Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

6 viewsUnit 2 Financing Foreign Trade

Unit 2 Financing Foreign Trade

Uploaded by

Devi Bala JUnit 2 discusses financing foreign trade through export finance. It covers pre-shipment finance which is offered before goods are shipped to help exporters with costs. This includes packing credit. It also discusses post-shipment finance which is offered after goods are shipped and helps exporters until payment is received. Post-shipment finance can include purchasing or discounting export bills. The unit also discusses providing export credit in foreign currency to offer competitive international rates to exporters.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Crunchbase InvestorsDocument436 pagesCrunchbase InvestorsDoc SaabNo ratings yet

- Problem Set 5 SolutionsDocument7 pagesProblem Set 5 SolutionsBouchra MrabetiNo ratings yet

- Blaine Kitchenware Case Study SolutionDocument5 pagesBlaine Kitchenware Case Study SolutionMohan Kumar89% (37)

- 2022 Nus Invest Responses & Stock Pitch ReportDocument12 pages2022 Nus Invest Responses & Stock Pitch ReportDev DesaiNo ratings yet

- INTERNATIONAL BANKING - FOREX MANAGEMENT - BCOM 5 Sem Ebook and NotesDocument31 pagesINTERNATIONAL BANKING - FOREX MANAGEMENT - BCOM 5 Sem Ebook and NotesMohammed Muzzamil82% (22)

- Export Finance: Group 5Document31 pagesExport Finance: Group 5sidpunjNo ratings yet

- Pre-Shipment-Post-Shipment 14519Document24 pagesPre-Shipment-Post-Shipment 14519aeeeNo ratings yet

- Pre Shipment & Post ShipmentDocument21 pagesPre Shipment & Post ShipmentVineeth Kunnath100% (4)

- Pre-Shipment and Post-Shipment Finance of State Bank of India (Sbi)Document5 pagesPre-Shipment and Post-Shipment Finance of State Bank of India (Sbi)Rohit OberoiNo ratings yet

- Export FinanceDocument14 pagesExport Financesamy7541No ratings yet

- Export Financing in IndiaDocument8 pagesExport Financing in IndiaRohit AggarwalNo ratings yet

- Export Finance and Letter of CreditDocument16 pagesExport Finance and Letter of Creditabhijeet186299No ratings yet

- 3b.export FinanceDocument36 pages3b.export FinanceADESH BAJPAINo ratings yet

- Export FinanceDocument29 pagesExport FinanceAishu KrishnanNo ratings yet

- Global Business Management UNIT 4Document11 pagesGlobal Business Management UNIT 4Nandhini VirgoNo ratings yet

- 14 PDFDocument15 pages14 PDFBindiya SalatNo ratings yet

- Export Finance (Case Study Need To Be Added)Document62 pagesExport Finance (Case Study Need To Be Added)rupalNo ratings yet

- Pre & Post Shipment Finance in Export Trade: Ssa JiDocument7 pagesPre & Post Shipment Finance in Export Trade: Ssa JivinmbaftNo ratings yet

- Export Financing: Nazmul Karim, CDCSDocument28 pagesExport Financing: Nazmul Karim, CDCSNazmul KarimNo ratings yet

- EIF BBA NOTES 3 and 4 UnitDocument17 pagesEIF BBA NOTES 3 and 4 UnitMOHAMMAD ZUBERNo ratings yet

- Export FinancingDocument61 pagesExport FinancingkanikaNo ratings yet

- Pre & Post Shipment Finance in Export TradeDocument6 pagesPre & Post Shipment Finance in Export TradeVodafone dbNo ratings yet

- Export FinanceDocument6 pagesExport FinanceMallikarjun RaoNo ratings yet

- Ib 18 GuideDocument28 pagesIb 18 GuidelalsinghNo ratings yet

- Export Financing (Final)Document66 pagesExport Financing (Final)kanabaramitNo ratings yet

- Pre ShipmentDocument8 pagesPre ShipmentRajesh ShahNo ratings yet

- Export Finance in INDIA Reading Material GvsraoDocument13 pagesExport Finance in INDIA Reading Material GvsraoPrabal SharmaNo ratings yet

- Chapter - 1: MeaningDocument84 pagesChapter - 1: MeaningManoj KumarNo ratings yet

- Fallsem2017-18 Bmt1018 TH Sjt626 Vl2017181002984 Reference Material I Exim 05aDocument27 pagesFallsem2017-18 Bmt1018 TH Sjt626 Vl2017181002984 Reference Material I Exim 05aPulkit JainNo ratings yet

- Ibo-04 2020-21Document16 pagesIbo-04 2020-21arun1974No ratings yet

- Export Finance in IndiaDocument6 pagesExport Finance in Indiaadil.abrar3504No ratings yet

- Methods of Financing ExportersDocument35 pagesMethods of Financing Exportersmilee_2009No ratings yet

- Export Packing CreditDocument4 pagesExport Packing CreditkarthicfinconNo ratings yet

- Post Shipment FinanceDocument4 pagesPost Shipment FinanceambrosialnectarNo ratings yet

- Unit 6: Export Financing and Documentation: Methods of Export CreditDocument9 pagesUnit 6: Export Financing and Documentation: Methods of Export CreditKhushi KaulNo ratings yet

- International Finance Pre Shipments FinanceDocument14 pagesInternational Finance Pre Shipments FinanceKiran AwasthiNo ratings yet

- Some Information On Export Some Information On Export Financing FinancingDocument23 pagesSome Information On Export Some Information On Export Financing FinancingRoshani JoshiNo ratings yet

- IB Unit - 4Document16 pagesIB Unit - 4abhishek_shukla_60No ratings yet

- Export Finance PreshipmentDocument11 pagesExport Finance PreshipmentIftekhar Ahmed100% (1)

- Pre Shipment FinanceDocument21 pagesPre Shipment FinanceSandip ShawNo ratings yet

- Export Pre Shipment and Post Shipment FinanceDocument10 pagesExport Pre Shipment and Post Shipment FinancembmmanishNo ratings yet

- Export Finance in India: Report OnDocument44 pagesExport Finance in India: Report OnAnkit Tilwani100% (1)

- Arranging Finance For ExportDocument14 pagesArranging Finance For ExportmaxsoniiNo ratings yet

- Financing Foreign Trade PDFDocument16 pagesFinancing Foreign Trade PDFHemanth Kumar89% (9)

- PCFCDocument6 pagesPCFCambrosialnectarNo ratings yet

- Pre-Shipment Finance: Dr. S. Gowri Ii Mba - EximtdDocument11 pagesPre-Shipment Finance: Dr. S. Gowri Ii Mba - EximtdGowri SekarNo ratings yet

- Presented By-Aakriti Gupta Arora Gaurav Singh 94972238253 94972238262Document71 pagesPresented By-Aakriti Gupta Arora Gaurav Singh 94972238253 94972238262sayedmaruf7866807No ratings yet

- Export Finance and Payment Presented by Sri Jintu Borthakur Sri Dipranjal KeotDocument45 pagesExport Finance and Payment Presented by Sri Jintu Borthakur Sri Dipranjal Keotjunet123123No ratings yet

- Pre Shipment Finance Is Issued by A Financial Institution When The Seller Want The Payment of The Goods Before ShipmentDocument5 pagesPre Shipment Finance Is Issued by A Financial Institution When The Seller Want The Payment of The Goods Before ShipmentBhanu MehraNo ratings yet

- Pre-Shipment and Post-Shipment Finance: Dr. A.K. Sengupta Former Dean, Indian Institute of Foreign TradeDocument7 pagesPre-Shipment and Post-Shipment Finance: Dr. A.K. Sengupta Former Dean, Indian Institute of Foreign TradeimadNo ratings yet

- Aditya Bhatt Anubhav Yadav Nitin Arora Shadab MansooriDocument34 pagesAditya Bhatt Anubhav Yadav Nitin Arora Shadab MansooriJc Duke M EliyasarNo ratings yet

- Trading FinanceDocument27 pagesTrading FinanceDhaval GaloliyaNo ratings yet

- Pre-Shipment Finance OverviewDocument11 pagesPre-Shipment Finance Overviewrajeshjain90No ratings yet

- C Packing CreditDocument6 pagesC Packing CreditKapil KumarNo ratings yet

- Requirment For Getting Packing CreditDocument6 pagesRequirment For Getting Packing CreditPrashant JainNo ratings yet

- Export Finance and Risk Insurance1Document40 pagesExport Finance and Risk Insurance1api-291598576No ratings yet

- Export FianceDocument32 pagesExport FiancedeoredevangiNo ratings yet

- Export Financing: Pre-Shipment & Post-Shipment FinanceDocument24 pagesExport Financing: Pre-Shipment & Post-Shipment Financevidhyaaravinthan100% (1)

- AniketDocument5 pagesAniketAjay PrajapatiNo ratings yet

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingFrom EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingNo ratings yet

- Chapter 2Document16 pagesChapter 2Devi Bala JNo ratings yet

- Chapter 1Document14 pagesChapter 1Devi Bala JNo ratings yet

- Chapter 3Document4 pagesChapter 3Devi Bala JNo ratings yet

- Export - MaterialsDocument117 pagesExport - MaterialsDevi Bala JNo ratings yet

- 134 Bba Honors MajorDocument59 pages134 Bba Honors MajorSuneel RamireddyNo ratings yet

- Research ProposalDocument7 pagesResearch Proposalpachpind jayeshNo ratings yet

- Final Accounts 2005Document44 pagesFinal Accounts 2005Mahmood KhanNo ratings yet

- Lecture 4 INVESTMENT CRITERIA FOR PROJECT APPRAISALDocument49 pagesLecture 4 INVESTMENT CRITERIA FOR PROJECT APPRAISALANH VÕ TỪNo ratings yet

- 2014 Annual ReportDocument132 pages2014 Annual Reportnaveen kumarNo ratings yet

- Comparative Analysis of Systematic Investment Plan and Lump Sum InvestmentDocument10 pagesComparative Analysis of Systematic Investment Plan and Lump Sum InvestmentAdit Sharma100% (1)

- Equitas Small Finance 2912024 MotiDocument12 pagesEquitas Small Finance 2912024 MotibzzziNo ratings yet

- INTEGRATIVE PROBLEM 2-17 and Solution For ReviewDocument11 pagesINTEGRATIVE PROBLEM 2-17 and Solution For ReviewNoor NabiNo ratings yet

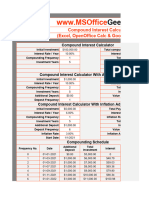

- Compound Interest CalculatorDocument14 pagesCompound Interest CalculatorSiyabongaNo ratings yet

- What Is A Bussness Plan ForDocument6 pagesWhat Is A Bussness Plan Forleealessandra71No ratings yet

- CFA一级百题预测 企业理财Document89 pagesCFA一级百题预测 企业理财Evelyn YangNo ratings yet

- SIP Project ReportDocument54 pagesSIP Project Reportjigar_kansagra100% (13)

- Feasibility StudyDocument14 pagesFeasibility StudyHassanRanaNo ratings yet

- Shariah Screening Process in Islamic Capital Market DR MD Nurdin NgadimonDocument40 pagesShariah Screening Process in Islamic Capital Market DR MD Nurdin NgadimonGabriel Sim0% (1)

- IFRS 13 Fair Value MeasurementDocument2 pagesIFRS 13 Fair Value MeasurementYogesh BhattaraiNo ratings yet

- Canapi 04 Activity 2Document2 pagesCanapi 04 Activity 2sora fpsNo ratings yet

- Industry Reports - ISB Consulting Casebook 2021Document36 pagesIndustry Reports - ISB Consulting Casebook 2021BalajiNo ratings yet

- Fsa Project - Group 6 - Bhushan SteelsDocument30 pagesFsa Project - Group 6 - Bhushan SteelsNipu KurupNo ratings yet

- Equity Structured Products Accumulator/ DecumulatorDocument5 pagesEquity Structured Products Accumulator/ DecumulatorRajulNo ratings yet

- Must HaveDocument13 pagesMust HaveSunny SkNo ratings yet

- Associated Cement Company LTD: Profit & Loss Account Balance SheetDocument3 pagesAssociated Cement Company LTD: Profit & Loss Account Balance SheetZulfiqar HaiderNo ratings yet

- Important Factors To Be Considered For Financial Investment and SuggestionsDocument5 pagesImportant Factors To Be Considered For Financial Investment and SuggestionsRISHABH SEN GUPTANo ratings yet

- Sample Problems For Intermediate Accounting 3Document2 pagesSample Problems For Intermediate Accounting 3Luxx LawlietNo ratings yet

- Hrum LK TW Ii 2023Document108 pagesHrum LK TW Ii 2023PC E490No ratings yet

- Advanced Financial AccountingDocument8 pagesAdvanced Financial AccountingricharddiagmelNo ratings yet

- Financial Markets AND Financial Services: Chapter-31Document7 pagesFinancial Markets AND Financial Services: Chapter-31Dipali DavdaNo ratings yet

Unit 2 Financing Foreign Trade

Unit 2 Financing Foreign Trade

Uploaded by

Devi Bala J0 ratings0% found this document useful (0 votes)

6 views15 pagesUnit 2 discusses financing foreign trade through export finance. It covers pre-shipment finance which is offered before goods are shipped to help exporters with costs. This includes packing credit. It also discusses post-shipment finance which is offered after goods are shipped and helps exporters until payment is received. Post-shipment finance can include purchasing or discounting export bills. The unit also discusses providing export credit in foreign currency to offer competitive international rates to exporters.

Original Description:

Original Title

Untitled

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentUnit 2 discusses financing foreign trade through export finance. It covers pre-shipment finance which is offered before goods are shipped to help exporters with costs. This includes packing credit. It also discusses post-shipment finance which is offered after goods are shipped and helps exporters until payment is received. Post-shipment finance can include purchasing or discounting export bills. The unit also discusses providing export credit in foreign currency to offer competitive international rates to exporters.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

6 views15 pagesUnit 2 Financing Foreign Trade

Unit 2 Financing Foreign Trade

Uploaded by

Devi Bala JUnit 2 discusses financing foreign trade through export finance. It covers pre-shipment finance which is offered before goods are shipped to help exporters with costs. This includes packing credit. It also discusses post-shipment finance which is offered after goods are shipped and helps exporters until payment is received. Post-shipment finance can include purchasing or discounting export bills. The unit also discusses providing export credit in foreign currency to offer competitive international rates to exporters.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 15

UNIT 2

FINANCING FOREIGN TRADE

EXPORT FINANCE

• Exporters offer attractive credit terms to their overseas

buyers

• This makes strain on the liquidity of the exporting

firms

• So adequate trade finances available to the exporters

from external sources at competitive terms during the

post-shipment stage

• As a part of export promotion strategy, national

governments around the world offer export credit,

often at concessional rates to facilitate exports.

1. PRE-SHIPMENT FINANCE

• Pre Shipment Finance is issued by a financial

institution when the seller wants the payment of the

goods before shipment.

• The main objectives behind pre-shipment finance or

pre-export finance is to enable exporter to: Procure

raw materials, manufacturing, warehousing, packing,

shipping, and financial costs

• Types of Pre Shipment Finance

1. Packing Credit

2. Advance against Cheques/Draft etc. representing

Advance Payments.

Preshipment finance is extended in the following forms :

Packing Credit in Indian Rupee

Packing Credit in Foreign Currency (PCFC)

Requirment for Getting Packing Credit

• A ten digit importerexporter code number allotted by DGFT.

• Exporter should not be in the caution list of RBI.

• If the goods to be exported are not under OGL (Open General

Licence), the exporter should have the required license /quota

permit to export the goods.

• Formal application form for credit

• Irrevocable letter of credit

• Licence issued by DGFT

• Exporter who has export order in his own name

• Quantum of Finance is granted to an exporter against the LC or an

expected order.

Different Stages of Pre Shipment Finance

1. Appraisal and Sanction of Limits – bank verifies country, product,

importer – ensures exporter’s bonafides, license and importer’s

country is Restricted cover country (RCC)

2. Disbursement of Packing Credit Advance – after bank ensures

exporter produces all documents – quantum of finance as per FOB

value – disbursals at stages only – maximum duration of packing

credit is 180 days + 90 days as per bank’s discretion

3. Follow up of Packing Credit Advance – exporter should submit stock

statement – used by banks to secure packing credit in advance

4. Liquidation of Packing Credit Advance – out of the export proceeds

of relevant shipment – converting preshipment into postshipment

credit

5. Overdue Packing – if borrower fails to liquidate the packing credit

on due date then bank takes the necessary step to recover its dues

as per normal recovery procedure

Special Cases

1. Packing Credit to Sub Supplier – exporter can transfer credit to

manufacturer

2. Running Account facility – exporter of any origin can get credit

3. Preshipment Credit in Foreign Currency (PCFC) – rate of interest linked to

LIBOR

4. Packing Credit Facilities to Deemed Exports - Deemed exports made to

multilateral funds, aided projects and programmes, under orders

secured through global tenders for which payments will be made in free

foreign exchange

5. Packing Credit facilities for Consulting Services - allow the exporter to

mobilize resources like technical personnel and training them

6. Advance against Cheque/Drafts received as advance payment - Where

exporters receive direct payments from abroad by means of

cheques/drafts etc. the bank may grant export credit at concessional

rate to the exporters of goods track record, till the time of realization of

the proceeds of the cheques or draft etc

2. POST SHIPMENT FINANCE

• Post Shipment Finance is a kind of loan provided by a financial

institution to an exporter or seller against a shipment that has already

been made.

Basic Features :-

1. Purpose of Finance: finance export sales receivable after the date of

shipment of goods to the date of realization of exports proceeds

2. Basis of Finance : against evidence of shipment of goods

3. Types of Finance : Post shipment finance can be secured or

unsecured.

4. Quantum of Finance - 100% of the invoice value of goods

5. Period of Finance : short term or long term - Concessive rate of

interest is available for a highest period of 180 days

Postshipment finance can be provided for three types of export :

1. Physical exports 2. Deemed export 3. Capital goods and project

exports

Types of Post Shipment Finance

1. Export Bills purchased/discounted.(Non L/c bills)

2. Export Bills negotiated ( Bill under L/c)

3. Advance against export bills sent on collection basis –

Banks may allow advance against these collection bills to

an exporter with a concessional rates of interest

4. Advance against export on consignment basis

5. Advance against undrawn balance on exports – Subject to

maximum of 10% export value

6. Advance against claims of Duty Drawback - Duty Drawback

is a type of discount given to the exporter in his own

country - lower rate of interest for a maximum period of

90 days

TOPIC-1.2 : POST CREDIT IN FOREIGN CURRENCY

Export credit in foreign currency:

In order to make credit available to the exporters at

internationally competitive rates, banks (authorized dealers)

also extend credit in foreign currency at LIBOR (London

Interbank Offered Rates), EURO LIBOR (London Interbank

Offered Rates dominated in Euro), or EURIBOR (Euro

Interbank Offered Rates)

Pre-shipment credit in foreign currency

Banks extend pre-shipment credit in foreign currency (PCFC) in

any one of the convertible currencies, such as US dollars,

pound sterling, Japanese yen, euro, etc.,

Under this scheme, the exporters have the following options

to avail export finance:

i. To avail pre-shipment credit in rupees and then the post-

shipment credit either in rupees or discounting/re-

discounting of export bills under Export Bills Abroad (EBR)

scheme

ii. To avail pre-shipment credit in rupees and then convert at

the discretion of the bank

Post-shipment credit in foreign currency

The exporters also have options to avail post-shipment export credit

either in foreign currency or domestic currency

• Post-shipment credit has also to be in foreign currency if the pre-

shipment credit has already been availed in foreign currency so as

to liquidate the pre-shipment credit

• Scheme covers bills with usance period up to 180 days from the

date of shipment.

• Rediscounting of Export Bills Abroad Scheme (EBR)

Export Finance to Overseas Importers: to finance export

transactions to the exporters and credit is also available to

overseas buyers so as to facilitate import of goods from India,

mainly under two forms:

Buyer’s credit:

It is a credit extended by a bank in exporter’s country to

an overseas buyer, enabling the buyer to pay for

machinery and equipment that s/he may be importing

for a specific project

Line of credit:

It is a credit extended by a bank in exporting country (for

example, India) to an overseas bank, institution, or

government for the purpose of facilitating the import of

a variety of listed goods from the exporting country

(India) into the overseas country. A number of importers

in the foreign country may be importing the goods

under one line of credit.

Topics for Once in a Semester

• IBRD – 3 PERSONS

• EXIM BANK – 2

• ASIAN DEVELOPMENT BANK – 3

• ECGC – 2

• MIGA - 4

You might also like

- Crunchbase InvestorsDocument436 pagesCrunchbase InvestorsDoc SaabNo ratings yet

- Problem Set 5 SolutionsDocument7 pagesProblem Set 5 SolutionsBouchra MrabetiNo ratings yet

- Blaine Kitchenware Case Study SolutionDocument5 pagesBlaine Kitchenware Case Study SolutionMohan Kumar89% (37)

- 2022 Nus Invest Responses & Stock Pitch ReportDocument12 pages2022 Nus Invest Responses & Stock Pitch ReportDev DesaiNo ratings yet

- INTERNATIONAL BANKING - FOREX MANAGEMENT - BCOM 5 Sem Ebook and NotesDocument31 pagesINTERNATIONAL BANKING - FOREX MANAGEMENT - BCOM 5 Sem Ebook and NotesMohammed Muzzamil82% (22)

- Export Finance: Group 5Document31 pagesExport Finance: Group 5sidpunjNo ratings yet

- Pre-Shipment-Post-Shipment 14519Document24 pagesPre-Shipment-Post-Shipment 14519aeeeNo ratings yet

- Pre Shipment & Post ShipmentDocument21 pagesPre Shipment & Post ShipmentVineeth Kunnath100% (4)

- Pre-Shipment and Post-Shipment Finance of State Bank of India (Sbi)Document5 pagesPre-Shipment and Post-Shipment Finance of State Bank of India (Sbi)Rohit OberoiNo ratings yet

- Export FinanceDocument14 pagesExport Financesamy7541No ratings yet

- Export Financing in IndiaDocument8 pagesExport Financing in IndiaRohit AggarwalNo ratings yet

- Export Finance and Letter of CreditDocument16 pagesExport Finance and Letter of Creditabhijeet186299No ratings yet

- 3b.export FinanceDocument36 pages3b.export FinanceADESH BAJPAINo ratings yet

- Export FinanceDocument29 pagesExport FinanceAishu KrishnanNo ratings yet

- Global Business Management UNIT 4Document11 pagesGlobal Business Management UNIT 4Nandhini VirgoNo ratings yet

- 14 PDFDocument15 pages14 PDFBindiya SalatNo ratings yet

- Export Finance (Case Study Need To Be Added)Document62 pagesExport Finance (Case Study Need To Be Added)rupalNo ratings yet

- Pre & Post Shipment Finance in Export Trade: Ssa JiDocument7 pagesPre & Post Shipment Finance in Export Trade: Ssa JivinmbaftNo ratings yet

- Export Financing: Nazmul Karim, CDCSDocument28 pagesExport Financing: Nazmul Karim, CDCSNazmul KarimNo ratings yet

- EIF BBA NOTES 3 and 4 UnitDocument17 pagesEIF BBA NOTES 3 and 4 UnitMOHAMMAD ZUBERNo ratings yet

- Export FinancingDocument61 pagesExport FinancingkanikaNo ratings yet

- Pre & Post Shipment Finance in Export TradeDocument6 pagesPre & Post Shipment Finance in Export TradeVodafone dbNo ratings yet

- Export FinanceDocument6 pagesExport FinanceMallikarjun RaoNo ratings yet

- Ib 18 GuideDocument28 pagesIb 18 GuidelalsinghNo ratings yet

- Export Financing (Final)Document66 pagesExport Financing (Final)kanabaramitNo ratings yet

- Pre ShipmentDocument8 pagesPre ShipmentRajesh ShahNo ratings yet

- Export Finance in INDIA Reading Material GvsraoDocument13 pagesExport Finance in INDIA Reading Material GvsraoPrabal SharmaNo ratings yet

- Chapter - 1: MeaningDocument84 pagesChapter - 1: MeaningManoj KumarNo ratings yet

- Fallsem2017-18 Bmt1018 TH Sjt626 Vl2017181002984 Reference Material I Exim 05aDocument27 pagesFallsem2017-18 Bmt1018 TH Sjt626 Vl2017181002984 Reference Material I Exim 05aPulkit JainNo ratings yet

- Ibo-04 2020-21Document16 pagesIbo-04 2020-21arun1974No ratings yet

- Export Finance in IndiaDocument6 pagesExport Finance in Indiaadil.abrar3504No ratings yet

- Methods of Financing ExportersDocument35 pagesMethods of Financing Exportersmilee_2009No ratings yet

- Export Packing CreditDocument4 pagesExport Packing CreditkarthicfinconNo ratings yet

- Post Shipment FinanceDocument4 pagesPost Shipment FinanceambrosialnectarNo ratings yet

- Unit 6: Export Financing and Documentation: Methods of Export CreditDocument9 pagesUnit 6: Export Financing and Documentation: Methods of Export CreditKhushi KaulNo ratings yet

- International Finance Pre Shipments FinanceDocument14 pagesInternational Finance Pre Shipments FinanceKiran AwasthiNo ratings yet

- Some Information On Export Some Information On Export Financing FinancingDocument23 pagesSome Information On Export Some Information On Export Financing FinancingRoshani JoshiNo ratings yet

- IB Unit - 4Document16 pagesIB Unit - 4abhishek_shukla_60No ratings yet

- Export Finance PreshipmentDocument11 pagesExport Finance PreshipmentIftekhar Ahmed100% (1)

- Pre Shipment FinanceDocument21 pagesPre Shipment FinanceSandip ShawNo ratings yet

- Export Pre Shipment and Post Shipment FinanceDocument10 pagesExport Pre Shipment and Post Shipment FinancembmmanishNo ratings yet

- Export Finance in India: Report OnDocument44 pagesExport Finance in India: Report OnAnkit Tilwani100% (1)

- Arranging Finance For ExportDocument14 pagesArranging Finance For ExportmaxsoniiNo ratings yet

- Financing Foreign Trade PDFDocument16 pagesFinancing Foreign Trade PDFHemanth Kumar89% (9)

- PCFCDocument6 pagesPCFCambrosialnectarNo ratings yet

- Pre-Shipment Finance: Dr. S. Gowri Ii Mba - EximtdDocument11 pagesPre-Shipment Finance: Dr. S. Gowri Ii Mba - EximtdGowri SekarNo ratings yet

- Presented By-Aakriti Gupta Arora Gaurav Singh 94972238253 94972238262Document71 pagesPresented By-Aakriti Gupta Arora Gaurav Singh 94972238253 94972238262sayedmaruf7866807No ratings yet

- Export Finance and Payment Presented by Sri Jintu Borthakur Sri Dipranjal KeotDocument45 pagesExport Finance and Payment Presented by Sri Jintu Borthakur Sri Dipranjal Keotjunet123123No ratings yet

- Pre Shipment Finance Is Issued by A Financial Institution When The Seller Want The Payment of The Goods Before ShipmentDocument5 pagesPre Shipment Finance Is Issued by A Financial Institution When The Seller Want The Payment of The Goods Before ShipmentBhanu MehraNo ratings yet

- Pre-Shipment and Post-Shipment Finance: Dr. A.K. Sengupta Former Dean, Indian Institute of Foreign TradeDocument7 pagesPre-Shipment and Post-Shipment Finance: Dr. A.K. Sengupta Former Dean, Indian Institute of Foreign TradeimadNo ratings yet

- Aditya Bhatt Anubhav Yadav Nitin Arora Shadab MansooriDocument34 pagesAditya Bhatt Anubhav Yadav Nitin Arora Shadab MansooriJc Duke M EliyasarNo ratings yet

- Trading FinanceDocument27 pagesTrading FinanceDhaval GaloliyaNo ratings yet

- Pre-Shipment Finance OverviewDocument11 pagesPre-Shipment Finance Overviewrajeshjain90No ratings yet

- C Packing CreditDocument6 pagesC Packing CreditKapil KumarNo ratings yet

- Requirment For Getting Packing CreditDocument6 pagesRequirment For Getting Packing CreditPrashant JainNo ratings yet

- Export Finance and Risk Insurance1Document40 pagesExport Finance and Risk Insurance1api-291598576No ratings yet

- Export FianceDocument32 pagesExport FiancedeoredevangiNo ratings yet

- Export Financing: Pre-Shipment & Post-Shipment FinanceDocument24 pagesExport Financing: Pre-Shipment & Post-Shipment Financevidhyaaravinthan100% (1)

- AniketDocument5 pagesAniketAjay PrajapatiNo ratings yet

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingFrom EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingNo ratings yet

- Chapter 2Document16 pagesChapter 2Devi Bala JNo ratings yet

- Chapter 1Document14 pagesChapter 1Devi Bala JNo ratings yet

- Chapter 3Document4 pagesChapter 3Devi Bala JNo ratings yet

- Export - MaterialsDocument117 pagesExport - MaterialsDevi Bala JNo ratings yet

- 134 Bba Honors MajorDocument59 pages134 Bba Honors MajorSuneel RamireddyNo ratings yet

- Research ProposalDocument7 pagesResearch Proposalpachpind jayeshNo ratings yet

- Final Accounts 2005Document44 pagesFinal Accounts 2005Mahmood KhanNo ratings yet

- Lecture 4 INVESTMENT CRITERIA FOR PROJECT APPRAISALDocument49 pagesLecture 4 INVESTMENT CRITERIA FOR PROJECT APPRAISALANH VÕ TỪNo ratings yet

- 2014 Annual ReportDocument132 pages2014 Annual Reportnaveen kumarNo ratings yet

- Comparative Analysis of Systematic Investment Plan and Lump Sum InvestmentDocument10 pagesComparative Analysis of Systematic Investment Plan and Lump Sum InvestmentAdit Sharma100% (1)

- Equitas Small Finance 2912024 MotiDocument12 pagesEquitas Small Finance 2912024 MotibzzziNo ratings yet

- INTEGRATIVE PROBLEM 2-17 and Solution For ReviewDocument11 pagesINTEGRATIVE PROBLEM 2-17 and Solution For ReviewNoor NabiNo ratings yet

- Compound Interest CalculatorDocument14 pagesCompound Interest CalculatorSiyabongaNo ratings yet

- What Is A Bussness Plan ForDocument6 pagesWhat Is A Bussness Plan Forleealessandra71No ratings yet

- CFA一级百题预测 企业理财Document89 pagesCFA一级百题预测 企业理财Evelyn YangNo ratings yet

- SIP Project ReportDocument54 pagesSIP Project Reportjigar_kansagra100% (13)

- Feasibility StudyDocument14 pagesFeasibility StudyHassanRanaNo ratings yet

- Shariah Screening Process in Islamic Capital Market DR MD Nurdin NgadimonDocument40 pagesShariah Screening Process in Islamic Capital Market DR MD Nurdin NgadimonGabriel Sim0% (1)

- IFRS 13 Fair Value MeasurementDocument2 pagesIFRS 13 Fair Value MeasurementYogesh BhattaraiNo ratings yet

- Canapi 04 Activity 2Document2 pagesCanapi 04 Activity 2sora fpsNo ratings yet

- Industry Reports - ISB Consulting Casebook 2021Document36 pagesIndustry Reports - ISB Consulting Casebook 2021BalajiNo ratings yet

- Fsa Project - Group 6 - Bhushan SteelsDocument30 pagesFsa Project - Group 6 - Bhushan SteelsNipu KurupNo ratings yet

- Equity Structured Products Accumulator/ DecumulatorDocument5 pagesEquity Structured Products Accumulator/ DecumulatorRajulNo ratings yet

- Must HaveDocument13 pagesMust HaveSunny SkNo ratings yet

- Associated Cement Company LTD: Profit & Loss Account Balance SheetDocument3 pagesAssociated Cement Company LTD: Profit & Loss Account Balance SheetZulfiqar HaiderNo ratings yet

- Important Factors To Be Considered For Financial Investment and SuggestionsDocument5 pagesImportant Factors To Be Considered For Financial Investment and SuggestionsRISHABH SEN GUPTANo ratings yet

- Sample Problems For Intermediate Accounting 3Document2 pagesSample Problems For Intermediate Accounting 3Luxx LawlietNo ratings yet

- Hrum LK TW Ii 2023Document108 pagesHrum LK TW Ii 2023PC E490No ratings yet

- Advanced Financial AccountingDocument8 pagesAdvanced Financial AccountingricharddiagmelNo ratings yet

- Financial Markets AND Financial Services: Chapter-31Document7 pagesFinancial Markets AND Financial Services: Chapter-31Dipali DavdaNo ratings yet