Professional Documents

Culture Documents

2.6. Derivatives Market

2.6. Derivatives Market

Uploaded by

Ketema Asfaw0 ratings0% found this document useful (0 votes)

6 views27 pagesThe document provides an overview of derivatives markets, including the different types of derivative contracts. It discusses that derivatives involve the transfer of risk and are used for hedging and speculation. It then describes various derivative contracts such as futures, forwards, swaps, and options. For each contract type, it explains the key terms, how the contracts work, and how they are valued. The document provides a high-level introduction to derivatives markets and the main derivative contract types.

Original Description:

Original Title

4_5773829625272600522

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides an overview of derivatives markets, including the different types of derivative contracts. It discusses that derivatives involve the transfer of risk and are used for hedging and speculation. It then describes various derivative contracts such as futures, forwards, swaps, and options. For each contract type, it explains the key terms, how the contracts work, and how they are valued. The document provides a high-level introduction to derivatives markets and the main derivative contract types.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

6 views27 pages2.6. Derivatives Market

2.6. Derivatives Market

Uploaded by

Ketema AsfawThe document provides an overview of derivatives markets, including the different types of derivative contracts. It discusses that derivatives involve the transfer of risk and are used for hedging and speculation. It then describes various derivative contracts such as futures, forwards, swaps, and options. For each contract type, it explains the key terms, how the contracts work, and how they are valued. The document provides a high-level introduction to derivatives markets and the main derivative contract types.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 27

Chapter 2

2.6. Derivatives market

Derivatives

• A derivative security is an agreement between two

parties to exchange a standard quantity of an asset

at a predetermined price at a specific date in the

future

• Derivative securities markets are the markets in

which derivative securities can be traded.

• Derivatives involve the buying and selling (i.e., the

transfer of) risk, which results in a positive impact on

the economic system

• Derivatives are used for hedging and for speculation.

Derivatives . . .

• Speculative or taking an advantage over

specific profit opportunity,

• Hedging a portfolio against a specific risk.

The development of Derivatives

• The first wave of modern derivatives were

foreign currency futures introduced by the

International Monetary Market (IMM) in 1971

and 1973

• The second wave of modern derivatives were

interest rate futures introduced by the Chicago

Board of Trade (CBT)

• The third wave of modern derivatives occurred in

the 1990s with the advent of credit derivatives.

Types of Derivative contracts

• Futures contracts

• Forwards- contracts

• Swap contracts -

• Options-

• Various forms of bonds.

Futures and Forward contracts

• A spot contract is an agreement to transact involving

the immediate exchange of assets and funds

• A futures contract is a legally binding commitment to

buy or sell a standard quantity of a something at a

price determined in the present (the futures price) on

a specified future date.

• Futures contracts are usually traded on organized

exchanges.

• The principal regulator of futures markets is the

Commodity Futures Trading Commission (CFTC)

Futures and Forward contracts. . .

Terms in Future contracts:

• A long position is the purchase of a futures contract

• A short position is the sale of a futures contract

• A clearinghouse is the unit that oversees trading on

the exchange and guarantees all trades made by the

exchange.

• Open interest is the total number of the futures,

put options, or call options outstanding at specific

date.

Futures and Forward contracts . . .

• Forward contract - a customized or non-

standardized contract to buy (sell) and asset at

a specified date and a specified price (forward

price.

• No payment takes place until maturity.

• The forward contract is a private agreement

between the two parties and nothing happens

between the contracting date and the date of

delivery.

Futures and Forward contracts. . .

Forwards and futures contracts markets include

diverse instruments on:

• Currencies;

• Commodities;

• Interest rate futures

• Short-term deposits

• Bonds

• Stock futures

• Single stock futures (contract for difference).

Futures and Forward contracts. . .

In Future contracts:

• There is no money exchanged when the

contract is signed.

• To ensure that each party shall fulfills its

commitments, a margin deposit is required.

• The exchanges set a minimum margin for

each contract and revise it periodically.

• Margin is determined depending upon the

risk of the individual contract

Forward and futures valuation

• Valuation of all derivative models are based on

arbitrage arguments.

• The pricing of futures and forward contracts is

similar.

• If the underlying asset for both contracts is the

same, the difference in pricing is due to

differences in features of the contract that

must be dealt with by the pricing model.

Forward and futures valuation . . .

• If a futures price equals the spot (cash market)

price at delivery, nothing happened during the

life of the contract.

• The difference between the two prices is called

the basis:

Basis = Futures price – Spot price = F – S

• The basis is often expressed as a percentage of

the spot price. (discount or premium)

= Percentage basis = ( F – S ) / S

Forward and futures valuation . . .

• Futures valuation models determine the

theoretical value of the basis.

• This value is constraint by the existence of

profitable riskless arbitrage between the

futures and spot markets for the asset.

Forward and futures valuation . . .

In general, the formula for determining the

theoretical price of the contract: (cash-and-carry

trade)

• Theoretical futures price = Spot price + (Spot price) x

(Financing cost - Cash yield)

Where:

Financing cost - is the interest rate to borrow funds,

Cash yield - is the payment received from investing

in the asset (e.g. dividend) as a percentage of the

cash price.

Forward and futures valuation . . .

Example

• Assume that the underlying asset price is 100 Euro,

financing cost is 1% and cash yield is 2%. Then the

theoretical futures price is:

100 Euro + [100 Euro × (1% − 2%)] = 99 Euro

• The future price can be above or below the spot

(cash) price depending on the difference between

the financing cost and cash yield.

• The difference between these rates is called the cost

of carry and determines the net financing cost.

Forward and futures valuation . . .

• Positive carry means that the cash yield

exceeds the financing cost, while the

difference between the financing cost and the

cash yield is a negative value.

• Negative carry means that the financing cost

exceeds the cash yield.

• Zero futures happen when the futures price is

equal to the spot (cash) price.

Options

• An option is a contract that gives the holder the right, but

not the obligation, to buy or sell the underlying asset at a

specified price within a specified period of time

• A call option is an option that gives the purchaser the

right, but not the obligation, to buy the underlying

security from the writer of the option at a specified

exercise price on (or up to) a specified date

• A put option is an option that gives the seller the right,

but not the obligation, to sell the underlying security to

the writer of the option at a specified exercise price on (or

up to) a specified date

Options

• The trading process for options is similar to

that for futures contracts

• The specified price is called the strike price or

exercise price

• The specified date is called the expiration date.

• The option seller grants this right in exchange for a

certain amount of money called the option premium

or option price.

• The option seller is also known as the option writer,

while the option buyer is the option holder.

Options

An option can also be categorized according to when

it may be exercised by the buyer or the exercise

style:

• European option can only be exercised at the

expiration date of the contract.

• American option can be exercised any time on or

before the expiration date.

• Bermuda option or Atlantic option – is an option

which can be exercised before the expiration date

but only on specified dates is called.

Components of the Option Price

The theoretical price of an option is made up of

two components:

• intrinsic value;

• premium over intrinsic value

Intrinsic value of an option

• Intrinsic value- of an option is the profit available

from immediately exercising of an option.

• Where the value of the right granted by the option

is equal to the market value of the underlying

instrument (the intrinsic value is zero), the option

is said to be at-the-money.

• If the intrinsic value is positive, the option is said to

be in-the-money.

• If exercising an option would produce a loss, it is

called out-of-the-money

Premium over intrinsic value of

options

• Time premium of an option, or time value of

the option, is the amount by which the

option’s market price exceeds its intrinsic

value.

• Because of the expectation of the underlying

asset will increase in contract period the

option buyer is willing to pay a premium

above the intrinsic value.

Determinants of the Option Price

The factors that affect the price of an option include:

• Market price of the underlying asset.

• Strike (exercise) price of the option.

• Time to expiration of the option.

• Expected volatility of the underlying asset over the

life of the option.

• Short-term, risk-free interest rate over the life of the

option.

• Anticipated cash payments on the underlying over

the life of the option.

Swaps

• A swap is an agreement between two parties to exchange

assets or a series of cash flows for a specific period of time at

a specified interval.

• The cash amount of the payments exchanged is based on

some predetermined principal amount, which is called the

notional principal amount or simply notional amount.

• The cash amount each counterparty pays to the other is

the agreed-upon periodic rate times the notional

amount.

• A swap is an over-the-counter (OTC) contract. Hence, the

counterparties to a swap are exposed to counterparty

risk.

Swaps

• An interest rate swap is an exchange of fixed-interest

payments for floating-interest payments by two

counterparties

– the swap buyer makes the fixed-rate payments

– the swap seller makes the floating-rate payments

– the principal amount involved in a swap is called the

notional principal

• A currency swap is a swap used to hedge against exchange

rate risk from mismatched currencies on assets and liabilities

• Credit swaps allow financial institutions to hedge credit risk

• Commodity swaps-based on the value of a particular physical

commodity.

Swaps

• Swaps are not standardized contracts

• Swap dealers (usually financial institutions)

keep markets liquid by matching counterparties

or by taking positions themselves

• The International Swaps and Derivatives

Association (ISDA) has more than 815 member

association among 56 countries that sets codes

of standards for swap documentation and

others.

Thank You!

The End !

You might also like

- Barclays Bank Statement 2Document5 pagesBarclays Bank Statement 2zainabNo ratings yet

- Accounting For Derivatives and Hedging-TransactionsDocument40 pagesAccounting For Derivatives and Hedging-TransactionsJoshua Sto Domingo100% (3)

- Top 20 Countries Found To Have The Most CybercrimeDocument5 pagesTop 20 Countries Found To Have The Most CybercrimeAman Dheer KapoorNo ratings yet

- Derivatives: Presented By: Errol CrastoDocument29 pagesDerivatives: Presented By: Errol CrastoParth MakwanaNo ratings yet

- Derivativesmarket 111dfsaf006143752 Phpapp02Document17 pagesDerivativesmarket 111dfsaf006143752 Phpapp02Aman TyagiNo ratings yet

- Derivatives Market: By-Ambika GargDocument17 pagesDerivatives Market: By-Ambika GargRahul MauryaNo ratings yet

- What Is A "Derivative"?Document15 pagesWhat Is A "Derivative"?mohammad ahmadNo ratings yet

- DerivativesDocument44 pagesDerivativesKhyati KariaNo ratings yet

- Commodity Market Chapter 3Document13 pagesCommodity Market Chapter 3Vidya B NNo ratings yet

- An Overview of Derivative SecuritiesDocument15 pagesAn Overview of Derivative SecuritiesHimanshu RastogiNo ratings yet

- Financial Derivatives: A Derivative A Financial InstrumentDocument17 pagesFinancial Derivatives: A Derivative A Financial InstrumentArisha KhanNo ratings yet

- Financial Derivatives: A Derivative A Financial InstrumentDocument17 pagesFinancial Derivatives: A Derivative A Financial Instrumentmohammad bilalNo ratings yet

- Introduction To Derivatives: By: Nilima DasDocument103 pagesIntroduction To Derivatives: By: Nilima DasDilip ThakurNo ratings yet

- 5 DerivativesDocument48 pages5 Derivativesdev hayaNo ratings yet

- DerivativesDocument3 pagesDerivativesshekharkuNo ratings yet

- Fim - 6 Derivative Security MarketsDocument19 pagesFim - 6 Derivative Security MarketsgashukelilNo ratings yet

- Prepared by K.Logasakthi MBA (PH.D) Assist.. Professor VSA School of Management, SalemDocument37 pagesPrepared by K.Logasakthi MBA (PH.D) Assist.. Professor VSA School of Management, SalemRohit OberoiNo ratings yet

- Financial Market-Lecture 9 PDFDocument28 pagesFinancial Market-Lecture 9 PDFJeffNo ratings yet

- Derivatives MKTDocument65 pagesDerivatives MKTMahesh DupareNo ratings yet

- Basics of DerivativesDocument27 pagesBasics of DerivativesSweety PawarNo ratings yet

- FRGN Curr Derivatives - FandO Os1qImUSkGDocument50 pagesFRGN Curr Derivatives - FandO Os1qImUSkGNikitha NithyanandhamNo ratings yet

- Financial Derivatives: An IntroductionDocument21 pagesFinancial Derivatives: An IntroductionPrakhar MishraNo ratings yet

- What Is A "Derivative" ?Document4 pagesWhat Is A "Derivative" ?RAHULNo ratings yet

- PMS - Bullet Point - PMS 4-6Document7 pagesPMS - Bullet Point - PMS 4-6sudeepmoitraNo ratings yet

- DerivativesDocument10 pagesDerivativesSalman MSDNo ratings yet

- Introduction To Derivative Markets & Instruments: - Types of Derivatives - Differences Between ExchangeDocument56 pagesIntroduction To Derivative Markets & Instruments: - Types of Derivatives - Differences Between Exchangene002No ratings yet

- Characteristics of DerivativesDocument17 pagesCharacteristics of DerivativesSwati SinhaNo ratings yet

- Derivativesmarket 111006143752 Phpapp02Document21 pagesDerivativesmarket 111006143752 Phpapp02sejalahir30_40759023No ratings yet

- Week 12 - Currency DerivativesDocument35 pagesWeek 12 - Currency Derivativesindah rahmaNo ratings yet

- ch11 PPT Kidwell 4e Derivatives-Markets FinalDocument23 pagesch11 PPT Kidwell 4e Derivatives-Markets FinalAlexa Daphne M. EquisabalNo ratings yet

- Off-Balance Banking Activities and Risk Management For Financial InstitutionsDocument29 pagesOff-Balance Banking Activities and Risk Management For Financial InstitutionsSahiba MaingiNo ratings yet

- Introduction To Derivatives MarketDocument42 pagesIntroduction To Derivatives Marketpriyank2110No ratings yet

- Pandeji: in The Indian Context The Securities Contracts (Regulation) Act, 1956 (SCRA) Defines "Derivative" To IncludeDocument6 pagesPandeji: in The Indian Context The Securities Contracts (Regulation) Act, 1956 (SCRA) Defines "Derivative" To IncludeANKITNo ratings yet

- Derivatives MarketDocument8 pagesDerivatives Marketsalandananenrico270No ratings yet

- Introduction To DerivativesDocument14 pagesIntroduction To Derivativesking410No ratings yet

- Chapter 4 DerivativesDocument38 pagesChapter 4 DerivativesTamrat KindeNo ratings yet

- Introduction To Derivatives: 17th August, 2010Document47 pagesIntroduction To Derivatives: 17th August, 2010Amrita JhaNo ratings yet

- Derivatives - Cheat SheetDocument12 pagesDerivatives - Cheat SheetUchit MehtaNo ratings yet

- MMS Derivatives Lec 1Document85 pagesMMS Derivatives Lec 1AzharNo ratings yet

- Module 2 - Forwards and FuturesDocument58 pagesModule 2 - Forwards and FuturesSunny SinghNo ratings yet

- Derivatives: Types of Derivative ContractsDocument20 pagesDerivatives: Types of Derivative ContractsXandarnova corpsNo ratings yet

- Introduction To Financial Futures Markets: Emre Dülgeroğlu Yasin Çöte Rahmi Özdemir Kaan SoğancıDocument27 pagesIntroduction To Financial Futures Markets: Emre Dülgeroğlu Yasin Çöte Rahmi Özdemir Kaan SoğancıJean CastroNo ratings yet

- Forward and Futures Contract For Crudes Options and Hedging-To UploadDocument30 pagesForward and Futures Contract For Crudes Options and Hedging-To UploadArchana BalikramNo ratings yet

- DerivativesDocument19 pagesDerivativesChandraprakash PrajapatNo ratings yet

- Derivative Markets and Instruments: Criticisms of DerivativesDocument10 pagesDerivative Markets and Instruments: Criticisms of DerivativesMayura KatariaNo ratings yet

- DerivativesDocument18 pagesDerivativesTaniya JainNo ratings yet

- 05-Arbitrage in Futures Pricing + Forward Contract ValueDocument56 pages05-Arbitrage in Futures Pricing + Forward Contract ValueMUSKAAN BAHLNo ratings yet

- By: Amit Mittal Nitin MittalDocument34 pagesBy: Amit Mittal Nitin Mittaltarun2172No ratings yet

- Derivative Contracts (Or Simply Derivatives)Document16 pagesDerivative Contracts (Or Simply Derivatives)mdashrafalamNo ratings yet

- Introduction To Financial Futures Markets: Emre Dülgeroğlu Yasin Çöte Rahmi Özdemir Kaan SoğancıDocument27 pagesIntroduction To Financial Futures Markets: Emre Dülgeroğlu Yasin Çöte Rahmi Özdemir Kaan Soğancırayhan555No ratings yet

- Funds FinalsDocument5 pagesFunds FinalsSydney Miles MahinayNo ratings yet

- Futures Contract: From Wikipedia, The Free EncyclopediaDocument16 pagesFutures Contract: From Wikipedia, The Free Encyclopediaapi-3722617No ratings yet

- Introduction To Derivatives Market: Khader ShaikDocument45 pagesIntroduction To Derivatives Market: Khader Shaikms.AhmedNo ratings yet

- Derivatives. ... Syet Derivatives..Document42 pagesDerivatives. ... Syet Derivatives..Francis Emmanuel TolentinoNo ratings yet

- Unit 3 FDDocument28 pagesUnit 3 FDsaurabh thakurNo ratings yet

- Chapter 21 Introduction To Derivative MarketsDocument31 pagesChapter 21 Introduction To Derivative MarketsSarika Thakur100% (1)

- 7 Derivatives and Risk ManagementDocument8 pages7 Derivatives and Risk ManagementIm NayeonNo ratings yet

- Determination of Forward and FuturesDocument55 pagesDetermination of Forward and FuturesMUSKAAN BAHLNo ratings yet

- Currency DerivativesDocument33 pagesCurrency DerivativesSubhan ImranNo ratings yet

- Analysis of Derivatives & Other Products: Presentation OnDocument19 pagesAnalysis of Derivatives & Other Products: Presentation OnRaghav SehgalNo ratings yet

- Final ResearchDocument43 pagesFinal ResearchKetema AsfawNo ratings yet

- Chapter Five: Audit of Governmental and Not For Profit OrganizationsDocument34 pagesChapter Five: Audit of Governmental and Not For Profit OrganizationsKetema AsfawNo ratings yet

- Advanced Taxation (ACFN 614) : Zeyad AhmedDocument199 pagesAdvanced Taxation (ACFN 614) : Zeyad AhmedKetema AsfawNo ratings yet

- Chapter One: Investment ProcessDocument39 pagesChapter One: Investment ProcessKetema AsfawNo ratings yet

- 4 5764982722787283560Document1 page4 5764982722787283560Ketema AsfawNo ratings yet

- Note That, Time Is Local: UniversityDocument6 pagesNote That, Time Is Local: UniversityKetema AsfawNo ratings yet

- 1 5150099021255147675Document5 pages1 5150099021255147675Ketema AsfawNo ratings yet

- Introduction: Meaning Nature and Basic Concepts: ObjectivesDocument16 pagesIntroduction: Meaning Nature and Basic Concepts: ObjectivesKetema AsfawNo ratings yet

- AECES Night Lights Sound ReservationDocument1 pageAECES Night Lights Sound ReservationVincent Carl CatigayNo ratings yet

- Internship ReportDocument61 pagesInternship ReportAheen ImtiazNo ratings yet

- Criteria For Master Teacher: (With Additional Proposed Documents and The Specific Points As Support To Other Criteria)Document19 pagesCriteria For Master Teacher: (With Additional Proposed Documents and The Specific Points As Support To Other Criteria)Dennis ReyesNo ratings yet

- Pumba Cap 3 2022Document15 pagesPumba Cap 3 2022adityakamble070103No ratings yet

- Data Cleansing Process For Master DataDocument4 pagesData Cleansing Process For Master DataAjay Kumar KhattarNo ratings yet

- Cases Study of Kellogg's Failure in Indian Market FullDocument17 pagesCases Study of Kellogg's Failure in Indian Market FullAjay PillaiNo ratings yet

- Umakanth's PMP Mock PDFDocument15 pagesUmakanth's PMP Mock PDFSDASDASDFADFSASDFNo ratings yet

- Specific PerformanceDocument3 pagesSpecific PerformanceAye AlexaNo ratings yet

- COCOMO II ExampleDocument26 pagesCOCOMO II ExampleQuốc ĐạiNo ratings yet

- AralPan9 q2 Mod10 Ang-Pamilihan-V5Document29 pagesAralPan9 q2 Mod10 Ang-Pamilihan-V5Wizly Von Ledesma TanduyanNo ratings yet

- Exam Preparation Chartered Member Solutions 20080403Document36 pagesExam Preparation Chartered Member Solutions 20080403Jordy NgNo ratings yet

- MAN 2866le-Parts-ManualDocument129 pagesMAN 2866le-Parts-ManualGiovanniJara67% (3)

- Accounting Q&ADocument6 pagesAccounting Q&AIftikharNo ratings yet

- SDL 11Document14 pagesSDL 11Sharmila BalaNo ratings yet

- BCG GE McKinsey MatrixDocument22 pagesBCG GE McKinsey MatrixAthmanath SR KrishnanNo ratings yet

- Quiz 1 Internet ShoppingDocument1 pageQuiz 1 Internet ShoppingEloy RicouzNo ratings yet

- Trad Ic Mock ExamDocument15 pagesTrad Ic Mock ExamArvin AltamiaNo ratings yet

- Funda ExamDocument115 pagesFunda ExamKate Onniel RimandoNo ratings yet

- Customer Perception Towards Bharti Axa Life Insurance Co. Ltd. atDocument94 pagesCustomer Perception Towards Bharti Axa Life Insurance Co. Ltd. atShubham MishraNo ratings yet

- Marketing Plan of AirconDocument16 pagesMarketing Plan of AirconJewel Virata100% (1)

- Corona RT 46 160Document120 pagesCorona RT 46 160Rimbert100% (2)

- Calculation of Emergency Lights Load: WattsDocument1 pageCalculation of Emergency Lights Load: WattsSandeep DeodharNo ratings yet

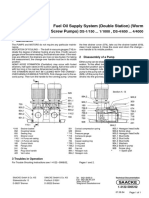

- Fuel Oil Supply System (Double Station) (Worm Screw Pumps) : DS 1/150 ... 1/1000, DS 4/650 ... 4/4000Document1 pageFuel Oil Supply System (Double Station) (Worm Screw Pumps) : DS 1/150 ... 1/1000, DS 4/650 ... 4/4000徐玉坤No ratings yet

- Res CCE (P) - 2018 13march2019 PDFDocument25 pagesRes CCE (P) - 2018 13march2019 PDFPriya SharmaNo ratings yet

- Jumping Through HoopsDocument4 pagesJumping Through HoopsCharles RusnellNo ratings yet

- Input Data Required For Pipe Stress AnalysisDocument4 pagesInput Data Required For Pipe Stress Analysisnor azman ab aziz100% (1)

- Manual de Usuario Motor Fuera de Borda.Document68 pagesManual de Usuario Motor Fuera de Borda.Carlos GallardoNo ratings yet

- Topic 6:sustainability & Green EngineeringDocument5 pagesTopic 6:sustainability & Green EngineeringyanNo ratings yet