Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

12 viewsThe First Budget of Amrit Kaal

The First Budget of Amrit Kaal

Uploaded by

Vincitta MuthappanThe budget document outlines the Indian government's plans for economic growth and development over the coming years called "Amrit Kaal". Key priorities include developing infrastructure, health, education, agriculture, youth skills, tourism, and promoting green growth. The budget increases capital investment, supports rural development and disadvantaged regions, and aims to boost the digital economy through new policies and initiatives. It also outlines tax reforms to promote domestic manufacturing and simplify compliance.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Request For Cash AdvanceDocument1 pageRequest For Cash AdvanceMD LebriaNo ratings yet

- Affidavit of Undertaking - SRADocument1 pageAffidavit of Undertaking - SRAElias Eslafor Jr.No ratings yet

- A Critique of The Social Security System Using Robert Nozick's Ideas of The Minimal State and Justice As EntitlementDocument64 pagesA Critique of The Social Security System Using Robert Nozick's Ideas of The Minimal State and Justice As EntitlementJj CastroNo ratings yet

- Budget Highlights - 2011-12Document3 pagesBudget Highlights - 2011-12Raman KapoorNo ratings yet

- Budget Review:: Zeebiz BureauDocument11 pagesBudget Review:: Zeebiz BureauMilan MeeraNo ratings yet

- Budget 2023 SummaryDocument2 pagesBudget 2023 SummarySidhartha Marketing CompanyNo ratings yet

- Presented By: Komal Maurya Neeraj Singh Galgotias Business SchoolDocument35 pagesPresented By: Komal Maurya Neeraj Singh Galgotias Business SchoolNishant RaghuwanshiNo ratings yet

- Annual Financial Statement 2023Document45 pagesAnnual Financial Statement 2023ROMEL CHAKMANo ratings yet

- Himachal Pradesh Budget 2015Document13 pagesHimachal Pradesh Budget 2015rupaliNo ratings yet

- Our Budget HighlightddDocument4 pagesOur Budget HighlightddkakkarNo ratings yet

- IT HighlightDocument4 pagesIT HighlightBinayKPNo ratings yet

- Union Budget 2022-23Document3 pagesUnion Budget 2022-23Siddartha ShettyNo ratings yet

- Background: Infrastructure DevelopmentDocument5 pagesBackground: Infrastructure DevelopmentvishwanathNo ratings yet

- Crux 3.0 - 01Document12 pagesCrux 3.0 - 01Neeraj GargNo ratings yet

- Budget 2011 HighlightsDocument4 pagesBudget 2011 Highlightsthesrajesh7120No ratings yet

- Budget 2013 PDFDocument6 pagesBudget 2013 PDFNitin NamdeoNo ratings yet

- Budget 2017-18Document5 pagesBudget 2017-18saqikhanNo ratings yet

- Cpfga 15645 BHDocument3 pagesCpfga 15645 BHShanthan ChippaNo ratings yet

- Budget 2010-11: by Karan Singh, MBA (General) Section - ADocument32 pagesBudget 2010-11: by Karan Singh, MBA (General) Section - AscherrercuteNo ratings yet

- Products Also To Get Costly As Excise Duty Hiked To 72% To 6%Document4 pagesProducts Also To Get Costly As Excise Duty Hiked To 72% To 6%Rajesh KumarNo ratings yet

- Union Budget 2007Document5 pagesUnion Budget 2007Pawan LingayatNo ratings yet

- FIN (Budget)Document19 pagesFIN (Budget)SumitChaturvediNo ratings yet

- Sop-G 8 PresentsDocument24 pagesSop-G 8 PresentsHimesh V NairNo ratings yet

- Budget 2012 13 HighlightsDocument66 pagesBudget 2012 13 HighlightsvickyvikashsinhaNo ratings yet

- Budget 2020 by CA. Abhishek RankaDocument23 pagesBudget 2020 by CA. Abhishek RankaNaveenJainNo ratings yet

- Budget 2023 Decoded With Asset Plus Compressed 0dafa4eed0Document10 pagesBudget 2023 Decoded With Asset Plus Compressed 0dafa4eed0BloreBuddyNo ratings yet

- Krishna Swaroop Ayush Srivastava Sheeba Singh Nikhil Suyesh Arya Vikram SrivastavaDocument20 pagesKrishna Swaroop Ayush Srivastava Sheeba Singh Nikhil Suyesh Arya Vikram SrivastavaSheeba Singh RanaNo ratings yet

- Highlights of The Union Budget 2023-24Document5 pagesHighlights of The Union Budget 2023-24Aspirant AspirantNo ratings yet

- Budget by Pavneet Singh PDFDocument4 pagesBudget by Pavneet Singh PDFNayan DhakreNo ratings yet

- Union Budget: Pragmatic Prudent Populist : Banking & FinancialsDocument6 pagesUnion Budget: Pragmatic Prudent Populist : Banking & FinancialsVikrant MalhotraNo ratings yet

- Union Budget F.Y. 2020-2 021: Presented By:-Ankit AggarwalDocument26 pagesUnion Budget F.Y. 2020-2 021: Presented By:-Ankit AggarwalankitNo ratings yet

- Business Economics Digital Assessment 2 Budget 2019 and Industry - Explain in DetailDocument4 pagesBusiness Economics Digital Assessment 2 Budget 2019 and Industry - Explain in Detailjayagokul saravananNo ratings yet

- Union Budget 2019 1Document6 pagesUnion Budget 2019 1saikiranNo ratings yet

- Budget Highlights 2018Document5 pagesBudget Highlights 2018KuruAnandNo ratings yet

- Union Budget 2019 - 2020Document26 pagesUnion Budget 2019 - 2020Sunil SaharanNo ratings yet

- Union Budget 2019 - 2020Document26 pagesUnion Budget 2019 - 2020Sunil SaharanNo ratings yet

- Highlights of Union Budget 2019-20Document26 pagesHighlights of Union Budget 2019-20Sunil SaharanNo ratings yet

- PIB Budget Highlights 2023-24Document8 pagesPIB Budget Highlights 2023-24Ratikanta SwainNo ratings yet

- Highlights of Budget 2019Document4 pagesHighlights of Budget 2019harisankar sureshNo ratings yet

- India Budget 2023 Most Important InformationDocument9 pagesIndia Budget 2023 Most Important InformationAlpesh KumarNo ratings yet

- Budget 2019 Notes Made From Budget WebsiteDocument10 pagesBudget 2019 Notes Made From Budget Websitelaxmi bhattNo ratings yet

- Highlights of Union Budget 2023-24Document17 pagesHighlights of Union Budget 2023-24boranihar34No ratings yet

- Background: GDP Wholesale Price Index Fiscal DeficitDocument5 pagesBackground: GDP Wholesale Price Index Fiscal Deficitdhimant_123No ratings yet

- LA Presentation FinalDocument29 pagesLA Presentation FinalMadhu Mohan BhukyaNo ratings yet

- Jagrati Sengar Public Finance CceDocument25 pagesJagrati Sengar Public Finance CceMRS.NAMRATA KISHNANI BSSSNo ratings yet

- Press Information BureauDocument9 pagesPress Information BureauGoutham YadavNo ratings yet

- What, According To You, Are The Pros and Cons of The Indian Union Budget 2015?Document4 pagesWhat, According To You, Are The Pros and Cons of The Indian Union Budget 2015?Mian Muhammad Rizwan SarwarNo ratings yet

- Budget 23Document10 pagesBudget 23Vineet UttamNo ratings yet

- Budget111ppt 130306122511 Phpapp01Document34 pagesBudget111ppt 130306122511 Phpapp01Santosh SinghNo ratings yet

- Commercial Banking Assignment Budget 2022 Highlights - 1) EconomyDocument9 pagesCommercial Banking Assignment Budget 2022 Highlights - 1) EconomyShruti UpadhyayNo ratings yet

- 40 11277 Icsi Highlights of The Union Budget 2012 13Document8 pages40 11277 Icsi Highlights of The Union Budget 2012 13shankarvittaNo ratings yet

- Indian Union Budget 2011 Key AnnouncementsDocument3 pagesIndian Union Budget 2011 Key AnnouncementsVizardlordNo ratings yet

- The Budget Broadly Focussed On 10 Themes Viz. Farming Sector, Rural Population, The Youth, The Poor To Name A FewDocument9 pagesThe Budget Broadly Focussed On 10 Themes Viz. Farming Sector, Rural Population, The Youth, The Poor To Name A Fewsachinp patilNo ratings yet

- BUDGETDocument17 pagesBUDGETAyushi GuptaNo ratings yet

- Key Features of Union Budget 2015 16Document3 pagesKey Features of Union Budget 2015 16prasannandaNo ratings yet

- Budget Sectoral-Impact-FY20-21Document12 pagesBudget Sectoral-Impact-FY20-21tempofaltuNo ratings yet

- Union Budget 2013-14 - Highlights and AnalysisDocument28 pagesUnion Budget 2013-14 - Highlights and AnalysisNaureen FatimaNo ratings yet

- Name: Rahul Jain Roll No: B-72 Specialisation: FinanceDocument3 pagesName: Rahul Jain Roll No: B-72 Specialisation: FinancejayeshkaushikNo ratings yet

- The Following Are The Union Budget 2014-15 HighlightsDocument5 pagesThe Following Are The Union Budget 2014-15 HighlightsSwapneel TankNo ratings yet

- India Budget Highlights - D N Sharma & Associates - FY14-15Document29 pagesIndia Budget Highlights - D N Sharma & Associates - FY14-15Deepak SharmaNo ratings yet

- Was Presented by The Finance Minister, Pranab MukherjeeDocument5 pagesWas Presented by The Finance Minister, Pranab MukherjeekapilpgdmNo ratings yet

- Cost of CapitalDocument24 pagesCost of CapitalVincitta MuthappanNo ratings yet

- Introduction To - PythonDocument102 pagesIntroduction To - PythonVincitta MuthappanNo ratings yet

- Introduction To Business AnalyticsDocument70 pagesIntroduction To Business AnalyticsVincitta MuthappanNo ratings yet

- ABA - Course Plan - MarchDocument5 pagesABA - Course Plan - MarchVincitta MuthappanNo ratings yet

- Boston Matrix and Product Portfolios BCG MatrixDocument4 pagesBoston Matrix and Product Portfolios BCG MatrixColin Anderson100% (1)

- ECO 322 - 3rd Short PaperDocument3 pagesECO 322 - 3rd Short PaperWF KrunkNo ratings yet

- Candlestick Pattern Cheat SheetDocument1 pageCandlestick Pattern Cheat SheetBetro PemilioNo ratings yet

- Purchase Order 00005Document1 pagePurchase Order 00005Ginson Precast ConstructionNo ratings yet

- TicketDocument4 pagesTicketMohamed EbrahimNo ratings yet

- Paras - 1678Document3 pagesParas - 1678Andrea RioNo ratings yet

- AC GST Tax InvoiceDocument1 pageAC GST Tax Invoiceankit panwarNo ratings yet

- Transportation IndicatorsDocument438 pagesTransportation IndicatorsAchraf ChtibiNo ratings yet

- BS Iso 8528-1-2005Document26 pagesBS Iso 8528-1-2005nknfive100% (1)

- Recent Trends in Industrial Growth in IndiaDocument8 pagesRecent Trends in Industrial Growth in IndiaAppan Kandala Vasudevachary86% (7)

- Justin SlayDocument2 pagesJustin SlayAbd EssamiaNo ratings yet

- Geop2 Gr12 Survival KitDocument26 pagesGeop2 Gr12 Survival Kitngqulungasnothando34No ratings yet

- Swot Analysis of IB in PakistanDocument2 pagesSwot Analysis of IB in PakistanMubeen Zubair100% (2)

- Pria,: Participatory Solid Waste Management (SWM) Planning: Experience of From Indian CitiesDocument13 pagesPria,: Participatory Solid Waste Management (SWM) Planning: Experience of From Indian Citiesram_kumar2839No ratings yet

- Chapter 11 - Home Office, Branch, & Agency Accounting.ADocument34 pagesChapter 11 - Home Office, Branch, & Agency Accounting.AMa. Andrea Paula LarcaNo ratings yet

- GE-3 Activity 3 MIDTERMDocument2 pagesGE-3 Activity 3 MIDTERMArn Dela CruzNo ratings yet

- DAGS Travel Order September 2023-Pick-Up I-BEAMSDocument8 pagesDAGS Travel Order September 2023-Pick-Up I-BEAMSFrancis Danver EmerzNo ratings yet

- 1 Ethiopia Agricultural MachineryDocument11 pages1 Ethiopia Agricultural Machinerytractorassembly100% (3)

- LAW Compiler 5.0 by CA Ravi AgarwalDocument692 pagesLAW Compiler 5.0 by CA Ravi Agarwalenila upretiNo ratings yet

- Cargo Arrival Notice: Consignee NotifyDocument2 pagesCargo Arrival Notice: Consignee NotifySRIKANTH VENKAMAMIDINo ratings yet

- Reverse LogisticsDocument37 pagesReverse Logisticsblogdogunleashed100% (7)

- SWOT of Quality Progress in Saudi Arabia & The Road Map Forward 29 March 2008Document43 pagesSWOT of Quality Progress in Saudi Arabia & The Road Map Forward 29 March 2008ainulhaque786No ratings yet

- Maths Test JulyDocument6 pagesMaths Test JulyTengku NorDiandaNo ratings yet

- Modern Banking InstrumentsDocument18 pagesModern Banking InstrumentsZaeem Laher33% (3)

- Working Capital Management in Indian Steel IndustryDocument74 pagesWorking Capital Management in Indian Steel Industryvineet lalmuniNo ratings yet

- LIC ProofDocument1 pageLIC ProofkhumarpraveenNo ratings yet

The First Budget of Amrit Kaal

The First Budget of Amrit Kaal

Uploaded by

Vincitta Muthappan0 ratings0% found this document useful (0 votes)

12 views21 pagesThe budget document outlines the Indian government's plans for economic growth and development over the coming years called "Amrit Kaal". Key priorities include developing infrastructure, health, education, agriculture, youth skills, tourism, and promoting green growth. The budget increases capital investment, supports rural development and disadvantaged regions, and aims to boost the digital economy through new policies and initiatives. It also outlines tax reforms to promote domestic manufacturing and simplify compliance.

Original Description:

Original Title

The First budget of Amrit Kaal

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe budget document outlines the Indian government's plans for economic growth and development over the coming years called "Amrit Kaal". Key priorities include developing infrastructure, health, education, agriculture, youth skills, tourism, and promoting green growth. The budget increases capital investment, supports rural development and disadvantaged regions, and aims to boost the digital economy through new policies and initiatives. It also outlines tax reforms to promote domestic manufacturing and simplify compliance.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views21 pagesThe First Budget of Amrit Kaal

The First Budget of Amrit Kaal

Uploaded by

Vincitta MuthappanThe budget document outlines the Indian government's plans for economic growth and development over the coming years called "Amrit Kaal". Key priorities include developing infrastructure, health, education, agriculture, youth skills, tourism, and promoting green growth. The budget increases capital investment, supports rural development and disadvantaged regions, and aims to boost the digital economy through new policies and initiatives. It also outlines tax reforms to promote domestic manufacturing and simplify compliance.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 21

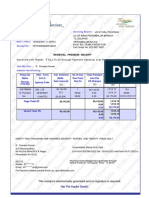

The First budget of Amrit Kaal

MAJOR BUDGET ANNOUNCEMENT IN LAST 10

YEARS

Vision for Amrit Kaal

• Technology-driven and knowledge-

based economy, with strong public

finances and a robust financial sector.

Sabka Saath Sabka-

Inclusive Development

AGRICULTURE AND COOPERATIVES

• Digital Public Infrastructure for Agriculture

• Agriculture Accelerator Fund

• Enhancing productivity of cotton crop

• Atmanirbhar Horticulture Clean Plant Program

• Global Hub for Millets

• National cooperative database

HEALTH AND

EDUCATION

• Medical & Nursing Colleges

• Sickle Cell Anaemia Elimination

Mission

• Medical Research

• Teachers’ Training

• National Digital Library for Children

and Adolescents

Reaching The Last Mile

• Aspirational Districts and Blocks Program

• Pradhan Mantri PVTG Development

Mission

• Eklavya Model Residential Schools

• Water for Drought Prone Region

• PM Awas Yojana

• Support for poor prisoners

Infrastructure

• Increased capital investment outlay by

33.4%.

• Continuation of 50 year interest free

loan to state governments to incentive

infrastructure and investment.

• Highest ever Capital outlay of 4.2 lakh

crore for Railways.

• 100 Transport infrastructure projects

identified for end-to-end Connectivity

for ports,coal,fertililizer sectors.

Unleashing the

Potential

• Mission Karmayogi

• Centres of Excellence for Artificial Intelligence

• National Data Governance Policy

• Simplification of Know Your Customer (KYC) process

• One stop solution for identity and address updating

• Common Business Identifier

• Unified Filing Process

• Lab Grown Diamonds

Unleashing the

Potential

• Vivad se Vishwas I – Relief for

MSMEs

• Vivad se Vishwas II – Settling

Contractual Disputes

• State Support Mission

• Result Based Financing

• E-Courts

• Fintech Services

• Entity DigiLocker

• 5G Services

Green

Growth

• Net Zero Carbon Emission by 2070

• National Green Hydrogen Mission (5

MMT by 2030)

• 35,000 Crore for priority capital

Investment

• Battery Storage Systems with 4,000

MWH

• 13 GW renewable energy from

Ladakh with 20,700 Crore Funding

• Green Credit Program

Green Growth

(cont)

7. PM Pranam Plan to promote alternative

fertilizers

8. GOBARdhan Scheme with 10,000 Crore

9. 1 Crore Farmers to adopt natural

Farming with 10,000 bio input resources

10. Mangrove Initiative along coastline

and salt pan lands

11. Coastal Shipping

12. Vehicle Replacement

YOUTH POWER

Pradhan Mantri Kaushal Vikas Yojana 4.0:

• The Pradhan Mantri Kaushal Vikas Yojana 4.0 will be

introduced to train thousands of young people.

• The focus will be on on-the-job training, industry

partnerships, and course alignment with industry

requirements.

• The scheme will also cover new age courses for Industry 4.0

like coding, AI, robotics, mechatronics, IOT, 3D printing,

drones, and soft skills.

Skill India Digital Platform:

• Thirty Skill India International Centers will be established

nationwide to help the younger generation for careers

abroad.

• Digital platform for engaging with employers, including

MSMEs, providing access to entrepreneurship programs.

National Apprenticeship Promotion Scheme:

• A direct benefit transfer under a pan-India national

apprenticeship promotion scheme will also be introduced in

order to support 47 lakh youths in 3 years with a stipend.

Tourism:

• Rs. 2400 crores allocated to Ministry of Tourism as the sector

holds huge opportunities for jobs and entrepreneurship for

youth

• 50 destinations will be developed as ‘a complete package of

tourism’. These destinations will be selected through

challenge mode, using an integrated and innovative

approach.

Unity Mall:

• States will be encouraged to establish a Unity Mall in their

state capital, most significant tourist destination, or financial

capital for the promotion and sale of their own ODOPs (one

district, one product), GI products, and other handicraft

products, as well as for providing space for such products of

all other States.

Financial Sector:

• NFIR (National Financial Information Registry) to be launched for

financial strategy.

• EPFO Numbers doubled to 27 crores.

• ‘Mahila Samman Bachat Scheme’ for Women up to Rs. 2,00,000 @

7.5%.

• Setting up a Central Data Processing Centre for the faster handling of

administrative work under the Companies Act.

• Benefits for Senior Citizens, Enhanced maximum deposit limit for

senior citizens savings scheme from 15 lakhs to 30 lakhs @ 8%

interest rate.

Direct and Indirect tax:

1. Promote domestic manufacturing and 10. Sections 54 and 54F are to be amended.

exports. 11. The rebate limit increased to 7 lakhs in the

2. Tax exemption on Capital Goods and Lithium new tax regime.

batteries.

12. The number of slabs was reduced from 7 to

3. Mobiles and camera lenses to become 5 in the new tax regime.

cheaper.

13. Only 5% tax on an Individual’s Annual

4. Gold, Silver & Diamonds, cigarettes, and income of 9,00,000 only to pay Rs. 45,000

imported rubber get expensive. as tax.

5. The enhanced limit for 3 crores and 75 lakhs

for presumptive taxation.

14. Salaried class and pensioner: Standard

Deduction increased.

6. Higher TDS limit of RS. 3 crores for

Cooperatives 15. Highest tax rate 42.74 % reduced.

7. New IT Return Form for easier filing. 16. Propose to reduce the Higher surcharge rate

from 37 % to 25% in the new tax regime.

8. 100 Joint Commissioners to be appointed for

disposal of small appeals. 17. Leave Encashment: Limit increased from Rs.

9. TDS reduced on EPF withdrawal. 3,00,000 to Rs. 25,00,000.

You might also like

- Request For Cash AdvanceDocument1 pageRequest For Cash AdvanceMD LebriaNo ratings yet

- Affidavit of Undertaking - SRADocument1 pageAffidavit of Undertaking - SRAElias Eslafor Jr.No ratings yet

- A Critique of The Social Security System Using Robert Nozick's Ideas of The Minimal State and Justice As EntitlementDocument64 pagesA Critique of The Social Security System Using Robert Nozick's Ideas of The Minimal State and Justice As EntitlementJj CastroNo ratings yet

- Budget Highlights - 2011-12Document3 pagesBudget Highlights - 2011-12Raman KapoorNo ratings yet

- Budget Review:: Zeebiz BureauDocument11 pagesBudget Review:: Zeebiz BureauMilan MeeraNo ratings yet

- Budget 2023 SummaryDocument2 pagesBudget 2023 SummarySidhartha Marketing CompanyNo ratings yet

- Presented By: Komal Maurya Neeraj Singh Galgotias Business SchoolDocument35 pagesPresented By: Komal Maurya Neeraj Singh Galgotias Business SchoolNishant RaghuwanshiNo ratings yet

- Annual Financial Statement 2023Document45 pagesAnnual Financial Statement 2023ROMEL CHAKMANo ratings yet

- Himachal Pradesh Budget 2015Document13 pagesHimachal Pradesh Budget 2015rupaliNo ratings yet

- Our Budget HighlightddDocument4 pagesOur Budget HighlightddkakkarNo ratings yet

- IT HighlightDocument4 pagesIT HighlightBinayKPNo ratings yet

- Union Budget 2022-23Document3 pagesUnion Budget 2022-23Siddartha ShettyNo ratings yet

- Background: Infrastructure DevelopmentDocument5 pagesBackground: Infrastructure DevelopmentvishwanathNo ratings yet

- Crux 3.0 - 01Document12 pagesCrux 3.0 - 01Neeraj GargNo ratings yet

- Budget 2011 HighlightsDocument4 pagesBudget 2011 Highlightsthesrajesh7120No ratings yet

- Budget 2013 PDFDocument6 pagesBudget 2013 PDFNitin NamdeoNo ratings yet

- Budget 2017-18Document5 pagesBudget 2017-18saqikhanNo ratings yet

- Cpfga 15645 BHDocument3 pagesCpfga 15645 BHShanthan ChippaNo ratings yet

- Budget 2010-11: by Karan Singh, MBA (General) Section - ADocument32 pagesBudget 2010-11: by Karan Singh, MBA (General) Section - AscherrercuteNo ratings yet

- Products Also To Get Costly As Excise Duty Hiked To 72% To 6%Document4 pagesProducts Also To Get Costly As Excise Duty Hiked To 72% To 6%Rajesh KumarNo ratings yet

- Union Budget 2007Document5 pagesUnion Budget 2007Pawan LingayatNo ratings yet

- FIN (Budget)Document19 pagesFIN (Budget)SumitChaturvediNo ratings yet

- Sop-G 8 PresentsDocument24 pagesSop-G 8 PresentsHimesh V NairNo ratings yet

- Budget 2012 13 HighlightsDocument66 pagesBudget 2012 13 HighlightsvickyvikashsinhaNo ratings yet

- Budget 2020 by CA. Abhishek RankaDocument23 pagesBudget 2020 by CA. Abhishek RankaNaveenJainNo ratings yet

- Budget 2023 Decoded With Asset Plus Compressed 0dafa4eed0Document10 pagesBudget 2023 Decoded With Asset Plus Compressed 0dafa4eed0BloreBuddyNo ratings yet

- Krishna Swaroop Ayush Srivastava Sheeba Singh Nikhil Suyesh Arya Vikram SrivastavaDocument20 pagesKrishna Swaroop Ayush Srivastava Sheeba Singh Nikhil Suyesh Arya Vikram SrivastavaSheeba Singh RanaNo ratings yet

- Highlights of The Union Budget 2023-24Document5 pagesHighlights of The Union Budget 2023-24Aspirant AspirantNo ratings yet

- Budget by Pavneet Singh PDFDocument4 pagesBudget by Pavneet Singh PDFNayan DhakreNo ratings yet

- Union Budget: Pragmatic Prudent Populist : Banking & FinancialsDocument6 pagesUnion Budget: Pragmatic Prudent Populist : Banking & FinancialsVikrant MalhotraNo ratings yet

- Union Budget F.Y. 2020-2 021: Presented By:-Ankit AggarwalDocument26 pagesUnion Budget F.Y. 2020-2 021: Presented By:-Ankit AggarwalankitNo ratings yet

- Business Economics Digital Assessment 2 Budget 2019 and Industry - Explain in DetailDocument4 pagesBusiness Economics Digital Assessment 2 Budget 2019 and Industry - Explain in Detailjayagokul saravananNo ratings yet

- Union Budget 2019 1Document6 pagesUnion Budget 2019 1saikiranNo ratings yet

- Budget Highlights 2018Document5 pagesBudget Highlights 2018KuruAnandNo ratings yet

- Union Budget 2019 - 2020Document26 pagesUnion Budget 2019 - 2020Sunil SaharanNo ratings yet

- Union Budget 2019 - 2020Document26 pagesUnion Budget 2019 - 2020Sunil SaharanNo ratings yet

- Highlights of Union Budget 2019-20Document26 pagesHighlights of Union Budget 2019-20Sunil SaharanNo ratings yet

- PIB Budget Highlights 2023-24Document8 pagesPIB Budget Highlights 2023-24Ratikanta SwainNo ratings yet

- Highlights of Budget 2019Document4 pagesHighlights of Budget 2019harisankar sureshNo ratings yet

- India Budget 2023 Most Important InformationDocument9 pagesIndia Budget 2023 Most Important InformationAlpesh KumarNo ratings yet

- Budget 2019 Notes Made From Budget WebsiteDocument10 pagesBudget 2019 Notes Made From Budget Websitelaxmi bhattNo ratings yet

- Highlights of Union Budget 2023-24Document17 pagesHighlights of Union Budget 2023-24boranihar34No ratings yet

- Background: GDP Wholesale Price Index Fiscal DeficitDocument5 pagesBackground: GDP Wholesale Price Index Fiscal Deficitdhimant_123No ratings yet

- LA Presentation FinalDocument29 pagesLA Presentation FinalMadhu Mohan BhukyaNo ratings yet

- Jagrati Sengar Public Finance CceDocument25 pagesJagrati Sengar Public Finance CceMRS.NAMRATA KISHNANI BSSSNo ratings yet

- Press Information BureauDocument9 pagesPress Information BureauGoutham YadavNo ratings yet

- What, According To You, Are The Pros and Cons of The Indian Union Budget 2015?Document4 pagesWhat, According To You, Are The Pros and Cons of The Indian Union Budget 2015?Mian Muhammad Rizwan SarwarNo ratings yet

- Budget 23Document10 pagesBudget 23Vineet UttamNo ratings yet

- Budget111ppt 130306122511 Phpapp01Document34 pagesBudget111ppt 130306122511 Phpapp01Santosh SinghNo ratings yet

- Commercial Banking Assignment Budget 2022 Highlights - 1) EconomyDocument9 pagesCommercial Banking Assignment Budget 2022 Highlights - 1) EconomyShruti UpadhyayNo ratings yet

- 40 11277 Icsi Highlights of The Union Budget 2012 13Document8 pages40 11277 Icsi Highlights of The Union Budget 2012 13shankarvittaNo ratings yet

- Indian Union Budget 2011 Key AnnouncementsDocument3 pagesIndian Union Budget 2011 Key AnnouncementsVizardlordNo ratings yet

- The Budget Broadly Focussed On 10 Themes Viz. Farming Sector, Rural Population, The Youth, The Poor To Name A FewDocument9 pagesThe Budget Broadly Focussed On 10 Themes Viz. Farming Sector, Rural Population, The Youth, The Poor To Name A Fewsachinp patilNo ratings yet

- BUDGETDocument17 pagesBUDGETAyushi GuptaNo ratings yet

- Key Features of Union Budget 2015 16Document3 pagesKey Features of Union Budget 2015 16prasannandaNo ratings yet

- Budget Sectoral-Impact-FY20-21Document12 pagesBudget Sectoral-Impact-FY20-21tempofaltuNo ratings yet

- Union Budget 2013-14 - Highlights and AnalysisDocument28 pagesUnion Budget 2013-14 - Highlights and AnalysisNaureen FatimaNo ratings yet

- Name: Rahul Jain Roll No: B-72 Specialisation: FinanceDocument3 pagesName: Rahul Jain Roll No: B-72 Specialisation: FinancejayeshkaushikNo ratings yet

- The Following Are The Union Budget 2014-15 HighlightsDocument5 pagesThe Following Are The Union Budget 2014-15 HighlightsSwapneel TankNo ratings yet

- India Budget Highlights - D N Sharma & Associates - FY14-15Document29 pagesIndia Budget Highlights - D N Sharma & Associates - FY14-15Deepak SharmaNo ratings yet

- Was Presented by The Finance Minister, Pranab MukherjeeDocument5 pagesWas Presented by The Finance Minister, Pranab MukherjeekapilpgdmNo ratings yet

- Cost of CapitalDocument24 pagesCost of CapitalVincitta MuthappanNo ratings yet

- Introduction To - PythonDocument102 pagesIntroduction To - PythonVincitta MuthappanNo ratings yet

- Introduction To Business AnalyticsDocument70 pagesIntroduction To Business AnalyticsVincitta MuthappanNo ratings yet

- ABA - Course Plan - MarchDocument5 pagesABA - Course Plan - MarchVincitta MuthappanNo ratings yet

- Boston Matrix and Product Portfolios BCG MatrixDocument4 pagesBoston Matrix and Product Portfolios BCG MatrixColin Anderson100% (1)

- ECO 322 - 3rd Short PaperDocument3 pagesECO 322 - 3rd Short PaperWF KrunkNo ratings yet

- Candlestick Pattern Cheat SheetDocument1 pageCandlestick Pattern Cheat SheetBetro PemilioNo ratings yet

- Purchase Order 00005Document1 pagePurchase Order 00005Ginson Precast ConstructionNo ratings yet

- TicketDocument4 pagesTicketMohamed EbrahimNo ratings yet

- Paras - 1678Document3 pagesParas - 1678Andrea RioNo ratings yet

- AC GST Tax InvoiceDocument1 pageAC GST Tax Invoiceankit panwarNo ratings yet

- Transportation IndicatorsDocument438 pagesTransportation IndicatorsAchraf ChtibiNo ratings yet

- BS Iso 8528-1-2005Document26 pagesBS Iso 8528-1-2005nknfive100% (1)

- Recent Trends in Industrial Growth in IndiaDocument8 pagesRecent Trends in Industrial Growth in IndiaAppan Kandala Vasudevachary86% (7)

- Justin SlayDocument2 pagesJustin SlayAbd EssamiaNo ratings yet

- Geop2 Gr12 Survival KitDocument26 pagesGeop2 Gr12 Survival Kitngqulungasnothando34No ratings yet

- Swot Analysis of IB in PakistanDocument2 pagesSwot Analysis of IB in PakistanMubeen Zubair100% (2)

- Pria,: Participatory Solid Waste Management (SWM) Planning: Experience of From Indian CitiesDocument13 pagesPria,: Participatory Solid Waste Management (SWM) Planning: Experience of From Indian Citiesram_kumar2839No ratings yet

- Chapter 11 - Home Office, Branch, & Agency Accounting.ADocument34 pagesChapter 11 - Home Office, Branch, & Agency Accounting.AMa. Andrea Paula LarcaNo ratings yet

- GE-3 Activity 3 MIDTERMDocument2 pagesGE-3 Activity 3 MIDTERMArn Dela CruzNo ratings yet

- DAGS Travel Order September 2023-Pick-Up I-BEAMSDocument8 pagesDAGS Travel Order September 2023-Pick-Up I-BEAMSFrancis Danver EmerzNo ratings yet

- 1 Ethiopia Agricultural MachineryDocument11 pages1 Ethiopia Agricultural Machinerytractorassembly100% (3)

- LAW Compiler 5.0 by CA Ravi AgarwalDocument692 pagesLAW Compiler 5.0 by CA Ravi Agarwalenila upretiNo ratings yet

- Cargo Arrival Notice: Consignee NotifyDocument2 pagesCargo Arrival Notice: Consignee NotifySRIKANTH VENKAMAMIDINo ratings yet

- Reverse LogisticsDocument37 pagesReverse Logisticsblogdogunleashed100% (7)

- SWOT of Quality Progress in Saudi Arabia & The Road Map Forward 29 March 2008Document43 pagesSWOT of Quality Progress in Saudi Arabia & The Road Map Forward 29 March 2008ainulhaque786No ratings yet

- Maths Test JulyDocument6 pagesMaths Test JulyTengku NorDiandaNo ratings yet

- Modern Banking InstrumentsDocument18 pagesModern Banking InstrumentsZaeem Laher33% (3)

- Working Capital Management in Indian Steel IndustryDocument74 pagesWorking Capital Management in Indian Steel Industryvineet lalmuniNo ratings yet

- LIC ProofDocument1 pageLIC ProofkhumarpraveenNo ratings yet