Professional Documents

Culture Documents

Untitled

Untitled

Uploaded by

Sakshi Yadav0 ratings0% found this document useful (0 votes)

6 views25 pagesThe document provides an overview of auditing including:

- Definitions of auditing from various sources and the meaning and origin of the term audit.

- The objectives, scope, principles, advantages, and limitations of auditing.

- The different types of audits according to organization, ownership, time, and objectives.

- The key elements of an audit report including the title, addressee, opening paragraph, scope paragraph, and opinion paragraph.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides an overview of auditing including:

- Definitions of auditing from various sources and the meaning and origin of the term audit.

- The objectives, scope, principles, advantages, and limitations of auditing.

- The different types of audits according to organization, ownership, time, and objectives.

- The key elements of an audit report including the title, addressee, opening paragraph, scope paragraph, and opinion paragraph.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

6 views25 pagesUntitled

Untitled

Uploaded by

Sakshi YadavThe document provides an overview of auditing including:

- Definitions of auditing from various sources and the meaning and origin of the term audit.

- The objectives, scope, principles, advantages, and limitations of auditing.

- The different types of audits according to organization, ownership, time, and objectives.

- The key elements of an audit report including the title, addressee, opening paragraph, scope paragraph, and opinion paragraph.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 25

TOPIC – AUDIT

Presented By – Sakshi Yadav

MHA (Sem – III)

Meaning of Audit

Definitions

Origin and evolution

Objectives of Auditing

Scope of Auditing

Principles of Audit

Advantages & limitation of Auditing

Types of Audit

Difference between Internal audit & External audit

Audit Report

Meaning of Audit

◦ The word “audit” comes from the Latin word audire, meaning “to

hear”.

◦ An audit is the examination of the financial report of an

organization - as presented in the annual report - by someone

independent of that organization.

◦ Auditing is a process in which their is systemic and scientific

examination of company accounts by a well qualified person.

◦ Auditor – An Individual appointed by the company owners to

check accounts whenever they suspected fraud, to hear the

explanation given by the person responsible for financial

transactions.

Auditor can examine the books of accounts to ensure that accounts

of the company is properly maintained or not.

Defintion of Audit

◦ ICAI – “The independent examination of financial information of any entity,

whether profit oriented or not, and irrespective of its size or legal form, when

such examination is conducted with a view to expressing an opinion thereon.”

◦ Prof Montgomery,– “Auditing is a systematic examination of the books and

records of a business or other organization, in order to ascertain or verify, and

to report upon the facts regarding its financial operations and the results

thereof”.

◦ “Audit may be said to be verification of the accuracy and correctness of the

books of accounts by an independent person qualified for the job and not in any

way connected with the preparation of such accounts.” -J.B. Bose

Origin and Evolution of auditing

◦ Auditing is as old as accounting, and there are signs of its existence in all ancient cultures such

as Mesopotamia, Greece, Egypt, Rome, UK, and India.

◦ Double-entry bookkeeping was first described in Italy by Luca Pacioli (1496).

◦ Luca also defined the duties and responsibilities of an auditor since then it is evolving.

◦ The modern auditing established during Industrial Revolution.

◦ In January 1923, the British Association of Accountants and Auditors got established, and a

person could be fully competent to work as a professional auditor after clearing this exam.

◦ In the year 1913 the audit of company account was made compulsory in India.

◦ First act for audit was formed in 1913 under the name of Indian Companies Act

◦ The Government of India Act 1935, gave further recognition to the importance and status of

the Auditor General.

◦ Errors which occur because of innocence and negligence, are of three types:

• Clerical error

• Compensating error

• Error of principles

◦ Again, clerical errors are of two types:

• Error of omission

• Error of commission

◦ However, the frauds which occur with a purpose to gain something by some

influencing methods, they are of three types:

• Exploitation or misuse of cash

• Exploitation of goods

• Manipulation of accounts.

Scope of An Audit

The scope of an audit is the determination of the range of activities and the period of records that are to

be subjected to an audit examination.

scopes of an audit are;

Legal Requirements

Entity Aspects

Reliable Information

Proper Communication

Evaluation

Test

Comparison

Judgments

Types of Auditing

According to the Organization of Business

According to the Ownership of Business

According to the Time of Audit

According to the Objectives of Audit

According to the Organization of Business

◦ Statutory Audit: A statutory audit is a legally required review of

the accuracy of a company's or government's financial statements

and records.

◦ Private Audit - Private companies, ranging from family businesses

to global, publicly trading corporations, are not part of the

government

According to the Ownership of Business

Audit of Companies: Under companies Act, audit of accounts of

companies in India is compulsory.

Audit of Trusts - Accounts of the trust are maintained as per the

conditions and terms of the trust deed.

In the trust deed as well as in the Public Trust Act which provide

for compulsory audit of the accounts of the trust by a qualified

auditor.

Audit of Proprietorship: In case of proprietary concerns, the

owner himself takes the decision to get the accounts audited

Audit of Accounts of Co-operative Societies: Co-Operative societies are established under

the Co-Operative Societies Act, 1912. It contains various provisions for the regulations and the

working of these societies

Audit of Government Offices: Audit of government offices and departments is covered under

this heading. A separate department is maintained by government of India known as Accounts

and Audit Department. This department is headed by the Comptroller and Auditor General of

India. This department works only for the government offices and departments..

Audit of Partnership: Partnership deed on mutual agreement between the partners may

provide for audit of financial statements.

Audit of Individuals: An Individual such as estate managers, rent collectors, investors, etc.

who engaged in business/ or profession is required to maintain books of account and to get

them audited and obtain and furnish Tax Audit Report of the Income Tax Act (1961) from a

Chartered Accountant if the sale, gross receipts or turnover etc. exceeds prescribed limit.

According to the Time of Audit

Interim Audit: When an audit is conducted between two annual audits, such audit is known

as Interim audit.

Continuous Audit: The Continuous Audit is conducted throughout the year or at the regular

short intervals of time. A continuous audit involves a detailed examination of all the

transactions by the auditor attending at regular intervals for example weekly, fortnightly or

monthly, during the whole period of trading.

Final Audit: Final Audit means when the audit work is conducted after the close of financial

year.

Balance Sheet Audit: Balance Sheet Audit relates to the verification of various items of

balance sheets such as assets, liabilities, reserves and surplus, provisions and profit and loss

balance.

According to the Objectives of Audit

Management Audit: Management audit is a systematic examination of decisions and actions

of the management to analyse the performance.

Internal Audit: It implies the audit of accounts by the staff of the business. Internal audit is an

appraisal activity within an organization for the review of the accounting, financial and other

operations as basis for protective and constructive service to the management

Cost Audit: Cost Audit is the verification of the correctness of cost accounts and adherence to

the cost accounting plans. Cost Audit is the detailed checking of costing system, techniques

and accounts to verifying correctness and to ensure adherence to the objectives of cost

accounting

Secretarial Audit: Secretarial Audit is concerned with verification

compliance by the company of various provisions of Companies Act and other

relevant laws.

Independent Audit: Is conducted by the independent qualified auditor. The

purpose of independent audit is to see whether financial statements give true

and fair view of financial position and profits.

Tax Audit: Tax audit mostly covers income returns, invoices, debit and credit

notes and various current and fixed assets.

Limitations of Auditing

◦ If the auditor gets the biased information the accounts will not reveal the true picture

◦ A detailed checking is not possible

◦ It is more useful for the future but less for the past

◦ The payment of audit fee brings extra cost burden to the organizations

◦ During and audit the auditors requires the attention several companies stuff and therefore cause

disruption

◦ An audit doesn’t assure future viability of the organization audited

◦ An audit doesn’t assure the effectiveness and efficiency of management

◦ Auditor express opinions and therefore doesn’t give total assurance of the two fair presentation of

annual reports

An audit report is usually of the financial

records and accounts of a company.

A report is a statement of collected and

considered facts, so drawn up as to give clear

and concise information to persons who are

not already in possession of the full facts of

subject matter of the report

The audit reporting is the communication of

audit conclusions after having carried out the

audit process in accordance with audit plan.

Basic element of an audit Report

Title used to prepare the financial statement and

Addressee Expression of opinion on the financial statement.

Opening or introductory paragraph- Date of the report;

Identification of financial statement audited and Place of signature

A statement on the responsibility of the entity’s auditor’s signature.

management and that of auditor

Scope paragraph-

A reference to the auditing standards generally

accepted in India and

A description of work performed by the auditor.

Opinion paragraph-

A reference to the financial reporting framework

You might also like

- Project On AuditingDocument23 pagesProject On AuditingRAM84% (25)

- Goodness of God Key of EDocument2 pagesGoodness of God Key of Estephen2buizonNo ratings yet

- N1 FitnessDocument84 pagesN1 FitnessDiana PruneanNo ratings yet

- The British Student's Guide To Obtaining Your Visa To Study at The Islamic University of Madinah v.2Document76 pagesThe British Student's Guide To Obtaining Your Visa To Study at The Islamic University of Madinah v.2Nouridine El KhalawiNo ratings yet

- Audit and AuditorDocument14 pagesAudit and AuditorAamir NabiNo ratings yet

- Audit Techniques and ProceduresDocument119 pagesAudit Techniques and Procedures04beingsammyNo ratings yet

- Auditing Unit 1Document34 pagesAuditing Unit 1ShaifaliChauhanNo ratings yet

- Accounting, Auditing Audit Com Sec-3Document41 pagesAccounting, Auditing Audit Com Sec-3Sagun Lal AmatyaNo ratings yet

- Chapter 1 Introduction To AuditDocument35 pagesChapter 1 Introduction To Auditafrainhossain65No ratings yet

- Audit Procedure in IndiaDocument29 pagesAudit Procedure in IndiaPendem Vamsi KrishnaNo ratings yet

- Tupes of AuditDocument18 pagesTupes of AuditLindsay SummersNo ratings yet

- Authors Are As FollowsDocument11 pagesAuthors Are As FollowsForam ChauhanNo ratings yet

- Ilovepdf MergedDocument57 pagesIlovepdf MergedHarish 13No ratings yet

- Indroduction: Group 2 'S Types of AuditDocument32 pagesIndroduction: Group 2 'S Types of Auditaliakhtar02No ratings yet

- Audit of BankDocument52 pagesAudit of BankNandini BajeNo ratings yet

- Chapter 1:introduction To AuditingDocument9 pagesChapter 1:introduction To Auditingshubhank RaoNo ratings yet

- Auditing NotesDocument126 pagesAuditing NotesDamarisNo ratings yet

- Unit 1Document6 pagesUnit 1Saniya HashmiNo ratings yet

- Auditing-Principles-And-Practices-I Handout BestDocument34 pagesAuditing-Principles-And-Practices-I Handout Besttarekegn gezahegnNo ratings yet

- AudtingDocument15 pagesAudtingSehr KhanNo ratings yet

- Statutory AuditDocument20 pagesStatutory Auditkalpesh mhatreNo ratings yet

- Unit 1 Auditing and Corporate GovernanceDocument23 pagesUnit 1 Auditing and Corporate Governancelaxmisruti123No ratings yet

- Types of AuditDocument11 pagesTypes of Auditbhaveshjaiin100% (2)

- Auditing: Text Book: Principles of Auditing by Khawaja Amjad SaeedDocument39 pagesAuditing: Text Book: Principles of Auditing by Khawaja Amjad SaeedShahoo Baloch100% (1)

- Principles and Practice of Auditing IDocument14 pagesPrinciples and Practice of Auditing Iyebegashet100% (1)

- AuditingDocument54 pagesAuditingShreya SinghNo ratings yet

- AuditDocument54 pagesAuditmadhumithamadhu2003No ratings yet

- Project On AuditingDocument23 pagesProject On AuditingAnshu LalitNo ratings yet

- Submitted To: Institute of Chartered Accountant of India: Submitted By: Sumit Arora REG. NO - NRO0210695Document23 pagesSubmitted To: Institute of Chartered Accountant of India: Submitted By: Sumit Arora REG. NO - NRO0210695Anshu LalitNo ratings yet

- Jahangirnagar University (IBA-JU) : Institute of Business AdministrationDocument9 pagesJahangirnagar University (IBA-JU) : Institute of Business Administrationtabassum tasnim SinthyNo ratings yet

- Advanced Accountancy: Shivaji University, KolhapurDocument99 pagesAdvanced Accountancy: Shivaji University, KolhapurEswari GkNo ratings yet

- Year Unit I Introduction To Auditing Meaning and Definition of AuditingDocument53 pagesYear Unit I Introduction To Auditing Meaning and Definition of AuditingTimothy KambuniNo ratings yet

- Auditing Notes-Merged-CompressedDocument69 pagesAuditing Notes-Merged-CompressedComeNo ratings yet

- Auditing Part 1Document54 pagesAuditing Part 1Deepak NayakNo ratings yet

- Audit and AssuranceDocument43 pagesAudit and AssuranceLalithaNo ratings yet

- Audit ProjectDocument23 pagesAudit ProjectPriyanka KhotNo ratings yet

- Module IDocument22 pagesModule ImathewosNo ratings yet

- Auditing NotesDocument26 pagesAuditing Notessakshi113No ratings yet

- CG Assignment #05 31466Document6 pagesCG Assignment #05 31466SheiryNo ratings yet

- Auditing Chapter 1Document12 pagesAuditing Chapter 1JewelNo ratings yet

- Types of Audit: Lecture - 2Document15 pagesTypes of Audit: Lecture - 2haya khanNo ratings yet

- Auditing PresentationDocument54 pagesAuditing PresentationMuzaFarNo ratings yet

- Chapter - 1 Introduction of 1) Meaning of AuditingDocument31 pagesChapter - 1 Introduction of 1) Meaning of AuditingRajesh GuptaNo ratings yet

- AuditingDocument3 pagesAuditingNameNo ratings yet

- Complete Auditing Notes Better VersionDocument61 pagesComplete Auditing Notes Better Versionbrilliant FrancisNo ratings yet

- Auditing (Paper-II) Unit-1 Introduction To Auditing: Meaning and Definition of AuditingDocument9 pagesAuditing (Paper-II) Unit-1 Introduction To Auditing: Meaning and Definition of AuditingVIJI SHYJUNo ratings yet

- Chapter 1Document10 pagesChapter 1vikings12345678900No ratings yet

- 5th Sem I Unit Auditing PPT 1.pdf334Document26 pages5th Sem I Unit Auditing PPT 1.pdf334Asad RNo ratings yet

- Unit-5 AuditingDocument20 pagesUnit-5 AuditingTrupti PoojaryNo ratings yet

- BCOM 411 & Bcop 341 & BPLM 422 AUDITING NOTES (Verification)Document35 pagesBCOM 411 & Bcop 341 & BPLM 422 AUDITING NOTES (Verification)anzenzenelson7No ratings yet

- Chapter 1Document9 pagesChapter 1Devidharsana SenthilkumarNo ratings yet

- Chapter 1-Introduction To AuditDocument31 pagesChapter 1-Introduction To AuditAnis Fariha RosliNo ratings yet

- A&a L1 EditedDocument9 pagesA&a L1 EditedKimosop Isaac KipngetichNo ratings yet

- Mid Term Exam-Auditing IDocument5 pagesMid Term Exam-Auditing IAmara PrabasariNo ratings yet

- Auditing Unit 1Document17 pagesAuditing Unit 1MonuNo ratings yet

- Introduction To Auditing Lecture 1Document14 pagesIntroduction To Auditing Lecture 1Gopti EmmanuelNo ratings yet

- Auditing I-Chapter 1 MLCDocument13 pagesAuditing I-Chapter 1 MLCHilew TSegayeNo ratings yet

- Auditing:-: Scope and Objective of AuditDocument31 pagesAuditing:-: Scope and Objective of AuditapuoctNo ratings yet

- Fundamentals of Auditing: Ajmal Khan MomandDocument29 pagesFundamentals of Auditing: Ajmal Khan MomandMasood khanNo ratings yet

- Chapter 1Document31 pagesChapter 1انيس AnisNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Dr. Sakshi Yadav - OBDocument10 pagesDr. Sakshi Yadav - OBSakshi YadavNo ratings yet

- Dr. Sakshi YadavDocument33 pagesDr. Sakshi YadavSakshi YadavNo ratings yet

- Dr. Sakshi Yadav - AdvertisingDocument19 pagesDr. Sakshi Yadav - AdvertisingSakshi YadavNo ratings yet

- UntitledDocument26 pagesUntitledSakshi YadavNo ratings yet

- UntitledDocument59 pagesUntitledSakshi YadavNo ratings yet

- UntitledDocument48 pagesUntitledSakshi YadavNo ratings yet

- Kula DeivamDocument5 pagesKula DeivamSri Kumar100% (2)

- Bridgewave 2x80ghzDocument2 pagesBridgewave 2x80ghzsimog1972No ratings yet

- 3i's Rubrics ACTIVITY 1Document2 pages3i's Rubrics ACTIVITY 1Jaeneth SimondoNo ratings yet

- 4 Week BodyweightDocument76 pages4 Week BodyweightariandapNo ratings yet

- El Educador Como Gestor de Conflictos 13 To 74Document62 pagesEl Educador Como Gestor de Conflictos 13 To 74AlExa Garzón100% (1)

- The Early History of Manganese and The Recognition of ItsDocument23 pagesThe Early History of Manganese and The Recognition of ItsPlutus PHNo ratings yet

- Ieep 104Document7 pagesIeep 104Praveen KumarpillaiNo ratings yet

- ThinkCentre E73 Tower SpecDocument1 pageThinkCentre E73 Tower SpecNalendra WibowoNo ratings yet

- Top Law Firm in Dubai, UAE - RAALCDocument20 pagesTop Law Firm in Dubai, UAE - RAALCraalc uaeNo ratings yet

- Parliament Denies Amidu's AllegationsDocument3 pagesParliament Denies Amidu's Allegationsmyjoyonline.comNo ratings yet

- CS1352 May07Document19 pagesCS1352 May07sridharanc23No ratings yet

- ENVIDIP Module 1. IntroductionDocument31 pagesENVIDIP Module 1. IntroductionLilia GC CasanovaNo ratings yet

- Lenntech: 60 Frame Plunger PumpDocument4 pagesLenntech: 60 Frame Plunger PumpJHONY TEODORO ALBORNOZ DIONICIONo ratings yet

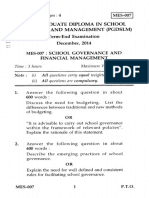

- Mes 007Document4 pagesMes 007dr_ashishvermaNo ratings yet

- Live Outside The BoxDocument2 pagesLive Outside The BoxKrishnaKumarDeepNo ratings yet

- In-Depth Interviews & EthnographyDocument29 pagesIn-Depth Interviews & EthnographyJin ZuanNo ratings yet

- It8078 Web Design and ManagementDocument27 pagesIt8078 Web Design and ManagementsanjayNo ratings yet

- The Beacon - April 11, 2013Document14 pagesThe Beacon - April 11, 2013Catawba SecurityNo ratings yet

- Writing Strategy and Tips - CAE PDFDocument11 pagesWriting Strategy and Tips - CAE PDFAntoSeitanNo ratings yet

- Unit 5: Implications of Developmental Biology: Teratogenesis: Types and Teratogenic AgentsDocument12 pagesUnit 5: Implications of Developmental Biology: Teratogenesis: Types and Teratogenic AgentsAmar Kant JhaNo ratings yet

- The Literature of Bibliometrics Scientometrics and Informetrics-2Document24 pagesThe Literature of Bibliometrics Scientometrics and Informetrics-2Juan Ruiz-UrquijoNo ratings yet

- (1912) Book of Home Building & DecorationDocument264 pages(1912) Book of Home Building & DecorationHerbert Hillary Booker 2nd100% (2)

- FUTURE MegoldásokDocument4 pagesFUTURE MegoldásokNikolett SzövőNo ratings yet

- Ceramic TilesDocument340 pagesCeramic TilesMihai ȘtefanNo ratings yet

- General Knowlege QuestionsDocument36 pagesGeneral Knowlege QuestionsSarahNo ratings yet

- 5 - Emergency MotionDocument14 pages5 - Emergency MotionTyler LofallNo ratings yet

- Reviewer For Statcon QuizDocument18 pagesReviewer For Statcon QuizShella Hannah SalihNo ratings yet