Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

12 viewsClass Examples 3

Class Examples 3

Uploaded by

TsekeCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- African Holistic Health - Llaila o Afrika PDFDocument305 pagesAfrican Holistic Health - Llaila o Afrika PDFGnostic the Ancient One93% (183)

- BIMB PresentationDocument33 pagesBIMB PresentationAhmadNajmi100% (1)

- 01 - Accounting For Trades and Other ReceivablesDocument5 pages01 - Accounting For Trades and Other ReceivablesCatherine CaleroNo ratings yet

- Ventura, Mary Mickaella R - Revenue From Contracts - p.209 - Group3Document5 pagesVentura, Mary Mickaella R - Revenue From Contracts - p.209 - Group3Mary VenturaNo ratings yet

- Receivable 1Document2 pagesReceivable 1Laura OliviaNo ratings yet

- ACC2001 Lecture 2Document42 pagesACC2001 Lecture 2michael krueseiNo ratings yet

- DocxDocument4 pagesDocxKimmy Shawwy0% (1)

- Accounting For Accounts ReceivablesDocument11 pagesAccounting For Accounts Receivableswekesai363No ratings yet

- AffDocument69 pagesAffdishanialahakoonNo ratings yet

- Chapter 7 ReceivablesDocument87 pagesChapter 7 ReceivablesLEE WEI LONGNo ratings yet

- Chapter 6 Brief ExercisesDocument8 pagesChapter 6 Brief ExercisesPatrick YazbeckNo ratings yet

- Lecture 3 Q&A - InnovateDocument3 pagesLecture 3 Q&A - InnovateZiyodullo IsroilovNo ratings yet

- Module - ReceivablesDocument10 pagesModule - ReceivablesJohn Lindy SorianoNo ratings yet

- AssignmentDocument3 pagesAssignmentjanineNo ratings yet

- Kas 6 Revenue Explanatory NotesDocument18 pagesKas 6 Revenue Explanatory NotesJordan SeatonNo ratings yet

- Basic Accounting Crash CourseDocument5 pagesBasic Accounting Crash CourseJolo RomanNo ratings yet

- Revenue From Contract With Customers (IFRS 15) & Accounting For Government Grants and Disclosure of Government Assistance (IAS 20)Document5 pagesRevenue From Contract With Customers (IFRS 15) & Accounting For Government Grants and Disclosure of Government Assistance (IAS 20)Kristen0% (1)

- Revenue Recognition 14Document5 pagesRevenue Recognition 14Silvia alfonsNo ratings yet

- Quiz Ia Quiz IaDocument2 pagesQuiz Ia Quiz IaMili Dit0% (1)

- Chapter 7 ReceivablesDocument58 pagesChapter 7 ReceivablesMuhammad AmirulNo ratings yet

- EXERCISES - Current LiabilitiesDocument6 pagesEXERCISES - Current LiabilitiesClaudette ClementeNo ratings yet

- Chapter 11Document59 pagesChapter 11patriquembeleonokokoNo ratings yet

- Illustrative Examples - Trade and Other ReceivablesDocument2 pagesIllustrative Examples - Trade and Other ReceivablesMelrose Eugenio ErasgaNo ratings yet

- Class Test 1 - Q+SolutionDocument4 pagesClass Test 1 - Q+Solutionmindofakira756No ratings yet

- 04 Accounts Receivable - (PS)Document2 pages04 Accounts Receivable - (PS)kyle mandaresioNo ratings yet

- Non-Financial LiabilitiesDocument15 pagesNon-Financial LiabilitiesPeter Banjao100% (1)

- Accounting For Bad DebtsDocument3 pagesAccounting For Bad Debtsanurag_09No ratings yet

- Ch.18 Revenue Recognition: Chapter Learning ObjectiveDocument5 pagesCh.18 Revenue Recognition: Chapter Learning ObjectiveFaishal Alghi FariNo ratings yet

- Session 2 Revenue Recognition AR InventoryDocument41 pagesSession 2 Revenue Recognition AR InventoryNANo ratings yet

- PFRS 15 HandoutDocument4 pagesPFRS 15 HandoutNye NyeNo ratings yet

- Installments SalesDocument21 pagesInstallments Salesbekbek12No ratings yet

- Quiz 2 AuditingDocument18 pagesQuiz 2 Auditingaldrin elsisuraNo ratings yet

- Test Fia F3Document8 pagesTest Fia F3Syed AftabNo ratings yet

- Adjusting EntriesDocument3 pagesAdjusting EntriesMarini HernandezNo ratings yet

- Module 3. Part 1 - Accounts Receivable For StudentsDocument36 pagesModule 3. Part 1 - Accounts Receivable For Studentslord kwantoniumNo ratings yet

- Accounts ReceivableDocument5 pagesAccounts ReceivableDianna DayawonNo ratings yet

- IFRS 15 Maths PDFDocument4 pagesIFRS 15 Maths PDFFeruz Sha RakinNo ratings yet

- Accounting Class NotesDocument5 pagesAccounting Class NotesalisandrobongokuhleNo ratings yet

- 1Document19 pages1Angelica Castillo0% (1)

- IFRS 15 Revenue - Out-Of-Class practice-ENDocument9 pagesIFRS 15 Revenue - Out-Of-Class practice-ENDAN NGUYEN THENo ratings yet

- Audit of Receivable PDFDocument7 pagesAudit of Receivable PDFRyan Prado Andaya100% (1)

- Problem 10Document6 pagesProblem 10Atika DaretyNo ratings yet

- Ifrs 15 Construction ContractsDocument67 pagesIfrs 15 Construction ContractsAJNo ratings yet

- IFRS 15 Part 2 Performance Obligations Satisfied Over TimeDocument26 pagesIFRS 15 Part 2 Performance Obligations Satisfied Over TimeKiri chrisNo ratings yet

- A10 PFRS 15 Part 2Document16 pagesA10 PFRS 15 Part 2john leo ambuyocNo ratings yet

- Basic Accounting Final - QuestionDocument6 pagesBasic Accounting Final - QuestionEdaNo ratings yet

- FDNACCT Quiz-2 Answer-Key Set-ADocument4 pagesFDNACCT Quiz-2 Answer-Key Set-APia DigaNo ratings yet

- Illustrative Examples - Accounting For Income TaxDocument3 pagesIllustrative Examples - Accounting For Income Taxr3rvpaudit.nfjpia2324supaccNo ratings yet

- Tugas Fia Pertemuan 6 - Ester Sabatini - 8312419007Document2 pagesTugas Fia Pertemuan 6 - Ester Sabatini - 8312419007Ester SabatiniNo ratings yet

- Chapter 4 - Accounts ReceivableDocument2 pagesChapter 4 - Accounts ReceivableJerome_JadeNo ratings yet

- Slides CH 05 UpdatedDocument44 pagesSlides CH 05 Updatedakshitnagpal9119No ratings yet

- Common Types of ProvisionsDocument7 pagesCommon Types of ProvisionsiyexrahmanNo ratings yet

- FRA Session 6 - Revenue and Monetray AssetsDocument34 pagesFRA Session 6 - Revenue and Monetray Assetsaayushi dubeyNo ratings yet

- Quiz ReceivablesDocument9 pagesQuiz ReceivablesJanella PatriziaNo ratings yet

- INTACC 1: Trade and Other ReceivablesDocument6 pagesINTACC 1: Trade and Other Receivablesdanica rozelNo ratings yet

- Ind As 115Document12 pagesInd As 115qwertyNo ratings yet

- Meaning of Revenue'Document56 pagesMeaning of Revenue'Mo HachimNo ratings yet

- PRACTICE QUESTIONS 1 (IA3) (Midterms) : AnswerDocument21 pagesPRACTICE QUESTIONS 1 (IA3) (Midterms) : AnswerShiena ApasNo ratings yet

- Accounts Receivables and Payables A&BDocument9 pagesAccounts Receivables and Payables A&BAb PiousNo ratings yet

- Revenue IAS 18Document7 pagesRevenue IAS 18Chota H MpukuNo ratings yet

- King Code Presentation - Principles 2Document28 pagesKing Code Presentation - Principles 2TsekeNo ratings yet

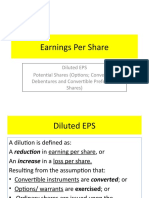

- 3.earnings Per ShareDocument13 pages3.earnings Per ShareTsekeNo ratings yet

- IAS 8 - Homework QuestionsDocument2 pagesIAS 8 - Homework QuestionsTsekeNo ratings yet

- CAATSDocument2 pagesCAATSTseke0% (1)

- 2020 DT Notes RevisionDocument7 pages2020 DT Notes RevisionTsekeNo ratings yet

- Contract ModificationsDocument16 pagesContract ModificationsTsekeNo ratings yet

- Class Example 2Document1 pageClass Example 2TsekeNo ratings yet

- 05 Current Taxation s19 FinalDocument29 pages05 Current Taxation s19 FinalTsekeNo ratings yet

- Audit of Inventory and Warehousing CycleDocument6 pagesAudit of Inventory and Warehousing CycleTsekeNo ratings yet

- Auditing 4 NotesDocument2 pagesAuditing 4 NotesTsekeNo ratings yet

- Minorities in IraqDocument272 pagesMinorities in IraqTsekeNo ratings yet

- Hba 2303 Financial Accounting Theory Assessment 1Document2 pagesHba 2303 Financial Accounting Theory Assessment 1kennedyNo ratings yet

- Admin Law CasesDocument74 pagesAdmin Law CasesAxel Gotos dela VegaNo ratings yet

- Car LoanDocument101 pagesCar LoanHarsimar Narula100% (2)

- Acc 124Document5 pagesAcc 124KISSEY ESTRELLANo ratings yet

- Corazon G. Ruiz vs. Court of AppealsDocument6 pagesCorazon G. Ruiz vs. Court of AppealsSoc SaballaNo ratings yet

- 12 Accountancy English 2020 21Document464 pages12 Accountancy English 2020 21Anuja bisht100% (1)

- My Invoice JULY 2023Document1 pageMy Invoice JULY 2023Ch JEEVANA SANDHYANo ratings yet

- ACCT Exam 2 Study GuideDocument12 pagesACCT Exam 2 Study GuideNhan TranNo ratings yet

- Engineering Mathematics Engineering Economics and SciencesDocument3 pagesEngineering Mathematics Engineering Economics and SciencesElla Grace Galang100% (1)

- Term Paper by ImranDocument14 pagesTerm Paper by ImranImran KhanNo ratings yet

- Qualified EntitiesDocument44 pagesQualified Entitiesdora tavarezNo ratings yet

- Chap003 Text Bank (1) SolutionDocument8 pagesChap003 Text Bank (1) SolutionMatt HonanNo ratings yet

- Building An E Commerce Site A Systematic ApproachDocument31 pagesBuilding An E Commerce Site A Systematic ApproachAlliah Fe Kyreh SegoviaNo ratings yet

- Odin Technical TraderDocument1 pageOdin Technical TraderAnkur ShahNo ratings yet

- Northwestern Lehigh School DistrictDocument4 pagesNorthwestern Lehigh School DistrictprideandpromiseNo ratings yet

- Auditing Problems Test Banks - IntangiblesDocument5 pagesAuditing Problems Test Banks - IntangiblesAlliah Mae ArbastoNo ratings yet

- Sapm Notes (Problems)Document11 pagesSapm Notes (Problems)anilkc9No ratings yet

- Basic Concepts of Income TaxDocument12 pagesBasic Concepts of Income TaxSumaira AslamNo ratings yet

- LP ApplicationsDocument31 pagesLP ApplicationsRishabh MishraNo ratings yet

- Income Taxation SchemesDocument12 pagesIncome Taxation SchemesargelenNo ratings yet

- Chapter 2 Recording Business Transactions: Acid)Document29 pagesChapter 2 Recording Business Transactions: Acid)Farhan Osman ahmedNo ratings yet

- Unofficial: Institute of Business Management (Iobm) Fall 2012 ScheduleDocument18 pagesUnofficial: Institute of Business Management (Iobm) Fall 2012 SchedulecoolbbeeeeeNo ratings yet

- MAS CPAR - EconomicsDocument7 pagesMAS CPAR - EconomicsJulie Ann LeynesNo ratings yet

- Developing A Housing Microfinance Product - The First Microfinance Banks Experience in AfghanistanDocument32 pagesDeveloping A Housing Microfinance Product - The First Microfinance Banks Experience in AfghanistanBhagyanath MenonNo ratings yet

- Luyong - Fabm1 - 4thQDocument4 pagesLuyong - Fabm1 - 4thQJonavi Luyong0% (1)

- Performance Highlights: NeutralDocument11 pagesPerformance Highlights: NeutralAngel BrokingNo ratings yet

- BAF-SW Risk MGMT DerivativesDocument2 pagesBAF-SW Risk MGMT DerivativesstudentNo ratings yet

- Your Holiday ConfirmationDocument1 pageYour Holiday Confirmationmaureen.ruane1No ratings yet

- Project ReportDocument51 pagesProject Reportvishal141993No ratings yet

Class Examples 3

Class Examples 3

Uploaded by

Tseke0 ratings0% found this document useful (0 votes)

12 views6 pagesOriginal Title

CLASS EXAMPLES 3

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views6 pagesClass Examples 3

Class Examples 3

Uploaded by

TsekeCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 6

CLASS EXAMPLES 3

Determining the transaction price

Example 7 – Transaction price,

collectability and the loss allowance

We sign a contract with a customer on 1 January 2001. The contract price is R100 000.

Collectability is probable but, based on assessment of the credit risk of similar customers, we

expect to incure a loss of R10 000(We expect to receive 90%). We satisfy our performance

obligation on 20 June 2001. At 31 December 2001, reporting date, the expected credit loss is re-

assessed at R15 000.

Required: Show journals

a) For 2001 to account for information provided above

b) For 2002 if the customer pays, on 15 January 2002, an amount of R85 000, in full and final

settlement.

c) For 2002 if the customer pays, on 15 January 2002, an amount of R100 000, in full and final

settlement

d) For 2002 if the customer pays, on 15 January 2002, an amount of R80 000, in full and final

settlement

Example 8 – Transaction price:

Collectibility vs implied price concession

An entity signs a contract on 1 January 2001 with a new customer in a new

region. The contract price is R100 000, when the contract was signed, the

entity was aware the customer had a significant cash flow problems.

However, the entity believed that the customer’s financial situation would

improve and that it would probably be able to pay R60 000 when the amount

falls due for payment. The entity also believed that the transacting with this

new customer would possibly result in further potential customers in this

region. The entity satidfied its performance obligation on 20 January 2001

Required: Show journals

a) Discuss how this information should be considered.

Example 9 – Variable consideration

(discounts)

AnaPal Ltd sold inventory to a customer, on credit for R100 000, less a 10%

trade discount.

A further discount of 5% is offered to customers who pay within 30 days.

Based on experience, AnaPal expects most of its customers to pay within 30

days. Based on experience AnaPal expects most of its customers to pay

within this time frame.

This customer obtained control of the inventory on 1 February 2002 and paid

on 20 February 2002

Required: Show journals

a) Provide the necessary journals to account for the above information

Example 12 – Estimating variable

consideration (Constraining the estimate)

An entity has entered into a contract, which has a fixed consideration of

R400 000 and a variable consideration estimated at R300 000.

The amount of variable consideration that would be highly probable of not

resulting in a significant reversal of the cumulative revenue recognised to

the date that the uncertainty is resolved, is R250 000.

Required: Show journals

a) Explain the calculation of the final estimated transaction price

Example 15 – Receipts exceeds constrained

estimate of variable consideration

An entity signed a contract with a customer in 2001, in which the promised consideration is

represented entirely by variable consideration, estimated at R90 000 and which was

constrained to R80 000.

By end of 2001, the entity had completed 80% of its performance obligation. The customer

made its first payment a few days before reporting date, in an amount of R72 000 cash.

In 2002, the uncertainty resolves and R90 000 is due in total by the customer. The entity

has now completed 95% of the performance obligation. There were no further receipts

from the customer.

Required: Show journals

a) Prepare the journal entries to reflect the information provided.

You might also like

- African Holistic Health - Llaila o Afrika PDFDocument305 pagesAfrican Holistic Health - Llaila o Afrika PDFGnostic the Ancient One93% (183)

- BIMB PresentationDocument33 pagesBIMB PresentationAhmadNajmi100% (1)

- 01 - Accounting For Trades and Other ReceivablesDocument5 pages01 - Accounting For Trades and Other ReceivablesCatherine CaleroNo ratings yet

- Ventura, Mary Mickaella R - Revenue From Contracts - p.209 - Group3Document5 pagesVentura, Mary Mickaella R - Revenue From Contracts - p.209 - Group3Mary VenturaNo ratings yet

- Receivable 1Document2 pagesReceivable 1Laura OliviaNo ratings yet

- ACC2001 Lecture 2Document42 pagesACC2001 Lecture 2michael krueseiNo ratings yet

- DocxDocument4 pagesDocxKimmy Shawwy0% (1)

- Accounting For Accounts ReceivablesDocument11 pagesAccounting For Accounts Receivableswekesai363No ratings yet

- AffDocument69 pagesAffdishanialahakoonNo ratings yet

- Chapter 7 ReceivablesDocument87 pagesChapter 7 ReceivablesLEE WEI LONGNo ratings yet

- Chapter 6 Brief ExercisesDocument8 pagesChapter 6 Brief ExercisesPatrick YazbeckNo ratings yet

- Lecture 3 Q&A - InnovateDocument3 pagesLecture 3 Q&A - InnovateZiyodullo IsroilovNo ratings yet

- Module - ReceivablesDocument10 pagesModule - ReceivablesJohn Lindy SorianoNo ratings yet

- AssignmentDocument3 pagesAssignmentjanineNo ratings yet

- Kas 6 Revenue Explanatory NotesDocument18 pagesKas 6 Revenue Explanatory NotesJordan SeatonNo ratings yet

- Basic Accounting Crash CourseDocument5 pagesBasic Accounting Crash CourseJolo RomanNo ratings yet

- Revenue From Contract With Customers (IFRS 15) & Accounting For Government Grants and Disclosure of Government Assistance (IAS 20)Document5 pagesRevenue From Contract With Customers (IFRS 15) & Accounting For Government Grants and Disclosure of Government Assistance (IAS 20)Kristen0% (1)

- Revenue Recognition 14Document5 pagesRevenue Recognition 14Silvia alfonsNo ratings yet

- Quiz Ia Quiz IaDocument2 pagesQuiz Ia Quiz IaMili Dit0% (1)

- Chapter 7 ReceivablesDocument58 pagesChapter 7 ReceivablesMuhammad AmirulNo ratings yet

- EXERCISES - Current LiabilitiesDocument6 pagesEXERCISES - Current LiabilitiesClaudette ClementeNo ratings yet

- Chapter 11Document59 pagesChapter 11patriquembeleonokokoNo ratings yet

- Illustrative Examples - Trade and Other ReceivablesDocument2 pagesIllustrative Examples - Trade and Other ReceivablesMelrose Eugenio ErasgaNo ratings yet

- Class Test 1 - Q+SolutionDocument4 pagesClass Test 1 - Q+Solutionmindofakira756No ratings yet

- 04 Accounts Receivable - (PS)Document2 pages04 Accounts Receivable - (PS)kyle mandaresioNo ratings yet

- Non-Financial LiabilitiesDocument15 pagesNon-Financial LiabilitiesPeter Banjao100% (1)

- Accounting For Bad DebtsDocument3 pagesAccounting For Bad Debtsanurag_09No ratings yet

- Ch.18 Revenue Recognition: Chapter Learning ObjectiveDocument5 pagesCh.18 Revenue Recognition: Chapter Learning ObjectiveFaishal Alghi FariNo ratings yet

- Session 2 Revenue Recognition AR InventoryDocument41 pagesSession 2 Revenue Recognition AR InventoryNANo ratings yet

- PFRS 15 HandoutDocument4 pagesPFRS 15 HandoutNye NyeNo ratings yet

- Installments SalesDocument21 pagesInstallments Salesbekbek12No ratings yet

- Quiz 2 AuditingDocument18 pagesQuiz 2 Auditingaldrin elsisuraNo ratings yet

- Test Fia F3Document8 pagesTest Fia F3Syed AftabNo ratings yet

- Adjusting EntriesDocument3 pagesAdjusting EntriesMarini HernandezNo ratings yet

- Module 3. Part 1 - Accounts Receivable For StudentsDocument36 pagesModule 3. Part 1 - Accounts Receivable For Studentslord kwantoniumNo ratings yet

- Accounts ReceivableDocument5 pagesAccounts ReceivableDianna DayawonNo ratings yet

- IFRS 15 Maths PDFDocument4 pagesIFRS 15 Maths PDFFeruz Sha RakinNo ratings yet

- Accounting Class NotesDocument5 pagesAccounting Class NotesalisandrobongokuhleNo ratings yet

- 1Document19 pages1Angelica Castillo0% (1)

- IFRS 15 Revenue - Out-Of-Class practice-ENDocument9 pagesIFRS 15 Revenue - Out-Of-Class practice-ENDAN NGUYEN THENo ratings yet

- Audit of Receivable PDFDocument7 pagesAudit of Receivable PDFRyan Prado Andaya100% (1)

- Problem 10Document6 pagesProblem 10Atika DaretyNo ratings yet

- Ifrs 15 Construction ContractsDocument67 pagesIfrs 15 Construction ContractsAJNo ratings yet

- IFRS 15 Part 2 Performance Obligations Satisfied Over TimeDocument26 pagesIFRS 15 Part 2 Performance Obligations Satisfied Over TimeKiri chrisNo ratings yet

- A10 PFRS 15 Part 2Document16 pagesA10 PFRS 15 Part 2john leo ambuyocNo ratings yet

- Basic Accounting Final - QuestionDocument6 pagesBasic Accounting Final - QuestionEdaNo ratings yet

- FDNACCT Quiz-2 Answer-Key Set-ADocument4 pagesFDNACCT Quiz-2 Answer-Key Set-APia DigaNo ratings yet

- Illustrative Examples - Accounting For Income TaxDocument3 pagesIllustrative Examples - Accounting For Income Taxr3rvpaudit.nfjpia2324supaccNo ratings yet

- Tugas Fia Pertemuan 6 - Ester Sabatini - 8312419007Document2 pagesTugas Fia Pertemuan 6 - Ester Sabatini - 8312419007Ester SabatiniNo ratings yet

- Chapter 4 - Accounts ReceivableDocument2 pagesChapter 4 - Accounts ReceivableJerome_JadeNo ratings yet

- Slides CH 05 UpdatedDocument44 pagesSlides CH 05 Updatedakshitnagpal9119No ratings yet

- Common Types of ProvisionsDocument7 pagesCommon Types of ProvisionsiyexrahmanNo ratings yet

- FRA Session 6 - Revenue and Monetray AssetsDocument34 pagesFRA Session 6 - Revenue and Monetray Assetsaayushi dubeyNo ratings yet

- Quiz ReceivablesDocument9 pagesQuiz ReceivablesJanella PatriziaNo ratings yet

- INTACC 1: Trade and Other ReceivablesDocument6 pagesINTACC 1: Trade and Other Receivablesdanica rozelNo ratings yet

- Ind As 115Document12 pagesInd As 115qwertyNo ratings yet

- Meaning of Revenue'Document56 pagesMeaning of Revenue'Mo HachimNo ratings yet

- PRACTICE QUESTIONS 1 (IA3) (Midterms) : AnswerDocument21 pagesPRACTICE QUESTIONS 1 (IA3) (Midterms) : AnswerShiena ApasNo ratings yet

- Accounts Receivables and Payables A&BDocument9 pagesAccounts Receivables and Payables A&BAb PiousNo ratings yet

- Revenue IAS 18Document7 pagesRevenue IAS 18Chota H MpukuNo ratings yet

- King Code Presentation - Principles 2Document28 pagesKing Code Presentation - Principles 2TsekeNo ratings yet

- 3.earnings Per ShareDocument13 pages3.earnings Per ShareTsekeNo ratings yet

- IAS 8 - Homework QuestionsDocument2 pagesIAS 8 - Homework QuestionsTsekeNo ratings yet

- CAATSDocument2 pagesCAATSTseke0% (1)

- 2020 DT Notes RevisionDocument7 pages2020 DT Notes RevisionTsekeNo ratings yet

- Contract ModificationsDocument16 pagesContract ModificationsTsekeNo ratings yet

- Class Example 2Document1 pageClass Example 2TsekeNo ratings yet

- 05 Current Taxation s19 FinalDocument29 pages05 Current Taxation s19 FinalTsekeNo ratings yet

- Audit of Inventory and Warehousing CycleDocument6 pagesAudit of Inventory and Warehousing CycleTsekeNo ratings yet

- Auditing 4 NotesDocument2 pagesAuditing 4 NotesTsekeNo ratings yet

- Minorities in IraqDocument272 pagesMinorities in IraqTsekeNo ratings yet

- Hba 2303 Financial Accounting Theory Assessment 1Document2 pagesHba 2303 Financial Accounting Theory Assessment 1kennedyNo ratings yet

- Admin Law CasesDocument74 pagesAdmin Law CasesAxel Gotos dela VegaNo ratings yet

- Car LoanDocument101 pagesCar LoanHarsimar Narula100% (2)

- Acc 124Document5 pagesAcc 124KISSEY ESTRELLANo ratings yet

- Corazon G. Ruiz vs. Court of AppealsDocument6 pagesCorazon G. Ruiz vs. Court of AppealsSoc SaballaNo ratings yet

- 12 Accountancy English 2020 21Document464 pages12 Accountancy English 2020 21Anuja bisht100% (1)

- My Invoice JULY 2023Document1 pageMy Invoice JULY 2023Ch JEEVANA SANDHYANo ratings yet

- ACCT Exam 2 Study GuideDocument12 pagesACCT Exam 2 Study GuideNhan TranNo ratings yet

- Engineering Mathematics Engineering Economics and SciencesDocument3 pagesEngineering Mathematics Engineering Economics and SciencesElla Grace Galang100% (1)

- Term Paper by ImranDocument14 pagesTerm Paper by ImranImran KhanNo ratings yet

- Qualified EntitiesDocument44 pagesQualified Entitiesdora tavarezNo ratings yet

- Chap003 Text Bank (1) SolutionDocument8 pagesChap003 Text Bank (1) SolutionMatt HonanNo ratings yet

- Building An E Commerce Site A Systematic ApproachDocument31 pagesBuilding An E Commerce Site A Systematic ApproachAlliah Fe Kyreh SegoviaNo ratings yet

- Odin Technical TraderDocument1 pageOdin Technical TraderAnkur ShahNo ratings yet

- Northwestern Lehigh School DistrictDocument4 pagesNorthwestern Lehigh School DistrictprideandpromiseNo ratings yet

- Auditing Problems Test Banks - IntangiblesDocument5 pagesAuditing Problems Test Banks - IntangiblesAlliah Mae ArbastoNo ratings yet

- Sapm Notes (Problems)Document11 pagesSapm Notes (Problems)anilkc9No ratings yet

- Basic Concepts of Income TaxDocument12 pagesBasic Concepts of Income TaxSumaira AslamNo ratings yet

- LP ApplicationsDocument31 pagesLP ApplicationsRishabh MishraNo ratings yet

- Income Taxation SchemesDocument12 pagesIncome Taxation SchemesargelenNo ratings yet

- Chapter 2 Recording Business Transactions: Acid)Document29 pagesChapter 2 Recording Business Transactions: Acid)Farhan Osman ahmedNo ratings yet

- Unofficial: Institute of Business Management (Iobm) Fall 2012 ScheduleDocument18 pagesUnofficial: Institute of Business Management (Iobm) Fall 2012 SchedulecoolbbeeeeeNo ratings yet

- MAS CPAR - EconomicsDocument7 pagesMAS CPAR - EconomicsJulie Ann LeynesNo ratings yet

- Developing A Housing Microfinance Product - The First Microfinance Banks Experience in AfghanistanDocument32 pagesDeveloping A Housing Microfinance Product - The First Microfinance Banks Experience in AfghanistanBhagyanath MenonNo ratings yet

- Luyong - Fabm1 - 4thQDocument4 pagesLuyong - Fabm1 - 4thQJonavi Luyong0% (1)

- Performance Highlights: NeutralDocument11 pagesPerformance Highlights: NeutralAngel BrokingNo ratings yet

- BAF-SW Risk MGMT DerivativesDocument2 pagesBAF-SW Risk MGMT DerivativesstudentNo ratings yet

- Your Holiday ConfirmationDocument1 pageYour Holiday Confirmationmaureen.ruane1No ratings yet

- Project ReportDocument51 pagesProject Reportvishal141993No ratings yet