Professional Documents

Culture Documents

100%(1)100% found this document useful (1 vote)

101 viewsBearish Harami - Double Candlestick Pattern

Bearish Harami - Double Candlestick Pattern

Uploaded by

Ting Zhi Peng (Ethan)The Bearish Harami is a candlestick pattern indicating a potential trend reversal from bullish to bearish. It consists of a long first or "mother" candle followed by a small second or "child" candle that gaps down, opens lower, and closes within the mother candle's real body. This suggests a loss of bullish momentum. Traders watch for this pattern after an extended bull run and look to sell on a break below the first candle's low, using its high as a stop loss and targeting a move equal to twice the first candle's range.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Forex Swing Traders: 3 Ways How To Use Moving AverageDocument4 pagesForex Swing Traders: 3 Ways How To Use Moving AverageekawiratamaNo ratings yet

- Support & Resistance Strategy GuideDocument5 pagesSupport & Resistance Strategy GuideChristopher McManusNo ratings yet

- Bearish Belt Hold Candlestick PatternDocument6 pagesBearish Belt Hold Candlestick PatternTing Zhi Peng (Ethan)No ratings yet

- Bearish+Engulfing+CandleStick+Pattern Double+Candlestick+Pattern+ +Document5 pagesBearish+Engulfing+CandleStick+Pattern Double+Candlestick+Pattern+ +Ting Zhi Peng (Ethan)No ratings yet

- Bearish Inverted Hammer Candlestick PatternDocument6 pagesBearish Inverted Hammer Candlestick PatternTing Zhi Peng (Ethan)No ratings yet

- Trading Plan EnglishDocument3 pagesTrading Plan Englishهادی جهانیNo ratings yet

- Flames of Binary Option Vip Secrets: 60% Winrate MethodeDocument12 pagesFlames of Binary Option Vip Secrets: 60% Winrate MethodeEtienne METO100% (1)

- How To Trade The Forex Pin Bar SetupDocument2 pagesHow To Trade The Forex Pin Bar SetupFederico De LeonNo ratings yet

- Japanese Candlesticks: Strategy GuideDocument3 pagesJapanese Candlesticks: Strategy GuideJean Claude DavidNo ratings yet

- The Set Up For Candlestick TradingDocument5 pagesThe Set Up For Candlestick TradingDejan JankuloskiNo ratings yet

- Types of Candlestick PatternDocument2 pagesTypes of Candlestick Pattern07 Bhavesh JagtapNo ratings yet

- 4 Powerful Harami Candlestick Trading StrategiesDocument15 pages4 Powerful Harami Candlestick Trading StrategiesAzam NizamNo ratings yet

- All Abou EngulfDocument36 pagesAll Abou EngulfAlberto BonuccelliNo ratings yet

- Candlestick Charting PrimerDocument131 pagesCandlestick Charting PrimerScorchNo ratings yet

- Simple Trading Techniques, Powerful Results-1Document103 pagesSimple Trading Techniques, Powerful Results-1Fernando Magalhães100% (2)

- Trading - Nexus 7 Pro SetupsDocument10 pagesTrading - Nexus 7 Pro Setupspareshpatel700qxNo ratings yet

- Trading Ways For BinaryDocument1 pageTrading Ways For Binaryssembatya reaganNo ratings yet

- Bearish Candle - Stick PatternDocument48 pagesBearish Candle - Stick Patternpdhamgaye49No ratings yet

- Binary Trading Option Higher, Lower.Document8 pagesBinary Trading Option Higher, Lower.stefan MichaelsonNo ratings yet

- Trading Bitcoin CandlesDocument12 pagesTrading Bitcoin CandlesSean SmythNo ratings yet

- 200 EMA StrategyDocument4 pages200 EMA Strategyluisc110No ratings yet

- Price Action Cheatsheet PDFDocument19 pagesPrice Action Cheatsheet PDFcRi SocietyNo ratings yet

- Lesson 1 - Trading Tactics 1Document1 pageLesson 1 - Trading Tactics 1KOF.ETIENNE KOUMANo ratings yet

- Make Profitable Trading Strategy Using MACD Histogram PDFDocument12 pagesMake Profitable Trading Strategy Using MACD Histogram PDFElizabeth John RajNo ratings yet

- PDF BinqryDocument11 pagesPDF BinqryseydiNo ratings yet

- Learn To Trade: THE Cheat SheetDocument1 pageLearn To Trade: THE Cheat SheetRK SolNo ratings yet

- Forex Trading Tips For BeginnerDocument29 pagesForex Trading Tips For BeginnerHayden C.Smith100% (1)

- Tagline of LMBO: "This Is Not Investment Advice"Document11 pagesTagline of LMBO: "This Is Not Investment Advice"Ex TradersNo ratings yet

- IQ TRADER CANDLESTICK BOOK (English Edition)Document57 pagesIQ TRADER CANDLESTICK BOOK (English Edition)a baluNo ratings yet

- Rolling and Jamming With BollingerDocument62 pagesRolling and Jamming With BollingerPrakashNo ratings yet

- DocumentDocument29 pagesDocumenthisgrace100% (1)

- K's Trading SystemDocument11 pagesK's Trading SystemBinh KieuNo ratings yet

- Using Candlestick Charts To Improve Profitability: Presented by Vema RTDocument17 pagesUsing Candlestick Charts To Improve Profitability: Presented by Vema RTVema Reddy TungaNo ratings yet

- Kiss H4 Strategy Trading SystemDocument5 pagesKiss H4 Strategy Trading SystemChrisLaw123No ratings yet

- 1 123s and Bollinger Manual PDFDocument10 pages1 123s and Bollinger Manual PDFFounder InteraxinesiaNo ratings yet

- Forex Candlestick Ambush Trade .Document31 pagesForex Candlestick Ambush Trade .Malik SaraikiNo ratings yet

- When To Use Fresh Levels and When To Use Original Levels?: Check Counter-Trend Lesson HereDocument26 pagesWhen To Use Fresh Levels and When To Use Original Levels?: Check Counter-Trend Lesson HereRASOLOMALALA Joan LalainaNo ratings yet

- Combining Support and Resistance Levels With Supply and Demand ZonesDocument8 pagesCombining Support and Resistance Levels With Supply and Demand Zonesmajid abbasNo ratings yet

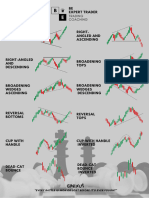

- TA Secrets #4 - Basic Chart PatternsDocument7 pagesTA Secrets #4 - Basic Chart PatternsBlueNo ratings yet

- New Training Slides Forex JalatamaDocument111 pagesNew Training Slides Forex Jalatamakamalezwan100% (2)

- Chart PattrenDocument5 pagesChart PattrenmouddenzaydNo ratings yet

- Candlestick PaternsDocument12 pagesCandlestick Paternsdarshan wareNo ratings yet

- Buy and Sell Power Trading StrategyDocument11 pagesBuy and Sell Power Trading StrategyErigmo0% (1)

- Candlestick Flashcards 101Document10 pagesCandlestick Flashcards 101Viet Nguyen DuyNo ratings yet

- 2.technical Analysis Part 2Document20 pages2.technical Analysis Part 2trisha chandroo100% (1)

- Cup and HandleDocument9 pagesCup and HandleVinay Kumar100% (1)

- Ascending & Descending BroadingDocument9 pagesAscending & Descending BroadingvvpvarunNo ratings yet

- Bullish Hammer: Reversal Candlestick Pattern: HammerDocument23 pagesBullish Hammer: Reversal Candlestick Pattern: HammerCinaru Cosmin100% (1)

- The Lazy Trader GuideDocument15 pagesThe Lazy Trader GuideAlex Adallom67% (3)

- A Deep Dive Into Candlestick PatternsDocument36 pagesA Deep Dive Into Candlestick PatternsRamlal DevnathNo ratings yet

- 2 Candlestick Bullish Reversal Pattern Bullish Candlestick #2 Completely Engulfs #1Document10 pages2 Candlestick Bullish Reversal Pattern Bullish Candlestick #2 Completely Engulfs #1Sanjay MalhotraNo ratings yet

- 4.all About Support and ResistanceDocument36 pages4.all About Support and Resistancetrisha chandrooNo ratings yet

- Summary Cheat Sheet: Top Forex Reversal Patterns That Every Trader Should KnowDocument2 pagesSummary Cheat Sheet: Top Forex Reversal Patterns That Every Trader Should Knowsselvaraj109613100% (1)

- Free Price Action Trading PDF GuideDocument20 pagesFree Price Action Trading PDF Guidemohamed hamdallah100% (2)

- Strategy #1 - Stochastic Oscillator + RSI + Triple EMA: Entering A TradeDocument3 pagesStrategy #1 - Stochastic Oscillator + RSI + Triple EMA: Entering A Tradegurdev singh0% (1)

- Guide To Trading With Bollinger Bands and Support/Resistance On IQ OptionDocument14 pagesGuide To Trading With Bollinger Bands and Support/Resistance On IQ OptionTathego GomolemoNo ratings yet

- Multi Pinbar Hunter ReferenceDocument34 pagesMulti Pinbar Hunter Referencerogerrod61No ratings yet

- Introduction To CandlestickDocument28 pagesIntroduction To CandlestickAhmed Saeed AbdullahNo ratings yet

- Binary Option Trading: Introduction to Binary Option TradingFrom EverandBinary Option Trading: Introduction to Binary Option TradingNo ratings yet

- The Empowered Forex Trader: Strategies to Transform Pains into GainsFrom EverandThe Empowered Forex Trader: Strategies to Transform Pains into GainsNo ratings yet

- Bearish Inverted Hammer Candlestick PatternDocument6 pagesBearish Inverted Hammer Candlestick PatternTing Zhi Peng (Ethan)No ratings yet

- Bearish Long Legged Doji Candlestick PatternDocument6 pagesBearish Long Legged Doji Candlestick PatternTing Zhi Peng (Ethan)No ratings yet

- Bearish Belt Hold Candlestick PatternDocument6 pagesBearish Belt Hold Candlestick PatternTing Zhi Peng (Ethan)No ratings yet

- Bearish+Engulfing+CandleStick+Pattern Double+Candlestick+Pattern+ +Document5 pagesBearish+Engulfing+CandleStick+Pattern Double+Candlestick+Pattern+ +Ting Zhi Peng (Ethan)No ratings yet

- Lecture 6-Forensic ToolsDocument46 pagesLecture 6-Forensic ToolsTing Zhi Peng (Ethan)No ratings yet

- Avishai Margalit and Moshe Halbertal IdoDocument14 pagesAvishai Margalit and Moshe Halbertal IdoTing Zhi Peng (Ethan)No ratings yet

- Practical 9 ToolsDocument4 pagesPractical 9 ToolsTing Zhi Peng (Ethan)No ratings yet

- Lecture 4-CyberstalkingDocument21 pagesLecture 4-CyberstalkingTing Zhi Peng (Ethan)No ratings yet

- Moshe Halbertal and Avishai Margalit IdoDocument2 pagesMoshe Halbertal and Avishai Margalit IdoTing Zhi Peng (Ethan)No ratings yet

Bearish Harami - Double Candlestick Pattern

Bearish Harami - Double Candlestick Pattern

Uploaded by

Ting Zhi Peng (Ethan)100%(1)100% found this document useful (1 vote)

101 views5 pagesThe Bearish Harami is a candlestick pattern indicating a potential trend reversal from bullish to bearish. It consists of a long first or "mother" candle followed by a small second or "child" candle that gaps down, opens lower, and closes within the mother candle's real body. This suggests a loss of bullish momentum. Traders watch for this pattern after an extended bull run and look to sell on a break below the first candle's low, using its high as a stop loss and targeting a move equal to twice the first candle's range.

Original Description:

Original Title

Bearish+Harami+CandleStick+Pattern Double+Candlestick+Pattern

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Bearish Harami is a candlestick pattern indicating a potential trend reversal from bullish to bearish. It consists of a long first or "mother" candle followed by a small second or "child" candle that gaps down, opens lower, and closes within the mother candle's real body. This suggests a loss of bullish momentum. Traders watch for this pattern after an extended bull run and look to sell on a break below the first candle's low, using its high as a stop loss and targeting a move equal to twice the first candle's range.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

100%(1)100% found this document useful (1 vote)

101 views5 pagesBearish Harami - Double Candlestick Pattern

Bearish Harami - Double Candlestick Pattern

Uploaded by

Ting Zhi Peng (Ethan)The Bearish Harami is a candlestick pattern indicating a potential trend reversal from bullish to bearish. It consists of a long first or "mother" candle followed by a small second or "child" candle that gaps down, opens lower, and closes within the mother candle's real body. This suggests a loss of bullish momentum. Traders watch for this pattern after an extended bull run and look to sell on a break below the first candle's low, using its high as a stop loss and targeting a move equal to twice the first candle's range.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 5

Bearish Harami – Double

Candlestick pattern

• Bearish Harami is a trend reversal pattern – Bullish to Bearish.

• Harami means a pregnant women .

Candlestick Analysis by Stocks AiM

How Bearish Harami Looks Like

Gap down open

1st Candle 2nd Candle

(Mother candle) (Child Candle)

Key points of Bearish Harami

Stocks AiM

It’s a Trend reversal sign – Bearish sign.

Find it only after a big bullish trend.

Don’t care in sideways market.

Good if on Resistance .

1st candle should be long bullish. ( may be marubozu )

2nd candle should GAP DOWN open and close should above 1 st candle’s low.

2nd candle should bearish & smaller then 1st one

2nd candle in between 1st candle

Good if Volume should on increasing order.

High of that bullish trend should 1st candle’s high .

For Swing trading you can use Hourly or Daily chart .

For Intraday use 15 min timeframe. ( if you are a risky trader then only use 5 min timeframe )

Stocks AiM

When to Sell using Bearish Harami

SELL => If next candle break 1st candle’s Low.

STOPLOSS => High of that 1st candle .

TARGET => ( Ranger of 1st candle )*2

Here game of 1:2

Find something like this in Market

High of this Uptrend Stop Loss (High of 1st candle)

Bearish Harami

SELL Entry (1st candle Low)

d

Gap down Opening

en

tr

Up

Target (1:2)

You might also like

- Forex Swing Traders: 3 Ways How To Use Moving AverageDocument4 pagesForex Swing Traders: 3 Ways How To Use Moving AverageekawiratamaNo ratings yet

- Support & Resistance Strategy GuideDocument5 pagesSupport & Resistance Strategy GuideChristopher McManusNo ratings yet

- Bearish Belt Hold Candlestick PatternDocument6 pagesBearish Belt Hold Candlestick PatternTing Zhi Peng (Ethan)No ratings yet

- Bearish+Engulfing+CandleStick+Pattern Double+Candlestick+Pattern+ +Document5 pagesBearish+Engulfing+CandleStick+Pattern Double+Candlestick+Pattern+ +Ting Zhi Peng (Ethan)No ratings yet

- Bearish Inverted Hammer Candlestick PatternDocument6 pagesBearish Inverted Hammer Candlestick PatternTing Zhi Peng (Ethan)No ratings yet

- Trading Plan EnglishDocument3 pagesTrading Plan Englishهادی جهانیNo ratings yet

- Flames of Binary Option Vip Secrets: 60% Winrate MethodeDocument12 pagesFlames of Binary Option Vip Secrets: 60% Winrate MethodeEtienne METO100% (1)

- How To Trade The Forex Pin Bar SetupDocument2 pagesHow To Trade The Forex Pin Bar SetupFederico De LeonNo ratings yet

- Japanese Candlesticks: Strategy GuideDocument3 pagesJapanese Candlesticks: Strategy GuideJean Claude DavidNo ratings yet

- The Set Up For Candlestick TradingDocument5 pagesThe Set Up For Candlestick TradingDejan JankuloskiNo ratings yet

- Types of Candlestick PatternDocument2 pagesTypes of Candlestick Pattern07 Bhavesh JagtapNo ratings yet

- 4 Powerful Harami Candlestick Trading StrategiesDocument15 pages4 Powerful Harami Candlestick Trading StrategiesAzam NizamNo ratings yet

- All Abou EngulfDocument36 pagesAll Abou EngulfAlberto BonuccelliNo ratings yet

- Candlestick Charting PrimerDocument131 pagesCandlestick Charting PrimerScorchNo ratings yet

- Simple Trading Techniques, Powerful Results-1Document103 pagesSimple Trading Techniques, Powerful Results-1Fernando Magalhães100% (2)

- Trading - Nexus 7 Pro SetupsDocument10 pagesTrading - Nexus 7 Pro Setupspareshpatel700qxNo ratings yet

- Trading Ways For BinaryDocument1 pageTrading Ways For Binaryssembatya reaganNo ratings yet

- Bearish Candle - Stick PatternDocument48 pagesBearish Candle - Stick Patternpdhamgaye49No ratings yet

- Binary Trading Option Higher, Lower.Document8 pagesBinary Trading Option Higher, Lower.stefan MichaelsonNo ratings yet

- Trading Bitcoin CandlesDocument12 pagesTrading Bitcoin CandlesSean SmythNo ratings yet

- 200 EMA StrategyDocument4 pages200 EMA Strategyluisc110No ratings yet

- Price Action Cheatsheet PDFDocument19 pagesPrice Action Cheatsheet PDFcRi SocietyNo ratings yet

- Lesson 1 - Trading Tactics 1Document1 pageLesson 1 - Trading Tactics 1KOF.ETIENNE KOUMANo ratings yet

- Make Profitable Trading Strategy Using MACD Histogram PDFDocument12 pagesMake Profitable Trading Strategy Using MACD Histogram PDFElizabeth John RajNo ratings yet

- PDF BinqryDocument11 pagesPDF BinqryseydiNo ratings yet

- Learn To Trade: THE Cheat SheetDocument1 pageLearn To Trade: THE Cheat SheetRK SolNo ratings yet

- Forex Trading Tips For BeginnerDocument29 pagesForex Trading Tips For BeginnerHayden C.Smith100% (1)

- Tagline of LMBO: "This Is Not Investment Advice"Document11 pagesTagline of LMBO: "This Is Not Investment Advice"Ex TradersNo ratings yet

- IQ TRADER CANDLESTICK BOOK (English Edition)Document57 pagesIQ TRADER CANDLESTICK BOOK (English Edition)a baluNo ratings yet

- Rolling and Jamming With BollingerDocument62 pagesRolling and Jamming With BollingerPrakashNo ratings yet

- DocumentDocument29 pagesDocumenthisgrace100% (1)

- K's Trading SystemDocument11 pagesK's Trading SystemBinh KieuNo ratings yet

- Using Candlestick Charts To Improve Profitability: Presented by Vema RTDocument17 pagesUsing Candlestick Charts To Improve Profitability: Presented by Vema RTVema Reddy TungaNo ratings yet

- Kiss H4 Strategy Trading SystemDocument5 pagesKiss H4 Strategy Trading SystemChrisLaw123No ratings yet

- 1 123s and Bollinger Manual PDFDocument10 pages1 123s and Bollinger Manual PDFFounder InteraxinesiaNo ratings yet

- Forex Candlestick Ambush Trade .Document31 pagesForex Candlestick Ambush Trade .Malik SaraikiNo ratings yet

- When To Use Fresh Levels and When To Use Original Levels?: Check Counter-Trend Lesson HereDocument26 pagesWhen To Use Fresh Levels and When To Use Original Levels?: Check Counter-Trend Lesson HereRASOLOMALALA Joan LalainaNo ratings yet

- Combining Support and Resistance Levels With Supply and Demand ZonesDocument8 pagesCombining Support and Resistance Levels With Supply and Demand Zonesmajid abbasNo ratings yet

- TA Secrets #4 - Basic Chart PatternsDocument7 pagesTA Secrets #4 - Basic Chart PatternsBlueNo ratings yet

- New Training Slides Forex JalatamaDocument111 pagesNew Training Slides Forex Jalatamakamalezwan100% (2)

- Chart PattrenDocument5 pagesChart PattrenmouddenzaydNo ratings yet

- Candlestick PaternsDocument12 pagesCandlestick Paternsdarshan wareNo ratings yet

- Buy and Sell Power Trading StrategyDocument11 pagesBuy and Sell Power Trading StrategyErigmo0% (1)

- Candlestick Flashcards 101Document10 pagesCandlestick Flashcards 101Viet Nguyen DuyNo ratings yet

- 2.technical Analysis Part 2Document20 pages2.technical Analysis Part 2trisha chandroo100% (1)

- Cup and HandleDocument9 pagesCup and HandleVinay Kumar100% (1)

- Ascending & Descending BroadingDocument9 pagesAscending & Descending BroadingvvpvarunNo ratings yet

- Bullish Hammer: Reversal Candlestick Pattern: HammerDocument23 pagesBullish Hammer: Reversal Candlestick Pattern: HammerCinaru Cosmin100% (1)

- The Lazy Trader GuideDocument15 pagesThe Lazy Trader GuideAlex Adallom67% (3)

- A Deep Dive Into Candlestick PatternsDocument36 pagesA Deep Dive Into Candlestick PatternsRamlal DevnathNo ratings yet

- 2 Candlestick Bullish Reversal Pattern Bullish Candlestick #2 Completely Engulfs #1Document10 pages2 Candlestick Bullish Reversal Pattern Bullish Candlestick #2 Completely Engulfs #1Sanjay MalhotraNo ratings yet

- 4.all About Support and ResistanceDocument36 pages4.all About Support and Resistancetrisha chandrooNo ratings yet

- Summary Cheat Sheet: Top Forex Reversal Patterns That Every Trader Should KnowDocument2 pagesSummary Cheat Sheet: Top Forex Reversal Patterns That Every Trader Should Knowsselvaraj109613100% (1)

- Free Price Action Trading PDF GuideDocument20 pagesFree Price Action Trading PDF Guidemohamed hamdallah100% (2)

- Strategy #1 - Stochastic Oscillator + RSI + Triple EMA: Entering A TradeDocument3 pagesStrategy #1 - Stochastic Oscillator + RSI + Triple EMA: Entering A Tradegurdev singh0% (1)

- Guide To Trading With Bollinger Bands and Support/Resistance On IQ OptionDocument14 pagesGuide To Trading With Bollinger Bands and Support/Resistance On IQ OptionTathego GomolemoNo ratings yet

- Multi Pinbar Hunter ReferenceDocument34 pagesMulti Pinbar Hunter Referencerogerrod61No ratings yet

- Introduction To CandlestickDocument28 pagesIntroduction To CandlestickAhmed Saeed AbdullahNo ratings yet

- Binary Option Trading: Introduction to Binary Option TradingFrom EverandBinary Option Trading: Introduction to Binary Option TradingNo ratings yet

- The Empowered Forex Trader: Strategies to Transform Pains into GainsFrom EverandThe Empowered Forex Trader: Strategies to Transform Pains into GainsNo ratings yet

- Bearish Inverted Hammer Candlestick PatternDocument6 pagesBearish Inverted Hammer Candlestick PatternTing Zhi Peng (Ethan)No ratings yet

- Bearish Long Legged Doji Candlestick PatternDocument6 pagesBearish Long Legged Doji Candlestick PatternTing Zhi Peng (Ethan)No ratings yet

- Bearish Belt Hold Candlestick PatternDocument6 pagesBearish Belt Hold Candlestick PatternTing Zhi Peng (Ethan)No ratings yet

- Bearish+Engulfing+CandleStick+Pattern Double+Candlestick+Pattern+ +Document5 pagesBearish+Engulfing+CandleStick+Pattern Double+Candlestick+Pattern+ +Ting Zhi Peng (Ethan)No ratings yet

- Lecture 6-Forensic ToolsDocument46 pagesLecture 6-Forensic ToolsTing Zhi Peng (Ethan)No ratings yet

- Avishai Margalit and Moshe Halbertal IdoDocument14 pagesAvishai Margalit and Moshe Halbertal IdoTing Zhi Peng (Ethan)No ratings yet

- Practical 9 ToolsDocument4 pagesPractical 9 ToolsTing Zhi Peng (Ethan)No ratings yet

- Lecture 4-CyberstalkingDocument21 pagesLecture 4-CyberstalkingTing Zhi Peng (Ethan)No ratings yet

- Moshe Halbertal and Avishai Margalit IdoDocument2 pagesMoshe Halbertal and Avishai Margalit IdoTing Zhi Peng (Ethan)No ratings yet