question)Document1 pageRiver LTD (External Tutorial Question)PetrinaNo ratings yet

- Assignment 1 and 2 AFE3692 2023Document23 pagesAssignment 1 and 2 AFE3692 2023Petrina0% (1)

- General Deductions NotesDocument47 pagesGeneral Deductions NotesPetrinaNo ratings yet

- Auditing AssignmentDocument12 pagesAuditing AssignmentPetrinaNo ratings yet

- Specific Inclusions 24Document46 pagesSpecific Inclusions 24PetrinaNo ratings yet

- Unit 2 Interval Estimation-1Document31 pagesUnit 2 Interval Estimation-1PetrinaNo ratings yet

- Unit 4 Exam 2021 JuneDocument3 pagesUnit 4 Exam 2021 JunePetrinaNo ratings yet

- AAM3691Consolidated Semester AssessmentsDocument8 pagesAAM3691Consolidated Semester AssessmentsPetrinaNo ratings yet

- Oxygen CareDocument4 pagesOxygen CarePetrinaNo ratings yet

- AAM3692 Assignment 1 and 2Document17 pagesAAM3692 Assignment 1 and 2PetrinaNo ratings yet

- Class Excercise 1management AccountingDocument3 pagesClass Excercise 1management AccountingPetrinaNo ratings yet

- Assignments 1 and 2 ACL 3632Document16 pagesAssignments 1 and 2 ACL 3632PetrinaNo ratings yet

- B33C7F3C-F7A0-4F42-B984-CB921072326CDocument2 pagesB33C7F3C-F7A0-4F42-B984-CB921072326CPetrinaNo ratings yet

- Partnership - Changes in Ownership Structures (Galaxy Sports - Exercise)Document6 pagesPartnership - Changes in Ownership Structures (Galaxy Sports - Exercise)PetrinaNo ratings yet

- Partnership Class ExercisesDocument2 pagesPartnership Class ExercisesPetrinaNo ratings yet

- UNIT 2 Partnerships - Question Bank (2020)Document20 pagesUNIT 2 Partnerships - Question Bank (2020)Petrina100% (1)

- Management Accounting ExercisesDocument82 pagesManagement Accounting ExercisesPetrinaNo ratings yet

- Manufacturing Accounts in AccountingDocument32 pagesManufacturing Accounts in AccountingPetrinaNo ratings yet

- Study Guide For Close CorporationsDocument25 pagesStudy Guide For Close CorporationsPetrinaNo ratings yet

- Partnership - Liquidation (Powerpoint Presentation)Document21 pagesPartnership - Liquidation (Powerpoint Presentation)PetrinaNo ratings yet

- Manufacturing Accounts (Study Guide)Document17 pagesManufacturing Accounts (Study Guide)PetrinaNo ratings yet

- UNIT 4 Companies - Question Bank (2020)Document41 pagesUNIT 4 Companies - Question Bank (2020)PetrinaNo ratings yet

- UNIT 2 - Partnerships - Changes in Ownership StructursDocument19 pagesUNIT 2 - Partnerships - Changes in Ownership StructursPetrinaNo ratings yet

- UNIT 1 Partnerships - Question Bank (2020)Document13 pagesUNIT 1 Partnerships - Question Bank (2020)PetrinaNo ratings yet

- Summarized Notes On Close-CooperativesDocument31 pagesSummarized Notes On Close-CooperativesPetrinaNo ratings yet

- Chapter 4 - Microbiology and BiotechnologyDocument68 pagesChapter 4 - Microbiology and BiotechnologyPetrinaNo ratings yet

- Companies NotesDocument40 pagesCompanies NotesPetrinaNo ratings yet

- BSC410S-Basic Science 1 - 1ST Opp-Nov 17Document11 pagesBSC410S-Basic Science 1 - 1ST Opp-Nov 17PetrinaNo ratings yet

- Unit 1 - Introduction To PartnershipsDocument26 pagesUnit 1 - Introduction To PartnershipsPetrinaNo ratings yet

- Brochure OSH CONNECT 2020Document7 pagesBrochure OSH CONNECT 2020fauzi5878No ratings yet

- PCAB JV Application GuideDocument10 pagesPCAB JV Application GuideobaguecNo ratings yet

- 1021047119-Integrated Bill PDFDocument2 pages1021047119-Integrated Bill PDFPcrNo ratings yet

- Icmrm11 MemoryDocument272 pagesIcmrm11 MemoryAnas TounsiNo ratings yet

- Audit Through CBSDocument159 pagesAudit Through CBSInfotomathiNo ratings yet

- Special Journals Lecture No. 6Document25 pagesSpecial Journals Lecture No. 6Yuu100% (1)

- Huda Agreement To Sell FormatDocument3 pagesHuda Agreement To Sell FormatLive lifeNo ratings yet

- Ap820ach Pfizer ExampleDocument7 pagesAp820ach Pfizer ExampleravikanthpNo ratings yet

- Application For Certificate of Evidence' Under Section 131 of The Home Building ActDocument2 pagesApplication For Certificate of Evidence' Under Section 131 of The Home Building Actapi-3751980No ratings yet

- Test Information Release Order Form 2019-2020: Test Date Postmark Deadline Mail To: FeeDocument1 pageTest Information Release Order Form 2019-2020: Test Date Postmark Deadline Mail To: FeeSusan WerbNo ratings yet

- Carvetizer Purchase FormDocument1 pageCarvetizer Purchase FormKarl IskandarNo ratings yet

- Solution To Illustrative Problem On Petty Cash FundDocument3 pagesSolution To Illustrative Problem On Petty Cash FundHoy CrushNo ratings yet

- ERP Customize Integration With SBODocument3 pagesERP Customize Integration With SBOfuadNo ratings yet

- ds4194 PDFDocument3 pagesds4194 PDFBen DzhonsNo ratings yet

- Complaint For Specific PerformanceDocument6 pagesComplaint For Specific PerformanceJacquelyn RamosNo ratings yet

- Negotiable Instruments Act CHARTSDocument16 pagesNegotiable Instruments Act CHARTSJames power100% (4)

- SAP FI HighlightsDocument28 pagesSAP FI Highlightsejas.cbitNo ratings yet

- Lightricks™ Terms of Use: Arbitration Notice: This Agreement Contains A Mandatory Arbitration AgreementDocument19 pagesLightricks™ Terms of Use: Arbitration Notice: This Agreement Contains A Mandatory Arbitration AgreementCicer AmeeNo ratings yet

- Dma 5097 PDFDocument2 pagesDma 5097 PDFAnonymous GpfoR36pNo ratings yet

- MIDTERM EXAMINATION OBLICON Answer KeyDocument5 pagesMIDTERM EXAMINATION OBLICON Answer KeyTaj-Mahal KumpaNo ratings yet

- Intro To Financial ManagementDocument12 pagesIntro To Financial Managementwei hongNo ratings yet

- Marketing Anylytics - Final Business ProjectDocument18 pagesMarketing Anylytics - Final Business ProjectMUHAMMAD ARSHADNo ratings yet

- Uk Payment Markets SUMMARY 2020: June 2020Document8 pagesUk Payment Markets SUMMARY 2020: June 2020Ankit GuptaNo ratings yet

- Presidential DecreeDocument5 pagesPresidential DecreeLeanemae Candilado AgabonNo ratings yet

- QBO Prep Time 1Document9 pagesQBO Prep Time 1ENIDNo ratings yet

- Due Date Telephone No Amount Payable: Summary of Charges Usage History (6 Months)Document3 pagesDue Date Telephone No Amount Payable: Summary of Charges Usage History (6 Months)Amjath MohammedNo ratings yet

- Tax Deduction Authority: Purpose of This FormDocument1 pageTax Deduction Authority: Purpose of This FormRosamaria FranzeNo ratings yet

- Student Management System Project in C++Document1 pageStudent Management System Project in C++sanwalNo ratings yet