Professional Documents

Culture Documents

Excise Duty

Excise Duty

Uploaded by

suyash dugar0 ratings0% found this document useful (0 votes)

14 views14 pagesCentral Excise duty is levied on goods manufactured in India under the Constitution. Duties are charged on goods specified in the Central Excise Tariff Act if they are movable, marketable, and manufactured or produced in India. Manufacture means that a new, identifiable product emerges through a process. Assembly may constitute manufacture if a new product results that is movable and marketable. Certain processes are also deemed manufacture even if they don't meet the standard definition of manufacture. The manufacturer is generally considered to be the person who actually produces the new good.

Original Description:

Original Title

Untitled

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCentral Excise duty is levied on goods manufactured in India under the Constitution. Duties are charged on goods specified in the Central Excise Tariff Act if they are movable, marketable, and manufactured or produced in India. Manufacture means that a new, identifiable product emerges through a process. Assembly may constitute manufacture if a new product results that is movable and marketable. Certain processes are also deemed manufacture even if they don't meet the standard definition of manufacture. The manufacturer is generally considered to be the person who actually produces the new good.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

14 views14 pagesExcise Duty

Excise Duty

Uploaded by

suyash dugarCentral Excise duty is levied on goods manufactured in India under the Constitution. Duties are charged on goods specified in the Central Excise Tariff Act if they are movable, marketable, and manufactured or produced in India. Manufacture means that a new, identifiable product emerges through a process. Assembly may constitute manufacture if a new product results that is movable and marketable. Certain processes are also deemed manufacture even if they don't meet the standard definition of manufacture. The manufacturer is generally considered to be the person who actually produces the new good.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 14

EXCISE DUTY

• Power to levy Central Excise duty is derived from the Constitution.

• Tax on Excise duty is listed in the Entry 84 of VII schedule,

Constitution of India

• Duties are levied on goods manufactured or produced in India

(excluding Special Economic Zone).

• Charging Section of Excise Duty:-Four basic conditions define the

duty

• Duty is on goods.

The goods must be movable and marketable.

• The goods must be excisable

It must be included in the Central Excise Tariff Act.

• The goods must be manufactured or produced

New and identifiable product known in the market must emerge.

• Such manufacture or production must be in India.

Goods manufactures in SEZ are excluded excisable goods.

Types of excise duties:

Basic excise duty, special excise duty, education Cess, Additional

excise duty on goods of special importance-pan masala, tobacco

products.

Excisable goods: Nature and scope

• Goods specified in the schedule due to Central Excise Tariff

Act,1985 as being subject to a duty of excise and includes salt.

• Unless the item is specified in the Central Excise Tariff Act, as

subject to duty, no duty is leviable.

• However, once an item is mentioned in the Tariff, it will be

‘excisable goods’ even if duty rate is NIL and even if it is exempted

from the excise duty.

• Excisable goods does not become non-excisable goods because

they are exempt from duty by an exemption notification.

• Few goods are not mentioned in the Tariff like flowers. Similarly,

some mentioned but rate is ‘blank’. These are non-excisable item

though they may be goods.

• Onus of the proof that the articles are goods and are marketable

is on the department to establish.

• What are excisable goods?

- Must be movable

- Must be marketable

- Actual sale not necessary

- Actual open market not necessary

- Article capable of being bought or sold is deemed to be

marketable.

- Mere mention in tariff is not enough.

• Since excise is a duty on manufacture, duty is payable whether or

not goods are sold

• Duty is payable even

– when goods are used within the factory

– Captively consumed within factory for further manufacture.

– Goods are given as free samples.

– Goods are given as free replacements.

• Goods are not marketable if not considered to be saleable as per

law.

• Everything that is sold is not marketable.

• Goods includes any article ,material or substances which I capable

of being bought and sold for a consideration and such goods shall

be deemed to be manufactured.

• The commodity which is sought to be made liable to excise duty

must be a commodity that is marketable as it is, and not as a

commodity that may, by further processing, be made marketable.

• Some examples of goods under Excise Act

Gas and steam(good tangible property)

Electricity is movable property though not tangible.

Drawings, designs, etc are goods (relating to

machinery or technology)

By product- something (something produced in

making main product or a substance obtained in the

course of a specific product)

Waste and scrap is a final product-scrap can be

goods

Waste and scrap cannot be goods if not marketable

Waste is dutiable only if there is a manufacture.

What are not goods?

• Goods having very short life are not goods if not

marketable.

• If goods are marketablein shoprt shelf life, they

will be ‘excisable goods’.

• Plant and machinery assembled at site cannot be

treated as ‘goods’ for the purpose of Excise duty,

if it is not marketable and movable.

• Assembly is manufacture only if machinery can

be removed without dis-assembly(dismantle),

NATURE AND SCOPE OF MANUFACTURE

• Taxable event is manufacture or production in India.

• Excise duty is mainly levied on goods manufactured or

produced.

• If there is no manufacture, there is no liability of payment of

Central Excise duty.

• Excise duty is a duty on manufacture and he duty is fastened

immediately after goods are manufactured.

• “produced’, though not defined under Central Excise Act, it

has to be understood in the common parlance.

• Manufacture is not defined completely. But it means

a) Manufacture as specified in various Court decisions. i.e.,

new identifiable product having a distinctive name,

character or use must emerge. Or

b) deemed manufacture

• In conclusive, manufacture is when a new substance

having distinct name, character or use must emerge.

• The commodity should fit for commercial use.

• The commodity should come into existence as a separate

and distinct commodity.

• Mere value addition is not enough to be a manufacture.

i.e., identity of the original article should be lost.

• Manufacture is the end result of one or ore processes.

• And when the change occurs to a point where

commercially it can be identified as a new separate

article, manufacture is said to have taken place.

• Such manufacture must be in India for the purpose of

effecting the excise duty.

• Burden of proof of manufacture is on the department.

• Assembly of various parts and components may amount to

manufacture if new product emerges, which is movable and

marketable.

• But mere assembling of parts cannot be manufacture if it does

not stand to be a distinctive product.

• Sometimes, two different types of goods are supplied together

in different packing.it is not manufacture at the use’s end.

• For ex: araldite and aluminum painting is supplied in two

different packings which is to be mixed prior to its usage. This

does not mean that the user has manufactured the product.

• Purchasing various items and packing them together will not

amount to manufacture if new product does not emerge.

• Ancillary and incidental process of manufacture is essential for

the completion of product manufacture. Incidental is a casual

process and ancillary is a substantial process.

Few examples of manufacture

• Coffee beans from raw coffee berries- new and different article which

is recognised in trade as new and distinct commodity emerges.

• Roasting, salting and spicing of nuts is manufacture.

• Cotton seed from unginned cotton

• Oil from oil seeds

• making of pan masala by mixing various ingredients.

• Paddy to rice

• Stitching of cloth.

• Blending and packing tea.

• Making masala powder

• Wheat to wheat flour

• Cutting of fabrics from running length to make bedsheets.

• Recording of cassette- pre- recorded audio cassettes is difficult from

blank cassettes in the market.

What is not manufacture? few illustrations

• Testing, inspection and packing of items manufactured by others is not

manufacture.

• Blending and packing tea- loose tea does not lose it nature or character as such

when it is put in packets of different sizes, small or large.

• Cutting and polishing of diamond.

• Betel nut to supari powder is not manufacture

• Printing on glass bottles.

• Plain glazed tile to decorated tiles.

• Crushing of boulders into smaller stones.

• Affixing brand name is not manufacture.

• Reconditioning or repair is not manufacture.

• Vanaspati from groundnut oil is not manufacture.’

• Repacking of goods is not a manufacture unless the process is specified as

‘amounting to manufacture’

• Processing food or fruits into slices is not manufacture.

• Upgradation or modification in the computer system, increasing the processsing

capacity of hard disk is not manufacture.

• Re processing of defective goods and putting fresh label is not manufacture.

Deemed manufacture:

• CETA specifies some process as ‘amounting to

manufacture’.

• If any of these process is carried out, goods will be said

to be manufactured, even if as per court decision, the

process may not amount to ‘manufacture’.

• Process amounting to manufacture may be mentioned in

Tariff Entry also.

• But it must be specified that the process amounts to

“manufacture’.

• Even if the process is ‘deemed manufacture’, the test of

marketability is still to be satisfied.

• Unless the goods are marketable after that process, duty

cannot be levied.

Who is a manufacturer?

• Manufacturer is the person who actually brings new and

identifiable product into existence.

• It is an important issue in the Central Excise, since the liability to

pay the duty is basically on ‘manufacturer’ or ‘producer’.(except

few)

• The word manufacturer shall include not only a person who

employs hired labour in the production or manufacture of

excisable goods, but also any person who engages in their

production or manufacture on his own account. They are called

deemed manufacturer.

• Examples:

a) wheat belongs to a person. But Mill owner is another person

who converts the wheat into the flour. The Mill owner will be the

manufacturer.

b) Cloth being given to the tailor to stitch. Tailor is the manufacturer.

• Manufacture/ fabrication at the site of the buyer by an independent

contractor is a manufacturer

• Example: assembly of crane: an independent contractor who assembles

the parts in a factory will be manufacturer and not the owner of the

factory.

• Manufacturer through hired labour: a person may be treated as

manufacturer if he engages ‘hired labour’ who may be an employee or

contractor for manufacture of excisable goods.

• Independent contractor having own factory and the employees are not the

hired labour, then independent contractor is the manufacturer.

• Raw material supplier is not a manufacturer.

• Independent contractor is a manufacturer even if the manufacture is

carried on in the premises of raw material supplier.

• Contractor supplying labours or doing work in the premises of manufacture

is not a manufacturer.

• Brand owner is not the manufacturer.(BATA, BAJAJ Electricals are the brand

owners who purchases goods in bulk and affix the brand name on the

gods)

You might also like

- Relations and Functions Performance TaskDocument8 pagesRelations and Functions Performance Taskapi-242221534100% (1)

- Cost SheetDocument4 pagesCost Sheetvidhicool1360% (5)

- Powder Coating: A How-to Guide for Automotive, Motorcycle, and Bicycle PartsFrom EverandPowder Coating: A How-to Guide for Automotive, Motorcycle, and Bicycle PartsRating: 4.5 out of 5 stars4.5/5 (17)

- Dir Indir DiffDocument19 pagesDir Indir DiffDrNitin PathakNo ratings yet

- Chapter No 2 PRODUCTIONDocument12 pagesChapter No 2 PRODUCTIONBin MassoudNo ratings yet

- Uka Tarsadia University B. V. Patel Institute of BMC & ITDocument43 pagesUka Tarsadia University B. V. Patel Institute of BMC & ITBhavin GhoniyaNo ratings yet

- Microeconomics: Module 7: Production and CostsDocument31 pagesMicroeconomics: Module 7: Production and CostsErica Auriell FadilaNo ratings yet

- Nature TypeDocument50 pagesNature TypeRhea BadanaNo ratings yet

- Documents Connected With ExportersDocument114 pagesDocuments Connected With ExportersPARAMASIVAM SNo ratings yet

- CIN India LocalizationSD Ver 1Document76 pagesCIN India LocalizationSD Ver 1YogeshNo ratings yet

- Indirect Taxation: Chapter 01 - Central ExciseDocument56 pagesIndirect Taxation: Chapter 01 - Central ExciseSanjay JajundaNo ratings yet

- Ellora Time's Manufacturing WoesDocument22 pagesEllora Time's Manufacturing Woesutsa sarkerNo ratings yet

- Cet - TaxDocument12 pagesCet - TaxRajna Rajan NambiarNo ratings yet

- Excise DutyDocument4 pagesExcise DutySwapnil BhalaNo ratings yet

- Types of Inventory: Group 6 Rachel Angelo Ajith Reji Aswin Krishna R Midhuna Manohar Toraj Inteashi Siba SajiDocument16 pagesTypes of Inventory: Group 6 Rachel Angelo Ajith Reji Aswin Krishna R Midhuna Manohar Toraj Inteashi Siba SajiAswinrkrishnaNo ratings yet

- Manufacturing and TypesDocument10 pagesManufacturing and Typesalihyderabro166No ratings yet

- Introduction To Operation ManagementDocument48 pagesIntroduction To Operation ManagementSwati KatariaNo ratings yet

- Accounting Standards - 2: Valuation of InventoriesDocument22 pagesAccounting Standards - 2: Valuation of Inventoriesmahesh19689No ratings yet

- MNG Accounting Week 4Document16 pagesMNG Accounting Week 4jesslynNo ratings yet

- Enter 5Document40 pagesEnter 5Mekoninn HylemariamNo ratings yet

- Valuation of InventoriesDocument28 pagesValuation of InventoriesAATHARSH RADHAKRISHNANNo ratings yet

- Group 6 OM PresentationDocument18 pagesGroup 6 OM PresentationAswinrkrishnaNo ratings yet

- Chapter 1 ACCOUNTING FOR MANUFACTURING OPERATIONDocument36 pagesChapter 1 ACCOUNTING FOR MANUFACTURING OPERATIONMaimoona AsadNo ratings yet

- Manufacturing Account MainDocument21 pagesManufacturing Account Mainlloydbwalya588No ratings yet

- 1.intro To MP 2Document37 pages1.intro To MP 2Ali ArsalanNo ratings yet

- WK 4 Inventories - NewDocument38 pagesWK 4 Inventories - NewThùy Linh Lê ThịNo ratings yet

- Note Feb 26, 2024Document2 pagesNote Feb 26, 2024aleksandrakho1907No ratings yet

- Questionnaire: GS1 WebsiteDocument6 pagesQuestionnaire: GS1 WebsiteSOHEL BANGINo ratings yet

- Chapter 19Document51 pagesChapter 19Yasir MehmoodNo ratings yet

- Introduction To Management AccountingDocument51 pagesIntroduction To Management AccountingnikkinikkzNo ratings yet

- Inventories and Plant Assets: Lecture-5Document12 pagesInventories and Plant Assets: Lecture-5Nirjon BhowmicNo ratings yet

- Central Excise - Into & Basic ConceptsDocument21 pagesCentral Excise - Into & Basic ConceptsMruduta JainNo ratings yet

- As 2 - Valuation of InventoriesDocument27 pagesAs 2 - Valuation of Inventoriesabhishek200918177825100% (1)

- 3-Introduction To Lean Manufacturing - TQM - SS Run#57Document36 pages3-Introduction To Lean Manufacturing - TQM - SS Run#57Omar moatyNo ratings yet

- Chapter 5Document19 pagesChapter 5mbalenhle jezaNo ratings yet

- Merchandising and ManufacturingDocument23 pagesMerchandising and ManufacturingARABELLA CLARICE JIMENEZNo ratings yet

- Inventory Control: Prof. Subhash DalviDocument39 pagesInventory Control: Prof. Subhash DalviRajesh UmbarkarNo ratings yet

- BMMW3893 - Lecture 01Document40 pagesBMMW3893 - Lecture 01Nurain ZamriNo ratings yet

- Duties and Taxes For Govt Purchase ProposalsDocument45 pagesDuties and Taxes For Govt Purchase Proposalsdate_milindNo ratings yet

- Job Costing MBA 2019 Session 4Document33 pagesJob Costing MBA 2019 Session 4Rafay FarooqNo ratings yet

- Inventory Accounting: Presented by Team 5Document40 pagesInventory Accounting: Presented by Team 5Mohammad BathishNo ratings yet

- IA 1 - Chapter 10 - ReviewerDocument4 pagesIA 1 - Chapter 10 - Reviewerkimingyuse1010No ratings yet

- Inventory Management in ServicesDocument60 pagesInventory Management in ServicesAAKASH KANAKIANo ratings yet

- Power Point of Repo & ProDocument81 pagesPower Point of Repo & ProKirubel MogesNo ratings yet

- 8 July-Absent - Kavya's Notes 9 JulyDocument57 pages8 July-Absent - Kavya's Notes 9 JulyAnurag SinghNo ratings yet

- Introduction To Management AccountingDocument52 pagesIntroduction To Management Accountingvenkata nareshNo ratings yet

- Unit 5. ManufacturingDocument8 pagesUnit 5. Manufacturingpapa1No ratings yet

- Production of Goods & ServicesDocument46 pagesProduction of Goods & ServicesmitchNo ratings yet

- Manufacturing IntroductionDocument65 pagesManufacturing IntroductionMuhammad IshaqNo ratings yet

- L2 (Manufacturing Concepts)Document16 pagesL2 (Manufacturing Concepts)Shubhangi Arora AgarwalNo ratings yet

- Business Env. 5th AugDocument16 pagesBusiness Env. 5th Augcooldude690No ratings yet

- Spoilage AccountingDocument26 pagesSpoilage AccountingParth BarotNo ratings yet

- Understanding Business Activity: Contents-Section 1Document53 pagesUnderstanding Business Activity: Contents-Section 1Allan IshimweNo ratings yet

- Chapter 18 Spring 2023Document33 pagesChapter 18 Spring 2023Mah ElNo ratings yet

- BY Vinod K Raju Musaliar College PathanamthittaDocument20 pagesBY Vinod K Raju Musaliar College PathanamthittaAvinashNo ratings yet

- Introduction To Management AccountingDocument49 pagesIntroduction To Management AccountingGuruKPO75% (4)

- Measuring and Marking Metals for Home Machinists: Accurate Techniques for the Small ShopFrom EverandMeasuring and Marking Metals for Home Machinists: Accurate Techniques for the Small ShopRating: 4 out of 5 stars4/5 (1)

- How To Start a Hot Dog Cart Business: Your Step-By-Step Guide To Hot Dog Stand Business SuccessFrom EverandHow To Start a Hot Dog Cart Business: Your Step-By-Step Guide To Hot Dog Stand Business SuccessNo ratings yet

- Relationship Between Residential Status and Incidence of TaxDocument5 pagesRelationship Between Residential Status and Incidence of Taxsuyash dugarNo ratings yet

- Registration Under GSTDocument13 pagesRegistration Under GSTsuyash dugarNo ratings yet

- Goods and Services Tax Council Article-279ADocument5 pagesGoods and Services Tax Council Article-279Asuyash dugarNo ratings yet

- UntitledDocument9 pagesUntitledsuyash dugarNo ratings yet

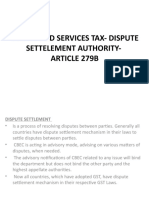

- Goods and Services Tax-Dispute Settelement Authority - Article 279BDocument6 pagesGoods and Services Tax-Dispute Settelement Authority - Article 279Bsuyash dugarNo ratings yet

- Basic Principles of Income-Tax: BY Bommaraju Ramakotaiah. M SC, LLB, IrsDocument75 pagesBasic Principles of Income-Tax: BY Bommaraju Ramakotaiah. M SC, LLB, Irssuyash dugarNo ratings yet

- Transaction Value, Which Is The Price Actually Paid or PayableDocument10 pagesTransaction Value, Which Is The Price Actually Paid or Payablesuyash dugarNo ratings yet

- UntitledDocument14 pagesUntitledsuyash dugarNo ratings yet

- Historical Development of The Customs Act and Customs DutyDocument47 pagesHistorical Development of The Customs Act and Customs Dutysuyash dugarNo ratings yet

- UntitledDocument14 pagesUntitledsuyash dugarNo ratings yet

- Relationship Between Residential Status and Incidence of TaxDocument5 pagesRelationship Between Residential Status and Incidence of Taxsuyash dugarNo ratings yet

- International TaxationDocument10 pagesInternational Taxationsuyash dugarNo ratings yet

- Customs ValuationDocument6 pagesCustoms Valuationsuyash dugarNo ratings yet

- Than Money and Securities But Includes Actionable Claim, Growing CropsDocument8 pagesThan Money and Securities But Includes Actionable Claim, Growing Cropssuyash dugarNo ratings yet

- UntitledDocument26 pagesUntitledsuyash dugarNo ratings yet

- Clubbing of Income-PrintDocument5 pagesClubbing of Income-Printsuyash dugarNo ratings yet

- UntitledDocument17 pagesUntitledsuyash dugarNo ratings yet

- UntitledDocument7 pagesUntitledsuyash dugarNo ratings yet

- International TaxationDocument6 pagesInternational Taxationsuyash dugarNo ratings yet

- Income Tax Slabs Tax RateDocument7 pagesIncome Tax Slabs Tax Ratesuyash dugarNo ratings yet

- Connotation of Receipt of Income and Accrual of IncomeDocument8 pagesConnotation of Receipt of Income and Accrual of Incomesuyash dugarNo ratings yet

- Taxable EventDocument2 pagesTaxable Eventsuyash dugarNo ratings yet

- Adv & Dis Adv.Document6 pagesAdv & Dis Adv.suyash dugarNo ratings yet

- PrintDocument6 pagesPrintsuyash dugarNo ratings yet

- UntitledDocument8 pagesUntitledsuyash dugarNo ratings yet

- Constitutional Amendments and Provisions of GST in IndiaDocument20 pagesConstitutional Amendments and Provisions of GST in Indiasuyash dugarNo ratings yet

- A Partnership Firm With A, B and C Partners.: IllustrationsDocument4 pagesA Partnership Firm With A, B and C Partners.: Illustrationssuyash dugarNo ratings yet

- UntitledDocument12 pagesUntitledsuyash dugarNo ratings yet

- Tax FeeDocument1 pageTax Feesuyash dugarNo ratings yet

- Agricultural IncomeDocument16 pagesAgricultural Incomesuyash dugarNo ratings yet

- Captcha SeminarDocument35 pagesCaptcha SeminarSachin ItgampalliNo ratings yet

- Sample Assignment 1-1Document20 pagesSample Assignment 1-1Nir IslamNo ratings yet

- CVPDocument20 pagesCVPThomas K. AddaiNo ratings yet

- Velocity String Installation and Performance ReviewDocument13 pagesVelocity String Installation and Performance ReviewSilicon Density100% (1)

- Office THE: OF SecretaryDocument9 pagesOffice THE: OF SecretaryAling KinaiNo ratings yet

- Lab ManualDocument14 pagesLab Manualhak creationNo ratings yet

- GregormendelandhispeasreadingandquestionsDocument2 pagesGregormendelandhispeasreadingandquestionsapi-248015505No ratings yet

- Wissman Stroke Center PDFDocument2 pagesWissman Stroke Center PDFyasinNo ratings yet

- English RevisionDocument3 pagesEnglish RevisionKhanssaa AboutayabNo ratings yet

- Introduction To Spread Spectrum CommunicationDocument7 pagesIntroduction To Spread Spectrum CommunicationAli KashiNo ratings yet

- Behaviorism: Althea AlabanzasDocument6 pagesBehaviorism: Althea Alabanzasalabanzasalthea100% (1)

- Ixys P-Channel Power Mosfets and Applications Abdus Sattar, Kyoung-Wook Seok, Ixan0064Document14 pagesIxys P-Channel Power Mosfets and Applications Abdus Sattar, Kyoung-Wook Seok, Ixan0064Kikuvi JohnNo ratings yet

- EQ 5D 5L Index Value Calculator V1.1Document146 pagesEQ 5D 5L Index Value Calculator V1.1mmmaw mmNo ratings yet

- Pediatric Vestibular Disorders PDFDocument10 pagesPediatric Vestibular Disorders PDFNati GallardoNo ratings yet

- hw4 SolDocument3 pageshw4 SoladvifulNo ratings yet

- Perceptual Stability in Atonal MusicDocument30 pagesPerceptual Stability in Atonal Musicmarcela pavia100% (1)

- Lesson 10Document19 pagesLesson 10AnilNo ratings yet

- Chapter 4 - Braking System 4.1 Brake LinesDocument14 pagesChapter 4 - Braking System 4.1 Brake LinesEmanuel VidalNo ratings yet

- Xoco Bistro MainMenu PDFDocument2 pagesXoco Bistro MainMenu PDFDaniel GerzinaNo ratings yet

- Chapter No. 25 Maintenance of Canals & DrainsDocument4 pagesChapter No. 25 Maintenance of Canals & DrainsMANJEET SINGHNo ratings yet

- SuperDoctor5 UserGuideDocument139 pagesSuperDoctor5 UserGuidemlody45No ratings yet

- BIO Genetics Eukaryote TranscriptionDocument23 pagesBIO Genetics Eukaryote TranscriptionAnonymous SVy8sOsvJDNo ratings yet

- 802.1AEbw-2013 - IEEE STD For LAN&MANs - Media Access Control (MAC) Security. Amendment 2. Extended Packet NumberingDocument67 pages802.1AEbw-2013 - IEEE STD For LAN&MANs - Media Access Control (MAC) Security. Amendment 2. Extended Packet NumberingLenina Viktoriya TeknyetovaNo ratings yet

- Subaru - CHASSISDocument520 pagesSubaru - CHASSISIS52100% (1)

- Bhubneshwor LeadsDocument4 pagesBhubneshwor LeadsCo2 RenuUNo ratings yet

- Analysis of Financial StatementsDocument46 pagesAnalysis of Financial StatementsSwaroop Ranjan Baghar25% (4)

- Computer SpecsDocument29 pagesComputer SpecsDiego Lorenzo AparicioNo ratings yet

- Weather ChangesDocument34 pagesWeather ChangesEmina PodicNo ratings yet

- Account Summary: Consolidated StatementDocument7 pagesAccount Summary: Consolidated StatementSrinivasan RamachandranNo ratings yet